The Wall Street Code (2013)

Tag Archives: Stock Market

Housing Bubble Getting Ready to Pop: Mortgage Applications to Purchase a Home Drop to Lockdown Lows, “Bad Time to Buy” Hits Record amid Sky-High Prices, Spiking Mortgage Rates

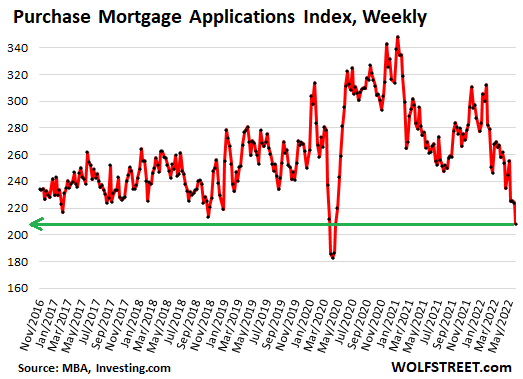

(Wolf Richter) This just keeps getting worse: Applications for mortgages to purchase a home dropped 7% for the week, and were down 21% from a year ago, the Mortgage Bankers Association reported today. An indicator of future home sales: Potential homebuyers try to get pre-approved for a mortgage, lock in a mortgage rate, and then start house-hunting.

Mortgage rates have soared this year, and home prices have soared for years to ridiculous levels, causing layers and layers of potential buyers to abandon the market, amid “worsening affordability challenges,” as the MBA called it. And these applications to purchase a home hit the lowest point since the depth of the lockdown in April 2020 (data via Investing.com):

The MBA’s Purchase Mortgage Applications Index has now dropped below the lows of late 2018. By November 2018, the Fed had been hiking rates for years (slowly), and its QT was in full swing, and mortgage rates had edged above 5%, which was enough to begin shaking up the housing market. Home sales volume slowed, prices began to come down in some markets, and stocks were selling off. But with inflation below the Fed’s target, and with Trump, who’d taken ownership of the Dow, constantly throwing darts at Powell, the Fed signaled in December 2018 that it would cave, and instantly mortgage rates began to fall, and volume and prices took off again.

Today, raging inflation is the #1 economic issue, and the Fed is chasing after it, with backing from the White House, and so this issue in the housing market is just going to have to play out.

Holy-Moly Mortgage Rates.

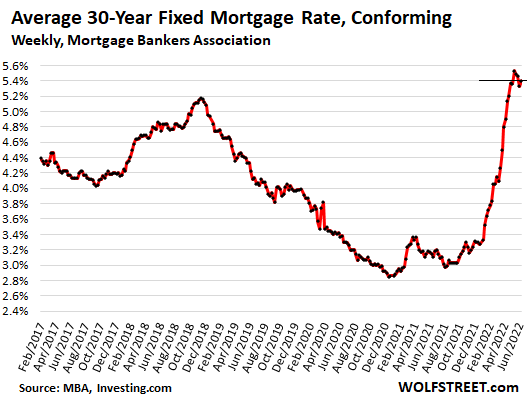

The average 30-year fixed mortgage rate with conforming balances and 20% down rose to 5.40% this week, according to the MBA today, having been in this 5.4% range, plus or minus a little, since the end of April, the highest since 2009.

I call them holy-moly mortgage rates because that’s the reaction you get when you apply this rate to figure a mortgage payment for a home at current prices and then accidentally look at the resulting mortgage payment (data via Investing.com):

“Bad time to buy a home.”

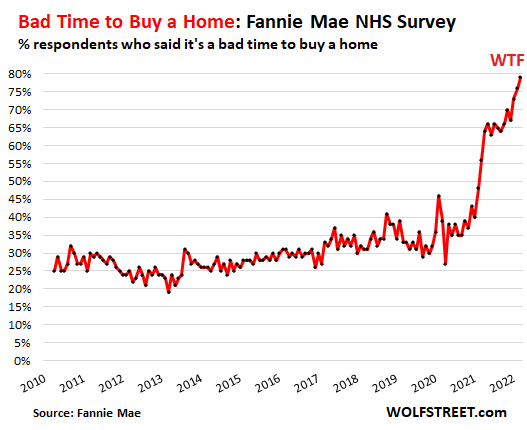

Turns out, sky-high home prices to be financed with holy-moly mortgage rates, plus uncertainty about the economy, dropping stock prices, and inflation eating everyone’s lunch make a toxic mix for homebuyers.

The percentage of people who said that now is a “bad time to buy” a home jumped to 79%, another record-worst in the data going back to 2010, according to Fannie Mae’s National Housing Survey for May. Sentiment has been deteriorating since February 2021:

“Consumers’ expectations that their personal financial situations will worsen over the next year reached an all-time high in the May survey, and they expressed greater concern about job security,” according to Fannie Mae’s report.

“These results suggest to us that increased mortgage rates, high home prices, and inflation will likely continue to squeeze would-be home buyers – as well as those potential sellers with lower, locked-in mortgage rates – out of the market, supporting our forecast that home sales will slow meaningfully through the rest of this year and into next,” said Fannie Mae.

Sagging stock prices keep getting blamed.

The stock market is on the front pages every day. Only a small percentage of Americans own any significant amount of equities, but that doesn’t matter. Stock market declines, with many high-flying stocks plunging 70% or 80% or even 90% since February 2021, have rattled a lot of nerves. Which is in part why Fannie Mae pointed out, “consumers’ expectations that their personal financial situations will worsen over the next year reached an all-time high.”

The MBA also had previously pointed at the financial markets as one of the reasons for the plunge in purchase mortgage applications.

In the tech and social media sector, the big declines in stock prices have now triggered the first hiring freezes and a few layoffs. And this too – just the idea of nirvana being somehow over – is shaking up some folks.

Sharp increases in stock portfolios, stock options from employers, or cryptos empowered potential homebuyers and enabled many to borrow against their portfolios to come up with down payments. This option has either vanished or is looking very shaky for many.

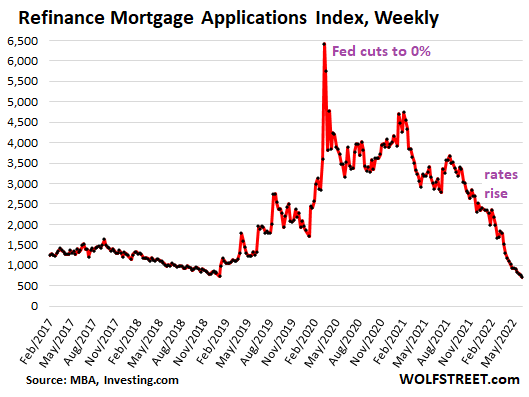

Refi applications collapsed to lowest since year 2000.

Applications for mortgages to refinance an existing mortgage dropped another 6% for the week, and have collapsed by 75% from a year ago, to the lowest level since the year 2000, according to the MBA’s Refinance Mortgage Applications Index. The MBA obtains this data from a weekly survey of mortgage bankers.

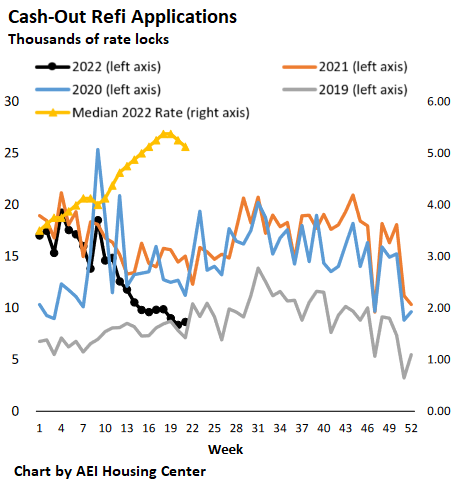

With these holy-moly mortgage rates, just about the only reason to refinance is to extract cash from the home via a cash-out refi (data via Investing.com):

Cash-Out Refi mortgage applications.

According to the AEI Housing Center, which tracks mortgage applications by the number of rate locks, no-cash-out refi applications have collapsed by 92% from a year ago. But cash-out refi applications are primarily driven by the desire to extract cash from a home, with mortgage rates being a secondary issue – and so they continue but a slower pace.

Cash out refi applications in week through May 30 (black line) plunged by 42% from the same week in 2021 and have stabilized roughly level with 2019:

A cash-out refi provides a big lump sum for the homeowner to spend on all kinds of things, from cars to home improvement projects. They are also used to pay off high-cost debts, such as credit cards so that these credit cards can then be used for more purchases. The plunge in cash-out refi reduces the availability of these lump-sums, and therefore reduces the stimulus to the economy they provide.

No-cash-out refi mortgages at lower mortgage rates also boost consumer spending, as the lower rates reduce payments that then leave some extra every month to spend on other stuff. But the spike in mortgage rates, and the subsequent 92% collapse of no-cash-out refi mortgage applications ends this program.

Source: by Wolf Richter | Wolf Street

***

George Gammon: Thinking of buying a house? Stop and watch this first – MS

US housing implosion about to start – Market Sanity

Bank of America declares ‘technical recession’ – NTD

Inflation, consumer woe add to worries that recession is already here – CNBC

“Warning flags are everywhere” – ECB, inflation and U.S. stocks – QTR

Bond market rout so severe double-digit losses are the norm – Yahoo!

Get ready for currency collapses – King World News

Retail Stock Buying In July Blew Away All Records, 50% Higher Than Previous All Time High

(ZeroHedge) Last month, when out of the blue we saw a sharp surge in a handful of gigacap names among which Amazon, which rapidly broke out of the range it had been trading in for the past year as a result of an aggressive bid in short-dated OTM calls, a move we dubbed Gammazon, we speculated that a key driver behind this move are retail investors who had moved away from their usual small and mid-cap stomping grounds and decided to target illiquid tech giants during the lowest volume season of the year.

Now that the data is in, it appears that we were right.

The Zombification Of America – Over 40% Of Listed Companies Don’t Make Money

It’s absolutely stunning how the Fed/ECB/BoJ injected upwards of $1.1 trillion into global markets in the last quarter and cut rates 80 times in the past 12 months, which allowed money-losing companies to survive another day.

The leader of all this insanity is Telsa, the biggest money-losing company on Wall Street, has soared 120% since the Fed launched ‘Not QE.’

Tesla investors are convinced that fundamentals are driving the stock higher, but that might not be the case, as central bank liquidity has been pouring into anything with a CUSIP.

