Fed pauses after ten hikes but more increases are coming.

Tag Archives: Federal Reserve

We Are Almost There

The banks need to break before the Fed will change direction. We are almost there. Just a few more banks failing, along with gold at an all time high and a few more lousy economic data reports… that should get the Fed into panic mode.

Fed Blocks Release Of Documents On Pandemic Insider Trading By Policymakers

(Howard Schneider) – The U.S. Federal Reserve, responding to a Freedom of Information Act request by Reuters, said there are about 60 pages of correspondence between its ethics officials and policymakers regarding financial transactions conducted during the pandemic year 2020.

But it “denied in full” to release the documents, citing exemptions under the information act that it said applied in this case.

And Again: The Fed Monetizes $4.1 Billion In Debt Sold Just Days Earlier

Over the past week, when looking at the details of the Fed’s ongoing QE4, we showed out (here and here) that the New York Fed was now actively purchasing T-Bills that had been issued just days earlier by the US Treasury. As a reminder, the Fed is prohibited from directly purchasing Treasurys at auction, as that is considered “monetization” and directly funding the US deficit, not to mention is tantamount to “Helicopter Money” and is frowned upon by Congress and established economists. However, insert a brief, 3-days interval between issuance and purchase… and suddenly nobody minds. As we summarized:

“for those saying the US may soon unleash helicopter money, and/or MMT, we have some ‘news’: helicopter money is already here, and the Fed is now actively monetizing debt the Treasury sold just days earlier using Dealers as a conduit… a “conduit” which is generously rewarded by the Fed’s market desk with its marked up purchase price. In other words, the Fed is already conducting Helicopter Money (and MMT) in all but name. As shown above, the Fed monetized T-Bills that were issued just three days earlier – and just because it is circumventing the one hurdle that prevents it from directly purchasing securities sold outright by the Treasury, the Fed is providing the Dealers that made this legal debt circle-jerk possible with millions in profits, even as the outcome is identical if merely offset by a few days”

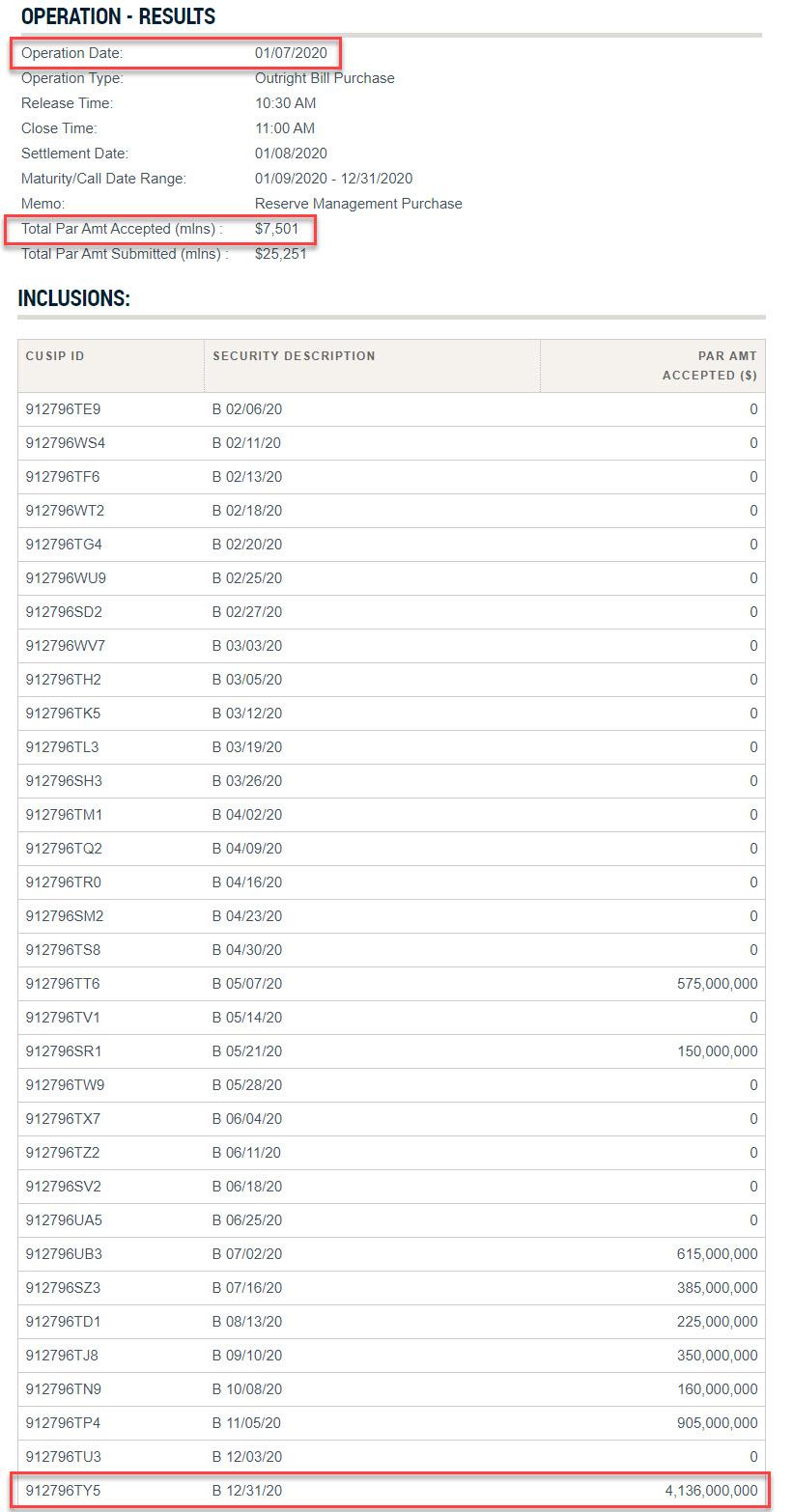

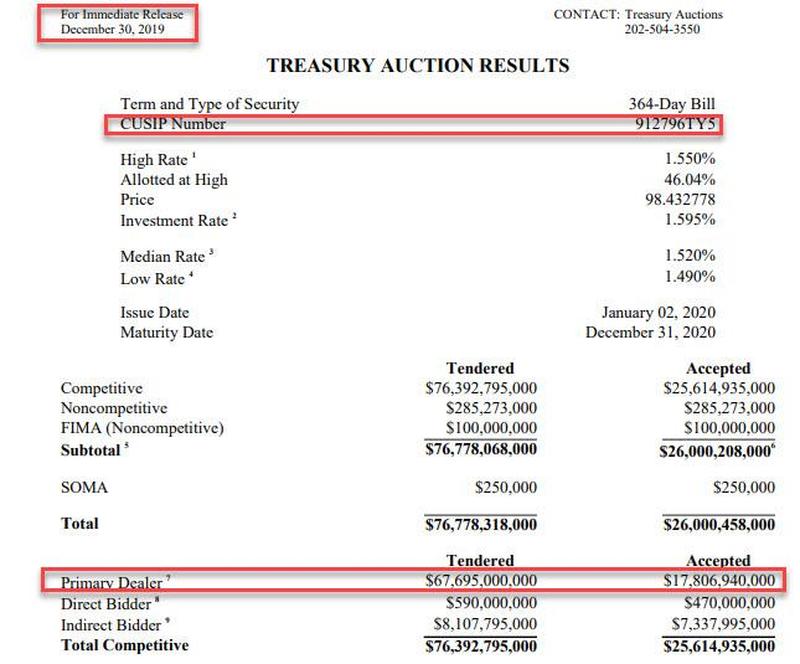

So, predictably, fast forward to today when the Fed conducted its latest T-Bill POMO in which, as has been the case since early October, the NY Fed’s market desk purchased the maximum allowed in Bills, some $7.5 billion, out of $25.3 billion in submissions. What was more notable were the actual CUSIPs that were accepted by the Fed for purchase. And here, once again, we find just one particular issue that stuck out: TY5 (due Dec 31, 2020) which was the most active CUSIP, with $4.136BN purchased by the Fed, and TU3 (due Dec 3, 2020) of which $905MM was accepted.

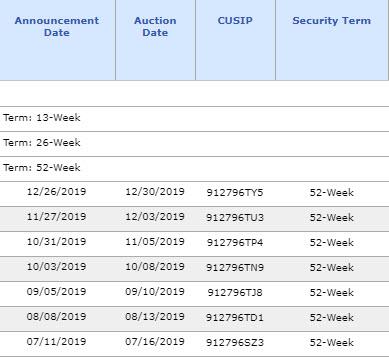

Why is the highlighted CUSIP notable? Because as we just showed on Friday, the Fed – together with the Primary Dealers – appears to have developed a knack for monetizing, pardon, purchasing in the open market, bonds that were just issued. And sure enough, TY5 was sold just one week ago, on Monday, Dec 30, with the issue settling on Jan 2, just days before today’s POMO, and Dealers taking down $17.8 billion of the total issue…

… and just a few days later turning around and flipping the Bill back to the Fed in exchange for an unknown markup. Incidentally, today the Fed also purchased $615MM of CUSIP UB3 (which we profiled last Friday), which was also sold on Dec 30, and which the Fed purchased $5.245BN of last Friday, bringing the total purchases of this just issued T-Bill to nearly $6 billion in just three business days.

In keeping with this trend, the rest of the Bills most actively purchased by the Fed, i.e., TP4, TN9, TJ8, all represent the most recently auctioned off 52-week bills…

… confirming once again that the Fed is now in the business of purchasing any and all Bills that have been sold most recently by the Treasury, which is – for all intents and purposes – debt monetization.

As we have consistently shown over the past week, these are not isolated incidents as a clear pattern has emerged – the Fed is now monetizing debt that was issued just days or weeks earlier, and it was allowed to do this just because the debt was held – however briefly – by Dealers, who are effectively inert entities mandated to bid for debt for which there is no buyside demand, it is not considered direct monetization of Treasurys. Of course, in reality monetization is precisely what it is, although since the definition of the Fed directly funding the US deficit is negated by one small temporal footnote, it’s enough for Powell to swear before Congress that he is not monetizing the debt.

Oh, and incidentally the fact that Dealers immediately flip their purchases back to the Fed is also another reason why NOT QE is precisely QE4, because the whole point of either exercise is not to reduce duration as the Fed claims, but to inject liquidity into the system, and whether the Fed does that by flipping coupons or Bills, the result is one and the same.

The Federal Reserve Is A Barbarous Relic

The Sky is Falling

“We believe monetary policy is in a good place.”

– Federal Reserve Chairman Jerome Powell, October 30, 2019.

The man from good place. “As I was going up the stair, I met a man who wasn’t there. He wasn’t there again today, Oh how I wish he’d go away!” [PT]

“We fear no man: there is but one thing that we fear, namely, that the sky should fall on us.”

