https://www.thedailydoom.com/p/the-deeper-dive-where-are-we

Summery article about the following podcast from December 5th, 2023 that describes everything leading up to today’s frozen real estate market and probable circumstances that will break the ice wall during 2024 and 2025.

Tag Archives: real estate

The Music is Slowing

Mortgage Lending Just Broke, Fannie & Freddie Freaking Out!

Something is seriously wrong in the mortgage lending business with all the major players now on the defensive as once again it appears that widespread fraud is causing a major disruption to the flow of credit in real estate. Chaos has erupted in the mortgage business this week that the mainstream press is ignoring.

Real Estate Brokers Pocketing Up to 6% in Fees Draw Antitrust Scrutiny

(Bloomberg) — The lucrative broker commission system at the heart of the US residential housing market is facing unprecedented antitrust scrutiny from the Justice Department and two private class-action lawsuits that risk weakening the National Association of Realtors, the industry’s powerful lobbying group.

Unfinished High-Rises Coming Down In China

Should have flown airplanes into them so they just drop straight down into their own footprint.

Redfin Reports November Asking Rents Post Smallest Annual Increase in 15 Months

Rents are growing at half the pace they were in the summer and are expected to keep cooling, which should help bring down overall inflation

What Happened To Dubai Man Made Islands?

It has been over twenty years since the construction of the man-made islands of Dubai began, the world’s largest artificial archipelago. Widely announced as the star project of the urban development of the United Emirate, two decades later, the story is very different to what the developers would have imagined. Islands yet to be completed, abandoned projects, the sea reclaiming its space… even so, Dubai is not giving up and it is confident that, despite the delay, it’s dream will become a reality.

Real Estate Just Did It

Home prices cool at a record pace as real estate sales grind down further every week across America. While some people are still wondering when real estate prices will go down, I am here to explain how the housing crash has already begun!

Referenced In The Video: Home prices cooled at a record pace in June, according to housing data firm

Squatters Occupy Portland Homes As Helpless Homeowners Desperately Try To Sell

“Unfortunately there are squatters on the property and seller does not have resources to remove them and is willing to negotiate the price for a buyer to take the risk of closing.”

Steve Cortes Explains The Economic Crisis Coming To China: ‘2008 Will Seem Tame’

The CCP is losing legitimacy with the Chinese people.

Sharp Decline in Pending Sales, Inventory Surges In California

“Real Estate Tech” in Existential Crisis

“Real Estate Tech” in Existential Crisis as Housing Sours, Stocks Plunge, New Money Out of Reach: Redfin & Compass Try to Survive by Cutting Staff. Opendoor, Zillow Sag

In short, the party ran out of bamboozle.

Goldman Sachs-Backed Funds Buy Up Entire Florida Neighborhood for $45 Million

(Abby Liebing) In the midst of a growing housing and economic crisis, Wall Street investors are using this as an opportunity to purchase rental properties. Two investment funds backed by Goldman Sachs bought a community of Florida homes for $45 million, WFLA reported. The development is Cypress Bay, which is located in Brevard County in Palm Bay, Florida. It is a community of 87 single-family rental homes.

Curveballs In The Housing Bubble Bust

All these curveballs will further fragment the housing market.

No Way Does China Save Us From The Next Bust

Hawaii’s Ultra-Luxury Real Estate Market Smashes Records, As Sales Soar 600%

- In Hawaii, an average of 16 luxury homes sold per week every single week for 39 weeks straight, according to data from Hawaii Life’s Luxury Market Report.

- For the first three quarters of the year, deal volume hit a record-breaking $3.698 billion, and many of these transactions were done in cash.

- There was staggering growth in the ultra-luxury market, which includes homes priced above $10 million, as well.

This $23.5 million mansion in Kauai recently sold to guitarist Carlos Santana (PanaViz).

Inside The Most Expensive Listing Ever In Weston, FL | Mansion Tour

Go inside the most expensive home to ever hit the market in Weston, FL. The $14,000,000 mansion is located around 20 miles west of Fort Lauderdale. The residence is called the Monarch Estate. It unfolds over 12,323 sq ft with 7 bedrooms, 11 baths, and a 93 foot infinity pool all situated on a gorgeous lake. Take the exclusive mansion tour with CNBC’s Ray Parisi and real estate broker Senada Adzem. Take a look.

Signs Of V-Shaped Housing Recovery In May

Summary

- U.S. equity markets surged this week, buoyed by positive vaccine data and on renewed hopes of a V-shaped economic recovery as countries around the world begin the reopening process.

- The S&P 500 ended the week higher by 3.1%, closing nearly 35% above its lows in late March despite another slate of ugly unemployment data that looms over the recovery.

- Real estate equities led the gains this week, propelled by a bounce-back in many of the most beaten-down property sectors including retail and hotels that were ravaged by the lock downs.

- Home builders continued their recent resurgence as high-frequency housing data has indicated that the housing industry may indeed be leaders of the post-coronavirus economic rebound.

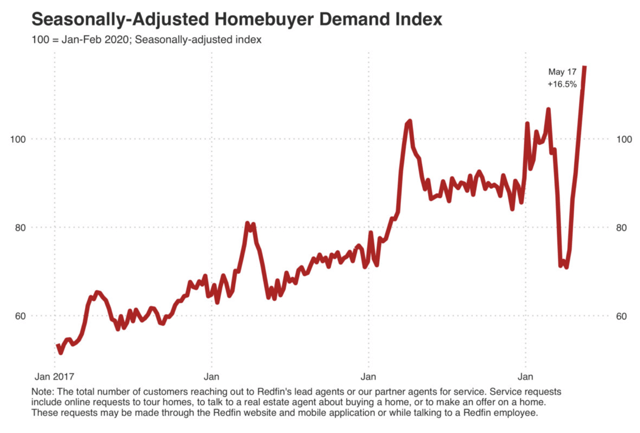

- Fresh data from Redfin showed a “stunning” rebound in housing market activity over the last month as home buying demand is now 16.5% above pre-coronavirus levels while home values have seen accelerating growth.

Real Estate Weekly Outlook

(via Hoya Capital) U.S. equity markets surged this week, buoyed by news of positive clinical trial results from Moderna (MRNA) and Inovio Pharmaceuticals (INO) and on renewed hopes of a V-shaped economic recovery as most states and countries around the world have begun the post-coronavirus reopening process. Contrary to the predictions of some experts, the virus has remained on the retreat even in states that were among the first to reopen, while emerging evidence – detailed in a report by JPMorgan – suggests that lock downs may have actually aggravated rather than mitigated the impacts of the disease. Uncertainty remains, however, over how quickly the economic damage can be reversed and the “shape” of the economic recovery in the back half of 2020.

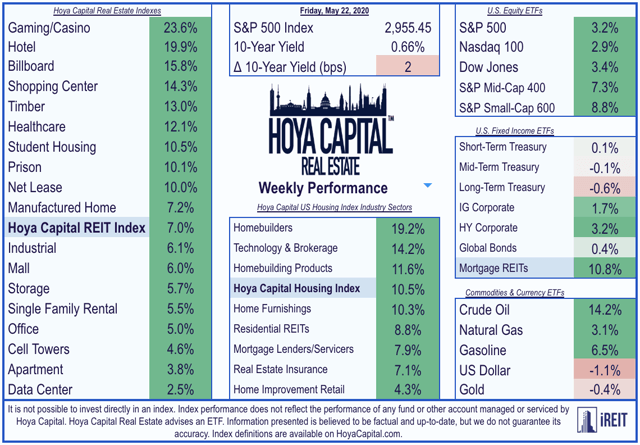

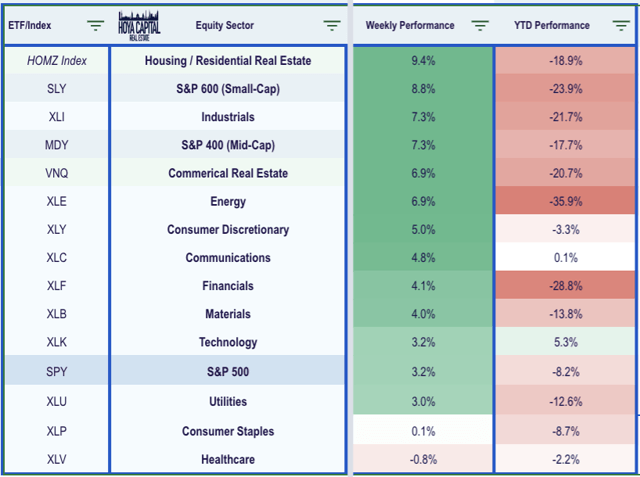

Following a decline of 2.1% last week, the S&P 500 ETF (SPY) ended the week higher by 3.1%, closing nearly 35% above its lows in late March. Real estate equities led the gains this week, reversing almost all of last week’s steep declines, propelled by a bounce-back in many of the most beaten-down property sectors that were ravaged by the economic lock downs. Closing roughly 30% off its lows in March, the broad-based Equity REIT ETFs (VNQ) (SCHH) surged 7.0% with all 18 property sectors in positive territory while Mortgage REITs (REM) jumped 10.8% on the week, closing 55% above its March lows amid clear signs of stabilizing in the mortgage markets.

The more pronounced strength this week was seen in the recently lagging Mid-Cap (MDY) and Small-Cap (SLY) indexes which delivered strong out performance, surging by 7.3% and 8.8% respectively. The gains this week came despite another round of ugly economic data including Initial Jobless Claims data that showed that another 2.43 million Americans filed for unemployment benefits last week, bringing the eight-week total to over 38 million. However, flashes of strength have become increasingly more evident in recent weeks – particularly in the all-important U.S. housing market – and commentary from corporate earnings reports over the last two weeks indicated that the economic rebound is already beginning to take hold in many segments of the economy. The Industrials (XLI), Energy (XLE), and Consumer Discretionary (XLY) sectors joined the real estate sectors as top-performers on the week while Healthcare (XLV) was the lone sector in the red.

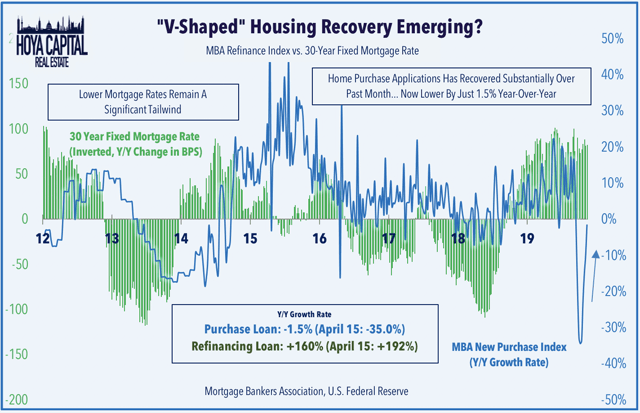

Home builders and the broader Hoya Capital Housing Index were among the standouts this week as recent high-frequency housing data has indicated that the housing market may indeed be the leader of the post-coronavirus economic rebound. The gains came following fresh data from Redfin (RDFN) that showed a “stunning” rebound in housing market activity over the last month as home buying demand is now 16.5% above pre-coronavirus levels on a seasonally-adjusted basis, gains which have been “driven by record-low mortgage rates as pent-up demand is unleashed.” This data was broadly consistent with recent commentary from home builders and data released earlier this week from the Mortgage Bankers Association which showed that home purchase mortgage applications rose for the 5th straight week and are now lower by just 1.5% from last year compared to the 35% decline in April.