The company has lost money over the last 12 months, and to be fair, Elon Musk reported one quarter that turned a profit, but overall – Tesla is a black hole. Its market capitalization is larger than Ford and General Motors put together. When you listen to Tesla investors, near-term profitability isn’t important because if it were, the stock would be much lower.

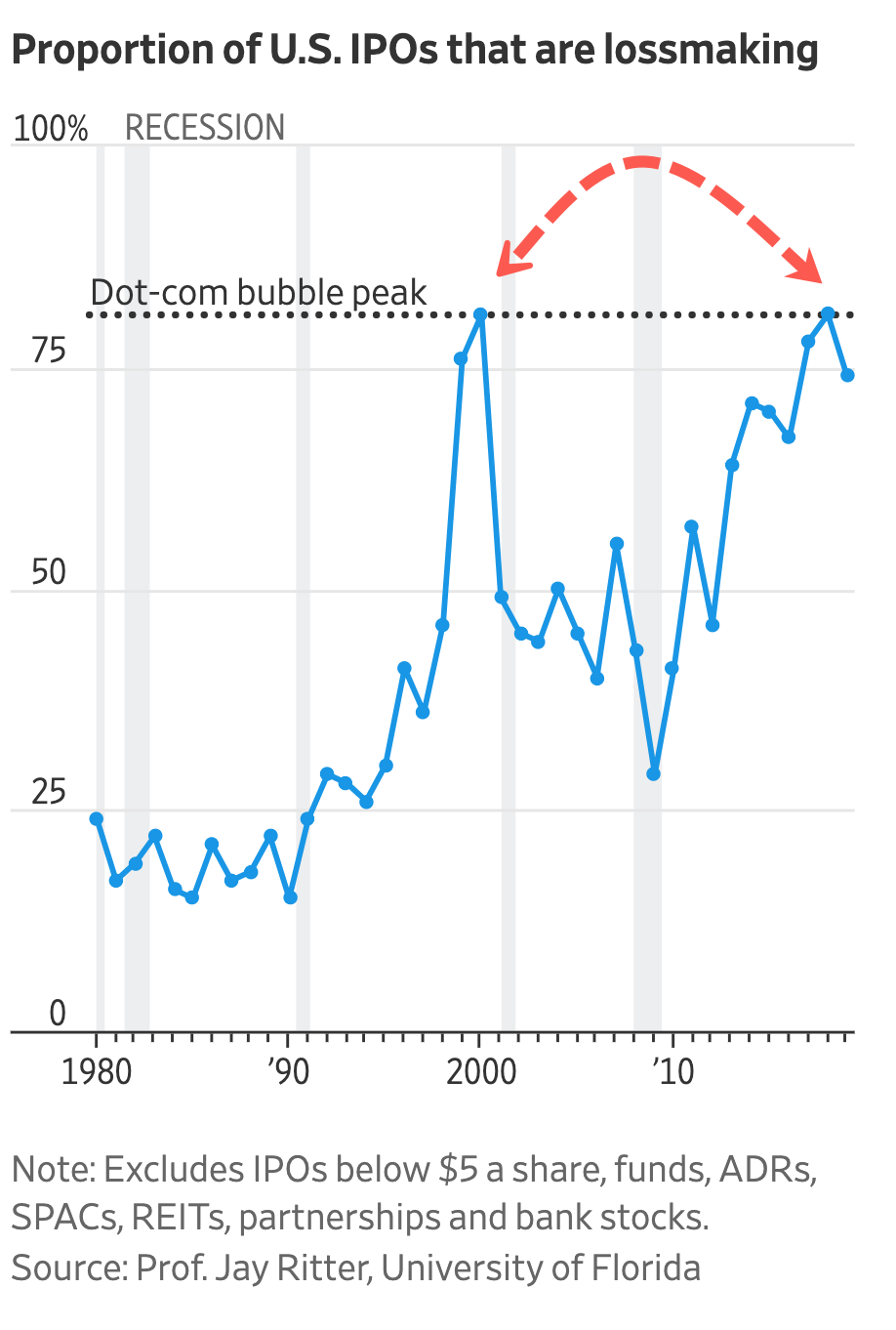

The Wall Street Journal notes that in the past 12 months, 40% of all US-listed companies were losing money, the highest level since the late 1990s – or a period also referred to as the Dot Com bubble.

Jay Ritter, a finance professor at the University of Florida, provided The Journal with a chart that shows the percentage of money-losing IPOs hit 81% in 2018, the same level that was also seen in 2000.

The Journal notes that 42% of health-care companies lost money, mostly because of speculative biotech. About 17% of technology companies also fail to turn a profit.

A more traditional company that has been losing money is GE. Its shares have plunged 60% in the last 42 months as a slowing economy, and insurmountable debts have forced a balance sheet recession that has doomed the company.

Data from S&P Global Market Intelligence shows for small companies, losing money is part of the job. About 33% of the 100 biggest companies reported losses over the last 12 months.

Among the smallest 80% of companies, there has been a notable rise in money-losing operations in the last three years.

“The proportion of these loss-making companies rose after each of the last two recessions and didn’t come down again afterward. The story should be familiar by now: Many small companies are being dominated by the biggest corporates, squeezing them out of markets and crushing their ability to invest for growth,” The Journal noted.

And while central bank liquidity has zombified companies, investors are already starting to make a mad dash out of trash into companies that turn a profit ahead of the next recession.

Goldman Sachs Has Just Issued An Ominous Warning About Stock Market Crash In October

Are we about to see the stock market crash this year? That is what Goldman Sachs seems to think, and it certainly wouldn’t be the first time that great financial chaos has been unleashed during the month of October. When the stock market crashed in October 1929, it started the worst economic depression that we have ever witnessed. In October 1987, the largest single day percentage decline in U.S. stock market history rocked the entire planet. And the nightmarish events of October 2008 set the stage for a “Great Recession” that we still haven’t fully recovered from. So could it be possible that something similar may happen in October 2019?

The storm clouds are looming and disaster could strike at any time. This is one of the most critical times in the history of our nation, and most Americans are completely unprepared for what is going to happen next.

This Time Is Different

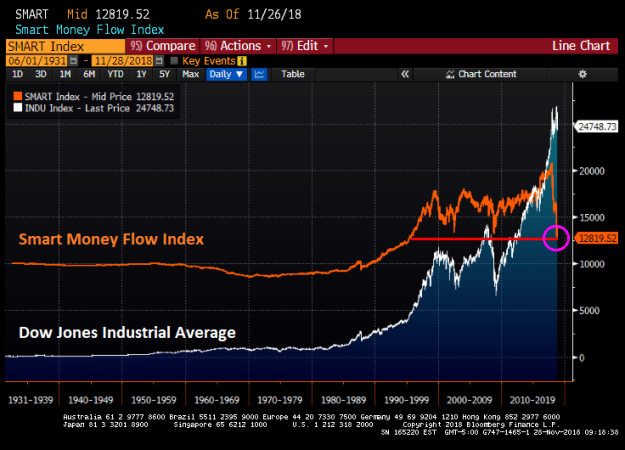

Bubble Burst? Smart Money Flow Index Continues To Decline To 1995 Levels

The Smart Money Flow Index, measuring the movement of the Dow in two time periods: the first 30 minutes and the last hour, has just declined AGAIN.

The Smart Money Flow Index, like the DJIA, has been around for decades. But it has just fallen to the lowest level since 1995.

Is the asset bubble starting to burst? Or is it just one lone indicator getting sick?

September YoY Home Sales Down 13.2%, Median Price Down 3.5%, S&P Down 6.5% From High

New Home Sales (SAAR) in September plunged to their lowest since Dec 2016, crashing 5.5% MoM (and revised dramatically lower in August)… Maybe Trump has a point on Fed rate hikes?

Remember this is the first month that takes the impact of the latest big spike in rates – not good!

This is a disastrous print:

August’s 629k SAAR was revised drastically lower to 585k and September printed 553k (SAAR) massively missing expectations of 625k (SAAR) – plunging to the weakest since Dec 2016…

That is a 13.2% collapse YoY – the biggest drop since May 2011

The median sales price decreased 3.5% YoY to $320,000…

New homes sales were down across all regions … except the midwest.

As the supply of homes at current sales rate rose to 7.1 months, the highest since March 2011, from 6.5 months.

The decline in purchases was led by a 40.6 percent plunge in the Northeast to the lowest level since April 2015 and 12 percent drop in the West.

70% Of S&P 500 Stocks Are Already In A Correction

Spooked by fears about peak profits, the slowing Chinese economy, Trump’s tariffs, ongoing political turmoil in the UK and Italy, and ongoing jitters among systematic, vol-targeting funds, on Tuesday the S&P tumbled as much as 2.34% in early trade – a drop which almost wiped out all gains for the year – before paring losses and closing only -0.55% lower. The drop pushed the S&P’s decline from its September highs to 6.5%, two-thirds on the way to a technical correction.

However the relatively stability at the index level has masked turmoil among individual names where some 1,256 stocks hit 52-week lows, while only 21 establishing new highs.

More concerning, and a testament to the tech-heavy leadership of the market concentrated amid just a handful of stocks, is that while the broader S&P 500 index has yet to enter a correction, more than three quarters of all S&P stocks – or 353 – have already fallen more than 10% from their highs. Worse, of those, more than half 179 have already fallen by 20% or more from their highs, entering a bear market.

The reason why the broader index has so far avoided a similar fate is because Apple, whose $1 trillion market value makes it by far the most heavily weighted stock within the S&P 500, has fallen only 4.6% from its October 3 record high. That has helped the S&P 500 itself stay out of correction territory.

Broken down by sector, the S&P 500 materials index – the closest proxy of Chinese economic growth – has fared the worst in October, leaving it down 19% from its 52-week highs, with the utilities index is the outperformer, down just 5 percent.

At the individual level, among the bottom 10 S&P 500 performers, are names likes Wynn Resorts and Western Digital, both highly exposed to China. Nektar Therapeutics and Newell Brands are also among the S&P 500’s worst performers.

Taking a step back, despite its relative resilience, the S&P 500 is still on track for its worst month since August 2015, while most global equities are down for the year. North America is still the best performing region with 67% of the six countries having benchmark equities trading higher on the year in US dollar terms, according to Deutsche Bank. In EMEA, only 23% of countries are up, and only 6% of countries in the European Union (in USD). In South American (6 countries) and Asia (18), not a single country has a positive return in USD terms this year.