Today, at the risk of being called Chicken Little, we tug on a thread that weaves back to the ancient Celts. Our message is grave: The sky is falling. Though the implications are still unclear.

Various Celts – left: fearsome warriors; middle: fearsome warriors afraid of the sky falling on their heads; right: Cernunnos, fearsome Celtic horned god amid his collection of skulls. [PT]

At the G-10 Rome meeting held in late-1971, Treasury Secretary John Connally reduced the new dollar reserve standard to a bite-sized nugget for his European finance minister counterparts, stating:

“The dollar is our currency, but it’s your problem.”

The Nixon-Connally tag team in the White House. [PT]

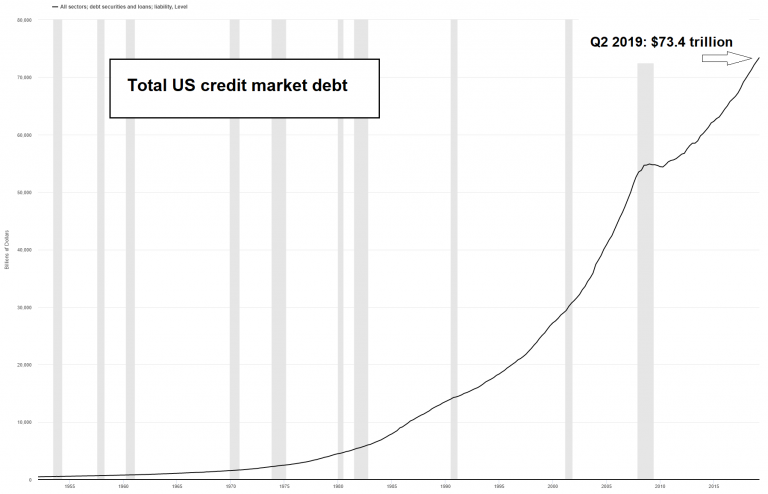

Hence, public, private, and corporate debt levels in the U.S. have multiplied beyond comprehension. Total US debt is now on the order of $74 trillion. \The consequences, no doubt, are an economy that is equally distorted and disfigured beyond comprehension.

Behold the debt-berg in all its terrible glory. [PT]

Selective Blind Spots

America is no longer a dynamic, free-market economy. Rather, the economy is stagnant and operates under the central planning authority of Washington and the Fed. The illusion of prosperity is simulated by spending trillions of dollars funded by history’s greatest debt bubble.

Simple arithmetic shows the country is headed for economic catastrophe. Clearly, Social Security and Medicare face long-term financial challenges. Current workers must shoulder a greater and greater burden to pay for the benefits of retired workers.

At the same time, the world that brought the debt based dollar reserve standard into being no longer exists. Yet the dollar reserve standard and the Federal Reserve still remain as legacy institutions.

The divergence between the world as it exists – with its massive trade imbalances, massive debt loads, wealth inequality, and inflated asset prices – and the legacy dollar reserve standard is irreversible. Unless the unstable condition that has developed is allowed to transform naturally, there will be outright collapse.

Rather than adopting policies that allow for economic transformation and minimizing the ultimate disruption of a collapse, today’s planners and policy makers are doing everything they can to hold the failing financial order together. They are deeply invested academically and professionally; their livelihoods depend on it.

You see, selective blind spots of the best and brightest are normal when the sky is falling. For example, in 1989, just two years before the Soviet Union collapsed, Paul Samuelson – the “Father of Modern Day Economics” – and co-author William Nordhaus, wrote:

“The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.” – Paul Samuelson and William Nordhaus, Economics, 13th ed. [New York: McGraw Hill, 1989], p. 837.

Could Samuelson and Nordhaus possibly have been more clueless?

The bizarre chart illustrating the alleged “growth miracle” of the “superior” Soviet command economy, as seen by Samuelson – published about one and a half years before the Soviet Bloc imploded in what was undoubtedly the biggest bankruptcy in history. [PT]

The Federal Reserve is a Barbarous Relic

On Wednesday, following the October federal open market committee (FOMC) meeting, the Federal Reserve stated that it will cut the federal funds rate 25 basis points to a range of 1.5 to 1.75. No surprise there.

But the real insights were garnered several days earlier. Leading up to the FOMC meeting Fed Chair Jerome Powell received some public encouragement from one of his former cohorts – former President of the Federal Reserve Bank of New York, Bill Dudley. What follows is an excerpt of Dudley’s mental diarrhea, which he released in a Bloomberg Opinion article on Monday:

“People shouldn’t be as worried as they are about the risk of a U.S. recession. That said, it wouldn’t take much to trigger one, which is why the Federal Reserve should take out some insurance by providing added stimulus this week.

“Sometimes, an adverse event and human psychology can reinforce each other in such a way that they bring about a recession. Given how slowly the economy is growing, even a modest shock could do the trick.

“This danger bolsters the argument for the Fed to ease monetary policy at this week’s meeting of the Federal Open Market Committee. Such a preemptive move will reduce the chances that the economy will slow sufficiently to hit stall speed. Even if the insurance turns out to be unnecessary, the potential consequences aren’t bad. It just means that the economy will be stronger and the inflation rate will likely move more quickly back toward the Fed’s 2 percent target.”

Retired former central planner Bill Dudley. These days an armchair planner, and as deluded as ever. [PT]

Like Samuelson, Dudley doesn’t have a clue. The Fed cannot preemptively stop a recession. And after the dot com bubble and bust, the housing bubble and bust, the great financial crisis, zero interest rate policy, negative interest rate policy, quantitative easing, operation twist, quantitative tightening, reserve management, and many other failures, the Fed’s standing is clear to everyone but Dudley…

The Federal Reserve is a barbarous relic. The next downturn will be its death knell. Alas, what comes after the Fed will probably be even worse. Populism demands it.

Source: by NM Gordon | ZeroHedge

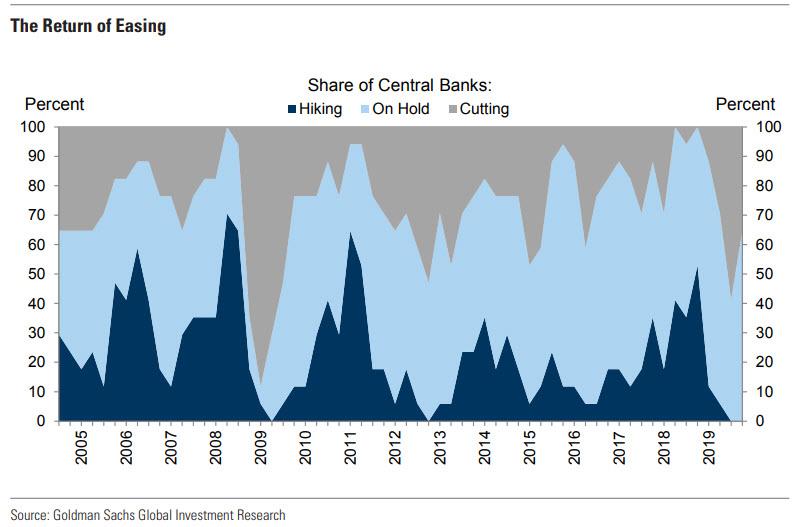

For The First Time In 6 Years, No Central Bank Is Hiking

The global central bank experiment with re-normalization is officially over.

After roughly half the world’s central banks hiked rates at least once in 2018, the major central banks have returned to easing mode, and as the chart below shows, for the first time since 2013, not a single central bank is hiking rates.

How The Fed Wrecks The Economy Over And Over Again

When people talk about the economy, they generally focus on government policies such as taxation and regulation. For instance, Republicans credit President Trump’s tax cuts for the seemingly booming economy and surging stock markets. Meanwhile, Democrats blame “deregulation” for the 2008 financial crisis. While government policies do have an impact on the direction of the economy, this analysis completely ignores the biggest player on the stage – the Federal Reserve.

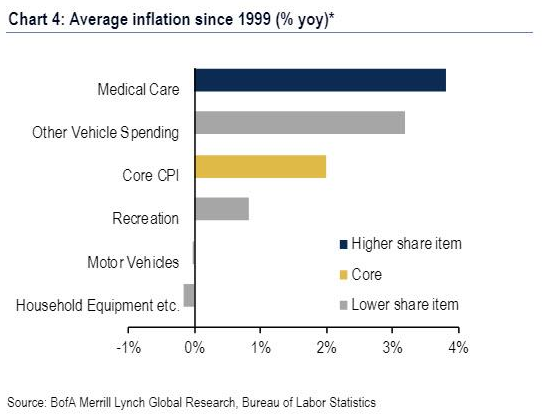

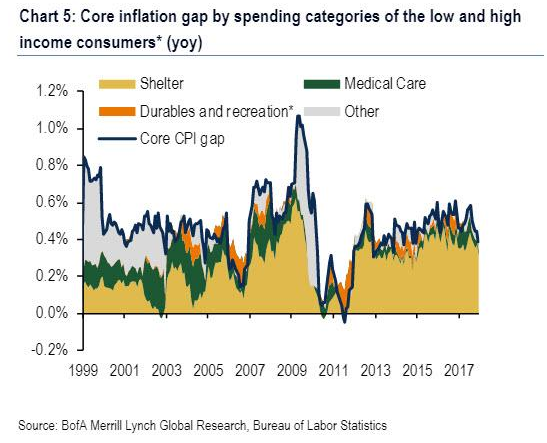

Lower Income Americans Are Begging The Fed For Less Inflation

While the Fed may be surprised that low income workers aren’t as enthused about inflation as they are, we are not. A recent Bloomberg report looked at the stark disconnect between Fed policy and well, everybody else but banks and the 1%.

While the Fed sees low inflation as “one of the major challenges of our time,” Shawn Smith, who trains some of the nation’s most vulnerable, low-income workers stated the obvious: people don’t want higher prices. Smith is the director of workforce development at Goodwill of Central and Coastal Virginia.

In fact, he said that “even slight increases make a huge difference to someone who is living on a limited income. Whether it is a 50 cents here or 10 cents there, they are managing their dollars day to day and trying to figure out how to make it all work.’’ Indeed, as we discussed yesterday, it is the low-income workers – not the “1%”ers, who are most impacted by rising prices, as such all attempts by the Fed to “help” just make life even more unaffordable for millions of Americans.

Fears, and risks, associated higher prices comprise much of the feedback that the Fed has getting as part of its “Fed Listens” 2019 strategy tour, labeled as a multi-city “outreach tour”. So much for objectivity. Fed Governor Lael Brainard faced additional feedback from community leaders earlier this week in Chicago when she chaired a panel on full employment.

Patrick Dujakovich, president of the Greater Kansas City AFL-CIO, told the audience in Chicago: “I have heard a lot about price stability and fiscal sustainability from the Fed for a very, very long time. Maybe I wasn’t listening, but today is the first time I’ve heard about employment sustainability and employment security.”

