California homebuyers making up to $211,000 annually will be able to receive a 20% down payment, and all closing costs, at a 0% interest rate.

Tag Archives: California

California Is Now Castrating Children From All 50 States Without Parental Consent

California Democrats recently passed SB-107, which allows all American children to access destructive transgender surgeries without parental consent. What is their end game? (source)

Greg Reese explains how. Laura Logan explains why…

Just Days After Phasing Out New Gas Cars, California Says “Avoid Charging EVs” Amid Grid Emergency

Shortly after 1800ET, just as Californians begin to head home for the day, the California Independent System Operator issued a level-1 energy emergency alert shortly after tapping all its available power supplies. Despite earlier warnings to reduce usage, Californians – in all their self-righteous virtue – decided to charge their EV anyway, pushing demand above capacity.

California to Ban Sale of New Gas-Powered Cars – All Electric Vehicles in Next Decade

(Cristina Laila) California on Thursday is expected to ban the sale of gas-powered vehicles by 2035.

CA To Charge Landowners For Their Own Water

(Bob Unruh) California has announced to landowners that they now are going to be billed for the water they take out of their own wells, on their own land.

3rd Look at Local Housing Markets in June, Sales Down Sharply, Inventory “Surged”

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in June, Sales Down Sharply, Inventory “Surged”

A brief excerpt: Continue reading

California Agrees To Extend Eviction Ban, Cover Back Rent & Utilities Through September

(Louis Hansen) Gov. Gavin Newsom and legislative leaders announced a package today to extend the eviction moratorium through September and streamline an aid program to pay landlords 100% of unpaid rent.

Monarch, the last California Grizzly Bear in captivity

Watch Food Delivery Robot Sidestep Homeless Man In Los Angeles

White privilege? A person of pallor is so low on the totem pole of L.A. streets that even a food delivery robot avoids him.

CAR on California July Housing: Sales up 6% YoY, Active Listings down 48% YoY

The CAR reported: California housing recovery continues in July as median home price sets another record high, C.A.R. reports

California’s housing market continued to recover as home sales climbed to their highest level in more than two and a half years in July, while setting another record-high median home price, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 437,890 units in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July’s sales total climbed above the 400,000 level for the first time since February 2020, before the COVID-19 crisis depressed the housing market, and was the highest level in more than two and a half years. July sales rose 28.8 percent from 339,910 in June and were up 6.4 percent from a year ago, when 411,630 homes were sold on an annualized basis. July marked the first time in five months that home sales posted an annual gain.

Housing inventory continued to trend downward on a year-over-year basis, with active listings falling more than 25 percent for the eighth consecutive month. The year-over-year 48 percent decline was the biggest drop in active listings since January 2013. The continued recovery in closed escrow sales, combined with a sharp drop in active listings, led to a plunge in the Unsold Inventory Index (UII) to 2.1 months in July, down from 3.2 months a year ago. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales. The July UII was the lowest level since November 2004.

CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in May and June. Sales-to-date, through July, are down 10% compared to the same period in 2019.

California Is Teetering On The Edge Of Financial Ruin Again

For years, it had been speculated that California’s state-wide model of heavy regulation, expensive education, high taxes and bloated spending would eventually drive the state into financial ruin, according to a new Bloomberg Opinion piece. Over the last 15 years, the state also has had to deal with widespread blackouts and an unemployment rate that ballooned to 12% after the financial crisis.

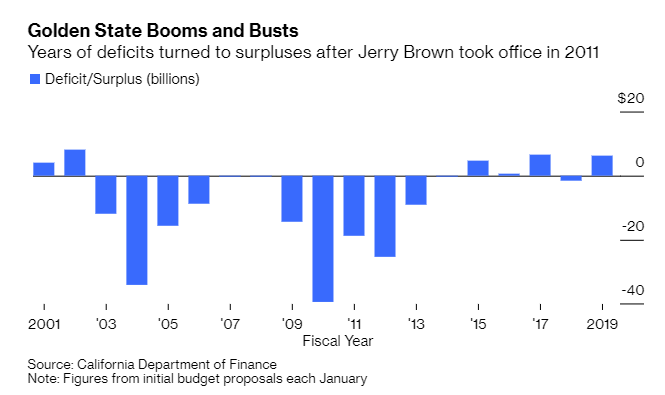

After deficits exploded under Governor Schwarzenegger, the state eventually got back on track. Under Governor Jerry Brown, the state raised taxes again (surprise) and bumped up its sales tax. These tax hikes, combined with a recovery in housing and in the stock market, helped swing the state’s budget back into the black.

But now, the symptoms of larger problems in California are bubbling to the surface yet again. For instance, the recent “planned blackouts” by power provider PG&E to try and prevent wildfires are indicative of a crumbling energy infrastructure across the state.

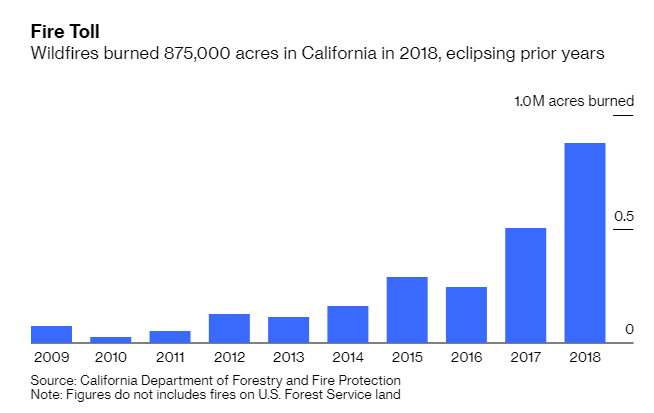

Losses from recent wildfires in California have been “staggering”, totaling upwards of $400 billion in 2018. This figure represents about 1/7th of the state’s total GDP and is comprised of health costs, lost property, lost jobs and asset prices falling. It also takes into account migration out of the state.

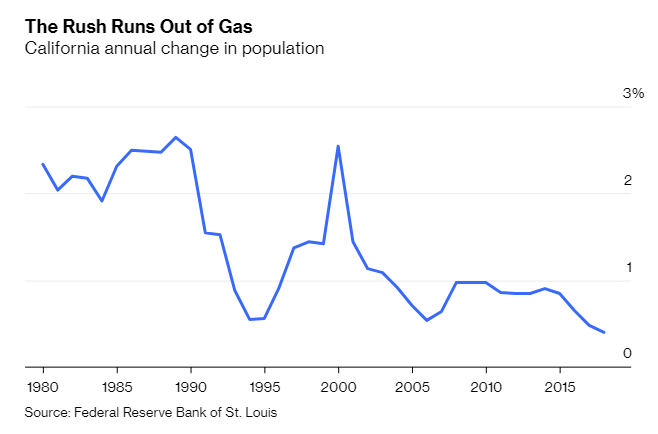

PG&E has said that the “safety” blackouts will continue, which means that the state isn’t going to have reliable year-round electricity. This will inevitably take its toll on property values and slow migration inflows into the state.

While wildfires rage across the state, another issue is plaguing California: homelessness. The state’s homeless population has increased by 5.3% from 2010 to 2018. California is already home to almost half of the country’s homeless. We have documented, at length, the homelessness issues in areas like San Francisco, where the epidemic is reaching a fever pitch.

At the same time, government pension costs are rising across the state; faster in California than in the rest of the nation. The cost saving measures being put in place to offset this problem are degrading the state’s education system.

And so, the inevitable has happened: people are leaving the state.

In fact, a recent paper by economists Joshua Rauh and Ryan Shyu found that out-migration of top-bracket taxpayers accelerated after the state’s 2012 income tax hike.

“Among top-bracket California taxpayers, outward migration and behavioral responses by stayers together eroded 45.2% of the windfall tax revenues from the reform,” the paper’s abstract says.

With Democrats back in the saddle, holding a super majority in the state, California seems doomed to repeat its dysfunctional history from the early 2000’s. Making matters worse, an initiative called Proposition 13 is making it difficult for California to alleviate its burdens by raising property taxes, the op-ed notes:

But California’s political system is making it hard to respond to these pressures. Thanks to a 1978 ballot initiative called Proposition 13, California cities have stringent limits on raising revenue from local property taxes. That forces the state to provide many services, financing them with hefty income taxes. Those are inherently more unreliable than property taxes, since wealthy taxpayers can move away (while property can’t move), and since California’s income taxes fluctuate a lot because they depend so much on the profits residents earn on volatile stock prices.

“Proposition 13 must be repealed, and property taxes raised,” the piece continues, in order for the state to avoid what it calls another “dark path”. It also suggests that the state legislature pass bills to allow greater housing density and more construction throughout the state.

Only time will tell whether these proposed solutions, if implemented, would even work. But one thing is for sure: if California doesn’t do something soon, the state could become (further) living proof that creating a liberal utopia by hiking taxes and adding regulation is nothing more than a pipe dream, if not a full blown recipe for exactly how to drive an economy into the ground.

