‘The time has come to pick your poison or become unwitting collateral damage’

Ed Steer joins Wall Street Silver today to talk about the COMEX Silver withdrawals continuing as registered totals remain at the lowest levels since 2018. Furthermore, we discuss about Gold, Banks shorting the metals, silver squeeze, and more. Ed’s Website: https://edsteergoldsilver.com/

***

Conspiracy at the US Mint? Silver Eagle Premiums Explained

(Ronan Manly) There is an unprecedented situation emerging in London, where the relentless hemorrhaging of one of the world’s largest stockpiles of silver is now well and truly under way.

(Neils Christensen) The debate between gold and bitcoin, as to which is the ultimate safe-haven and inflation hedge, continued to rage this past week. However, I feel that the longer this debate goes on, the more investors are missing the bigger picture.

The stark reality is that there is more than $16 trillion worth of negative-yielding debt floating around the world right now. The U.S. government continues to move forward with its proposed $1.9 trillion stimulus package to support the U.S. economy. The Federal Reserve’s balance sheeting grows from record high to record high, pushing above $7.4 trillion.

The U.S. also isn’t in this boat alone; central banks around the world are maintaining extremely accommodative monetary policies and growing their balance sheets to record levels.

Summary

(Austrolib) Gold and silver bugs are understandably frustrated with the lack of movement on the silver price while Bitcoin goes beyond the moon. Demand for physical silver has skyrocketed, and physical shortages at coin dealers are acute internationally. New American Silver Eagles from the US Mint are out of stock at even the largest US-based dealers like Apmex, and are only selling in pre-sales at near 50% premiums. ATS Bullion, a London-based precious metals retailer, is completely out of silver coins.

(Ronan Manley) With the ongoing #SilverSqueeze and huge associated dollar inflows into silver-backed Exchange Traded Funds (ETFs), it is now time to look at which of these ETFs store their silver in the LBMA vaults in London, England, and to calculate how much physical silver these combined funds store in those London vaults.

Summary

(Peter Krauth) “Temporarily out of stock.” – That’s the message most hopeful physical silver buyers have been getting since the last days of January. Odds are bullion dealers going to have a tough time keeping any silver in stock.

While all eyes have been focused on GameStop and a handful of other heavily-shorted stocks as they exploded higher under continuous fire from WallStreetBets traders igniting a short-squeeze coinciding with a gamma-squeeze, the last few days saw another asset suddenly get in the crosshairs of the ‘Reddit-Raiders’ – Silver.

(Jhanders) Soon to be confirmed, US Treasury Secretary Janet Yellen made the case earlier this past week for many more trillions in stimulus and infrastructure spending. All, of course, will be financed out of thin air and rationalized given the viral shock to the economy and still current historically low-interest rate regime.

Of course, ours is not the only privately owned central bank in the world, creating currency out of thin air and adding to their balance sheet.

This year 2021, we can again expect the private Federal Reserve’s balance sheet to balloon as the US government rolls over and refinances a record $8.5 trillion in government IOUs.

Simultaneously this week, as Janet Yellen was selling our spending many more trillions we have not saved, a record-sized one day inflow of over $1/2 billion showed up in the silver derivative markets.

Silver bulls are again laying down long bets assuming silver spot prices will rise given all the upcoming trillion in stimulus behind and ahead.

(Stewart Jones) As the Federal Reserve’s quantitative easing practices generate the biggest debt bubble in history, gold futures are trading at record highs, a phenomenon some have called “a bit of a mystery.” However, this “mystery” was solved long ago by the laws of economics. The only “mystery” here is why—contrary to centuries of economic wisdom—we allowed centralized paper money to become the dominant form of currency in the first place.

As recent waves of civil unrest and economic turmoil have prompted some to look back in time and reflect on the observations of the Founding Fathers, it seems most have opted to reject them entirely. Yet among the founders’ many warnings against the institutions that would eventually dominate the modern world are the timeless—and astonishingly accurate—warnings against central banking.

On August 1, 1787, George Washington wrote in a letter to Thomas Jefferson that “paper currency [can] ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” Jefferson also opposed the concept, warning that “banking establishments are more dangerous than standing armies.” James Madison called paper money “unjust,” recognizing that it allowed the government to confiscate and redistribute property through inflation: “It affects the rights of property as much as taking away equal value in land.”

In other words, inflation is a hidden form of taxation. Washington understood this. Jefferson understood this. Madison understood this. And generations of preeminent economists since then—from Ludwig von Mises to F.A. Hayek, to Murray Rothbard—have understood this quite clearly.

And there’s nothing controversial or mysterious about sound money, that is, currency backed by some form of secure, fixed weight commodity like gold or silver. Both have been valued in some fashion for six thousand years and have been used as currency for around twenty-six hundred years. As confidence in the dollar continues to nosedive, the market is not only putting more confidence in gold and silver, but in some crypto currencies sharing many of the characteristics of gold.

