Having totally and utterly failed in 2014, the consensus for 2015 is once again higher rates (well they can’t go any lower right?) with year-end 2015 expectations of 3.006% currently (having already plunged from over 3.65% in July). However, at the other end of the spectrum, DoubleLine’s Jeff Gundlach told Barron’s this weekend, the 10-yr Treasury yield may test the 2012 low of 1.38% as the Fed’s short-term rate increase is poised to trigger “surprising flattening” of the yield curve. Source: Zero Hedge

Gundlach’s forecast is ‘very’ anti-consensus…

as the curve has already flattened dramatically…

Following the 2002-06 path almost unbelievably perfectly…

Gundlach adds,

U.S. GDP growth for ’15, ’16 may not achieve 3%+ target as dollar strength hurts exporters, oil price drops cause deflationary pressure, job and spending cuts for energy industries, Gundlach said

USD appreciation will continue as growth stumbles in other parts of the world, making U.S. bonds “all the more attractive” for foreign buyers, Gundlach said

“Trouble lies ahead” for the euro zone; people in Europe “are obviously losing confidence and scared” as German yield turns negative, Gundlach told Barron’s

And here is Jeff Gundlach’s latest chartapalooza presentation…

12-9-14 This Time – JEG Webcast Slides – FINAL for Distribution

—————————————————————–

Glory To The New Bond King

This story by Matt Schfrin appears in the November 24, 2014 issue of Forbes.

