‘The time has come to pick your poison or become unwitting collateral damage’

Demand for American Gold Eagles exploded in May according to the latest data from the US Mint.

(Jp Cortez) Last year was a good year for state-level sound money legislation across the United States. 2022 could be even better.

Ohio’s $16 billion Police & Fire Pension Fund is following in the steps of Warren Buffett and making a big statement about owning gold. It has approved a 5% allocation to gold to help diversify the fund’s portfolio and to “hedge against the risk of inflation” according to Bloomberg.

The change was approved as “the first step” in an ongoing asset review that was presented to the fund’s board on August 26.

The fund was following the advice of its investment consultant, Wilshire Assocaites, in adding the gold allocation, according to Pensions & Investments. Additionally, the fund plans on adding the gold stake by borrowing; the fund is reportedly increasing its leverage from 20% to 25% to make the change.

“No new manager has been selected, and there currently is no timeline for implementing this change,” P&I reported.

Buffett’s move into gold has opened the door for fund managers to follow suit. Except, instead of playing in a hundred trillion dollar equity market, they are dealing with barely over $1 trillion in investable gold. This means that if the fund becomes a trend setter in the industry and if others follow suit, look out above.

Peter Schiff said on a recent podcast: “Warren Buffett seems to have a very good understanding of inflation. He doesn’t regard it as rising prices, he regards it as money supply. He’s talked about inflation as a hidden tax on savers. As a cruel tax. He understands the loss of value of money. He basically says that that’s inflation: the erosion of purchasing power of money. I think Buffett now has a much darker outlook on inflation than he did in the past.”

“Buffett is now of the opinion that inflation is going to be so high that gold is going to be particularly important to own, rather than just owning businesses,” he says.

You can listen to Schiff’s comments here:

If the inflation message starts to become clear to pension funds and main street asset managers, we could see a major sea change in psychology regarding gold as an investment.

Additionally, Rick Rule recently commented about exactly how under-owned gold was in the U.S.: “A major bank study, which I read, and I’ve quoted it before in interviews with you, says that between 0.3%-0.5% of savings and investment assets in the United States involve precious metals or precious metals securities.”

He continued: “That may have gone up because the denominator has declined the value, the Dow is an example, but the three decade-long mean was between 1.5%-2%. So gold is still very broadly under-owned, and I would suggest it’s even under-owned among people who are listening to this broadcast.”

But in plain English, another way to say it is that there simply isn’t enough gold available in the world for every pension fund to make the same 5% allocation.

(Stewart Jones) As the Federal Reserve’s quantitative easing practices generate the biggest debt bubble in history, gold futures are trading at record highs, a phenomenon some have called “a bit of a mystery.” However, this “mystery” was solved long ago by the laws of economics. The only “mystery” here is why—contrary to centuries of economic wisdom—we allowed centralized paper money to become the dominant form of currency in the first place.

As recent waves of civil unrest and economic turmoil have prompted some to look back in time and reflect on the observations of the Founding Fathers, it seems most have opted to reject them entirely. Yet among the founders’ many warnings against the institutions that would eventually dominate the modern world are the timeless—and astonishingly accurate—warnings against central banking.

On August 1, 1787, George Washington wrote in a letter to Thomas Jefferson that “paper currency [can] ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” Jefferson also opposed the concept, warning that “banking establishments are more dangerous than standing armies.” James Madison called paper money “unjust,” recognizing that it allowed the government to confiscate and redistribute property through inflation: “It affects the rights of property as much as taking away equal value in land.”

In other words, inflation is a hidden form of taxation. Washington understood this. Jefferson understood this. Madison understood this. And generations of preeminent economists since then—from Ludwig von Mises to F.A. Hayek, to Murray Rothbard—have understood this quite clearly.

And there’s nothing controversial or mysterious about sound money, that is, currency backed by some form of secure, fixed weight commodity like gold or silver. Both have been valued in some fashion for six thousand years and have been used as currency for around twenty-six hundred years. As confidence in the dollar continues to nosedive, the market is not only putting more confidence in gold and silver, but in some crypto currencies sharing many of the characteristics of gold.

The presidencies of Woodrow Wilson and Franklin D. Roosevelt are rightfully regarded as some of the darkest years for freedom in America. Often overlooked, however, are the deeply repressive monetary policies introduced by both presidents. In 1838, Senator John C. Calhoun foreshadowed the economic evils that would eventually emerge at the peak of the Progressive Era, explaining,

“It is the nature of stimulus…to excite first, and then depress afterwards….Nothing is more stimulating than an expanding and depreciating currency. It creates a delusive appearance of prosperity, which puts everything in motion. Everyone feels as if he was growing richer as prices rise.”

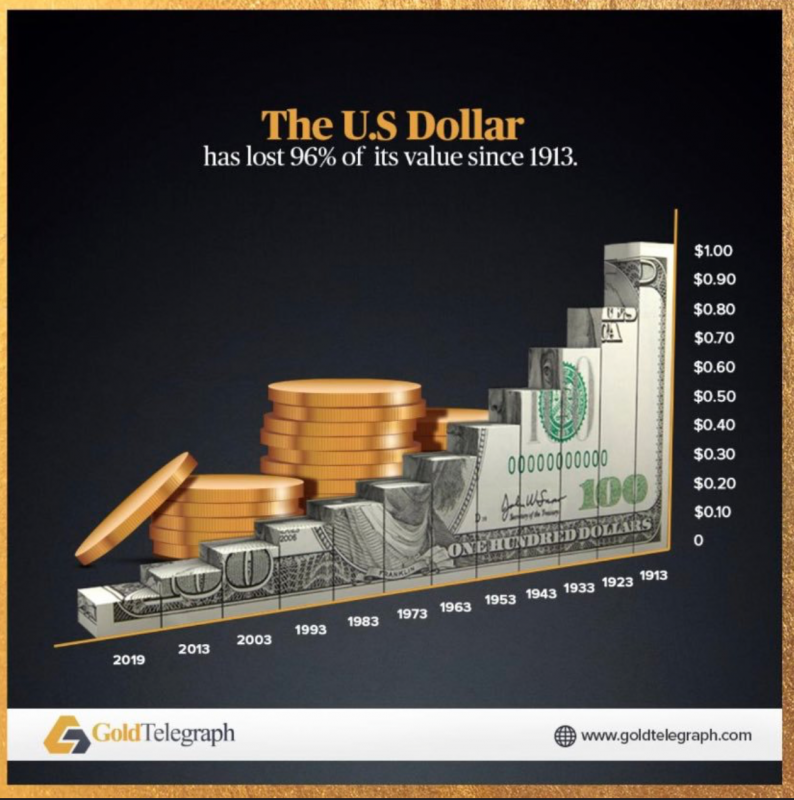

Seventy-five years later, the autocrats running the Wilson administration dealt two devastating blows to liberty with the Federal Reserve Act and the Revenue Act, forever marking 1913 as a tragic year for liberty. Both laws struck at the heart of property rights by establishing the Federal Reserve System and the income tax, respectively. Then, in 1933, Roosevelt issued Executive Order No. 6102, requiring Americans to surrender much of their gold to the US government. Shortly after, Congress passed the Gold Reserve Act of 1934, artificially raising the price of gold and guaranteeing the government a profit of $14.33 for each ounce of gold it had seized from the people.

Finally, in 1971, President Richard Nixon—like any self-respecting twentieth-century Keynesian—committed himself to finishing the work of Wilson and Roosevelt by closing the gold window, forever divorcing the gold standard from the dollar. Rather than usher in a new era of economic stability, this unnatural union between the Fed and the federal government produced a vicious loop of boom-bust cycles and depressions. The consequences have not only been inflation and devaluation (both of which have stripped the people of their purchasing power and savings); now, every time a depression hits, the government is allowed to do two things: grow its power and tax and spend at will without fear of accountability.

In other words, with every inflation of currency comes an inflation of government power.

With government shutdowns of local economies, the second economic quarter of this year was among the worst in history, with the total debt-to-GDP reaching a staggering 136 percent. As the national debt approaches $27 trillion (with even bigger spending bills in the works), we can expect the days of such flagrant government spending to come to a screeching halt. If we continue on this path, that correction will result in an unprecedented collapse of the dollar and the monetary system. The ultimate danger in this scenario: the government eventually confiscates the vast majority or even all private property in order to pay off the national debt. As German American economist Hans Sennholz once said, “Government debt is a government claim against personal income and private property—an unpaid tax bill.”

This is why a dramatic downsizing of government is key to bringing the US out of this manic, outmoded cycle of depressions and upswings. For the government to fulfill its core function as a safeguard of liberty, we must prevent it from meddling in affairs beyond the boundaries prescribed by the Founding Fathers. This includes a swift withdrawal from the use of paper fiat currency and spending cuts across the board.

Such a sweeping transformation could begin with the state governments, the legislatures of which could override the federal government by passing legislation allowing individuals to use gold and silver currency.

Regardless, if meaningful legislative action is not taken somewhere, we have little choice other than to acquiesce to the gloom and terror of socialism—a system that would devour all in its path and make slaves of once free people for generations to come. Freedom is the natural ability of people to control their own destiny. Sound money has the ability to help keep people free.

(Alasdair Macleod) There appears to be no way out for the bullion banks deteriorating $53bn short gold futures positions ($38bn net) on Comex. An earlier attempt between January and March to regain control over paper gold markets has backfired on the bullion banks.

Unallocated gold account holders with LBMA member banks will shortly discover that that market is trading on vapour. According to the Bank for International Settlements, at the end of last year LBMA gold positions, the vast majority being unallocated, totalled $512bn — the London Mythical Bullion Market is a more appropriate description for the surprise to come.

