“There are no signs of recession. Employment growth is strong. Jobless claims are low and the stock market is up.”

This is heard almost daily from the media mainstream pablum.

The problem with a majority of the “analysis” done today is that it is primarily short-sighted and lazy, produced more for driving views and selling advertising rather than actually helping investors.

For example:

“The economy is currently growing at more than 2% annualized with current estimates near 2% as well.”

If you are growing at 2%, how could you have a recession anytime soon?

Let’s take a look at the data below of real economic growth rates:

- January 1980: 1.43%

- July 1981: 4.39%

- July 1990: 1.73%

- March 2001: 2.30%

- December 2007: 1.87%

If you look at each of those dates, the economy was clearly growing. But each of those dates is the growth rate of the economy immediately prior to the onset of a recession.

You will remember that during the entirety of 2007, the majority of the media, analyst, and economic community were proclaiming continued economic growth into the foreseeable future as there was “no sign of recession.”

I myself was rather brutally chastised in December of 2007 when I wrote that:

“We are now either in, or about to be in, the worst recession since the ‘Great Depression.’”

Of course, a full year later, after the annual data revisions had been released by the Bureau of Economic Analysis (BEA), the recession was officially revealed. Unfortunately, by then it was far too late to matter.

It is here the mainstream media should have learned their lesson. But unfortunately, they didn’t.

The chart below shows the S&P 500 index with recessions and when the National Bureau of Economic Research dated the start of the recession.

There are three lessons that should be learned from this:

- The economic “number” reported today will not be the same when it is revised in the future.

- The trend and deviation of the data are far more important than the number itself.

- “Record” highs and lows are records for a reason as they denote historical turning points in the data.

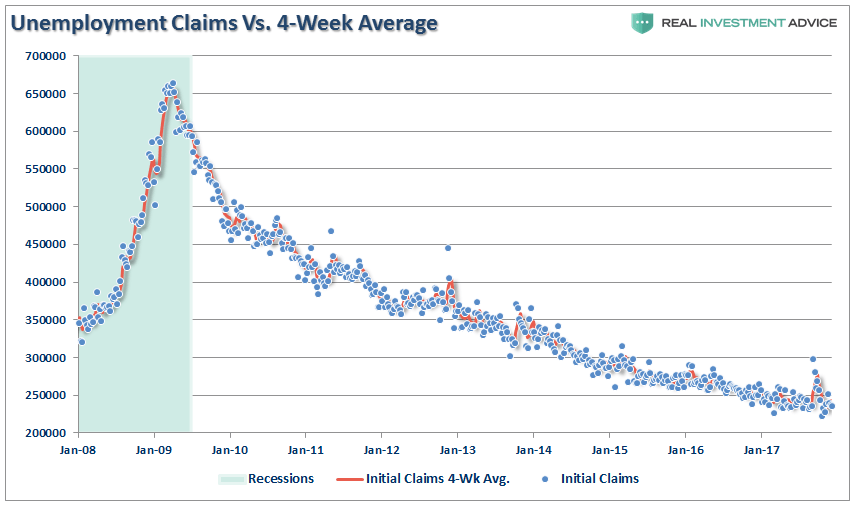

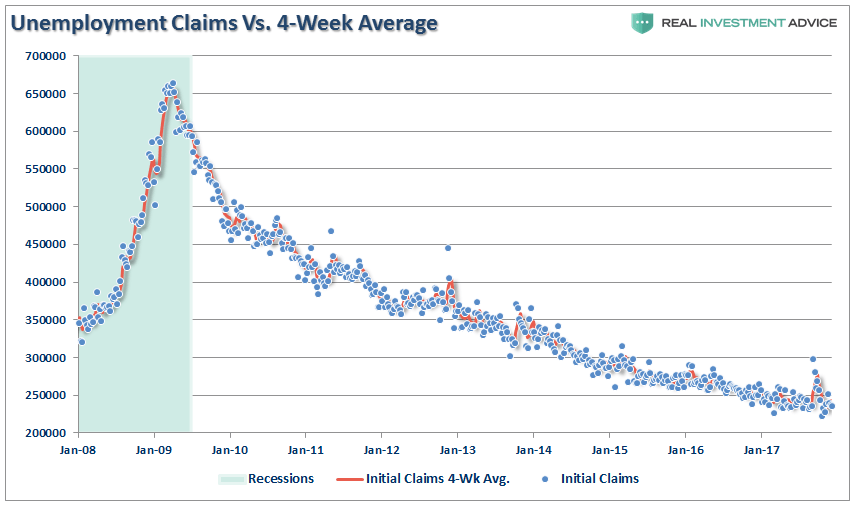

For example, the level of jobless claims is one data series currently being touted as a clear example of why there is “no recession” in sight. As shown below, there is little argument that the data currently appears extremely “bullish” for the economy.

However, if we step back to a longer picture we find that such levels of jobless claims have historically noted the peak of economic growth and warned of a pending recession.

