Somewhere, Albert Edwards is dancing a jig as the ice age he predicted will grip the world, appears to finally be here.

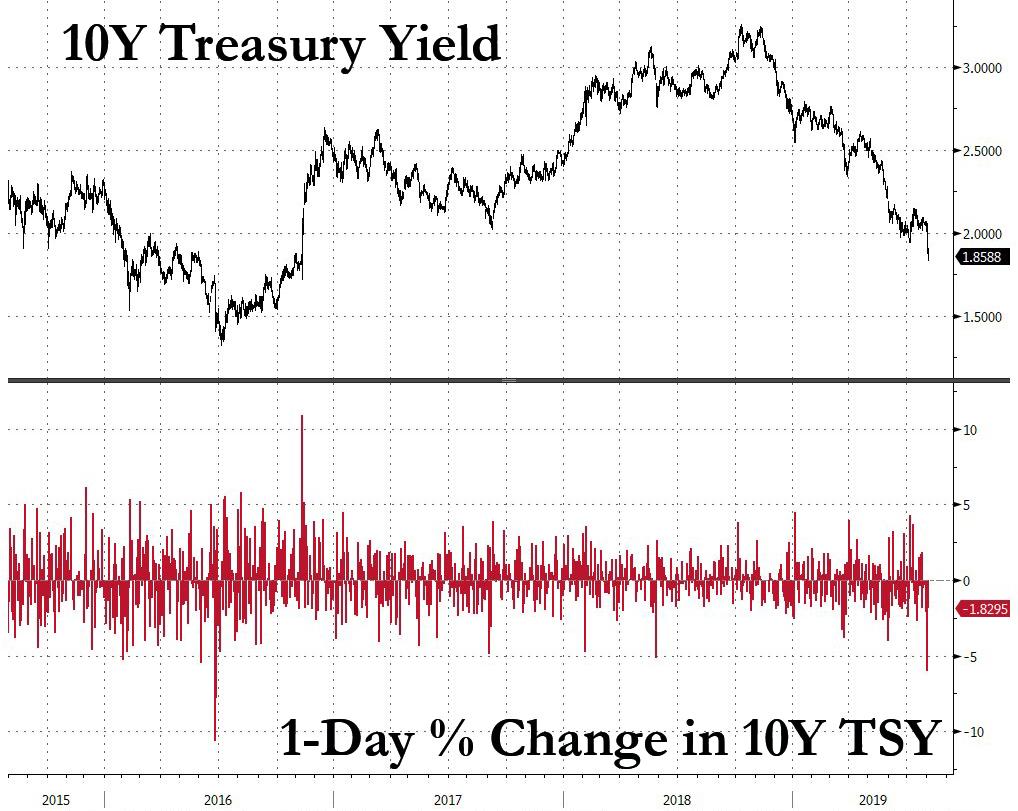

While global equities are sharply lower today following the end of the US-China trade ceasefire, it’s nothing compared to what is going on in the bond market, where one day after the 10Y US Treasury plunged a whopping 6% to 1.832% – the biggest one day drop since Brexit – to the lowest since the Trump election…