An awful lot of gold bulls are going to be disappointed when their unallocated bullion bank holdings turn to dust in the coming months — perhaps it’s a matter of a few weeks, perhaps only days — and synthetic ETFs will also blow up. The systemic demolition of paper gold and silver markets is a predictable catastrophe in the course of the collapse of fiat money’s purchasing power, for which the evidence is mounting. It is set to drive gold and silver much higher, or more correctly put, fiat currencies much lower.

This is only the initial catalysing phase in the rapidly approaching death of fiat currencies.

Informative And Educational:

Are gold and silver becoming what Mike Maloney has always suggested, Unaffordium and Unobtainium? The last few weeks have given us a preview of how stretched the physical gold and silver markets can become when the markets move. Join Mike as he welcomes GoldSilver.com President Alex Daley for a special Retail Bullion Update.

(BullionStar.com) In the last month, from 14 February 2020 to 14 March 2020, we have seen a record number of orders, record order revenue and a record number of visits to our newly renovated and extended bullion centre at 45 New Bridge Road in Singapore.

For the above-mentioned period, we have served 2,626 customers with a sales revenue of more than SGD 50 M, which is 477% higher compared to the same period last year.

The last few days have been our busiest days of all time. Our staff members have been doing a fantastic job in going out of their way to serve as many customers as possible.

Gold & Silver Shortages – Supply Squeeze

The enormous increase in demand is straining our supply chains. BullionStar has supplier relations with most of the major refineries, mints and wholesalers around the world. Most of our suppliers don’t have any stock of precious metals and are not taking orders currently. The U.S. Mint for example announced just this Thursday that American Silver Eagle coins are sold out. The large wholesalers in the U.S. are completely sold out of ALL gold and ALL silver and are not able to replenish.

We are already sold out of several products and will sell out of additional products shortly if this supply squeeze continues. All products listed as “In Stock” on our website are available for immediate delivery. For items listed as “Pre-Sale”, the items have been ordered and paid by us with incoming shipments on the way to us.

Paper Gold vs. Physical Gold

As we have repeated frequently over the years, only physical gold is a safe haven.

It’s noteworthy that the paper price of gold, although up 5.7% Year-to-Date denominated in SGD, has been trading downward in the last few days.

Paper gold is traded on the unallocated OTC gold spot market in London and on the COMEX futures market in New York. Both of these markets are derivative markets and neither is connected to the physical gold market.

This means that the physical gold market is a price taker, inheriting the price from the paper market, and that the derivative markets are the exclusive and dominant price makers. The entire market structure of this financialized gold trading is flawed. So while there is unprecedented demand for physical gold, this is not reflected in the gold price as derived by COMEX and the London unallocated spot market.

By now it is abundantly clear that the physical gold market and paper gold market will disconnect.

If the paper market does not correct this imbalance, widespread physical shortages of precious metals will be prolonged and may lead to the entire monetary system imploding.

And with progressive central banks in Eastern Europe and Asia having stocked up on gold in the last three years, gold will likely be the anchor of the new monetary system arising out of the ashes.

Mainstream media assertions that “Gold has been stripped of its Safe Haven Status” are utterly ridiculous and distorted beyond belief, when in fact the complete opposite is true. Unbacked paper gold and silver may be stripped of safe haven status, but certainly not real physical gold bullion.

Physical Premiums & Spreads

The current supply squeeze and physical bullion shortage has caused and is causing an increase in price premiums. It’s currently difficult and expensive for us to acquire any inventory. We have therefore had to increase premiums on products to compensate for the constraints. We have endeavored to also raise our prices offered to customers selling to us, but with the extreme volatility and wild price fluctuations, the spread between the buy and sell price may temporarily be larger than normal. It is regrettable that premiums and spreads are larger than normal but it is outside our control that the paper market is not reflecting the demand and supply of the physical market. As many of you know, we are one of the largest critical voices of the LBMA run paper market and its bullion bank members in London.

Please note that premiums are likely to be higher on weekends when the markets are closed compared to weekdays.

We do not take lightly the decision to alter premiums but feel that it is a better alternative than to stop accepting orders altogether during weekends. Likewise it is a better alternative than to stop accepting orders when the paper gold market is in turmoil and failing to reflect the demand and supply realities of the physical bullion market.

Currently, we are completely sold out on BullionStar Gold Bars, BullionStar Silver Bars and are running low on several other products which we are not able to replenish for now. Several stock items will therefore likely go out of stock shortly. This is despite us having been aggressively buying bullion to create a buffer reserve inventory.

We are living in an age of records in the financial world. The stock market is in its longest bull market in history and near all-time highs. The world has more debt than ever before while interest rates are near record lows, and some are negative in many countries for the first time ever. Nick Barisheff, CEO of Bullion Management Group (BMG), is seeing a dark ending for the era of financial records. Barisheff explains,

“I have been in the business for 40 years, and this is the first time we have had a simultaneous triple bubble, a bubble in real estate, stocks and bonds all at the same time. In 1999, it was a stock bubble. In 2007, it was a real estate bubble. This time, we’ve got a triple simultaneous bubble. So, when we have the correction, it’s going to be massive. Value calculations on equities say it’s worse than 1999, and in some cases worse than 1929. The big problem is this triple bubble is sitting on a mountain of debt like never before.”

What is going to be the reaction to this record bubble in everything crashing? Barisheff says, “I think you are going to be getting riots in the streets. It’s already happening in California. CalPERS is the pension fund administrator for a lot of the pension funds in California. So, already retired teachers, firefighters and policemen that are sitting in retirement getting their pension checks all got letters saying sorry, your pension checks from now on are going to be reduced by 60%. How do you get by then?”

What happens if the meltdown picks up speed and casualties? Barisheff says,

“I think the only option will be for the government is to print more money and postpone the problem yet a little bit longer, but that leads to massive inflation and eventually hyperinflation. Every fiat currency that has ever existed has always ended in hyperinflation, every single one. Since 1800, there have been 56 hyper inflations. Hyperinflation is defined as 50% inflation per month. That’s where we are going and what other choice is there?”

So, what do you do? Barisheff says,

“In the U.S. dollar since 2000, gold is up an average of 9.4% per year. In some countries, it’s up 14% and so on. If you take the overall average of all the countries, the average increase is 10% a year. Every time Warren Buffett is on CNBC, he seems to go out of his way to disparage gold, but if you look at a chart of Berkshire Hathaway and gold, gold has outperformed Berkshire Hathaway. . . Everybody worships Warren Buffett as the best investor in the world, and gold has outperformed his fund in U.S. dollars. I would not disparage gold if I were him. I’d keep quiet about it.”

There is a first for Barisheff, too, in this financial environment. He says for the first time ever, he’s “100% invested in gold” as a percentage of his portfolio. He says the bottom “is in for gold,” and “the bottom is in for silver, too.”

Barisheff contends that with the record bubbles and the record debt, both gold and silver will be setting new all-time high records as well in the not-so-distant future.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Nick Barisheff, CEO of BMG and the author of the popular book “$10,000 Gold.”

After years of being kept in the doldrums by orchestrated short selling described on this website by Roberts and Kranzler, gold has lately moved up sharply, reaching over $1,500 this week. The gold price has continued to rise despite the continuing practice of dumping large volumes of naked contracts in the futures market. The gold price is driven down but quickly recovers and moves on up. I haven’t an explanation at this time for the new force that is more powerful than the short-selling that has been used to control the price of gold.

Various central banks have been converting their dollar reserves into gold, which reduces the demand for dollars and increases the demand for gold. Existing stocks of gold available to fill orders are being drawn down, and new mining output is not keeping pace with the rise in demand. Perhaps this is the explanation for the rise in the price of gold.

During the many years of Quantitative Easing the exchange value of the dollar was protected by the Japanese, British, and EU central banks also printing money to insure that their currencies did not rise in value relative to the dollar. The Federal Reserve needs to protect the dollar’s exchange value so that it continues in its role as the world’s reserve currency in which international transactions are conducted. If the dollar loses this role, the US will lose the ability to pay its bills by printing dollars. A dollar declining in value relative to other countries would cause flight from the dollar to the rising currencies. Catastrophe quickly occurs from increasing the supply of a currency that central banks are unwilling to hold.

One problem remained. The dollar was depreciating relative to gold. Rigging the currency market was necessary but not sufficient to stabilize the dollar’s value. The gold market also had to be rigged. To stop the dollar’s depreciation, naked short selling has been used to artificially increase the supply of paper gold in order to suppress the price. Unlike equities, gold shorts don’t have to be covered. This turns the price-setting gold futures market into a paper market where contracts are settled primarily in cash and not by taking delivery of gold. Therefore, participants can increase the supply of the paper gold traded in the futures market by printing new contracts. When large numbers of contracts are suddenly dumped in the market, the sudden increase in paper gold supply drives down the price. This has worked until now.

If flight from the dollar is beginning, it will make it difficult for the Federal Reserve to accommodate the growing US budget deficit and continue its policy of lowering interest rates. With central banks moving their reserves from dollars (US Treasury bonds and bills) to gold, the demand for US government debt is not keeping up with supply. The supply will be increasing due to the $1.5 trillion US budget deficit. The Federal Reserve will have to take up the gap between the amount of new debt that has to be issued and the amount that can be sold by purchasing the difference. In other words, the Fed will print more money with which to purchase the unsold portion of the new debt.

The creation of more dollars when the dollar is experiencing pressure puts more downward pressure on the dollar. To protect the dollar, that is, to make it again attractive to investors and central banks, the Federal Reserve would have to raise interest rates substantially. If the US economy is in recession or moving toward recession, the cost of rising interest rates would be high in terms of unemployment.