Contrast with SoCal, early 1950’s…

Orange County California Q1 Home Sales Off To Coldest Start Since Great Recession

Welcome to the Land of… Jumbo mortgages and All-cash! Aka, Orange County, home of surfing legend (and Realtor) Bob “The Greek” Bolen.

But Orange County has just experienced their slowest start to a year in terms of home sales since The Great Recession.

And home prices in Orange County are falling despite mortgage rate declines.

Now Ain’t that a kick in the head!

Is This A Solution To California’s Housing Crisis, Or Threat To Single Family Homes?

Could this be the end of single-family zoning in California?

Changes to the comprehensive housing measure Senate Bill 50 – already hotly debated – allow property owners broad rights to turn single-family homes and vacant lots into two-, three- and four-unit homes and apartments.

C.A.R. Report: California Housing Market Sputtered In November

California Association Of Realtors Report, Absent Seasonal Adjustments

– Existing, single-family home sales totaled 381,400 in November on a seasonally adjusted annualized rate, down 3.9 percent from October and down 13.4 percent from November 2017.

– November’s statewide median home price was $554,760, down 3.0 percent from October and up 1.5 percent from November 2017.

– Statewide active listings rose for the eighth straight month, increasing 31 percent from the previous year.

– The statewide Unsold Inventory Index was 3.7 months in November, up from 3.6 months in October.

– As of November, year-to-date sales were down 4.6 percent.

LOS ANGELES (Dec. 18) – California home sales remained on a downward trend for the seventh consecutive month in November as prospective buyers continued to wait out the market, according to the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.).

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 381,400 units in November, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLS’ statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

November’s sales figure was down 3.9 percent from the revised 397,060 level in October and down 13.4 percent from home sales in November 2017 of a revised 440,340. November marked the fourth month in a row that sales were below 400,000.

“While many home buyers continue to sit on the sidelines, serious buyers who are in a position to purchase should take advantage of this window of opportunity,” said C.A.R. President Jared Martin. “Now that interest rates have pulled back, home prices have tapered, and inventory has improved, home buyers’ prospects of getting into a home are more positive.”

The statewide median home price declined to $554,760 in November. The November statewide median price was down 3.0 percent from $572,000 in October and up 1.5 percent from a revised $546,820 in November 2017.

“The slowdown in price growth is occurring throughout the state, including regions that have strong economic fundamentals such as the San Francisco Bay Area,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The deceleration in home price appreciation should be a welcome sign for potential buyers who have struggled in recent years against low inventory and rapidly rising home prices.”

Other key points from C.A.R.’s November 2018 resale housing report include:

- On a region wide, non-seasonally adjusted basis, sales dropped double-digits on a year-over-year basis in the San Francisco Bay Area, the Central Coast, and the Southern California regions, while the Central Valley region experienced a relatively small sales dip of 3.9 percent.

- Forty-one of the 51 counties reported by C.A.R. posted a sales decline in November with an average year-over-year sales decline of 16.8 percent. Twenty-six counties recorded double-digit sales drops on an annual basis.

- Sales for the San Francisco Bay Area as a whole fell 11.5 percent from a year ago. All nine Bay Area counties recorded annual sales decreases, with Marin, San Francisco, San Mateo, and Sonoma counties posting double-digit annual declines.

- The Los Angeles Metro region posted a year-over-year sales drop of 10.1 percent, as home sales fell 11.2 percent in Los Angeles County and 14.4 percent in Orange County.

- Home sales in the Inland Empire decreased 6.7 percent from a year ago as Riverside and San Bernardino counties posted annual sales declines of 9.0 percent and 3.2 percent, respectively.

- Home prices in the San Francisco Bay Area are no longer climbing at the double-digit pace that occurred throughout much of this year. On a year-over-year basis, the Bay Area median price ticked up 0.6 percent from November 2017. While home prices in Marin, San Francisco, San Mateo, and Santa Clara counties continued to remain above $1 million, all but San Mateo County recorded a year-over-year price decline.

- Statewide active listings rose for the eighth consecutive month after nearly three straight years of declines, increasing 31 percent from the previous year. November’s listings increase was the largest since April 2014.

- The unsold inventory index, which is a ratio of inventory over sales, increased year-to-year from 2.9 months in November 2017 to 3.7 months in November 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

- The median number of days it took to sell a California single-family home edged up from 22 days in November 2017 to 28 days in November 2018.

- C.A.R.’s statewide sales price-to-list-price ratio* declined from a year ago at 98.9 percent in November 2017 to 97.9 percent in November 2018.

- The average statewide price per square foot** for an existing, single-family home statewide was $282 in November 2018, up from $277 in November 2017.

- The 30-year, fixed-mortgage interest rate averaged 4.87 percent in November, up from 3.92 percent in November 2017, according to Freddie Mac. The five-year, adjustable mortgage interest rate also increased in November to an average of 4.11 percent from 3.24 from November 2017.

Key Graphics (click links to open):

- Calif. historical existing home sales.

- Calif. historical median home price.

- Year-over-year sales by price segment.

- Unsold inventory index of single-family homes.

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data are not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower-end or the upper-end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 50 counties.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 190,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

# # #

November 2018 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

| November 2018 | Median Sold Price of Existing Single-Family Homes | Sales | |||||||

| State/Region/County | Nov.

2018 |

Oct.

2018 |

Nov.

2017 |

Price MTM% Chg | Price YTY% Chg | Sales MTM% Chg | Sales YTY% Chg | ||

| Calif. Single-family home | $554,760 | $572,000 | $546,820 | -3.0% | 1.5% | -3.9% | -13.4% | ||

| Calif. Condo/Townhome | $465,770 | $476,440 | $451,250 | -2.2% | 3.2% | -19.1% | -17.4% | ||

| Los Angeles Metro Area | $512,000 | $516,000 | $500,500 | -0.8% | 2.3% | -14.0% | -10.1% | ||

| Central Coast | $672,500 | $669,500 | $685,000 | 0.4% | -1.8% | -15.9% | -18.0% | ||

| Central Valley | $320,000 | $320,000 | $310,000 | 0.0% | 3.2% | -11.7% | -3.9% | ||

| Inland Empire | $363,620 | $359,000 | $340,000 | 1.3% | 6.9% | -12.2% | -6.7% | ||

| San Francisco Bay Area | $905,000 | $958,800 | $900,000 | r | -5.6% | 0.6% | -12.7% | -11.5% | |

| San Francisco Bay Area | |||||||||

| Alameda | $900,000 | $900,000 | $880,000 | 0.0% | 2.3% | -10.9% | -6.7% | ||

| Contra Costa | $641,000 | $657,000 | $615,000 | -2.4% | 4.2% | -5.8% | -8.0% | ||

| Marin | $1,172,940 | $1,450,000 | $1,230,000 | -19.1% | -4.6% | -25.7% | -26.8% | ||

| Napa | $683,500 | $709,500 | $682,000 | -3.7% | 0.2% | -11.5% | -6.1% | ||

| San Francisco | $1,442,500 | $1,600,000 | $1,500,000 | -9.8% | -3.8% | -14.0% | -12.2% | ||

| San Mateo | $1,500,000 | $1,588,000 | $1,486,000 | -5.5% | 0.9% | -22.1% | -13.7% | ||

| Santa Clara | $1,250,000 | $1,290,000 | $1,282,500 | -3.1% | -2.5% | -10.9% | -9.9% | ||

| Solano | $450,000 | $430,000 | $410,000 | 4.7% | 9.8% | -2.7% | -3.6% | ||

| Sonoma | $612,500 | $650,000 | $655,000 | -5.8% | -6.5% | -25.5% | -29.1% | ||

| Southern California | |||||||||

| Los Angeles | $553,940 | $614,500 | $530,920 | -9.9% | 4.3% | -17.5% | -11.2% | ||

| Orange | $795,000 | $810,000 | $785,000 | -1.9% | 1.3% | -7.5% | -14.4% | ||

| Riverside | $400,000 | $400,000 | $383,000 | 0.0% | 4.4% | -14.8% | -9.0% | ||

| San Bernardino | $299,450 | $289,000 | $280,000 | 3.6% | 6.9% | -8.0% | -3.2% | ||

| San Diego | $626,000 | $635,500 | $619,900 | -1.5% | 1.0% | -8.4% | -11.0% | ||

| Ventura | $643,740 | $650,000 | $640,000 | -1.0% | 0.6% | -18.8% | -11.7% | ||

| Central Coast | |||||||||

| Monterey | $630,000 | $620,000 | $618,120 | 1.6% | 1.9% | -6.1% | -11.2% | ||

| San Luis Obispo | $624,000 | $586,000 | $615,000 | 6.5% | 1.5% | -14.4% | -17.5% | ||

| Santa Barbara | $550,000 | $659,000 | $742,000 | -16.5% | -25.9% | -20.3% | -18.8% | ||