The problem that the Fed continues to face is that it has backed itself into a corner. With the economy supposedly “booming” and the stock market at all time highs, rates remain low and any tick higher would likely begin to cause massive shocks to a debt-laden and spending-addicted economy that has been swelling into dangerously uncharted waters over the last 10 years.

As one potential answer, the Fed is now looking at “inflation targeting” (whose disastrous policies we discussed here yesterday), which amounts to simply pursuing higher inflation for a while to “make up” for “undershoots” of the Fed’s 2% target since 2009. But the reality is that this idea cripples consumers, especially those at the lower end of the income spectrum.

Stuart Comstock-Gay, president of Delaware Community Foundation, told an audience at the Philadelphia Fed: “The sometimes positive impacts of inflation for certain of us have no good benefits for people at the lower end of the spectrum.”

And even former Fed economists agree. Andrew Levin, who’s now a Dartmouth College professor said: “The Fed and other central banks need to make sure they can foster the recovery from a severe adverse shock. But the answer is not to push inflation higher. Elevated inflation would be particularly burdensome for lower-income families.’’

Other economists have similar takes:

University of Chicago economist Greg Kaplan found that the cumulative inflation rate was 8-to-9 percentage points lower for households with incomes above $100,000 versus those with incomes below $20,000 over the 2004-2012 period. During that time, inflation averaged 2.2% which would be in the range of what Fed officials are now discussing as a possible strategy.

US Federal Reserve Bank’s Net Worth Turns Negative, They’re Insolvent, A Zombie Bank, That’s All Folks

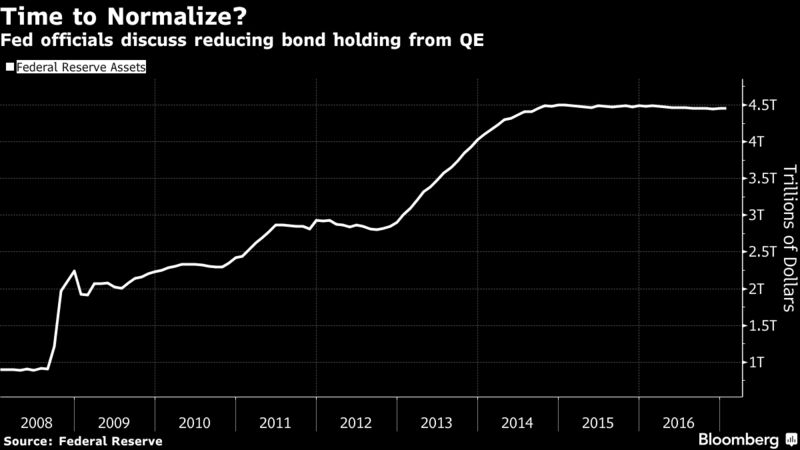

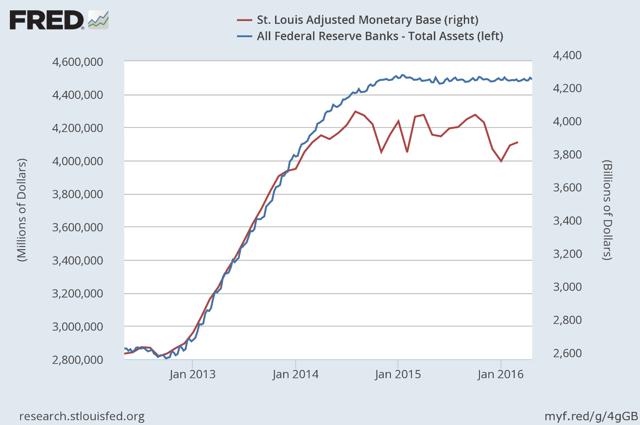

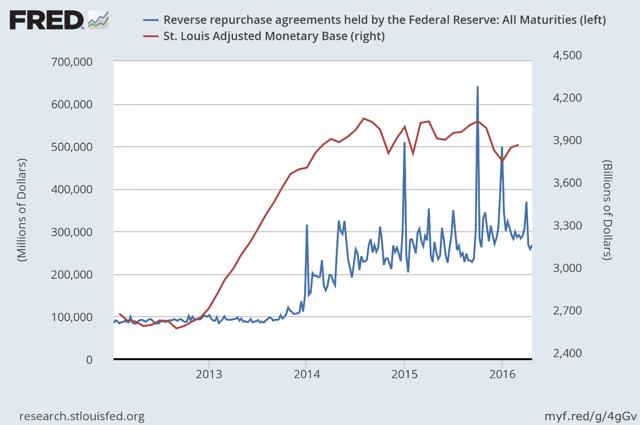

While the Fed has been engaging in quantitative tightening for over a year now in an attempt to shrink its asset holdings, it still has over $4.1 trillion in bonds on its balance sheet, and as a result of the spike in yields since last summer, their massive portfolio has suffered substantial paper losses which according to the Fed’s latest quarterly financial report, hit a record $66.453 billion in the third quarter, raising questions about their strategy at a politically charged moment for the central bank, whose “independence” has been put increasingly into question as a result of relentless badgering by Donald Trump.

What immediately caught the attention of financial analysts is that the gaping Q3 loss of over $66 billion, dwarfed the Fed’s $39.1 billion in capital, leaving the US central bank with a negative net worth…

… which would suggest insolvency for any ordinary company, but since the Fed gets to print its own money, it is of course anything but an ordinary company as Bloomberg quips.

It’s not just the fact that the US central bank prints the world’s reserve currency, but that it also does not mark its holdings to market. As a result, Fed officials usually play down the significance of the theoretical losses and say they won’t affect the ability of what they call “a unique non-profit entity’’ to carry out monetary policy or remit profits to the Treasury Department. Indeed, confirming this the Fed handed over $51.6 billion to the Treasury in the first nine months of the year.

The risk, however, is that should the Fed’s finances continue to deteriorate if only on paper, it could impair its standing with Congress and the public when it is already under attack from President Donald Trump as being a bigger problem than trade foe China.

Commenting on the Fed’s paper losses, former Fed Governor Kevin Warsh told Bloomberg that “a central bank with a negative net worth matters not in theory. But in practice, it runs the risk of chipping away at Fed credibility, its most powerful asset.’’

Additionally, the growing unrealized losses provide fuel to critics of the Fed’s QE and the monetary operating framework underpinning them, just as central bankers begin discussing the future of its balance sheet. And, as Bloomberg cautions, the metaphoric red ink also could make it politically more difficult for the Fed to resume QE if the economy turns down.

“We’re seeing the downside risk of unconventional monetary policy,’’ said Andy Barr, the outgoing chairman of the monetary policy and trade subcommittee of the House Financial Services panel. “The burden should be on them to tell us why this does not compromise their credibility and why the public and Congress should not be concerned about their solvency.’’

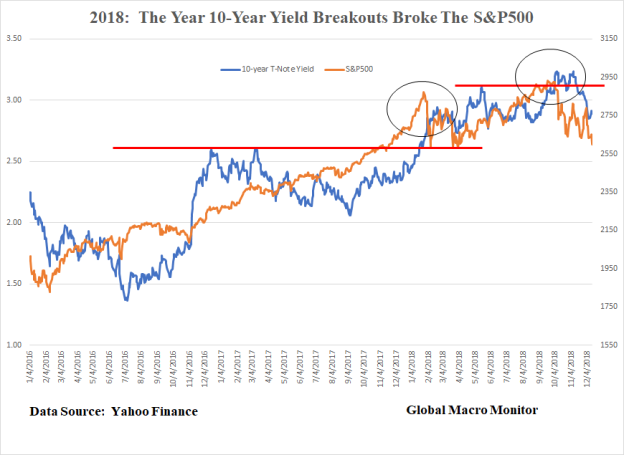

Of course, the culprit for the record loss is not so much the holdings, as the impact on bond prices as a result of rising rates which spiked in the summer as a result of the Fed’s own overoptimism on the economy, and which closed the third quarter at 3.10% on the 10Y Treasury. Indeed, with rates rising slower in the second quarter, the loss for Q3 was a more modest $19.6 billion.

And with yields tumbling in the fourth quarter as a result of the current growth and markets scare, it is likely that the Fed could book a major “profit” for the fourth quarter as the 10Y yield is now trading just barely above the 2.86% where it was on June 30.

Meanwhile, the Fed continues to shrink its bond holdings by a maximum of $50 billion per month, an amount that was hit on October 1, not by selling them, which could force it to recognize but by opting not to reinvest some of the proceeds of securities as they mature.

The Fed is expected to continue shrinking its balance sheet at rate of $50BN / month until the end of 2020 (as shown below) unless of course market stress forces the Fed to halt QT well in advance of its tentative conclusion.

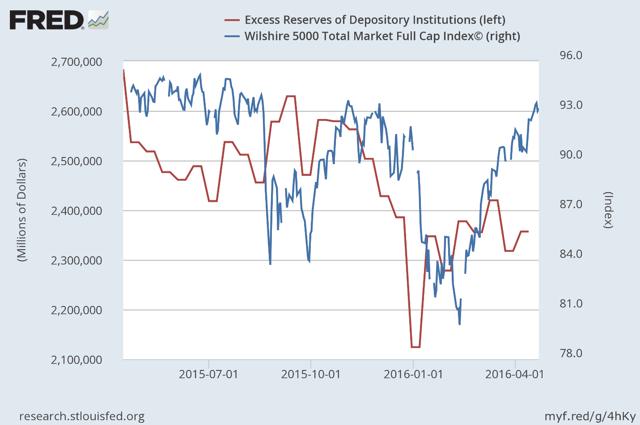

In any case, the Fed will certainly never return to its far leaner balance sheet from before the crisis, which means that it will continue to indefinitely pay banks interest on the excess reserves they park at the Fed, with many of the recipient banks being foreign entities.

Barr, a Kentucky Republican, has accurately criticized that as a subsidy for the banks, one which will amount to tens of billions in annual “earnings” from the Fed, the higher the IOER rate goes up. He is not alone: so too has California Democrat Maxine Waters, who will take over as chair of the House Financial Services Committee in January following her party’s victory in the November congressional elections.

* * *

Going back to the Fed’s unique treatment of losses on its income statement and its under capitalization, in an Aug. 13 note, Fed officials Brian Bonis, Lauren Fiesthumel and Jamie Noonan defended the central bank’s decision not to follow GAAP in valuing its portfolio. Not only is the central bank a unique creation of Congress, it intends to hold its bonds to maturity, they wrote.

Under GAAP, an institution is required to report trading securities and those available for sale at fair or market value, rather than at face value. The Fed reports its balance-sheet holdings at face value.

The Fed is far less cautious with the treatment of its “profits”, which it regularly hands over to the Treasury: the interest income on its bonds was $80.2 billion in 2017. The central bank turns a profit on its portfolio because it doesn’t pay interest on one of its biggest liabilities – $1.7 trillion in currency outstanding.