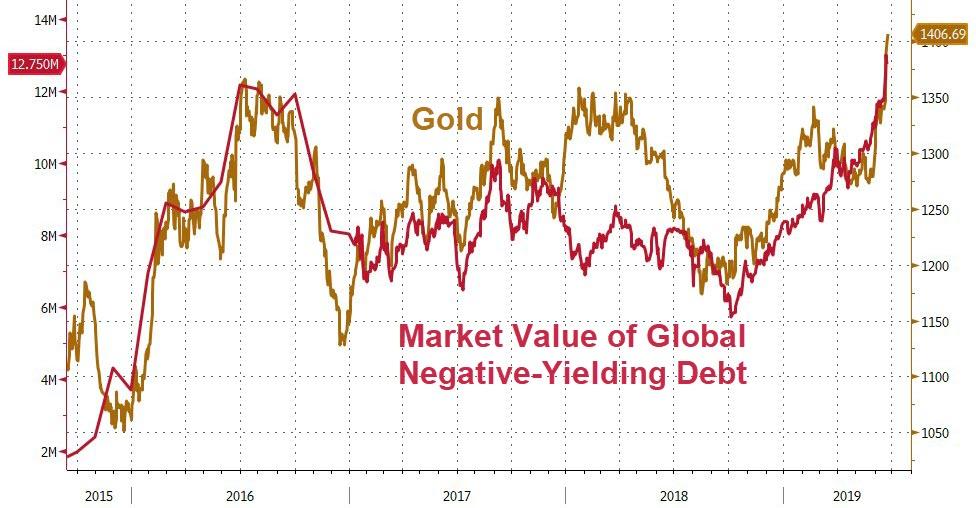

With a rising price of gold, who would want to hold debt denominated in a rapidly depreciating currency when interest rates are low, zero, or negative?

The Federal Reserve might have no awareness of the pending crisis that it has set up for itself. On the other hand, the Federal Reserve is responsive to the elite who want to rid themselves of Trump. Collapsing the economy on Trump’s head is one way to prevent his reelection.

Gold and silver prices continue to push higher. They’re starting to get some attention from the mainstream, too. A new uptrend in gold is clearly underway, but silver’s performance has so far trailed gold’s. Let’s take a look at the price behavior over the past six-plus years of both metals to see if we can gain any insights about silver.

(Alex Deluce) There may be readers who weren’t even born when the U.S. still had a gold-backed dollar. Since the gold standard was abolished in 1971, the value of the dollar has decreased annually by 3.96 percent. You would need over $600 today to purchase the same goods you purchased for $100 in 1973. Still, a dollar is a dollar, right? No, it is not. It is just a piece of paper.

Is there a chance the U.S. could return to the gold standard and provide real value to the U.S. currency? Judy Shelton and Christopher Waller are President Trump’s pick for Federal Reserve governors. As it happens, Ms. Shelton is a believer in the gold standard and a critic of current Federal Reserve policies. She believes that the Fed has become unnecessarily involved in trade policies instead of adhering to its function of regulating the monetary system. Returning to the gold standard is not a popular idea these days when economists support the limitless printing for currency, high debt, and inflation.

Ms. Shelton would have been considered mainstream 35 years ago. Today, she is thought of as unorthodox. In 2018, she wrote in an article published by the conservative thinktank, Cato Institute,

“If the appeal of cryptocurrencies is their capacity to provide a common currency, and to maintain a uniform value for every issued unit, we need only consult historical experience to ascertain that these same qualities were achieved through the classical international gold standard.”

She also authored a book, Fixing the Dollar Now. In it, she advocates for linking the dollar to a benchmark of value, preferably gold. More than four decades ago, the currency of all major countries, such a Britain, Japan, France, Russia, and others were linked to gold. In 1933, the dollar was linked to $35 worth of gold. In 2019, the value of the dollar is less than one-thirtieth of that.

The gold standard helped the U.S. prosper for 180 years. The signers of the U.S. Constitution included this requirement in Article 10.

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.

Almost two hundred years later, such a concept is deemed unorthodox. Ideologies change, and not always for the better.

The reason the Founding Fathers included a monetary policy in the Constitution is that they wanted money to be as far away as possible from any human intervention. This was achieved by linking the dollar to gold. Gold is a stable commodity, and thus ensures a stable U.S. currency.

Countries today link their currency to some other, stronger currency, such as the dollar or the euro. This means that these countries have no control over their own currency and are at the mercy of an arbitrary link. But as the dollar and euro weaken, so do the currencies that have linked themselves to it. This serves as a disruption of all global economies.

“Stable money” provides us with logical economic guidelines. Market forces become the determining factor of what is produced and where capital is spent. For example, if the price of oil becomes too high, the consumer will reduce oil consumption while companies will either increase their production of oil or seek other sources. When market forces rule, everyone benefits.

Market forces have largely been replaced by government interference and manipulation. The cost of a loaf of bread is what the government says it will be. (See Venezuela for an extreme example.) To manipulate prices, the government, or the Fed, needs to manipulate the value of the dollar. The loaf of bread purchased a year ago for $2.00 now costs $2.50. Same bread, manipulated price. When market forces rule, the price of a loaf of bread would be determined by consumer choice. Under central banking rules, the price would be manipulated by some artificial whim.

One of the easiest ways to manipulate money is through easy credit. Print unlimited currency with no intrinsic value and you create a mountain of debt. This will inevitably lead to inflation and higher prices. If the dollar were once again linked to gold, only a certain amount of money, backed by gold, could be printed. Debt, inflation and higher prices would almost immediately go into a tailspin. Money cannot be manipulated under the gold standard. Perhaps that is why so many economists fear to return to such a standard.

Judy Shelton will be duly criticized for her opinions. Stable money is a new concept for a new generation of bankers and economists. But gold has been around for thousands of years and will undoubtedly outlast these new thinkers.

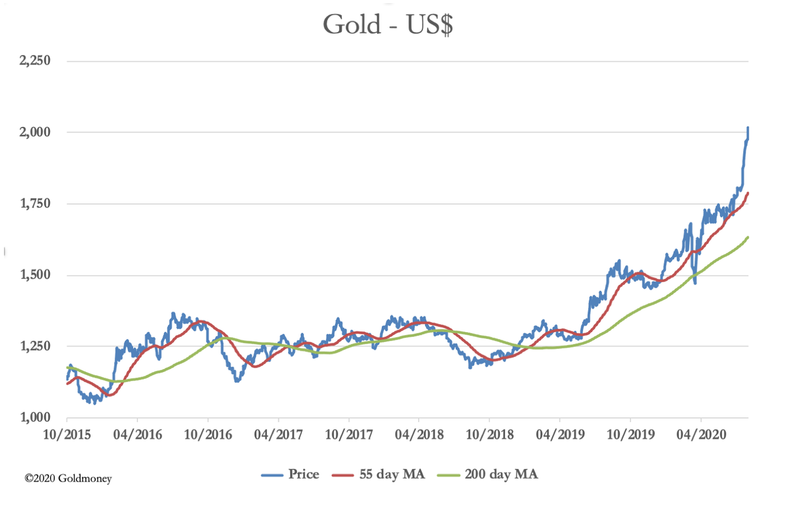

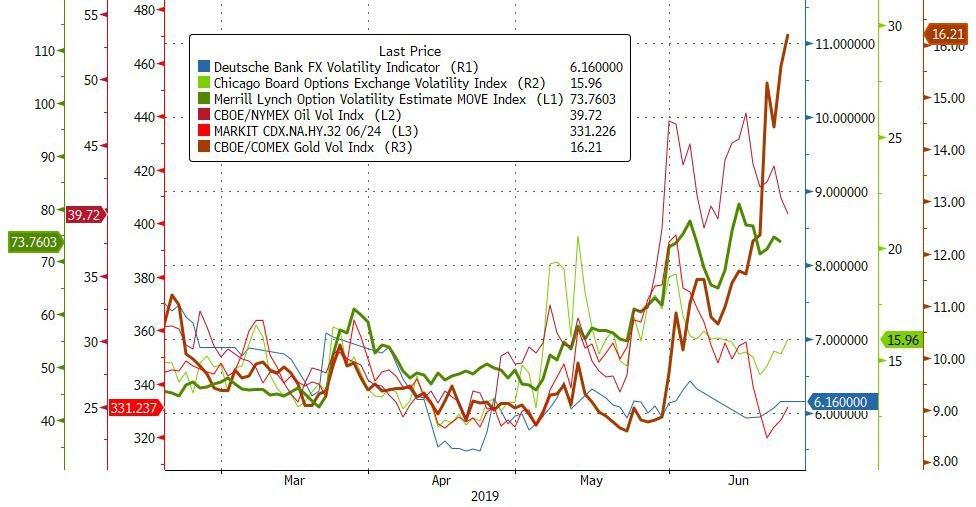

Having tested $1300 numerous times over the past few years, gold has broken dramatically higher in the last month, hitting 6-year highs as President Trump rhetoric around the world raises tensions, increasing the odds of open WWIII conflict.