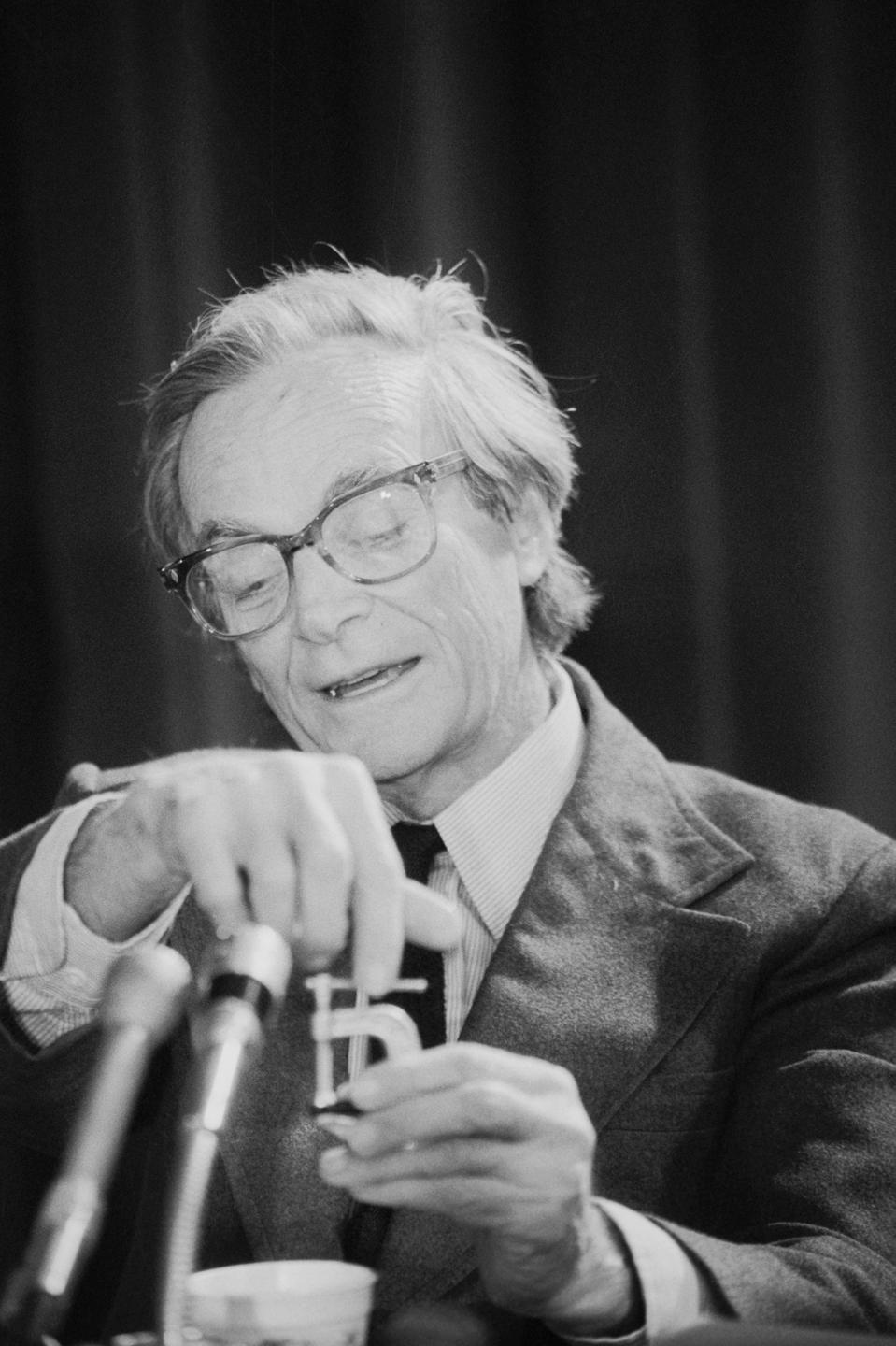

The master of his domain: DoubleLine founder Jeffrey Gundlach relaxes among his Warhols in Los Angeles (photo: Ethan Pines

Bill Gross’ spectacular fall from the top of the bond market has put tens of billions in play at a time when minuscule yields demand a fixed-income superstar. A brilliant, battle-scarred billionaire, Jeffrey Gundlach, stands ready to be coronated.

Bond manager Jeffrey Gundlach is wearing a white T-shirt, faded blue jeans and worn leather boat shoes as he traipses about the blooming morning glories in his perfectly landscaped backyard, perched high above a canyon overlooking the deep blue Pacific Ocean. It’s the middle of the afternoon on a work Monday in October; European bank stocks are tumbling; oil prices are down 25% since June; and against the backdrop of an anemic economy and 2.25% ten-year Treasury, the Federal Open Market Committee is about to make an important announcement. These are unsettling times in the financial markets, but for Gundlach it’s a picture-perfect autumn day in southern California, and he is living in paradise.

What’s next for the Fed? Gundlach would much rather discuss the iconic framed “Lemon Marilyn,” by Andy Warhol, above his mantel or how his “Progressions,” by minimalist Donald Judd, in the hallway is influenced by the Fibonacci sequence. “It is negative and positive space governed by a rule that happens to describe the shape of the solar system, which is exactly the opposite of what was popular in the ’50s, all this emotional stuff,” he says, pointing to his de Kooning. A few moments later he is explaining to a visitor that the geometry of the lot on which his new 13,000-square-foot, $16 million Tuscan mansion sits was designed to be in perfect harmony with the canyon cliff side it mirrors.

It is a paradise, but importantly Gundlach is finally feeling at ease because his new sanctuary is well fortified. Anyone wanting to get close to him or his prize paintings must breach the 8-foot wall surrounding his suburban residence or face the scrutiny of an armed naval vet at his front gate who asks visitors for a picture ID. Gundlach makes a point to show off one of the 50 concrete foundation caissons supporting his property. Each measures 3 feet in diameter and extends down as much as 75 feet through the porous desert soil into California bedrock.

After 30 years of staring into the black-and-green abyss of a Bloomberg terminal managing bond portfolios, Gundlach is making a statement with his magnificent new residence, one that underscores his ascendance in the business. Casa Gundlach is unlikely to succumb to the sudden mudslides known to take down other California palaces in places like Mill Valley or Malibu. And with a stellar performance record, $60 billion in assets under management and a killer contemporary art collection accumulated over the last decade, Jeffrey Gundlach has finally joined the billionaires club. More importantly, Los Angeles-based DoubleLine Capital, the house that Gundlach built in under five years, couldn’t be on better footing.