One day later, and despite widespread call for an imminent market bounce, traders remain completely ambivalent as today’s market cash open action shows:

- Half of S&P 500 stocks rising, half falling

- 5 of 11 S&P 500 groups rising, 6 falling

- 15 DJIA stocks rising, 15 falling

Meanwhile, the Nasdaq has a more negative tone with decliners outpacing advancers. In other words, as Bloomberg’s Andrew Cinko writes, “there’s no follow through on either the upside or the downside after yesterday’s epic rebound. At this moment, he who hesitates isn’t lost, in fact, he’s got a lot of company as stock market pundits engage in verbal duel over where we go from here.”

Insider Selling Soars In “Cautionary Sign” To Market

One month ago, when Apple finally crossed above $1 trillion in market cap, Goldman’s chief equity strategist David Kostin said that investors had been focusing on the “wrong $1 trillion question”, adding that the correct question was: what amount of buyback will companies authorize in 2018? The reason was that according to the latest estimate from Goldman’s buyback desk, stock buyback authorizations in 2018 had increased to a record $1.0 trillion – a result of tax reform and strong cash flow growth – a 46% rise from last year.

The upward revision was warranted: according to TrimTabs calculations, buyback announcements swelled to a record $436.6 billion in the second quarter, smashing the previous record of $242.1 billion set just one quarter earlier, in Q1. Combined, this meant that buybacks in the first half totaled a ridiculous $680 billion which annualized amounted to a staggering $1.35 trillion, indicating that Goldman’s revised estimate may in fact be conservative.

Furthermore, with many strategists warning that August could be a volatile month, Goldman remained optimistic noting that “August is the most popular month for repurchase executions, accounting for 13% of annual activity”, implying that a solid buyback bid would support the market in a worst case scenario which never materialized as the S&P rose to a fresh all time high at the end of the month.

Based on the Goldman data and estimates, it is probably safe to say that August was one of the all-time record months in terms of buyback activity. That companies would be scrambling to repurchase their stock last month was not lost on one particular group of investors: the corporate insiders of the companies buying back their own stocks.

According to data compiled by TrimTabs, insider selling reached $450 million daily in August, the highest level this year; on a monthly basis, insiders sold more than $10 billion of their stock, the most of any month this year and near the most on record.

“As corporate buying is at least taking a breather, corporate insiders are ramping up share selling as the major U.S. stock market averages are at or near record highs,” TrimTabs wrote in a note.

In other words, as insiders and management teams authorized record buybacks, the same insiders and management teams were some of the biggest sellers into this very bid, which one would say is a rather risk-free way of dumping their stock without any risk of the clearing price declining. It also suggests that contrary to prevailing expectations, stocks are anything but cheap when viewed from the lens of insiders who know their own profit potential best.

There is another consideration: September is traditionally the most volatile month for the stock market (especially the last two weeks), and it may be the insiders are simply looking to offload their holdings ahead of a potential air pocket in prices.

As CNBC further notes, September is usually the worst month for stocks, possibly explaining why corporate executives sold so much stock last month. Data from the “Stock Trader’s Almanac” show the S&P 500 and Nasdaq both fall an average of 0.5% in September. The Dow Jones Industrial Average, meanwhile, averages a loss of 0.7% in September.

TrimTabs summarizes this best:

“One cautionary sign for U.S. stocks is that corporate insiders have accelerated their selling of U.S. equities,” said Winston Chua, an analyst at TrimTabs. “They’ve dedicated record amounts of shareholder money to buybacks but aren’t doing the same with their own which suggests that companies aren’t buying stocks because they’re cheap.”

Finally, as we noted yesterday, the September selling may have started early this year in an ominous sign for the rest of the month:

it’s already been a tough start to the month of September for the S&P 500, which has fallen for the fourth day in a row. This is notable, as LPL Financial notes “going back to the Great Depression, only two times did it start down the first four days. 1987 and 2001.“

And with insiders dumping a near record amount of stock, it may be the case that the selling is only just getting started.

Excluding FAANG Stocks, The S&P Would Be Negative

Two weeks ago, Goldman made a surprising finding: as of July 1, just one stock alone was responsible for more than a third of the market’s YTD performance: Amazon, whose 45% YTD return has contributed to 36% of the S&P 3% total return this year, including dividends. Goldman also calculated that the rest of the Top 10 S&P 500 stocks of 2018 are the who’s who of the tech world, and collectively their total return amounted to 122% of the S&P total return in the first half of the year.

And another striking fact: just the Top 4 stocks, Amazon, Microsoft, Apple and Netflix have been responsible for 84% of the S&P upside in 2018 (and yes, these are more or less the stocks David Einhorn is short in his bubble basket, which explains his -19% YTD return).

Now, in a review of first half performance, Bank of America has performed a similar analysis and found that excluding just the five FAANG stocks, the S&P 500 return in H1 would have been -0.7%; Staples (-8.6%) and Telco (-8.4%) were the worst.

FAANGs aside, here are the other notable sector observations about a market whose leadership has rarely been this narrow:

- Only three sectors outperformed in the 1H (Discretionary, Tech and Energy). Meanwhile, Staples and Telecom were the worst-performers in the 1H.

- Energy staged the biggest comeback in 2Q to become the quarter’s best-performing sector after turning in among the worst returns in 1Q.

- Industrials and Financials notably underperformed in June, the 2Q, and the 1H while Discretionary and Energy outperformed in all three.

Looking at the entire first half performance, tech predictably was the biggest contributor to the S&P 500’s 1H gain, contributing 2.6ppt or 98% of the S&P 500’s 2.6% total return.

The broader market did ok: trade tensions, negative headlines, and the slow withdrawal of Fed liquidity contributed to volatility’s return in June and earlier in February, but the S&P 500 still ended 2Q +3.4% and the 1H +2.6%, outperforming bonds and gold.

The Russell 2000 led the Russell 1000 by 4.9ppt in the 1H as small caps may have benefitted from expectations of a stronger US economy, a strong USD and the sense that smaller more domestic companies are shielded from trade tensions (where we take issue with this notion). However, mega-caps also did well: the “Nifty 50” largest companies within the S&P 500 beat the “Not-so-nifty 450” in the 2Q and the 1H. Non-US performed worst.

Some additional return details by asset class:

- US stocks outperformed most other asset classes in the 1H, including bonds, cash, and gold.

- Within equities, the US was the only major region to post positive returns, outperforming non-US equities by 6.1ppt in US dollar terms in the 1H.

- Amid concerns over global growth, a stronger dollar and trade, coupled with a strong US economic backdrop, small caps outperformed large caps in the 1H.

- Megacaps also did well: the “Nifty 50” mega-caps within the S&P 500 beat the “Other 450” stocks in 2Q and the 1H.

Performance by quant groups:

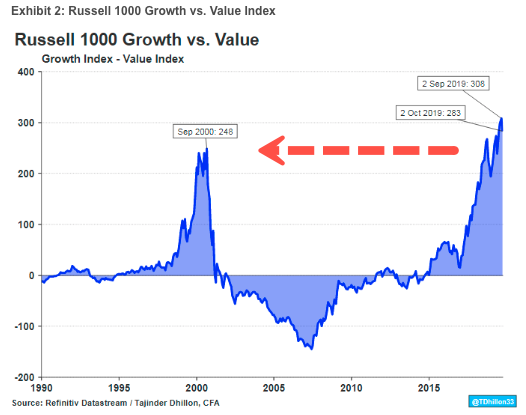

- Growth factors were the best-performing group in the 1H (+6.7% on average), leading Momentum/Technical factors (the second best-performing group) by 1.7ppt while Value factors were among the weakest.

- Despite the macro risks, the best way to make money was to stick to the fundamentals and own stocks with the highest Upward Estimate Revisions (+12.4% in the 1H), a Growth factor.

- Low Quality (B or worse) stocks beat High Quality (B+ or better) stocks in June, 2Q and the 1H. But both the lowest and highest quality stocks outperformed the rest of the market in all three periods.

The Russell 1000 Growth Index beat the Russell 1000 Value Index by 9ppt in the 1H, on track to exceed last year’s 17ppt spread. Growth factors were the best-performing group in the 1H (+6.7% on avg.), followed by Momentum factors. But Momentum broke down in June, and June saw the 56th worst month out of 60, -1.4 standard deviations from average returns.

What About Alpha?

Unfortunately for active managers, BofA notes that while pair-wise correlations remain lows, alpha remained scarce. The average pairwise correlation of S&P 500 stocks rose sharply in 1Q with the increased volatility which typically hurts stock pickers, but quickly came down below its long-term average of 26% in 2Q. However, performance dispersion (long-short alpha) continues to trail its long-term average.

What does this mean for active managers? According to BofA, never has the herding been this profound: since the bank began to track large cap fund holdings in 2008, managers have been increasing their tilts towards expensive, large, low dividend yield and low quality stocks. And today, their respective factor exposure relative to the S&P 500 is near its record level.

This is a risk because as we discussed recently, the threat is that as a result of an adverse surprise, “everyone” would be forced to sell at the same time. As BofA notes, “positioning matters more than fundamentals in the short-term, and this has been especially true around the quarter-end rebalancing. Since 2012, a long-short strategy of selling the 10 most overweight stocks and buying the 10 most underweight stocks by managers over the 15 days post-quarter-end would have yielded an average annualized spread of 90ppt, 15x higher than the average annualized spread of 6ppt over the full 90 days.”

Keep an eye on the first FAANG today when Netflix reports after the close.

Stocks Suffer Worst Q2 Start Since The Great Depression

Well that really escalated quickly…

After last week’s “paint the tape ahead of a long-weekend” melt-up into the close, the first trading day of the second quarter was a bloodbath… In fact the worst since The Great Depression…

As David Rosenberg (@EconguyRosie) summed up so precisely: New math: every tweet by @realDonaldTrump subtracts 70 points off the Dow. Keep ’em coming.