| Santa Cruz | $862,500 | $885,000 | $870,000 | -2.5% | -0.9% | -24.0% | -26.1% | ||

| Central Valley | |||||||||

| Fresno | $265,750 | $272,000 | $264,000 | -2.3% | 0.7% | -6.4% | -2.9% | ||

| Glenn | $225,000 | $253,000 | $232,000 | -11.1% | -3.0% | 12.5% | -5.3% | ||

| Kern | $235,250 | $240,000 | $235,000 | -2.0% | 0.1% | -14.8% | -1.8% | ||

| Kings | $222,000 | $229,000 | $230,000 | -3.1% | -3.5% | -3.4% | 6.3% | ||

| Madera | $265,000 | $254,950 | $245,000 | 3.9% | 8.2% | 2.1% | -2.0% | ||

| Merced | $261,930 | $271,850 | r | $255,000 | -3.6% | 2.7% | -22.5% | -13.0% | |

| Placer | $461,000 | $470,000 | $450,000 | -1.9% | 2.4% | -5.1% | -13.6% | ||

| Sacramento | $365,000 | $360,000 | $349,900 | 1.4% | 4.3% | -10.2% | -7.1% | ||

| San Benito | $583,200 | $597,000 | $649,880 | -2.3% | -10.3% | -4.3% | 10.0% | ||

| San Joaquin | $365,000 | $369,200 | $360,500 | -1.1% | 1.2% | -20.1% | 17.5% | ||

| Stanislaus | $310,000 | $319,000 | $298,750 | -2.8% | 3.8% | -17.2% | -9.2% | ||

| Tulare | $237,400 | $232,000 | $215,000 | 2.3% | 10.4% | -16.2% | -2.5% | ||

| Other Calif. Counties | |||||||||

| Amador | NA | NA | $348,950 | NA | NA | NA | NA | ||

| Butte | $326,940 | $318,000 | $315,000 | 2.8% | 3.8% | -7.1% | 8.3% | ||

| Calaveras | $325,000 | $302,500 | $318,000 | 7.4% | 2.2% | -33.6% | -31.9% | ||

| Del Norte | $250,000 | $223,000 | $214,000 | 12.1% | 16.8% | -20.0% | -42.9% | ||

| El Dorado | $461,750 | $500,000 | $470,000 | -7.7% | -1.8% | -28.6% | -27.5% | ||

| Humboldt | $310,000 | $315,000 | $310,000 | -1.6% | 0.0% | -24.0% | 3.2% | ||

| Lake | $255,000 | $265,250 | $262,000 | -3.9% | -2.7% | -11.4% | -23.5% | ||

| Lassen | $184,000 | $148,000 | $189,000 | 24.3% | -2.6% | -40.0% | -48.3% | ||

| Mariposa | $355,000 | $305,500 | $250,000 | 16.2% | 42.0% | -12.5% | 180.0% | ||

| Mendocino | $414,000 | $420,000 | $374,500 | -1.4% | 10.5% | -13.1% | 6.0% | ||

| Mono | $725,000 | $599,900 | $400,000 | 20.9% | 81.3% | -47.1% | -35.7% | ||

| Nevada | $399,000 | $401,500 | $405,750 | -0.6% | -1.7% | -30.6% | -13.9% | ||

| Plumas | $289,500 | $310,000 | $302,000 | -6.6% | -4.1% | -44.7% | -42.2% | ||

| Shasta | $283,000 | $261,000 | $250,000 | 8.4% | 13.2% | -17.2% | 7.1% | ||

| Siskiyou | $226,000 | $181,500 | $189,500 | 24.5% | 19.3% | -19.6% | -15.9% | ||

| Sutter | $296,000 | $290,000 | $270,000 | 2.1% | 9.6% | -16.9% | -14.7% | ||

| Tehama | $199,000 | $233,250 | $224,500 | -14.7% | -11.4% | -38.1% | -46.9% | ||

| Tuolumne | $288,500 | $304,000 | $325,000 | -5.1% | -11.2% | -15.4% | -9.6% | ||

| Yolo | $429,500 | $443,750 | $440,000 | -3.2% | -2.4% | -12.5% | -26.3% | ||

| Yuba | $263,000 | $282,000 | $285,000 | -6.7% | -7.7% | -1.3% | 14.5% | ||

r = revised

NA = not available

November 2018 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

| November 2018 | Unsold Inventory Index | Median Time on Market | ||||||||

| State/Region/County | Nov. 2018 | Oct. 2018 | Nov. 2017 | Nov. 2018 | Oct. 2018 | Nov. 2017 | ||||