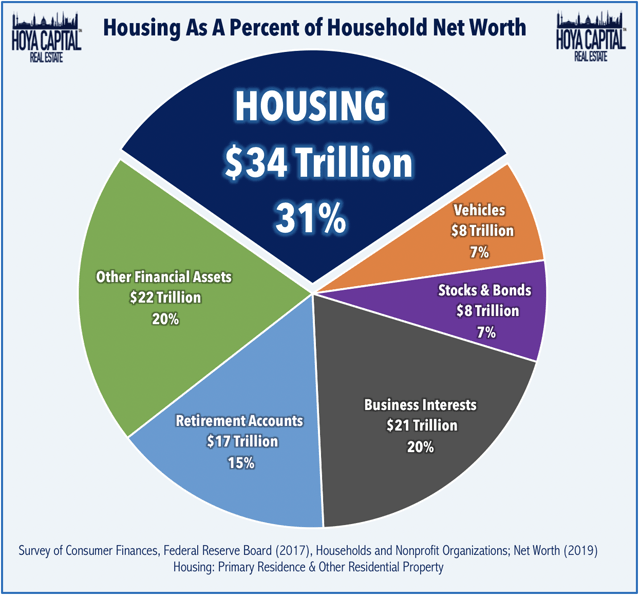

As goes the U.S. housing market, so goes the U.S. economy. Residential real estate is by far the most significant asset on the aggregate U.S. household balance sheet and the value of the U.S. housing market is larger than the combined market capitalization of every U.S. listed company. As we’ve discussed for many years, it’s impossible to overstate the importance of the U.S. housing market in forecasting macroeconomic trends for the broader economy and just as it was impossible to avoid a deep and lasting economic recession from the sub-prime housing crisis, it is difficult to envision the “depression-like” economic environment forecasted by some analysts without first seeing substantial instability in the housing market. While very early in the economic recovery, we’re so far observing quite the opposite as the combination of favorable millennial-led demographics, record-low mortgage rates, and a substantial under supply of housing units after a decade of historically low levels of new construction continue to be relentless tailwinds.

Real Estate Earnings Season Wrap-Up

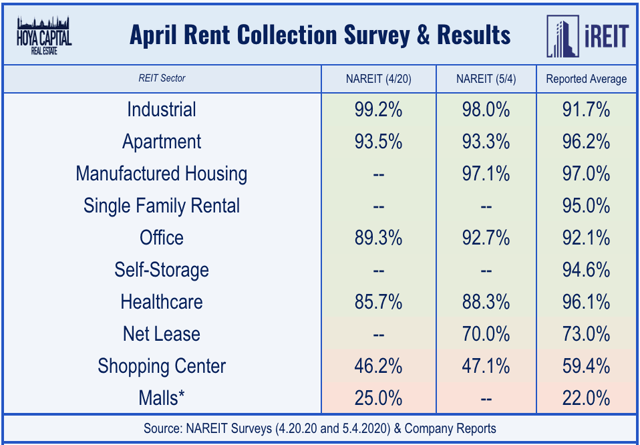

While the residential real estate sector may be an area of relative out performance during the post-coronavirus economic recovery, other areas of the commercial real estate sector face a more uncertain future. Real estate earnings season wrapped up this week with a handful of late-reporting stragglers, so the final numbers for rent collection are now in. Rent collection has been largely a non-issue for residential, industrial, and office REITs, as each sector has collected over 90% of April rents. For retailers, if you’re not essential, you’re not probably paying the rent. Collection among mall REITs averaged around 22% while shopping center REITs collected roughly 60% of April rents and net lease REITs collected 73% of rents.

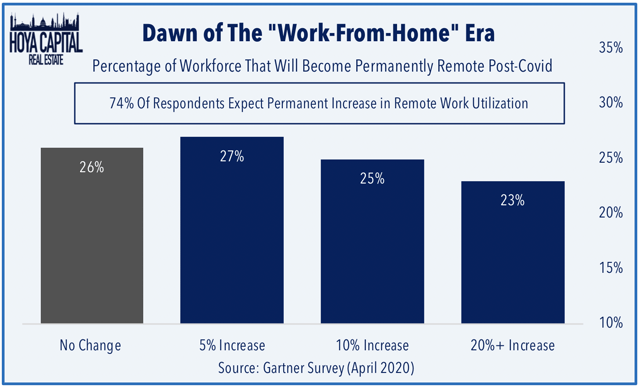

Even among the commercial REIT sectors that reported solid rent collection in April, there are some areas of concern regarding their respective long-term outlook in the post-coronavirus world. Earlier this week, we published Office REITs: Coronavirus Killed Corporate Culture. Office REITs have been pummeled during the coronavirus pandemic amid mounting questions over the long-term demand outlook as businesses become increasingly more comfortable with “remote work” environments as reports surfaced this week that Facebook (FB) and others plan to permanently shift workers to work-from-home arrangements. Zoom (ZM) and “work-from-home” technology suites have emerged as the bigger competitive threat to the office REIT sector as more than half of the companies expect to shrink their physical footprint.

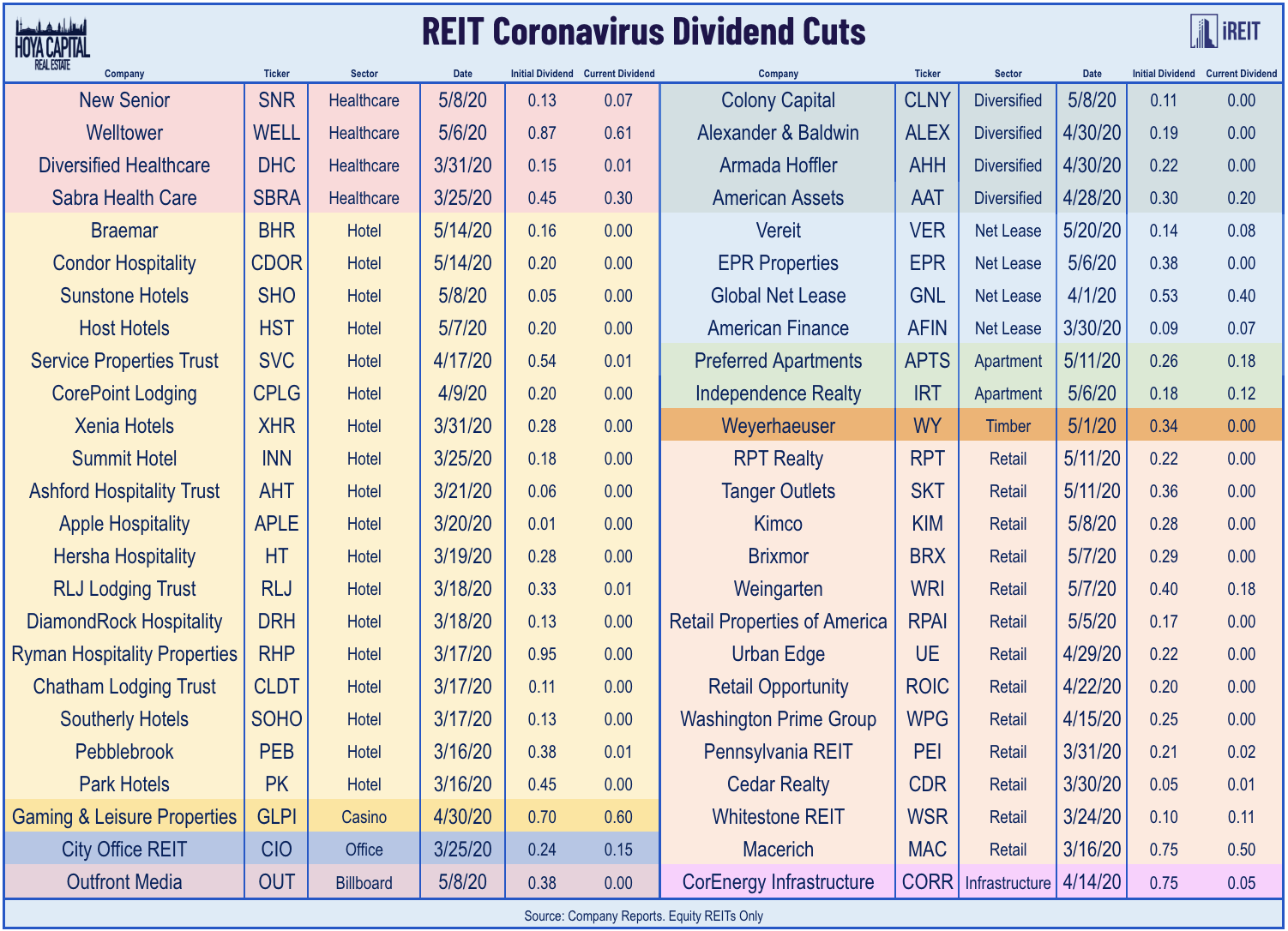

Two more equity REITs were added to the Coronavirus Dividend Cut list this week: net lease REIT VEREIT (VER) and Braemar Hotels (BHR). We’ve now tracked 50 equity REITs in our universe of 165 names to announce a cut or suspension of their dividends, the vast majority of which have come from the retail and hotel REIT sectors. Apart from their sector affiliations, the equity REITs that have cut or suspended their dividends have been almost exclusively companies in the smallest third of market capitalization within the REIT sector and in the highest third in terms of leverage metrics as the “outperforming factors” that we discussed earlier this year in The REIT Paradox: Cheap REITs Stay Cheap have been on full display in 2020.

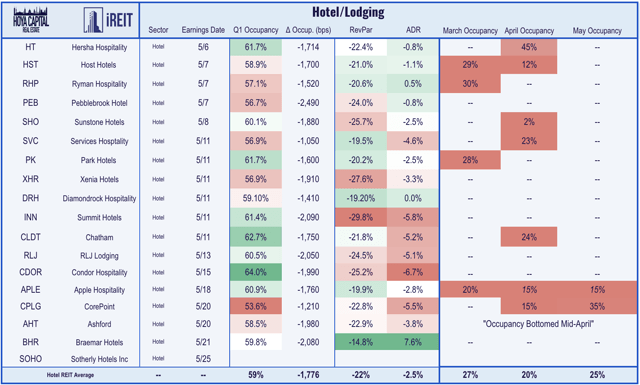

Among the handful of stragglers to report results this week were four hotel REITs including the aforementioned Braemar Hotels along with Apple Hospitality (APLE), CorePoint (CPLG), and Ashford (AHT). While Q1 occupancy and Revenue Per Available Room (RevPAR) metrics were understandably ugly across the hotel REIT sector, commentary on earnings calls this week suggested that we’ve likely seen the worst of the occupancy declines as Ashford’s management noted that “occupancy continues to increase on a weekly basis. We are seeing pick-up of room nights on a short-term basis and the pace of that pickup is increasing almost daily.”