This makes complete sense as “jobless claims” fall to low levels when companies “hoard existing labor” to meet current levels of demand. In other words, companies reach a point of efficiency where they are no longer terminating individuals to align production to aggregate demand. Therefore, jobless claims naturally fall.

But there is more to this story.

Less Than Meets The Eye

The Trump Administration has taken a LOT of credit for the recent bumps in economic growth. We have warned this was not only dangerous, credibility-wise, but also an anomaly due to three massive hurricanes and two major wildfires that had the “broken window” fallacy working overtime.

“The fallacy of the ‘broken window’ narrative is that economic activity is only changed and not increased. The dollars used to pay for the window can no longer be used for their original intended purpose.”

If economic destruction led to long-term economic prosperity, then the U.S. should just regularly drop a “nuke” on a major city and then rebuild it. When you think about it in those terms, you realize just how silly the whole notion is.

However, in the short-term, natural disasters do “pull forward” consumption as individuals need to rebuild and replace what was previously lost. This activity does lead to a short-term boost in the economic data, but fades just as quickly.

A quick look at core retail sales over the last few months, following the hurricanes, shows the temporary bump now fading.

The other interesting aspect of this is the rise in consumer credit as a percent of disposable personal income. The chart below indexes both consumer credit to DPI and retail sales to 100 starting in 1993. What is interesting to note is the rising level of credit card debt required to sustain retail sales.

Given that retail sales make up roughly 40% of personal consumption expenditures which in turn comprises roughly 70% of GDP, the impact to sustained economic growth is important to consider.

Furthermore, what the headlines miss is the growth in the population. The chart below shows retails sales divided by the current 16-and-over population. (If you are alive, you consume.)

Retail sales per capita were previously on a 5% annualized growth trend beginning in 1992. However, after the financial crisis, the gap below that long-term trend has yet to be filled as there is a 23.2% deficit from the long-term trend. It is also worth noting the sharp drop in retail sales per capita over just the last couple of months in particular.

Since 1992, as shown below, there have only been 5-other times in which retail sales were negative 3-months in a row (which just occurred). Each time, the subsequent impact on the economy, and the stock market, was not good.

So, despite record low jobless claims, retail sales remain exceptionally weak. There are two reasons for this which are continually overlooked, or worse simply ignored, by the mainstream media and economists.

The first is that despite the “longest run of employment growth in U.S. history,” those who are finding jobs continues to grow at a substantially slower pace than the growth rate of the population.

If you don’t have a job, and are primarily living on government support (1-of-4 Americans receive some form of benefit) it is difficult to consume at higher levels to support economic growth.

Secondly, while tax cuts may provide a temporary boost to after-tax incomes, that income boost is simply being absorbed by higher energy, gasoline, health care and borrowing costs. This is why 80% of Americans continue to live paycheck-to-paycheck and have little saved in the bank. It is also why, as wages have continued to stagnate, the cost of living now exceeds what incomes and debt increases can sustain.

As I have discussed several times during the 4th-quarter of 2017:

“Very likely, the next two quarters will be weaker than expected as the boost from hurricanes fade and higher interest rates take their toll on consumers. So, when mainstream media acts astonished that economic growth has once again slowed, you will already know why.”

Not surprisingly the economic data rolling in has been exceptionally weak and the first quarter GDP growth is now targeted at less than 2% annualized growth.

However, it is not only in the U.S. the economic “bump” is fading, but globally as well as Central Banks have started to remove their monetary accommodations. As noted by the ECRI:

“Our prediction last year of a global growth downturn was based on our 20-Country Long Leading Index, which, in 2016, foresaw the synchronized global growth upturn that the consensus only started to recognize around the spring of 2017.

With the synchronized global growth upturn in the rear view mirror, the downturn is no longer a forecast, but is now a fact.

The chart below shows that quarter-over-quarter annualized gross domestic product growth rates in the three largest advanced economies — the U.S., the euro zone, and Japan — have turned down. In all three, GDP growth peaked in the second or third quarter of 2017, and fell in the fourth quarter. This is what the start of a synchronized global growth downswing looks like.”

“Still, the groupthink on the synchronized global growth upturn is so pervasive that nobody seemed to notice that South Korea’s GDP contracted in the fourth quarter of 2017, partly due to the biggest drop in its exports in 33 years. And that news came as the country was in the spotlight as host of the winter Olympics.

Because it’s so export-dependent, South Korea is often a canary in the coal mine of global growth. So, when the Asian nation experiences slower growth — let alone negative growth — it’s a yellow flag for the global economy.