The surge in the precious metal has accompanied a collapse in bond yields around the world and a record level of negative-yielding debt…

And while Gold volatility is soaring…

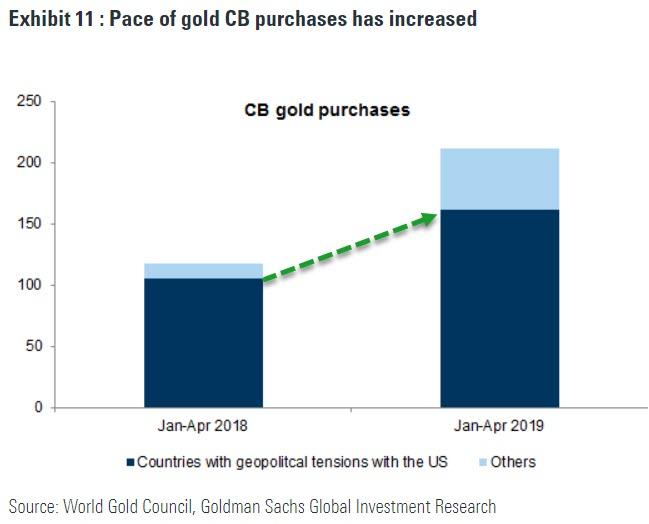

Demand remains abundant, as Goldman details in its latest note, raising its outlook for gold, countries with “geopolitical tensions with the US” are buying everything:

Central bank demand is gaining momentum and we now expect 2019 purchases to reach 750 tonnes vs 650 tonnes last year. Visible gold purchases YTD are running at 211 tonnes until April vs 117 tonnes over the same period last year (see Exhibit 11).

Importantly, China just raised its gold purchasing pace from 10 tonnes per month to 15 tonnes for April and May as it aims to diversify its reserve holdings.

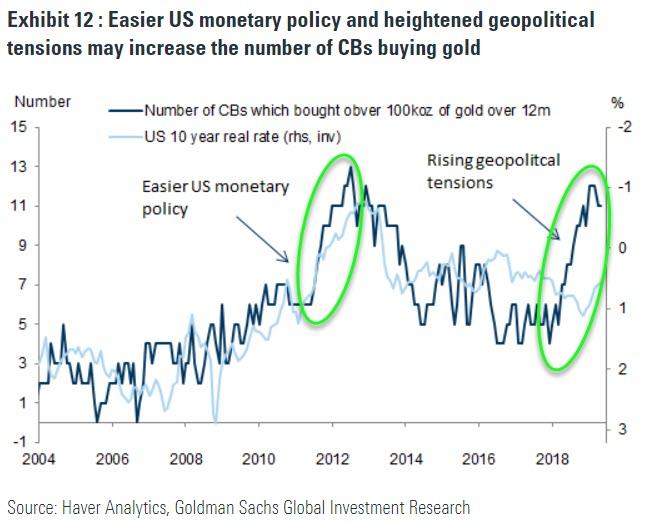

With the Fed and ECB now both likely easing monetary policy, more CBs may decide to add gold to their portfolios as they did between 2008 and 2012 (see Exhibit 12).

Also, just recently, trade tensions between India and the US have begun to escalate as India retaliated with tariffs on US goods in response to US steel tariffs. Rising tensions with the US often create upside potential to a country’s gold purchases

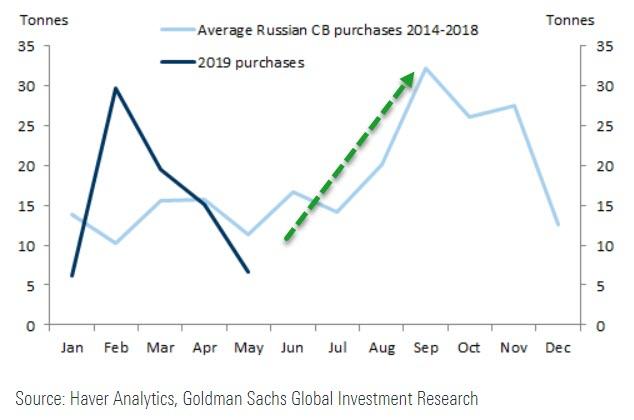

Additionally, in case you thought the move was exhausted, Goldman notes that there is about to a pick up in demand as Russia purchases tend to be strongest in Q3…

And finally, Goldman notes that good economic news and bad economic news could both be positive for the precious metal at this point in the cycle.

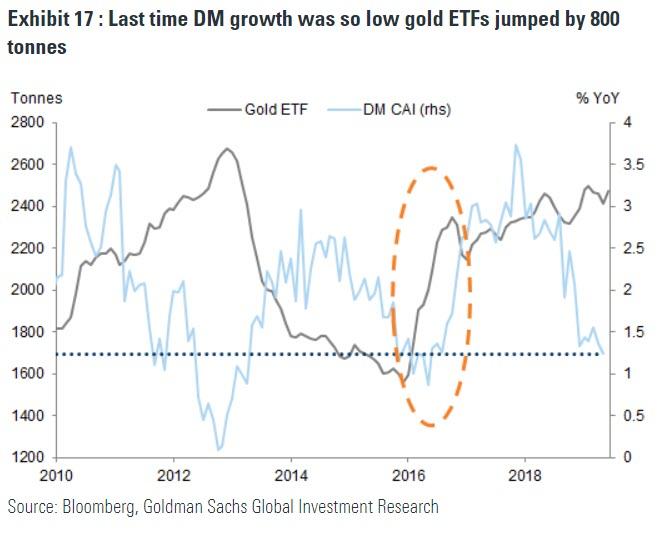

If DM growth fails to pick up in the second half, gold has substantial upside potential

If DM growth continues to underperform, there is room for a much more substantial build in ETF positions. Last time we were in a similar environment was in 2016. DM growth back then was as weak as it is now and both the Fed and the ECB turned more dovish.

But back then the push into ETFs was significantly higher than it is currently… we think that current low growth makes owning gold appealing from a diversification perspective.

And Goldman notes that an improvement in global economic growth is not necessarily bearish for gold.

Our economists expect the bulk of the acceleration in GDP growth to come from ex-US and EM countries in particular. This should support gold through the “wealth” channel. Importantly, a reduced US growth outperformance points to a weakening of the dollar, which should boost the dollar purchasing power of the world ex-US (see Exhibit 7). In addition to this, gold is starting to build momentum in the local currencies of its two biggest consumers, India and China.

And the momentum gold prices built in the first half of 2019 can lead to an increase in EM (emerging markets) retail gold demand in the second half.

Goldman concludes, we believe that gold continues to offer significant diversification value with substantial upside if DM (developed markets) growth continues to underperform… or, as we noted above, global tensions continue to rise.

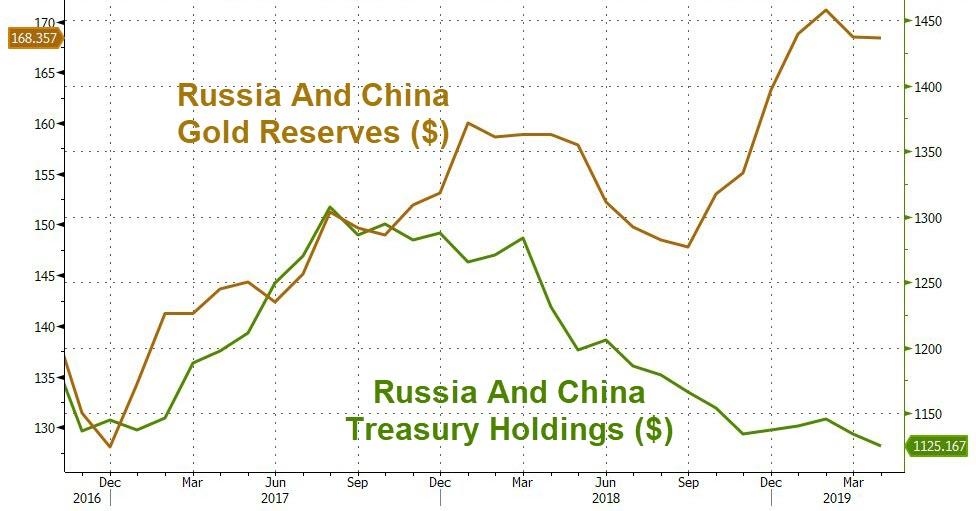

As we noted previously, combined Russia and China Treasury holdings are at their lowest since June 2010 as China and Russia’s gold holdings have soared…

The reaction to the “Weaponization” of the US dollar via US sanctions has accelerated the ongoing global de-dollarization efforts. We outlined the rapidly unfolding developments earlier this year in our 151 page Annual Thesis paper entitled, De-Dollarization. Documented de-dollarization efforts are now underway in China, Russia, Venezuela, Iran, India, Turkey, Syria, Qatar, Pakistan, Lebanon, Libya, Egypt, Philippines and more.

The real power of the dollar is its relationship with sanctions programs. Legislation such as the International Emergency Economic Powers Act, The Trading With the Enemy Act and The Patriot Act have allowed Washington to weaponize payment flows. The proposed Defending Elections From Threats by Establishing Redlines Act and Defending American Security From Kremlin Aggression Act would extend that armory.

When combined with access it gained to data from Swift, the Society for Worldwide Interbank Financial Telecommunication’s global messaging system, the U.S. exerts unprecedented control over global economic activity. Sanctions target persons, entities, organizations, a regime or an entire country. Secondary curbs restrict foreign corporations, financial institutions and individuals from doing business with sanctioned entities. Any dollar payment flowing through a U.S. bank or the American payments system provides the necessary nexus for the U.S. to prosecute the offender or act against its American assets. This gives the nation extraterritorial reach over non-Americans trading with or financing a sanctioned party. The mere threat of prosecution can destabilize finances, trade and currency markets, effectively disrupting the activities of non-Americans.

The countries cited above are aggressively reacting to this. Gold is non-digital and does not move through electronic payments systems, so it is impossible for the U.S. to freeze on interdict.

Central banks are stocking up on gold. According to the World Gold Council, net buying by central banks reached 145.5 tons in the first quarter of 2019. That’s a 68% increase over last year. And it’s the most gold central banks have bought in the first quarter since 2013.

Soon both the buying of gold by major players such as Russia, China, India, Iran and Turkey, along with an emerging gold backed cryptocurrency for international settlements, will take gold towards testing prior 2011 highs.