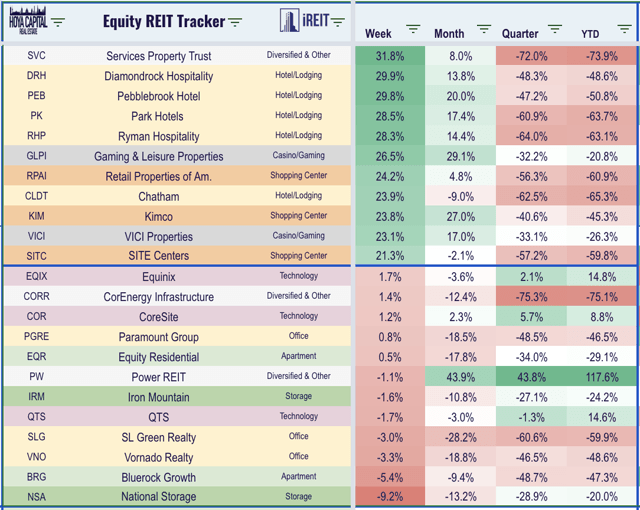

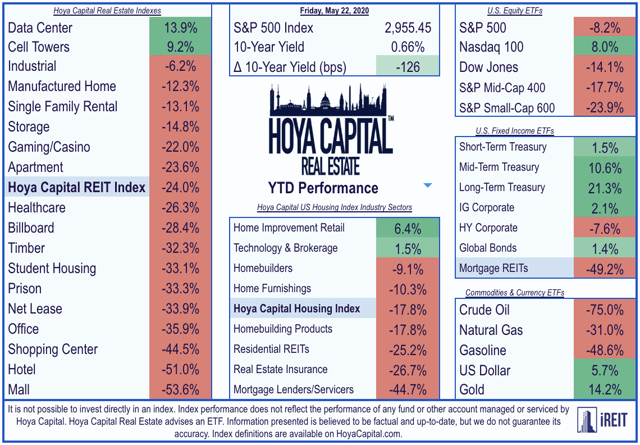

All 18 REIT sectors finished in positive territory this week as hotel and casino REITs including Gaming & Leisure Properties (GLPI) and VICI Properties (VICI) were among the top performers this week as a growing number of hotels and casino properties across the country have announced plans to re-open over the next several weeks. Shopping center REITs, particularly those focused on the big-box segments like Retail Properties of America (RPAI), Kimco Realty (KIM), and SITE Centers (SITC), were also leaders this week after generally positive commentary on reopening plans from several big-box retailers including Best Buy (BBY). The technology REIT sectors – data centers and cell towers – were among the laggards this week, but remain the only two REIT sectors in positive territory on the year.

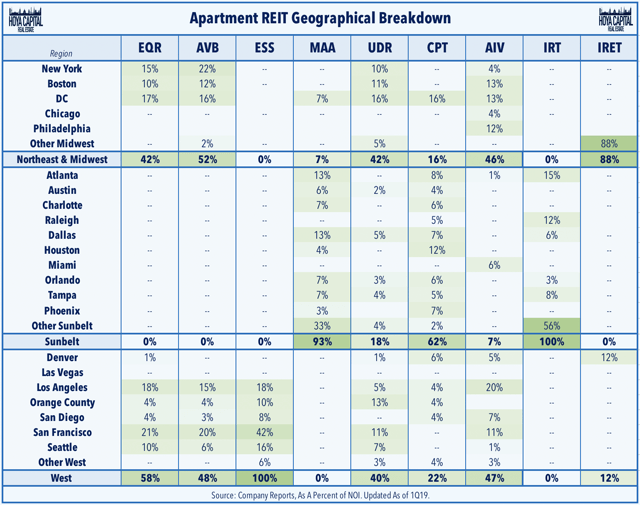

This week, published Apartment REITs: No Rent Strike, But Fears Of Urban Exodus. We discussed how apartment REITs reported limit issues with rent collection in April and early-May amid the depths of the pandemic-related shutdowns as more than 95% of rents were collected. Ultra-dense metros like NYC, Chicago, and San Francisco, however, may see lasting pain as residents flee to lower-cost and “safer” semi-urban and suburban markets, including faster-growing Sunbelt metros. Several REITs are more exposed than others from this trend and we detailed the geographical exposure of the nine largest multifamily REITs. As one of the more defensively-oriented and counter cyclical REIT sectors, we remain bullish on long-term rental fundamentals.

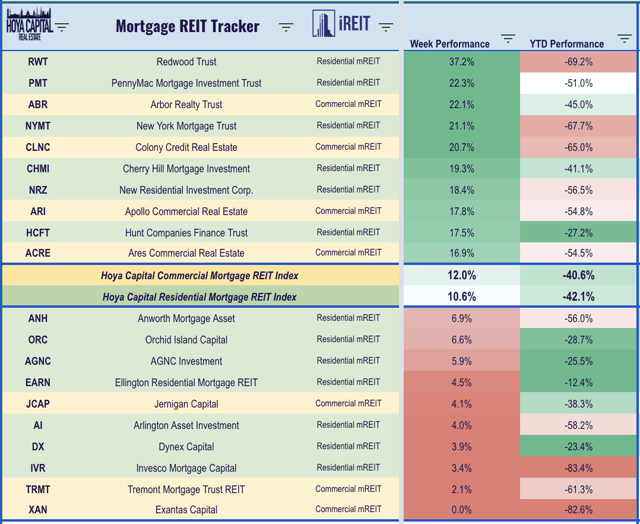

Mortgage REITs

Strong housing market data over the last several weeks has been good news for mortgage REITs as well as residential mREITs jumped another 10.6% this week while commercial mREITs gained 12.0%, each rebounding more than 50% from their lows in early April. New York Mortgage REIT (NYMT) was among the leaders this week after reporting solid Q1 results. New Residential (NRZ) was also among the leaders after providing an interim update in which it noted that had bolstered its liquidity position through an additional capital raise and noting that forbearance requests have continued to be lower than previously forecasted.

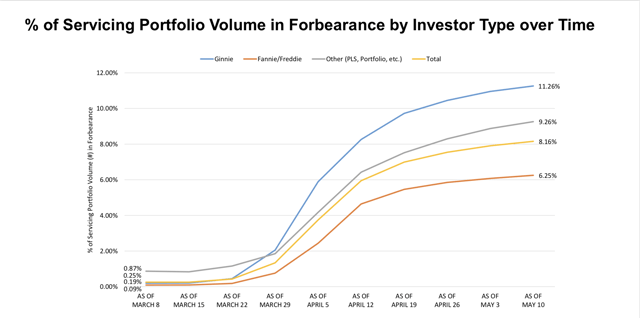

Helping the residential mREITs this week was news the FHFA has issued temporary guidance that should make it easier for homeowners who have taken advantage of COVID forbearance programs to refinance or buy a new home. Borrowers will be allowed to get a new mortgage three months after their forbearance period ends and they have made three consecutive payments under their repayment plan. Roughly 9% of mortgage loans representing roughly 4.75 million homeowners are now in forbearance, according to data released this week from Black Knight (BK), but a recent survey from LendingTree found that the majority of these borrowers chose to enter forbearance not out of necessity but simply because it was offered and available without any apparent penalty under the CARES Act.

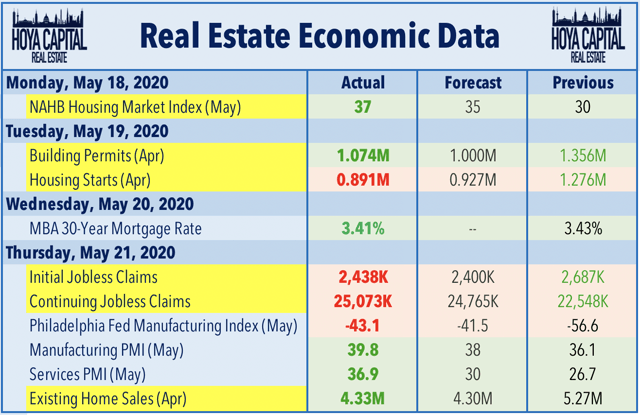

Real Estate Economic Data

Below, we analyze the most important macroeconomic data points over the last week affecting the residential and commercial real estate marketplace.

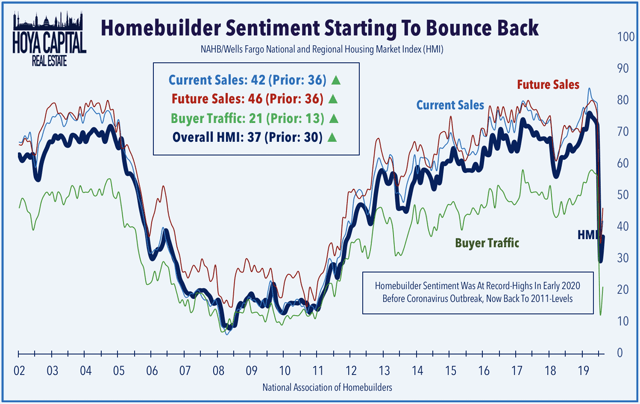

Housing Recovery Has Already Begun

Home builder Sentiment data released on Monday showed that confidence among home builders – particularly in the Southern region where the majority of publicly-traded home builders are based – has begun to bounce back from the lows in April. The NAHB Housing Market Index climbed to 37 from last month’s reading of 30, driven by a 12-point rebound in Future Sales expectations and an 8 point bounce in Buyer Traffic. Consistent with recent reports from other home builders, Meritage Home (MTH) announced this week that it believes that May orders could be “in line” with last May’s as the strong sales momentum seen during the last two weeks of April has carried over into early May.

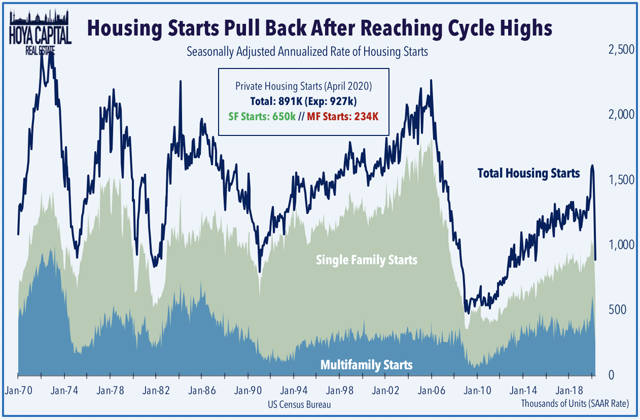

The U.S. housing industry was red-hot before the onset of the coronavirus crisis with Housing Starts, Building Permits, and New Home Sales all eclipsing post-cycle highs in early 2020. Backward-looking data released this week by the U.S. Census Bureau showed the magnitude of the decline in construction activity in April amid the worst of the pandemic. On a seasonally-adjusted annualized basis, housing starts and building permits fell to the lowest level since 2015 in April at 891k and 1,074k units, respectively, following a relatively solid March. Single-family starts and permits were actually quite a bit stronger than expected while the always volatile multifamily construction activity showed sharper declines in April.

Existing Home Sales also beat expectations in April, coming in at 4.33 million versus expectations of 4.30 million. Home purchase mortgage applications – a leading indicator of Existing Home Sales – rose for the 5th straight week and are now remarkably lower by just 1.5% from last year compared to the 35% decline in April according to data released this week by the Mortgage Bankers Association. The 30-Year Mortgage rate remains lower by roughly 90 basis points from the same week last year, a level of decline in mortgage rates that has historically been strongly correlated with robust growth in housing market activity under normal conditions.

2020 Performance Check-Up

REITs are now lower by roughly 24.0% this year compared with the 8.2% decline on the S&P 500 and 14.1% decline on the Dow Jones Industrial Average. Consistent with the trends displayed within the REIT sector, mid-cap and small-cap stocks continue to under perform their larger-cap peers as the S&P Mid-Cap 400 and S&P Small-Cap 600 are lower by 17.7% and 23.9%, respectively. The top-performing REIT sectors of 2019 have continued their strong relative performance through the early stages of 2020 as data centers and cell tower REITs remain the real estate sectors in positive territory for the year, while industrial and residential REITs have also delivered notable out performance. At 0.66%, the 10-Year Treasury Yield has retreated by 126 basis points since the start of the year and is roughly 260 basis points below recent peak levels of 3.25% in late 2018.

