(Bruce Wilds) Unnoticed by most taxpayers and touted as good news was the fact we the taxpayers of America have stepped up to the plate and bailed out hundreds of failing pensions. Much of this took place without the average citizen even knowing it occurred.

Tag Archives: Pension

185 Union Pensions Got Their $86 Billion Piece Of The COVID-19 Rescue “Pie”

(Birch Gold) Both private and public pensions have been having major funding issues and struggling to get a good ROI for a number of years.

So it’s no surprise that any sort of economic relief package presented to Congress would include funds for pensions. Especially since a “bailout” culture seems to have taken root in America.

$16 Billion Ohio Police & Fire Pension Fund Approves A 5% Allocation For Gold

Ohio’s $16 billion Police & Fire Pension Fund is following in the steps of Warren Buffett and making a big statement about owning gold. It has approved a 5% allocation to gold to help diversify the fund’s portfolio and to “hedge against the risk of inflation” according to Bloomberg.

The change was approved as “the first step” in an ongoing asset review that was presented to the fund’s board on August 26.

The fund was following the advice of its investment consultant, Wilshire Assocaites, in adding the gold allocation, according to Pensions & Investments. Additionally, the fund plans on adding the gold stake by borrowing; the fund is reportedly increasing its leverage from 20% to 25% to make the change.

“No new manager has been selected, and there currently is no timeline for implementing this change,” P&I reported.

Buffett’s move into gold has opened the door for fund managers to follow suit. Except, instead of playing in a hundred trillion dollar equity market, they are dealing with barely over $1 trillion in investable gold. This means that if the fund becomes a trend setter in the industry and if others follow suit, look out above.

Peter Schiff said on a recent podcast: “Warren Buffett seems to have a very good understanding of inflation. He doesn’t regard it as rising prices, he regards it as money supply. He’s talked about inflation as a hidden tax on savers. As a cruel tax. He understands the loss of value of money. He basically says that that’s inflation: the erosion of purchasing power of money. I think Buffett now has a much darker outlook on inflation than he did in the past.”

“Buffett is now of the opinion that inflation is going to be so high that gold is going to be particularly important to own, rather than just owning businesses,” he says.

You can listen to Schiff’s comments here:

If the inflation message starts to become clear to pension funds and main street asset managers, we could see a major sea change in psychology regarding gold as an investment.

Additionally, Rick Rule recently commented about exactly how under-owned gold was in the U.S.: “A major bank study, which I read, and I’ve quoted it before in interviews with you, says that between 0.3%-0.5% of savings and investment assets in the United States involve precious metals or precious metals securities.”

He continued: “That may have gone up because the denominator has declined the value, the Dow is an example, but the three decade-long mean was between 1.5%-2%. So gold is still very broadly under-owned, and I would suggest it’s even under-owned among people who are listening to this broadcast.”

But in plain English, another way to say it is that there simply isn’t enough gold available in the world for every pension fund to make the same 5% allocation.

Lock Downs Have Pushed Government Pensions Over The Edge

Posted last day of Q2-Jun 30, 2020 by Martin Armstrong

COMMENT: Facing a vicious circle of conflicting demands and priorities, the California Public Employees Retirement System is turning to debt – a risky scheme to borrow billions of dollars in hopes of juicing its investment returns.

The California Public Employees Retirement System, the nation’s largest pension trust, benefited greatly from the run up in stocks and other investments during the last few years, topping $400 billion early this year.

CalPERS needed it because it was still reeling from a $100 billion decline in its investment portfolio during the previous decade’s Great Recession and was tapping state and local governments for ever-increasing, mandatory “contributions” to keep pensions flowing and reduce its immense “unfunded liability.” But it faced a backlash from local officials who said vital services were being cut to make their CalPERS payments.

Just when CalPERS appeared to be climbing out of its hole, the COVID-19 pandemic erupted early this year, sending the economy into a tailspin. Virtually overnight, the fund saw its value take a $69 billion hit as the stock market — CalPERS’ biggest investment sector — tanked. Stocks have since recovered, but CalPERS is still down about $13 billion from its high early this year.

Further investment erosions would, almost automatically, trigger even greater CalPERS demands for contributions from government employers, but the recession is also eating into their tax revenues, creating substantial budget deficits.

It underscores CalPERS’ vulnerability to capital market gyrations. Investments more immune to fluctuations would be safer but they offer very low returns and CalPERS could not safely meet its lofty earnings goal — an average of 7% a year.