The presidencies of Woodrow Wilson and Franklin D. Roosevelt are rightfully regarded as some of the darkest years for freedom in America. Often overlooked, however, are the deeply repressive monetary policies introduced by both presidents. In 1838, Senator John C. Calhoun foreshadowed the economic evils that would eventually emerge at the peak of the Progressive Era, explaining,

“It is the nature of stimulus…to excite first, and then depress afterwards….Nothing is more stimulating than an expanding and depreciating currency. It creates a delusive appearance of prosperity, which puts everything in motion. Everyone feels as if he was growing richer as prices rise.”

Seventy-five years later, the autocrats running the Wilson administration dealt two devastating blows to liberty with the Federal Reserve Act and the Revenue Act, forever marking 1913 as a tragic year for liberty. Both laws struck at the heart of property rights by establishing the Federal Reserve System and the income tax, respectively. Then, in 1933, Roosevelt issued Executive Order No. 6102, requiring Americans to surrender much of their gold to the US government. Shortly after, Congress passed the Gold Reserve Act of 1934, artificially raising the price of gold and guaranteeing the government a profit of $14.33 for each ounce of gold it had seized from the people.

Finally, in 1971, President Richard Nixon—like any self-respecting twentieth-century Keynesian—committed himself to finishing the work of Wilson and Roosevelt by closing the gold window, forever divorcing the gold standard from the dollar. Rather than usher in a new era of economic stability, this unnatural union between the Fed and the federal government produced a vicious loop of boom-bust cycles and depressions. The consequences have not only been inflation and devaluation (both of which have stripped the people of their purchasing power and savings); now, every time a depression hits, the government is allowed to do two things: grow its power and tax and spend at will without fear of accountability.

In other words, with every inflation of currency comes an inflation of government power.

With government shutdowns of local economies, the second economic quarter of this year was among the worst in history, with the total debt-to-GDP reaching a staggering 136 percent. As the national debt approaches $27 trillion (with even bigger spending bills in the works), we can expect the days of such flagrant government spending to come to a screeching halt. If we continue on this path, that correction will result in an unprecedented collapse of the dollar and the monetary system. The ultimate danger in this scenario: the government eventually confiscates the vast majority or even all private property in order to pay off the national debt. As German American economist Hans Sennholz once said, “Government debt is a government claim against personal income and private property—an unpaid tax bill.”

This is why a dramatic downsizing of government is key to bringing the US out of this manic, outmoded cycle of depressions and upswings. For the government to fulfill its core function as a safeguard of liberty, we must prevent it from meddling in affairs beyond the boundaries prescribed by the Founding Fathers. This includes a swift withdrawal from the use of paper fiat currency and spending cuts across the board.

Such a sweeping transformation could begin with the state governments, the legislatures of which could override the federal government by passing legislation allowing individuals to use gold and silver currency.

Regardless, if meaningful legislative action is not taken somewhere, we have little choice other than to acquiesce to the gloom and terror of socialism—a system that would devour all in its path and make slaves of once free people for generations to come. Freedom is the natural ability of people to control their own destiny. Sound money has the ability to help keep people free.

(Alasdair Macleod) There appears to be no way out for the bullion banks deteriorating $53bn short gold futures positions ($38bn net) on Comex. An earlier attempt between January and March to regain control over paper gold markets has backfired on the bullion banks.

Unallocated gold account holders with LBMA member banks will shortly discover that that market is trading on vapour. According to the Bank for International Settlements, at the end of last year LBMA gold positions, the vast majority being unallocated, totalled $512bn — the London Mythical Bullion Market is a more appropriate description for the surprise to come.

An awful lot of gold bulls are going to be disappointed when their unallocated bullion bank holdings turn to dust in the coming months — perhaps it’s a matter of a few weeks, perhaps only days — and synthetic ETFs will also blow up. The systemic demolition of paper gold and silver markets is a predictable catastrophe in the course of the collapse of fiat money’s purchasing power, for which the evidence is mounting. It is set to drive gold and silver much higher, or more correctly put, fiat currencies much lower.

This is only the initial catalysing phase in the rapidly approaching death of fiat currencies.