The Fed’s unique financial treatments also extends to Congress, which while limiting to $6.8 billion the amount of profits that the Fed can retain to boost its capital has also repeatedly “raided” the Fed’s capital to pay for various government programs, including $19 billion in 2015 for spending on highways.

Still, a negative net worth is sure to raise eyebrows especially after Janet Yellen said in December 2015 that “capital is something that I believe enhances the credibility and confidence in the central bank.”

* * *

Furthermore, as Bloomberg adds, if it had to the Fed could easily operate with negative net worth – as it is doing now – like other central banks in Chile, the Czech Republic and elsewhere have done, according to Nathan Sheets, chief economist at PGIM Fixed Income. That said, questionable Fed finances pose communications and mostly political problems for Fed policymakers.

As for long-time Fed critic and former Fed governor, Kevin Warsh, he zeroed in on the potential impact on quantitative easing.

“QE works predominantly through its signaling to financial markets,’’ he said. “If Fed credibility is diminished for any reason — by misunderstanding the state of the economy, under-estimating the power of QE’s unwind or carrying a persistent negative net worth — QE efficacy is diminished.’’

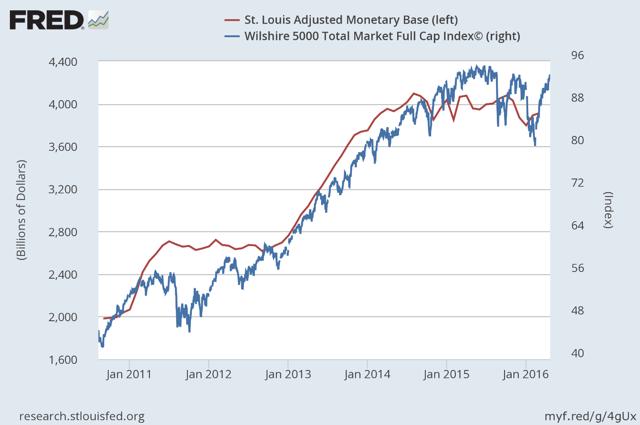

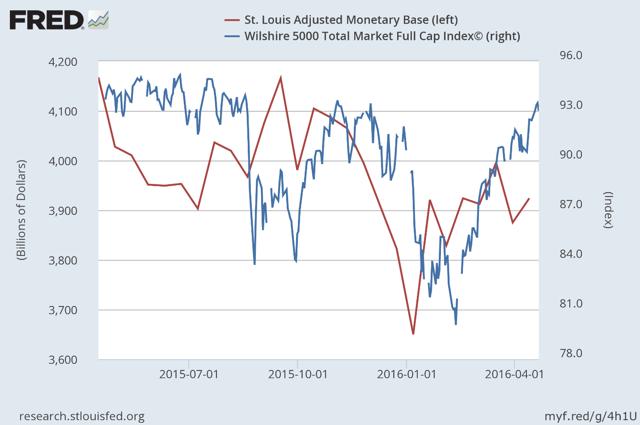

The biggest irony, of course, is that the more “successful” the Fed is in raising rates – and pushing bond prices lower – the greater the un-booked losses on its bond holdings will become; should they become great enough to invite constant Congressional oversight, the casualty may be none other than the equity market, which owes all of its gains since 2009 to the Federal Reserve.

While a central bank can operate with negative net worth, such a condition could have political consequences, Tobias Adrian, financial markets chief at the IMF said. “An institution with negative equity is not confidence-instilling,’’ he told a Washington conference on Nov. 15. “The perception might be quite destabilizing at some point.”

That point will likely come some time during the next two years as the acrimonious relationship between Trump and Fed Chair Jerome Powell devolves further, at which point the culprit by design, for what would be the biggest market crash in history will be not the Fed – which in the past decade blew the biggest asset bubble in history – but President Trump himself.

***

Diagnosing What Ails The Market

The Central Bank Bubble’s Bursting: It Will Be Ugly

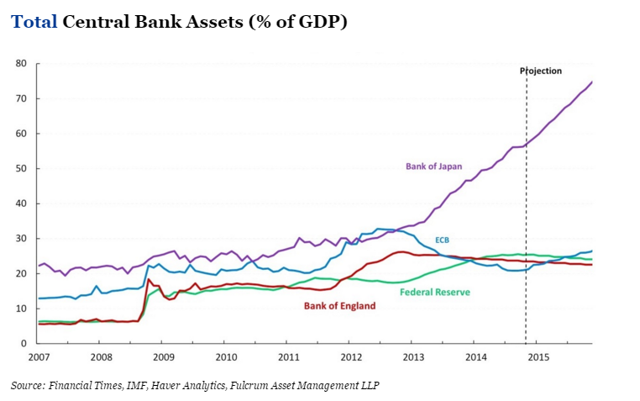

The global economy has been living through a period of central bank insanity, thanks to a little-understood expansion strategy known as quantitative easing, which has destroyed main-street and benefited wall street.

Central Banks over the last decade simply created credit out of thin air. Snap a finger, and credit magically appears. Only central banks can perform this type of credit magic. It’s called printing money and they have gone on the record saying they are magic people.

Increasing the money supply lowers interest rates, which makes it easier for banks to offer loans. Easy loans allow businesses to expand and provides consumers with more credit to buy goods and increase their debt. As a country’s debt increases, its currency eventually debases, and the world is currently at historic global debt levels.

Simply put, the world’s central banks are playing a game of monopoly.

With securities being bought by a currency that is backed by debt rather than actual value, we have recently seen $9.7 trillion in bonds with a negative yield. At maturity, the bond holders will actually lose money, thanks to the global central banks’ strategies. The Federal Reserve has already hinted that negative interest rates will be coming in the next recession.

These massive bond purchases have kept volatility relatively stable, but that can change quickly. High inflation is becoming a real possibility. China, which is planning to dethrone the dollar by backing the Yuan with gold, may survive the coming central banking bubble. Many other countries will be left scrambling. Some central banks are attempting to turn the current expansion policies around. Both the Federal Reserve, the Bank of Canada, and the Bank of England have plans to hike interest rates. The European Central Bank is planning to reduce its purchases of bonds. Is this too little, too late?

The recent global populist movement is likely to fuel government spending and higher taxes as protectionist policies increase. The call to end wealth inequality may send the value of overvalued bonds crashing in value. The question is, how can an artificially stimulated economic boom last in a debtors’ economy?

Central bankers began to embrace their quantitative easing strategies as a remedy to the 2007 economic slump. Instead of focusing on regulatory policies, central bankers became the rescuers of last resort as they snapped up government bonds, mortgage securities, and corporate bonds. For the first time, regulatory agencies became the worlds’ largest investment group. The strategy served as a temporary band-aid as countries slowly recovered from the global recession. The actual result, however, has been a tremendous distortion of asset valuation as interest rates remain low, allowing banks to continue a debt-backed lending spree.

It’s a monopoly game on steroids.

The results of the central banks’ intervention were mixed. While a small, elite wealthy segment was purchasing assets, the rest of the population felt the widening income gap as wage increases failed to meet expectations and the cost of consumer goods kept rising. The policies of the Federal Reserve were not having the desired effect. While the Federal Reserve Bank began to reverse its quantitative easing policy, other central banks, such as the European Central Bank, the Swiss National Bank, and the European National Bank have become even more aggressive in the quantitative easing strategies by continuing to print money with abandon. By 2017, the Bank of Japan was the owner of three-quarters of Japan’s exchange-traded funds, becoming the major shareholder trading in the Nikkei 225 Index.

The Swiss National Bank is expanding its quantitative easing policy by including international investments. It is now one of Apple’s major shareholders, with a $2.8 billion investment in the company.

Centrals banks have become the world’s largest investors, mostly with printed money. This is inflating global asset prices at an unprecedented rate. Negative bond yields are just one consequence of this financial distortion.

While the Federal Reserve is reducing its investment purchases, other global banks are keeping a watchful eye on the results. Distorted interest rates will hit investors hard, especially those who have sought out riskier and higher yields as a consequence of quantitative easing (malinvestment).

The policies of the central banks were unsustainable from the start. The stakes in their monopoly game are rising as they are attempting to rectify their negative-yield bond purchasing with purchases of stocks. This is keeping the game alive for the time being. However, these stocks cannot be sold without crashing the market. Who will end up losers and winners? Middle America certainly isn’t going to be happy when the game ends. If central banks continue in their role as stockholders funded by fiat currency, it will change the game completely.

Middle America has cause to feel uneasy…

The Fed’s “Magic Trick” Exposed

In 1791, the first Secretary of the Treasury of the US, Alexander Hamilton, convinced then-new president George Washington to create a central bank for the country.

Secretary of State Thomas Jefferson opposed the idea, as he felt that it would lead to speculation, financial manipulation, and corruption. He was correct, and in 1811, its charter was not renewed by Congress.

Then, the US got itself into economic trouble over the War of 1812 and needed money. In 1816, a Second Bank of the United States was created. Andrew Jackson took the same view as Mister Jefferson before him and, in 1836, succeeded in getting the bank dissolved.

Then, in 1913, the leading bankers of the US succeeded in pushing through a third central bank, the Federal Reserve. At that time, critics echoed the sentiments of Messrs. Jefferson and Jackson, but their warnings were not heeded. For over 100 years, the US has been saddled by a central bank, which has been manifestly guilty of speculation, financial manipulation, and corruption, just as predicted by Mister Jefferson.

From its inception, one of the goals of the bank was to create inflation. And, here, it’s important to emphasize the term “goals.” Inflation was not an accidental by-product of the Fed – it was a goal.

Over the last century, the Fed has often stated that inflation is both normal and necessary. And yet, historically, it has often been the case that an individual could go through his entire lifetime without inflation, without detriment to his economic life.

Yet, whenever the American people suffer as a result of inflation, the Fed is quick to advise them that, without it, the country could not function correctly.

In order to illustrate this, the Fed has even come up with its own illustration “explaining” inflation. Here it is, for your edification:

If the reader is of an age that he can remember the inventions of Rube Goldberg, who designed absurdly complicated machinery that accomplished little or nothing, he might see the resemblance of a Rube Goldberg design in the above illustration.

And yet, the Fed’s illustration can be regarded as effective. After spending several minutes taking in the above complex relationships, an individual would be unlikely to ask, “What did they leave out of the illustration?”

Well, what’s missing is the Fed itself.

As stated above, back in 1913, one of the goals in the creation of the Fed was to have an entity that had the power to create currency, which would mean the power to create inflation.

It’s a given that all governments tax their people. Governments are, by their very nature, parasitical entities that produce nothing but live off the production of others. And, so, it can be expected that any government will increase taxes as much and as often as it can get away with it. The problem is that, at some point, those being taxed rebel, and the government is either overthrown or the tax must be diminished. This dynamic has existed for thousands of years.

However, inflation is a bit of a magic trick. Now, remember, a magician does no magic. What he does is create an illusion, often through the employment of a distraction, which fools the audience into failing to understand what he’s really doing.