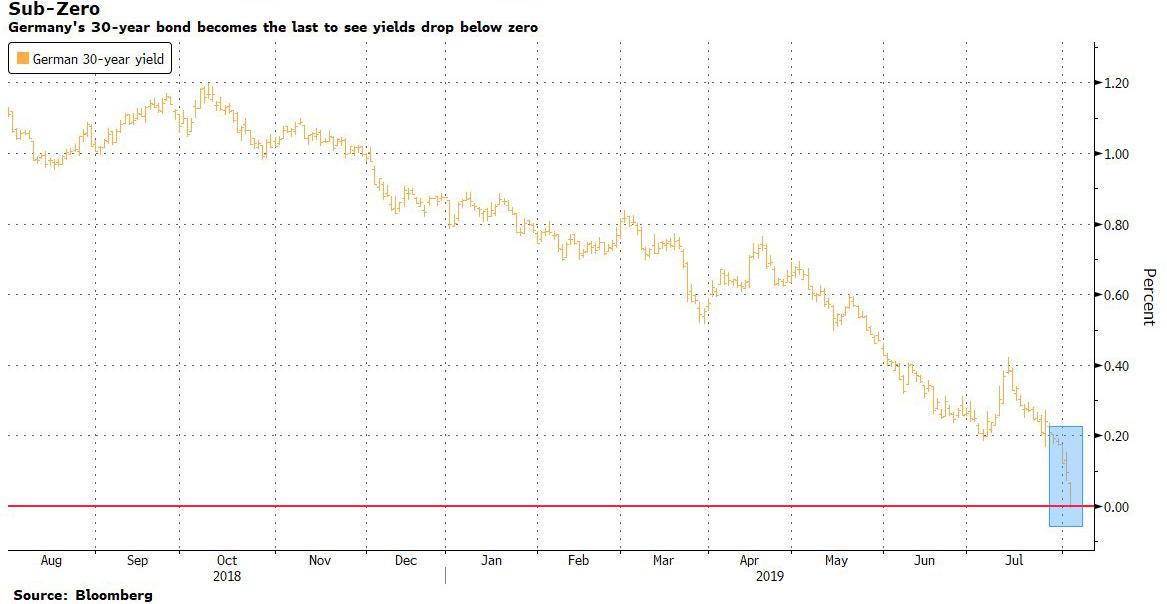

… the real show is in Germany, where not only did German 10Y Bunds tumble to the lowest on record, sliding to -0.503%, far below the ECB’s -0.40% deposit rate, the highlight was the plunge in 30Y yield, which today dropped below 0%…

… dragging the entire German yield curve in negative territory for the first time ever.

Enter “Japanification”: as Bloomberg notes, “the move will add to fears that the region’s economic slowdown is being driven by more structural factors akin to Japan’s lost decade”, which is ironic because not even Japan’s 30Ys trade negative. Germany’s bond market is widely perceived as being one of the world’s safest, with investors lured in by the liquidity and credit quality offered. Funds still looking to extract a positive return from European sovereign assets have been forced further out the yield curve or into riskier debt markets such as Italy. And as of today, anyone investing in German paper is guaranteed to lose money if holding to maturity.

“It underlines that the hunt for yield, or rather hunt to avoid negative yields, is accelerating day by day,” said Arne Lohmann Rasmussen, head of fixed-income research at Danske Bank A/S. “It just makes things more complicated.”

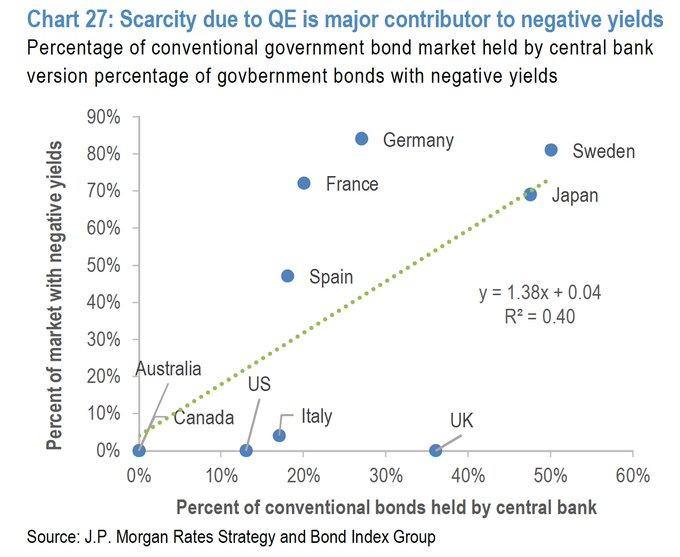

In addition to fears about a German recession sparked by the renewed Trump tariff threat, Germany’s bond market is also plagued by a problem of scarcity, with the government mandated by law to effectively maintain a budget surplus. The ECB holds nearly a third of the existing debt, leaving less to trade, which has helped to compress yields even further.

“It is a combination of a very uncertain economic outlook, a central bank that left all doors open in terms of new easing measures, the absence of inflation and vigorous search for yield,” said Nordea Bank chief strategist Jan von Gerich. “It was almost bound to happen.”