Woah…a ubiquitous opening bounce, then puked into Europe’s close, then another attempt to ignite momentum, fails and stocks puked into red for the year again…

3rd dead cat bounce in a week…

The S&P 500 and The Dow broke below their critical 200DMA… (Nasdaq is closest to its 200DMA since Brexit plunge) –

there was a desperate last few minutes attempt to rally ’em back above the 200DMAs – Dow ended back above its 200DMA

First time the S&P has closed below the 200DMA since June 27th 2016 (Brexit)

VIX topped 25, leading the US equity index vols higher today…

Tech led the tumble…

Lowest close for NYSE FANG+ Index since January 5th…

With Tesla bonds…

and Stocks really ugly – We suspect Elon is regretting the April Fools’ joke…

Tesla Tumbles After Elon Musk Jokes About Bankruptcy

This morning shareholders of Tesla are hardly laughing, with Tesla stock tumbling as much as 5%, down to $254, the lowest level in a year.

And the 10Y Yield dropping to neat two-month lows…

***

The very next day…

Stocks Soar After Bloomberg Report Unleashes Amazon Buying Panic

It was generally a quiet day, with no macro news and equities range-bound, seemingly spooked by the ongoing verbal war between Trump and Jeff Bezos, where first in a tweet then a White House press conference, the president warned that US taxpayers will no longer subsidize Amazon “by the billions.” And, as has been the case recently, every time Trump spoke or tweeted, Amazon turned negative.

And then, just around 2:45pm, a Bloomberg headline hit, according to which President Trump is not formally looking at options to address his concerns with Amazon, which immediately unleashed a buying panic first in Amazon and then across the broader market:

Bonds Finally Noticed What Is Going On… Are Stocks Next?

It is safe to say that one of the most popular, and important, charts of 2017, was the one showing the ongoing and projected decline across central bank assets, which from a record expansion of over $2 trillion in early 2017 is expected to turn negative by mid 2019. This is shown on both a 3- and 12-month rolling basis courtesy of these recent charts from Citi.

The reason the above charts are key, is because as Citi’s Matt King, DB’s Jim Reid, BofA’s Barnaby Martin and countless other Wall Street commentators have pointed out, historically asset performance has correlated strongly with the change in central bank balance sheets, especially on the way up.

As a result, the big question in 2017 (and 2018) is whether risk assets would exhibit the same correlation on the way down as well, i.e. drop.

We can now say that for credit the answer appears to be yes, because as the following chart shows, the ongoing decline in CB assets is starting to have an adverse impact on investment grade spreads which have been pushing wider in recent days, in large part due to the sharp moves in government bonds underline the credit spread.

And, what is more important, is that investors appear to have noticed the repricing across credit. This is visible in two places: on one hand while inflows into broader credit have remained generally strong, there has been a surprisingly sharp and persistent outflow from US high yield funds in recent weeks. These outflows from junk bond funds have occurred against a backdrop of rising UST yields, which recently hit 2.67%, the highest since 2014, another key risk factor to credit investors.

But while similar acute outflows have yet to be observed across the rest of the credit space, and especially among investment grade bonds, JPM points out that the continued outflows from HY and some early signs of waning interest in HG bonds in the ETF space in the US has also been accompanied by sharp increases in short interest ratios in LQD (Figure 13), the largest US investment grade bond ETF…

… as well as HYG, the largest US high yield ETF by total assets,

This, together with the chart showing the correlation of spreads to CB assets, suggests that positioning among institutional investors has turned markedly more bearish recently.

Putting the above together, it is becoming increasingly apparent that a big credit-quake is imminent, and Wall Street is already positioning to take advantage of it when it hits.

So what about stocks?

Well, as Citi noted two weeks ago, one of the reasons why there has been a dramatic surge in stocks in the new years is that while the impulse – i.e., rate of change – of central bank assets has been sharply declining on its way to going negative in ~18 months, the recent boost of purchases from EM FX reserve managers, i.e. mostly China, has been a huge tailwind to stocks.

This “intervention”, as well as the recent retail capitulation which has seen retail investors unleashed across stock markets, buying at a pace not seen since just before both the 1987 and 2008 crash, helps explain why stocks have – for now – de-correlated from central bank balance sheets. This is shown in the final chart below, also from Citi.

And while the blue line and the black line above have decoupled, it is only a matter of time before stocks notice the same things that are spooking bonds, and credit in general, and get reacquainted with gravity.

What happens next? Well, if the Citi correlation extrapolation is accurate, and historically it has been, it would imply that by mid-2019, equities are facing a nearly 50% drop to keep up with central bank asset shrinkage. Which is why it is safe to say that this is one time when the bulls will be praying that correlation is as far from causation as statistically possible.

… age makes absolutely no difference

Morgan Stanley: “Client Cash Is At Its Lowest Level” As Institutions Dump Stocks To Retail

The “cash on the sidelines” myth is officially dead.

Recall that at the end of July, we reported that in its Q2 earnings results, Schwab announced that after years of avoiding equities, clients of the retail brokerage opened the highest number of brokerage accounts in the first half of 2017 since 2000. This is what Schwab said on its Q2 conference call:

New accounts are at levels we have not seen since the Internet boom of the late 1990s, up 34% over the first half of last year. But maybe more important for the long-term growth of the organization is not so much new accounts, but new-to-firm households, and our new-to-firm retail households were up 50% over that same period from 2016.

In total, Schwab clients opened over 350,000 new brokerage accounts during the quarter, with the year-to-date total reaching 719,000, marking the biggest first-half increase in 17 years. Total client assets rose 16% to $3.04 trillion. Perhaps more ominously to the sustainability of the market’s melt up, Schwab also adds that the net cash level among its clients has only been lower once since the depths of the financial crisis in Q1 2009:

Now, it’s clear that clients are highly engaged in the markets, we have cash being aggressively invested into the equity market, as the market has climbed. By the end of the second quarter, cash levels for our clients had fallen to about 11.5% of assets overall, now, that’s a level that we’ve only seen one time since the market began its recovery in the spring of 2009.

While some of this newfound euphoria may have been due to Schwab’s recent aggressive cost-cutting strategy, it is safe to say that the wholesale influx of new clients, coupled with the euphoria-like allocation of cash into stocks, means that between ETFs and other passive forms of investing, as well as on a discretionary basis, US retail investors are now the most excited to own stocks since the financial crisis. In a confirmation that retail investors had thrown in the towel on prudence, according to a quarterly investment survey from E*Trade, nearly a third of millennial investors were planning to move out of cash and into new positions in the second half of 2017. By comparison, only 19% of Generation X investors (aged 35-54) were planning such a change to their portfolio, while 9% of investors above the age of 55 had plans to buy in.

Furthermore, according to a June survey from Legg Mason, nearly 80% of millennial investors plan to take on more risk this year, with 66% of them expressing an interest in equities. About 45% plan to take on “much more risk” in their portfolios.

In short, retail investors – certainly those on the low end which relies on commodity brokerages to invest – are going “all in.”

This was also confirmed by the recent UMichigan Consumer Survey, according to which surveyed households said there has – quite literally – never been a better time to buy stocks.

What about the higher net worth segment? For the answer we go to this morning’s Morgan Stanley earnings call, where this exchange was particularly notable:

Question: Hey good morning. Maybe just on the Wealth Management side, you guys had very good growth, sequential growth in deposits. There’s been some discussion in the industry about kind of a pricing pressure. Can you discuss where you saw the positive rates in Wealth Management business and how you’re able to track, I think, about $10 billion sequentially on deposit franchise?

Answer: Sure. I think, as you recall, we’ve been talking about our deposit deployment strategy for quite sometime, and we’ve been investing excess liquidity into our loan product over the last several years. In the beginning of the year, we told you that, that trend would come to an end. We did see that this year. It happened a bit sooner than we anticipated as we saw more cash go into the markets, particularly the equity markets, as those markets rose around the world. And we’ve seen cash in our clients’ accounts at its lowest level.

In other words, when it comes to retail investors – either on the low, or high net worth side – everyone is now either all in stocks or aggressively trying to get there.

Which reminds us of an article we wrote early this year, in which JPM noted that “both institutions and hedge funds are using the rally to sell to retail.” Incidentally, the latest BofA client report confirmed that while retail investors scramble into stocks, institutions continue to sell. To wit:

Equity euphoria continues to remain absent based on BofAML client flows. Last week, during which the S&P 500 climbed 0.2% to yet another new high, BofAML clients were net sellers of US equities for the fourth consecutive week. Large net sales of single stocks offset small net buys of ETFs, leading to overall net sales of $1.7bn. Net sales were led by institutional clients, who have sold US equities for the last eight weeks; hedge funds were also (small) net sellers for the sixth straight week. Private clients were net buyers, which has been the case in four of the last five weeks, but with buying almost entirely via ETFs. Clients sold stocks across all three size segments last week.”

The best way to visualize what BofA clients, and especially institutions, have been doing in 2017 is the following chart:

Meanwhile, a familiar buyer has returned: “buybacks by corporate clients picked up as US earnings season kicked off, with Financials buybacks continuing to dominate this flow.”

And just like during the peak of the last bubble, retail is once again becoming the last bagholder; now it is only a question of how long before the rug is pulled out. For now, however, enjoy the Dow 23,000.

Fed Warns Markets “Vulnerable to Elevated Valuations” [charts]

Hussman Predicts Massive Losses As Cycle Completes After Fed Warns Markets “Vulnerable to Elevated Valuations”

Buried deep in today’s FOMC Minutes was a warning to the equity markets that few noticed…

This overall assessment incorporated the staff’s judgment that, since the April assessment, vulnerabilities associated with asset valuation pressures had edged up from notable to elevated, as asset prices remained high or climbed further, risk spreads narrowed, and expected and actual volatility remained muted in a range of financial markets…

According to another view, recent rises in equity prices might be part of a broad-based adjustment of asset prices to changes in longer-term financial conditions, importantly including a lower neutral real interest rate, and, therefore, the recent equity price increases might not provide much additional impetus to aggregate spending on goods and services.

According to one view, the easing of financial conditions meant that the economic effects of the Committee’s actions in gradually removing policy accommodation had been largely offset by other factors influencing financial markets, and that a tighter monetary policy than otherwise was warranted.

Roughly translated means – higher equity prices are driving financial conditions to extreme ‘easiness’ and The Fed needs to slow stock prices to regain any effective control over monetary conditions.

And with that ‘explicit bubble warning’, it appears the ‘other’ side of the cycle, that Hussman Funds’ John Hussman has been so vehemently explaining to investors, is about to begin…

Nothing in history leads me to expect that current extremes will end in something other than profound disappointment for investors. In my view, the S&P 500 will likely complete the current cycle at an index level that has only 3-digits. Indeed, a market decline of -63% would presently be required to take the most historically reliable valuation measures we identify to the same norms that they have revisited or breached during the completion of nearly every market cycle in history.