And, for a central bank, inflation is the ideal magic trick. The public do not see inflation as a tax; the magician has presented it as a normal and even necessary condition of a healthy economy.

However, what inflation (which has traditionally been defined as the increase in the amount of currency in circulation) really accomplishes is to devalue the currency through oversupply. And, of course, anyone who keeps his wealth (however large or small) in currency units loses a portion of their wealth with each devaluation.

In the 100-plus years since the creation of the Federal Reserve, the Fed has steadily inflated the US dollar. Over time, this has resulted in the dollar being devalued by over 97%.

The dollar is now virtually played out in value and is due for disposal. In order to continue to “tax” the American people through inflation, a reset is needed, with a new currency, which can then also be steadily devalued through inflation.

Once the above process is understood, it’s understandable if the individual feels that his government, along with the Fed, has been robbing him all his life. He’s right—it has.

And it’s done so without ever needing to point a gun to his head.

The magic trick has been an eminently successful one, and there’s no reason to assume that the average person will ever unmask and denounce the magician. However, the individual who understands the trick can choose to mitigate his losses. He or she can take measures to remove their wealth from any state that steadily imposes inflation upon their subjects and store it in physically possessed gold, silver and private cryptocurrency keys.

Bringing Forward Important Questions About The Fed’s Role In Our Economy Today

I hope this article brings forward important questions about the Federal Reserves role in the US as it attempts to begin a broader dialogue about the financial and economic impacts of allowing the Federal Reserve to direct America’s economy. At the heart of this discussion is how the Federal Reserve always was, or perhaps morphed, into a state level predatory lender providing the means for a nation to eventually bankrupt itself.

Against the adamant wishes of the Constitution’s framers, in 1913 the Federal Reserve System was Congressionally created. According to the Fed’s website, “it was created to provide the nation with a safer, more flexible, and more stable monetary and financial system.” Although parts of the Federal Reserve System share some characteristics with private-sector entities, the Federal Reserve was supposedly established to serve the public interest.

A quick overview; monetary policy is the Federal Reserve’s actions, as a central bank, to achieve three goals specified by Congress: maximum employment, stable prices, and moderate long-term interest rates in the United States. The Federal Reserve conducts the nation’s monetary policy by managing the level of short-term interest rates and influencing the availability and cost of credit in the economy. Monetary policy directly affects interest rates; it indirectly affects stock prices, wealth, and currency exchange rates. Through these channels, monetary policy influences spending, investment, production, employment, and inflation in the United States.

I suggest what truly happened in 1913 was that Congress willingly abdicated a portion of its responsibilities, and through the Federal Reserve, began a process that would undermine the functioning American democracy. “How”, you ask? The Fed, believing the free-market to be “imperfect” (aka; wrong) believed it (the Fed) should control and set interest rates, determine full employment, determine asset prices; not the “free market”. And here’s what happened:

- From 1913 to 1971, an increase of $400 billion in federal debt cost $35 billion in additional annual interest payments.

- From 1971 to 1981, an increase of $600 billion in federal debt cost $108 billion in additional annual interest payments.

- From 1981 to 1997, an increase of $4.4 trillion cost $224 billion in additional annual interest payments.

- From 1997 to 2017, an increase of $15.2 trillion cost “just” $132 billion in additional annual interest payments.

Stop and read through those bullet points again…and then one more time. In case that hasn’t sunk in, check the chart below…

What was the economic impact of the Federal Reserve encouraging all that debt? The yellow line in the chart below shows the annual net impact of economic growth (in growing part, spurred by the spending of that new debt)…gauged by GDP (blue columns) minus the annual rise in federal government debt (red columns). When viewing the chart, the problem should be fairly apparent. GDP, subtracting the annual federal debt fueled spending, shows the US economy is collapsing except for counting the massive debt spending as “economic growth”.

Same as above, but a close-up from 1981 to present. Not pretty.

Consider since 1981, the Federal Reserve set FFR % (Federal Funds rate %) is down 94% and the associated impacts on the 10yr Treasury (down 82%) and the 30yr Mortgage rate (down 77%). Four decades of cheapening the cost of servicing debt has incentivized and promoted ever greater use of debt.

Again, according to the Fed’s website, “it was created to provide the nation with a safer, more flexible, and more stable monetary and financial system.” However, the chart below shows the Federal Reserve policies’ impact on the 10yr Treasury, stocks (Wilshire 5000 representing all publicly traded US stocks), and housing to be anything but “safer” or “stable”.

Previously, I have made it clear the asset appreciation the Fed is providing is helping a select few, at the expense of the many, HERE.

But a functioning democratic republic is premised on a simple agreement that We (the people) will freely choose our leaders who will (among other things) compromise on how taxation is to be levied, how much tax is to be collected, and how that taxation is to be spent. The intervention of the Federal Reserve into that equation, controlling interest rates, outright purchasing assets, and plainly goosing asset prices has introduced a cancer into the nation which has now metastasized.

In time, Congress (& the electorate) would realize they no longer had to compromise between infinite wants and finite means. The Federal Reserve’s nearly four decades of interest rate reductions and a decade of asset purchases motivated the election of candidates promising ever greater government absent the higher taxation to pay for it. Surging asset prices created fast rising tax revenue. Those espousing “fiscal conservatism” or living within our means (among R’s and/or D’s) were simply unelectable.

This Congressionally created mess has culminated in the accumulation of national debt beyond our means to ever repay. As the chart below highlights, the Federal Reserve set interest rate (Fed. Funds Rate=blue line) peaked in 1981 and was continually reduced until it reached zero in 2009. The impact of lower interest rates to promote ever greater national debt creation was stupendous, rising from under $1 trillion in 1981 to nearing $21 trillion presently. However, thanks to the seemingly perpetually lower Federal Reserve provided rates, America’s interest rate continually declined inversely to America’s credit worthiness or ability to repay the debt.

The impact of the declining rates meant America would not be burdened with significantly rising interest payments or the much feared bond “Armageddon” (chart below). All the upside of spending now, with none of the downside of ever paying it back, or even simply paying more in interest. Politicians were able to tell their constituencies they could have it all…and anyone suggesting otherwise was plainly not in contention. Federal debt soared and soared but interest payable in dollars on that debt only gently nudged upward.

- In 1971, the US paid $36 billion in interest on $400 billion in federal debt…a 9% APR.

- In 1981, the US paid $142 billion on just under $1 trillion in debt…a 14% APR.

- In 1997, the US paid $368 billion on $5.4 trillion in debt or 7% APR…and despite debt nearly doubling by 2007, annual interest payments in ’07 were $30 billion less than a decade earlier.

- By 2017, the US will pay out about $500 billion on nearly $21 trillion in debt…just a 2% APR.

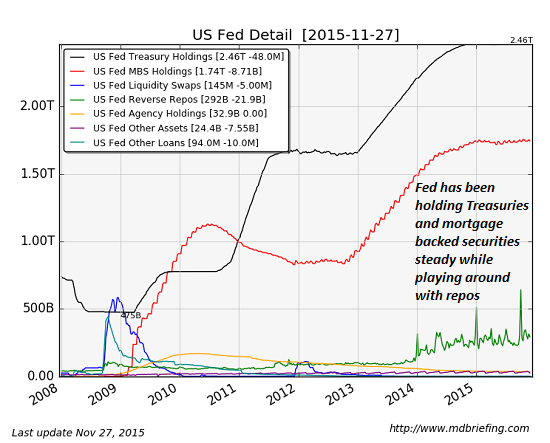

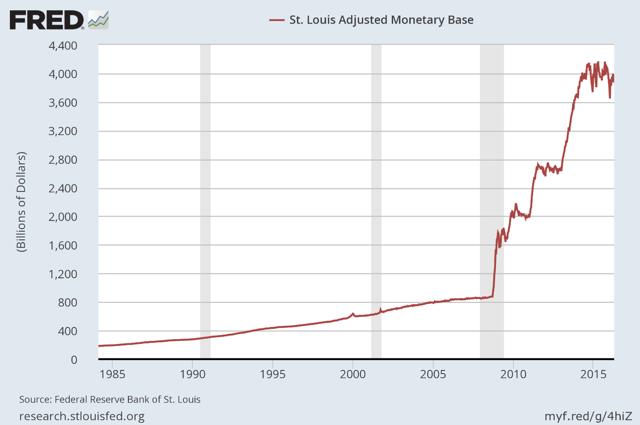

The Federal Reserve began cutting its benchmark interest rates in 1981 from peak rates. Few understood that the Fed would cut rates continually over the next three decades. But by 2008, lower rates were not enough. The Federal Reserve determined to conjure money into existence and purchase $4.5 trillion in mid and long duration assets. Previous to this, the Fed has essentially held zero assets beyond short duration assets in it’s role to effect monetary policy. The change to hold longer duration assets was a new and different self appointed mandate to maintain and increase asset prices.

But why the declining interest rates and asset purchases in the first place?

The Federal Reserve interest rates have very simply primarily followed the population cycle and only secondarily the business cycle. What the chart below highlights is annual 25-54yr/old population growth (blue columns) versus annual change in 25-54yr/old employees (black line), set against the Federal Funds Rate (yellow line). The FFR has followed the core 25-54yr/old population growth…and the rising, then decelerating, now declining demand that that represented means lower or negative rates are likely just on the horizon (despite the Fed’s current messaging to the contrary).

Below, a close-up of the above chart from 2000 to present.

Running out of employees??? Each time the 25-54yr/old population segment has exceeded 80% employment, economic dislocation has been dead ahead. We have just exceeded 78% but given the declining 25-54yr/old population versus rising employment…and the US is likely to again exceed 80% in 2018.

Given the FFR follows population growth, consider that the even broader 20-65yr/old population will essentially see population growth grind to a halt over the next two decades. This is no prediction or estimate, this population has already been born and the only variable is the level of immigration…which is falling fast due to declining illegal immigration meaning the lower Census estimate is more likely than the middle estimate.

So where will America’s population growth take place? The 65+yr/old population is set to surge.

But population growth will be shifting to the most elderly of the elderly…the 75+yr/old population. I outlined the problems with this previously HERE.

Back to the Federal Reserve, consider the impact on debt creation prior and post the creation of the Federal Reserve:

- 1790-1913: Debt to GDP Averaged 14%

- 1913-2017: Debt to GDP Averaged 53%

- 1913-1981: 46% Average

- 1981-2000: 52% Average

- 2000-2017: 79% Average

As the chart below highlights, since the creation of the Federal Reserve the growth of debt (relative to growth of economic activity) has gone to levels never dreamed of by the founding fathers. In particular, the systemic surges in debt since 1981 are unlike anything ever seen prior in American history. Although the peak of debt to GDP seen in WWII may have been higher (changes in GDP calculations mean current GDP levels are likely significantly overstating economic activity), the duration and reliance upon debt was entirely tied to the war. Upon the end of the war, the economy did not rely on debt for further growth and total debt fell.