It’s a vicious circle of conflicting demands and priorities, driven by an official policy of providing generous, inflation-adjusted pensions for government workers, bolstered by the political clout of public employee unions.

CalPERS desperately needs an escape route and has chosen the perilous path of debt.

It plans to borrow billions of dollars — as much as $80 billion — to fatten its investment portfolio in fingers-crossed hopes that earnings gains will outstrip borrowing costs. It mirrors the recent and risky practice of local governments borrowing heavily to pay their pension bills via “pension obligation bonds.”

“More assets refers to a plan to use leverage, or borrowing, to increase the base of the assets generating returns in the portfolio,” the system’s chief investment officer, Ben Meng, wrote in the Wall Street Journal recently. “Leverage allows CalPERS to take advantage of low-interest rates by borrowing and using those funds to acquire assets with potentially higher returns.”

What could possibly go wrong?

The new scheme is an implicit admission that CalPERS can’t meet its 7% mark without increasing its exposure to the vagaries of the market. “There are only a few asset classes with a long-term expected return clearing the 7% hurdle,” Meng wrote.

Perhaps, then, the real problem is the 7% goal, much higher than those of private industry pension plans.

CalPERS and other public systems use higher earnings projections because they need them to pay for the expensive pensions that politicians have awarded. Inferentially, if they fall short of the mark, they can tap employers — i.e. taxpayers — to close the gap. However, that option is pretty much maxed out, which may explain why the very risky borrow-and-invest approach is being adopted.

This is serious stuff, so risky that the Legislature should dump its informal hands-off policy toward CalPERS and order up a comprehensive and independent examination of the system’s assets, liabilities, and long-term prospects of meeting its pension obligations.

SB

REPLY: We are looking at state and local pension funds collapsing. There is not much they can do. This is the collapse of socialism of which I am referring to. This is why the 2020 election will be so critical. The left is determined to overthrow Trump because they are looking to raise taxes dramatically. The World Economic Forum is already suggesting a 400% increase in taxation in Europe. These people are insane. We have states raising property taxes between 30-40% because the lock downs have deprived them of revenues that are pushing pension funds over the edge. They are brain dead, for so many people live hand-to-mouth and cannot afford such drastic increases in taxation. The Democrats are really hoping to draft Hillary for they believe that is their best shot to beat Trump. This is the entire objective for career politicians who have no real business to return to and they will always exempt trusts and themselves. Trump would never agree to the agenda and this is the battle to the death here in 2020.

First Ever Triple Bubble in Stocks, Real Estate & Bonds – With Nick Barisheff

We are living in an age of records in the financial world. The stock market is in its longest bull market in history and near all-time highs. The world has more debt than ever before while interest rates are near record lows, and some are negative in many countries for the first time ever. Nick Barisheff, CEO of Bullion Management Group (BMG), is seeing a dark ending for the era of financial records. Barisheff explains,

“I have been in the business for 40 years, and this is the first time we have had a simultaneous triple bubble, a bubble in real estate, stocks and bonds all at the same time. In 1999, it was a stock bubble. In 2007, it was a real estate bubble. This time, we’ve got a triple simultaneous bubble. So, when we have the correction, it’s going to be massive. Value calculations on equities say it’s worse than 1999, and in some cases worse than 1929. The big problem is this triple bubble is sitting on a mountain of debt like never before.”

What is going to be the reaction to this record bubble in everything crashing? Barisheff says, “I think you are going to be getting riots in the streets. It’s already happening in California. CalPERS is the pension fund administrator for a lot of the pension funds in California. So, already retired teachers, firefighters and policemen that are sitting in retirement getting their pension checks all got letters saying sorry, your pension checks from now on are going to be reduced by 60%. How do you get by then?”

What happens if the meltdown picks up speed and casualties? Barisheff says,

“I think the only option will be for the government is to print more money and postpone the problem yet a little bit longer, but that leads to massive inflation and eventually hyperinflation. Every fiat currency that has ever existed has always ended in hyperinflation, every single one. Since 1800, there have been 56 hyper inflations. Hyperinflation is defined as 50% inflation per month. That’s where we are going and what other choice is there?”

So, what do you do? Barisheff says,

“In the U.S. dollar since 2000, gold is up an average of 9.4% per year. In some countries, it’s up 14% and so on. If you take the overall average of all the countries, the average increase is 10% a year. Every time Warren Buffett is on CNBC, he seems to go out of his way to disparage gold, but if you look at a chart of Berkshire Hathaway and gold, gold has outperformed Berkshire Hathaway. . . Everybody worships Warren Buffett as the best investor in the world, and gold has outperformed his fund in U.S. dollars. I would not disparage gold if I were him. I’d keep quiet about it.”

