With nearly 90% of millennials reporting that they have less than $10,000 in savings and more than 100 million Americans of working age with nothing in retirement accounts, we have bad news for basement-dwelling millennials invested in the “waiting for Mom and Dad to die” model;

Reverse mortgages are set to make a comeback if a consortium of lenders have their way, according to Bloomberg.

Columbia Business School real estate professor Chris Mayer – who’s also the CEO of reverse mortgage lender Longbridge Financial, says the widely-panned financial arrangements deserve a second look. Mayer is a former economist at the Federal Reserve of Boston with a Ph.D. from MIT.

In 2012, Mayer co-founded Longbridge, based in Mahwah, New Jersey, and in 2013 became CEO. He’s on the board of the National Reverse Mortgage Lenders Association. He said his company, which services 10,000 loans, hasn’t had a single completed foreclosure because of failure to pay property taxes or insurance. –Bloomberg

Reverse mortgages allow homeowners to pull equity from their home in monthly installments, lines of credit or lump sums. Over time, their loan balance grows – coming due upon the borrower’s death. At this point, the house is sold to pay off the loan – typically leaving heirs with little to nothing.

Elderly borrowers, meanwhile, must continue to pay taxes, insurance, maintenance and utilities – which can lead to foreclosure.

While even some critics agree that reverse mortgages make sense for some homeowners – they have been criticized for excessive fees and tempting older Americans into spending their home equity early instead of using it for things such as healthcare expenses. Fees on a $100,000 loan on a house worth $200,000, for example, can total as much as $10,000 – and are typically wrapped into the mortgage.

“The profits are significant, the oversight is minimal, and greed could work to the disadvantage of seniors who should be protected by government programs and not targeted as prey,” said critic Dave Stevens – former Obama administration Federal Housing Administration commissioner and former CEO of the Mortgage Bankers Association.

To support his claims that reverse mortgages are far less risky than they used to be, Mayer cites a 2014 study by Alicia Munnell of Boston College’s Center for Retirement Research. Munnell, a professor and former assistant secretary of the Treasury Department in the Clinton Administration (who once invested $150,000 in Mayer’s company and has since sold her stake). Munnell concluded that industry changes requiring lenders to assess a prospective borrower’s ability to pay property taxes and homeowner’s insurance significantly reduces the risk of a reverse mortgage.

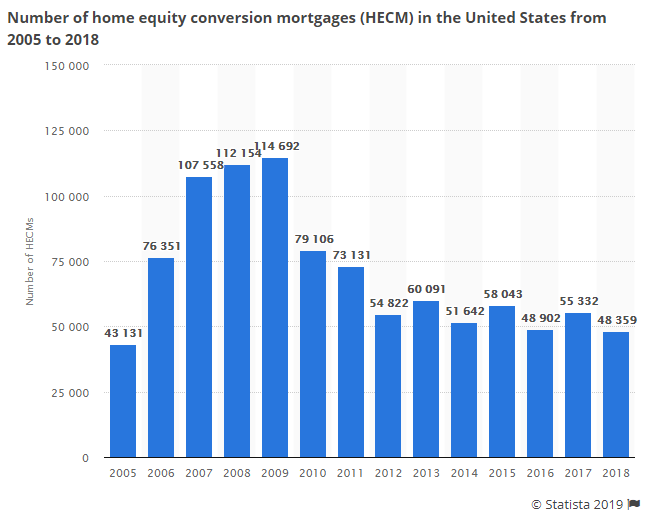

The number of reverse mortgages, or Home Equity Conversion Mortgages (HECM) in the United States between 2005 and 2018 has not shown a recent upward trend – however that may change if Mayer and his cohorts are able to convince homeowners that reverse mortgages aren’t what they used to be.

Cleaning up their image

For years, the reverse mortgage industry has relied on celebrity pitchmen to convince Americans to part with the equity in their homes in order to maintain their lifestyle.

The late Fred Thompson, a U.S. senator and Law & Order actor, represented American Advisors Group, the industry’s biggest player. These days, the same company leans on actor Tom Selleck.

“Just like you, I thought reverse mortgages had to have some catch,” Selleck says in an online video. “Then I did some homework and found out it’s not any of that. It’s not another way for a bank to get your house.”

Michael Douglas, in his Golden Globe-winning performance on the Netflix series The Kominsky Method, satirizes such pitches. His financially desperate character, an acting teacher, quits filming a reverse mortgage commercial because he can’t stomach the script. –Bloomberg

In 2016, American Advisers and two other companies were accused by the US Consumer Financial Protection Bureau of running deceptive ads. Without admitting guilt, American Advisers agreed to add more caveats to its promotions and paid a $400,000 fine.

As a result, the company has made “significant investments” in compliance, according to company spokesman Ryan Whittington, adding that reverse mortgages are now “highly regulated, viable financial tools,” which require homeowners to undergo third-party counseling before participating in one.

The FHA has backed more than 1 million such reverse mortgages. Homeowners pay into an insurance fund an upfront fee equal to 2 percent of a home’s value, as well as an additional half a percentage point every year.

After the last housing crash, taxpayers had to make up a $1.7 billion shortfall because of reverse mortgage losses. Over the past five years, the government has been tightening rules, such as requiring homeowners to show they can afford tax and insurance payments. –Bloomberg

As a result of tightened regulations, the number of reverse mortgage loans has dropped significantly since 2008.

Making the case for reverse mortgages is Shelly Giordino – a former executive at reverse mortgage company Security 1 Lending, who co-founded the Funding Longevity Task Force in 2012.

Giordino now works for Mutual of Obama’s reverse mortgage division as their “head cheerleader” for positive reverse mortgages research. One Reverse Mortgage CEO Gregg Smith said that the group is promoting “true academic research” to convince the public that reverse mortgages are a good idea.

Mayer under fire

University of Massachusetts economics professor Gerald Epstein says that Columbia may need to scrutinize Mayer’s business relationships for conflicts of interest.

“They really should be careful when people have this kind of dual loyalty,” said Epstein.

Columbia said it monitors Mayer’s employment as CEO of the mortgage company to ensure compliance with its policies. “Professor Mayer has demonstrated a commitment to openness and transparency by disclosing outside affiliations,” said Chris Cashman, a spokesman for the business school. Mayer has a “special appointment,” which reduces his salary and teaching load and also caps his hours at Longbridge, Cashman said.

Likewise, Boston College said it reviewed Professor Munnell’s investment in Mayer’s company, on whose board she served from 2012 through 2014. Munnell said another round of investors in 2016 bought out her $150,000 stake in Longbridge for an additional $4,000 in interest.

“Anytime I had a conversation like this, I had to say at the beginning that I have $150,000 in Longbridge,” said Munnell. “I had to do it all the time. I’m just as happy to be out, for my academic life.”