When Shorting Stops Silver Pops

Demand for gold delivery is exploding, and that is a big reason for the upward price pressure. What about silver? Why is it lagging behind gold? It takes nearly 100 ounces of silver to equal 1 ounce of gold today. That ratio is going to start coming down dramatically. Financial writer and precious metals expert Craig Hemke explains why, “JP Morgan has been accumulating all this silver and shorting against it as a hedge, managing the price and monopolistically controlling it. Now, the COMEX is a delivery vehicle, and people were standing for delivery. JP Morgan was short nearly 6,000 contracts (of silver) on delivery day, and JP Morgan had to deliver (29 million ounces of physical silver). In doing so, they have now reduced their stockpile down to 120 million ounces of physical silver… Now, JP Morgan is left with a dilemma. They can continue to play this game of shorting or hedging … and run the risk of losing another 8,000 to 10,000 contracts (at 5,000 ounces per contract) and see that stockpile of physical silver get cut again. Or, they can stand down and stop shorting. Either way, they are in a jam… If they keep shorting while there is increasing demand for delivery, they are going to lose it all, and once they lose it all, they won’t be able to issue anymore contracts. This is going to allow the price (of silver) to go up. If they simply stop shorting, once again, the price of silver goes up… JP Morgan may not have a choice but to stand down… The demand is going to continue to grow… JP Morgan will make $120 million for every $1 silver goes up… I think they have to stop interfering with the market. When JP Morgan stops shorting silver, you are going to get the change to the question of why is silver not going up?” Hemke says there will come a time in the markets when there will be no sellers of physical gold or silver. Then, Hemke says the price will skyrocket. Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Craig Hemke of TFMetalsReport.com.

Informative And Educational:

Are gold and silver becoming what Mike Maloney has always suggested, Unaffordium and Unobtainium? The last few weeks have given us a preview of how stretched the physical gold and silver markets can become when the markets move. Join Mike as he welcomes GoldSilver.com President Alex Daley for a special Retail Bullion Update.

The global pandemic has shut down several mining jurisdictions around the world, taking off a large chunk of silver production, this according to Keith Neumeyer, CEO of First Majestic Silver. “In 2018, we produced, as a global industry, 855 million ounces of silver. So far, we’ve had Peru come offline, with 145 million ounces, we’ve had Chile come offline with 42 million ounces, we’ve had Argentina come offline with 26.5 million ounces. That’s a total of 213.5 million ounces that has now been shut down,” Neumeyer told Kitco News.

Discount silver bullion dealers via the internet are all out of stock, as of this writing, leaving us to explore retail silver price discovery via eBay auction for bargains today:

VS,

(BullionStar.com) In the last month, from 14 February 2020 to 14 March 2020, we have seen a record number of orders, record order revenue and a record number of visits to our newly renovated and extended bullion centre at 45 New Bridge Road in Singapore.

For the above-mentioned period, we have served 2,626 customers with a sales revenue of more than SGD 50 M, which is 477% higher compared to the same period last year.

The last few days have been our busiest days of all time. Our staff members have been doing a fantastic job in going out of their way to serve as many customers as possible.

Gold & Silver Shortages – Supply Squeeze

The enormous increase in demand is straining our supply chains. BullionStar has supplier relations with most of the major refineries, mints and wholesalers around the world. Most of our suppliers don’t have any stock of precious metals and are not taking orders currently. The U.S. Mint for example announced just this Thursday that American Silver Eagle coins are sold out. The large wholesalers in the U.S. are completely sold out of ALL gold and ALL silver and are not able to replenish.

We are already sold out of several products and will sell out of additional products shortly if this supply squeeze continues. All products listed as “In Stock” on our website are available for immediate delivery. For items listed as “Pre-Sale”, the items have been ordered and paid by us with incoming shipments on the way to us.

Paper Gold vs. Physical Gold

As we have repeated frequently over the years, only physical gold is a safe haven.

It’s noteworthy that the paper price of gold, although up 5.7% Year-to-Date denominated in SGD, has been trading downward in the last few days.

Paper gold is traded on the unallocated OTC gold spot market in London and on the COMEX futures market in New York. Both of these markets are derivative markets and neither is connected to the physical gold market.

This means that the physical gold market is a price taker, inheriting the price from the paper market, and that the derivative markets are the exclusive and dominant price makers. The entire market structure of this financialized gold trading is flawed. So while there is unprecedented demand for physical gold, this is not reflected in the gold price as derived by COMEX and the London unallocated spot market.

By now it is abundantly clear that the physical gold market and paper gold market will disconnect.

If the paper market does not correct this imbalance, widespread physical shortages of precious metals will be prolonged and may lead to the entire monetary system imploding.

And with progressive central banks in Eastern Europe and Asia having stocked up on gold in the last three years, gold will likely be the anchor of the new monetary system arising out of the ashes.

Mainstream media assertions that “Gold has been stripped of its Safe Haven Status” are utterly ridiculous and distorted beyond belief, when in fact the complete opposite is true. Unbacked paper gold and silver may be stripped of safe haven status, but certainly not real physical gold bullion.

Physical Premiums & Spreads

The current supply squeeze and physical bullion shortage has caused and is causing an increase in price premiums. It’s currently difficult and expensive for us to acquire any inventory. We have therefore had to increase premiums on products to compensate for the constraints. We have endeavored to also raise our prices offered to customers selling to us, but with the extreme volatility and wild price fluctuations, the spread between the buy and sell price may temporarily be larger than normal. It is regrettable that premiums and spreads are larger than normal but it is outside our control that the paper market is not reflecting the demand and supply of the physical market. As many of you know, we are one of the largest critical voices of the LBMA run paper market and its bullion bank members in London.