There is a first for Barisheff, too, in this financial environment. He says for the first time ever, he’s “100% invested in gold” as a percentage of his portfolio. He says the bottom “is in for gold,” and “the bottom is in for silver, too.”

Barisheff contends that with the record bubbles and the record debt, both gold and silver will be setting new all-time high records as well in the not-so-distant future.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Nick Barisheff, CEO of BMG and the author of the popular book “$10,000 Gold.”

California Faces Pension Showdown

Governor Jerry Brown, as he leaves office is warning that California and its public agencies are on the road to “fiscal oblivion” if pension benefits can’t be adjusted down.

The media have been celebrating Governor Brown’s management skills at reversing the $27-billion state deficit he inherited from in 2010 from his predecessor, Arnold Schwarzenegger, to leave office in January with an alleged $13.8-billion surplus and a $14.5-billion rainy-day fund balance.

But Brown recently told reporters that California will be financially distressed again if the California Supreme Court rules in a case titled Cal Fire Local 2881 v. California Public Employees’ Retirement System against Brown’s 2012 California’s Public Employees’ Pension Reform Act that stopped the state and local selling of “airtime” that allowed public employees to spike their pension benefits by purchasing up to five years of un-worked service credit seniority.

California drastically increased public employee pension benefits in the fall of 2003, when the state allowed employees to purchase “airtime.” Prior to the pension spike, a 50-year-old fireman making $89,000 a year could retire at age 50 after 30 years of service and collect an $80,100-a-year pension with life expectancy of 76.3 years.

But under “airtime,” the fireman could purchase extra years of seniority at a cost per of $0.18022 per year for every $1 of salary. For $80,197.90, the fireman could increase his pension by $13,350 to $93,450. Such an investment in “airtime” would return a spectacular income stream of $351,105 over the next 26.3 years of life expectancy.

With many California public employees purchasing “airtime” to retire at 50 and make more than when employed, Democrat Brown ended the practice in 2013 for new hires after criticism that the practice amounted to a “gift of public funds” to his union allies.

Stanford University’s Institute for Economic Policy Research found that despite the state terminating “airtime” for new employees in 2013, the annual cost of funding the California Public Employee Retirement System (CalPERS) rose by 400 percent from 2003 to 2018 and would be up by 704 percent by 2030.

With an estimated unfunded pension liability of $464.4 billion in 2015, Stanford researchers estimated that the average unfunded liability per California household jumped from $9,127 in 2008; jumped to $21,491 in 2015; and would be over $40,000 in 2030.

The California Supreme Court heard testimony in Cal Fire v. CalPERS on December 5 over claims by the union that a 1955 decision set a precedent, referred to as the “California Rule,” that bars state and local government from reducing any promised retirement benefits without equivalent new compensation.

Lawyers for the state argued that the California Constitution is not a “straitjacket” and that making pension benefit changes should not be illegal under the California Constitution:

If the impairment is limited and does not meaningfully alter an employee’s right to a substantial or reasonable pension or if it is reasonable and necessary to serve an important public purpose, it may be permissible under the contract clause.

The biggest challenge for Brown’s effort to eliminate the California Rule is that he successfully lobbied the state legislature to pass collective bargaining for public employees in 1982, just as he was retiring from his second four-year term as governor.

The Bureau of Labor Statistics reported that average cost for the average private sector employee contribution for retirement and savings was 3.9 percent, and the average public-sector cost was 11.6 percent.

But even if the California’s Public Employees’ Pension Reform Act survives it Supreme Court appeal, CalPERS’ 2018 average cost for pensions as a percentage of worker compensation was 20.4 percent for State Industrial; 21.5 percent for State Safety; 43.5 percent for State Peace Officer/Fireman; and 55.2 percent for Highway Patrol.

The California Supreme Court is expected to release a decision regarding the California Rule in early 2019, just after Brown leaves office on January 7.

Meet America’s Next Pension Casualty

In 1923, a young Jewish immigrant from a small town in modern-day Ukraine founded a candy company in Brooklyn, New York that he called “Just Born”.

His name was Samuel Bernstein. And if you enjoy chocolate sprinkles or the hard, chocolate coating around ice cream bars, you can thank Bernstein– he invented them.

Nearly 100 years later, the company is still a family-owned business, producing some well-known brands like Peeps and Hot Tamales.

But business conditions in the Land of the Free have changed quite dramatically since Samuel Bernstein founded the company in 1923.

The costs to manufacture in the United States are substantial. And business regulations can be outright debilitating.

One of the major challenges facing Just Born these days is its gargantuan, underfunded pension fund.

Like a lot of large businesses, Just Born contributes to a pension fund that pays retirement benefits to its employees.

And in 2015, Just Born’s pension fund was deemed to be in “critical status”, prompting management to negotiate a solution with the employee union.

The union simply demanded that Just Born plug the funding gap, as if the company could merely write a check and make the problem go away.

Management pushed back, explaining that the pension gap could bankrupt the company.

And as an alternative, the company proposed to keep all existing retirees and current employees in the old pension plan, while putting all new employees into a different retirement plan.

It seemed like a reasonable solution that would maintain all the benefits that had been promised to existing employees, while still fixing the company’s long-term financial problem.

But the union refused, and the case went to court.

Two weeks ago the judges ruled… and the union won. Just Born would have no choice but to maintain a pension plan that puts the company at serious risk.

It’s literally textbook insanity. The court (and the union) both want to continue the same pension plan and the same terms… but they expect different results.

It’s as if they think the entire situation will somehow magically fix itself.

Those of us living on Planet Earth can probably figure out what’s coming next.

In a few years the fund will be completely insolvent.

And this company, which employs hundreds upon hundreds of well-paid factory workers in the United States, will probably have to start manufacturing overseas in order to save costs.

Honestly it’s some kind of miracle that Just Born is still producing in the US. The owners could have relocated overseas years ago and pocketed tens of millions of dollars in labor and tax savings.

But they didn’t. You’d think the union would have acknowledged that, and tried to find a way to work WITH the company to benefit everyone in the long-term.

Yet thanks to their idiotic union, these workers are stuck with an insolvent pension fund and zero job security.

Now, here’s the really bizarre part: Just Born contributes to something called a “Multi-Employer Pension Fund”.

In other words, it’s not Just Born’s pension fund. They don’t own it. They don’t manage it. And they’re just one of the several large companies (typically within the candy industry) who contribute to it.

So this raises an important question: WHO manages the pension fund?

Why… the UNION, of course.

The multi-employer pension fund that Just Born contributes to is called the Bakery and Confectionery Union and Industry International Pension Fund.

This is a UNION pension fund. It was founded by the Union. And the President of the Union even serves as chairman of the fund.

This is truly incredible.

So basically the union mismanaged its own pension fund, and then legally forced the company into an unsustainable financial position that could cost all the employees their jobs. It’s genius!

Just Born, of course, is just one of countless other businesses that faces a looming pension shortfall.

General Electric has a pension fund that’s underfunded by a whopping $31 billion.

Bloomberg reported last summer that the biggest corporations in the United States collectively have a $382 billion pension shortfall.

Not to worry, though. The federal government long ago set up an agency called the Pension Benefit Guarantee Corporation to bail out insolvent pension funds.

(It’s sort of like an FDIC for pension funds.)

Problem is– the Pension Benefit Guarantee Corporation is itself insolvent and in need of a bailout.

According to the PBGC’s own financial statements, they have a “net financial position” of MINUS $75 billion, and they lost $1.3 billion last year alone.

The federal government isn’t really in a position to help; according to the Treasury Department’s financial statements, Social Security and Medicare have a combined shortfall exceeding $40 TRILLION.

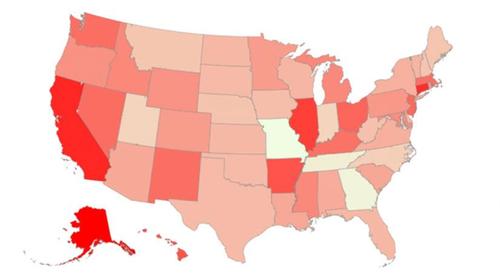

And public pension funds across the 50 states have an estimated combined shortfall of $1.4 TRILLION, according to a 2016 report by the Pew Charitable Trusts.

It doesn’t take a rocket scientist to see what’s coming.

Solvent, well-funded pensions and state/national retirement programs are as rare as mythical unicorns.

Nearly all of them have terminal problems and will likely become insolvent (if they’re not already).

The unions are driving their own pensions into the ground; and the government has ZERO bandwidth to bail anyone out, least of all itself.

So if you’re still more than two decades out from retirement, you can forget about any of these programs being there for you as advertised.

You must be logged in to post a comment.