Any suggestion that the current situation is like any America has seen previously is simply ludicrous. Consider that during WWII, debt was used to fight a war and initiate a global rebuild via the Marshall Plan…but by 1948, total federal debt had already been paid down by $19 billion or a seven percent reduction…and total debt would not exceed the 1946 high water mark again until 1957. During that ’46 to ’57 stretch, the economy would boom with zero federal debt growth.

- 1941…Fed debt = $58 b (Debt to GDP = 44%)

- 1946…Fed debt = $271 b (Debt to GDP = 119%)

- 1948…Fed debt = $252 b <$19b> (Debt to GDP = 92%)

- 1957…Fed debt = $272 b (Debt to GDP = 57%)

If the current crisis ended in 2011 (recession ended by 2010, by July of 2011 stock markets had recovered their losses), then the use of debt as a temporary stimulus should have ended?!? Instead, debt and debt to GDP are still rising.

- 2007…Federal debt = $8.9 T (Debt to GDP = 62%)

- 2011…Federal debt = $13.5 T (Debt to GDP = 95%)

- 2017…Federal Debt = $20.5 T (Debt to GDP = 105%)

July of 2011 was the great debt ceiling debate when America determined once and for all, that the federal debt was not actually debt. America had no intention to ever repay it. It was simply monetization and since the Federal Reserve was maintaining ZIRP, and all oil importers were forced to buy their oil using US dollars thanks to the Petrodollar agreement…what could go wrong?

But who would continue to buy US debt if the US was addicted to monetization in order to pay its bills? Apparently, not foreigners. If we look at foreign Treasury buying, some very notable changes are apparent beginning in July of 2011:

- The BRICS (Brazil, Russia, India, China, S. Africa…represented in red in the chart below) ceased net accumulating US debt as of July 2011.

- Simultaneous to the BRICS cessation, the BLICS (Belgium, Luxembourg, Ireland, Cayman Island, Switzerland…represented in black in the chart below) stepped in to maintain the bid.

- Since QE ended in late 2014, foreigners have followed the Federal Reserve’s example and nearly forgone buying US Treasury debt.

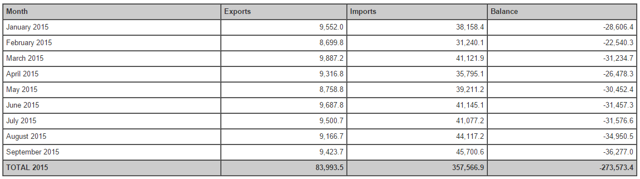

China was first to opt out and began net selling US Treasuries as of August, 2011 (China in red, chart below). China has continued to run record trade driven dollar surplus but has net recycled none of that into US debt since July, 2011. China had averaged 50% of its trade surplus into Treasury debt from 2000 to July of 2011, but from August 2011 onward China stopped cold.

As China (and more generally the BRICS) ceased buying US Treasury debt, a strange collection of financier nations (the BLICS) suddenly became very interested in US Treasury debt. From the debt ceiling debate to the end of QE, these nations were suddenly very excited to add $700 billion in near record low yielding US debt while China net sold.

The chart below shows total debt issued during periods, from 1950 to present, and who accumulated the increase in outstanding Treasurys.

The Federal Reserve plus foreigners represented nearly 2/3rds of all demand from ’08 through ’14. However, since the end of QE, and that 2/3rds of demand gone…rates continue near generational lows??? Who is buying Treasury debt? According to the US Treasury, since QE ended, it is record domestic demand that is maintaining the Treasury bid. The same domestic public buying stocks at record highs and buying housing at record highs.

Looking at who owns America’s debt 2007 through 2016, the chart below highlights the four groups that hold nearly 90% of the debt:

- The combined Federal Reserve/Government Accounting Series

- Foreigners

- Domestic Mutual Funds

- And the massive rise in Treasury holdings by domestic “Other Investors” who are not domestic insurance companies, not local or state governments, not depository institutions, not pensions, not mutual funds, nor US Saving bonds.

Treasury buying by foreigners and the Federal Reserve has collapsed since QE ended (chart below). However, the odd surge of domestic “other investors”, Intra-Governmental GAS, and domestic mutual funds have nearly been the sole buyer preventing the US from suffering a very painful surge in interest payments on the record quantity of US Treasury debt.

No, this is nothing like WWII or any previous “crisis”. While America has appointed itself “global policeman” and militarily outspends the rest of the world combined, America is not at war. Simply put, what we are looking at appears little different than the Madoff style Ponzi…but this time it is a state sponsored financial fraud magnitudes larger.

The Federal Reserve and its systematic declining interest rates to perpetuate unrealistically high rates of growth in the face of rapidly decelerating population growth have fouled the American political system, its democracy, and promoted the system that has now bankrupted the nation. And it appears that the Federal Reserve is now directing a state level fraud and farce. If it isn’t time to reconsider the Fed’s role and continued existence now, then when?

Fed Warns Markets “Vulnerable to Elevated Valuations” [charts]

Hussman Predicts Massive Losses As Cycle Completes After Fed Warns Markets “Vulnerable to Elevated Valuations”

Buried deep in today’s FOMC Minutes was a warning to the equity markets that few noticed…

This overall assessment incorporated the staff’s judgment that, since the April assessment, vulnerabilities associated with asset valuation pressures had edged up from notable to elevated, as asset prices remained high or climbed further, risk spreads narrowed, and expected and actual volatility remained muted in a range of financial markets…

According to another view, recent rises in equity prices might be part of a broad-based adjustment of asset prices to changes in longer-term financial conditions, importantly including a lower neutral real interest rate, and, therefore, the recent equity price increases might not provide much additional impetus to aggregate spending on goods and services.

According to one view, the easing of financial conditions meant that the economic effects of the Committee’s actions in gradually removing policy accommodation had been largely offset by other factors influencing financial markets, and that a tighter monetary policy than otherwise was warranted.

Roughly translated means – higher equity prices are driving financial conditions to extreme ‘easiness’ and The Fed needs to slow stock prices to regain any effective control over monetary conditions.

And with that ‘explicit bubble warning’, it appears the ‘other’ side of the cycle, that Hussman Funds’ John Hussman has been so vehemently explaining to investors, is about to begin…

Nothing in history leads me to expect that current extremes will end in something other than profound disappointment for investors. In my view, the S&P 500 will likely complete the current cycle at an index level that has only 3-digits. Indeed, a market decline of -63% would presently be required to take the most historically reliable valuation measures we identify to the same norms that they have revisited or breached during the completion of nearly every market cycle in history.

The notion that elevated valuations are “justified” by low interest rates requires the assumption that future cash flows and growth rates are held constant. But any investor familiar with discounted cash flow valuation should recognize that if interest rates are lower because expected growth is also lower, the prospective return on the investment falls without any need for a valuation premium.

At present, however, we observe not only the most obscene level of valuation in history aside from the single week of the March 24, 2000 market peak; not only the most extreme median valuations across individual S&P 500 component stocks in history; not only the most extreme overvalued, overbought, over bullish syndromes we define; but also interest rates that are off the zero-bound, and a key feature that has historically been the hinge between overvalued markets that continue higher and overvalued markets that collapse: widening divergences in internal market action across a broad range of stocks and security types, signaling growing risk-aversion among investors, at valuation levels that provide no cushion against severe losses.

We extract signals about the preferences of investors toward speculation or risk-aversion based on the joint and sometimes subtle behavior of numerous markets and securities, so our inferences don’t map to any short list of indicators. Still, internal dispersion is becoming apparent in measures that are increasingly obvious. For example, a growing proportion of individual stocks falling below their respective 200-day moving averages; widening divergences in leadership (as measured by the proportion of individual issues setting both new highs and new lows); widening dispersion across industry groups and sectors, for example, transportation versus industrial stocks, small-cap stocks versus large-cap stocks; and fresh divergences in the behavior of credit-sensitive junk debt versus debt securities of higher quality. All of this dispersion suggests that risk-aversion is rising, no longer subtly. Across history, this sort of shift in investor preferences, coupled with extreme overvalued, overbought, over bullish conditions, has been the hallmark of major peaks and subsequent market collapses.

The chart below shows the percentage of U.S. stocks above their respective 200-day moving averages, along with the S&P 500 Index. The deterioration and widening dispersion in market internals is no longer subtle.

Market internals suggest that risk-aversion is now accelerating. The most extreme variants of “overvalued, overbought, over bullish” conditions we identify are already in place.

A market loss of [1/2.70-1 =] -63% over the completion of this cycle would be a rather run-of-the-mill outcome from these valuations. All of our key measures of expected market return/risk prospects are unfavorable here. Market conditions will change, and as they do, the prospective market return/risk profile will change as well. Examine all of your investment exposures, and ensure that they are consistent with your actual investment horizon and tolerance for risk.

Fed Announced They’re Ready To Start Shrinking Their 4.5T Balance Sheet ― Prepare For Higher Mortgage Rates

Federal Reserve Shocker! What It Means For Housing

The Federal Reserve has announced it will be shrinking its balance sheet. During the last housing meltdown in 2008, it bought the underwater assets of big banks. It has more than two trillion dollars in mortgage-backed securities that are now worth something because of the latest housing boom. Gregory Mannarino of TradersChoice.net says the Fed is signaling a market top in housing. It pumped up the mortgage-backed securities it bought by inflating another housing bubble. Now, the Fed is going to dump the securities on the market. Mannarino predicts housing prices will fall and interest rates will rise.

Janet Yellen Explains Why She Hiked In A 0.9% GDP Quarter

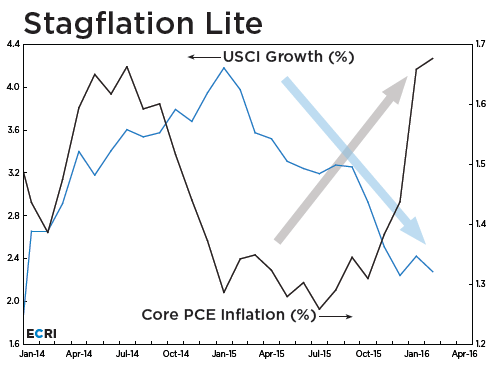

It appears, the worse the economy was doing, the higher the odds of a rate hike.

Putting the Federal Reserve’s third rate hike in 11 years into context, if the Atlanta Fed’s forecast is accurate, 0.9% GDP would mark the weakest quarter since 1980 in which rates were raised (according to Bloomberg data).

We look forward to Ms. Yellen explaining her reasoning – Inflation no longer “transitory”? Asset prices in a bubble? Because we want to crush Trump’s economic policies? Because the banks told us to?