| Calif. Single-family home | 3.7 | 3.6 | 2.9 | 28.0 | 26.0 | 22.0 | ||||

| Calif. Condo/Townhome | 3.4 | 3.1 | 2.2 | 25.0 | 21.0 | 17.0 | ||||

| Los Angeles Metro Area | 4.2 | 4.0 | 3.3 | 32.0 | 30.0 | 27.0 | ||||

| Central Coast | 4.4 | 4.1 | 3.4 | 34.0 | 30.0 | 30.0 | ||||

| Central Valley | 3.3 | 3.3 | 2.9 | 25.0 | 21.0 | 18.0 | ||||

| Inland Empire | 4.7 | 4.3 | 3.9 | 37.0 | 35.0 | 31.0 | ||||

| San Francisco Bay Area | 2.3 | 2.5 | 1.5 | 23.0 | 19.0 | 15.0 | ||||

| San Francisco Bay Area | ||||||||||

| Alameda | 1.9 | 2.1 | 1.2 | 17.0 | 15.0 | 13.0 | ||||

| Contra Costa | 2.2 | 2.6 | 1.7 | 19.0 | 16.0 | 14.0 | ||||

| Marin | 3.0 | 3.0 | 1.6 | 35.0 | 22.0 | 36.0 | ||||

| Napa | 4.6 | 5.0 | 3.8 | 49.0 | 41.0 | 57.5 | ||||

| San Francisco | 1.7 | 1.9 | 1.1 | 16.5 | 15.0 | 16.0 | ||||

| San Mateo | 1.9 | 1.9 | 1.2 | 16.0 | 12.0 | 12.0 | ||||

| Santa Clara | 2.1 | 2.4 | 1.2 | 18.0 | 14.0 | 9.0 | ||||

| Solano | 3.0 | 3.4 | 2.4 | 41.0 | 39.0 | 32.5 | ||||

| Sonoma | 3.8 | 3.3 | 1.7 | 49.0 | 47.5 | 44.0 | ||||

| Southern California | ||||||||||

| Los Angeles | 3.9 | 3.7 | 2.9 | 27.0 | 25.0 | 22.0 | r | |||

| Orange | 3.9 | 4.1 | 2.8 | 28.0 | 29.0 | 24.0 | ||||

| Riverside | 4.9 | 4.3 | 3.9 | 36.0 | 34.0 | 29.0 | ||||

| San Bernardino | 4.3 | 4.3 | 3.9 | 42.0 | 35.0 | 34.0 | ||||

| San Diego | 3.9 | 3.9 | 2.7 | 22.0 | 24.0 | 17.0 | ||||

| Ventura | 5.4 | 5.1 | 4.4 | 53.0 | 51.0 | 51.0 | ||||

| Central Coast | ||||||||||

| Monterey | 4.3 | 4.4 | 3.8 | 25.0 | 25.0 | 28.0 | ||||

| San Luis Obispo | 4.6 | 4.3 | 3.7 | 40.0 | 29.0 | 30.0 | ||||

| Santa Barbara | 5.2 | 4.5 | 3.7 | 41.0 | 40.0 | 35.0 | ||||

| Santa Cruz | 3.2 | 3.1 | 2.2 | 30.5 | 21.0 | 22.5 | ||||

| Central Valley | ||||||||||

| Fresno | 3.5 | 3.6 | r | 3.0 | 19.0 | 19.0 | 18.0 | |||

| Glenn | 4.8 | 4.9 | 3.8 | 73.5 | 22.5 | 45.0 | ||||

| Kern | 3.1 | 2.9 | 3.3 | 26.0 | 21.0 | 25.0 | ||||

| Kings | 3.5 | 3.8 | 3.5 | 23.5 | 26.0 | 16.0 | ||||

| Madera | 5.1 | 5.7 | r | 4.4 | r | 34.0 | 30.0 | 28.0 | ||

| Merced | 4.8 | 3.7 | 3.6 | 23.0 | 22.0 | 25.0 | ||||

| Placer | 3.0 | 3.4 | 2.3 | 27.0 | 25.0 | 17.0 | ||||

| Sacramento | 2.7 | 2.8 | 2.3 | 24.0 | 19.0 | 17.0 | ||||

| San Benito | 3.1 | 3.6 | 4.1 | 41.5 | 23.0 | 23.5 | ||||

| San Joaquin | 3.6 | 3.1 | 2.9 | 24.0 | 22.0 | 14.0 | ||||

| Stanislaus | 3.3 | 3.1 | 2.6 | 25.0 | 21.0 | 18.0 | ||||

| Tulare | 4.1 | 3.6 | 3.9 | 35.0 | 28.0 | 29.5 | ||||

| Other Counties in California | ||||||||||

| Amador | NA | NA | 5.4 | NA | NA | 69.0 | ||||

| Butte | 2.9 | 3.3 | 2.8 | 24.0 | 21.0 | 18.0 | ||||

| Calaveras | 6.5 | 4.7 | 4.3 | 53.0 | 43.5 | 60.0 | ||||

| Del Norte | 5.6 | 5.0 | 4.0 | 110.0 | 95.0 | 111.0 | ||||

| El Dorado | 4.4 | 3.6 | 2.7 | 41.5 | 48.0 | 40.0 | ||||

| Humboldt | 5.8 | 4.9 | 5.3 | 24.5 | 27.0 | 28.0 | ||||

| Lake | 7.0 | 6.7 | 4.7 | 60.5 | 51.0 | 54.0 | ||||

| Lassen | 8.6 | 6.1 | 5.0 | 110.0 | 109.0 | 85.0 | ||||

| Mariposa | 4.8 | 4.6 | 12.2 | 147.0 | 24.0 | 6.0 | ||||

| Mendocino | 7.9 | 7.3 | 5.7 | 66.0 | 87.0 | 63.5 | ||||

| Mono | 8.4 | 4.8 | 4.9 | 127.0 | 115.0 | 153.5 | ||||

| Nevada | 5.7 | 4.3 | 3.9 | 41.0 | 40.5 | 33.0 | ||||

| Plumas | 9.8 | 6.1 | 5.1 | 152.0 | 87.0 | 143.0 | ||||

| Shasta | 4.4 | 3.9 | 4.3 | 26.5 | 34.5 | 33.0 | ||||

| Siskiyou | 7.1 | 6.6 | 5.5 | 60.5 | 20.0 | 60.5 | ||||

| Sutter | 2.9 | 3.1 | 3.0 | 29.5 | 34.0 | 32.0 | ||||

| Tehama | 9.2 | 5.4 | 4.0 | 49.5 | 48.5 | 63.0 | ||||

| Tuolumne | 5.8 | 5.6 | 3.9 | 58.5 | 47.0 | 42.0 | ||||

| Yolo | 3.7 | 3.7 | 1.9 | 27.0 | 22.0 | 22.0 | ||||

| Yuba | 2.9 | 3.0 | 3.4 | 30.0 | 33.0 | 17.0 | ||||

r = revised

NA = not available

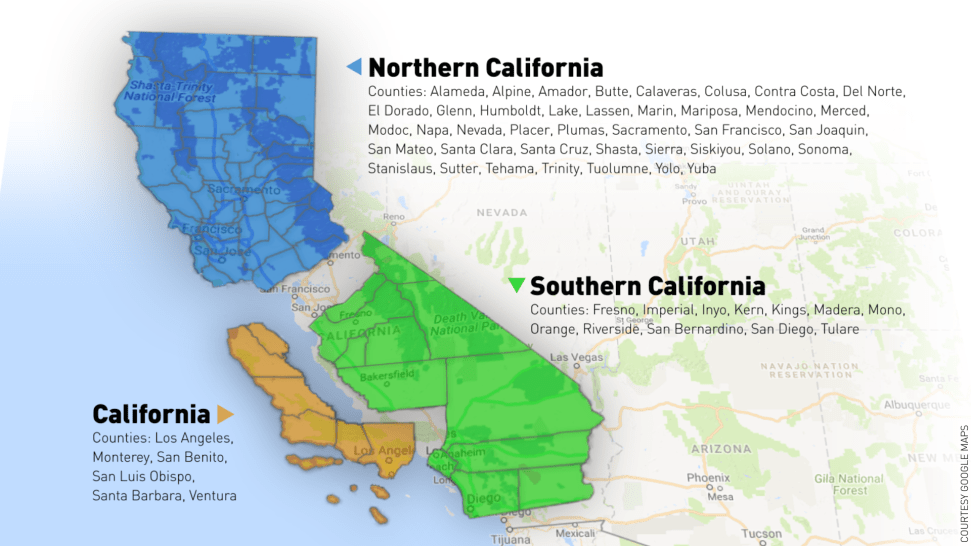

Proposal To Split California Into Three States Earns Spot On November Ballot

California’s 168-year run as a single entity, hugging the continent’s edge for hundreds of miles and sprawling east across mountains and desert, could come to an end next year — as a controversial plan to split the Golden State into three new jurisdictions qualified Tuesday for the Nov. 6 ballot.

If a majority of voters who cast ballots agree, a long and contentious process would begin for three separate states to take the place of California, with one primarily centered around Los Angeles and the other two divvying up the counties to the north and south. Completion of the radical plan — far from certain, given its many hurdles at judicial, state and federal levels — would make history.

It would be the first division of an existing U.S. state since the creation of West Virginia in 1863.

“Three states will get us better infrastructure, better education and lower taxes,” Tim Draper, the Silicon Valley billionaire venture capitalist who sponsored the ballot measure, said in an email to The Times last summer when he formally submitted the proposal. “States will be more accountable to us and can cooperate and compete for citizens.”

Jerry Brown Forbids Landlords from Cooperating with ICE to Deport Illegal Aliens

California Gov. Jerry Brown signed a pair of new laws Thursday designed to protect illegal alien tenants from being threatened with deportation by making it illegal for landlords to report a tenant’s immigration status to Immigrations Customs Enforcement (ICE).

The bills were part of a package of laws pushed by the Democrat majority and signed by Brown ostensibly to protect illegal aliens from any increased enforcement measures under theTrump administration.

According to the Los Angeles Times,

One proposal by Assemblyman David Chiu (D-San Francisco) would bar landlords from disclosing information about immigration status in order to intimidate, harass or evict tenants without following proper procedures. It also would allow immigrant tenants to file civil claims against their landlords if they do.

Another bill by Assembly Majority Leader Ian Calderon (D-Whittier) would ensure that no state office or entity in California could compel a landlord to obtain and disclose information on a tenant’s immigration status.

The rationale behind the latest package of bills protecting illegal aliens, according to the Sacramento Bee, is fear of enforcement by ICE under President Trump, and fear that unscrupulous landlords might use a tenant’s illegal status to harass, intimidate or abuse them.

Chiu argues that tenants should not have to “live in fear” because they’re immigrants or refugees. He cited the legal uncertainty over young immigrants who were brought to the country illegally but have been educated here and hold down jobs as one of several reasons for the legislation.

“Trump’s escalating war on immigrants is ripping apart families and mass deportations could be our new reality,” Chiu said recently.

“This bill will deter the small minority of landlords who unscrupulously take advantage of the real or perceived immigration status of their tenants to engage in abusive acts.”

With the package of bills signed into law Thursday—including SB54 making California a “Sanctuary State” for criminal aliens— California Democrats have kept their word to put the interests of illegal aliens first, ahead of legal, law-abiding California citizens.

Required Pension Contributions of California Cities Will Double in Five Years says Policy Institute: Quadruple is More Likely

The California Policy Center estimates Required Pension Contributions Will Nearly Double in 5 Years. I claim it will be much worse.

In the fiscal year beginning in July, local payments to the California Public Employees’ Retirement System will total $5.3 billion and rise to $9.8 billion in fiscal 2023, according to the right-leaning group that examines public pensions.

The increase reflects Calpers’ decision in December to roll back the expected rate of return on its investments. That means the system’s 3,000 cities, counties, school districts and other public agencies will have to put more taxpayer money into the fund because they can’t count as heavily on anticipated investment income to cover future benefit checks.

Including the costs paid by cities and counties that run their own systems, the fiscal 2018 tab will be at least $13 billion to meet retirement obligations for public workers, according to the analysis, which is based on actuarial reports and audited financial statements.

Barring any changes to pensions, “several California cities and counties will find themselves forced to slash other spending,” the group wrote in its report. “The less fortunate will simply be unable to pay the bills they receive from Calpers or their local retirement system.”

Quadruple is More Likely

The California Policy Center Report details 20 cities and counties reporting pension contribution-to-revenue ratios exceeding 10%. San Rafael, San Jose, and Santa Barbara County head the list at 18.29%, 13.49%, and 13.06% respectively.

The report “reflects the impact of CalPERS’ recent decision to change the rate at which it discounts future liabilities from 7.5% to 7%“.

Lovely.

A plan assumption of 7.0% is not going to happen. Returns are more likely to be negative than to hit 7% a year for the next five years.

As in 2000 and again in 2007, investors believe the stock market is flashing an all clear signal. It isn’t.

GMO 7-Year Expected Returns

Source: GMO

*The chart represents local, real return forecasts for several asset classes and not for any GMO fund or strategy. These forecasts are forward‐looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward‐looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward looking statements. Forward‐looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated in forward‐looking statements. U.S. inflation is assumed to mean revert to long‐term inflation of 2.2% over 15 years.