Major investors such as Paul Tudor Jones recently went on record as saying:

“The best trade is going to be gold. If I have to pick my favorite for the next 12-24 months it probably would be gold. I think gold goes beyond $1,400… it goes to $1,700 rather quickly. It has everything going for it in a world where rates are conceivably going to zero in the United States.”

“Remember we’ve had 75 years of expanding globalization and trade, and we built the machine around the believe that’s the way the world’s going to be. Now all of a sudden it’s stopped, and we are reversing that. When you break something like that, the consequences won’t be seen at first, it might be seen one year, two years, three years later. That would make one think that it’s possible that we go into a recession. That would make one think that rates in the US go back toward the zero bound and in the course of that situation, gold is going to scream. “

Of course, we have heard this sort of talk ever since gold hit its prior high in 2011.

However, this time the technical charts are starting to sing the same tune with lyrics such as “Reverse Head & Shoulders”, “Cup & Handle” and “Bullish Ascending Triangle”.

All of this leaves us currently at critical overhead resistance levels, which if broken will likely take gold denominated in US dollar towards previous highs.

What the gold buying strategies of Russia, China, India, Iran, Turkey et al. have in common is a desire to escape from dollar hegemony and the imposition of dollar-based sanctions by the U.S. The practical implication for gold investors is a firm floor under gold prices since these players can be relied upon to buy any dips.

According to James Rickards:

“The primary factor that has been keeping a lid on gold prices is the strong dollar. The dollar itself has been propped up by the Fed’s policy of raising interest rates and reducing money supply, so-called “quantitative tightening” or QT. These tight money policies have amplified disinflationary trends and pushed the Fed further away from its 2% inflation goal.

However, the Fed reversed course on rate hikes last December and has announced it will end QT next September. These actions will make gold more attractive to dollar investors and lead to a dollar devaluation when measured in gold.

The price of gold in euros, yen and yuan could go even higher since the ECB, Bank of Japan and People’s Bank of China will still be trying to devalue against the dollar as part of the ongoing currency wars. The only way all major currencies can devalue at the same time is against gold, since they cannot simultaneously devalue against each other.

A situation in which there is a solid floor on the dollar price of gold and a need to devalue the dollar means only one thing – higher dollar prices for gold. A breakout to the upside is the next move for gold.“

In 2018, central banks added nearly 23 million ounces of gold, up 74% from 2017. This is the highest annual purchase rate increase since 1971, and the second-highest rate in history. Russia was the biggest buyer. And not surprisingly, the lion’s share of gold is flowing into central banks of countries that are in the sights of America’s killing machine—the Military Industrial Complex that Eisenhower warned us about in 1958.

The Bank for International Settlements (BIS), located in Basal, Switzerland, is often referred to as the central bankers’ bank. Related to this issue of central bank hoarding of gold is the fact that on March 29 the BIS will permit central banks to count the physical gold it holds (marked to market) as a reserve asset just the same as it allows cash and sovereign debt instruments to be counted.

There has been a long-term view that China and other nations dishoarding dollars in favor of gold have been quite happy about western banks trashing the gold price through the synthetic paper markets. But one has to wonder if that might not change, once physical gold is marked to market for the sake of enlarging bank balance sheets.

This also raises the question with regard to how much gold the U.S. actually holds as opposed to what it claims to hold. James Sinclair has always argued that the only way the world can overcome the debt that is strangling the global economy is to remonetize gold on the balance sheets of central banks at a price in many thousands of dollars higher. This would mean a major change in the global monetary system away from the dollar, as China has been pushing for the last decade or so.

If banks own and possess gold bullion, they can use that asset as equity and thus this will enable them to print more money. It may be no coincidence that as March 29th has been approaching banks around the world have been buying huge amounts of physical gold and taking delivery. For the first time in 50 years, central banks bought over 640 tons of gold bars last year, almost twice as much as in 2017 and the highest level raised since 1971, when President Nixon closed the gold window and forced the world onto a floating rate currency system.

But as Chris Powell of GATA noted, that in itself is not news. The move toward making gold equal to cash and bonds was anticipated several years ago. However, what is news is the realization by a major Italian Newspaper, II Sole/24 Ore, that “synthetic gold,” or “paper gold,” has been used to suppress the price of gold, thus enabling countries and their central banks to continue to buy gold and build up their reserves at lower and lower prices as massive amounts of artificially-created “synthetic gold” triggers layer upon layer of artificially lower priced gold as unaware private investors panic out of their positions.

The paper concludes that,

“In recent years, but especially in 2018, a jump in the price of gold would have been the normal order of things. On the contrary, gold closed last year with a 7-percent downturn and a negative financial return. How do you explain this? While the central banks raided “real” gold bars behind the scenes, they pushed and coordinated the offer of hundreds of tons of “synthetic gold” on the London and New York exchanges, where 90 percent of the trading of metals takes place. The excess supply of gold derivatives obviously served to knock down the price of gold, forcing investors to liquidate positions to limit large losses accumulated on futures. Thus, the more gold futures prices fell, the more investors sold “synthetic gold,” triggering bearish spirals exploited by central banks to buy physical gold at ever-lower prices”.

The only way governments can manage the levels of debt that threaten the financial survival of the Western world is to inflate (debase) their currencies. The ability to count gold as a reserve from which banks can create monetary inflation is not only to allow gold to become a reserve on the balance sheet of banks but to have a much, much higher, gold price to build up equity in line with the massive debt in the system.

If you were contemplating an investment at the beginning of 2014, which of the two assets graphed below would you prefer to own?

Data Courtesy: Bloomberg

Data Courtesy: Bloomberg

In the traditional and logical way of thinking about investing, the asset that appreciates more is usually the preferred choice.

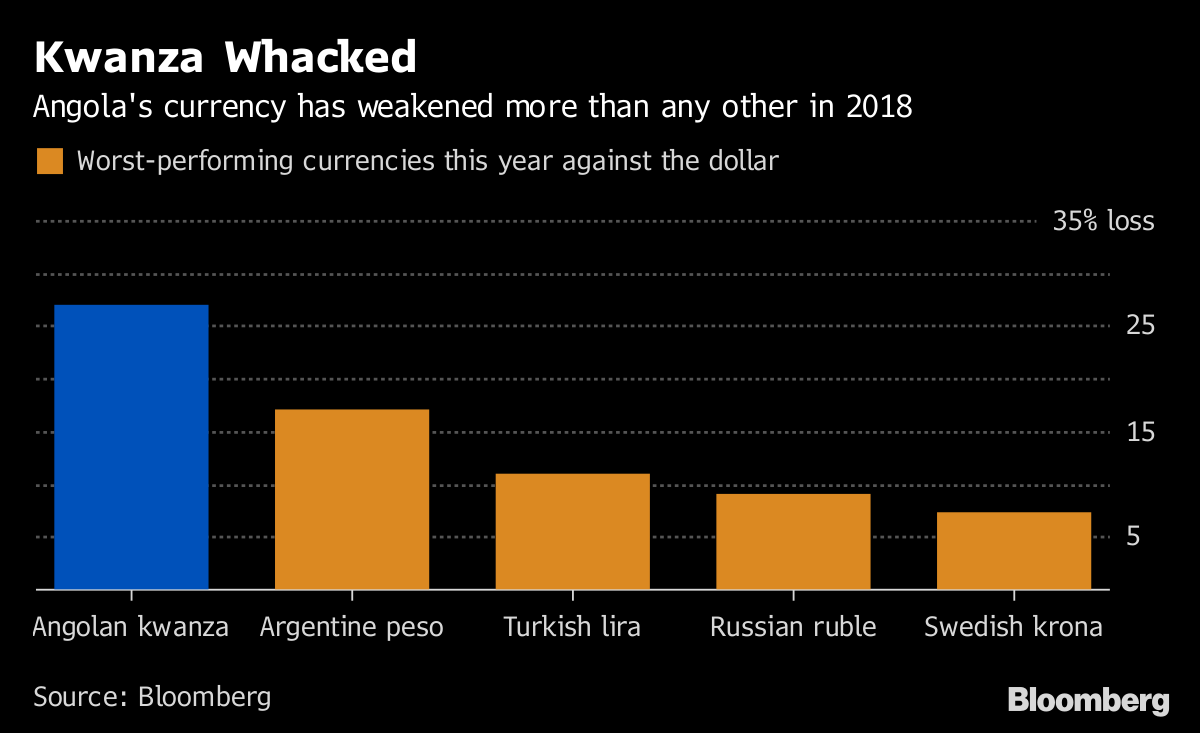

However, the chart above depicts the same asset expressed in two different currencies. The orange line is gold priced in U.S. dollars and the teal line is gold priced in Turkish lira. The y-axis is the price of gold divided by 100.

Had you owned gold priced in U.S. dollar terms, your investment return since 2014 has been relatively flat. Conversely, had you bought gold using Turkish Lira in 2014, your investment has risen from 2,805 to 7,226 or 2.58x. The gain occurred as the value of the Turkish lira deteriorated from 2.33 to 6.04 relative to the U.S. dollar.

Although the optics suggest that the value of gold in Turkish Lira has risen sharply, the value of the Turkish Lira relative to the U.S. dollar has fallen by an equal amount. A position in gold acquired using lira yielded no more than an investment in gold using U.S. dollars.

Data Courtesy: Bloomberg

This real-world example is elusive but important. It helps quantify the effects of the recent economic chaos in

This real-world example is elusive but important. It helps quantify the effects of the recent economic chaos in Turkey. Turkey’s economic future remains uncertain, but the reality is that their currency has devalued as a result of large fiscal deficits and heavy borrowing used to make up the revenue shortfall. Inflation is not the cause of the problem; it is a symptom. The cause is the dramatic increase in the supply of lira designed to solve the poor fiscal condition.

A Turkish citizen who held savings in lira is much worse off today than even two months ago as the lira has fallen in value. She still has the same amount of savings, but the savings will buy far less today than only a few weeks ago. Her neighbor, who held gold instead of lira, has retained spending power and therefore wealth. This illustration highlights the ability of gold to convey clear comparisons of various countries’ circumstances. It also illustrates the damage that imprudent monetary policy can inflict and the importance of gold as insurance against those policies.

Using Turkey as an example also helps illustrate why we say that inflationary regimes impose a penalty on savers. Inflation encourages and even forces people to spend, invest or speculate to offset the effects of inflation. Investing and speculating entail risk, however, so in an inflationary regime one must assume risk or accept a decline in purchasing power.

Most people think of inflation as rising prices. Although that is the way most economists represent inflation, the truth is that inflation is actually your money losing value. Inflation is not caused by rising prices; rising prices are a symptom of inflation. The value of money declines as a result of increasing money supply provided by the stewards of monetary discipline, the Federal Reserve or some other global central bank.

This is difficult to conceptualize, so let’s bring it home in a simple example. If you live in a country where the annual inflation rate is a steady 2%, the value of the currency will decline every year by 2% on a compounded basis. At this rate, the purchasing power of the currency will be cut in half in less than 35 years.

Now consider a country, like Turkey, that has been running chronic deficits, printing money rapidly to make up a revenue shortfall, and begins to experience accelerating inflation. The annual inflation rate in Turkey is now estimated to be over 100% or 8.30% per month, a difficult number to comprehend. The value of their currency is currently falling at an accelerating pace so that what might have been purchased with 500 lira 9 months ago now requires 1,000 lira.

Put another way, for the prudent retiree who had 10,000 lira in cash stashed away nine months ago, the inflation-adjusted value of that money has now fallen to less than 5,000 lira. If inflation persists at that rate, the 10,000 will become less than 1,000 in 29 months.

Believe it or not, Turkey is, so far, a relatively mild example compared to hyperinflationary episodes previously seen in Germany, Czechoslovakia, Venezuela, and Zimbabwe. These instances devastated the currencies and the wealth of the affected citizens. Fiscal imprudence is a real phenomenon and one that eventually destroys the financial infrastructure of a country. For more on the insidious role that even low levels of inflation have on purchasing power, please read our article: The Fed’s Definition of Price Stability is Likely Different than Yours.

There are over 3,800 historical examples of paper currencies that no longer exist. Although some of these currencies, like the French franc or the Greek drachma disappeared as a result of being replaced by an alternative (euro), many disappeared as a result of government imprudence, debauching the currency and hyperinflation. In all of those cases, persistent budget deficits and printed money were common factors. This should sound worryingly familiar.

Modern day central banks function by employing a steady dose of propaganda arguing against the risks of deflation and in favor of the benefits of a “modest” level of inflation. The Fed’s Congressional mandate is to “foster economic conditions that promote stable prices and maximum sustainable employment” but promoting stable prices evolved into a 2% inflation target. The math is not complex but it is difficult to grasp. Any number, no matter how small, compounded over a long enough time frame eventually takes on a parabolic, hockey stick, shape. The purpose of the inflation target is clearly intended to encourage borrowing, spending and speculating as the value of the currency gradually erodes but at an ever-accelerating pace. Those not participating in such acts will get left behind.

In the same way that rising prices are a symptom of inflation attributable to too much printed money in the system, deflation is falling prices due to unfinanceable inventories and merchandise pushed on to the market caused by too much debt. Contrary to popular economic opinion, deflation is not falling prices caused by a technology-enhanced decline in the costs of production – that is more properly labeled as “progress.” The Fed is either knowingly or unknowingly conflating these two separate and very different issues under the deflation label as support for their “inflation target”. In doing so, they are creating the conditions for deflation as debt burdens mount.

Gold, for all its imperfections, offers a time-tested, stable base against which to measure the value of fiat currencies. Accountability cannot be denied. Despite the unwillingness of most central bankers to acknowledge gold’s relevance, the currencies of nations will remain beholden to the “barbarous relic”, especially as governments continue to prove feckless in their application of fiscal and monetary discipline.

Source: Authored by Michael Lebowitz via RealInvestmentAdvice.com| ZeroHedge

Gold Surges To Record In Turkey and Other Emerging Markets as Currencies Collapse

from Bloomberg:

With just a month until elections, shopkeepers at Turkey’s biggest bazaar say they’re seeing a jump in demand for gold coins.

“Turkish people have an interesting behavior — they buy gold when the prices are rising, they think it’s gonna rise more,” said Gokhan Karakan, 32, who runs a gold exchange office in the heart of Istanbul’s Grand Bazaar. “People think there is a trend here and choose to buy gold until uncertainty is out of the way.”

On Friday afternoon, at the Grand Bazaar — one of the world’s oldest covered markets — shopkeepers said more customers were buying gold, instead of selling it, in hopes that the metal will keep its worth as the value of the lira plunges.

Gold priced in lira is more “expensive” than ever, but that’s not deterring buyers, who are looking for a safe haven.

“Turkish people love gold,” said Tekin Firat, 30, who owns and runs a gold store the bazaar. “People think that it will never lose in the long run.”

Citizens are buying up gold as the lira plunges in latest currency crisis. Recep Tayyip Erdogan, who’s about to launch a re-election campaign that may provide the toughest electoral test of his 15 years in power, is an outspoken advocate of cheap money. He’s up against investors demanding higher returns to fund an economy beset by inflation and a swollen current account deficit.

Gold has a special importance in Turkey. The country is to home the ancient kingdom of Lydia, where the earliest known gold coinage originated in the 7th century B.C.

Turkey imported 118 metric tons of bullion, worth $5 billion at today’s prices, in first four months of this year, the most over that period, according to data going back to 1995 from the Istanbul Gold Exchange. Last year, imports reached a record.

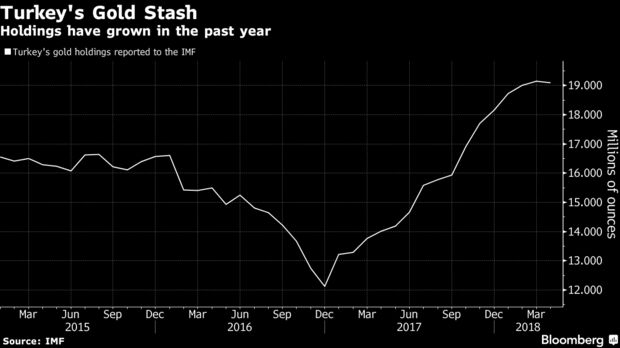

It’s not just consumers that are snapping up gold. Official reserves have also increased over the past year. The central bank doesn’t comment on its gold strategy, but previously said the changes in its holdings are part of an effort to diversify its reserves.

The reported figure may be misleadingly high because the central bank allows commercial banks to deposit gold as part of their reserves. The government last year launched a campaign to get more “under-the-pillow gold” into the formal banking system. About half of the 216 ton inflow since the start of 2017 can be attributed to this alternative source, according to Matthew Turner, a strategist at Macquarie Group Ltd. in London.

Even so, the purchases have happened a year after Erdogan urged Turks to convert their foreign currency savings into liras and gold, and tensions with the U.S. reached a new low.

“The central bank certainly has been more active in the gold market,” said Turner. “It seems the government would like a larger share of its reserves in assets that’s not related to the U.S. dollar.”

In 2017, the central bank withdrew of its 28.7 tons of gold, worth about $1.2 billion, from Federal Reserve vaults. It didn’t say where the gold went, but holdings increased at Borsa Instanbul, the Bank of England and Bank of International Settlements, according to a report released in April.

The decision for any country to withdraw gold from U.S. vaults is rare — happening only a handful of times in the past decade. Since 2011, Germany, the Netherlands, Hungary and Venezuela have repatriated their gold holdings from the U.S.

Turkey’s decision to withdraw gold may have been a reaction to U.S. court cases against Turkish banks for alleged deals struck with Iran, said Cagdas Kucukemiroglu, a Middle Eastern gold analyst at research firm Metals Focus.

“Having the gold physically at home allows countries to feel like they are in control of their reserves,” said Brian Lucey, a professor of finance at Trinity Business School in Dublin.

The Turkish government has withdrawn its reserves of gold from the Federal Reserve. Erdogan clearly is positioning himself to be able to seek its own power that will be contrary to international policy. Erdogan is one of those politicians who still think in the old days of Empire. As a member of NATO, he has constantly been threatening Greece. So what happens if we see a war between two NATO members? Who does NATO then support? When in doubt, bring the gold home in preparation for in time of war, a currency will not suffice.

A Fox Business report states demand for gold is at a 10-year low. What’s the real story?

Please consider Gold Demand Slumps to a 10-Year Low.

For gold investors, the rising market volatility is no match for the currently growing economy, with gold holdings slumping to a decade low, according to the World Gold Council (WGC).

The WGC reported that global gold demand fell to its lowest first-quarter level since 2008, falling to 973 metric tons in the first quarter of 2018, a 7% drop compared to the 1,047 metric tons in the first quarter of 2017.

More Luster in Stock Markets

Reuters reports U.S. Gold Coin Sales Slide as Stock Markets Show More Luster.

U.S. retail investors are losing their appetite for physical gold as buoyant stock markets offer tempting alternatives, sending sales of newly minted coins to their lowest in a decade.

More and more coins are also being sold back onto the market, further eroding demand for newly minted products.

Gold American Eagle bullion coin sales from the U.S. Mint slumped to a third of the previous year’s level in 2017, their weakest since 2007.

They were down nearly 60 percent year on year in the first quarter. Sales so far this month, at 2,500 ounces, are less than half last April’s total, and a fraction of the 105,500 ounces sold in April 2016.

Contrary Indicator

For starters. retail investors dumping gold coins is a contrary indicator. And if they are dumping gold coins to buy Bitcoin or stock that is a contrary indicator for Bitcoin and Stocks.

What About Demand?

Actually, demand for gold bottomed in December of 2015.

How do I know? By looking at the price.

Gold Demand

As noted by the chart, demand for gold peaked in September of 2011. Demand bottomed in December of 2015.

Wait a second, you say, those are prices!

Yes, exactly.

Unlike silver, which is used up industrially, nearly every ounce of gold ever mined is available for sale.

Someone has to own those ounces. The price of gold represents the demand for gold.

Gold Up 31%, Retail Selling

Gold is up 31% but retail investors are selling their coins. That’s a major contrary indicator.

Driver for Gold

The primary driver for the price of gold is faith in central banks. In 2011, there were worries the Eurozone would break up.

In 2012, ECB president Mario Draghi made a famous speech, declaring, “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Curiously, he did not do a thing at the time. The speech restored faith.

Gold vs. Faith in Central Banks

Faith on the Wane

Some believe the Fed is way behind the curve. Others thinks a deflationary bust is coming and the Fed will engage in more QE.

Pick your reason, but faith in central banks is on the wane.

Deflationary Bust

Given the amount of global financial leverage, I strongly suggest a deflationary bust is the most likely outcome looking ahead.

“If I were trying to create a deflationary bust, I would do exact exactly what the world’s central bankers have been doing the last six years,” said Stanley Druckenmiller.

For details of Druckenmiller’s excellent speech, please see Can We Please Try Capitalism? Just Once?

How will the Fed respond to a deflationary bust?

The obvious answer is more printing and more QE. I expect a move higher in gold similar to the move from 2009-2011.

Silver is down 1% year-to-date, while the dollar has tumbled 3.5% and gold has surged 4%, sending a possible warning signal to the broader market.

This dramatic divergence between gold and silver prices has sent the ratio of the two to multi-year highs.

The divergence between the two means prices for gold are 82 times those of silver, which is 27% more than the 10-year average.

As The Wall Street Journal reports, a higher gold-to-silver ratio is viewed by some investors as a negative economic indicator because money managers tend to favor gold when they think markets might turn rocky and discard silver when they are worried about slower global growth crimping consumption.

“There’s just not many people looking to buy silver at this point in time,” said Walter Pehowich, senior vice president at Dillon Gage Metals.

“There’s a lot of silver that comes out of the refineries, and they can’t find a home for it.”

The precious metals ratio last stayed above 80 in early 2016, when worries about a Chinese economic slowdown roiled markets, and in 2008 during the financial crisis. The ratio’s recent rise comes as speculators have turned the most bearish ever on silver and inventories in warehouses have risen, a sign there could be too much supply.

While investors have flocked toward gold with equity markets wobbling, money managers seeking safety or alternative assets haven’t favored silver.

“It’s not seeing great hedge demand because it’s just easy to go to gold,” said Dan Denbow, who manages the USAA Precious Metals and Minerals Fund . “Gold is a bit more predictable.”

As WSJ conclude, some analysts think silver’s underperformance is a negative sign for precious metals broadly because it is a less actively traded commodity, making it more vulnerable to bigger price swings on the way up and down.

One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia.

In his speech, Shvetsov provided an update on an important development involving the Russian central bank in the worldwide gold market, and gave further insight into the continued importance of physical gold to the long term economic and strategic interests of the Russian Federation.

Firstly, in his speech Shvetsov confirmed that the BRICS group of countries are now in discussions to establish their own gold trading system. As a reminder, the 5 BRICS countries comprise the Russian Federation, China, India, South Africa and Brazil.

Four of these nations are among the world’s major gold producers, namely, China, Russia, South Africa and Brazil. Furthermore, two of these nations are the world’s two largest importers and consumers of physical gold, namely, China and Russia. So what these economies have in common is that they all major players in the global physical gold market.

Shvetsov envisages the new gold trading system evolving via bilateral connections between the BRICS member countries, and as a first step Shvetsov reaffirmed that the Bank of Russia has now signed a Memorandum of Understanding with China (see below) on developing a joint trading system for gold, and that the first implementation steps in this project will begin in 2018.

Interestingly, the Bank of Russia first deputy chairman also discounted the traditional dominance of London and Switzerland in the gold market, saying that London and the Swiss trading operations are becoming less relevant in today’s world. He also alluded to new gold pricing benchmarks arising out of this BRICS gold trading cooperation.

BRICS cooperation in the gold market, especially between Russia and China, is not exactly a surprise, because it was first announced in April 2016 by Shvetsov himself when he was on a visit to China.

At the time Shvetsov, as reported by TASS in Russian, and translated here, said:

“We (the Central Bank of the Russian Federation and the People’s Bank of China) discussed gold trading. The BRICS countries (Brazil, Russia, India, China and South Africa) are major economies with large reserves of gold and an impressive volume of production and consumption of the precious metal. In China, gold is traded in Shanghai, and in Russia in Moscow. Our idea is to create a link between these cities so as to intensify gold trading between our markets.”

Also as a reminder, earlier this year in March, the Bank of Russia opened its first foreign representative office, choosing the location as Beijing in China. At the time, the Bank of Russia portrayed the move as a step towards greater cooperation between Russia and China on all manner of financial issues, as well as being a strategic partnership between the Bank of Russia and the People’s bank of China.

The Memorandum of Understanding on gold trading between the Bank of Russia and the People’s Bank of China that Shvetsov referred to was actually signed in September of this year when deputy governors of the two central banks jointly chaired an inter-country meeting on financial cooperation in the Russian city of Sochi, location of the 2014 Winter Olympics.

Deputy Governors of the People’s Bank of China and Bank of Russia sign Memorandum on Gold Trading, Sochi, September 2017. Photo: Bank of Russia

At the Moscow bullion market conference last week, Shvetsov also explained that the Russian State’s continued accumulation of official gold reserves fulfills the goal of boosting the Russian Federation’s national security. Given this statement, there should really be no doubt that the Russian State views gold as both as an important monetary asset and as a strategic geopolitical asset which provides a source of wealth and monetary power to the Russian Federation independent of external financial markets and systems.

And in what could either be a complete coincidence, or a coordinated update from another branch of the Russian monetary authorities, Russian Finance Minister Anton Siluanov also appeared in public last weekend, this time on Sunday night on a discussion program on Russian TV channel “Russia 1”.

Siluanov’s discussion covered the Russian government budget and sanctions against the Russian Federation, but he also pronounced on what would happen in a situation where a foreign power attempted to seize Russian gold and foreign exchange reserves. According to Interfax, and translated here into English, Siluanov said that:

“If our gold and foreign currency reserves were ever seized, even if it was just an intention to do so, that would amount to financial terrorism. It would amount to a declaration of financial war between Russia and the party attempting to seize the assets.”

As to whether the Bank of Russia holds any of its gold abroad is debatable, because officially two-thirds of Russia’s gold is stored in a vault in Moscow, with the remaining one third stored in St Petersburg. But Silanov’s comment underlines the importance of the official gold reserves to the Russian State, and underscores why the Russian central bank is in the midst of one of the world’s largest gold accumulation exercises.

From 2000 until the middle of 2007, the Bank of Russia held around 400 tonnes of gold in its official reserves and these holdings were relatively constant. But beginning in the third quarter 2007, the bank’s gold policy shifted to one of aggressive accumulation. By early 2011, Russian gold reserves had reached over 800 tonnes, by the end of 2014 the central bank held over 1200 tonnes, and by the end of 2016 the Russians claimed to have more than 1600 tonnes of gold.

Although the Russian Federation’s gold reserves are managed by the Bank of Russia, the central bank is under federal ownership, so the gold reserves can be viewed as belonging to the Russian Federation. It can therefore be viewed as strategic policy of the Russian Federation to have embarked on this gold accumulation strategy from late 2007, a period that coincides with the advent of the global financial market crisis.

According to latest figures, during October 2017 the Bank of Russia added 21.8 tonnes to its official gold reserves, bringing its current total gold holdings to 1801 tonnes. For the year to date, the Russian Federation, through the Bank of Russia, has now announced additions of 186 tonnes of gold to its official reserves, which is close to its target of adding 200 tonnes of gold to the reserves this year.

With the Chinese central bank still officially claiming to hold 1842 tonnes of gold in its national gold reserves, its looks like the Bank of Russia, as soon as the first quarter 2018, will have the distinction of holdings more gold than the Chinese. That is of course if the Chinese sit back and don’t announce any additions to their gold reserves themselves.

The Bank of Russia now has 1801 tonnes of gold in its official reserves

The Bank of Russia now has 1801 tonnes of gold in its official reserves

The new gold pricing benchmarks that the Bank of Russia’s Shvetsov signalled may evolve as part of a BRICS gold trading system are particularly interesting. Given that the BRICS members are all either large producers or consumers of gold, or both, it would seem likely that the gold trading system itself will be one of trading physical gold. Therefore the gold pricing benchmarks from such a system would be based on physical gold transactions, which is a departure from how the international gold price is currently discovered.

Currently the international gold price is established (discovered) by a combination of the London Over-the-Counter (OTC) gold market trading and US-centric COMEX gold futures exchange.

However, ‘gold’ trading in London and on COMEX is really trading of very large quantities of synthetic derivatives on gold, which are completely detached from the physical gold market. In London, the derivative is fractionally-backed unallocated gold positions which are predominantly cash-settled, in New York the derivative is exchange-traded gold future contracts which are predominantly cash-settles and again are backed by very little real gold.