Please note that premiums are likely to be higher on weekends when the markets are closed compared to weekdays.

We do not take lightly the decision to alter premiums but feel that it is a better alternative than to stop accepting orders altogether during weekends. Likewise it is a better alternative than to stop accepting orders when the paper gold market is in turmoil and failing to reflect the demand and supply realities of the physical bullion market.

Currently, we are completely sold out on BullionStar Gold Bars, BullionStar Silver Bars and are running low on several other products which we are not able to replenish for now. Several stock items will therefore likely go out of stock shortly. This is despite us having been aggressively buying bullion to create a buffer reserve inventory.

We are living in an age of records in the financial world. The stock market is in its longest bull market in history and near all-time highs. The world has more debt than ever before while interest rates are near record lows, and some are negative in many countries for the first time ever. Nick Barisheff, CEO of Bullion Management Group (BMG), is seeing a dark ending for the era of financial records. Barisheff explains,

“I have been in the business for 40 years, and this is the first time we have had a simultaneous triple bubble, a bubble in real estate, stocks and bonds all at the same time. In 1999, it was a stock bubble. In 2007, it was a real estate bubble. This time, we’ve got a triple simultaneous bubble. So, when we have the correction, it’s going to be massive. Value calculations on equities say it’s worse than 1999, and in some cases worse than 1929. The big problem is this triple bubble is sitting on a mountain of debt like never before.”

What is going to be the reaction to this record bubble in everything crashing? Barisheff says, “I think you are going to be getting riots in the streets. It’s already happening in California. CalPERS is the pension fund administrator for a lot of the pension funds in California. So, already retired teachers, firefighters and policemen that are sitting in retirement getting their pension checks all got letters saying sorry, your pension checks from now on are going to be reduced by 60%. How do you get by then?”

What happens if the meltdown picks up speed and casualties? Barisheff says,

“I think the only option will be for the government is to print more money and postpone the problem yet a little bit longer, but that leads to massive inflation and eventually hyperinflation. Every fiat currency that has ever existed has always ended in hyperinflation, every single one. Since 1800, there have been 56 hyper inflations. Hyperinflation is defined as 50% inflation per month. That’s where we are going and what other choice is there?”

So, what do you do? Barisheff says,

“In the U.S. dollar since 2000, gold is up an average of 9.4% per year. In some countries, it’s up 14% and so on. If you take the overall average of all the countries, the average increase is 10% a year. Every time Warren Buffett is on CNBC, he seems to go out of his way to disparage gold, but if you look at a chart of Berkshire Hathaway and gold, gold has outperformed Berkshire Hathaway. . . Everybody worships Warren Buffett as the best investor in the world, and gold has outperformed his fund in U.S. dollars. I would not disparage gold if I were him. I’d keep quiet about it.”

There is a first for Barisheff, too, in this financial environment. He says for the first time ever, he’s “100% invested in gold” as a percentage of his portfolio. He says the bottom “is in for gold,” and “the bottom is in for silver, too.”

Barisheff contends that with the record bubbles and the record debt, both gold and silver will be setting new all-time high records as well in the not-so-distant future.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Nick Barisheff, CEO of BMG and the author of the popular book “$10,000 Gold.”