Just about a month earlier Bill Gross of Pacific Investment Management Co., the reigning master of the bond universe for two decades, requested an audience with Gundlach. In a scene that can only be described as Shakespearean, the incumbent bond king drove an hour up the 405 Freeway in the middle of the afternoon to Gundlach’s new castle to more or less grovel at his feet. Gross was certain PIMCO’s German owners were about to fire him, and he was asking his nemesis for a job–a portfolio manager position at DoubleLine. Gross said he wanted to run an “unconstrained” bond fund a small fraction of the size of the $200 billion-plus Total Return Fund he was famous for building. With the sun falling over the Pacific and shimmering on the surface of Gundlach’s infinity pool, Gross was deep in suck-up mode.

“He said to me, ‘I’m Kobe Bryant, you’re LeBron James. I’ve got five rings, you’ve got two, but you are maybe on your way to five and you’ve got time,’ ” says Gundlach, 55. (Gross, 70, refuses to comment on the meeting.) “ Bill was in his own world,” says a house-proud Gundlach, with a tone of disdain. “He doesn’t say anything [about my place]. Nothing. Doesn’t eat anything or even take a sip of water in three hours.”

Gross left the meeting with no deal in hand and ultimately jumped to Denver-based stock manager Janus Capital. From his office in Orange County’s Newport Beach, Gross now manages a $79 million mutual fund for Janus, roughly 0.03% the amount of assets he used to control.

Though a Gundlach-Gross alliance would have surely quickened the asset flight to DoubleLine from PIMCO–which has reported redemptions of $48 billion since Gross was forced to resign on Sept. 26–Gundlach claims to be relieved. “Our clients would have asked, ‘What is this? How is this going to work?’ I hear he is a difficult guy.”

Jeffrey Gundlach: A big thinker whose ambitions go beyond bonds (photo credit: Ethan Pines)

With Gross’ banishment the battle was over, but the spoils of the greatest market share shakeup in the history of the $45 trillion bond business is just getting under way. There may be as much as $100 billion in PIMCO assets in play, and DoubleLine is vying for them against larger rivals BlackRock, Dodge & Cox, Loomis Sayles and even index fund giant Vanguard. All are strong competitors, but none has lead managers like Gundlach, who combine bold market predictions with impressive long-term performance.

Gundlach’s superstar status can be viewed as both a blessing and a curse for DoubleLine. Like Gross–who has helped transform stodgy bond investing from a financial backwater to a lucrative playground for young M.B.A.s and Ph.D.s–Gundlach is well known for his arrogance, eccentricities and volatility. Institutional investors loathe the type of drama that unfolded at PIMCO–also, unfortunately, the hallmark of Gundlach’s style.

“You can’t please everybody, and I’m not gonna try,” insists Gundlach, as Pandora’s Sinatra Radio streams over his home’s sound system. “They point to our key man risk, and we say, ‘Everyone knows that it is key man reward.’ ” The lesson of Bill Gross is: Don’t put your money with a star manager who is owned by a parent company that controls him.”

The importance of being in control is something that Gundlach learned the hard way. For most of his 24-year tenure at Los Angeles’ Trust Company of the West (TCW), leading up to 2009, Gundlach was pegged as a star, a brash and brilliant money manager with a knack for calling markets. His specialty is mortgage-backed securities. The mutual fund he managed through 2009 beat 98% of all mutual funds in its category for a decade. Even more impressive was that he correctly foresaw the coming collapse of the housing market in 2007 and managed to hold on to more of his pre-crisis gains than any of his peers. In 2005, at age 46, he was made chief investment officer of mighty TCW, and by 2009 he was overseeing some $70 billion of its $110 billion in assets under management. In 2009 alone Gundlach’s annual compensation totaled no less than $40 million.