While the London and New York gold markets together trade virtually 24 hours, they interplay with the current status quo gold reference rate in the form of the LBMA Gold Price benchmark. This benchmark is derived twice daily during auctions held in London at 10:30 am and 3:00 pm between a handful of London-based bullion banks. These auctions are also for unallocated gold positions which are only fractionally-backed by real physical gold. Therefore, the de facto world-wide gold price benchmark generated by the LBMA Gold Price auctions has very little to do with physical gold trading.

It seems that slowly and surely, the major gold producing nations of Russia, China and other BRICS nations are becoming tired of the dominance of an international gold price which is determined in a synthetic trading environment which has very little to do with the physical gold market.

The Shanghai Gold Exchange’s Shanghai Gold Price Benchmark which was launched in April 2016 is already a move towards physical gold price discovery, and while it does not yet influence prices in the international market, it has the infrastructure in place to do so.

When the First Deputy Chairman of the Bank of Russia points to London and Switzerland as having less relevance, while spearheading a new BRICS cross-border gold trading system involving China and Russia and other “major economies with large reserves of gold and an impressive volume of production and consumption of the precious metal”, it becomes clear that moves are afoot by Russia, China and others to bring gold price discovery back to the realm of the physical gold markets. The icing on the cake in all this may be gold price benchmarks based on international physical gold trading.

Frank Holmes, CEO of US Global Investors, reported back from the LBMA/LPPM Precious Metals conference that took place in Barcelona last week. Holmes gave the key note address on Day 2 “Quant Investing: From Gold to Cryptocurrencies.”

According to a thrilled Holmes, his presentation was voted the best – no doubt helped by the topical subject matter – and he was the recipient of an ounce of gold. He went on to relate the views of the conference attendees regarding the relative performance of gold and cryptos should there be (heaven forbid but sadly topical) a conflict involving nuclear weapons.

“Speaking of gold and cryptocurrencies, the LBMA conducted several interesting polls on which of the two assets would benefit the most in certain scenarios. In one such poll, attendees overwhelmingly said the gold price would skyrocket in the event of a conflict involving nuclear weapons. Bitcoin, meanwhile, would plummet, according to participants—which makes some sense. As I pointed out before, trading bitcoin and other cryptos is dependent on electricity and WiFi, both of which could easily be knocked out by a nuclear strike. Gold, however, would still be available to convert into cash.”

Unsurprisngly, the conference attendees gold voted gold as the superior store of value – a view which echoed the recent Goldman Sachs primer on precious metals. Goldman asked whether cryptos are the new gold and concluded “We think not, gold wins out over cryptocurrencies in a majority of the key characteristics of money…(precious metals) are still the best long-term store of value out of the known elements.”

However, there is obviously a difference between a superior store of value and shorter-term upside…and Holmes is far from bearish on bitcoin and other virtual currencies.

One of his observations is, alas, only too relevant for many gold investors that “Because they’re decentralized and therefore less prone to manipulation by governments and banks – unlike paper money and even gold – I think they could also have a place in portfolios. He goes on to aim a couple of blows on Bitcoin’s biggest recent detractors “Even those who criticize cryptocurrencies the loudest seem to agree. JPMorgan Chase CEO Jaime Dimon, if you remember, called bitcoin ‘stupid’ and a ‘fraud,’ and yet his firm is a member of the pro-blockchain Enterprise Ethereum Alliance (EEA). Russian president Vladimir Putin publicly said cryptocurrencies had ‘serious risks,’ and yet he just called for the development of a new digital currency, the ‘cryptoruble,’ which will be used as legal tender throughout the federation.”

It was Holmes observation on Bitcoin and Metcalfe’s Law that we particularly enjoyed …

Most people are probably (at least vaguely) familiar with Metcalfe’s Law on the economics of network effects. Wikipedia notes “Metcalfe’s law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n2). First formulated in this form by George Gilder in 1993, and attributed to Robert Metcalfe in regard to Ethernet, Metcalfe’s law was originally presented, c. 1980, not in terms of users, but rather of ‘compatible communicating devices’ (for example, fax machines, telephones, etc.). Only later with the globalization of the Internet did this law carry over to users and networks as its original intent was to describe Ethernet purchases and connections.[The law is also very much related to economics and business management, especially with competitive companies looking to merge with one another.”

This was Holmes’ take:

“Metcalfe’s law states that the bigger the network of users, the greater that network’s value becomes.

Robert Metcalfe, distinguished electrical engineer, was speaking specifically about Ethernet, but it also applies to cryptos. Bitcoin might look like a bubble on a simple price chart, but when we place it on a logarithmic scale, we see that a peak has not been reached yet.

Holmes is not the first to link Bitcoin with Metcalfe’s Law. For example, the Journal of Electronic Commerce Research published a study earlier this year. As TrustNodes reported

“The study measured the value of the network based on the price of relevant digital currencies and compared it to the number of unique addresses that engage in transactions on the network each day, according to the abstract. The results show that ‘the networks were fairly well modeled by Metcalfe’s Law, which identifies the value of a network as proportional to the square of the number of its nodes, or end users,’ the study says…The application of Metcalfe’s law towards transaction numbers specifically has long been suggested, with a fairly strong correlation between the price of digital currencies and their transaction numbers observed over many years. Ethereum, for example, was barely handling 20,000 transactions at the beginning of the year. Now it manages nearly 300,000 a day. Likewise, price has risen some 10x during the same time period. The reason for this relationship is fairly intuitive. As more projects build on ethereum, more users find it useful as there are more things they can do with it, which in turn makes ethereum more useful for new projects as it allows them to tap into more users. The same can be said about merchants. As more of them accept eth for payments, more think Ethereum can be useful for everyday things, which means more merchants want to accept it to tap into the increased number of users, so forming a virtuous cycle. Metcalfe’s law of network effects can be applied to developers too, or investors, including speculators. The more that use it, the more useful it becomes, with the reverse applying too. The fewer individuals that use it or the more that stop using it, the less useful it becomes.”

If that was his killer chart, however, this was perhaps his killer comment.

“Bitcoin adoption could multiply the more people become aware of how much of their wealth is controlled by governments and the big banks.“

This was among the hallway chatter I overheard at the Precious Metals Conference, with one person commenting that what’s said in private during International Monetary Fund (IMF) meetings is far more important than what’s said officially. We have a similar view of the G20, whose mission was once to keep global trade strong. Since at least 2008, though, the G20 has been all about synchronized taxation to grow not the economy but the role government plays in our lives. Trading virtual currencies is one significant way to get around that.

QUESTION #1: [_____] says that the dollar will collapse because with the debt ceiling gone – no more buyers of Treasuries in the markets and only the Fed Reserve buying – inflation goes to the wazoo. All over USA. care to comment?

ANSWER: Total nonsense. The USA debt of $20 trillion is a tiny fraction of global debt at $160 trillion. This entire theory does not hold up. Just where is all the money going to run? Gold? Institutions do not buy gold and cannot function with gold, which is not legal tender for even paying your taxes. The only thing that matters is the general public confidence. When the average person on the street no longer trusts government, that is the tipping point.

There is a whole series of people given a choice between a bar of chocolate and a bar of silver. They take the chocolate. Kids line up in Starbucks and pay with their phone – not even cash. Not until you shake the confidence of these people will you see the explosion in markets. That is what took place in the late 1970s. I was there. OPEC created the image of wholesale inflation. People were hoarding toilet paper.

QUESTION #2: What will Fed Balance Sheet Shrinkage do to Gold?

ANSWER: The opposite of what people think. Shrinking the Balance Sheet will be anti-inflationary to the standard reasoning and thus gold should collapse with deflation. However, the Fed has turned away from QE because pension funds are at serious risk. They have run off to emerging markets and bought very long-term paper desperately trying to get their yields up. As the stock market rises because there is no alternative, the Fed politically will be forced to raise rates. They will end up creating inflation with rising rates that will blow interest expenditure through the roof.

QUESTION #3: Since we bounced off the reversal again, obviously this still does not negate a break of $1k and then the slingshot up. But it just seems as if gold is on its deathbed. If nuclear war could not get it to exceed last year’s high, is there anything left in this bag of fundamentals we have been hearing about forever?

ANSWER: I understand. This is what the Reversal System is good at. We stopped within a dime of that number. What will be will be. We are running out of fundamentals to keep buying gold. It’s like the fake news about the storm in Florida that a 15 foot wall of water would destroy the coast. It never came and many people are really angry at the media. How many times can they do this before people no longer listen. Gold is a confidence game – plain and simple. This number is just incredibly important far more than most people dare to consider. I will be doing the gold report soon. It is very critical at this point.

CLOSING COMMENT: The number of long positions verse net shorts in gold reached about 5:1 and you saw what happened – it simply bounced off of the reversal and did not exceed last year’s high. I am always amazed at how people get so bullish and say I am wrong and then within 2 days they lose their shirt. As they say, you can lead a horse to water, but you cannot make him drink. Some people judge the next 10 years by a few days of price movement. That is how the market separates traders from fools.

Buy Martin Armstrong | Armstrong Economics

While many of the largest cryptocurrencies are fading modestly this morning, Bitcoin is holding on to dramatic agains which saw the largest virtual currency spike to as high as $4190 as Yen, Yuan, and Won trading activity dominated volumes.

Bitcoin Cash remains in 4th place overall by market cap but Bitcoin is the only currency higher among the top 5 this morning.

Soaring past $4000…

As CoinTelegraph reports, the trading of Bitcoin in Japanese yen has accounted for almost 46 percent of total trade volume worldwide. The trading of Bitcoin in US dollar accounted for around 25 percent, while the trading of Bitcoin in South Korean won and Chinese yuan accounted for approximately 12 percent each.

Additionally, anticipated demand is being priced in after VanEck filed for an ‘active strategy’ Bitcoin ETF: