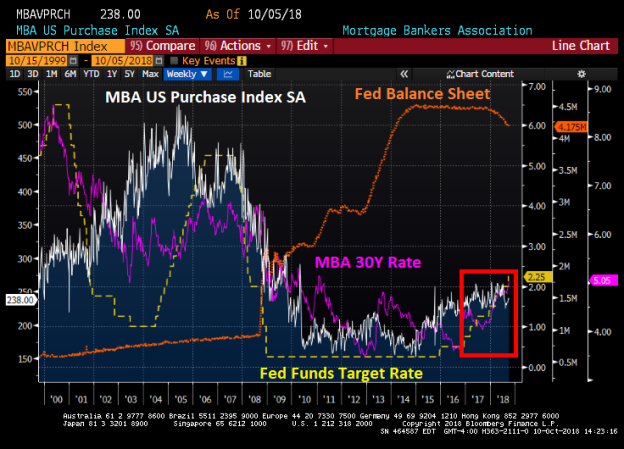

It was inevitable. Federal Reserve rate hikes and balance sheet shrinkage is having the predictive effect: killing mortgage refinancing applications.

And, mortgage purchases applications SA have stalled in terms of growth with Fed rate hikes and balance sheet shrinkage.

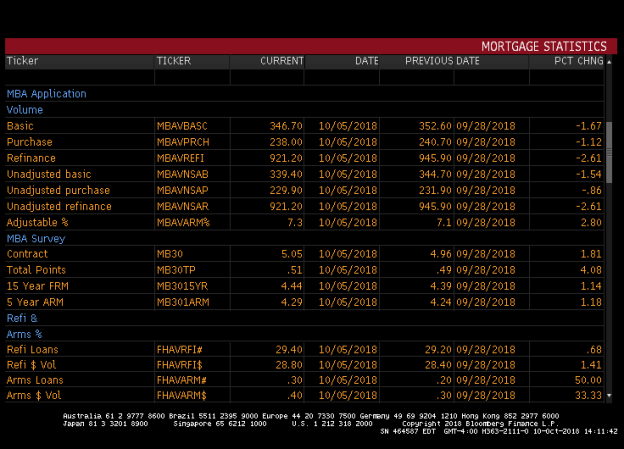

WASHINGTON, D.C. (October 10, 2018) – Mortgage applications decreased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 5, 2018.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.7 percent on a seasonally adjusted basis from one week earlier. On an un-adjusted basis, the Index decreased 2 percent compared with the previous week. The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The un-adjusted Purchase Index decreased 1 percent compared with the previous week and was 2 percent higher than the same week one year ago.

The refinance share of mortgage activity decreased to 39.0 percent of total applications from 39.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 7.3 percent of total applications.

The FHA share of total applications increased to 10.5 percent from 10.2 percent the week prior. The VA share of total applications remained unchanged at 10.0 percent from the week prior. The USDA share of total applications increased to 0.8 percent from 0.7 percent the week prior.

Yes, The Fed has begun its bomb run.