“Real Estate Tech” in Existential Crisis as Housing Sours, Stocks Plunge, New Money Out of Reach: Redfin & Compass Try to Survive by Cutting Staff. Opendoor, Zillow Sag

In short, the party ran out of bamboozle.

(Wolf Richter) Here’s the problem with companies whose hype-and hoopla stocks have collapsed by 80% or 90%: They’re facing an existential crisis. They cannot raise more money. But their operations were never designed to make money in the first place. Their business model relied on burning cash, and the whole thing was designed from get-go to use home-made growth metrics to bamboozle investors into buying the stock and pump up the shares. Then the companies, based on their high share price, could issue more shares and raise more money, and feed their cash-burn machine. The plan was to fake it until they could make it.

But with their shares down 80% or 90%, they cannot fake it any longer, and they cannot sell more shares because no one wants them, and they’re going to run out of cash and won’t be able to cover their expenses, and then they cease to exist, and their shares will go to zero, unless they can get the cash-outflows under control, which means cost-cutting. And the fastest and most significant places to cut cost is staff and advertising.

If they cannot cut their costs enough, and cannot get their expenses to be less than their revenues, they’ll eventually run out of money. And then that’s it.

But if they can cut costs enough, and cut their staff and advertising and other things enough, so that costs come in line, their revenues may sag, or sag even more, and then they may be reporting declining revenues, or more rapidly declining revenues, and continued losses because revenues are now declining faster than expenses, and the whole thing turns into a classic mess.

There are hundreds of companies in this position that went public during the hype-and-hoopla era of money printing and interest rate repression, and they’re all fundamentally facing the same existential crisis, though each company has unique challenges, and in addition, all have to face their industry challenges.

Just to stay within one industry: Today two companies in “real estate tech” with collapsed hype-and-hoopla stocks announced job cuts: Compass and Redfin. Two others had massive layoffs earlier. Zillow, which is also in real estate tech, has been laying off people since last year, when it exited its home-flipping fiasco, with layoffs occurring through at least April this year. Unrepentant home flipper Opendoor went through a bunch of layoffs in 2020, but has not recently announced any new layoffs.

They all have one thing in common: They lost lots of money every year of their existence as a publicly traded company.

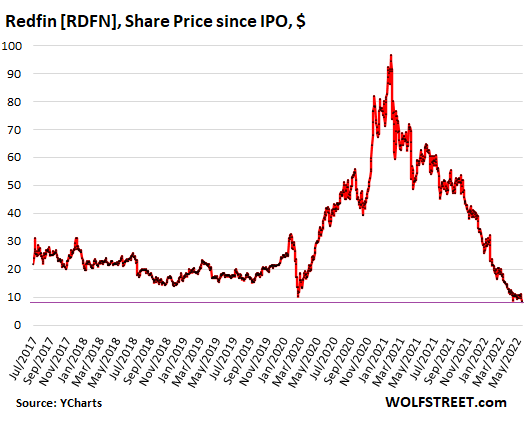

Redfin, the “Amazon of real estate,” as CEO Glenn Kelman called it as part of the bamboozle before the IPO in 2017, announced today that it would lay off 8% of its staff “today” because “It’s time to make money.”

“We’re losing many good people today, but in order for the rest to want to stay, we have to increase Redfin’s value. And to increase our value, we have to make money,” it said.

Apparently, there had been some kind of come-to-Jesus meeting at the top, with “May demand 17% below expectations,” and “not enough work for our agents and support staff,” and the decline in revenues means “less money for headquarters projects.” Yup, the holy-moly mortgage rates that just went over 6%.

Redfin has been a publicly traded company since July 2017, and has existed for 13 years before then as a startup, and it’s just now time to think about how to make money?

Good grief. I mean, Oopsiespalooza. I mean, WTF. This is the definition of what’s wrong with the entire hype-and-hoopla startup scene.

On the news, shares of Redfin [RDFN] fell to a new closing low of $8.13. Back when it was still the Amazon of Real Estate, in 2017, it went public at the IPO price of $15. Shares briefly spiked to $30 then got stuck at around $20 for years.