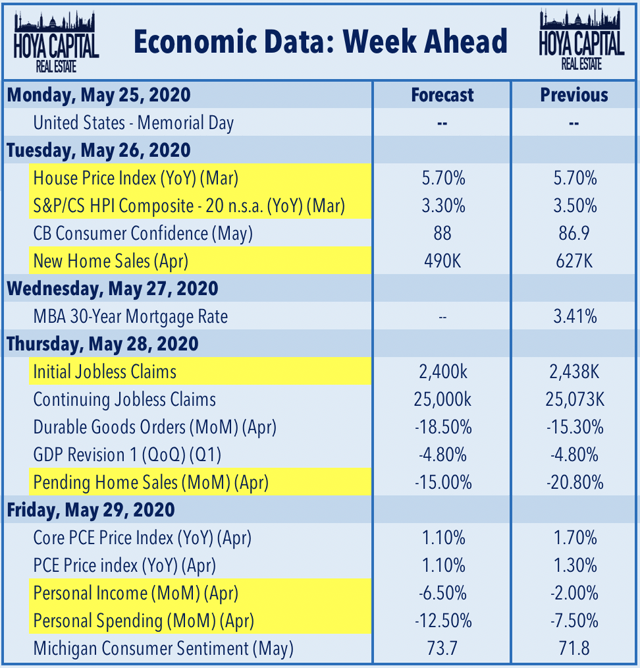

Next Week’s Economic Calendar

A busy two-week stretch of housing data continues next week with Home Price data from the FHFA and S&P Case-Shiller on Tuesday which is expected to show a steady rise in home prices in March during the early stages of the pandemic. New Home Sales data for April is also released on Tuesday while Pending Home Sales data for April is released on Thursday. Initial Jobless Claims data on Thursday will again be another “blockbuster” report with expectations that we will see another 2.5 million job losses, but we’ll be watching closely to the continuing claims for indications that temporarily-unemployed Americans are returning to work.

3 Reasons Real Estate Could CRASH That Investors Should Focus On Today

Is the real estate market on the brink of collapse? The US economy is headed for a recession if not a depression and as a result, real estate prices may drop. But there are no certainties, only probabilities. These are catalysts that could trigger incredible amounts of selling, which would flood the market with additional supply. IF this type of forced selling takes place, prices could collapse.

Will it play out like 2008-2012? Most likely not, but it could rhyme and the net result would be the same, prices plummeting in real terms (adjusted for inflation). If you’re interested in real estate, the housing market or the future of the economy, George Gammon dives deep into the demographic setup that may foreshadow much of tomorrow’s residential real estate market.

Expect Something Close To An Exodus From Expensive, Large Cities: Redfin CEO

Glenn Kelman, Redfin CEO, discusses the state of the residential home market and where he sees it headed as the coronavirus pandemic continues.

“Nobody was selling in March or April unless they absolutely had to. There was a sign of distress or panic in the market so sellers just withdrew. There weren’t many foreclosures because we’ve got so much forbearance in the lending markets, and that just means there was very little inventory in April”

Glen, where do you see markets that are going to be in trouble and distress potentially, and where do you see the opportunity.

“Yeah, well I’m worried about the big cities.

There will be something close to an exodus from these really large cities where housing is so expensive, to places like Charleston, Madison Wisconsin or Boise Idaho, places where it’s just more affordable and you can still walk around town a little bit. That’s where the search traffic has already shifted on our website. If you look where people are searching on Redfin, it is overwhelmingly people living in big cities, looking into small towns”

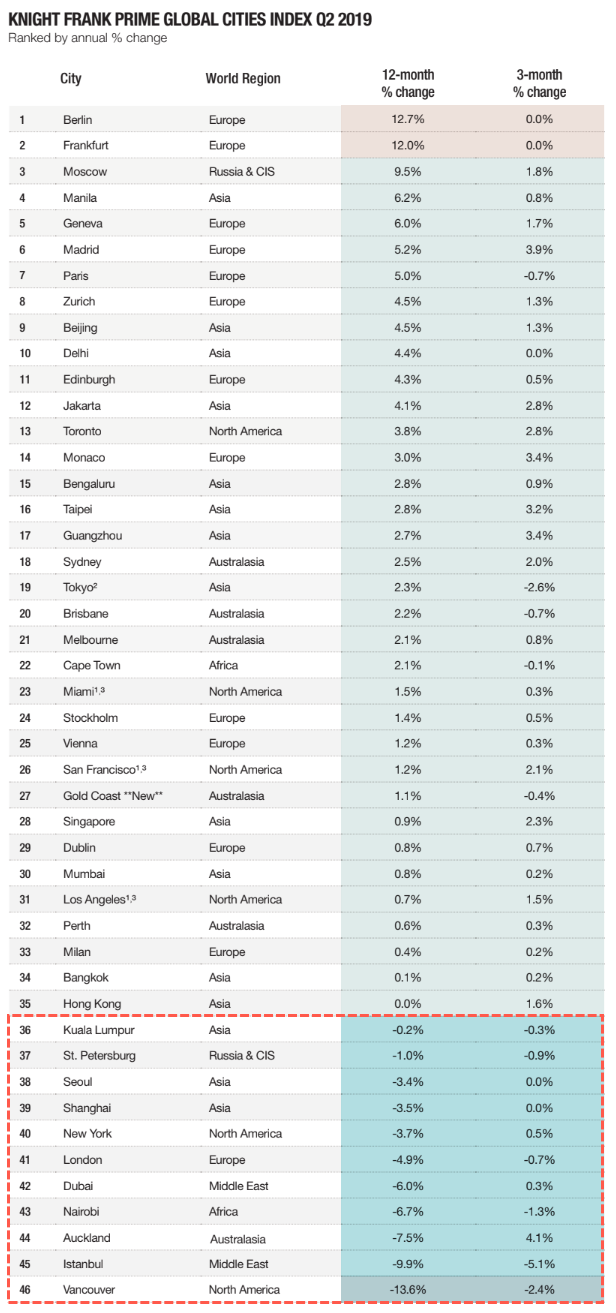

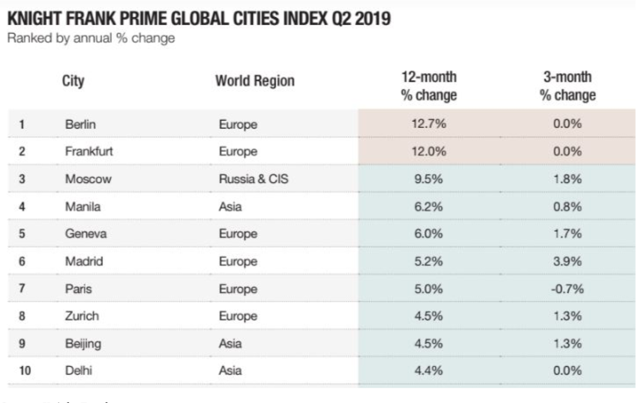

The Global Mansion Bust Has Begun

Global real estate consultancy firm Knight Frank LLP has warned that the global synchronized decline in growth coupled with an escalating trade war has heavily weighed on luxury home prices in London, New York, and Hong Kong.

According to Knight Frank’s quarterly index of luxury homes across 46 major cities, prices expanded at an anemic 1.4% in 2Q19 YoY, could see further stagnation through 2H19.

Wealthy buyers pulled back on home buying in the quarter thanks to a global slowdown, trade war anxieties, higher taxes by governments, and restrictions on foreign purchases.

Mansion Global said Vancouver was the hottest real estate market on Knight Frank’s list when luxury home prices surged 30% in 2016, has since crashed to the bottom of the list amid increased taxes on foreign buyers. Vancouver luxury home prices plunged 13.6% in 2Q19 YoY.

Financial hubs like Manhattan and London fell last quarter to the bottom of the list as luxury home prices slid 3.7% and 4.9%, respectively.

Hong Kong recorded zero growth in the quarter thanks to a manufacturing slowdown in China, an escalating trade war, and protests across the city since late March.

However, European cities bucked the trend, recorded solid price growth in 2Q19 YoY, though the growth was muted when compared to 2017-18.

Berlin and Frankfurt were the only two cities out of the 46 to record double-digit price growth for luxury homes. Both cities benefited from a so-called catch-up trade because prices are lower compared to other European cities. Moscow is No. 3 on the list, saw luxury home prices jump 9.5% in 2Q19 YoY.

The downturn in luxury real estate worldwide comes as central banks are frantically dropping interest rates. The Federal Reserve cut rates 25bps for the first time since 2008 last month, along with Central banks in New Zealand, India and Thailand have all recently reduced rates.

The main takeaway from central banks easing points to a global downturn in growth, and resorting to sharp monetary policy action is the attempt to thwart a global recession that would ultimately correct luxury home prices.

“Sluggish economic growth explains the wave of interest rate cuts evident in the last three months as policymakers try to stimulate growth,” wrote Knight Frank in the report.

* * *

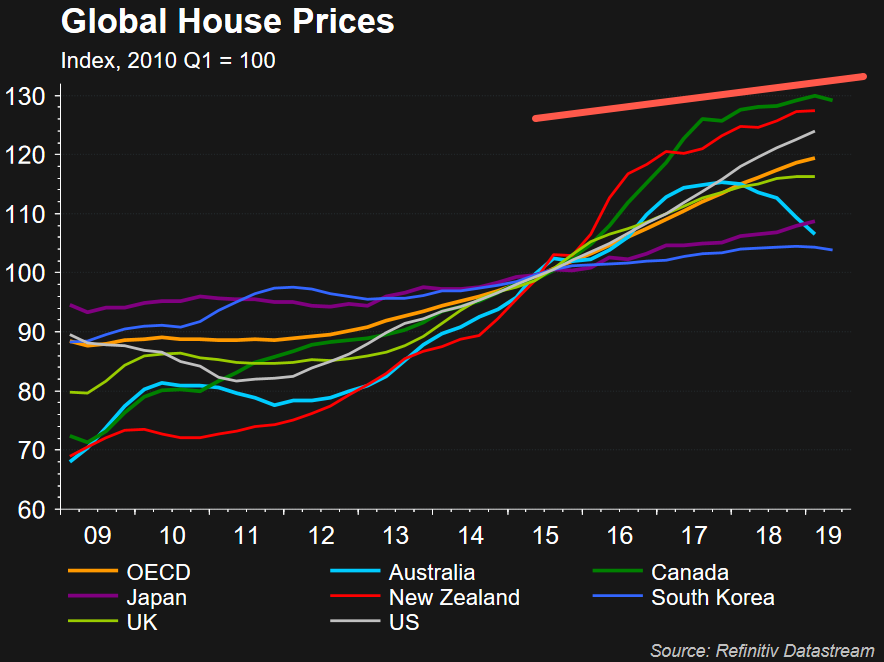

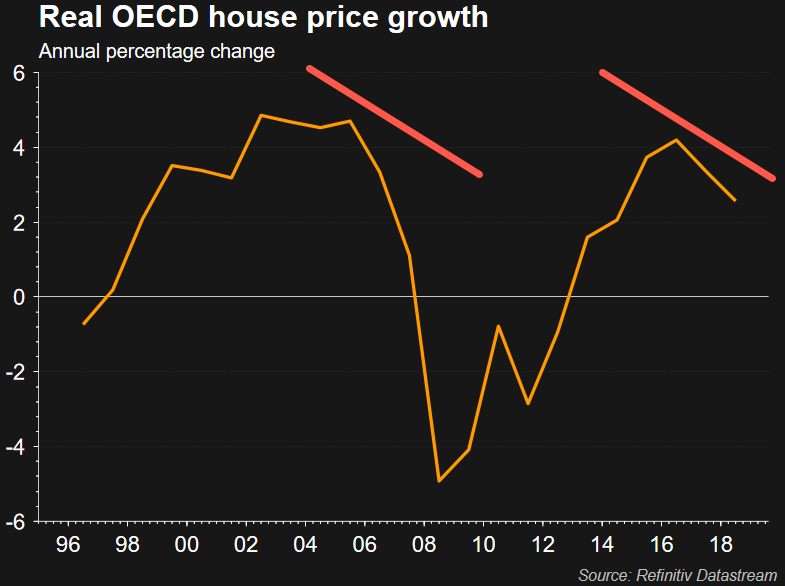

As for a composite of all global house prices, Refinitiv Datastream shows price trends started to weaken in 2018, and in some cases, completely reversed like in Australia.