But despite his immense contribution to TCW’s success, at the end of the day Gundlach was still just a hired hand with no equity or control of his own destiny. He wanted more. He wanted to be named chief executive of TCW, but perhaps because of his abrasive style, the firm’s French owners, Société Générale and its billionaire founder, Robert Day, didn’t think he was fit for the job.

DoubleLine’s global developed credit chief Bonnie Baha and Luz Padilla (seated), who heads the firm’s emerging markets team (photo credit: Ethan Pines for Forbes)

“Look, it is clear that Jeffrey doesn’t suffer fools gladly, and he doesn’t tolerate people not thinking before opening their mouths,” says Bonnie Baha, a 19-year TCW veteran who has witnessed Gundlach’s biting tongue but is currently DoubleLine’s global developed credit chief.

Gundlach’s unhappiness prompted him to consider alternatives. He was courted by competitors, including Western Asset Management and PIMCO, which according to court documents considered him a potential successor to Gross. Then on Friday, Dec. 4, 2009, just after the market closed in New York, TCW fired Gundlach preemptively and had its outside counsel chase him out of its downtown L.A. office tower. In an effort to prevent institutional investors from taking their money and leaving with him, TCW simultaneously acquired cross-town bond manager Metropolitan West. In what former TCW employees describe as a surreal scene, Gundlach team members showed up the following Monday morning to find Met West traders sitting at their desks.

Despite promises of huge pay raises by TCW, 40 Gundlach loyalists defected, and within a month Gundlach had formed DoubleLine Capital. He found backers in Howard Marks and Bruce Karsh of Oaktree Capital Management, who had a similar acrimonious divorce from TCW 14 years earlier. (Distressed bond specialist Oaktree shares an office tower with DoubleLine and still owns 20% of the firm.) TCW had been gutted of its best fixed-income talent, and some $30 billion in assets eventually fled the firm.

But the drama was only beginning. Ugly lawsuits and counter lawsuits were filed. Gundlach was sued for more than $300 million and accused of everything from stealing hard drives to maintaining stashes of porno and pot. Distraught, Gundlach called a meeting of the 45 TCW coworkers he had lured away with a handshake promise of equity. His new firm had no assets and faced an immense potential liability, but he pledged that if the firm was forced out of business, he would find them all jobs. Gundlach counter sued for more than $500 million in fees he said he was owed.

The whole ordeal lasted two years, including a six-week jury trial in Los Angeles County Superior Court. All the while Gundlach and his bond traders persevered. The group continued to outperform, and DoubleLine assets swelled. By late 2010, barely a year after the firm opened its doors, assets reached $7 billion, hitting break-even, according to Gundlach.

Ultimately in late 2011 the jury found that Gundlach & Co. stole TCW’s trade secrets, but no damages were awarded. Instead, the jury awarded Gundlach $67 million for compensation he was owed. Before the appeals could be filed, TCW and Gundlach settled.

By then DoubleLine funds were already a screaming success and fast on the way to $50 billion in assets. Meanwhile, Morningstar’s “fund manager of the decade,” Bill Gross, was suffering from subpar returns in his mighty PIMCO Total Return fund. In 2011 he bet wrong on rates, missing the rally in Treasury bonds. That left PIMCO’s Total Return fund 87th among its competitors, returning just 4.2% to investors, compared with 9.5% for Gundlach’s flagship Total Return fund.

On Dec. 4, 2012, exactly three years from the day he had been fired from TCW, Gundlach rented a restaurant in the lobby of TCW’s headquarters to throw a lavish party. Cristal champagne was flowing, and his now wealthy employees and partners were treated to filet mignon and tuna tartare. A banner that read “DoubleLine $50 billion” was hung over the bar for all of TCW’s remaining salary men to see as they filed out of the building.