The notion that elevated valuations are “justified” by low interest rates requires the assumption that future cash flows and growth rates are held constant. But any investor familiar with discounted cash flow valuation should recognize that if interest rates are lower because expected growth is also lower, the prospective return on the investment falls without any need for a valuation premium.

At present, however, we observe not only the most obscene level of valuation in history aside from the single week of the March 24, 2000 market peak; not only the most extreme median valuations across individual S&P 500 component stocks in history; not only the most extreme overvalued, overbought, over bullish syndromes we define; but also interest rates that are off the zero-bound, and a key feature that has historically been the hinge between overvalued markets that continue higher and overvalued markets that collapse: widening divergences in internal market action across a broad range of stocks and security types, signaling growing risk-aversion among investors, at valuation levels that provide no cushion against severe losses.

We extract signals about the preferences of investors toward speculation or risk-aversion based on the joint and sometimes subtle behavior of numerous markets and securities, so our inferences don’t map to any short list of indicators. Still, internal dispersion is becoming apparent in measures that are increasingly obvious. For example, a growing proportion of individual stocks falling below their respective 200-day moving averages; widening divergences in leadership (as measured by the proportion of individual issues setting both new highs and new lows); widening dispersion across industry groups and sectors, for example, transportation versus industrial stocks, small-cap stocks versus large-cap stocks; and fresh divergences in the behavior of credit-sensitive junk debt versus debt securities of higher quality. All of this dispersion suggests that risk-aversion is rising, no longer subtly. Across history, this sort of shift in investor preferences, coupled with extreme overvalued, overbought, over bullish conditions, has been the hallmark of major peaks and subsequent market collapses.

The chart below shows the percentage of U.S. stocks above their respective 200-day moving averages, along with the S&P 500 Index. The deterioration and widening dispersion in market internals is no longer subtle.

Market internals suggest that risk-aversion is now accelerating. The most extreme variants of “overvalued, overbought, over bullish” conditions we identify are already in place.

A market loss of [1/2.70-1 =] -63% over the completion of this cycle would be a rather run-of-the-mill outcome from these valuations. All of our key measures of expected market return/risk prospects are unfavorable here. Market conditions will change, and as they do, the prospective market return/risk profile will change as well. Examine all of your investment exposures, and ensure that they are consistent with your actual investment horizon and tolerance for risk.

BofA: This Entire Rally Has Been Institutions Selling To “Animal Spirited” Retail Investors

Important considerations for those who acquire and leverage real estate with financial market assets.

Another paradoxical observation emerges when combing through the latest Bank of America data.

First, as discussed earlier today, while a net 48% of surveyed fund managers had an allocation to equities in March, the highest in two years, this flood into stocks has taken place even as the highest number of respondents since 2000 admitted stocks were overvalued.

That was one part.

The other part is that while fund managers respond that they are loading up on stocks, what they are doing is very different, and as BofA’s Jill Hall reported overnight, the bank’s clients sold stocks for the fifth consecutive week led entirely by institutional clients.

According to the report, last week, during which the S&P 500 climbed 0.2% (but remained below its early-March highs), BofA clients were net sellers of US equities for the fifth consecutive week, in the amount of $891MM. ETFs continued to see muted inflows, while single stocks saw outflows. There was one smallchange: unlike the previous four weeks, when sales had been broad-based across client groups, net sales last week were entirely due to institutional clients, while private clients and hedge funds were net buyers for the first time in five and seven weeks, respectively. These two groups had been the chief buyers of equities post-election prior to the recent selling streak. In other words, while previously the great rotation was out of institutions and hedge funds to “animal spirited” rich retail investors, last week hedge funds joined the buy parade, perhaps pressured by a need to catch up to their benchmark at quarter-end, and buy any overvalued garbage they could find.

More Details:

- Clients were net sellers across all three size segments last week. Buybacks by corporate clients slowed from the prior week’s levels, and year-to-date continue to track their lowest of any comparable period since 2013.

- Biggest buying of Health Care stocks in over a year

- Clients sold stocks in eight of the eleven sectors last week, led by Consumer Discretionary and Industrials (which have both seen net sales for the last five weeks). Real Estate-the worst-performing sector in March-continues to have the longest selling streak (for seven consecutive weeks).

- And amid the Fed rate hike last week, Utilities saw their biggest sales in three months. Health Care stocks saw the largest net buying, with the biggest inflows since last January and the first positive flows in six weeks, driven by institutional clients. This sector saw the greatest outflows of any sector in 2016 and has seen the second-largest outflows (after Discretionary) year-to-date.

- Bearish sentiment, light positioning and attractive valuations are several reasons we are positive on Health Care stocks, where we see political risks as overly discounted. Other sectors which saw inflows last week were Materials and Telecom, where flows into Materials were the largest since last February.

Other notable flows: Broad-based sales of Disc. & bond proxies

- Hedge funds, private clients and institutional clients alike were net sellers of Consumer Discretionary stocks last week-which typically underperform during tightening cycles-along with stocks in the bond-proxy sectors of Utilities and Real Estate. No sector saw net buying by all three groups.

- Hedge funds’ net buying last week was spread across five cyclical sectors, while private clients’ net buying was entirely in ETFs and Financials stocks last week.

- Pension fund clients were net sellers of US stocks for the second straight week, led by sales of ETFs and Real Estate stocks. Their biggest purchases last week were of Energy stocks. For more details, see Pension fund flows.

Finally, here is the breakdown of institutional, HF and retail client flow prior to US election through present. What it clearly shows is that the whole rally has been one “great rotation” from selling institutional investors to buying “animal spirited” retail traders.

And when institutions sell enough, the bottom from the market is pulled, retail panics to sell as the S&P tumbled, institutions reload, and the whole cycle repeats.

110-Day Streak Is Over – S&P Drops 1% For First Time Since October

The S&P 500 is down over 1% this morning. While in the old normal that would be nothing much to note, in the new normal, this is the biggest drop since October 11th!

The 110-day streak without a 1% drop is over… this was the longest streak since May 1995

Below is a look at historical streaks of trading days without a 1%+ decline going back to 1928:

VIX topped 12.5 for the first time since february and is breaking towards its 100DMA…

And for those expecting The Fed to step in and save the day… Don’t hold your breath!

Don’t care about stock market fall itself. Care abt potential financial instability. Stock market drop unlikely to trigger crisis. #AskNeel https://t.co/Cv7ENuJuqU

— Neel Kashkari (@neelkashkari) March 21, 2017

And sure enough,

The “Mystery” Of Who Is Pushing Stocks To All Time Highs Has Been Solved

One conundrum stumping investors in recent months has been how, with investors pulling money out of equity funds (at last check for 17 consecutive weeks) at a pace that suggests a full-on flight to safety, as can be seen in the chart below which shows record fund outflows in the first half of the year – the fastest pace of withdrawals for any first half on record…

… are these same markets trading at all time highs? We now have the answer.

Recall at the end of January when global markets were keeling over, that Citi’s Matt King showed that despite aggressive attempts by the ECB and BOJ to inject constant central bank liquidity into the gunfible global markets, it was the EM drain via reserve liquidations, that was causing a shock to the system, as net liquidity was being withdrawn, and in the process stocks were sliding.

Fast forward six months when Matt King reports that “many clients have been asking for an update of our usual central bank liquidity metrics.”

What the update reveals is “a surge in net global central bank asset purchases to their highest since 2013.”

And just like that the mystery of who has been buying stocks as everyone else has been selling has been revealed.

But wait, there’s more because as King suggests “credit and equities should rally even more strongly than they have done already.”

More observations from King:

The underlying drivers are an acceleration in the pace of ECB and BoJ purchases, coupled with a reversal in the previous decline of EMFX reserves. Other indicators also point to the potential for a further squeeze in global risk assets: a broadening out of mutual fund inflows from IG to HY, EM and equities; the second lowest level of positions in our credit survey (after February) since 2008; and prospects of further stimulus from the BoE and perhaps the BoJ.

His conclusion:

While we remain deeply skeptical of the durability of such a policy-induced rally, unless there is a follow-through in terms of fundamentals, and in credit had already started to emphasize relative value over absolute, we suspect those with bearish longer-term inclinations may nevertheless feel now is not the time to position for them.

And some words of consolation for those who find themselves once again fighting not just the Fed but all central banks:

The problems investors face are those we have referred to many times: markets being driven more by momentum than by value, and most negatives being extremely long-term in nature (the need for deleveraging; political trends towards deglobalization; a steady erosion of confidence in central banks). Against these, the combination of UK political fudge (and perhaps Italian tiramisu), a lack of near-term catalysts, and overwhelming central bank liquidity risks proving overwhelming – albeit only temporarily.

Why have central banks now completely turned their backs on the long-run just to provide some further near-term comfort? Simple: as Keynes said, in the long-run we are all dead.

The Bubble No One Is Talking About

Summary

- There has been an inexplicable divergence between the performance of the stock market and market fundamentals.

- I believe that it is the growth in the monetary base, through excess bank reserves, that has created this divergence.

- The correlation between the performance of the stock market and the ebb and flow of the monetary base continues to strengthen.

- This correlation creates a conundrum for Fed policy.

- It is the bubble that no one is talking about.