But during the pandemic, the stock encountered the miracles of the stock jockeys that plowed their stimmies into whatever, the meme-stock chasers, and the hedge funds that followed them, and they all had a hoot and catapulted the shares to $98.44 in February 2021, yes, that infamous February 2021, after which the bamboozle ran out, and everyone began ever so slowly to sober up, and everything came unglued. Since then, Redin’s shares have collapsed 92%:

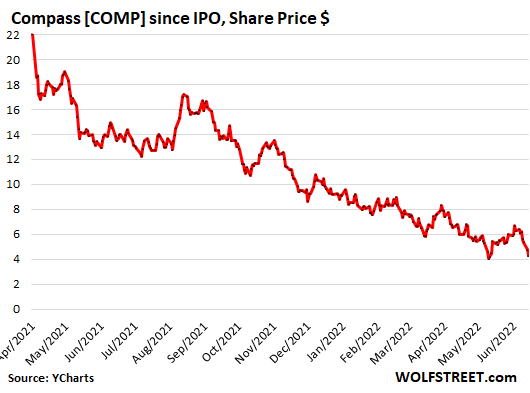

Compass announced today – after they too apparently had a come-to-Jesus meeting at the top – the “elimination” of 10% of its staff, about 450 folks. It said it would shut down its title and escrow software company, Modus Technologies, which it had bought in 2020, get out of some office leases, and halt further acquisitions, “to drive toward profitability and positive free cash flow.”

The real estate brokerage was backed by SoftBank and had raised $1.5 billion before the IPO, which it then spent, plus the money it raised in the IPO, on buying up real estate brokerages and on hiring brokers away from other brokerages.

So, now it wants to cost-cut its way to positive cash-flow and profitability after it couldn’t make money in what was for years the hottest housing market ever, where people paid no matter what to buy no matter what, sight-unseen, inspections-waived, no-questions-asked?

It is facing an existential crisis because its stock crashed, and it cannot raise new money to burn, and the real estate market has turned south, with demand withering amid holy-moly mortgage rates over 6%, and home sales are going to be far fewer and far harder to get.

Upon the news that Compass is now trying to figure out how to cost-cut its way to a positive cash flow as revenues are going to take a hit, and as its fake growth model fell apart, the shares kathoomphed 10.5%, to $4.26 a share, down 81% from the high, which occurred on the day of the IPO. Just about every investor that got bamboozled into touching this got shookalacked:

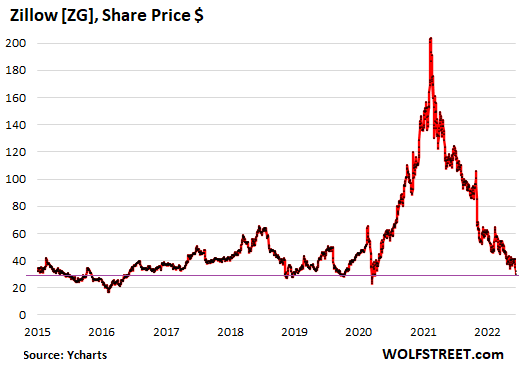

Zillow didn’t make any additional layoff announcements today, but given the conditions that the housing market is now facing, and the plight of Redfin and Compass, its shares dropped 6.2% today, to $30.22, down 86% from its meme-stock-stimmie-miracle high of February 2021, and back where it had first been in 2013. It probably saw something coming in its vast housing market data when it decided to get out of the house-flipping business last year:

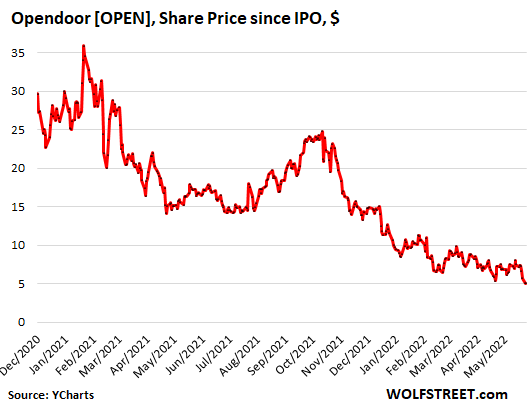

Opendoor Technologies, the home flipper that decided to stay in the home-flipping business – because what else is it going to do? – didn’t announce any layoffs today either. Its shares inched up 2 cents from its all-time low yesterday, to $5.04, down 87% from its high which occurred, you guessed it, in February 2021.

The company now faces the inconvenient challenge of selling thousands of houses that it had bought in the hottest housing market ever, but now there are these new holy-moly mortgage rates, and price drops are spreading, inventories rising, and volume is dropping, and everything is going to get a lot tougher than before.