A brilliant analytical thinker who is both meticulous with his facts and mercenary in making rational decisions, Gundlach cares deeply for the loyalists who followed him to DoubleLine but rarely shows any emotion. He almost never socializes with his 125 co-workers.

A native of suburban Buffalo, N.Y., Gundlach’s DNA practically preordained him for entrepreneurial success. His paternal grandfather, Emanuel, was the son of a German minister and became a stockbroker during the roaring 1920s. Gundlach claims his grandfather foresaw the 1929 crash and banked the sizable sum of $30,000 ($400,000 in today’s dollars) ahead of the Great Depression. He then became a bathtub chemist, concocting hair tonic from the roots of witch hazel shrub. His product, Wildroot Hair Cream, became a national brand by the 1950s.

“He would give us bottles when I was a kid,” says Gundlach. “It was called greasy kid’s stuff. You know, like the Fonz.”

Gundlach’s uncle Robert was a physicist and renowned inventor, coming up with a process that allowed Rochester, N.Y.’s Haloid Photographic Co. (later known as Xerox) to make the copy machine commercially viable.

Gundlach’s father was a chemist for coatings maker Pierce & Stevens, and his mother a teacher and homemaker from a working-class family. Though the extended Gundlach clan spent summers at his grandfather’s rural upstate New York retreat, Starlit, his branch of the family never enjoyed the affluence of his famous uncle Robert, who had dozens of Xerox patents. “My uncle was very parsimonious–never wanted to spend a dime,” laments Gundlach.

Thus Gundlach was raised squarely in the middle class and to this day is uncomfortable hobnobbing with moneyed society members. Gundlach recalls that his maternal grandparents had such a distrust for the upper crust that they lobbied for his older brother Brad to go to the University of Buffalo over Princeton. (He eventually chose Tiger orange and black.) To this day Gundlach continues to brag about his “hammer swinging” eldest brother, Drew, who never went to college and remodels houses in upstate New York. Gundlach spends his Fourth of July and Thanksgiving holidays at Drew’s home.

Gundlach was a top student in high school with a near perfect score on the math SAT. Financial aid allowed him to attend Dartmouth, where he graduated summa cum laude in 1981 with a degree in math and philosophy. He considered becoming a philosophy professor, but then after studying the works of Austrian-British philosopher Ludwig Wittgenstein, he gave up. “I stopped caring about philosophy,” he says, explaining, “Wittgenstein was a mathematical philosopher, and his whole thing is that philosophy is just words that don’t mean anything. It’s like a fly that goes into a fly bottle and can’t find its way out. What is the meaning of life? It sounds like a , but it doesn’t mean anything.”

So Gundlach dived deeper into mathematics and was accepted in the doctoral program at Yale.

“My thesis was the probabilistic implications of the nonexistence of infinity,” explains Gundlach. “There is no infinity. It’s an illusion; there is absolutely nothing empirical that suggests infinity exists and nothing that operates under the assumption of infinity that has any practical implications.”

Apparently Gundlach’s thesis not only didn’t please his Yale advisor but was diametrically opposed to the work of one of the most influential mathematicians since Aristotle, Austrian logician Kurt Gödel and his Incompleteness Theorem.

So in 1985 Gundlach, who had been playing drums in bands while at Dartmouth and Yale, donned a spiky bleached-blond haircut and moved to Los Angeles to become an alternative rock star. A series of bands he played in, including one called Radical Flat, had limited success, and Gundlach was forced to hold down a day job in the actuarial department of Transamerica. He decided to apply for a job in the investment business after he watched a Lifestyles of the Rich and Famous episode lauding the profession as the highest paying.

A blind solicitation letter ultimately landed Gundlach in the fixed-income

department of the Trust Company of the West. He devoured the math-heavy bond market primer Inside the Yield Book the week before starting, learned trading on the job and eventually came to be the most powerful mortgage-backed securities money manager in the company.