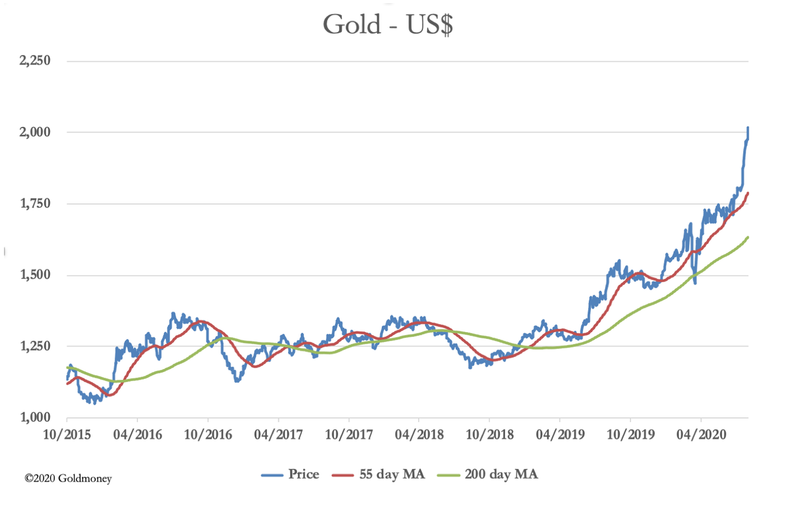

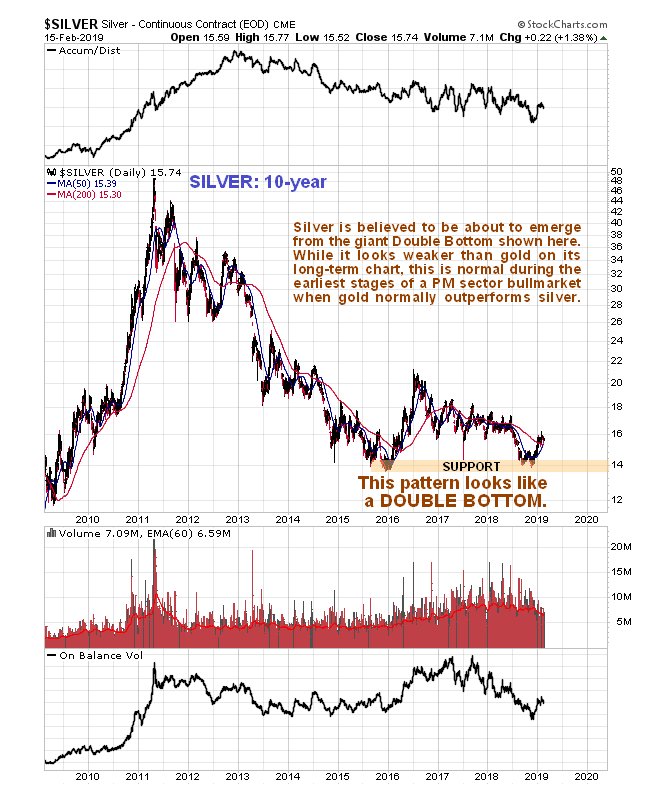

Gold and silver prices continue to push higher. They’re starting to get some attention from the mainstream, too. A new uptrend in gold is clearly underway, but silver’s performance has so far trailed gold’s. Let’s take a look at the price behavior over the past six-plus years of both metals to see if we can gain any insights about silver.

It’s been a pretty good couple of months for precious metals, but more so for gold than silver. Both are up but gold is up more, and the imbalance that this creates might be one of the major investment themes of the next few years.

The gold/silver ratio – that is, how many ounces of silver it takes to buy an ounce of gold – has bounced all over the place since the 1960s. But whenever it’s gotten extremely high – say above 80 – silver outperformed gold, sometimes dramatically.

As this is written, the ratio stands at almost 93x, which is not far from its record high. With precious metals finally breaking out of a five-year siesta – and the world getting dramatically scarier – it’s not a surprise that safe haven assets are catching a bid. And it would also not be a surprise if the current move has legs, as central banks resume their easing and geopolitical tensions persist.

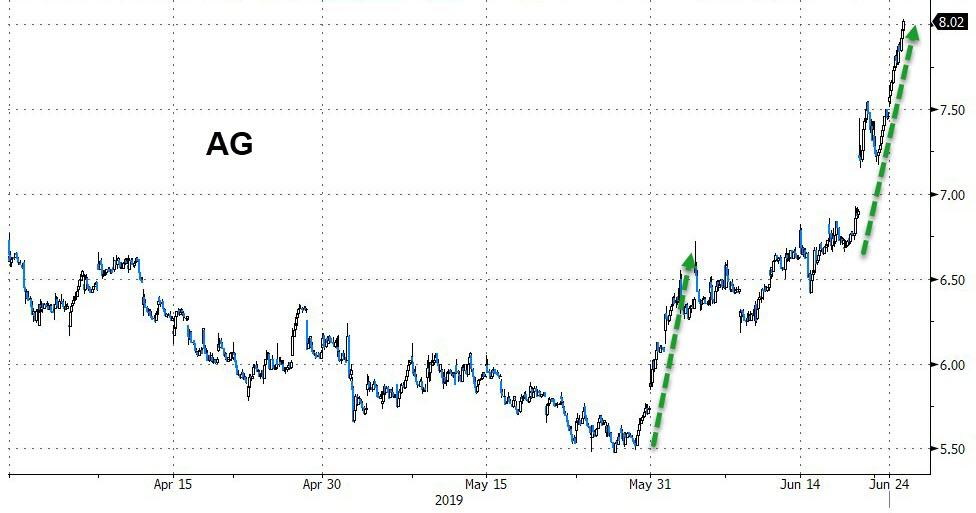

Combine a chaotic, easy-money world with silver’s relative cheapness and the result is a nice set-up, for both the metal and the stocks of the companies that mine it. Here’s the one-month chart for First Majestic Silver (AG), a large primary silver producer. It’s up about 40%, even while silver underperforms gold. Let the metal start to outperform in the context of an overall precious metals bull run, and stocks like this will go parabolic.

(by Jeff Clark) The data is in: based on a review of reports from multiple consultancies, the silver market has officially entered a supply/demand imbalance. The structure now in place sets up a scenario where a genuine crunch could occur.