The Inexplicable Divergence

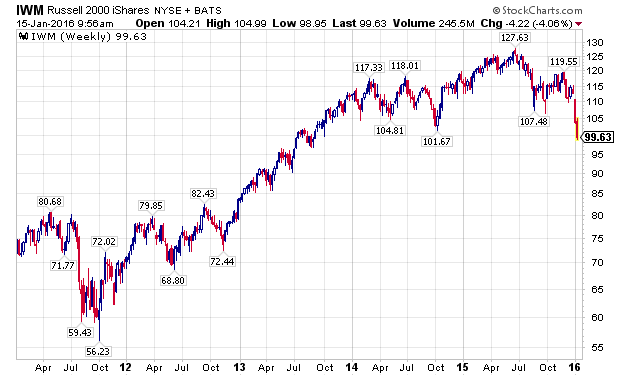

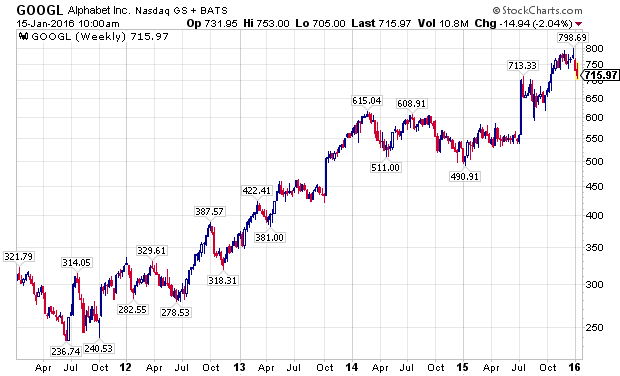

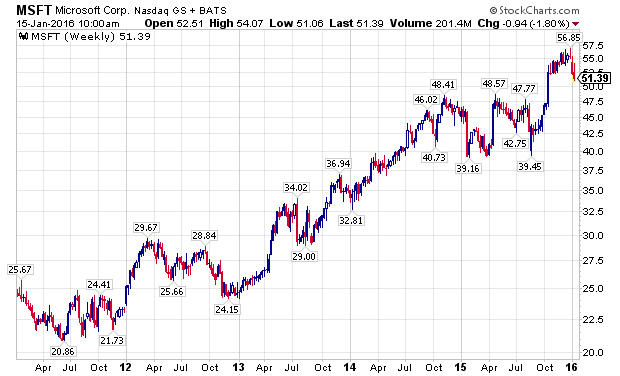

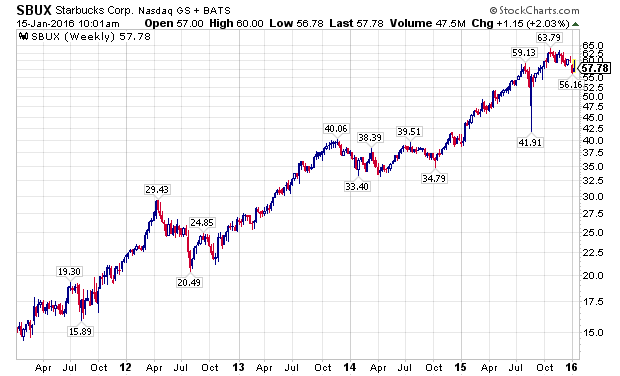

After the closing bell last Thursday, four heavyweights in the S&P 500 index (NYSEARCA:SPY) reported results that disappointed investors. The following morning, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Starbucks (NASDAQ:SBUX) and Visa (NYSE:V) were all down 4% or more in pre-market trading, yet the headlines read “futures flat even as some big names tumble post-earnings.” This was stunning, as I can remember in the not too distant past when a horrible day for just one of these goliaths would have sent the broad market reeling due to the implications they had for their respective sector and the market as a whole. Today, this is no longer the case, as the vast majority of stocks were higher at the opening of trade on Friday, while the S&P 500 managed to close unchanged and the Russell 2000 (NYSEARCA:IWM) rallied nearly 1%.

This is but one example of the inexplicable divergence between the performance of the stock market and the fundamentals that it is ultimately supposed to reflect – a phenomenon that has happened with such frequency that it is becoming the norm. It is as though an indiscriminate buyer with very deep pockets has been supporting the share price of every stock, other than the handful in which the selling is overwhelming due to company-specific criteria. Then again, there have been rare occasions when this buyer seems to disappear.

Why did the stock market cascade during the first six weeks of the year? I initially thought that the market was finally discounting fundamentals that had been deteriorating for months, but the swift recovery we have seen to date, absent any improvement in the fundamentals, invalidates that theory. I then surmised, along with the consensus, that the drop in the broad market was a reaction to the increase in short-term interest rates, but this event had been telegraphed repeatedly well in advance. Lastly, I concluded that the steep slide in stocks was the result of the temporary suspension of corporate stock buybacks that occur during every earnings season, but this loss of demand has had only a negligible effect during the month of April.

The bottom line is that the fundamentals don’t seem to matter, and they haven’t mattered for a very long time. Instead, I think that there is a more powerful force at work, which is dictating the short- to intermediate-term moves in the broad market, and bringing new meaning to the phrase, “don’t fight the Fed.” I was under the impression that the central bank’s influence over the stock market had waned significantly when it concluded its bond-buying programs, otherwise known as quantitative easing, or QE. Now I realize that I was wrong.

The Monetary Base

In my view, the most influential force in our financial markets continues to be the ebb and flow of the monetary base, which is controlled by the Federal Reserve. In layman’s terms, the monetary base includes the total amount of currency in public circulation in addition to the currency held by banks, like Goldman Sachs (NYSE:GS) and JPMorgan (NYSE:JPM), as reserves.

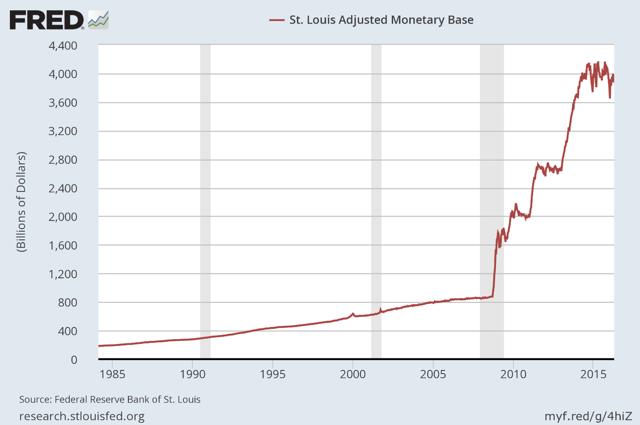

Bank reserves are deposits that are not being lent out to a bank’s customers. Instead, they are either held with the central bank to meet minimum reserve requirements or held as excess reserves over and above these requirements. Excess reserves in the banking system have increased from what was a mere $1.9 billion in August 2008 to approximately $2.4 trillion today. This accounts for the majority of the unprecedented increase in the monetary base, which now totals a staggering $3.9 trillion, over the past seven years.

The Federal Reserve can increase or decrease the size of the monetary base by buying or selling government bonds through a select list of the largest banks that serve as primary dealers. When the Fed was conducting its QE programs, which ended in October 2014, it was purchasing US Treasuries and mortgage-backed securities, and then crediting the accounts of the primary dealers with the equivalent value in currency, which would show up as excess reserves in the banking system.

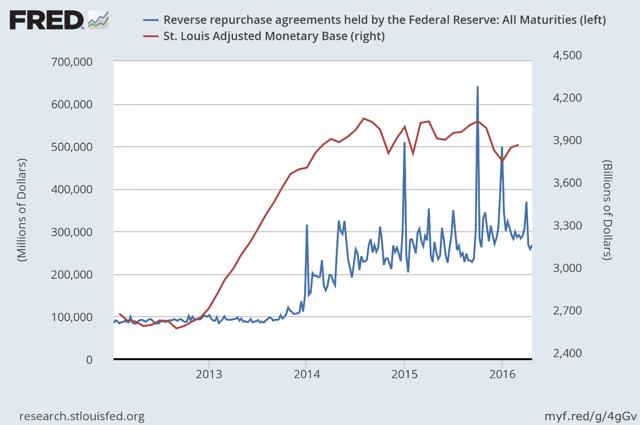

A Correlation Emerges

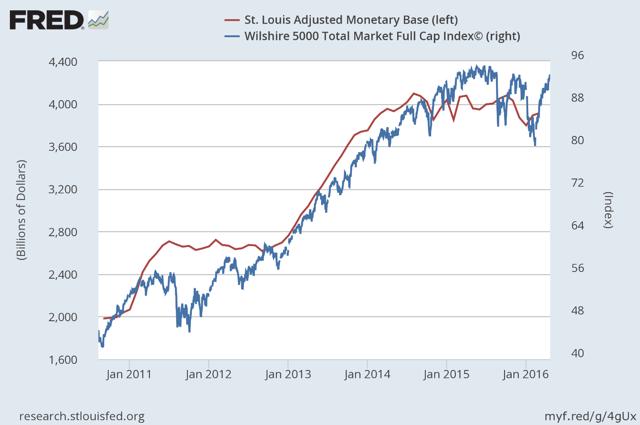

Prior to the financial crisis, the monetary base grew at a very steady rate consistent with the rate of growth in the US economy, as one might expect. There was no change in the growth rate during the booms and busts in the stock market that occurred in 2000 and 2008, as can be seen below. It wasn’t until the Federal Reserve’s unprecedented monetary policy intervention that began during the financial crisis that the monetary base soared, but something else also happened. A very close correlation emerged between the rising value of the overall stock market and the growth in the monetary base.

It is well understood that the Fed’s QE programs fueled demand for higher risk assets, including common stocks. The consensus view has been that the Fed spurred investor demand for stocks by lowering the interest rate on the more conservative investments it was buying, making them less attractive, which encouraged investors to take more risk.

Still, this does not explain the very strong correlation between the rising value of the stock market and the increase in the monetary base. This is where conspiracy theories arise, and the relevance of this data is lost. It would be a lot easier to measure the significance of this correlation if I had proof that the investment banks that serve as primary dealers had been piling excess reserves into the stock market month after month over the past seven years. I cannot. What is important for investors to recognize is that an undeniable correlation exists, and it strengthens as we shorten the timeline to approach present day.

The Correlation Cuts Both Ways

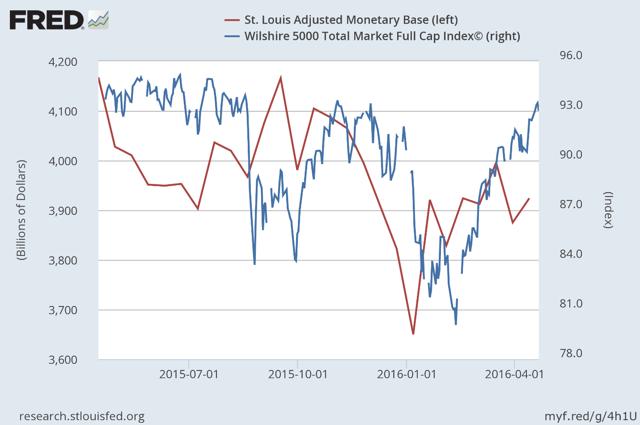

Notice that the monetary base (red line) peaked in October 2014, when the Fed stopped buying bonds. From that point moving forward, the monetary base has oscillated up and down in what is a very modest downtrend, similar to that of the overall stock market, which peaked a few months later.