Forecast Analysis

GMO forecasts seven years of negative real returns. Allowing for 2.2% inflation, nominal returns are expected to be negative for seven full years.

Even +3.0% returns would wreck pension plans, most of which assume six to seven percent returns.

If we see the kinds of returns I expect, even quadruple contributions will not come close to matching the actuarial needs.

California Renter Apocalypse

The rise in rents and home prices is adding additional pressure to the bottom line of most California families. Home prices have been rising steadily for a few years largely driven by low inventory, little construction thanks to NIMBYism, and foreign money flowing into certain markets. But even areas that don’t have foreign demand are seeing prices jump all the while household incomes are stagnant. Yet that growth has hit a wall in 2016, largely because of financial turmoil. We’ve seen a big jump in the financial markets from 2009. Those big investor bets on real estate are paying off as rents continue to move up. For a place like California where net home ownership has fallen in the last decade, a growing list of new renter households is a good thing so long as you own a rental.

The rise in rents and home prices is adding additional pressure to the bottom line of most California families. Home prices have been rising steadily for a few years largely driven by low inventory, little construction thanks to NIMBYism, and foreign money flowing into certain markets. But even areas that don’t have foreign demand are seeing prices jump all the while household incomes are stagnant. Yet that growth has hit a wall in 2016, largely because of financial turmoil. We’ve seen a big jump in the financial markets from 2009. Those big investor bets on real estate are paying off as rents continue to move up. For a place like California where net home ownership has fallen in the last decade, a growing list of new renter households is a good thing so long as you own a rental.

The problem of course is that household incomes are not moving up and more money is being siphoned off into an unproductive asset class, a house. Let us look at the changing dynamics in California households.

More renters

Many people would like to buy but simply cannot because their wages do not justify current prices for glorious crap shacks. In San Francisco even high paid tech workers can’t afford to pay $1.2 million for your typical Barbie house in a rundown neighborhood. So with little inventory investors and foreign money shift the price momentum. With the stock market moving up nonstop from 2009 there was plenty of wealth injected back into real estate. The last few months are showing cracks in that foundation.

It is still easy to get a mortgage if you have the income to back it up. You now see the resurrection of no money down mortgages. In the end however the number of renter households is up in a big way in California and home ownership is down:

Source: Census

So what we see is that since 2007 we’ve added more than 680,000 renter households but have lost 161,000 owner occupied households. At the same time the population is increasing. When it comes to raw numbers, people are opting to rent for whatever reason. Also, just because the population increases doesn’t mean people are adding new renter households. You have 2.3 million grown adults living at home with mom and dad enjoying Taco Tuesdays in their old room filled with Nirvana and Dr. Dre posters.

And yes, with little construction and unable to buy, many are renting and rents have jumped up in a big way in 2015:

Source: Apartmentlist.com

This has slowed down dramatically in 2016. It is hard to envision this pace going on if a reversal in the economy hits (which it always does as the business cycle does its usual thing).

Home ownership rate in a steep decline

In the LA/OC area home prices are up 37 percent in the last three years:

Of course there are no accompanying income gains. If you look at the stock market, the unemployment rate, and real estate values you would expect the public to be happy this 2016 election year. To the contrary, outlier momentum is massive because people realize the system is rigged and are trying to fight back. Watch the Big Short for a trip down memory lane and you’ll realize nothing has really changed since then. The house humping pundits think they found some new secret here. It is timing like buying Apple or Amazon stock at the right time. What I’ve seen is that many that bought no longer can afford their property in a matter of 3 years! Some shop at the dollar store while the new buyers are either foreign money or dual income DINKs (which will take a big hit to their income once those kids start popping out). $2,000 a month per kid daycare in the Bay Area is common.

If this was such a simple decision then the home ownership rate would be soaring. Yet the home ownership rate is doing this:

In the end a $700,000 crap shack is still a crap shack. That $1.2 million piece of junk in San Francisco is still junk. And you better make sure you can carry that housing nut for 30 years. For tech workers, mobility is key so renting serves more as an option on housing versus renting the place from the bank for 30 years. Make no mistake, in most of the US buying a home makes total sense. In California, the massive drop in the home ownership rate shows a different story. And that story is the middle class is disappearing.

California Home Sales Make Comeback in December, After Slower November

According to the California Association of Realtors, California existing home sales rebounded in December 2015, after new loan disclosure rules delayed closings in November 2015.

U.S. home sales exceeded the 400,000-unit level in December after falling short in November. Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 405,530 units in December, according to information collected by C.A.R.

The statewide sales figure represents what would be the total number of homes sold during 2015 if sales maintained the December pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

For 2015 as a whole, a preliminary figure of 407,060 single-family homes closed escrow in California, up 6.4 percent from a revised 382,720 in 2014.

The December figure was up 9.6 percent from the revised 370,070 level in November and up 10.7 percent compared with home sales in December 2014 of a revised 366,460. The month-to-month increase in sales was the largest since January 2011, and the year-to-year increase was the largest since July 2015.

“As we speculated, sales that were delayed in November because of The Consumer Financial Protection Bureau’s new loan disclosure rules closed in December instead, which led to the greatest monthly sales increase in nearly five years,” said C.A.R. President Ziggy Zicarelli. “Sales increased across the board in all price segments in December, but improvement in the sub-$500,000 market was more pronounced as many homes affected by the new loan disclosures were priced under the conforming loan limit.”

The median price of an existing, single-family detached California home rose 2.6 percent in December to $489,310 from $477,060 in November. December’s median price was 8.0 percent higher than the revised $453,270 recorded in December 2014. The median sales price is the point at which half of homes sold for more and half sold for less; it is influenced by the types of homes selling as well as a general change in values. The year-to-year price gain was the largest since August 2014.

“In line with our forecast, California’s housing market experienced strong sales and price growth throughout last year, with the median price increasing 6.2 percent for the year as a whole to reach $474,420 in 2015,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “Looking forward, we expect the foundation for the housing market to remain strong throughout the year, with moderate increases in home sales and prices, but headwinds of tight housing supply and low affordability will remain a challenge.”

Other key points from C.A.R.’s December 2015 resale housing report include:

- While more sales closed in December, the number of active listings continued to drop from both the previous month and year. Active listings at the statewide level dropped 11.7 percent from November and decreased 7.9 percent from December 2014. At the regional level, total active listings continued to decline from the previous year in Southern California, Central Valley, and the San Francisco Bay Area, dropping 9.6 percent, 7.6 percent, and 5.2 percent, respectively.

- The sharp increase in sales in December and fewer listings combined to tighten the available supply of homes on the market. C.A.R.’s Unsold Inventory Index fell to 2.8 months in December from 4.2 months in November. The index stood at 3.2 months in December 2014. The index indicates the number of months needed to sell the supply of homes on the market at the current sales rate. A six- to seven-month supply is considered typical in a normal market.

- The median number of days it took to sell a single-family home increased in December to 39.5 days, compared with 37.5 days in November and 44.1 days in December 2014.

- According to C.A.R.’s newest housing market indicator, which measures the sales-to-list price ratio*, properties are generally selling below the list price, except in the San Francisco Bay Area, where a lack of homes for sale is pushing sales prices higher than original asking prices. The statewide measure suggests that homes sold at a median of 97.9 percent of the list price in December, up from 97.2 percent at the same time last year. The Bay Area is the only region where homes are selling above original list prices due to constrained supply with a ratio of 100.7 percent in December, up from 100 percent a year ago.

- The average price per square foot** for an existing, single-family home was $230 in December 2015, up from $222 in December 2014.

- San Francisco continued to have the highest price per square foot in December at $749/sq. ft., followed by San Mateo ($715/sq. ft.), and Santa Clara ($568/sq. ft.). The three counties with the lowest price per square foot in December were Siskiyou ($107/sq. ft.), Tulare ($123/sq. ft.), and Merced ($124/sq. ft.).

- Mortgage rates inched up in December, with the 30-year, fixed-mortgage interest rate averaging 3.96 percent, up from 3.94 percent in November and up from 3.86 percent in December 2014, according to Freddie Mac. Adjustable-mortgage interest rates also edged up, averaging 2.66 percent in December, up from 2.63 percent in November and up from 2.40 percent in December 2014.

FHA 203(k) Home Improvement Loan

Planning to buy a fixer-upper, or make improvements to your existing home? The FHA 203k loan may be your perfect home improvement loan.

Planning to buy a fixer-upper, or make improvements to your existing home? The FHA 203k loan may be your perfect home improvement loan.

In combining your construction loan and your mortgage into a single home loan, the 203k loan program limits your loan closing costs and simplifies the home renovation process.

FHA 203k mortgages are available in California in loan amounts of up to $625,500.

About FHA Mortgages

The Federal Housing Administration (FHA) is a federal agency which is more than 80 years old. It was formed as part of the National Housing Act of 1934 with the stated mission of making homes affordable.

Prior to the FHA, home buyers were typically required to make down payments of fifty percent or more; and were required to repay loans in full within five years of closing.

The FHA and its loan programs changed all that.

The agency launched a mortgage insurance program through which it would protect the nation’s lenders against “bad loans”.

In order to receive such insurance, lenders were required to confirm that loans met FHA minimum standards which included verifications of employment; credit history reviews; and, satisfactory home appraisals.

These minimum standards came to be known as the FHA mortgage guidelines and, for loans which met guidelines, banks were granted permission to offer loan terms which put home ownership within reach for U.S. buyers.

Today, the FHA loan remains among the most forgiving and favorable of today’s home loan programs.

FHA mortgages require down payments of just 3.5 percent; make concessions for borrowers with low credit scores; and provide access to low mortgage rates.

The FHA has insured more than 34 million mortgages since its inception.

What Is The FHA 203k Construction Loan?

The FHA 203k loan is the agency’s specialized home construction loan.

Available to both buyers and refinancing households, the 203k loan combines the traditional “home improvement” loan with a standard FHA mortgage, allowing mortgage borrowers to borrow their costs of construction.

The FHA 203k Loan Comes In Two Varieties.

The first type of 203k loan is the Streamlined 203k. The Streamlined 203k loan is for less extensive projects and cost are limited to $35,000. The other 203k loan type is the “standard” 203k.

The standard 203k loan is meant for projects requiring structural changes to home including moving walls, replacing plumbing, or anything else which may prohibit you from living in the home while construction is underway.

There are no loan size limits with the standard 203k but there is a $5,000 minimum loan size.

The FHA says there are three ways you can use the program.

1. You can use the FHA 203k loan to purchase a home on a plot of land, then repair it

2. You can use the FHA 203k loan to purchase a home on another plot of land, move it to a new plot of land, then repair it

3. You can use the FHA 203k loan to refinance an existing home, then repair it

All proceeds from the mortgage must be spent on home improvement. You may not use the 203k loan for “cash out” or any other purpose. Furthermore, the 203k mortgage may only be used on single-family homes; or homes of fewer than 4 units.

You may use the FHA 203k to convert a building of more than four units to a home of 4 units or fewer. The program is available for homes which will be owner-occupied only.

203k Loan Eligibility Standards

The 203k loan is an FHA-backed home loan, and follows the eligibility standards of a standard FHA mortgage.

For example, borrowers are expected to document their annual income via federal tax returns and to show a debt-to-income ratio within program limits. Borrowers must also be U.S. citizens or legal residents of the United States.

And, while there is no specific credit score required in order to qualify for the 203k rehab loan, most mortgage lenders will enforce a minimum 580 FICO.

Like all FHA loans, the minimum down payment requirement on a 203k rehab loan is 3.5 percent and FHA 203k homeowners can borrow up to their local FHA loan size limit, which reaches $625,500 in higher-cost areas including Los Angeles, New York City, New York; and, San Francisco.

Furthermore, 203k loans are available as fixed-rate or adjustable-rate loans; and loan sizes may exceed a home’s after-improvement value by as much as 10%. for borrowers with a recent bankruptcy, short sale or foreclosure; and the FHA’s Energy Efficiency Mortgage program.

What Repairs Does The 203k Loan Allow?

The FHA is broad with the types of repairs permitted with a 203k loan. However, depending on the nature of the repairs, borrowers may be required to use the “standard” 203k home loan as compared to the simpler, faster Streamlined 203k.

The FHA lists several repair types which require the standard 203k:

• Relocation of loan-bearing walls

• Adding new rooms to a home

• Landscaping of a property

• Repairing structural damage to a home

• Total repairs exceeding $35,000

For most other home improvement projects, borrowers should look to the FHA Streamlined 203k . The FHA Streamlined 203k requires less paperwork as compared to a standard 203k and can be a simpler loan to manage.

A partial list of projects well-suited for the Streamlined 203k program include :

• HVAC repair or replacement

• Roof repair or replacement

• Home accessibility improvements for disabled persons

• Minor remodeling, which does not require structural repair

• Basement finishing, which does not require structural repair

• Exterior patio or porch addition, repair or replacement

Borrowers can also use the Streamlined 203k loan for window and siding replacement; interior and exterior painting; and, home weatherization.

For today’s home buyers, the FHA 203k loan can be a terrific way to finance home construction and repairs.

‘Most Expensive’ Mansion Listing In U.S., Palazzo di Amore Cut Price By $46 Million

Despite the $46-million price cut, the 53,000-square-foot Beverly Hills home is still asking a top-of-the-charts $149 million. (Marc Angeles | Inset: Tribune Publishing)

US Home Sales Surge In June To Fastest Pace In 8-Plus Years

WASHINGTON (AP) — Americans bought homes in June at the fastest rate in over eight years, pushing prices to record highs as buyer demand has eclipsed the availability of houses on the market.

The National Association of Realtors said Wednesday that sales of existing homes climbed 3.2 percent last month to a seasonally adjusted annual rate of 5.49 million, the highest rate since February 2007. Sales have jumped 9.6 percent over the past 12 months, while the number of listings has risen just 0.4 percent.

Median home prices climbed 6.5 percent over the past 12 months to $236,400, the highest level reported by the Realtors not adjusted for inflation.

Home-buying has recently surged as more buyers are flooding into the real estate market. Robust hiring over the past 21 months and an economic recovery now in its sixth year have enabled more Americans to set aside money for a down payment. But the rising demand has failed to draw more sellers into the market, causing tight inventories and escalating prices that could cap sales growth.

“The recent pace can’t be sustained, but it points clearly to upside potential,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

A mere five months’ supply of homes was on the market in June, compared to 5.5 months a year ago and an average of six months in a healthy market.

Some markets are barely adding any listings. The condominium market in Massachusetts contains just 1.8 months’ supply, according to a Federal Reserve report this month. The majority of real estate agents in the Atlanta Fed region – which ranges from Alabama to Florida- said that inventories were flat or falling over the past year.

Some of the recent sales burst appears to come from the prospect of low mortgage rates beginning to rise as the Federal Reserve considers raising a key interest rate from its near-zero level later this year. That possibility is prompting buyers to finalize sales before higher rates make borrowing costs prohibitively expensive, noted Daren Blomquist, a vice president at RealtyTrac, a housing analytics firm.

The premiums that the Federal Housing Administration charges to insure mortgages are also lower this year, further fueling buying activity, Blomquist said.

It’s also possible that home buyers are checking the market for listings more aggressively, making it possible for them to act fast with offers despite the lack of new inventory.

“Buyers can more quickly be alerted of new listings and also more conveniently access real estate data to help them pre-search a potential purchase before they even step foot in the property,” Blomquist said. “That may mean we don’t need such a large supply of inventory to feed growing sales.”

Properties typically sold last month in 34 days, the shortest time since the Realtors began tracking the figure in May 2011. There were fewer all-cash, individual investor and distressed home sales in the market, as more traditional buyers have returned.

Sales improved in all four geographical regions: Northeast, Midwest, South and West.

Still, the limited supplies could eventually prove to be a drag on sales growth in the coming months.

Ever rising home values are stretching the budgets of first-time buyers and owners looking to upgrade. As homes become less affordable, the current demand will likely taper off.

Home prices have increased nearly four times faster than wages, as average hourly earnings have risen just 2 percent over the past 12 months to $24.95 an hour, according to the Labor Department.

Some buyers are also bristling at the few available options on the market. Tony Smith, a Charlotte, North Carolina real estate broker, said some renters shopping for homes are now choosing instead to re-sign their leases and wait until a better selection of properties comes onto the market.

New construction has yet to satisfy rising demand, as builders are increasingly focused on the growing rental market.

Approved building permits rose increased 7.4 percent to an annual rate of 1.34 million in June, the highest level since July 2007, the Commerce Department said last week. Almost all of the gains came for apartment complexes, while permits for houses last month rose only 0.9 percent.

The share of Americans owning homes has fallen this year to a seasonally adjusted 63.8 percent, the lowest level since 1989.

Real estate had until recently lagged much of the six-year rebound from the recession, hobbled by the wave of foreclosures that came after the burst housing bubble.

But the job market found new traction in early 2014. Employers added 3.1 million jobs last year and are on pace to add 2.5 million jobs this year. As millions more Americans have found work, their new paychecks are increasingly going to housing, both in terms of renting and owning.

Low mortgage rates have also helped, although rates are now starting to climb to levels that could slow buying activity.

Average 30-year fixed rates were 4.09 percent last week, according to the mortgage giant Freddie Mac. The average has risen from a 52-week low of 3.59 percent.

Southern California Home Sales Soar in June

The Southern California housing market, known for its dramatic swings, is settling into a more normal, healthy pattern.

Home sales are up. All-cash and investor purchases are down. And home prices are rising at a more sustainable pace than in the last few years.

Economists said those factors put the regional housing market on a path for growth that won’t wash away in a tsunami of foreclosures and ruined credit scores.

“The healing continues,” said Stuart Gabriel, director of UCLA’s Ziman Center for Real Estate.

On Thursday, fresh evidence of that trend emerged in a report from CoreLogic. Home sales posted a sizable 18.1% pop in June from a year earlier, while the median price rose 5.7% from June 2014 to $442,000, the real estate data firm said.

The sales increase, the largest in nearly three years, put the number of sales just 9.6% below average, CoreLogic said. A year ago, sales were nearly 24% below average.

Notably, it appears more families are entering the market as the economy improves. Although still elevated in comparison to long-term averages, the share of absentee buyers — mostly investors — slid to 21.1%, the lowest percentage since April 2010, CoreLogic said.

“This is the real recovery,” Christopher Thornberg, founding partner of Beacon Economics, said of a market where increasingly buyers actually want to live in the houses they purchase. “The last was the investor recovery.”

Sustained job growth has given more people the confidence to buy houses, CoreLogic analyst Andrew LePage said. California added a robust 54,200 jobs in May, one of the strongest showings in the last year.

The housing market improvement extends nationally, with sales of previously owned homes up in May to the highest pace in nearly six years, partly because more first-time buyers entered the market, according to data from the National Assn. of Realtors.

One factor driving deals is an expected decision from the Federal Reserve to raise its short-term interest rate later this year, real estate agents say.

In response, families rushed to lock in historically low rates this spring, agents say. CoreLogic’s sales figures represent closed deals, meaning most went into escrow during May.

Leslie Appleton-Young, chief economist for the California Association of Realtors, cautioned that the market still has too few homes for sale and that prices have risen to a point where many can’t afford a house.

Unless that changes, sales are unlikely to reach levels in line with historical norms, she said.

“I am not saying the housing market isn’t robust,” she said.

“I think housing affordability is a big issue…The biggest problem is losing millennials to places like Denver and Austin and Seattle.”

For now, deals are on the rise and people are paying more.

Sales and prices climbed in all six south land counties: Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura. In Orange County, the median price rose 4.9% from a year earlier to $629,500.

In Los Angeles County, prices climbed 8.7% to $500,000.

NAR Releases Mid-2015 U.S. Economic and Housing Forecast

According to the National Association of Realtors (NAR), the U.S. housing market will continue its gradual pace of recovery as more home buyers enter a tight housing market for the balance of 2015, being nudged by rising mortgage rates and improving consumer confidence.

NAR’s chef economist Lawrence Yun has released the following observations for the US economy at large, and for the U.S. housing market specifically:

The U.S. Economy

- GDP growth was slightly negative in the first quarter but will pick up in the second half. For the year as whole, GDP will expand at 2.1 percent. Not bad but not great. A slow hum.

- Consumer spending will open up because of lower gasoline prices. Personal consumption expenditure grew at 2.1 percent rate in the first quarter. Look for 3 percent growth rate in the second half.

- Auto sales dropped a bit in the first quarter because of heavy snow, but will ramp up nicely in the second half.

- Spending for household furnishing and equipment has been solid, growing 6 percent in the first quarter after clocking 6 percent in the prior. Recovering housing sector is the big reason for the nice numbers.

- Spending at restaurants was flat. That is why retail vacancy rates are not notching down.

- Online shopping is up solidly. That is why industrial and warehouse vacancy rates are coming down.

- Spending for health care grew at 5 percent in the first quarter, marking two consecutive quarters of fast growth. The Affordable Care Act has expanded health care demand. The important question for the future is will the supply of new doctors and nurses expand to meet this rising demand or will it lead to medical care shortage?

- Business spending was flat in the first quarter but will surely rise because of large cash holdings and high profits.

- Spending for business equipment rose by 3 percent in the first quarter. Positive and good, but nothing to shout about.

- Spending for business structures (building of office and retail shops, for example) fell by 18 percent. The freezing first-quarter weather halted some construction. This just means pent-up construction activity in the second half.

- In the past small business start-ups spent and invested. It was not uncommon to experience double-digit growth rates for 3 years running for business equipment. Not happening now. But business spending will inevitably grow because of much improved business financial conditions of lower debt and more profits and rising GDP.

- What has been missing is the “animal spirit” of entrepreneurship. The number of small business start-ups remains surprisingly low at this phase of economic expansion.

- Residential construction spending increased 6 percent in the first quarter. Housing starts are rising and therefore this component will pick up even at a faster pace in the second half.

- Government spending fell by 1 percent. At the federal level, non-defense spending grew by 2 percent, while national defense spending fell by 1 percent. At the state and local level, spending fell by 1 percent.

- The federal government is still running a deficit. Even though it is spending more than what it takes in from tax revenue, the overall deficit level has been falling to a sustainable level. It would be ideal to run a surplus, but a falling deficit nonetheless does provide the possibility of less severe sequestration.

- U.S. government finances are ugly. Interestingly though, they are less ugly than other countries. That is why the U.S. dollar has been strengthening against most other major currencies. It’s like finding the least dirty shirt from a laundry basket.

- Imports have been rising while exports have been falling. The strong dollar makes it so. Imports grew by 7 percent while exports fell by 6 percent. The net exports (at minus $548 billion) were the worst in seven years. Fortunately, with the West Coast longshoremen back at work, the foreign trade situation will not worsen, which means it will help GDP growth.

- All in all, GDP will growth by 2.5 to 3 percent in the second half. That translates into jobs. A total of 2.5 million net new jobs are likely to be created this year.

- Unemployment insurance filings have been rising in oil-producing states of Texas and North Dakota.

- Unemployment insurance filings for the country as a whole have been falling, which implies lower level of fresh layoffs and factory closings. That assures continuing solid job growth in the second half of the year.

- We have to acknowledge that not all is fine with the labor market. The part-time jobs remain elevated and wage growth remains sluggish with only 2 percent annual growth. There are signs of tightening labor supply and the bidding up of wages. Wages are to rise by 3 percent by early next year. The total income of the country and the total number of jobs are on the rise.

The U.S. Housing Market Mid-2015 Trends

- Existing home sales in May hit the highest mark since 2009, when there had been a homebuyer tax credit … remember, buy a home and get $8,000 from Uncle Sam. This tax credit is no longer available but the improving economy is providing the necessary incentive and financial capacity to buy. Meanwhile new home sales hit a seven-year high and housing permits to build new homes hit an eight-year high. Pending contracts to buy existing homes hit a nine-year high.

- Buyers are coming back in force. One factor for the recent surge could have been due to the rising mortgage rates. As nearly always happens, the initial phase of rising rates nudges people to make decision now rather than wait later when the rates could be higher still.

- The first-time buyers are scooping up properties with 32 percent of all buyers being as such compared to only 27 percent one year ago. A lower fee on FHA mortgages is helping.

- Investors are slowly stepping out. The high home prices are making the rate of return numbers less attractive.

- Buyers are back. What about sellers? Inventory remains low by historical standards in most markets. In places like Denver and Seattle, where a very strong job growth is the norm, the inventory condition is just unreal – less than one month supply.

- The principal reason for the inventory shortage is the cumulative impact of homebuilders not being in the market for well over five years. Homebuilders typically put up 1.5 million new homes annually. Here’s what they did from 2009 to 2014:

- 550,000

- 590,000

- 610,000

- 780,000

- 930,000

- 1.0 million

- Where is 1.5 million? Maybe by 2017.

- Building activity for apartments has largely come back to normal. The cumulative shortage is on the ownership side.

- Builders will construct more homes. By 1.1 million in 2015 and 1.4 million in 2016. New home sales will follow this trend. This rising trend will steadily relieve housing shortage.

- There is no massive shadow inventory that can disrupt the market. The number of distressed home sales has been steadily falling – now accounting for only 10 percent of all transactions. It will fall further in the upcoming months. There is simply far fewer mortgages in the serious delinquent stage (of not being current for 3 or more months). In fact, if one specializes in foreclosure or short sales, it is time to change the business model.

- In the meantime, there is still a housing shortage. The consequence is a stronger than normal home price growth. Home price gains are beating wage-income growths by at least three or four times in most markets. Few things in the world could be more frustrating and demoralizing than for renters to start a savings program but only to witness home prices and down payment requirements blowing past them by.

- Housing affordability is falling. Home prices rising too fast is one reason. The other reason is due to rising mortgage rates. Cash-buys have been coming down so rates will count for more in the future.

- The Federal Reserve will be raising short-term rates soon. September is a maybe, but it’s more likely to be in October. The Fed will also signal the continual raising of rates over the next two years. This sentiment has already pushed up mortgage rates. They are bound to rise further, particularly if inflation surprises on the upside.

- Inflation is likely to surprise on the upside. The influence of low gasoline prices in bringing down the overall consumer price inflation to essentially zero in recent months will be short-lasting. By November, the influence of low gasoline prices will no longer be there because it was in November of last year when the oil prices began their plunge. That is, by November, the year-over-year change in gasoline price will be neutral (and no longer big negative). Other items will then make their mark on inflation. Watch the rents. It’s already rising at near 8-year high with a 3.5 percent growth rate. The overall CPI inflation could cross the red line of above 3 percent by early next year. The bond market will not like it and the yields on all long-term borrowing will rise.

- Mortgage rates at 4.3% to 4.5% by the year end and easily surpassing 5% by the year end of 2016.

- The rising mortgage rates initially rush buyers to decide but a sustained rise will choke off as to who can qualify for a mortgage. Fortunately, there are few compensating factors to rising rates.

- Credit scores are not properly aligned with expected default rate. New scoring methodology is being tested and will be implemented. In short, credit scores will get boosted for many individuals after the new change.

- FHA mortgage premium has come down a notch thereby saving money for consumers. By the end of the year, FHA program will show healthier finances. That means, there could be additional reduction to premiums in 2016. Not certain, but plausible.

- Fannie and Freddie are owned by the taxpayers. And they are raking-in huge profits as mortgages have not been defaulting over the past several years. The very high profit is partly reflecting too-tight credit with no risk taking. There is a possibility to back a greater number of lower down payment mortgages to credit worthy borrowers without taking on much risk. In short, mortgage approvals should modestly improve next year.

- Portfolio lending and private mortgage-backed securities are slowly reviving. Why not? Mortgages are not defaulting and there is fat cash reserves held by financial institutions. Less conventional mortgages will therefore be more widely available.

- Improving credit available at a time of likely rising interest rates is highly welcome. Many would-be first-time buyers have been more focused about getting a mortgage (even at a higher rate) than with low rates.

- All in all, existing and new home sales will be rising. Combined, there will be 5.8 million home sales in 2015, up 7 percent from last year. Note the sales total will still be 25 percent below the decade ago level during the bubble year. Home prices will be rising at 7 percent. For the industry, the business revenue will be rising by 14 percent in 2015. The revenue growth in 2016 will be additional 7 to 10 percent.

Not Buying a Home Could Cost You $65,000 a Year

Renters are missing out on savings in most metros

Not buying a home right now will cost you, because home prices and interest rates are going to rise. Many renters would like to own, but they can’t afford down payments or don’t qualify for mortgages. Those two conclusions, drawn from separate reports released this week, sum up the housing market dilemma for many young professionals: Buyers get more for their money than renters—but most renters can’t afford to enter the home buying market.

The chart below comes from data published today by realtor.com that estimates the financial benefits of buying a home based on projected increases in mortgage rates and home prices in local housing markets. Specifically, it shows the amount that buyers gain, over a 30-year period, over renters in the country’s largest metropolitan areas.

The penalties for waiting to buy tend to be greater in smaller metro areas, especially in California. For example, the estimated cost of waiting one year was $61,805 in San Jose and $65,780 in Santa Cruz. Over the course of 30 years, homeowners save more than $1 million in Santa Cruz, the largest amount of any U.S. city.

To compile those numbers, realtor.com compared median home prices and the cost of renting a three-bedroom home in 382 local markets, then factored in estimates for transaction costs, price appreciation, future mortgage rates, and interest earned on any money renters saved when it was cheaper to rent.

In other words, researchers went to a lot of trouble to quantify something that renters intuitively know: They would probably be better off if they could come up with the money to buy. Eighty-one percent of renters said they would prefer to own but can’t afford it, according to a new report on Americans’ economic well-being published by the Federal Reserve.

Not all markets favor buyers over renters. In Dallas, the benefit of buying was about $800 over 30 years, according to realtor.com’s model, which expects price appreciation to regress to historical norms. In many popular markets, though, there are greater benefits to owning.

“It shouldn’t be a surprise that the places where you can have the highest reward over time also have the highest prices,” said Jonathan Smoke, chief economist for realtor.com. “It’s not true that if you’re a median-income household, that you can’t find a home that’s affordable, but in places like San Jose and Santa Cruz, less than 10 percent of inventory would be affordable.”

Or as Logan Mohtashami, a senior loan officer at AMC Lending Group in Irvine, Calif., told Bloomberg Radio this week: “The rich have no problem buying homes.”

Junk-Rated Oil & Gas Companies in a “Liquidity Death Spiral”

On the face of it, the oil price appears to be stabilizing. What a precarious balance it is, however.

Behind the facade of stability, the re-balancing triggered by the price collapse has yet to run its course, and it might be overly optimistic to expect it to proceed smoothly. Steep drops in the US rig count have been a key driver of the price rebound. Yet US supply so far shows precious little sign of slowing down. Quite to the contrary, it continues to defy expectations.

So said the International Energy Agency in its Oil Market Report on Friday. West Texas Intermediate plunged over 4% to $45 a barrel.

The boom in US oil production will continue “to defy expectations” and wreak havoc on the price of oil until the power behind the boom dries up: money borrowed from yield-chasing investors driven to near insanity by the Fed’s interest rate repression. But that money isn’t drying up yet – except at the margins.

Companies have raked in 14% more money from high-grade bond sales so far this year than over the same period in 2014, according to LCD. And in 2014 at this time, they were 27% ahead of the same period in 2013. You get the idea.

Even energy companies got to top off their money reservoirs. Among high-grade issuers over just the last few days were BP Capital, Valero Energy, Sempra Energy, Noble, and Helmerich & Payne. They’re all furiously bringing in liquidity before it gets more expensive.

In the junk-bond market, bond-fund managers are chasing yield with gusto. Last week alone, pro-forma junk bond issuance “ballooned to $16.48 billion, the largest weekly tally in two years,” the LCD HY Weekly reported. Year-to-date, $79.2 billion in junk bonds have been sold, 36% more than in the same period last year.

But despite this drunken investor enthusiasm, the bottom of the energy sector – junk-rated smaller companies – is falling out.

Standard & Poor’s rates 170 bond issuers that are engaged in oil and gas exploration & production, oil field services, and contract drilling. Of them, 81% are junk rated – many of them deep junk. The oil bust is now picking off the smaller junk-rated companies, one after the other, three of them so far in March.

On March 3, offshore oil-and-gas contractor CalDive that in 2013 still had 1,550 employees filed for bankruptcy. It’s focused on maintaining offshore production platforms. But some projects were suspended last year, and lenders shut off the spigot.

On March 8, Dune Energy filed for bankruptcy in Austin, TX, after its merger with Eos Petro collapsed. It listed $144 million in debt. Dune said that it received $10 million Debtor in Possession financing, on the condition that the company puts itself up for auction.

On March 9, BPZ Resources traipsed to the courthouse in Houston to file for bankruptcy, four days after I’d written about its travails; it had skipped a $60 million payment to its bondholders [read… “Default Monday”: Oil & Gas Companies Face Their Creditors].

And more companies are “in the pipeline to be restructured,” LCD reported. They all face the same issues: low oil and gas prices, newly skittish bond investors, and banks that have their eyes riveted on the revolving lines of credit with which these companies fund their capital expenditures. Being forever cash-flow negative, these companies periodically issue bonds and use the proceeds to pay down their revolver when it approaches the limit. In many cases, the bank uses the value of the company’s oil and gas reserves to determine that limit.

If the prices of oil and gas are high, those reserves have a high value. It those prices plunge, the borrowing base for their revolving lines of credit plunges. S&P Capital IQ explained it this way in its report, “Waiting for the Spring… Will it Recoil”:

Typically, banks do their credit facility redeterminations in April and November with one random redetermination if needed. With oil prices plummeting, we expect banks to lower their price decks, which will then lead to lower reserves and thus, reduced borrowing-base availability.

April is coming up soon. These companies would then have to issue bonds to pay down their credit lines. But with bond fund managers losing their appetite for junk-rated oil & gas bonds, and with shares nearly worthless, these companies are blocked from the capital markets and can neither pay back the banks nor fund their cash-flow negative operations. For many companies, according to S&P Capital IQ, these redeterminations of their credit facilities could lead to a “liquidity death spiral.”

Alan Holtz, Managing Director in AlixPartners’ Turnaround and Restructuring group told LCD in an interview:

We are already starting to see companies that on the one hand are trying to work out their operational problems and are looking for financing or a way out through the capital markets, while on the other hand are preparing for the events of contingency planning or bankruptcy.

Look at BPZ Resources. It wasn’t able to raise more money and ended up filing for bankruptcy. “I think that is going to be a pattern for many other companies out there as well,” Holtz said.

When it trickled out on Tuesday that Hercules Offshore, which I last wrote about on March 3, had retained Lazard to explore options for its capital structure, its bonds plunged as low as 28 cents on the dollar. By Friday, its stock closed at $0.41 a share.

When Midstates Petroleum announced that it had hired an interim CEO and put a restructuring specialist on its board of directors, its bonds got knocked down, and its shares plummeted 33% during the week, closing at $0.77 a share on Friday.