The silver price has been stuck in a trading range for five years now. But behind the scenes, an imbalance has been forming that could potentially lead to price spikes based solely on the inability of supply to meet demand.

That statement isn’t based on some far-out projection or end-of-world scenario. It comes solely from the latest supply and demand data. As you’ll see, it demonstrates just how precarious the state of the silver market is. And as a result, how easily the price could ignite.

Here’s a pictorial that summarizes the current state of supply and demand for the silver market. See what conclusion you draw…

Annual supply is in a major decline. And the downtrend is getting worse.

Check out how the amount of new metal coming to market has rolled over and continues to fall.

(Kitco News) – The silver market is seeing a turn in fortunes as demand for physical bullion picks up, with the U.S. Mint selling out of 2018 and 2019 American Eagle silver coins.

The mint issued a statement late Thursday saying they had run out of last year’s and this year’s dated one-ounce coins. “Market fluctuations have resulted in a temporary sellout of 2018 and 2019 silver bullion. Production at the Mint’s West Point facility continues and when sales resume, silver bullion will be offered under allocation,” the mint said.

Year to date the U.S. Mint has sold more than six million coins, the best start since 2017. The surge in sales comes after a dismal 2018 which saw the lowest coin sales in 11.

According to some analysts, silver is attracting renewed investor attention as both precious metals and base metals trade near multi-month highs.

Following in gold’s footsteps, silver prices saw some selling pressure Thursday as momentum traders took profits as the market was trading near a nine-month high earlier in the week. Spot silver futures on Kitco.com last traded at $15.77 an ounce, relatively unchanged on the day.

However, analysts have noted that despite Thursday’s selling pressure, technical momentum points to further upside.

“The silver bulls still have the overall near-term technical advantage. Prices are in a three-month-old price uptrend on the daily bar chart. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at the January high of $16.20 an ounce,”said Jim Wyckoff, senior technical analyst at Kitco.com.

Andrew Hecht, creator of the Weekly Hecht report, said that investors have been quietly accumulating silver since the start of the year with open interest has risen 25%.

“Silver is the kind of metal that sits hidden in the brush like a wild beast waiting for an opportunity to pounce,” he said in a report Thursday.

He added that he thinks silver has the potential to push to $21 an ounce in 2019. However, he said that the first level of significant resistance he is watching is at $17.35 an ounce.

JP Morgan is the custodian responsible for safe keeping physical silver backing the SLV ETF

JP Morgan is the custodian responsible for safe keeping physical silver backing the SLV ETF

An ex-J.P. Morgan Chase trader has admitted to manipulating the U.S. markets of an array of precious metals for about seven years — and he has implicated his supervisors at the bank.

John Edmonds, 36, pleaded guilty to one count of commodities fraud and one count each of conspiracy to commit wire fraud, price manipulation and spoofing, according to a Tuesday release from the U.S. Department of Justice. Edmonds spent 13 years at New York-based J.P. Morgan until leaving last year, according to his LinkedIn account.

As part of his plea, Edmonds said that from 2009 through 2015 he conspired with other J.P. Morgan traders to manipulate the prices of gold, silver, platinum and palladium futures contracts on exchanges run by the CME Group. He and others routinely placed orders that were quickly cancelled before the trades were executed, a price-distorting practice known as spoofing.

“For years, John Edmonds engaged in a sophisticated scheme to manipulate the market for precious metals futures contracts for his own gain by placing orders that were never intended to be executed,” Assistant Attorney General Brian Benczkowski said in the release.

Of note for J.P. Morgan, the world’s biggest investment bank by revenue: Edmonds, a relatively junior employee with the title of vice president, said that he learned this practice from more senior traders and that his supervisors at the firm knew of his actions.

Edmonds pleaded guilty under a charging document known as an “information.” Prosecutors routinely use them to charge defendants who have agreed to cooperate with an ongoing investigation of other people or entities.

His sentencing is scheduled for Dec. 19. Edmonds faces up to 30 years in prison but is likely to receive less time than that. The guilty plea was entered under seal Oct. 9 and unsealed on Tuesday.

New York-based J.P. Morgan declined to comment on the case through a spokesman. It was reported earlier by the Financial Times.

J.P. Morgan learned about this case only recently, according to a person with knowledge of the matter. A recent regulatory filing from the bank didn’t make any mention of the issue.

Recent downturns in gold prices and silver prices have spurred a dramatic increase in both old and new bullion buyers snapping up physical precious metals at perceived low valuations.

For many decades now, the US Mint American Silver Eagle coin has remained the #1 choice for most physical silver bullion buyers worldwide.

In terms of annual sales volumes and total US dollars sold versus other silver bullion government mint and private mint competitors, the 1 oz American Silver Eagle coin is still the most highly purchased form of silver bullion worldwide (find updated US Mint sales data here).

Not surprising, with this recent downturn in precious metal prices, available silver bullion inventories are beginning to sell out and back order.