For now it appears what matters to The Fed is not ‘hard’ real economic data but ‘soft’ survey and confidence data…

The Mortgage-Bond Whale That Everyone Is Suddenly Worried About

◆ Fed holds $1.75 Trillion of MBS from quantitative easing program ◆

◆ Comments spur talk Fed may start draw down as soon as this year

Almost a decade after it all began, the Federal Reserve is finally talking about unwinding its grand experiment in monetary policy.

And when it happens, the knock-on effects in the bond market could pose a threat to the U.S. housing recovery.

Just how big is hard to quantify. But over the past month, a number of Fed officials have openly discussed the need for the central bank to reduce its bond holdings, which it amassed as part of its unprecedented quantitative easing during and after the financial crisis. The talk has prompted some on Wall Street to suggest the Fed will start its drawdown as soon as this year, which has refocused attention on its $1.75 trillion stash of mortgage-backed securities.

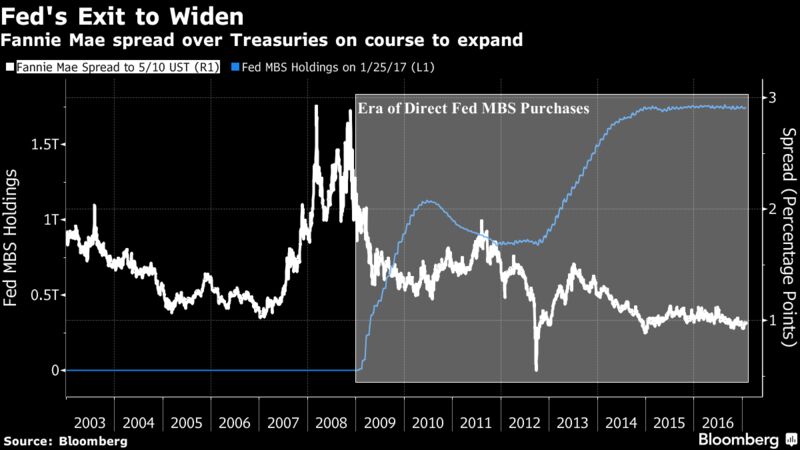

While the Fed also owns Treasuries as part of its $4.45 trillion of assets, its MBS holdings have long been a contentious issue, with some lawmakers criticizing the investments as beyond what’s needed to achieve the central bank’s mandate. Yet because the Fed is now the biggest source of demand for U.S. government-backed mortgage debt and owns a third of the market, any move is likely to boost costs for home buyers.

In the past year alone, the Fed bought $387 billion of mortgage bonds just to maintain its holdings. Getting out of the bond-buying business as the economy strengthens could help lift 30-year mortgage rates past 6 percent within three years, according to Moody’s Analytics Inc.

Unwinding QE “will be a massive and long-lasting hit” for the mortgage market, said Michael Cloherty, the head of U.S. interest-rate strategy at RBC Capital Markets. He expects the Fed to start paring its investments in the fourth quarter and ultimately dispose of all its MBS holdings.

Unprecedented Buying

Unlike Treasuries, the Fed rarely owned mortgage-backed securities before the financial crisis. Over the years, its purchases have been key in getting the housing market back on its feet. Along with near-zero interest rates, the demand from the Fed reduced the cost of mortgage debt relative to Treasuries and encouraged banks to extend more loans to consumers.

In a roughly two-year span that ended in 2014, the Fed increased its MBS holdings by about $1 trillion, which it has maintained by reinvesting its maturing debt. Since then, 30-year bonds composed of Fannie Mae-backed mortgages have only been about a percentage point higher than the average yield for five- and 10-year Treasuries, data compiled by Bloomberg show. That’s less than the spread during housing boom in 2005 and 2006.

Talk of the Fed pulling back from the market has bond dealers anticipating that spreads will widen. Goldman Sachs Group Inc. sees the gap increasing 0.1 percentage point this year, while strategists from JPMorgan Chase & Co. say that once the Fed actually starts to slow its MBS reinvestments, the spread would widen at least 0.2 to 0.25 percentage points.

“The biggest buyer is leaving the market, so there will be less demand for MBS,” said Marty Young, fixed-income analyst at Goldman Sachs. The firm forecasts the central bank will start reducing its holdings in 2018. That’s in line with a majority of bond dealers in the New York Fed’s December survey.

The Fed, for its part, has said it will keep reinvesting until its tightening cycle is “well underway,” according to language that has appeared in every policy statement since December 2015. The range for its target rate currently stands at 0.5 percent to 0.75 percent.

Mortgage Rates

Mortgage rates have started to rise as the Fed moves to increase short-term borrowing costs. Rates for 30-year home loans surged to an almost three-year high of 4.32 percent in December. While rates have edged lower since, they’ve jumped more than three-quarters of a percentage point in just four months.

The surge in mortgage rates is already putting a dent in housing demand. Sales of previously owned homes declined more than forecast in December, even as full-year figures were the strongest in a decade, according to data from the National Association of Realtors.

People are starting to ask the question, “Gee, did I miss my opportunity here to get a low-rate mortgage?” said Tim Steffen, a financial planner at Robert W. Baird & Co. in Milwaukee. “I tell them that rates are still pretty low. But are rates going to go up? It certainly seems like they are.”

Part of it, of course, has to do with the Fed simply raising interest rates as inflation perks up. Officials have long wanted to get benchmark borrowing costs off rock-bottom levels (another legacy of crisis-era policies) and back to levels more consist with a healthy economy. This year, the Fed has penciled in three additional quarter-point rate increases.

The move to taper its investments has the potential to cause further tightening. Morgan Stanley estimates that a $325 billion reduction in the Fed’s MBS holdings from April 2018 through end of 2019 may have the same impact as nearly two additional rate increases.

Finding other sources of demand won’t be easy either. Because of the Fed’s outsize role in the MBS market since the crisis, the vast majority of transactions are done by just a handful of dealers. What’s more, it’s not clear whether investors like foreign central banks and commercial banks can absorb all the extra supply — at least without wider spreads.

On the plus side, getting MBS back into the hands of private investors could help make the market more robust by increasing trading. Average daily volume has plunged more than 40 percent since the crisis, Securities Industry and Financial Markets Association data show.

“Ending reinvestment will mean there are more bonds for the private sector to buy,” said Daniel Hyman, the co-head of the agency-mortgage portfolio management team at Pacific Investment Management Co.

What’s more, it may give the central bank more flexibility to tighten policy, especially if President Donald Trump’s spending plans stir more economic growth and inflation. St. Louis Fed President James Bullard said last month that he’d prefer to use the central bank’s holdings to do some of the lifting, echoing remarks by his Boston colleague Eric Rosengren.

Nevertheless, the consequences for the U.S. housing market can’t be ignored.

The “Fed has already hiked twice and the market is expecting” more, said Munish Gupta, a manager at Nara Capital, a new hedge fund being started by star mortgage trader Charles Smart. “Tapering is the next logical step.”

Fed Raised Rates Once During Obama Years, Yet Promises Constant Rate Hikes During Trump Era?

Now that Donald Trump has won the election, the Federal Reserve has decided now would be a great time to start raising interest rates and slowing down the economy. Over the past several decades, the U.S. economy has always slowed down whenever interest rates have been raised significantly, and on Wednesday the Federal Open Market Committee unanimously voted to raise rates by a quarter point. Stocks immediately started falling, and by the end of the session it was their worst day since October 11th.

The funny thing is that the Federal Reserve could have been raising rates all throughout 2016, but they held off because they didn’t want to hurt Hillary Clinton’s chances of winning the election.

And during Barack Obama’s eight years, there has only been one rate increase the entire time up until this point.

But now that Donald Trump is headed for the White House, the Federal Reserve has decided that now would be a wonderful time to raise interest rates. In addition to the rate hike on Wednesday, the Fed also announced that it is anticipating that rates will be raised three more times each year through the end of 2019…

Fed policymakers are also forecasting three rate increases in 2017, up from two in September, and maintained their projection of three hikes each in 2018 and 2019, according to median estimates. They predict the fed funds rate will be 1.4% at the end of 2017, 2.1% at the end of 2018 and 2.9% at the end of 2019, up from forecasts of 1.1%, Federa1.9% and 2.6%, respectively, in September. Its long-run rate is expected to be 3%, up slightly from 2.9% previously. The Fed reiterated rate increases will be “gradual.”

So Barack Obama got to enjoy the benefit of having interest rates slammed to the floor throughout his presidency, and now Donald Trump is going to have to fight against the economic drag that constant interest rate hikes will cause.

How is that fair?

As rates rise, ordinary Americans are going to find that mortgage payments are going to go up, car payments are going to go up and credit card bills are going to become much more painful. The following comes from CNN…

Higher interest rates affect millions of Americans, especially if you have a credit card or savings account, or want to buy a home or a car. American savers have earned next to nothing at the bank for years. Now they could be a step closer to earning a little more interest on savings account deposits, even though one rate hike won’t change things overnight.

Rates on car loans and mortgages are also likely to be affected. Those are much more closely tied to the interest on a 10-year U.S. Treasury bond, which has risen rapidly since the election. With a Fed hike coming at a time when interest on the 10-year note is also rising, that won’t help borrowers.

The higher interest rates go, the more painful it will be for the economy.

If you recall, rising rates helped precipitate the financial crisis of 2008. When interest rates rose it slammed people with adjustable rate mortgages, and suddenly Americans could not afford to buy homes at the same pace they were before. We have already been watching the early stages of another housing crash start to erupt all over the nation, and rising rates will certainly not help matters.

But why does the Federal Reserve set our interest rates anyway?

We are supposed to be a free market capitalist economy. So why not let the free market set interest rates?

Many Americans are expecting an economic miracle out of Trump, but the truth is that the Federal Reserve has far more power over the economy than anyone else does. Trump can try to reduce taxes and tinker with regulations, but the Fed could end up destroying his entire economic program by constantly raising interest rates.

Of course we don’t actually need economic central planners. The greatest era for economic growth in all of U.S. history came when there was no central bank, and in my article entitled “Why Donald Trump Must Shut Down The Federal Reserve And Start Issuing Debt-Free Money” I explained that Donald Trump must completely overhaul how our system works if he wants any chance of making the U.S. economy great again.

One way that Trump can start exerting influence over the Fed is by nominating the right people to the Federal Open Market Committee. According to CNN, it looks like Trump will have the opportunity to appoint four people to that committee within his first 18 months…

Two spots on the Fed’s committee are currently open for Trump to nominate. Looking ahead, Fed Chair Janet Yellen’s term ends in January 2018, while Vice Chair Stanley Fischer is up for re-nomination in June 2018.

Within the first 18 months of his presidency, Trump could reappoint four of the 12 people on the Fed’s powerful committee — an unusual amount of influence for any president.

By endlessly manipulating the economy, the Fed has played a major role in creating economic booms and busts. Since the Fed was created in 1913, there have been 18 distinct recessions or depressions, and now the Fed is setting the stage for another one.