House price growth for OECD countries shows the slowdown started in 2016, a similar move to the 2005 decline.

If it’s luxury real estate or less expensive homes, the trend in price has peaked and could reverse hard into the early 2020s.

Central banks are desperately lowering interest rates as the global economy turns down. Likely, the top is in, prepare for a bust cycle.

How Low Will Housing Prices Go?

Now that Housing Bubble #2 Is Bursting… How Low Will It Go?

Unless the Fed is going to start buying millions of homes outright, prices are going to fall to what buyers can afford.

There are two generalities that can be applied to all asset bubbles:

1. Bubbles inflate for longer and reach higher levels than most pre-bubble analysts expected

2. All bubbles burst, despite mantra-like claims that “this time it’s different”

The bubble burst tends to follow a symmetrical reversal of very similar time durations and magnitudes as the initial rise. If the bubble took four years to inflate and rose by X, the retrace tends to take about the same length of time and tends to retrace much or all of X.

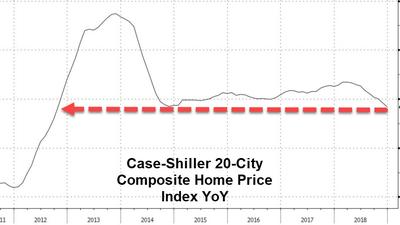

If we look at the chart of the Case-Shiller Housing Index below, this symmetry is visible in Housing Bubble #1 which skyrocketed from 2003-2007 and burst from 2008-2012.

Housing Bubble #1 wasn’t allowed to fully retrace the bubble, as the Federal Reserve lowered interest rates to near-zero in 2009 and bought $1+ trillion in sketchy mortgage-backed securities (MBS), essentially turning America’s mortgage market into a branch of the central bank and federal agency guarantors of mortgages (Fannie and Freddie, VA, FHA).

These unprecedented measures stopped the bubble decline by instantly making millions of people who previously could not qualify for a privately originated mortgage qualified buyers. This vast expansion of the pool of buyers (expanded by a flood of buyers from China and other hot-money locales) drove sales and prices higher for six years (2012-2018).

As noted on the chart below, this suggests the bubble burst will likely run from 2019-2025, give or take a few quarters.

The question is: what’s the likely magnitude of the decline? Scenario 1 (blue line) is a symmetrical repeat of Housing Bubble #2: a retrace of the majority of the bubble’s rise but not 100%, which reverses off this somewhat higher base to start Housing Bubble #3.

Since the mainstream consensus denies the possibility that Housing Bubble #2 even exists (perish the thought that real estate prices could ever–gasp–drop), they most certainly deny the possibility that prices could retrace much of the gains since 2012.

More realistic analysts would probably agree that if the current slowdown (never say recession, it might cost you your job) gathers momentum, some decline in housing prices is possible. They would likely agree with Scenario 1 that any such decline would be modest and would simply set the stage for an even grander housing bubble #3.

But there is a good case for Scenario 2, in which price plummets below the 2012 lows and keeps on going, ultimately retracing the entire housing bubble gains from 2003.

Why is Scenario 2 not just possible but likely? There are no more “saves” in the Fed’s locker. Dropping interest rates to zero and buying another trillion in MBS won’t have the same positive effects they had in 2009-2018. Those policies have run their course.

Among independent analysts, Chris Hamilton is a must-read for his integration of demographics and economics. Please read (via Zero Hedge) Demographics, Debt, & Debasement: A Picture Of American Insolvency if you want to understand why near-zero interest rates and buying mortgage-backed securities isn’t going to spark Housing Bubble #3.

Millennials are burdened with $1 trillion in student loans and most don’t earn enough to afford a home at today’s nosebleed prices. When the Fed drops the Fed Funds Rate to zero, it doesn’t follow that mortgage rates drop to zero. They drop a bit, but not enough to transform an unaffordable house into an affordable one.

Buying up $1 trillion in sketchy mortgages worked in 2009 because it bailed out everyone who was at risk of absorbing huge losses as a percentage of those mortgages defaulted. The problem now isn’t one of liquidity or iffy mortgages: it’s the generation that would like to buy homes finds they don’t earn enough, and their incomes are not secure enough, to gamble everything on an overpriced house that chains them to a local economy they might want to leave if opportunities arise elsewhere.

In other words, the economy has changed, and the sacrifices required to buy a house in hot markets at today’s prices make no sense. The picture changes, of course, in areas where 2X or 3X a typical income will buy a house, and 1X a pretty good income will buy a house.

Unless the Fed is going to start buying millions of homes outright, prices are going to fall to what buyers can afford. As China’s debt bubble implodes, the Chinese buyers with cash (probably not even cash, just money borrowed in China’s vast unregulated Shadow Banking System) who have propped up dozens of markets from France to Vancouver will vanish, leaving only the unwealthy as buyers.

The only question of any real interest is how low prices will drop by 2025. We’re so accustomed to being surprised on the upside that we’ve forgotten we can surprised on the downside as well.

Source: by Charles Hugh Smith | Of Two Minds

***

US Home Price Growth Weakest Since 2012

“A decline in interest rates in the fourth quarter was not enough to offset the impact of rising prices on home sales,”

US Housing Starts Crashed In December

Year-over-year, housing starts tumbled 10.9% – the biggest drop since March 2011…

Debt Among Millennials Rockets Past $1 Trillion

“Student loans make up the majority of the $1,005,000,000,000″, a massive handicap on ability to mortgage a home purchase at today’s prices.

Realtor.com: Number of New Listings Jumps Most Since 2013

Home buyers may soon get at least a little relief. After years of steadily worsening housing shortages, more homes are finally going up for sale.

Home buyers may soon get at least a little relief. After years of steadily worsening housing shortages, more homes are finally going up for sale.

The number of new listings on realtor.com® in September shot up 8% year over year, according to a recent report from realtor.com. That’s the biggest jump since 2013, when the country was still clawing its way out of the financial crisis. And it gives eager buyers a lot more options to choose from.

“It’s a key inflection point,” says Chief Economist Danielle Hale of realtor.com. “There are still more buyers in the market than homes for sale. But in some [parts of the country], the competition is among sellers to attract buyers.”

That’s a big shift from a year ago, when bidding wars and insane offers over asking price were par for the course. But it doesn’t mean the housing shortage has suddenly dissipated.

Nationally, the total inventory of homes for sale was essentially flat compared with the year before—moving down 0.2%. Hale expects the bump in new listings to buoy that inventory.

And while the median home price, at $295,000, was up 7% in September compared with a year ago, the increase in homes hitting the market helped to slow that rise. The median home price in September 2017 was a 10% increase over the previous year.

The new inventory tended to be a little cheaper, by about $25,000, and about 200 square feet smaller than what was already on the market. That could be due to the 3% rise in condo and town home listings.

The influx of homes on the market is partly due to sellers betting that we’ve reached the peak of the market. So they’re rushing to list their homes and get top dollar while they can. But those owners are learning that their home, particularly if it’s priced high, may no longer sell immediately for that price. And homes need to be staged and in tiptop shape.

The increase in inventory is likely to slow wild price growth as well, although prices aren’t likely to fall anytime soon. It all comes back to supply and demand. Folks will pay a premium for something if there’s not enough of it to go around. So while this is fantastic news for buyers, there are bound to be some disappointed sellers who were hoping to get a little more for their abodes.

Of the 45 largest housing markets, San Jose, CA, in the heart of Silicon Valley, saw the biggest boost in new listings, according to the report. It was followed by Seattle; Jacksonville, FL; San Diego; and San Francisco. That’s a boon to buyers in these ultra expensive markets.

But make no mistake: Prices are still rising, and there aren’t enough homes to go around. Still, the uptick in homes going up for sale “will eventually shift the market from a seller’s market … to a buyer’s market,” says Hale.

China’s Building-Boom Hits A Wall As Shadow-Banking System Collapses

Beijing wants to shore up growth without inundating the economy with cheap credit.

But, as WSJ’s Walter Russell Mead pointed out previously, it’s not easy…

Chinese leaders know that their country suffers from massive over-investment in construction and manufacturing, that its real-estate market is a bubble that makes the Dutch tulip frenzy look restrained, that both conventional debt and debt in the shadow-banking system are too large and growing too rapidly.

But even as the Communist Party centralizes power and clamps down on dissent, it dithers when it comes to the costly and difficult work of shifting China’s economic development onto a sustainable track.

Chinese authorities have tried to tackle some of these problems, but often retreat when reforms start to bite and powerful interests push back.

To see how hard that will be, The Wall Street Journal’s Nathaniel Taplin takes a look at China’s roads and railways.

China is the 800-pound gorilla of global infrastructure. Its building prowess has permeated popular culture, as in the disaster movie “2012” where China constructs giant ships to help humankind escape rising seas.

Recently, however, China’s infrastructure build has all but ground to a halt.

Here’s why…

The central government last year started to crack down on unregulated, opaque – so-called ‘shadow-bank’ borrowing – alarmed at its vast scale, and potential for corruption.

For five straight months, the shadow banking system has contracted under this pressure, sucking the malinvestment lifeblood out of economic growth and construction booms as Chinese local governments, which account for the bulk of such investment, set up as so-called local-government financing vehicles (off balance sheet), or LGFVs, and have seen an unprecedented net $19 billion outflow in recent months.

As WSJ’s Talpin notes, these days Beijing prefers that local governments borrow on-the-books, through the now legal municipal bond market. The problem is that lower-rated and smaller cities are mostly shut out, even though they do most actual capital spending. As a result, investment has kept slowing even though China’s net muni bond issuance in July was three times higher than it was in March. Infrastructure investment excluding power and heat was up just 5.7% in the first seven months of 2018 compared with a year earlier, down from 19% growth in 2017.

Eventually, all the cash big cities and provinces are raising through muni bonds will start filtering down. Meanwhile, the investment drought will likely worsen, raising pressure on Beijing to ease credit conditions further – making the incipient rally in the yuan hard to sustain.

That also means China’s debt-to-GDP ratio, which fell marginally in 2017, could start rising again next year.