We foresaw and wrote about this shrinking silver bullion supply situation coming a weeks ago in SD Bullion’s new research blog.

Thus today, the following communication issued by the US Mint’s Branch Chief was not surprising to us:

Date: Wed, 5 Sep 2018

Subject: 2018 American Eagle Silver Bullion Coins Temporarily Sold Out

This is to inform you that due to recent increased demand, the United States Mint has temporarily sold out of its inventories of 2018 American Eagle Silver Bullion Coins.

All orders received prior to this communication shall be honored and settled according to pre-agreed upon value date arrangements.

The United States Mint is in the process of producing additional 2018 American Eagle Silver Bullion Coins. We will make these coins available for sale shortly.

Please let me know if you have any additional questions.

Jack A. Szczerban

Branch Chief, Bullion Directorate

United States Mint

Of course this latest US Mint sell out only pertains to Silver Eagle coins.

US Mint American Gold Eagle coin supplies still stand at reasonable, albeit recently lightened levels.

For seasoned bullion buyers, this latest sell out of US Mint 1 oz American Silver Eagle Coins is not a new phenomenon.

We have seen this happen in various years past, including periods of bullion product rationing, sell outs, etc.

What is different this time around is the low Silver Eagle coin volumes being sold by the US Mint month on month, compared to somewhat recent years of 2009 through 2016.

See below,

It appears like much of our industry, perhaps the US Mint has cut down on staffing, even silver planchet inventory levels, and other resources required to meet this latest spike in silver bullion product demand.

Typical to past US Mint silver sell outs and coin rationings, product and price premiums usually also increase in order to meet the silver bullion supply demand equilibrium. Smart bullion dealers are not going to sell out of their shrinking inventories without a reasonable profit to match.

You can see various 1 oz American Silver Eagle coin premium price over spot spikes in the following chart below.

The price premiums spike coincide with the fall 2008 fiasco where virtually any and all bullion dealers ran out of bullion inventories, the early 2013 allocation rationing, and the middle 2015 sell out and order shut down.

Historically price premium spikes for American Silver Eagles tend to flow into other silver bullion product premiums. In other words, if the price premiums for Silver Eagles pops higher, you can expect various price increases and sellouts in competing silver bullion products to also ensue.

Yet even most industry onlookers and bullion buyers do not know that a small change to US law was made in 2010. It allows the Secretary of the US Treasury by fiat, and not outright public demand per say, to alone determine what quantities of American Silver Eagle coin supplies are sufficient to meet ongoing demand.

Pre 2010 amendment and law change:

(e)Notwithstanding any other provision of law, the Secretary shall mint and issue, in quantities sufficient to meet public demand,

(e)Notwithstanding any other provision of law, the Secretary shall mint and issue, in qualities and quantities that the Secretary determines are sufficient to meet public demand,

We do not expect the recent sell out of Silver Eagle coins to the be the highest priority of Secretary of the Treasury at the moment.

Bullion buyers should expect further silver bullion supply constraints both currently and ahead, especially if silver spot prices dip into the $13 or $12 oz zone some respected technical analysts have been calling for weeks / months in advance.

The following US Mint Silver Eagle coin annual sales chart encompassed the entire history of the US Mint American Eagle Bullion Coin Program. As you can see, the 2008 global financial crisis took the program to another level entirely.

Even 10 years after the greatest financial crisis started, the worst since the 1929 depression, there are still both new and an already established base of silver bullion buyers who continue to aggressively buy silver bullion on spot price dips.

This recent US Mint sell out is just one example of that fact.

The following US Mint tour video was cut in 2014, but it’s still applicable to the way in which the American Silver Eagle coins are produced today. The only real difference is that the US Mint is currently selling less than ½ the volume it was then, yet still having issues meeting demand spikes in the short term.

More than likely the US Mint is currently dealing with a shortfall of silver planchets on hand.

The silver used in the program does not have to be mined in the USA as that law too was amended many years back. The US Mint does use silver coin planchet suppliers from Australia as well as domestic suppliers like the Sunshine Mint.

In terms of silver bullion on hand, don’t expect the Secretary of the US Treasury to have any available as they rely on private silver planchet suppliers and ‘just in time’ delivery for their program.

As most bullion buyers know, en masse the US government figuratively sold silver out in 1964.

The fact that the US government’s often clunky silver bullion coin program remains the largest in the world, illustrates just how tiny the silver bullion industry remains in the grand scope of global finance and economic financialization.

Sneaky law amendments aside, it does not take much silver bullion demand to break the industry’s small supply demand equilibrium.

Source: by James Anderson | SilverDoctors.com

Silver is down 1% year-to-date, while the dollar has tumbled 3.5% and gold has surged 4%, sending a possible warning signal to the broader market.

This dramatic divergence between gold and silver prices has sent the ratio of the two to multi-year highs.