And anyone that tries to claim that the Fed is not political is only fooling themselves. Everyone knew that they were not going to raise rates during the months leading up to the election, and it was quite clear that this was going to benefit Hillary Clinton.

But now that Donald Trump has won the election, the Fed all of a sudden has decided that the time is perfect to begin a program of consistently raising rates.

If I was Donald Trump, I would be looking to shut down the Federal Reserve as quickly as I could. The essential functions that the Fed performs could be performed by the Treasury Department, and we would be much better off if the free market determined interest rates instead of some bureaucrats.

Unfortunately, most Americans have come to accept that it is “normal” to have a bunch of unelected, unaccountable central planners running our economic system, and so it is unlikely that we will see any major changes before our economy plunges into yet another Fed-created crisis.

The Fed Launches A Facebook Page… And The Result Is Not What It Had Expected

While it is not exactly clear what public relations goals the privately-owned Fed (recall Bernanke’s Former Advisor: “People Would Be Stunned To Know The Extent To Which The Fed Is Privately Owned“) hoped to achieve by launching its first Facebook page last Thursday, the resultant outpouring of less than euphoric public reactions suggest this latest PR effort may have been waster at best, and at worst backfired at a magnitude that matches JPM’s infamous #AskJPM twitter gaffe.

Here are some examples of the public responses to the Fed’s original posting: they all share a certain uniformity…

We wonder how long until the Fed pulls a “blogger Ben Bernanke”, and starts moderating, if not outright blocks, all Facebook comments.

Beware: The $10 Trillion Glut of Treasuries Can Suddenly Pull Interest Rates Up, as Big Deficits Loom

-

Net issuance seen rising after steady declines since 2009

-

Fed seen adding to supply as Treasury ramps up debt sales

Negative yields. Political risk. The Fed. Now add the U.S. deficit to the list of worries to keep beleaguered bond investors up at night.

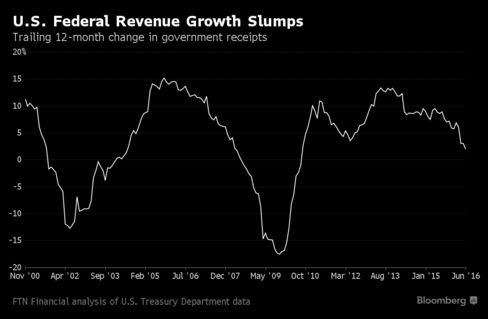

Since peaking at $1.4 trillion in 2009, the budget deficit has plunged amid government spending cuts and a rebound in tax receipts. But now, America’s borrowing needs are rising once again as a lackluster economy slows revenue growth to a six-year low, data compiled by FTN Financial show. That in turn will pressure the U.S. to sell more Treasuries to bridge the funding gap.

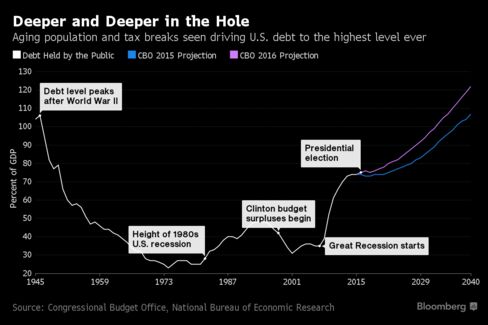

No one predicts an immediate jump in issuance, or a surge in bond yields. But just about everyone agrees that without drastic changes to America’s finances, the government will have to ramp up its borrowing in a big way in the years to come. After a $96 billion increase in the deficit this fiscal year, the U.S. will go deeper and deeper into the red to pay for Social Security and Medicare, projections from the Congressional Budget Office show. The public debt burden could swell by almost $10 trillion in the coming decade as a result.

All the extra supply may ultimately push up Treasury yields and expose holders to losses. And it may come when the Federal Reserve starts to unwind its own holdings — the biggest source of demand since the financial crisis.

“It’s looking like we are at the end of the line,” when it comes to declining issuance of debt that matures in more than a year, said Michael Cloherty, head of U.S. interest-rate strategy at RBC Capital Markets, one of 23 dealers that bid at Treasury debt auctions. “We have deficits that are going to run higher, and at some point, a Fed that will start allowing its Treasury securities to mature.”

After the U.S. borrowed heavily in the wake of the financial crisis to bail out the banks and revive the economy, net issuance of Treasuries has steadily declined as budget shortfalls narrowed. In the year that ended September, the government sold $560 billion of Treasuries on a net basis, the least since 2007, data compiled by Bloomberg show.

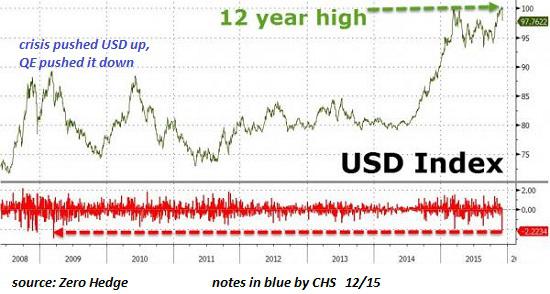

Coupled with increased buying from the Fed, foreign central banks and investors seeking low-risk assets, yields on Treasuries have tumbled even as the overall size of the market ballooned to $13.4 trillion. For the 10-year note, yields hit a record 1.318 percent this month. They were 1.57 percent today. Before the crisis erupted, investors demanded more than 4 percent.

One reason the U.S. may ultimately have to boost borrowing is paltry revenue growth, said Jim Vogel, FTN’s head of interest-rate strategy.

With the economy forecast to grow only about 2 percent a year for the foreseeable future as Americans save more and spend less, there just won’t enough tax revenue to cover the burgeoning costs of programs for the elderly and poor. Those funding issues will ultimately supersede worries about Fed policy, regardless of who ends up in the White House come January.

As a percentage of the gross domestic product, revenue will remain flat in the coming decade as spending rises, CBO forecasts show. That will increase the deficit from 2.9 percent this fiscal year to almost 5 percent by 2026.

“As the Fed recedes a little bit into the background, all of these other questions need to start coming back into the foreground,” Vogel said.

The potential for a glut in Treasuries is emerging as some measures show buyers aren’t giving themselves any margin of safety. A valuation tool called the term premium stands at minus 0.56 percentage point for 10-year notes. As the name implies, the term premium should normally be positive and has been for almost all of the past 50 years. But in 2016, it’s turned into a discount.

Some of the highest-profile players are already sounding the alarm. Jeffrey Gundlach, who oversees more than $100 billion at DoubleLine Capital, warned of a “mass psychosis” among investors piling into debt securities with ultra-low yields. Bill Gross of Janus Capital Group Inc. compared the sky-high prices in the global bond market to a “supernova that will explode one day.”

Despite the increase in supply, things like the gloomy outlook for global growth, an aging U.S. society and more than $9 trillion of negative-yielding bonds will conspire to keep Treasuries in demand, says Jeffrey Rosenberg, BlackRock Inc.’s chief investment strategist for fixed income.

What’s more, the Treasury is likely to fund much of the deficit in the immediate future by boosting sales of T-bills, which mature in a year or less, rather than longer-term debt like notes or bonds.

“We don’t have any other choice — if we’re going to increase the budget deficits, they have to be funded” with more debt, Rosenberg said. But, “in today’s environment, you’re seeing the potential for higher supply in an environment that is profoundly lacking supply of risk-free assets.”

Deutsche Bank AG also says the long-term fiscal outlook hinges more on who controls Congress. And if the Republicans, who hold both the House and Senate, retain control in November, it’s more likely future deficits will come in lower than forecast, based on the firm’s historical analysis.

FED HOLDINGS OF TREASURIES COMING DUE

2016 ────────────── $216 BILLION

2017 ────────────── $197 BILLION

2018 ────────────── $410 BILLION

2019 ────────────── $338 BILLION

However things turn out this election year, what the Fed does with its $2.46 trillion of Treasuries may ultimately prove to be most important of all for investors. Since the Fed ended quantitative easing in 2014, the central bank has maintained its holdings by reinvesting the money from maturing debt into Treasuries. The Fed will plow back about $216 billion this year and reinvest $197 billion in the next, based on current policy.

While the Fed has said it will look to reduce its holdings eventually by scaling back re-investments when bonds come due, it hasn’t announced any timetable for doing so.

“It’s the elephant in the room,” said Dov Zigler, a financial markets economist at Bank of Nova Scotia. “What will the Fed’s role be and how large will its participation be in the Treasury market next year and the year after?”

The “Mystery” Of Who Is Pushing Stocks To All Time Highs Has Been Solved

One conundrum stumping investors in recent months has been how, with investors pulling money out of equity funds (at last check for 17 consecutive weeks) at a pace that suggests a full-on flight to safety, as can be seen in the chart below which shows record fund outflows in the first half of the year – the fastest pace of withdrawals for any first half on record…

… are these same markets trading at all time highs? We now have the answer.

Recall at the end of January when global markets were keeling over, that Citi’s Matt King showed that despite aggressive attempts by the ECB and BOJ to inject constant central bank liquidity into the gunfible global markets, it was the EM drain via reserve liquidations, that was causing a shock to the system, as net liquidity was being withdrawn, and in the process stocks were sliding.

Fast forward six months when Matt King reports that “many clients have been asking for an update of our usual central bank liquidity metrics.”

What the update reveals is “a surge in net global central bank asset purchases to their highest since 2013.”

And just like that the mystery of who has been buying stocks as everyone else has been selling has been revealed.

But wait, there’s more because as King suggests “credit and equities should rally even more strongly than they have done already.”

More observations from King:

The underlying drivers are an acceleration in the pace of ECB and BoJ purchases, coupled with a reversal in the previous decline of EMFX reserves. Other indicators also point to the potential for a further squeeze in global risk assets: a broadening out of mutual fund inflows from IG to HY, EM and equities; the second lowest level of positions in our credit survey (after February) since 2008; and prospects of further stimulus from the BoE and perhaps the BoJ.

His conclusion:

While we remain deeply skeptical of the durability of such a policy-induced rally, unless there is a follow-through in terms of fundamentals, and in credit had already started to emphasize relative value over absolute, we suspect those with bearish longer-term inclinations may nevertheless feel now is not the time to position for them.

And some words of consolation for those who find themselves once again fighting not just the Fed but all central banks:

The problems investors face are those we have referred to many times: markets being driven more by momentum than by value, and most negatives being extremely long-term in nature (the need for deleveraging; political trends towards deglobalization; a steady erosion of confidence in central banks). Against these, the combination of UK political fudge (and perhaps Italian tiramisu), a lack of near-term catalysts, and overwhelming central bank liquidity risks proving overwhelming – albeit only temporarily.

Why have central banks now completely turned their backs on the long-run just to provide some further near-term comfort? Simple: as Keynes said, in the long-run we are all dead.

Dollar Drops for Second Day as Traders Rule Out June Fed Move