Simply put, as with water and wine, China’s leaders haven’t figured out how to crack down on local governments’ dubious infrastructure spending during good times without severely damaging growth – or how to loosen the reins during bad times without creating lots more bad debt.

Unless they can square that circle, it bodes ill for the nation’s long-term prospects.

Housing Starts Jump On Spike In Rental Units As Permits Decline

While the single-family housing stagnation continues, multi-family, or rental, housing starts and permits jumped in the month of July according to the latest Census data.

In the latest month, housing starts rose by 2.1% from June, and were higher by 5.6% from a year ago, rising to 1.211MM, above the 1.180MM expected, driven by a 33K jump in rental unit starts, which rose to 433K, while single-family units remained largely unchanged at 770K, up 0.5% from last month’s 766K. As the chart below shows, single-family start have barely budged in the past year even as rental units appear to once again be growing at a solid pace.

On an annual basis, the rate of change continues to hug the flat line, and after last month’s modest decline, starts rose by 5.6% in the latest month.

Meanwhile, the more important building permits data series, fell modestly to 1.152MM in July from 1.160MM in June, on top of the 1.153MM expected.

While these series are notoriously volatile, if indeed multi-family housing is picking up it could provide a modest ray of hope for America’s renters who continue to suffer under record high asking rents, in part due to a lack of supply. Then again, it depends who ends up being the ultimate owner of these buildings, and if the units end up controlled by Wall Street it is likely that there will be no respite from record high rates any time soon as the “curtailing” of supply is set to continue for the indefinite future.

Top Ten Cocktails For Real Estate Agents

Real estate agents work very hard and deal with a wide array of emotions on a day to day basis. Sometimes, it’s an hour by hour basis! Sometimes, we need a little something to unwind, or to perk up, or to celebrate, or to drown our sorrows in. Basically, there’s always a reason for an agent to need a drink, so here’s the top ten list of drinks for real estate agents.. Drink responsibly!

1. The Broker Blues – The time when you don’t have any pending deals. You’re feeling sorry for yourself and wondering why the hell you work in real estate.

Ingredients:

½ oz. Blue Curaco

½ oz. Vodka

A squeeze of lime juice

Shake with ice and strain into a shot gloss. Repeat, as necessary.

2. The New Listing Lemon Drop – When you get a new listing and you’re feeling your inner Superhero coming back, baby!

Ingredients:

1 ½ oz. Vodka

½ oz. Triple Sec

1 tsp. sugar

1 tsp. lemon juice

Maraschino cherry

Mix Vodka,Triple Sec,sugar,and lemon juice in a cocktail shaker half-filled with ice; shake well until sugar is well blended. Pour strained liquor into sugar-rimmed martini glass and don’t forget to garnish with a cherry on top! Note: To create a sugar-rimmed glass, take a lemon wedge and rub the rim of the glass. Dip the edge of the glass into superfine sugar.

3. The Red Hot Realtor – You’re dominating the market. You have homes flying off the streets and clients lining up wanting your help. You’re on fire! This drink is simple, because you don’t have time to make anything complicated.

Ingredients:

1 8oz. glass of 7-up

1 shot of Fireball Cinnamon Whisky

4. The All-Nighter – You’ve had a long day. You spent hours on the phone and computer pulling comps, setting up showings and answering calls and emails. You have offers to respond to and draft, and you know you’ll be up late tonight. The All-Nighter drink has your back. It’s also simple and knows you don’t have the time to measure and bust out a ton of ingredients.

Ingredients:

Red Bull Energy Drink

1 shot of Captain Morgan’s spiced rum

1 shot of orange juice

5. The Home Wrecker – The day the inspection or appraisal kills the deal. You need something STRONG! Also called the Long Island Iced Tea, this is one of the strongest and most alcoholic drinks ever created. It’s also delicious. It also helps take away your anger, bitterness, and extreme sorrow!

Ingredients:

1 shot of vodka

1 shot of rum

1 shot of tequila

1 shot of gin

1 shot of triple sec

1 lemon wedge

Coke

Fill a cocktail shaker with ice and add the spirits and the juice from a squeezed lemon and shake like hell. Pour into a tall glass, add ice and slowly pour the coke on top of the ice. The less coke you add, the better you will feel.

6. The Double Agent Dance – This is when you’re acting as both the listing agent and buyer’s agent. You know you have a lot of work ahead of you, and that it requires a delicate dance. This drink is also known as The Dancing Goldfish.

Ingredients:

1 bottle of white wine (chardonnay or white zinfandel are best)

12 oz. of 7-Up

12 oz. Peach Schnapps

1 can of mandarin oranges

Over ice and in a large pitcher, pour in wine and peach schnapps. Stir in mandarin oranges and 7-Up. Serve in tall glass with ice and watch the fishes dance! Keep refilling to keep the fishes alive!

7. The Orgasm – When you’ve worked so long and so hard, and given all you can, and you finally get the satisfaction of a job well done. The build-up has been intense, and then… you get an OFFER! You explode with relief!! Also known as a Screaming Orgasm (if the offer was all cash or over asking)! There’s no better feeling in the world. 😉

Ingredients:

1 oz. Bailey’s

1 oz. Kahlua

1 oz. Vodka

1 oz. Amaretto

Makes one shot. Can be doubled for a Multiple Orgasm.

8. The Hail Mary – When you have a deal hanging by a thread and you need that one last burst of energy or negotiation super power to get the deal done. This is when you need your Hail Mary, also known as a Bloody Mary.

Ingredients:

1 ½ oz. vodka

3 oz. tomato juice

1 tbsp. lemon juice

½ tsp. worcestershire sauce

3 drops of tabasco sauce

½ tbsp. horseradish

salt, pepper

Mix everything together and pour into a tall glass. Garnish with lemon or lime wedge, celery stalk, green onion, pickled green bean, rotisserie chicken or anything you have laying around the kitchen.

9. The Superman – It’s closing day! You did your job, did it very well, and made it look easy. You finally got your hard-earned paycheck and saved the world for your client. You feel like a Superhero, and if this isn’t your drink of choice, then a beer will never taste better than after a closing! Cheers!

Ingredients:

1/2 oz Stoli Blueberi vodka

1/2 oz Absolut vanilla vodka

1/2 oz Bacardi white rum

1/2 oz Malibu coconut rum

1/2 oz Blue Curacao liqueur

1 1/2 oz pineapple juice

Cranberry Juice

Sprite

Fill shaker with ice and add all of the alcoholic ingredients and pineapple juice and shake till frothy. Pour mixture into a tall glass, then add a quick pour of Sprite and top with a splash of cranberry juice. This will layer red, white, and blue into the glass and will rejuvenate your super-hero powers!

10. Love Potion – When your happy clients refer you to a friend or family member and you get to start all over again, and your love for the wacky world of real estate is renewed.

Ingredients:

1 oz Grey Goose Vodka

1 oz amaretto almond liqueur

1 oz peach schnapps

1 oz orange juice

1 oz cranberry juice

Pour ingredients into a shaker with ice, shake and serve on the rocks. Now get to work and go party!

Tear Downs Are On A Tear

Houston lost its locally famous Bullock-City Federation Mansion in 2014 to a developer who plans to erect townhouses on the site.

The house may not have been worthy of a place on a list of historically significant structures. But the 5,000-square-foot structure that was erected in 1906 on a 30,000-square-foot lot was the first in the sweltering Texas city to have air conditioning. And its demise was mourned by more than a few people.

“It’s a beautiful building,” Ernesto Aguilar, general manager of KPFT Radio, which sits next door, told the Houston Chronicle at the time. “It is sad to see a piece of Houston history going the same way as many others do.”

Tear downs — in which builders or private individuals purchase an aging, outmoded house, then demolish it and replace it with a modern home that will suit today’s homeowners — are currently on a tear in Houston. Permits for tear downs are up by 22% in the city this year.

And that phenomenon isn’t limited to Houston. Barry Sulphor, a real estate agent in the Los Angeles area, counts no less than 100 tear down sites in the so-called beach cities where he plies his trade: Hermosa Beach, Redonda Beach and Manhattan Beach. “And I’m sure there are just as many in Venice, Santa Monica and Beverly Hills,” Sulphor says.

According to the National Association of Home Builders’ best count, nearly 8% of all single-family housing starts in 2015 were attributable to tear down-related construction. That’s roughly 55,000 older houses gone forever, and that’s on top of the 31,800 single-family tear down starts in 2014.

In some instances, the houses that are destroyed are outmoded, functionally obsolete relics that no longer serve a useful purpose. But in other cases, they work just fine and simply lack up-to-date amenities. And some have historical significance that may or may not be worthy of saving.

Usually, the places that replace a tear down are larger, covering more of the lot and rising higher than the old place — often to the maximum height allowable under local zoning rules.

Sulphor recently sold two lots where the old houses were taken down. One was bought for $1.35 million by a builder who plans to put up a house with a nearly $4 million price tag. The other was purchased for $2.15 million by a retired couple who “love the creativity of working with architects to design luxury beach properties,” according to Sulphor. “When the new place is completed, it will fetch close to $5 million.”

Not everyone sees the benefit of tear downs. The leading opponent is the National Trust for Historic Preservation, which argues that they are an “epidemic” that is “wiping out historic neighborhoods one house at a time. As older homes are demolished and replaced with dramatically larger, out-of-scale new structures, the historic character of the existing neighborhood is changed forever.”

Richard Moe, a former president of the National Trust, said, “From 19th-century Victorian to 1920s bungalows, the architecture of America’s historic neighborhoods reflects the character of our communities. Tear downs radically change the fabric of a community. Without proper safeguards, historic neighborhoods will lose the identities that drew residents to put down roots in the first place.”

But the NAHB, which admits that tear downs “have become a significant modus operandi” for its members in some parts of the country, counters that the new houses often “breathe new life into older communities.”

Because tea rdowns are sometimes controversial, folks considering buying an older place with the idea of taking it down and putting up a new house should proceed cautiously. Often, these old homes are not advertised for sale on the open market or in the multiple listing service, so the challenge begins with finding out about one, says Sulphor. And once you do, the agent suggests making absolutely sure the condition of the current home is such that it cannot be salvaged.

Would-be buyers should also determine, before making an offer, whether what they plan to build conforms to local restrictions. Preservationists often use — or try to change — local building codes to push back against tear downs.

On the other hand, people trying to sell old properties that are tear down candidates should make sure whatever offers they receive are legit, Sulphor advises. Look for the proof that they have the funds to close the deal, especially if they say they will pay with cash and have no need of a mortgage.

Sellers should also realize that selling a property “as-is” does not insulate them from their obligation to disclose any issues that might impact value. The term “as-is” means only that the house is being offered and sold in its present condition.

Pending Home Sales Slip In May

Pending home sales slipped in May after three months of gains as demand outstrips supply amid rising prices.

The National Association of Realtors said Wednesday that its pending home sales index, a forward-looking indicator based on contract signings, slid 3.7 percent to 110.8 in May, from 115 in April.

While the reading is still the third highest in the past year, the contract signings declined year-over-year for the first time since August 2014.

All four major regions also saw a decrease in contract activity last month.

“With demand holding firm this spring and homes selling even faster than a year ago, the notable increase in closings in recent months took a dent out of what was available for sale in May and ultimately dragged down contract activity,” said Lawrence Yun, NAR chief economist.

“Realtors are acknowledging with increasing frequency lately that buyers continue to be frustrated by the tense competition and lack of affordable homes for sale in their market,” Yun said.

Meanwhile, mortgage rages are hovering around three-year lows — below 4 percent — keeping prospective buyers in the market despite the headwinds.

Together, scant supply and swiftly rising home prices — which surpassed their all-time high last month — are creating an availability and affordability crunch that is weighing on the pace of sales, Yun said.

“Total housing inventory at the end of each month has remarkably decreased year-over-year now for an entire year,” Yun said.

“There are simply not enough homes coming onto the market to catch up with demand and to keep prices more in line with inflation and wage growth,” he said.

The United Kingdom’s decision to leave the European Union has injected some uncertainty into the U.S. housing market; the turbulence in financial markets and a shift into safer investments like Treasuries could lead to lower mortgage rates.

The flip side, though, is that any “prolonged market angst” could negatively affect the economy and temper the interest from potential buyers.

Despite the pullback in contract signings, existing-home sales this year are still expected to reach 5.44 million, 3.7 percent above 2015.

After accelerating to 6.8 percent a year ago, national median existing-home price growth is forecast to moderate to between 4 and 5 percent.

Regionally, contract signings fell in the Northeast 5.3 percent, the index in the Midwest slipped 4.2 percent, signings dropped 3.1 percent in the South and by 3.4 percent in the West.

Case-Shiller Reports Home Prices Rise At Slowest Pace In 8 Months, As San Francisco Sales Volume Slump

April was not a good month for home prices – despite hopeful signs from seasonally adjusted sales data. S&P Case-Shiller 20-City index rose just 0.45% MoM (well below expectations and March’s 0.85% gain) – the weakest rise since Aug 2015. The broader Home Price Index hovered near unchanged for the 2nd month – the weakest since January 2012. Most worrisome, perhaps, is the 18.16% YoY plunge in San Francisco home sales… as perhaps the bubble is finally bursting.

20-City (Seasonally Adjusted) Index…

Broad (Seasonally-Adjusted) Home Price Index…

Blackstone Deal Hammers San Francisco Commercial Real Estate

Signs of a bust pile up.

Private-Equity firm Blackstone Group is planning to acquire Market Center in San Francisco, a 720,000 square-foot complex that consists of a 21-story tower and a 40-story tower.

The seller, Manulife Financial in Canada, had bought the property in September 2010, near the bottom of the last bust. In its press release at the time, it said that it “identified San Francisco as one of several potential growth areas for our real estate business and we are optimistic about the possibilities.” It raved that the buildings, dating from 1965 and 1975, had been “extensively renovated and modernized with state-of-the-art systems in the last few years….” It paid $265 million, or $344 per square foot.

After a six-year boom in commercial real-estate in San Francisco, and with near-impeccable timing, Manulife put the property on the market in February with an asking price of $750 per square foot – a hoped-for gain of 118%!

Now the excellent Bay Area real estate publication, The Registry, reported that Blackstone Real Estate Partners had agreed to buy it for $489.6 million, or $680 per square foot, “according to sources familiar with the transaction.” The property has been placed under contract, but the deal hasn’t closed yet.

If the deal closes, Manulife would still have a 6-year gain of nearly 100%. But here is a sign, one more in a series, that the phenomenal commercial real estate bubble is deflating: the selling price is 9.3% below asking price!

The property is 92% leased, according to The Registry. Alas, among the largest tenants is Uber, which recently acquired the Sears building in Oakland and is expected to move into its new 330,000 sq-ft digs in a couple of years, which may leave Market Center scrambling for tenants at perhaps the worst possible time.

It’s already getting tough

Sublease space in San Francisco in the first quarter “has soared to its highest mark since 2010,” according to commercial real estate services firm Savills Studley. Sublease space is the red flag. Companies lease excess office space because they expect to grow and hire and thus eventually fill this space. They warehouse this space for future use because they think there’s an office shortage despite the dizzying construction boom underway. This space sits empty, looming in the shadow inventory. When pressure builds to cut expenses, it hits the market overnight, coming apparently out of nowhere. With other companies doing the same, it creates a glut, and lease rates begin to swoon.

Manulife might have seen the slowdown coming

Tech layoffs in the four-county Bay Area doubled for the first four months this year, compared to the same period last year, according to a report by Wells Fargo senior economist Mark Vitner, cited by The Mercury News, “in yet another sign of a slowdown in the booming Bay Area economy.”

Announced layoffs in the counties of San Francisco, Santa Clara, San Mateo, and Alameda jumped to 3,135, from 1,515 in the same period in 2015, and from 1,330 in 2014 — based on the mandatory filings under California’s WARN Act. But…

The number of layoffs in the tech sector is undoubtedly larger, because WARN notices do not include cuts by many smaller companies and startups. In addition, notices of layoffs of fewer than 50 people at larger companies aren’t required by the act.

The filings also don’t take attrition into account – when jobs disappear without layoffs. “There is a lot of that,” Vitner explained. “When businesses begin to clamp down on costs, one of the first things they do is say, ‘Let’s put in a hiring freeze.’ I feel pretty certain that if you had a pickup in layoffs, then hiring slowed ahead of that.”

And hiring has slowed down. According to Vitner’s analysis of state employment data, Bay Area tech firms added only 800 jobs a month in the first quarter – half of the 1,600 a month they’d added in 2015 and less than half of the 1,700 a month in 2014.

“Employment in the tech sector has clearly decelerated over the past three months,” he said. “As job growth slows and the cost of living remains as high as it is, that’s going to put many people in a difficult position.”

It’s going to put commercial real estate into a difficult position as well. During the boom years, the key rationalization for the insane prices and rents has been the rapid growth of tech jobs. Now, the slowdown in hiring and the growth in layoffs come just when the construction boom is coming into full bloom, and as sublease space gets dumped on the market.

Here’s what a real estate investor — at the time co-founder of a company they later sold — told me about real estate during the dotcom bust. All tenants should write this in nail polish on their smartphone screens:

It was funny in 2000 because the rent market was still moving up. We rejected our extension option, hired a broker, and started looking around. As months went on, we kept finding more and more, better and better space while our existing landlord refused to renegotiate a lower renewal. We went from a “B” building to an “A” building at half the rent with hundreds of thousands of dollars of free furniture.

The point is that tenants are normally the last to find out that rents are dropping.

“All it takes is a couple of big tech companies folding and the floodgates open, causing the sublease market to blow up, rents to drop, and new construction to grind to a halt,” Savills Studley mused in its Q1 report on San Francisco. Read… “Market is on Edge”: US Commercial Real Estate Bubble Pops, San Francisco Braces for Brutal Dive

Caught On Tape: Chinese Wheel Loaders Battle As Economic Frustration Boils Over

It’s not an easy time to be a construction worker in China. In some cases, economic frustration bubbles over into the streets such as the other day, when workers from rival companies used their bulldozers as battle tanks.

The AP reports:

BEIJING (AP) — Police in northern China say an argument between construction workers escalated into a demolition derby-style clash of heavy machinery that left at least two bulldozers flipped over in a street.

The construction workers were from two companies competing for business, Xu Feng, a local government spokesman in Hebei province’s Xingtang county, said Monday. He said he couldn’t disclose details about arrests or injuries until an investigation concludes.

Now here’s the stunning video:

California Home Sales Make Comeback in December, After Slower November

According to the California Association of Realtors, California existing home sales rebounded in December 2015, after new loan disclosure rules delayed closings in November 2015.

U.S. home sales exceeded the 400,000-unit level in December after falling short in November. Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 405,530 units in December, according to information collected by C.A.R.

The statewide sales figure represents what would be the total number of homes sold during 2015 if sales maintained the December pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

For 2015 as a whole, a preliminary figure of 407,060 single-family homes closed escrow in California, up 6.4 percent from a revised 382,720 in 2014.

The December figure was up 9.6 percent from the revised 370,070 level in November and up 10.7 percent compared with home sales in December 2014 of a revised 366,460. The month-to-month increase in sales was the largest since January 2011, and the year-to-year increase was the largest since July 2015.

“As we speculated, sales that were delayed in November because of The Consumer Financial Protection Bureau’s new loan disclosure rules closed in December instead, which led to the greatest monthly sales increase in nearly five years,” said C.A.R. President Ziggy Zicarelli. “Sales increased across the board in all price segments in December, but improvement in the sub-$500,000 market was more pronounced as many homes affected by the new loan disclosures were priced under the conforming loan limit.”

The median price of an existing, single-family detached California home rose 2.6 percent in December to $489,310 from $477,060 in November. December’s median price was 8.0 percent higher than the revised $453,270 recorded in December 2014. The median sales price is the point at which half of homes sold for more and half sold for less; it is influenced by the types of homes selling as well as a general change in values. The year-to-year price gain was the largest since August 2014.

“In line with our forecast, California’s housing market experienced strong sales and price growth throughout last year, with the median price increasing 6.2 percent for the year as a whole to reach $474,420 in 2015,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “Looking forward, we expect the foundation for the housing market to remain strong throughout the year, with moderate increases in home sales and prices, but headwinds of tight housing supply and low affordability will remain a challenge.”

Other key points from C.A.R.’s December 2015 resale housing report include:

- While more sales closed in December, the number of active listings continued to drop from both the previous month and year. Active listings at the statewide level dropped 11.7 percent from November and decreased 7.9 percent from December 2014. At the regional level, total active listings continued to decline from the previous year in Southern California, Central Valley, and the San Francisco Bay Area, dropping 9.6 percent, 7.6 percent, and 5.2 percent, respectively.

- The sharp increase in sales in December and fewer listings combined to tighten the available supply of homes on the market. C.A.R.’s Unsold Inventory Index fell to 2.8 months in December from 4.2 months in November. The index stood at 3.2 months in December 2014. The index indicates the number of months needed to sell the supply of homes on the market at the current sales rate. A six- to seven-month supply is considered typical in a normal market.

- The median number of days it took to sell a single-family home increased in December to 39.5 days, compared with 37.5 days in November and 44.1 days in December 2014.

- According to C.A.R.’s newest housing market indicator, which measures the sales-to-list price ratio*, properties are generally selling below the list price, except in the San Francisco Bay Area, where a lack of homes for sale is pushing sales prices higher than original asking prices. The statewide measure suggests that homes sold at a median of 97.9 percent of the list price in December, up from 97.2 percent at the same time last year. The Bay Area is the only region where homes are selling above original list prices due to constrained supply with a ratio of 100.7 percent in December, up from 100 percent a year ago.

- The average price per square foot** for an existing, single-family home was $230 in December 2015, up from $222 in December 2014.

- San Francisco continued to have the highest price per square foot in December at $749/sq. ft., followed by San Mateo ($715/sq. ft.), and Santa Clara ($568/sq. ft.). The three counties with the lowest price per square foot in December were Siskiyou ($107/sq. ft.), Tulare ($123/sq. ft.), and Merced ($124/sq. ft.).

- Mortgage rates inched up in December, with the 30-year, fixed-mortgage interest rate averaging 3.96 percent, up from 3.94 percent in November and up from 3.86 percent in December 2014, according to Freddie Mac. Adjustable-mortgage interest rates also edged up, averaging 2.66 percent in December, up from 2.63 percent in November and up from 2.40 percent in December 2014.

From Real Estate To Stocks To Commodities, Is Deflation The New Reality?

- Rising interest rates are a negative for real estate.

- Gold and oil are still dropping.

- Company earnings are not beating expectations.

So, where do we begin?

The economy has been firing on all eight cylinders for several years now. So long, in fact, that many do not or cannot accept the fact that all good things must come to an end. Since the 2008 recession, the only negative that has remained constant is the continuing dilemma of the “underemployed”.

Let me digress for a while and delve into the real issues I see as storm clouds on the horizon. Below are the top five storms I see brewing:

- Real estate

- Subprime auto loans

- Falling commodity prices

- Stalling equity markets and corporate earnings

- Unpaid student loan debt

1. Real Estate

Just this past week there was an article detailing data from the National Association of Realtors (NAR), disclosing that existing home sales dropped 10.5% on an annual basis to 3.76 million units. This was the sharpest decline in over five years. The blame for the drop was tied to new required regulations for home buyers. What is perplexing about this excuse is NAR economist Lawrence Yun’s comments. The article cited Yun as saying that:

“most of November’s decline was likely due to regulations that came into effect in October aimed at simplifying paperwork for home purchasing. Yun said it appeared lenders and closing companies were being cautious about using the new mandated paperwork.”

Here is what I do not understand. How can simplifying paperwork make lenders “more cautious about using… the new mandated paperwork”?

Also noted was the fact that median home prices increased 6.3% in November to $220,300. This comes as interest rates are on the cusp of finally rising, thus putting pressure (albeit minor) on monthly mortgage rate payments. This has the very real possibility of pricing out investors whose eligibility for financing was borderline to begin with.

2. Subprime auto loans

Casey Research has a terrific article that sums up the problems in the subprime auto market. I strongly suggest that you read the article. Just a few of the highlights of the article are the following points:

- The value of U.S. car loans now tops $1 trillion for the first time ever. This means the car loan market is 47% larger than all U.S. credit card debt combined.

- According to the Federal Reserve Bank of New York, lenders have approved 96.7% of car loan applicants this year. In 2013, they only approved 89.7% of loan applicants.

- It’s also never been cheaper to borrow. In 2007, the average rate for an auto loan was 7.8%. Today, it’s only 4.1%.

- For combined Q2 2015 and Q3 2015, 64% of all new auto loans were classified as subprime.

- The average loan term for a new car loan is 67 months. For a used car, the average loan term is 62 months. Both are records.

The only logical conclusion that can be derived is that the finances of the average American are still so weak that they will do anything/everything to get a car. Regardless of the rate, or risks associated with it.

3. Falling commodity prices

Remember $100 crude oil prices? Or $1,700 gold prices? Or $100 ton iron ore prices? They are all distant faded memories. Currently, oil is $36 a barrel, gold is $1,070 an ounce, and iron ore is $42 a ton. Commodity stocks from Cliffs Natural Resources (NYSE:CLF) to Peabody Energy (NYSE:BTU) (both of which I have written articles about) are struggling to pay off debt and keep their operations running due to the declines in commodity prices. Just this past week, Cliffs announced that it sold its coal operations to streamline its business and strengthen its balance sheet while waiting for the iron ore business to stabilize and or strengthen. Similarly, oil producers and metals mining/exploration companies are either going out of business or curtailing their operations at an ever increasing pace.

For 2016, Citi’s predictions commodity by commodity can be found here. Its outlook calls for 30% plus returns from natural gas and oil. Where are these predictions coming from? The backdrop of huge 2015 losses obviously produced a low base from which to begin 2016, but the overwhelming consensus is for oil and natural gas to be stable during 2016. This is clearly a case of Citi sticking its neck out with a prediction that will garnish plenty of attention. Give it credit for not sticking with the herd mentality on this one.

4. Stalling equity markets and corporate earnings

Historically, the equities markets have produced stellar returns. According to an article from geeksonfinace.com, the average return in equities markets from 1926 to 2010 was 9.8%. For 2015, the markets are struggling to erase negative returns. Interestingly, the Barron’s round table consensus group predicted a nearly 10% rise in equity prices in 2015 (which obviously did not materialize) and also repeated that bullish prediction for 2016 by anticipating an 8% return in the S&P. So what happened in 2015? Corporate earnings were not as robust as expected. Commodity prices put pressure on margins of commodity producing companies. Furthermore, there are headwinds from external market forces that are also weighing on the equities markets. As referenced by this article which appeared on Business Insider, equities markets are on the precipice of doing something they have not done since 1939: see negative returns during a pre-election year. Per the article, on average, the DJIA gains 10.4% during pre-election years. With less than one week to go in 2015, the DJIA is currently negative by 1.5%

5. Unpaid student loan debt

Once again, we have stumbled upon an excellent Bloomberg article discussing unpaid student loan debt. The main takeaway from the article is the fact that “about 3 million parents have $71 billion in loans, contributing to more than $1.2 trillion in federal education debt. As of May 2014, half of the balance was in deferment, racking up interest at annual rates as high as 7.9 percent.” The rate was as low as 1.8 percent just four years ago. It is key to note that this is debt that parents have taken out for the education of their children and does not include loans for their own college education.

The Institute for College Access & Success released a detailed 36 page analysis of what the class of 2014 faces regarding student debt. Some highlights:

- 69% of college seniors who graduated from public and private non-profit colleges in 2014 had student loan debt.

- Average debt at graduation rose 56 percent, from $18,550 to $28,950, more than double the rate of inflation (25%) over this 10-year period.

Conclusion

So, what does this all mean?

To look at any one or two of the above categories and see their potential to stymie the economy, one would be smart to be cautious. To look at all five, one needs to contemplate the very real possibility of these creating the beginnings of another downturn in the economy. I strongly suggest a cautious and conservative investment outlook for 2016. While the risk one takes should always be based on your own risk tolerance levels, they should also be balanced by the very real possibility of a slowing economy which may also include deflation. Best of health and trading to all in 2016!

David Collum: The Next Recession Will Be A Barn-Burner

The Smart Money Is Getting Out Of Real Estate

Real estate investing is all about timing, and Sam Zell knows this better than anyone.

He sold his real estate firm, Equity Office, to Blackstone Group for $39 billion near the peak of the market. This was back in February 2007—only months before real estate credit markets started to spiral out of control.

He’s doing it again.

At the end of October, his real estate fund, Equity Residential, agreed to sell more than 23,000 apartment units to Starwood Capital for $5.4 billion. The sale represents over 20 percent of the Equity Residential portfolio.

The fund plans to sell another 4,700 apartment units in the near future. Most of the proceeds will be returned to investors in the form of a dividend sometime next year.

Another real estate fund managed by Zell, Equity Commonwealth, has sold 82 office properties worth $1.7 billion since February. The fund plans to raise another $1.3 billion by selling off more properties over the next few years.

Zell is cashing out of non-core assets after the run up in real estate prices in recent years. Rather than reinvest, much of the cash is being returned to investors. The message he is sending is clear—it’s time to sell.

High prices + rising interest rates = time to sell

REITs (real estate investment trusts) have been one of the hottest investment sectors in the aftermath of the 2008 credit crisis.

REIT prices are up 286% from their March 2009 low, compared to 209% for the S&P 500 over that same period. Real estate prices have benefited greatly from the Federal Reserve’s aggressive stimulus packages and zero-interest rate monetary policy.

Real Capital Analytics data showed that commercial property values across the country reached the highest level on record in August—up 14.5% on a nominal basis and surpassing the previous inflation adjusted mark from 2007 by 1.5%.

High prices have led to record low cap rates (cap rates measure a property’s yield by dividing the annual income by the property value). The average cap rate on all property types across the US hit 5.25% in September. This breaks the 5.65% low from 2007, according the Green Street Advisors.

The data dependent Fed has trapped itself in a corner. On the one hand, they can see that property values and stock markets have skyrocketed. On the other hand, real economic growth appears to have stalled.

The Fed has tried to signal an end to its easy money policies all year long. However, poor US economic data and fear of a global slowdown has kept them from taking action.

Still, the potential for higher interest rates has caused REIT investors to take a pause. Higher interest rates make dividend yields from REITs less attractive than the safer alternatives, such as Treasury bonds. It also makes it more costly to finance new acquisitions and real estate developments.

Warning signs

The S&P US REIT Index has under performed the S&P 500 benchmark so far this year. If this holds, it will mark only the second year since 2009 that REITs have under performed the S&P 500 index—the other being 2013, when the Fed began its process of backing out of its aggressive bond-buying program.

Sam Zell is not alone. Over the last twelve months, insiders were net sellers of shares at all but one of the top ten funds on the index.

And the institutional money has started to follow suit as well. Five of the top ten REITs on the index had net outflows from institutional investors as of the most recent quarterly filing.

As Steven Roth, CEO of Vornado Realty Trust, said on an investor call in August, “The easy money has been made in this cycle… this is a time when the smart guys are starting to build cash.” You can choose to ignore the writing on the wall or perhaps it’s time for investors to follow the smart money and move their cash out of real estate.

Source: Business Insider. Read the original article on Thoughts From The Frontline.

The Making of the Most Expensive Mansion in History

On a hilltop in Bel Air, a 100,000-square-foot giga-mansion is under construction, for no one in particular. The asking price—$500 million—would shatter records, but, as ridiculous as it sounds, in L.A.’s unbridled real-estate bubble, this house could be billed as a bargain.

My mansion really is worth $500M, claims the man behind most expensive home ever built which boasts five swimming pools, a casino and a VIP nightclub

- The Bel Air home, which will be finished in 2017, is close to those of celebrities such as Jennifer Aniston and Elon Musk

- The property has panoramic views of the LA basin and Pacific Ocean and will cover more than 100,000 square feet

- The price works out to about $5,000 per square foot, which the property’s developer Nile Niami says is a good price for what the buyer is getting

- The home will have five swimming pools, a casino, a nightclub and a lounge with jellyfish tanks replacing the walls and ceilings

- Niami, behind films including action-thriller The Patriot, hopes to double the world-record for the most expensive home ever sold

A mega-mansion in Bel Air has been listed for a whopping $500million – but the extravagant home is worth its value, the real-estate developer claims.

Sitting on a hilltop with views of the San Gabriel Mountains, LA basin, Beverly Hills and the Pacific Ocean, the home will have five swimming pools, a casino, a nightclub with VIP access, a lounge with jellyfish tanks replacing the walls and ceilings, and many other amenities.

The home, which will be finished in 2017 and boasts neighbors including Jennifer Aniston and Elon Musk, will be more than 100,000 square feet – twice the size of the White House.

A home being built in the Bel Air neighborhood of Los Angeles, California, by real-estate developer Nile Niami is being listed for $500million. Above is a depiction of what it will look like when finished.

A home being built in the Bel Air neighborhood of Los Angeles, California, by real-estate developer Nile Niami is being listed for $500million. Above is a depiction of what it will look like when finished

The 100,000-square-foot home, which is still being built (pictured) is close to several celebrities’ houses.

The 100,000-square-foot home, which is still being built (pictured) is close to several celebrities’ houses

The price works out to about $5,000 per square foot, which Hollywood producer-turned-developer 47-year-old Nile Niami notes is less than half of what some billionaires pay for Manhattan penthouses.

Niami, pictured in 2013, said the property will be worth the cost.

‘We have a very specific client in mind,’ Niami told Details magazine. ‘Someone who already has a $100million yacht and seven houses all over the world, in London and Dubai and whatever.

‘To be able to say that the biggest, most expensive house in the world is here, that will really be good for LA.’

Niami, behind films including action-thriller The Patriot, hopes to double the world-record for the most expensive home ever sold with the $500million asking price.

He grew unpopular with neighbors last fall, when he sliced off the top of a hill to create panoramic vistas on his four-acre lot.