It’s late October, and Gundlach is delivering the keynote speech at ETF.com’s Inside Fixed Income conference in Newport Beach, Calif. before an audience of 175 investment professionals and advisors. It’s about a month after the Bill Gross resignation bombshell shook the bond market, so attendance is higher than expected and the audience hangs on his every word.

“People like my macro stuff,” he muses. “There is very little patience for long wonky bond presentations, but people are interested in different ways of interpreting the forces behind macroeconomic events and geopolitics.”

His 56-slide PowerPoint presentation is entitled This Time It’s Different–directly thumbing his nose at legendary investor Sir John Templeton’s famous warning that those are the four most dangerous words in investing.

But Gundlach means it. His first slide is a quote from Greek philosopher Heraclitus: “No man ever steps in the same river twice, for it’s not the same river, and he’s not the same man.”

Gundlach is referring to the bizarre current market environment and insists that analysts studying the economic and monetary policy axioms of the past are making a serious mistake.

“In the past the feds would raise rates to be preemptive against inflation. There is no inflation today, and you see finance ministers saying that one of the dark clouds hanging over the global economy is that inflation is not accelerating,” he says. “So raising interest rates against that mentality is very different, and taking an average of the past rate-raising cycles is not going to give you a good road map as to where things go this time around.”

Here is the new bond king’s view of the world today:

The Fed may raise the federal funds rate for the wrong reasons.

“They don’t really need the rates to be higher, but they seem to want to reload the gun so they aren’t stuck at zero without any tools.”

Deflationary forces will accelerate if the Fed raises rates.

“With a tightening, the dollar is going to not just be strong, but it will run up like a scalded dog. If that happens, then commodity prices are going down, we will import deflation and you will see an episode of deflationary scare.”

The long end of the Treasury curve will stay put and possibly go down further.

“There’s a 30% chance that importing deflation creates a panic into Treasurys creating a ‘melt-up,’ moving rates to German Bund levels today of around 1%.

It’s not okay to own risk assets when the Fed starts hiking rates.

“What is fascinating is, if you sell junk bonds and buy Treasurys, the minute the Fed hikes the first time, going back to 1980, in every case you did well.”

Don’t be surprised to see the yield curve flatten and possibly invert.

“Long rates have done nothing but fall. That tells me the market is saying to the Fed, ‘Go ahead, make my day.’ The curve is going to invert when and if fed funds hit 2.5 to 3%.”

Be long the dollar, especially in emerging market bonds.

“We have been all dollar [denominated in our foreign bond holdings] since 2011. For a while it didn’t really matter, but now it matters a lot. If you are nondollar you are really in trouble.”

Stay away from home builders, TIPs and mortgage REITs, and oil will fall further.

“I am convinced the Saudis want the price of a barrel of oil to go to $70. They don’t care if they run a short-term deficit if it slows down U.S. fracking and turns the screws on countries in their region that mean them harm.”

As we get closer to 2020 interest rates and inflation (and taxes) could really start rising.

“We are in the calm right now before the hurricane. I’m talking about the aging of the great powers, which is undeniable and can’t be quickly reversed. The retiree-to-worker ratios, the size of labor forces globally. China will have no one in the labor force. Italy’s losing 39% of labor force in the next generation and a half. Japan has an implosion of working population and no immigration. Russia is facing one of the greatest demographic crisis in the history of the world, absent famine, war and disease. It’s pretty bad. Italy has no hope,” says Gundlach matter-of-factly.