The divergence between the two means prices for gold are 82 times those of silver, which is 27% more than the 10-year average.

As The Wall Street Journal reports, a higher gold-to-silver ratio is viewed by some investors as a negative economic indicator because money managers tend to favor gold when they think markets might turn rocky and discard silver when they are worried about slower global growth crimping consumption.

“There’s just not many people looking to buy silver at this point in time,” said Walter Pehowich, senior vice president at Dillon Gage Metals.

“There’s a lot of silver that comes out of the refineries, and they can’t find a home for it.”

The precious metals ratio last stayed above 80 in early 2016, when worries about a Chinese economic slowdown roiled markets, and in 2008 during the financial crisis. The ratio’s recent rise comes as speculators have turned the most bearish ever on silver and inventories in warehouses have risen, a sign there could be too much supply.

While investors have flocked toward gold with equity markets wobbling, money managers seeking safety or alternative assets haven’t favored silver.

“It’s not seeing great hedge demand because it’s just easy to go to gold,” said Dan Denbow, who manages the USAA Precious Metals and Minerals Fund . “Gold is a bit more predictable.”

As WSJ conclude, some analysts think silver’s underperformance is a negative sign for precious metals broadly because it is a less actively traded commodity, making it more vulnerable to bigger price swings on the way up and down.

Sound money advocates scored a major victory on Wednesday, when the Arizona state senate voted 16-13 to remove all income taxation of precious metals at the state level. The measure heads to Governor Doug Ducey, who is expected to sign it into law.

Sound money advocates scored a major victory on Wednesday, when the Arizona state senate voted 16-13 to remove all income taxation of precious metals at the state level. The measure heads to Governor Doug Ducey, who is expected to sign it into law.

Under House Bill 2014, introduced by Representative Mark Finchem (R-Tucson), Arizona taxpayers will simply back out all precious metals “gains” and “losses” reported on their federal tax returns from the calculation of their Arizona adjusted gross income (AGI).

If taxpayers own gold to protect themselves against the devaluation of America’s paper currency, they frequently end up with a “gain” when exchanging those metals back into dollars. However, this is not necessarily a real gain in terms of a gain in actual purchasing power. This “gain” is often a nominal gain because of the slow but steady devaluation of the dollar. Yet the government nevertheless assesses a tax.

Sound Money Defense League, former presidential candidate Congressman Ron Paul, and Campaign for Liberty helped secure passage of HB 2014 because “it begins to dismantle the Federal Reserve’s monopoly on money” according to JP Cortez, an alumnus of Mises University.

Ron Paul noted, “HB 2014 is a very important and timely piece of legislation. The Federal Reserve’s failure to reignite the economy with record-low interest rates since the last crash is a sign that we may soon see the dollar’s collapse. It is therefore imperative that the law protect people’s right to use alternatives to what may soon be virtually worthless Federal Reserve Notes.” In early March, Dr. Paul appeared before the state Senate committee that was considering the proposal.

“We ought not to tax money, and that’s a good idea. It makes no sense to tax money,” Paul told the state senators. “Paper is not money, it’s a substitute for money and it’s fraud,” he added, referring to the fractional-reserve banking practiced by the Federal Reserve and other central banks.

After the committee voted to pass the bill on to the full body of the Senate, Dr. Paul held a rally on the grounds of the state legislature, congratulating supporters of the measure and of sound money.

Paul told the crowd that “they were on the right side of history” and that even though those working to restore constitutional liberty to Arizona and all the states “had a great burden to bear,” there are “more than you know” working toward the same goal.

Referring to the bill’s elimination of capital gains taxes on gold and silver, the sponsor of the bill, State Representative Mark Finchem, said, “What the IRS has figured out at the federal level is to target inflation as a gain. They call it capital gains.”

Shortly after the vote in the state Senate, the Sound Money Defense League, an organization working to bring back gold and silver as America’s constitutional money, issued a press release announcing the good news.

“Arizona is helping lead the way in defending sound money and making it less difficult for citizens to protect themselves from the inflation and financial turmoil that flows from the abusive Federal Reserve System,” said Stefan Gleason, the organization’s director

As a reminder, in 1813 Thomas Jefferson warned, “paper money is liable to be abused, has been, is, and forever will be abused, in every country in which it is permitted.” This is also why the men who drafted the Constitution empowered Congress to mint gold and silver, sound money, and why they included not a single syllable authorizing the legislature to “surrender that critical power to a plutocracy with a penchant for printing fiat money.”

Slowly, states may be summoning back the days when money was actually worth something. At least 20 states are currently considering doing as Arizona is about to do and remove the income tax on the capital gains from the buying and selling of precious metals: some state legislatures, including Utah and Idaho, have taken steps toward eliminating income taxation on the monetary metals. Other states are rolling back sales taxes on gold and silver or setting up precious metals depositories to help citizens save and transact in gold and silver bullion.