After months (or years) of on-again, off-again headlines, President Trump is expected to sign a memo on an overhaul of Fannie Mae and Freddie Mac this afternoon, kick-starting a lengthy process that could lead to the mortgage giants being freed from federal control.

The White House has been promising to release a plan for weeks, and its proposal would be the culmination of months of meetings between administration officials on what to do about Fannie and Freddie.

Bloomberg reports that while Treasury Secretary Steven Mnuchin has said it’s a priority to return the companies to the private market, such a dramatic shift probably won’t happen anytime soon.

In its memo, the White House sets out a broad set of recommendations for Treasury and HUD, such as increasing competition for Fannie and Freddie and protecting taxpayers from losses.

The memo itself has a worryingly familiar title (anyone else thinking 2007 housing bubble?):

President Donald J. Trump Is Reforming the Housing Finance System to Help Americans Who Want to Buy a Home

“We’re lifting up forgotten communities, creating exciting new opportunities, and helping every American find their path to the American Dream – the dream of a great job, a safe home, and a better life for their children.”

President Donald J. Trump

REFORMING THE HOUSING FINANCE SYSTEM: The United States housing finance system is in need of reform to help Americans who want to buy a home.

- Today, the President Donald J. Trump is signing a Presidential memorandum initiating overdue reform of the housing finance system.

- During the financial crisis, Fannie Mae and Freddie Mac suffered significant losses and were bailed out by the Federal Government with billions of taxpayer dollars.

- Fannie Mae and Freddie Mac have been in conservatorship since September 2008.

- In the decade since the financial crisis, there has been no comprehensive reform of the housing finance system despite the need for it, leaving taxpayers exposed to future bailouts.

- Fannie Mae and Freddie Mac have grown in size and scope and face no competition from the private sector.

- The Department of Housing and Urban Development’s (HUD) housing programs are exposed to high levels of risk and rely on outdated business processes and systems.

PROMOTING COMPETITION AND PROTECTING TAXPAYERS: The Trump Administration will work to promote competition in the housing finance market and protect taxpayer dollars.

- The President is directing relevant agencies to develop a reform plan for the housing finance system. These reforms will aim to:

- End the conservatorship of Fannie Mae and Freddie Mac and improve regulatory oversight over them.

- Promote competition in the housing finance market and create a system that encourages sustainable homeownership and protects taxpayers against bailouts.

- The President is directing the Secretary of the Treasury and the Secretary of Housing and Urban Development to craft administrative and legislative options for housing finance reform.

- Treasury will prepare a reform plan for Fannie Mae and Freddie Mac.

- HUD will prepare a reform plan for the housing finance agencies it oversees.

- The Presidential memorandum calls for reform plans to be submitted to the President for approval as soon as practicable.

- Critically, the Administration wants to work with Congress to achieve comprehensive reform that improves our housing finance system.

HELPING PEOPLE ACHIEVE THE AMERICAN DREAM: These reforms will help more Americans fulfill their goal of buying a home.

- President Trump is working to improve Americans’ access to sustainable home mortgages.

- The Presidential memorandum aims to preserve the 30-year fixed-rate mortgage.

- The Administration is committed to enabling Americans to access Federal housing programs that help finance the purchase of their first home.

- Sustainable homeownership is the benchmark of success for comprehensive reforms to Government housing programs.

* * *

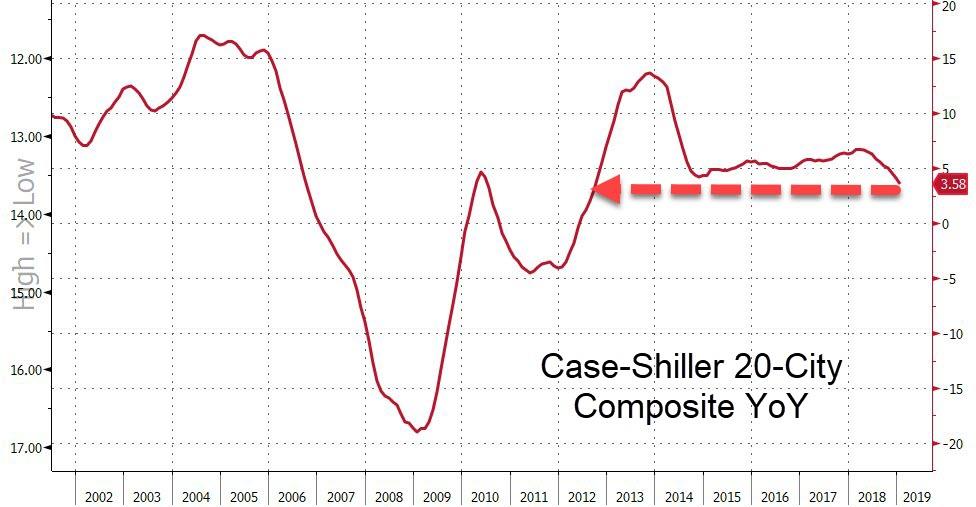

Because what Americans need is more debt and more leverage at a time when home prices are at record highs and rolling over.

Hedge funds that own Fannie and Freddie shares have long called on policy makers to let the companies build up their capital buffers and then be released from government control.

It’s unclear whether the White House would be willing to take such a significant step without first letting lawmakers take another stab at overhauling the companies.

But not everyone is excited about the recapitalizing Fannie Mae and Freddie Mac. Edward DeMarco, president of the Housing Policy Council, warned that releasing them from conservatorship would do nothing to fix the mortgage giants’ charters or alter their implied government guarantee:

“I’m not sure what is good about recap and release,” DeMarco, a former acting director of the Federal Housing Finance Agency, said in a phone interview.

DeMarco also noted that the government stepped in to save the companies in 2008, and they continue to operate with virtually no capital. On Tuesday, DeMarco told the Senate, during the first of two hearings on the housing finance system that “recap and release should not even be on the table.”

But shareholders in the firms were excitedly buying… once again.

Deciding the fate of Fannie and Freddie, which stand behind about $5 trillion of home loans, remains the biggest outstanding issue from the 2008 financial crisis.