What I have come to realize is that these ebbs and flows continue to have a measurable impact on the value of the overall stock market, but in both directions! This is important for investors to understand if the Fed continues to tighten monetary policy later this year, which would require reducing the monetary base.

If we look at the fluctuations in the monetary base over just the past year, in relation to the performance of the stock market, a pattern emerges, as can be seen below. A decline in the monetary base leads a decline in the stock market, and an increase in the monetary base leads a rally in the stock market. The monetary base is serving as a leading indicator of sorts. The one exception, given the severity of the decline in the stock market, would be last August. At that time, investors were anticipating the first rate increase by the Federal Reserve, which didn’t happen, and the stock market recovered along with the rise in the monetary base.

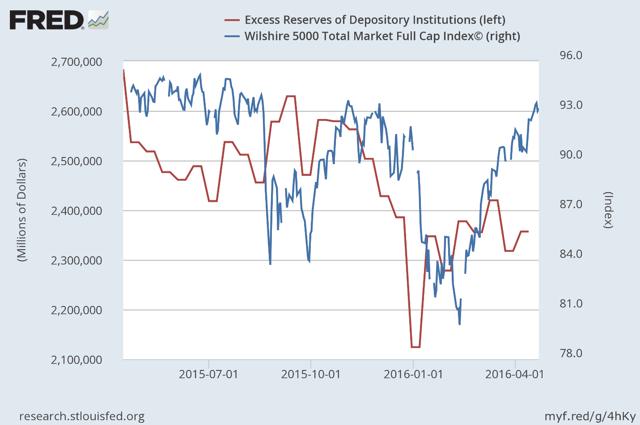

If we replace the fluctuations in the monetary base with the fluctuations in excess bank reserves, the same correlation exists with stock prices, as can be seen below. The image that comes to mind is that of a bathtub filled with water, or liquidity, in the form of excess bank reserves. This liquidity is supporting the stock market. When the Fed pulls the drain plug, withdrawing liquidity, the water level falls and so does the stock market. The Fed then plugs the drain, turns on the faucet and allows the tub to fill back up with water, injecting liquidity back into the banking system, and the stock market recovers. Could this be the indiscriminate buyer that I mentioned previously at work in the market? I don’t know.

What I can’t do is draw a road map that shows exactly how an increase or decrease in excess reserves leads to the buying or selling of stocks, especially over the last 12 months. The deadline for banks to comply with the Volcker Rule, which bans proprietary trading, was only nine months ago. Who knows what the largest domestic banks that hold the vast majority of the $2.4 trillion in excess reserves were doing on the investment front in the years prior. As recently as January 2015, traders at JPMorgan made a whopping $300 million in one day trading Swiss francs on what was speculated to be a $1 billion bet. Was that a risky trade?

Despite the ban on proprietary trading imposed by the Volcker Rule, there are countless loopholes that weaken the statute. For example, banks can continue to trade physical commodities, just not commodity derivatives. Excluded from the ban are repos, reverse repos and securities lending, through which a lot of speculation takes place. There is also an exclusion for what is called “liquidity management,” which allows a bank to put all of its relatively safe holdings in an account and manage them with no restrictions on trading, so long as there is a written plan. The bank can hold anything it wants in the account so long as it is a liquid security.

My favorite loophole is the one that allows a bank to facilitate client transactions. This means that if a bank has clients that its traders think might want to own certain stocks or stock-related securities, it can trade in those securities, regardless of whether or not the clients buy them. Banks can also engage in high-frequency trading through dark pools, which mask their trading activity altogether.

As a friend of mine who is a trader for one of the largest US banks told me last week, he can buy whatever he wants within his area of expertise, with the intent to make a market and a profit, so long as he sells the security within six months. If he doesn’t sell it within six months, he is hit with a Volcker Rule violation. I asked him what the consequences of that would be, to which he replied, “a slap on the wrist.”

Regardless of the investment activities of the largest banks, it is clear that a change in the total amount of excess reserves in the banking system has a significant impact on the value of the overall stock market. The only conclusion that I can definitively come to is that as excess reserves increase, liquidity is created, leading to an increase in demand for financial assets, including stocks, and prices rise. When that liquidity is withdrawn, prices fall. The demand for higher risk financial assets that this liquidity is creating is overriding any supply, or selling, that results from a deterioration in market fundamentals.

There is one aspect of excess reserves that is important to understand. If a bank uses excess reserves to buy a security, that transaction does not reduce the total amount of reserves in the banking system. It simply transfers the reserves from the buyer to the seller, or to the bank account in which the seller deposits the proceeds from the sale, if that seller is not another bank. It does change the composition of the reserves, as 10% of the new deposit becomes required reserves and the remaining 90% remains as excess reserves. The Fed is the only institution that can change the total amount of excess reserves in the banking system, and as it has begun to do so over the past year, I think it is finally realizing that it must reap what it has sown.

The Conundrum

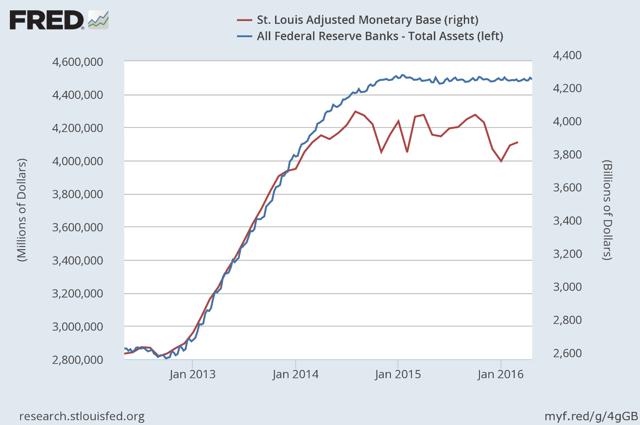

In order to tighten monetary policy, the Federal Reserve must drain the banking system of the excess reserves it has created, but it doesn’t want to sell any of the bonds that it has purchased. It continues to reinvest the proceeds of maturing securities. As can be seen below, it holds approximately $4.5 trillion in assets, a number which has remained constant over the past 18 months.

Therefore, in order to drain reserves, thereby reducing the size of the monetary base, the Fed has been lending out its bonds on a temporary basis in exchange for the reserves that the bond purchases created. These transactions are called reverse repurchase agreements. This is how the Fed has been reducing the monetary base, while still holding all of its assets, as can be seen below.

There has been a gradual increase in the volume of repurchase agreements outstanding over the past two years, which has resulted in a gradual decline in the monetary base and excess reserves, as can be seen below.

I am certain that the Fed recognizes the correlation between the rise and fall in excess reserves, and the rise and fall in the stock market. This is why it has been so reluctant to tighten monetary policy further. In lieu of being transparent, it continues to come up with excuses for why it must hold off on further tightening, which have very little to do with the domestic economy. The Fed rightfully fears that a significant market decline will thwart the progress it has made so far in meeting its mandate of full employment and a rate of inflation that approaches 2% (stable prices).

The conundrum the Fed faces is that if the rate of inflation rises above its target of 2%, forcing it to further drain excess bank reserves and increase short-term interest rates, it is likely to significantly deflate the value of financial assets, based on the correlation that I have shown. This will have dire consequences both for consumer spending and sentiment, and for what is already a stall-speed rate of economic growth. Slower rates of economic growth feed into a further deterioration in market fundamentals, which leads to even lower stock prices, and a negative-feedback loop develops. This reminds me of the deflationary spiral that took place during the financial crisis.

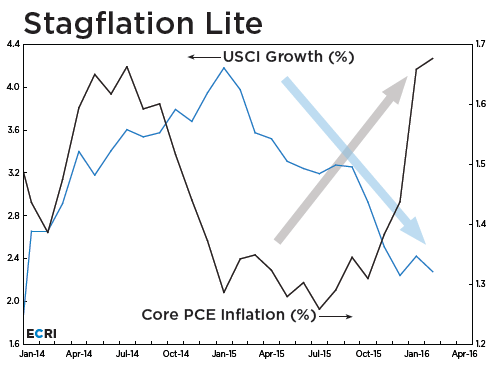

The Fed’s preferred measurement of inflation is the core Personal Consumption Expenditures, or PCE, price index, which excludes food and energy. The latest year-over-year increase of 1.7% is the highest since February 2013, and it is rapidly closing in on the Fed’s 2% target even though the rate of economic growth is moving in the opposite direction, as can be seen below.

The Bubble

If you have been wondering, as I have, why the stock market has been able to thumb its nose at an ongoing recession in corporate profits and revenues that started more than a year ago, I think you will find the answer in $2.4 trillion of excess reserves in the banking system. It is this abundance of liquidity, for which the real economy has no use, that is decoupling the stock market from economic fundamentals. The Fed has distorted the natural pricing mechanism of a free market, and at some point in the future, we will all learn that this distortion has a great cost.

Alan Greenspan once said, “how do we know when irrational exuberance has unduly escalated asset values?” Open your eyes.

What you see in the chart below is a bubble. It is much different than the asset bubbles we experienced in technology stocks and home prices, which is why it has gone largely unnoticed. It is similar from the standpoint that it has been built on exaggerated expectations of future growth. It is a bubble of the Fed’s own making, built on the expectation that an unprecedented increase in the monetary base and excess bank reserves would lead to faster rates of economic growth. It has clearly not. Instead, this mountain of money has either directly, or indirectly, flooded into financial assets, manipulating prices to levels well above what economic fundamentals would otherwise dictate.

The great irony of this bubble is that it is the achievement of the Fed’s objectives, for which the bubble was created, that will ultimately lead it to its bursting. It was an unprecedented amount of credit available at historically low interest rates that fueled the rise in home prices, and it has also been an unprecedented amount of credit at historically low interest rates that has fueled the rise in financial asset prices, including the stock market. How and when this bubble will be pricked remains a question mark, but what is certain is that the current level of excess reserves in the banking system that appear to be supporting financial markets cannot exist in perpetuity.

Is Wall Street Dancing On A Live Volcano?

The S&P 500 closed today exactly where it first crossed in November 2014. In the interim, its been a roller-coaster of rips, dips, spills and thrills.