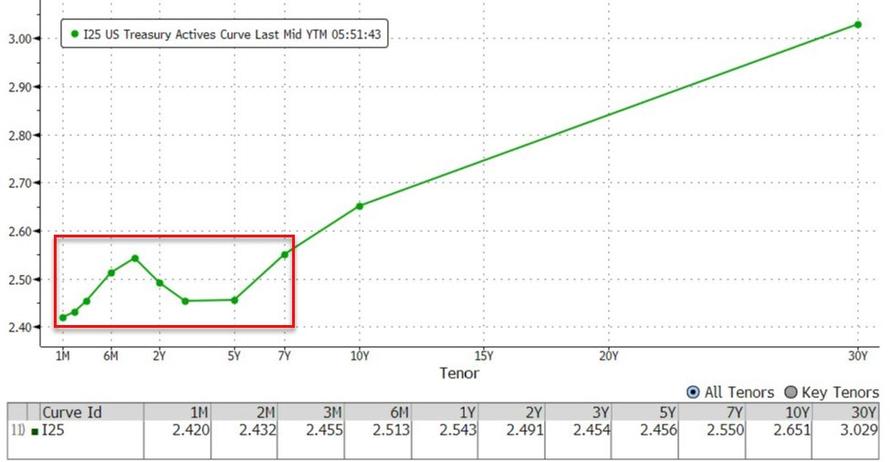

The international slowdown is becoming increasingly obvious from the widely followed economic indicators. The most popular U.S. measures seem to present more of a mixed bag. Yet, as we pointed out late last year, the bond market, following the U.S. Short Leading Index, started sniffing out the U.S. slowdown months ago.”

You can see the slowdown occurring “real time” by taking a look at Personal Consumption Expenditures (PCE) which comprises roughly 70% of U.S. economic growth. (It is also worth noting that PCE growth rates have been declining since 2016 which belies the “economic growth recovery” story.)

The point here is this:

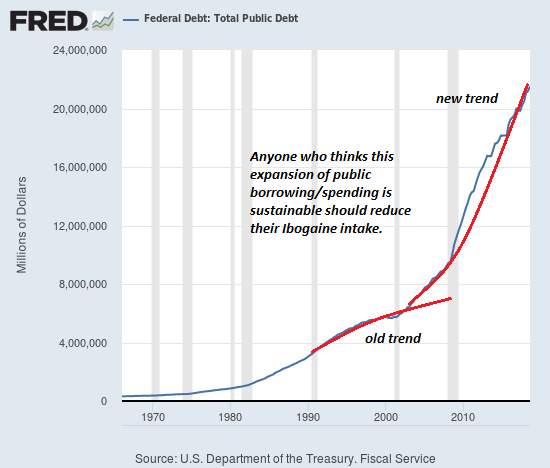

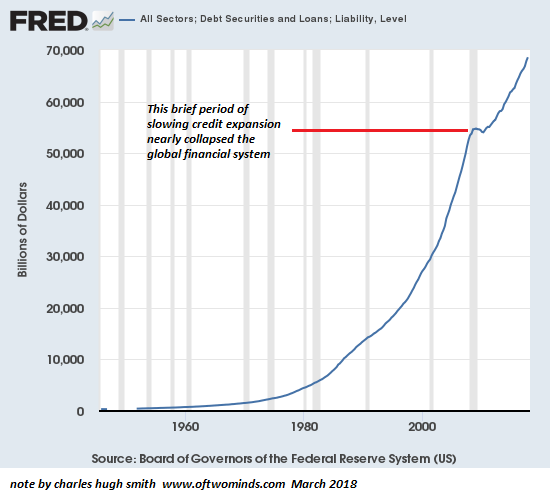

“Economic cycles are only sustainable for as long as excesses are being built. The natural law of reversions, while they can be suspended by artificial interventions, cannot be repealed.”

While there may currently be “no sign of recession,” there are plenty of signs of “economic stress” such as:

The shift caused by the financial crisis, aging demographics, massive monetary interventions and the structural change in employment which has skewed the seasonal-adjustments in economic data. This makes every report from employment, retail sales, and manufacturing appear more robust than they would be otherwise. This is a problem mainstream analysis continues to overlook but will be used as an excuse when it reverses.

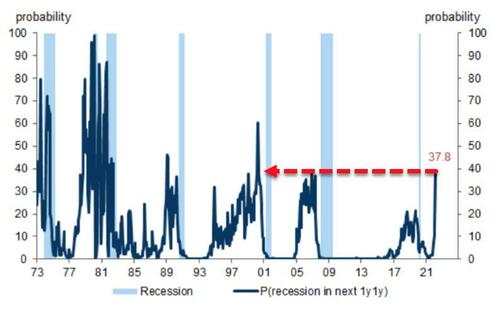

While the calls of a “recession” may seem far-fetched based on today’s economic data points, no one was calling for a recession in early 2000 or 2007 either. By the time the data is adjusted, and the eventual recession is revealed, it won’t matter as the damage will have already been done.

As Howard Marks once quipped:

“Being right, but early in the call, is the same as being wrong.”

While being optimistic about the economy and the markets currently is far more entertaining than doom and gloom, it is the honest assessment of the data, along with the underlying trends, which are useful in protecting one’s wealth longer-term.

Is there a recession currently? No.

Will there be a recession in the not so distant future? Absolutely.

But if you wait to “see it,” it will be too late to do anything about it.

Whether it is a mild, or “massive,” recession will make little difference to individuals as the net destruction of personal wealth will be just as damaging. Such is the nature of recessions on the financial markets.

By Lance Roberts | Real Investment Advice

by

by

You must be logged in to post a comment.