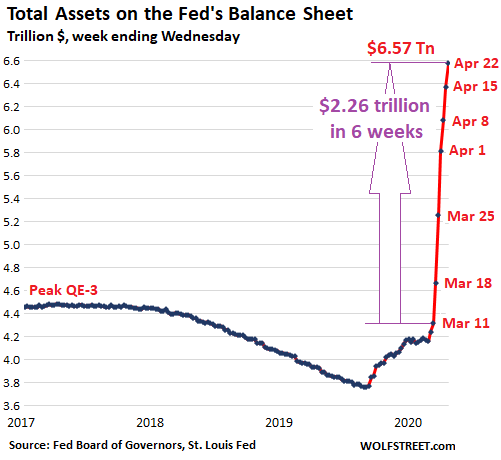

“The Federal Reserve bought the bonds from the deficits of 2011, 2012 and 2013, and those will roll off increasingly over time. Come 2020 you are not just financing massive entitlements like Social Security and Medicare but also old debt. No one talks about that. It’s a big deal. China doesn’t have the demographics to buy that debt. Who’s going to buy it?”

The coming debt storm–which Gundlach says is too early to worry about tactically–will hit financial markets just as DoubleLine approaches its tenth anniversary in business.

Giant pension funds and endowments are typically plodding in the redeployment of assets because it often requires coordinating board meetings, soliciting bids from new firms, listening to presentations and gathering votes. But with tens of billions likely to shift out of PIMCO over the next few months, DoubleLine is buzzing with activity. The task at hand is proving to existing clients and to new ones that the drama days are over and DoubleLine is all grown up.

“I don’t think the controversies surrounding his TCW days are really relevant anymore in the analysis of DoubleLine,” says Michael Rosen, the chief investment officer at Angeles Investment Advisors, whose firm advises on $47 billion in pension and endowment money and who had resisted recommending DoubleLine to clients in the past. “That is ancient history at this point.”

Perhaps because of Gundlach and DoubleLine’s toxic inception the majority of its $60 billion in assets is held by individuals in the firm’s mutual funds, predominantly his mortgage-heavy DoubleLine Total Return Bond Fund, which has $38 billion under management and is up 8.93% annually since inception in 2010, and DoubleLine Core Fixed Income Fund, which is up 7.19% annually since inception. DoubleLine also has $4.5 billion in its Opportunistic Income, a hedge fund strategy, which uses leverage and deploys an amalgam of its manager’s best ideas.

So far Gundlach reports that it has gulped down $4 billion in new assets since Gross’ departure. However, competitors like BlackRock, Loomis Sayles and Vanguard are also seeing big inflows.

Somewhat unique to DoubleLine among big competitors is that it has no interest in the low-fee bond index fund money that BlackRock and Vanguard specialize in. He also insists he will close his funds to new investors before they get too large. “Our so-called flagship strategy Total Return will never go to $100 billion unless the bond market grows ten times in size,” he says. “We are not ambulance chasers.” Still Gundlach is clearly drooling at the prospect of feasting on PIMCO’s remains, because he doesn’t hesitate to gun at his competition.

What does he say about the reorganization of Bill Gross’ famous Total Return Fund? “Who’s managing it?” says Gundlach. “I don’t buy for a second that they will all work together and with no conflict. ”

Of PIMCO’s newly named Chief Investment Officer Daniel Ivascyn: “

He is their hottest performer in recent times. I hear he is reasonably good at explaining things, the fact that he read from a teleprompter and couldn’t answer any of the real questions notwithstanding. I’m sure he’s articulate.”

Gundlach even feels the need to neutralize two seemingly nonexistent threats, Bill Gross and Mohamed El-Erian, the former PIMCO co-chief investment officer executive, who remains on the payroll of PIMCO parent Allianz.

“People are too harsh on Gross’ performance. It’s not bad, it’s just average,” he says. “This past year it’s been bad, but for 5 years it’s been average.”

As for El-Erian, “Mohamed’s track record is hard to find, and when you find it, it’s bad.”

Gundlach protege, Jeffrey Sherman: Gumdlach says he is the rare quant manager with the “special sauce.” (photo credit: Ethan Pines for Forbes)

Meanwhile DoubleLine is bending over backward to show off the breadth and depth of its bench as Gundlach’s top portfolio managers make the rounds with salesmen. Key in this pursuit are veteran emerging markets manager Luz Padilla, global developed credit manager Bonnie Baha, mortgage-backed manager Vitaliy Liberman and a young portfolio manager named Jeffrey Sherman.

Sherman, 37, rides shotgun to Gundlach at DoubleLine’s monthly fixed-income asset allocation meeting, attended by all key portfolio managers. Gundlach sits at the head of the table, but Sherman organizes large parts of the 70-plus slides Gundlach presents at these important meetings covering macro themes and sector allocations for the firm’s multi-asset strategies. Sherman is emerging as the front-runner to eventually succeed Gundlach.

With his shoulder-length brown hair parted in the middle and his hipster beard, Sherman gives off a laid-back California surfer vibe, yet he impresses visitors with his ability to demystify complicated economic concepts as well as articulate big-picture strategies.

“What we are trying to do in these asset allocation programs is look at the entire portfolio. We are not allocating to each sector and asking each manager to outperform each month, we are thinking about how the whole portfolio works,” says Sherman, mentioning that government bond chief Gregory Whiteley, for example, is currently being asked to underweight his sector and hold long-duration bonds. “We are paid not on assets that each one of us is managing but on the collective success of the firm. That is very deeply entrenched in our process and very different from other firms.”

Like Gundlach, Sherman has humble roots. Neither of his parents attended college: His father worked in the oilfields of Bakersfield, Calif., and his mother is a bookkeeper. Also like Gundlach, a scholarship helped pay for his applied mathematics degree at University of the Pacific, where he also taught statistics. Upon graduating in 1999, Sherman saw the wave of quants heading to Wall Street and wound up pursuing an M.S. in financial engineering from Claremont Graduate University. A summer internship led him to the risk analytics department of TCW, and ultimately he defected to DoubleLine.

“Sherman is extremely analytic, which I am always attracted to,” says Gundlach. “But he also understands psychology. There are a lot of people who are quants, and they think you can explain the world with an econometric model. You just get the coefficients right and you can explain everything about the future. Sherman understands all of the coefficients and can derive all the equations just like I used to do, but he understands that it won’t predict where the market is going to be in a month. He is also good at explaining, which, of course, is the secret sauce of this business.”

In addition to Sherman’s key role in DoubleLine’s multi-asset strategies, Gundlach has put him in charge of new product development. This is critical to long-term growth because DoubleLine is still largely perceived as a mortgage bond specialist.

Besides two new NYSE-listed closed-end funds, DoubleLine has developed a commodities strategy, gathered $164 million in an enhanced S&P 500 stock index fund created in partnership with Nobel laureate Robert Shiller and started a small-cap stock fund. It’s also developing an infrastructure loan fund and a commercial-mortgage-backed-securities fund.

“I am really interested in doing distressed funds when the credit cycle turns, but you have to wait,” says Gundlach in anticipation of the debt woes on the horizon. “That’s one reason why we have been expanding our capabilities in bank loans, high yield, emerging markets debt and CMBS.”

Original backer Oaktree Capital, which has never wavered in its Gundlach bet, has already taken out more than $90 million in distributions on its original $20 million investment ( Oaktree also invested $20 million in DoubleLine’s hedge fund) through September 2014, and its 20% stake is estimated to be worth close to $400 million. Says Howard Marks, Oaktree chairman: “Jeffrey thinks beyond being a bond manager, and I don’t know if you noticed, he is a pretty confident guy.”

Gundlach is so self-assured that he has even taken to painting in the style of the masters in his art collection. Piet Mondrian–the inspiration for DoubleLine’s red, blue and black logo–is his favorite. Says Gundlach, “I knocked [Mondrian] off. Very hard to do. Surprisingly hard. Hard to make the lines crisp. Mine are more crisp than his, but that’s because I used tape.” Gundlach pauses, reflecting on his work. “It’s an interesting thing: There is this moment when you are not sure if you are done or not.”