The thing is, however, this extended period of sideways churning has not materialized under a constant economic backdrop; it does not reflect a mere steady-state of dare-doing at the gaming tables.

Actually, earnings have been falling sharply and macroeconomic headwinds have been intensifying dramatically. So the level of risk in the financial system has been rocketing higher even as the stock averages have labored around the flat-line.

Thus, GAAP earnings of the S&P 500 in November 2014 were $106 per share on an LTM basis compared to $86.44 today. So earnings are down by 18.5%, meaning that the broad market PE multiple has escalated from an already sporty 19.3X back then to an outlandish 23.7X today.

Always and everywhere, such persistent profit collapses have signaled recession just around the corner. And there are plenty of macro-economic data points signaling just that in the remainder of this article (here)

by David Stockman | Contra Corner

Headlines Heading South

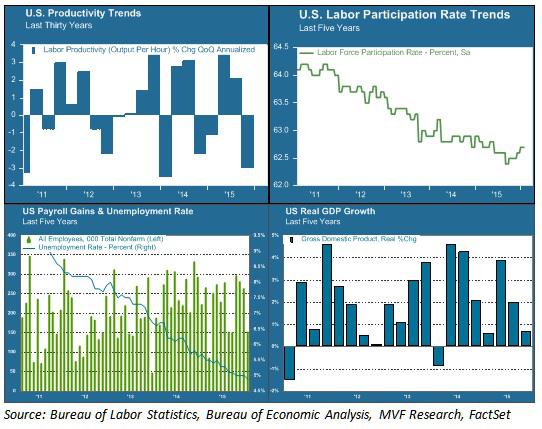

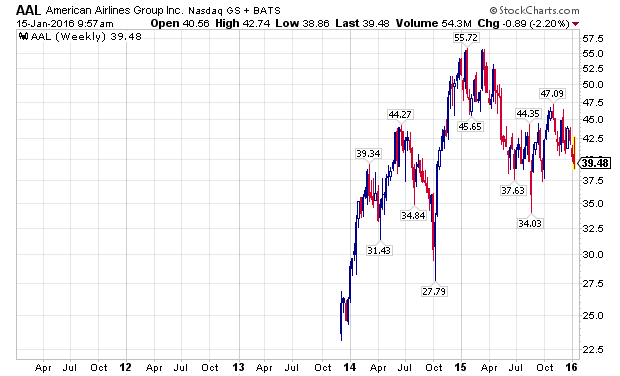

China’s slowdown, cash-strapped emerging markets, the negative interest rate contagion – news from the world economy has been almost uniformly negative for much of the past twelve months. The bright spot amid the gloom has been the relatively upbeat US economy, the strength of which finally convinced the Fed to nudge up interest rates last December. At that time, based on the available data, we concurred that a slow liftoff was the right course of action. But a growing number of macroeconomic reports issued since call that decision into question. From productivity to durable goods orders to real GDP growth, indications are that the pace of recovery is waning. Not enough to raise fears of an imminent recession, but enough to stoke the flames of negative sentiment currently afflicting risk asset markets around the world.

China’s slowdown, cash-strapped emerging markets, the negative interest rate contagion – news from the world economy has been almost uniformly negative for much of the past twelve months. The bright spot amid the gloom has been the relatively upbeat US economy, the strength of which finally convinced the Fed to nudge up interest rates last December. At that time, based on the available data, we concurred that a slow liftoff was the right course of action. But a growing number of macroeconomic reports issued since call that decision into question. From productivity to durable goods orders to real GDP growth, indications are that the pace of recovery is waning. Not enough to raise fears of an imminent recession, but enough to stoke the flames of negative sentiment currently afflicting risk asset markets around the world.

Mary Mary Quite Contrary, How Does Your Economy Grow?

Jobs Friday may be the headline event for macro data nerds, but in our opinion, Productivity Wednesday was the more significant event of the week. The Bureau of Labor Statistics release this past midweek showed that fourth quarter 2015 productivity declined by three percent (annualized) from the previous quarter. Now, productivity can be sporadic from quarter to quarter, but this week’s release is part of a larger trend of lackluster efficiency gains.

As measured by real GDP, an economy can only grow in three ways: population growth, increased labor force participation, or increased output per hour of labor – i.e. productivity. Unfortunately, none of these are trending positive. The chart below offers a snapshot of current labor, productivity and growth trends.

Labor force participation (upper right area of chart) has been in steep decline for the past five years – an outcome of both the jobs lost from the 2007-09 recession and the retirement of baby boomers from the workplace. This decline has helped keep the headline unemployment rate low (blue line in the bottom left chart) and also explains in part the anemic growth in hourly wages over this period. This trend is unlikely to reverse any time soon. If real GDP growth (bottom right chart) is to return to its pre-recession normal trend line, it will have to come from productivity gains. That is why the current trend in productivity (upper left chart) is of such concern.

Of Smartphones and Sewage

The last sustained productivity surge we experienced was in the late 1990s. It is attributed largely to the fruits of the Information Age – the period when the innovations in computing and automation of the previous decades translated into increased efficiencies in the workplace. From 1995 to 2000, quarterly productivity gains averaged 2.6 percent on an annual basis. The pace slackened in the first decade of the current century. In the first five years of this decade – from 2010 to the present – average quarterly productivity growth amounted to just 0.6 percent – more than three times slower than the gains of the late 1990s.

Is that all we can expect from the Smartphone Age? Or are we simply in the middle of an innovation gap – a period in between technological breakthroughs and the translation of those breakthroughs to actual results? It is possible that a new growth age is just around the corner, powered by artificial intelligence, virtual reality and the Internet of Things, among other inventions. It is also possible that the innovations of our day simply don’t pack the same punch as those of other ages. Economist Robert Gordon makes a version of this argument in his recent book, The Rise and Fall of American Growth. Gordon points to the extraordinary period of growth our country experienced from 1870 to 1970 – growth delivered largely thanks to the inventions of electricity and the internal combustion engine – and argues that this was a one-off anomaly that we should not expect to continue indefinitely. What would you rather live without – your Twitter feed and Uber app, or indoor plumbing?

We don’t necessarily agree with Gordon’s conclusion that nothing will ever again rival electricity and motorized transport as an economic growth driver. But we do believe that the growth equation is currently stuck, and the headline data we have seen so far this year do nothing to indicate its becoming unstuck. Long-term growth is not something that drives day-to-day fluctuations in asset prices. But its absence is a problem that is increasingly part of the conversation about where markets go from here. Stay tuned for more Productivity Wednesdays.

The Fed’s Stunning Admission Of What Happens Next

Following an epic stock rout to start the year, one which has wiped out trillions in market capitalization, it has rapidly become a consensus view (even by staunch Fed supporters such as the Nikkei Times) that the Fed committed a gross policy mistake by hiking rates on December 16, so much so that this week none other than former Fed president Kocherlakota openly mocked the Fed’s credibility when he pointed out the near record plunge in forward break evens suggesting the market has called the Fed’s bluff on rising inflation.

All of this happened before JPM cut its Q4 GDP estimate from 1.0% to 0.1% in the quarter in which Yellen hiked.

To be sure, the dramatic reaction and outcome following the Fed’s “error” rate hike was predicted on this website on many occasions, most recently two weeks prior to the rate hike in “This Is What Happened The Last Time The Fed Hiked While The U.S. Was In Recession” when we demonstrated what would happen once the Fed unleashed the “Ghost of 1937.”

As we pointed out in early December, conveniently we have a great historical primer of what happened the last time the Fed hiked at a time when it misread the US economy, which was also at or below stall speed, and the Fed incorrectly assumed it was growing.

We are talking of course, about the infamous RRR-hike of 1936-1937, which took place smack in the middle of the Great Recession.

Here is what happened then, as we described previously in June.

[No episode is more comparable to what is about to happen] than what happened in the US in 1937, smack in the middle of the Great Depression. This is the only time in US history which is analogous to what the Fed will attempt to do, and not only because short rates collapsed to zero between 1929-36 but because the Fed’s balance sheet jumped from 5% to 20% of GDP to offset the Great Depression.

Just like now.

Follows a detailed narrative of precisely what happened from a recent Bridgewater note:

The first tightening in August 1936 did not hurt stock prices or the economy, as is typical.

The tightening of monetary policy was intensified by currency devaluations by France and Switzerland, which chose not to move in lock-step with the US tightening. The demand for dollars increased. By late 1936, the President and other policy makers became increasingly concerned by gold inflows (which allowed faster money and credit growth).

The economy remained strong going into early 1937. The stock market was still rising, industrial production remained strong, and inflation had ticked up to around 5%. The second tightening came in March of 1937 and the third one came in May. While neither the Fed nor the Treasury anticipated that the increase in required reserves combined with the sterilization program would push rates higher, the tighter money and reduced liquidity led to a sell-off in bonds, a rise in the short rate, and a sell-off in stocks. Following the second increase in reserves in March 1937, both the short-term rate and the bond yield spiked.

Stocks also fell that month nearly 10%. They bottomed a year later, in March of 1938, declining more than 50%!

Or, as Bank of America summarizes it: “The Fed exit strategy completely failed as the money supply immediately contracted; Fed tightening in H1’37 was followed in H2’37 by a severe recession and a 49% collapse in the Dow Jones.”

* * *

As it turns out, however, the Fed did not even have to read this blog, or Bank of America, or even Bridgewater, to know the result of its rate hike. All it had to do was to read… the Fed.

But first, as J Pierpont Morgan reminds us, it was Charles Kindleberger’s “The World in Depression” which summarized succinctly just how 2015/2016 is a carbon copy of the 1936/1937 period. In explaining how and why both the markets and the economy imploded so spectacularly after the Fed’s decision to tighten in 1936, Kindleberger says:

“For a considerable time there was no understanding of what had happened. Then it became clear. The spurt in activity from October 1936 had been dominated by inventory accumulation. This was especially the case in automobiles, where, because of fears of strikes, supplies of new cars had been built up. It was the same in steel and textiles – two other industries with strong CIO unions.”

If all off this sounds oddly familiar, here’s the reason why: as we showed just last week, while inventories remain at record levels, wholesale sales are crashing, and the result is that the nominal spread between inventories and sales is all time high.

The inventory liquidation cycle was previewed all the way back in June in “The Coming US Recession Charted” long before it became “conventional wisdom.”

Kindleberger continues: