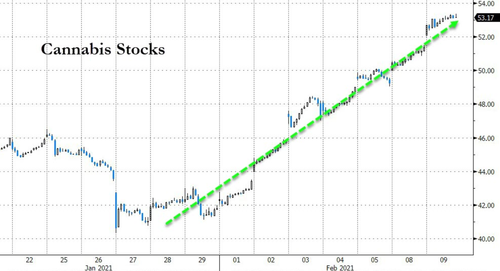

With Gamestop stock in freefall, down a further 5% Wednesday morning to the low 47-handle, r/WallStreetBets has gravitated to cannabis stocks in recent days, squeezing the living daylights out of any hedge fund that is short pot stocks.

With Gamestop stock in freefall, down a further 5% Wednesday morning to the low 47-handle, r/WallStreetBets has gravitated to cannabis stocks in recent days, squeezing the living daylights out of any hedge fund that is short pot stocks.

A week after New Jersey Governor Phil Murphy signaled his virtue to the ‘social justice’ agenda-watchers by proposing a tax on high frequency trading, no lesser establishment organization than The New York Stock Exchange has passive-aggressively signaled its displeasure by saying in a statement that it will test its ability to operate outside of New Jersey.

The major exchange operators previously have gone to court over proposals that they said would harm markets. NYSE, Nasdaq Inc. and CBOE Global Markets even took the extreme step of suing their main regulator, the U.S. Securities and Exchange Commission, over a transaction-fee pilot program last year. They won.

“A financial transaction tax is a recycled idea with a lousy track record — all over the world,” said the Equity Markets Association, a trade group that represents the three companies.

The move by New Jersey would “cause unintended and irreparable harm to the U.S. capital markets,” CBOE said in a separate statement. “A transaction tax is a direct cost shouldered by investors, who will also end up paying for the price of diminished liquidity and wider spreads in our markets.”

And as we noted previously, the NYSE has already threatened to depart the moment a tax was enacted:

“We have data centers in various states and the ability to move trading outside of New Jersey in a business day,” said Hope Jarkowski, co-head of government affairs for New York Stock Exchange parent Intercontinental Exchange.

And today, the exchange, in coordination with Nasdaq, CBOE Global Markets, and other industry participants, ramped up the rhetoric, saying that it will conduct a test of all its exchanges operating from their secondary locations on Sept. 26 to “confirm the industry’s ability to seamlessly move live trading out of New Jersey,” according to a statement.

* * *

Audience: NYSE, NYSE AmericanEquities, NYSE American Options, NYSE Arca Equities, NYSE Arca Options, NYSE Chicago, NYSE National, FINRA/NYSE TRF, and Global OTC Traders

Subject: NYSE exchanges to prepare for potential move from New Jersey data center, including temporary relocation of NYSE Chicago on September 28

Numerous NYSE member firms have recently reached out to the Exchange to understand our plans should New Jersey institute its proposed tax on financial transactions processed through electronic infrastructure located in the state. They are concerned, as are we, that any tax imposed will be passed through to NYSE members, and ultimately their clients, who are often the very same Main Street investors who reside in states like New Jersey and elsewhere.

NYSE has the ability to operate all of its markets out of either its primary data center in Mahwah, New Jersey or an alternate data center. Designed for various disaster recovery scenarios, a change in location can be performed in a matter of minutes, if necessary.

If our members express a strong preference to permanently relocate our trading infrastructure out of New Jersey, the process to do this is well-documented, regularly tested and would not cause any disruption to NYSE operations.

To help test and prepare our members for any such action, NYSE will implement two immediate measures:

1. Relocation of production trading for NYSE Chicago the week of September 28: The NYSE will operate one of its equity exchanges, NYSE Chicago, from its secondary data center from September 28th to October 2nd. This will confirm the industry’s ability to seamlessly move live trading out of New Jersey.

2. Weekend test of all markets: The NYSE, in coordination with Nasdaq, CBOE, SIFMA and other industry participants, will conduct a test of all its exchanges operating from their secondary locations on Saturday, September 26, 2020. This controlled test will exercise the industry’s preparedness for a potential wholesale transition out of New Jersey. Details for the weekend test will follow in a separate announcement.

* * *

Of course, the big question, as we previously noted, what happens when all the states in which NYSE have data centers follow NJ in establishing a paywall for ultra fast trades which do nothing to make the market more efficient unless one counts surging flash crashes “efficiency”?

Market liquidity is already at record lows!

A city boy, Kenny, moved to the country and bought a donkey from an old farmer for $100. The farmer agreed to deliver the donkey the next day.

The next day the farmer drove up and said: “Sorry son, but I have some bad news. The donkey died.”

Kenny replied, “Well then, just give me my money back.”

The farmer said, “Can’t do that. I went and spent it already.”

Kenny said, “OK, then just unload the donkey.”

The farmer asked, “What ya gonna do with him?”

Kenny: “I’m going to raffle him off.”

Farmer: “You can’t raffle off a dead donkey!”

Kenny: “Sure I can. Watch me. I just won’t tell anybody he is dead.”

A month later the farmer met up with Kenny and asked, “What happened with that dead donkey?”

Kenny: “I raffled him off. I sold 500 tickets at $2 a piece and made a profit of $998.00.”

Farmer: “Didn’t anyone complain?”

Kenny: “Just the guy who won. So I gave him his $2 back.”

Kenny grew up and eventually became the chairman of *****

Coronavirus has started a race into cash for all types of market participants. That has fueled rallies in reserve currencies—especially the dollar.

The U.S. dollar is approaching its highest level on record against other leading global currencies, according to the Bloomberg Dollar Spot Index. The index was up 1.1% in early trading Wednesday, and has climbed 6.5% in the past nine days. And derivatives markets indicate that even investors and banks in countries with their own major reserve currencies want to secure dollars.

Banks, companies, and investors have many good reasons to rush to secure dollar liquidity. Many businesses are facing the prospect of a steep decline in revenue as federal and local governments ask their constituents to stay home to prevent the spread of coronavirus.

That means businesses could struggle to keep paying leases, wages, and other costs. Workers (especially hourly workers) could struggle to pay their own living expenses. And banks could be met with withdrawal requests and surging demand for credit denominated in dollars.

“[The economic] front line in the crisis is the damage the pandemic is wreaking on companies in exposed sectors and on the economy more widely as the crisis spreads,” wrote Kit Juckes, a strategist at Société Générale. “So while market participants scramble [to] deleverage, the banks need money to lend to companies whose cash flow situation has changed almost overnight.”

The cash grab is echoing through markets in some striking ways. Even the lowest-risk markets—Treasuries and municipal bonds for example—have seen steep losses as investors move into cash. Benchmark 10-year and 30-year bond yields posted their steepest single-session jump since 1982 on Tuesday.

“This matters on a day-to-day basis for the [currency] market because liquidity stress, and a rush to get hold of dollar liquidity in particular, sends the dollar higher against everything,” Juckes wrote.

The widespread bid for liquidity has shown up in fund-flows data as well. Mutual funds in nearly every sector of markets lost billions of dollars in investor funds over the week ended March 11, the latest data reported by Refinitiv Lipper.

Taxable bond funds saw outflows of $11 billion that week, while equity funds lost $3.2 billion of cash and municipal (tax-exempt) bond funds lost $1.7 billion.

Money-market funds, on the other hand, brought in piles of cash. Investors put a net $87 billion into the sector as a whole over the week ended March 11, according to Refinitiv, the biggest inflow on record.

Within that category, even prime funds, or the money-market funds that buy short-term corporate debt, lost money over the week ended March 11, according to data from ICI.

Government money-market funds pulled in $97 billion, their second-biggest inflow on record, Refinitiv data show. The biggest week was in Sept. 2008, at the height of the financial crisis.

The results for the week ended March 18 won’t be out until Thursday. But if the steep declines in stocks, longer-term Treasuries, and corporate bonds are any indication, investors are still racing for the exits.

“That need for funds to flow into the economy isn’t going away any time soon,” Juckes wrote. “The result is that while direct financial effects of this crisis might be less acute than in ‘08, they will continue being felt for a long time.”

We just witnessed a global collapse in asset prices the likes we haven’t seen before. Not even in 2008 or 2000. All these prior beginnings of bear markets happened over time, relatively slowly at first, then accelerating to the downside.

This collapse here has come from some of the historically most stretched valuations ever setting the stage for the biggest bull trap ever. The coronavirus that no one could have predicted is brutally punishing investors that complacently bought into the multiple expansion story that was sold to them by Wall Street. Technical signals that outlined trouble way in advance were ignored while the Big Short 2 was already calling for a massive explosion in $VIX way before anybody ever heard of corona virus.

Worse, there is zero visibility going forward as nobody knows how to price in collapsing revenues and earnings amid entire countries shutting down virtually all public gatherings and activities. Denmark just shut down all of its borders on Friday, flight cancellations everywhere, the planet is literally shutting down in unprecedented fashion.

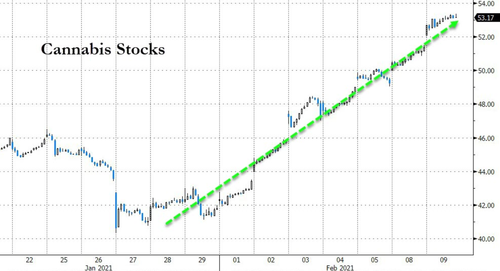

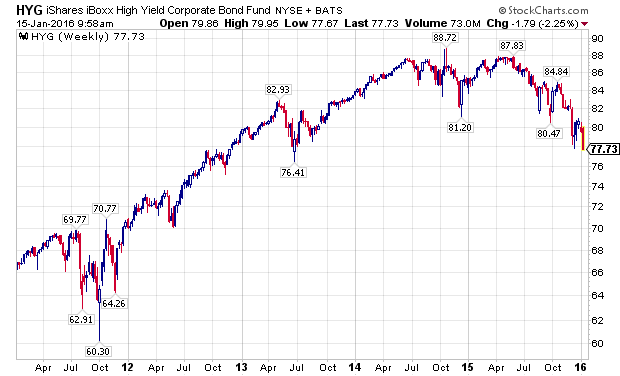

With energy junk bonds crashing…

… amid a (long-overdue) investor revulsion to the highly levered energy sector, much of which is funded in the high yield market, as crashing oil prices bring front and center a doomsday scenario of mass defaults as shale companies are unable to meet their debt and interest payment obligations, investor focus is shifting up the funding chain, and after assessing which shale names are likely to be hit the hardest, with many filing for bankruptcy if oil remains at or below $30, the next question is which banks have the most exposure to the energy loans funding these same E&P companies.

Conveniently, in a note this morning looking at the impact of plunging interest rates on bank profitability, Morgan Stanley also lays out the US banks that have the highest exposure to energy in their Q4 loan books.

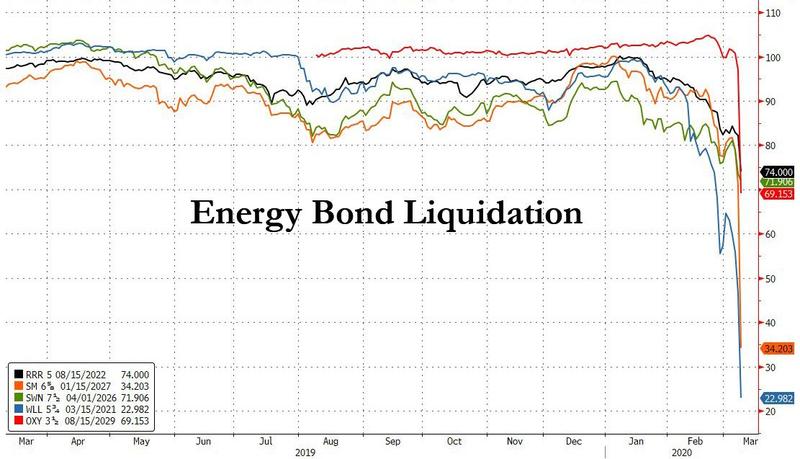

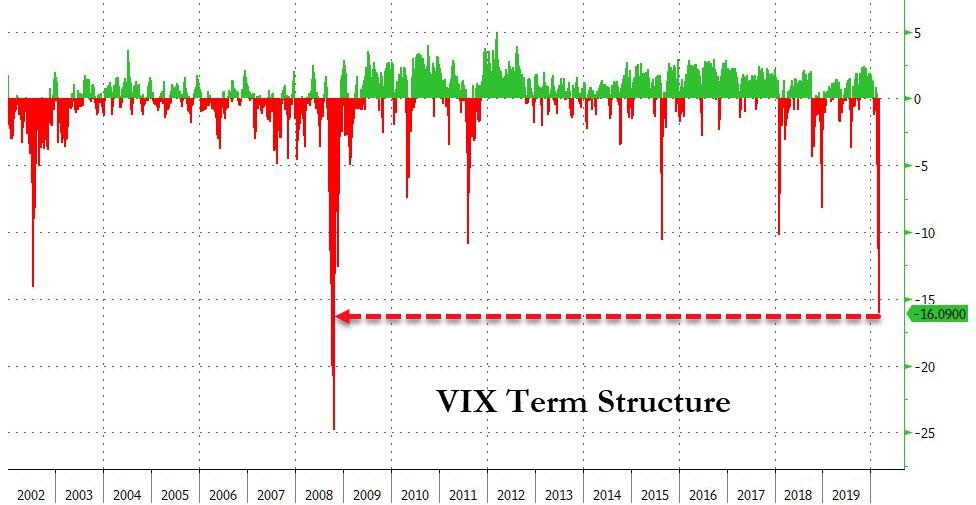

With stocks tumbling, the VIX has, predictably, soared, briefly tipping above 50 intraday on Friday and last trading above 46, surpassing the levels hit during the Volmageddon in Feb 2018 and the highest level since the US credit rating downgrade in August 2011.

Just as dramatic is the accelerating VIX term structure inversion, which has pushed the curve to the steepest backwardation since the financial crisis…

Gundlach Was Right – Even Investment Grade Credit Markets Are Crashing Today

It appears, as Jeff Gundlach warned last night, that the seizure in credit markets is about to get a lot more attention…

“The bond market is rallying because The Fed has reacted the seizure in the corporate bond market – which is not getting enough attention.”

The Fed cut rates, he added, “in reaction to even the investment being shutdown for 7 business days.“

Gundlach noted that Powell’s background in the private equity world – rather than academic economist land – has meant that his reaction function is driven by problems in the corporate bond market as “this will be problematic for the buyback aspect of the stock market.”

“I turned bullish on gold in the summer of 2018 on my Total Return webcast when it was at 1190. And it just seems to me, as I talked about my Just Markets webcast, which is up on DoubleLine.com on a replay, that the dollar is going to get weaker.

And the dollar getting weaker seems to be a policy. And the Fed cutting rates, slashing rates is clearly going to be dollar negative. And that means that gold is going to go higher.“

White House National Trade Council Director Peter Navarro sees the Dow a lot higher in 2020

‘I’m looking forward to a great 2020. I mean, forecast-wise, I’m seeing closer to 3% real GDP growth than 2%. I’m seeing at least 32,000 on the Dow.’

Peter Navarro

(by Mark Decambre / MarketWatch) President Donald Trump’s trade adviser Peter Navarro is calling for a roughly 13% gain by the Dow Jones Industrial Average DJIA, +0.27% in 2020, and on Monday described a long-awaited “Phase 1” trade deal as “in the bank.”

Speaking on CNBC on Tuesday, Navarro forecast another period of buoyancy for equity benchmarks and the U.S. economy, with a prediction that diminishing tensions between China and the U.S. over international trade policy will give way to another powerful uptrend for stocks. (Check out a clip of Navarro’s comments below):

Navarro’s comments made on the last trading session of 2019, came before President Donald Trump tweeted that a partial Sino-American trade resolution was set to be signed on Jan. 15. The president also said that he planned to travel to Beijing to start negotiations on the second phase of negotiations thereafter.

Softening tensions over import tariffs between Beijing and Washington have at least partly helped to lift U.S. stocks to their biggest annual gains in years. The Dow looked set to close out a banner year with a two-session skid but has advanced 21.8% this year to trade at around 28,410, picking up more than 5,000 points during the calendar year. Navarro’s forecast, atypical of a government trade negotiator, of a further 13% rise in the Dow to 32,000 in 2020 from currently levels would represent the equivalent of about a 3,600-point gain.

Broadly speaking, stock indexes have enjoyed a bumper year, notably in the past few months of 2019, with reports of an imminent detente on trade.

The S&P 500 SPX, +0.29% has climbed 28.4%, putting it on pace for its biggest gain since 2013 and the Nasdaq Composite Index COMP, +0.30% has gained about 35%, not far from its stellar 1997 return, when it jumped more than 38%.

This year’s gains followed a fall of 4.2% in the S&P 500 index on a total-return basis in 2018, though, so in aggregate there has been just a 12% compounded return over the last 2 years, Datatrek’s Nicholas Colas noted. That is not far off the average 50-year S&P return of 11.1%.

President Trump and his administration have been fixated on the performance of the stock market because they see it as a potential calling card for a second term in the White House after the 2020 elections.

Indeed, this isn’t the first time Navarro has made a forecast about the Dow.

Back in July on CNBC, Navarro said talks between Washington and Beijing were heading in a “very good direction” following a meeting between Trump and Chinese President Xi Jinping at the G-20 summit in Osaka.

At that point, about five months ago, he said that the 30,000 level for the Dow was achievable if Congress approved the U.S.-Mexico-Canada Agreement and the Federal Reserve lowered interest rates.

At its peak this year, the blue-chip index wasn’t that far off 30,000. The intraday peak for the Dow was 28,701, hit on Dec. 27, about 1,300 short of Navarro’s forecast. The Dow began trade in July, when Navarro made his earlier comments, at 26,720 and has climbed more than 6% thus far.

To be sure, investors harbor major concerns heading into next year that markets may not have room for further gains, particularly as investors worry that the China-U.S. trade pact may not yield substantive changes.

Trader’s Choice Gregory Mannarino describes how Navarro’s forecast is based upon far more debt and war in store for Americans …

First, the explanation from former CIA Director, current U.S. Secretary of State, Mike Pompeo:

“No matter what the market does from now until year end, there is simply not enough cash and/or liquidity to allow the plumbing of the market to cross into 2020 without a crisis”

For the past decade, the name of Zoltan Pozsar has been among the most admired and respected on Wall Street: not only did the Hungarian lay the groundwork for our current understanding of the deposit-free shadow banking system – which has the often opaque and painfully complex short-term dollar funding and repo markets – at its core…

… but he was also instrumental during his tenure at both the US Treasury and the New York Fed in laying the foundations of the modern repo market, orchestrating the response to the global financial crisis and the ensuing policy debate (as virtually nobody at the Fed knew more about repo at the time than Pozsar), serving as point person on market developments for Fed, Treasury and White House officials throughout the crisis (yes, Kashkari was just the figurehead); playing the key role in building the TALF to backstop the ABS market, and advising the former head of the Fed’s Markets Desk, Brian Sack, on just how the NY Fed should implement its various market interventions without disrupting and breaking the most important market of all: the multi-trillion repo market.

In short, when Pozsar speaks (or as the case may be, writes), people listen (and read).

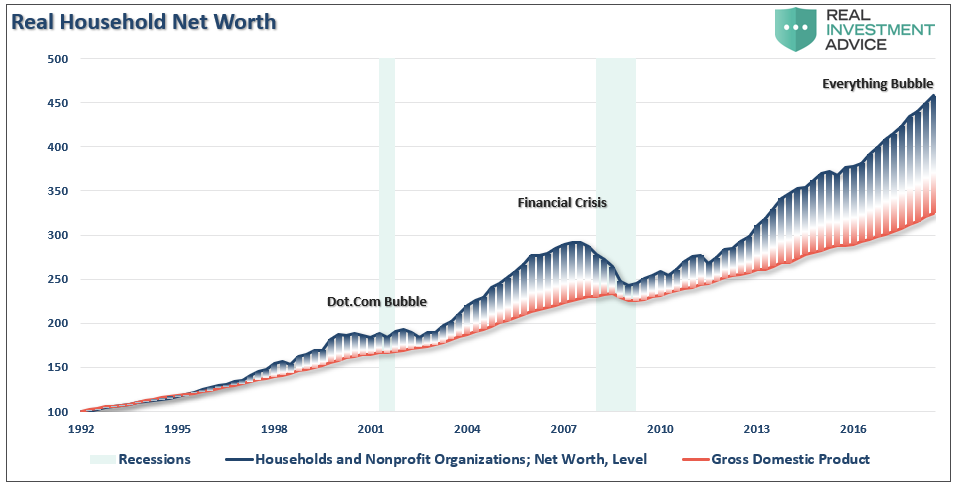

We are living in an age of records in the financial world. The stock market is in its longest bull market in history and near all-time highs. The world has more debt than ever before while interest rates are near record lows, and some are negative in many countries for the first time ever. Nick Barisheff, CEO of Bullion Management Group (BMG), is seeing a dark ending for the era of financial records. Barisheff explains,

“I have been in the business for 40 years, and this is the first time we have had a simultaneous triple bubble, a bubble in real estate, stocks and bonds all at the same time. In 1999, it was a stock bubble. In 2007, it was a real estate bubble. This time, we’ve got a triple simultaneous bubble. So, when we have the correction, it’s going to be massive. Value calculations on equities say it’s worse than 1999, and in some cases worse than 1929. The big problem is this triple bubble is sitting on a mountain of debt like never before.”

What is going to be the reaction to this record bubble in everything crashing? Barisheff says, “I think you are going to be getting riots in the streets. It’s already happening in California. CalPERS is the pension fund administrator for a lot of the pension funds in California. So, already retired teachers, firefighters and policemen that are sitting in retirement getting their pension checks all got letters saying sorry, your pension checks from now on are going to be reduced by 60%. How do you get by then?”

What happens if the meltdown picks up speed and casualties? Barisheff says,

“I think the only option will be for the government is to print more money and postpone the problem yet a little bit longer, but that leads to massive inflation and eventually hyperinflation. Every fiat currency that has ever existed has always ended in hyperinflation, every single one. Since 1800, there have been 56 hyper inflations. Hyperinflation is defined as 50% inflation per month. That’s where we are going and what other choice is there?”

So, what do you do? Barisheff says,

“In the U.S. dollar since 2000, gold is up an average of 9.4% per year. In some countries, it’s up 14% and so on. If you take the overall average of all the countries, the average increase is 10% a year. Every time Warren Buffett is on CNBC, he seems to go out of his way to disparage gold, but if you look at a chart of Berkshire Hathaway and gold, gold has outperformed Berkshire Hathaway. . . Everybody worships Warren Buffett as the best investor in the world, and gold has outperformed his fund in U.S. dollars. I would not disparage gold if I were him. I’d keep quiet about it.”

There is a first for Barisheff, too, in this financial environment. He says for the first time ever, he’s “100% invested in gold” as a percentage of his portfolio. He says the bottom “is in for gold,” and “the bottom is in for silver, too.”

Barisheff contends that with the record bubbles and the record debt, both gold and silver will be setting new all-time high records as well in the not-so-distant future.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Nick Barisheff, CEO of BMG and the author of the popular book “$10,000 Gold.”

Are we about to see the stock market crash this year? That is what Goldman Sachs seems to think, and it certainly wouldn’t be the first time that great financial chaos has been unleashed during the month of October. When the stock market crashed in October 1929, it started the worst economic depression that we have ever witnessed. In October 1987, the largest single day percentage decline in U.S. stock market history rocked the entire planet. And the nightmarish events of October 2008 set the stage for a “Great Recession” that we still haven’t fully recovered from. So could it be possible that something similar may happen in October 2019?

The storm clouds are looming and disaster could strike at any time. This is one of the most critical times in the history of our nation, and most Americans are completely unprepared for what is going to happen next.

(Sven Henrich) Are we hitting the wall? Markets. Economy. Technicals. Valuations. All appear at a key crossroads here. Last week’s 3% pullback, while in itself not seemingly dramatic, came at a very key point. Whether it is meaningful is too early to tell, but I have some eye opening data points for you that suggests it may very well turn out to be extremely meaningful.

In last weekend’s update (End Game) I highlighted the issue of market capitalization versus the underlying size of the economy. Let me dig a little deeper.

Is there a natural wall beyond which bubbles cannot go before they revert back to a more natural state of valuation? It’s a serious question especially looking at the structural context of the last few bubbles. The biggest bubbles in our lifetimes were the 2000 tech bubble, the 2007 real estate bubble and the monstrosity we are witnessing now, the central bank, cheap money bubble.

All 3 have done something unique. They have vastly accelerated asset prices above their historic track record. In 2000 and 2007 these bubbles moved stock markets wildly above the mean and investors got punished badly.

This is the chart I showed last week:

Peaks of 147% and 137% respectively. Now this bubble has arrived in full vengeance on the heels of $20 trillion in central bank intervention, a global collapse in yields and the TINA effects.

Now look closely what just happened in the past 18 months:

We keep hitting the same wall. January 2018 nearly 150% market cap to GDP and stocks got punished with a 10% correction.

Last September/October we hit a slightly lower high around 147% and stocks got hit with a 20% correction.

Now in July we hit 145%, another slightly lower high, and stocks have begun selling off again.

Is that it? Is that the valuation wall? How far and for how long can stock markets stay this far disconnected from the underlying size of the economy? All of history says: Not for very long.

Incidentally, why these slight lower highs? Because the larger stock market is weakening underneath from new high to new high. It’s what I’ve outlined with divergences and weakening participation, but neatly captured by the value line geometric index:

But the plot thickens.

The earth is not flat, despite some adherents to that fantasy, the same valuation wall can be observed across the globe (via Wordbank):

Each time market capitalizations cross the 110% mark things get iffy don’t they? Added plot twist: The world can lead in the realignment to reality process. Note the global valuation scheme peaked in 1999. US markets famously puked some more highs out into March of 2000. Well, this time around the world peaked in 2018 and since then it’s the US again squeezing out marginal new highs in 2019. Not Europe, not Asia, no, it’s the US on its own.

The earth is not flat.

The bull case from here is based on one factor alone: The Fed. I see it in every Wall Street case for new highs. The Fed is cutting, you must buy stocks. That’s it. It’s not earnings, not growth, no, Goldman is cutting earnings and growth, but raising price targets because of the Fed.

I submit to you that, while this may indeed come to fruition, it is structurally a reckless thing to do. For 2 reasons, both of which are predicated on the same thing: History.

There is no history, none, that supports stock market capitalizations above 145% of GDP for an extended period of time. None.

There is also no history, none, that’s suggests unemployment can stay this low for an extended period of time. None.

And their certainly is no history suggests that BOTH can be maintained for an extended period to time concurrently:

None. But you are welcome to believe it if you wish.

And hence, in context, Jay Powell’s comment about a ‘mid-cycle adjustment” was either disingenuous, ignorant or an outright lie.

We are here:

Looking at the yield curve, the reaction of the 10 year off of the 30+ year trend line and the basing of the low unemployment rate, does any of this suggest anything remotely close to mid-cycle? I submit to you that they don’t.

And switching to technicals, look at the trend lines in the $SPX chart above: The 2009 trend line STILL remains broken. I submit to you they jammed stocks higher in 2019 on the Fed pivot, the flip in policy, the promises of a rate cut, and the delivery of a rate cut, aided by still massive buybacks in the system. That’s it. They haven’t changed anything substantive on the economy. It’s still slowing, we still have trade wars and earnings growth remains flat to negative and there’s no growth in CAPEX or business investment.

Previous business cycles came to a sudden end when the employment picture changed trajectory, from a period of basing at the low end to shift to higher unemployment and a sudden steepening in the yield curves:

And guess what? Everything, the yield curves, the stock market valuation to GDP ratio at 145%, the Fed pivot, it all has led to here:

The magic 2.618 fib zone on $SPX (we missed it by a few handles) and exceeded it temporarily on the $DJIA:

We’ve hit walls everywhere. Technically, economically, valuation wise. To trust the Fed and to go long stocks here is to believe that none of these walls mean anything.

It’s to believe unemployment can be maintained at a historic 50 year low for an extended period of time, it’s to believe that stock market capitalization can be accelerated above a historic unproven 145% threshold for an extended period and it’s to believe in one’s ability to time any future steepening in the yield curves.

That’s a lot of believing.

I prefer seeing. And here’s what we just saw. We saw a market enter a technical risk zone that was outlined in advance:

And we saw market cleanly rejecting from that risk zone:

That doesn’t mean immediate confirmed doom and gloom, certainly not with a mere 3% from from the highs, but it speaks to the impressive confluence of technical and valuations factors that suggest that markets may be hitting the wall.

Technicals matter. Valuations matter.

For a run down on the technicals and implications please see the video below:

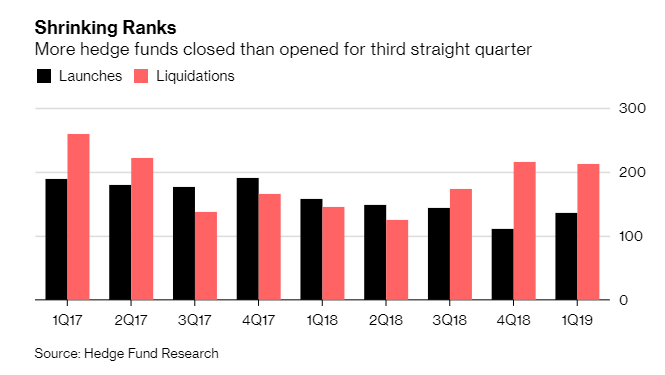

Global hedge fund liquidations exceeded launches for the third straight quarter as a result of a tougher capital raising environment, according to Bloomberg.

During the first quarter of this year, about 213 funds closed compared to 136 that opened. Liquidations remained steady from the quarter prior and launches were up about 23%.

But hedge fund startups remain under pressure due to poor performance and investors grappling with high fees. $17.8 billion was pulled from hedge funds during the first 3 months of the year, marking the fourth consecutive quarterly outflow. Additionally, the industry has seen a number of funds shut down or return capital, including Highbridge Capital Management and Duane Park Capital.

The average management fee for funds that launched in the first quarter was down 10 bps to 1.19%, while the average incentive fee increased to 18.79% from 17.9% in 2018.

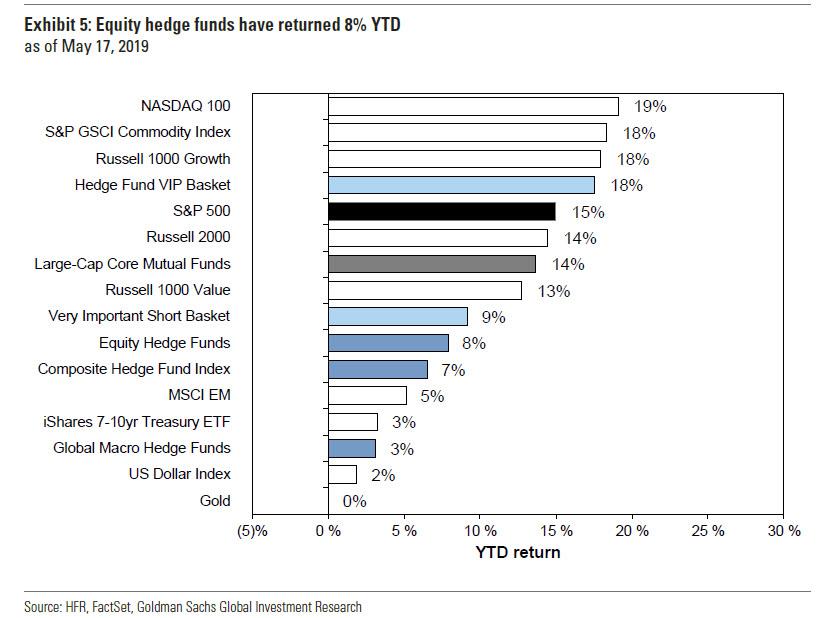

Hedge funds on average were up 3% in the first quarter on an asset weighted basis, which lagged the S&P index by a stunning 10.7% with dividends reinvested over the same period.

In May we had noted that the broader S&P 500 had trounced the average hedge fund, returning 18% YTD, and charging precisely nothing for this out performance.

Also in late May, we documented shocking losses from Horseman Global. The fund’s losses more than doubled in April, when the fund was down a was a staggering 12%, which brought its total loss YTD to more than 25%.

In early June, we wrote about Neil Woodford, the UK’s equivalent of David Tepper, blocking redemptions from his £3.7bn equity income fund after serial under performance led to an investor exodus, “inflicting a serious blow to the reputation of the UK’s highest-profile fund manager.”

It’s been a pretty good couple of months for precious metals, but more so for gold than silver. Both are up but gold is up more, and the imbalance that this creates might be one of the major investment themes of the next few years.

The gold/silver ratio – that is, how many ounces of silver it takes to buy an ounce of gold – has bounced all over the place since the 1960s. But whenever it’s gotten extremely high – say above 80 – silver outperformed gold, sometimes dramatically.

As this is written, the ratio stands at almost 93x, which is not far from its record high. With precious metals finally breaking out of a five-year siesta – and the world getting dramatically scarier – it’s not a surprise that safe haven assets are catching a bid. And it would also not be a surprise if the current move has legs, as central banks resume their easing and geopolitical tensions persist.

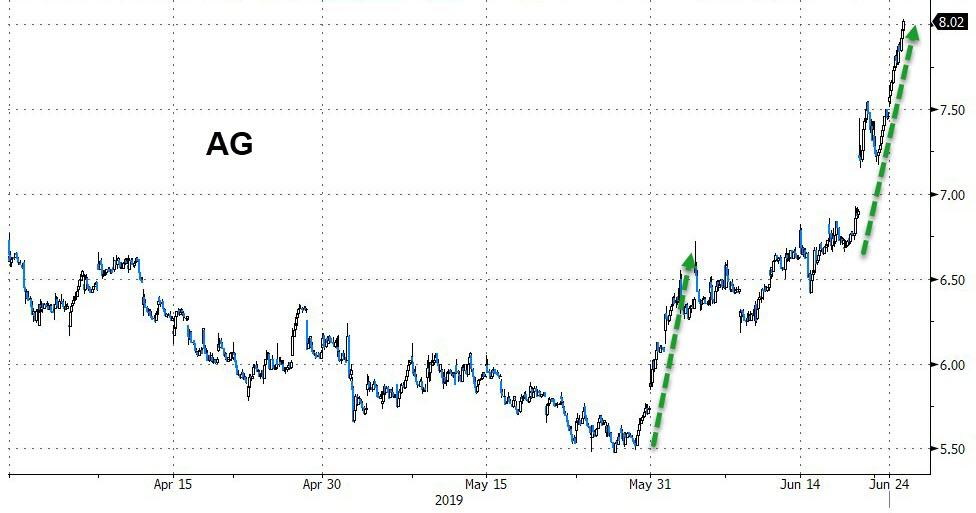

Combine a chaotic, easy-money world with silver’s relative cheapness and the result is a nice set-up, for both the metal and the stocks of the companies that mine it. Here’s the one-month chart for First Majestic Silver (AG), a large primary silver producer. It’s up about 40%, even while silver underperforms gold. Let the metal start to outperform in the context of an overall precious metals bull run, and stocks like this will go parabolic.

Authored by Kevin Ludolph via Crescat Capital,

Dear Investors:

The US stock market is retesting its all-time highs at record valuations yet again. We strongly believe it is poised to fail. The problem for bullish late-cycle momentum investors trying to play a breakout to new highs here is the oncoming freight train of deteriorating macro-economic conditions.

US corporate profit growth, year-over-year, for the S&P 500 already fully evaporated in the first quarter of 2019 and is heading toward outright decline for the full year based on earnings estimate revision trends. Note the alligator jaws divergence in the chart below between the S&P 500 and its underlying expected earnings for 2019. Expected earnings for 2019 already trended down sharply in the first quarter and have started trending down again after the May trade war escalation.

(Lance Roberts) On Tuesday, Federal Reserve Chairman Jerome Powell, in his opening remarks at a monetary policy conference in Chicago, raised concerns about the rising trade tensions in the U.S.,

“We do not know how or when these issues will be resolved. As always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.”

However, while there was nothing “new” in that comment, it was his following statement that sent “shorts” scrambling to cover.

“In short, the proximity of interest rates to the ELB has become the preeminent monetary policy challenge of our time, tainting all manner of issues with ELB risk and imbuing many old challenges with greater significance.

“Perhaps it is time to retire the term ‘unconventional’ when referring to tools that were used in the crisis. We know that tools like these are likely to be needed in some form in future ELB spells, which we hope will be rare.”

“To translate that statement, not only is the Fed ready to cut rates, but it may take ‘unconventional’ tools during the next recession, i.e., NIRP and even more QE.”

This is a very interesting statement considering that these tools, which were indeed unconventional“emergency” measures at the time, have now become standard operating procedure for the Fed.

Yet, these “policy tools” are still untested.

Clearly, QE worked well in lifting asset prices, but not so much for the economy. In other words, QE was ultimately a massive “wealth transfer” from the middle class to the rich which has created one of the greatest wealth gaps in the history of the U.S., not to mention an asset bubble of historic proportions.

However, they have yet to operate within the confines of an economic recession or a mean-reverting event in the financial markets. In simpler terms, no one knows for certain whether the bubbles created by monetary policies are infinitely sustainable? Or, what the consequences will be if they aren’t.

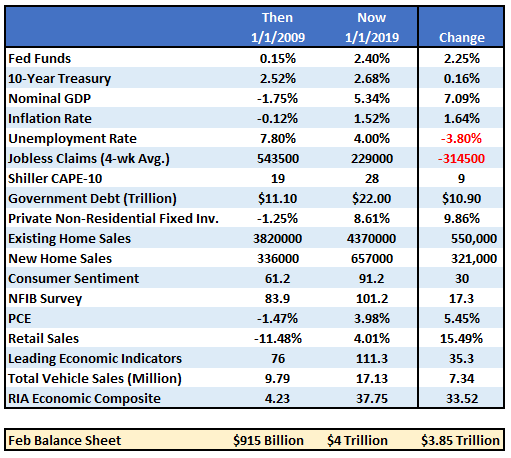

The other concern with restarting monetary policy at this stage of the financial cycle is the backdrop is not conducive for “emergency measures” to be effective. As we wrote in “QE, Then, Now, & Why It May Not Work:”

“If the market fell into a recession tomorrow, the Fed would be starting with roughly a $4 Trillion balance sheet with interest rates 2% lower than they were in 2009. In other words, the ability of the Fed to ‘bail out’ the markets today, is much more limited than it was in 2008.

But there is more to the story than just the Fed’s balance sheet and funds rate. The entire backdrop is completely reversed. The table below compares a variety of financial and economic factors from 2009 to present.

“The critical point here is that QE and rate reductions have the MOST effect when the economy, markets, and investors have been ‘blown out,’ deviations from the ‘norm’ are negatively extended, confidence is hugely negative.

In other words, there is nowhere to go but up.”

The extremely negative environment that existed, particularly in the asset markets, provided a fertile starting point for monetary interventions. Today, as shown in the table above, the economic and fundamental backdrop could not be more diametrically opposed.

This suggests that the Fed’s ability to stem the decline of the next recession, or offset a financial shock to the economy from falling asset prices, may be much more limited than the Fed, and most investors, currently believe.

While Powell is hinting at QE4, it likely will only be employed when rate reductions aren’t enough. Such was noted in 2016 by David Reifschneider, deputy director of the division of research and statistics for the Federal Reserve Board in Washington, D.C., released a staff working paper entitled “Gauging The Ability Of The FOMC To Respond To Future Recessions.”

The conclusion was simply this:

“Simulations of the FRB/US model of a severe recession suggest that large-scale asset purchases and forward guidance about the future path of the federal funds rate should be able to provide enough additional accommodation to fully compensate for a more limited [ability] to cut short-term interest rates in most, but probably not all, circumstances.”

In effect, Powell has become aware he has become caught in a liquidity trap. Without continued “emergency measures” the markets, and subsequently economic growth, cannot be sustained. This is where David compared three policy approaches to offset the next recession:

This is exactly the prescription that Jerome Powell laid out on Tuesday, suggesting the Fed is already factoring in a scenario in which a shock to the economy leads to additional QE of either $2 trillion, or in a worst-case scenario, $4 trillion, effectively doubling the current size of the Fed’s balance sheet.

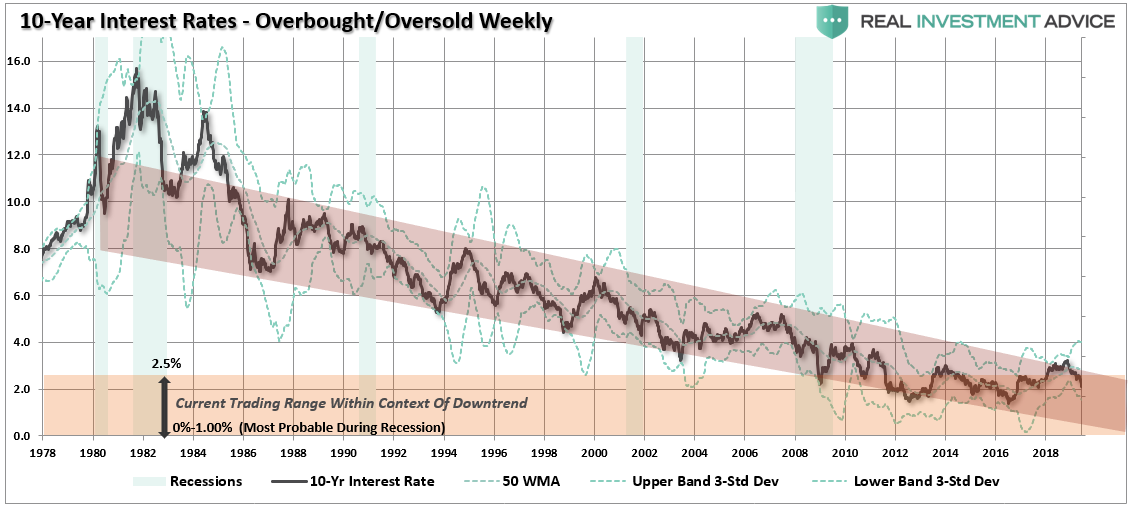

This is also why 10-year Treasury rates are going to ZERO.

I have been discussing over the last couple of years why the death of the bond bull market has been greatly exaggerated. To wit:

“There is an assumption that because interest rates are low, that the bond bull market has come to its inevitable conclusion. The problem with this assumption is three-fold:

- All interest rates are relative. With more than $10-Trillion in debt globally sporting negative interest rates, the assumption that rates in the U.S. are about to spike higher is likely wrong. Higher yields in U.S. debt attracts flows of capital from countries with negative yields which push rates lower in the U.S. Given the current push by Central Banks globally to suppress interest rates to keep nascent economic growth going, an eventual zero-yield on U.S. debt is not unrealistic.

- The coming budget deficit balloon. Given the lack of fiscal policy controls in Washington, and promises of continued largesse in the future, the budget deficit is set to swell back to $1 Trillion or more in the coming years. This will require more government bond issuance to fund future expenditures which will be magnified during the next recessionary spat as tax revenue falls.

- Central Banks will continue to be a buyer of bonds to maintain the current status quo, but will become more aggressive buyers during the next recession. The next QE program by the Fed to offset the next economic recession will likely be $2-4 Trillion which will push the 10-year yield towards zero.”

It’s item #3 that is most important.

In “Debt & Deficits: A Slow Motion Train Wreck”, I laid out the data constructs behind the points above.

However, it was in April 2016, when I stated that with more government spending, a budget deficit heading towards $1 Trillion, and real economic growth running well below expectations, the demand for bonds would continue to grow. Even from a purely technical perspective, the trend of interest rates suggested at that time a rate below one percent was likely during the next economic recession.

Outside of other events such as the S&L Crisis, Asian Contagion, Long-Term Capital Management, etc. which all drove money out of stocks and into bonds pushing rates lower, recessionary environments are especially prone at suppressing rates further. But, given the inflation of multiple asset bubbles, a credit-driven event that impacts the corporate bond market will drive rates to zero.

Furthermore, given rates are already negative in many parts of the world, which will likely be even more negative during a global recessionary environment, zero yields will still remain more attractive to foreign investors. This will be from both a potential capital appreciation perspective (expectations of negative rates in the U.S.) and the perceived safety and liquidity of the U.S. Treasury market.

Rates are ultimately directly impacted by the strength of economic growth and the demand for credit. While short-term dynamics may move rates, ultimately, the fundamentals, combined with the demand for safety and liquidity, will be the ultimate arbiter.

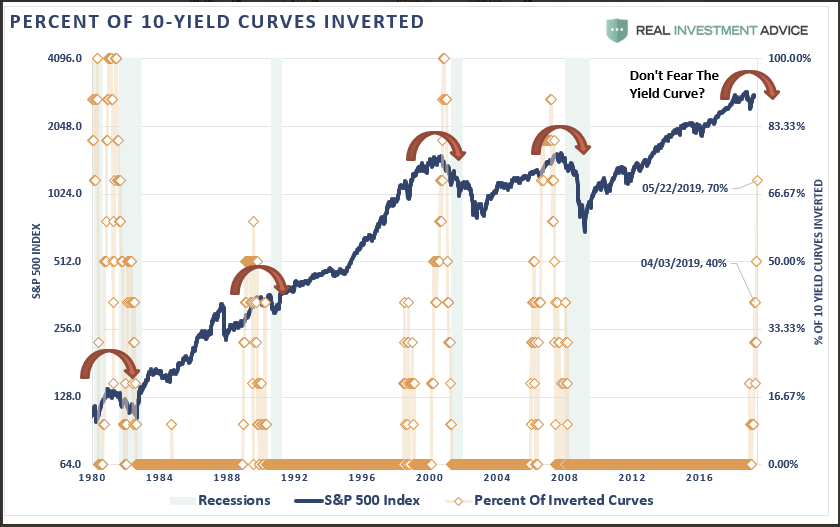

With the majority of yield curves that we track now inverted, many economic indicators flashing red, and financial markets dependent on “Fed action” rather than strong fundamentals, it is likely the bond market already knows a problem in brewing.

However, while I am fairly certain the “facts” will play out as they have historically, rest assured that if the “facts” do indeed change, I will gladly change my view.

Currently, there is NO evidence that a change of facts has occurred.

Of course, we aren’t the only ones expecting rates to go to zero. As Bloomberg noted:

“Billionaire Stan Druckenmiller said he could see the Fed funds rate going to zero in the next 18 months if the economy softens and that he recently piled into Treasuries as the U.S. trade war with China escalated.

‘When the Trump tweet went out, I went from 93% invested to net flat, and bought a bunch of Treasuries,’ Druckenmiller said Monday evening, referring to the May 5 tweet from President Donald Trump threatening an increase in tariffs on China. ‘Not because I’m trying to make money, I just don’t want to play in this environment.'”

It has taken a massive amount of interventions by Central Banks to keep economies afloat globally over the last decade, and there is rising evidence that growth is beginning to decelerate.

While another $2-4 Trillion in QE might indeed be successful in further inflating the third bubble in asset prices since the turn of the century, there is a finite ability to continue to pull forward future consumption to stimulate economic activity. In other words, there are only so many autos, houses, etc., which can be purchased within a given cycle.

There is evidence the cycle peak has been reached.

If I am correct, and the effectiveness of rate reductions and QE are diminished due to the reasons detailed herein, the subsequent destruction to the “wealth effect” will be far larger than currently imagined. There is a limit to just how many bonds the Federal Reserve can buy and a deep recession will likely find the Fed powerless to offset much of the negative effects.

If more “QE” works, great.

But, as investors, with our retirement savings at risk, what if it doesn’t?

(ZeroHedge) “There’s no mental health support. The employee suicide rate is extremely high,” one of the directors of the documentary, “The Cleaners” told CBS News last May. The film is an investigative look at the life of Facebook moderators in the Philippines. Throughout his 2018 apology tour, Mark Zuckerberg regularly referenced the staff of moderators the company had hired as one of two key solutions — along with AI — to the platform’s content evils. What he failed to disclose is that the majority of that army is subcontractors employed in the developing world.

For as long as ten hours a day, viewing as many as 25,000 images or videos per day, these low-paid workers are buried in the world’s horrors — hate speech, child pornography, rape, murder, torture, beheadings, and on and on. They are not experts in the subject matter or region they police. They rely on “guidelines” provided by Facebook — “dozens of unorganized PowerPoint presentations and Excel spreadsheets with bureaucratic titles like ‘Western Balkans Hate Orgs and Figures’ and ‘Credible Violence: Implementation standards’,” as The New York Times reported last fall. The rules are not even written in the languages the moderators speak, so many rely on Google Translate. As a recent op-ed by John Naughton in The Guardian declares bluntly in its headline, “Facebook’s burnt-out moderators are proof that it is broken.”

As we noted in last week’s issue, 41 of the 53 analysts tracked by Bloomberg currently list Facebook as a buy, with “the average price target… $187, which implies upside of nearly 36%.” That optimism springs from a basic assumption: the company’s monopolistic data dominance means it can continue extracting more from advertisers even if controversy after controversy continues to sap its user growth. Given the depth and intractability of Facebook’s problems, this is at best short-sighted.

The platform’s content ecosystem is too poisoned for human or machine moderators to cleanse. Users are fleeing in droves, especially in the company’s most valuable markets. Ad buyers are already shifting dollars to competitors’ platforms. Governments are stepping up to dramatically hinder Facebook’s data-collection capabilities, with Germany just this week banning third-party data sharing. The company is under investigation by the FTC, the Justice Department, the SEC, the FBI, and several government agencies in Europe. It has been accused by the U.N. of playing a “determining role” in Myanmar’s genocide. An executive exodus is underway at the company. And we believe, sooner or later, Facebook’s board will see no option but to remove Sheryl Sandberg and Mark Zuckerberg.

The market is drastically underestimating the peril the company is in. In the very short term, the user backlash may simply hinder its revenue growth. In the longer-term, however, the institutionalized failure to see and respond to the platform’s downsides may render Facebook the Digital Age’s Enron — a canonized example of how greed and corruption can fell even the mightiest.

According to data recently released by Statcounter, Facebook’s global social media market share dropped from 75.5% in December 2017 to 66.3% in December 2018. The biggest drop was in the U.S., from 76% to 52%. As Cowen survey results released this week suggest, these engagement declines will continue to depress the company’s earnings. Surveying 50 senior U.S. ad buyers controlling a combined $14 billion in digital ad budgets in 2018, 18% said they were decreasing their spend on Facebook. As a result, Cowen estimates the Facebook platform will lose 3% of its market share.

No doubt Facebook’s struggles are not just about the headline scandals. For years, one innovation priority after another has fallen flat, from VR to its video push to its laggard position in the digital-assistant race. The company’s most significant “innovation” success of the past few years was copying the innovation of a competitor — pilfering Snapchat’s ephemerality for its “moments” feature.

However, it’s the scandals that have most crippled the company’s brand and revealed the cultural rot trickling down from its senior ranks. Consider just the most-sensational revelations that emerged in 4Q18:

Scandal after scandal, the portrait of the company is the same: Ruthlessly and blindly obsessed with growth. Overwhelmed by that growth and unwilling to take necessary steps to compensate. Willing to lie and obfuscate until the truth becomes inescapable. And all the time excusing real-world consequences and clear violations of user and client trust because of the cultish belief that global interconnectedness is an absolute good, and therefore, Facebook is absolutely good.

The scale of Facebook’s global responsibility is staggering. As Naughton writes for The Guardian:

Facebook currently has 2.27bn monthly active users worldwide. Every 60 seconds, 510,000 comments are posted, 293,000 statuses are updated and 136,000 photos are uploaded to the platform. Instagram, which allows users to edit and share photos as well as videos and is owned by Facebook, has more than 1bn monthly active users. WhatsApp, the encrypted messaging service that is also owned by Facebook, now has 1.5bn monthly active users, more than half of whom use it several times a day.

Relying on tens of thousands of moderators to anesthetize the digital commons is both inadequate, and based on the reported working conditions, unethical and exploitative. AI is not the solution either, as we explored in WILTW April 12, 2018. According to Wired, Facebook has claimed that 96% of the adult and nude images users try to upload are now automatically detected and taken down by AI. That sounds like a success until you consider that that error rate means 1.3 million such images made it to the public in the third quarter of 2018 alone (30.8 million were taken down).

In fact, the company has acknowledged that views with nudity or sexual content have nearly doubled in the 12 months ending in September. And detecting nudity is a far easier task for a rules-based algorithm than deciding the difference between real and fake news, between hate speech and satire, or between pornography and art.

Facebook has economically and culturally empowered hundreds of millions of people around the world. It cannot be blamed for every destabilized government, war, or murder in every region it operates. However, more and more, it’s clear that one profit-driven platform that connects all of the world’s people to all of the world’s information — the vision Zuckerberg has long had for his invention — is a terminally-flawed idea. It leads to too much power in the hands of too few. It allows bad actors to centralize their bad actions. And it is incompatible with a world that values privacy, ownership, and truth.

Governments are waking up to this problem. So is the public. And no doubt, so are competitive innovators looking to expand or introduce alternatives. Collectively, they will chip away at Facebook’s power and profitability. Given the company’s leaders still appear blinded by and irrevocably attached to their business model and ideals, we doubt they can stave off the onslaught coming.

The Smart Money Flow Index, measuring the movement of the Dow in two time periods: the first 30 minutes and the last hour, has just declined AGAIN.

The Smart Money Flow Index, like the DJIA, has been around for decades. But it has just fallen to the lowest level since 1995.

Is the asset bubble starting to burst? Or is it just one lone indicator getting sick?

Last decade, there was a residential mortgage credit bubble that burst. While there doesn’t appear to be a residential mortgage credit bubble (well, just a little), there is most definitely a corporate debt credit bubble that appears to be bursting.

Take General Electric. Their stock price has slipped to under $10 per share from over $30 per share back in early 2017 while the 5% perpetual bond has rapidly gone from around par ($100) to $79 in the wink of The Fed’s eye.

Of course, GE’s earnings-per-share have been tanking as interest rates have been rising.

And to make matters worse, US investment grade debt is on track for worst year since 2008.

Like Robot Monster, the Federal Reserve has helped to create bubbles in the corporate bond market.

Two weeks after we reported that GE had found itself locked out of the commercial paper market following downgrades that made it ineligible for most money market investors, the pain has continued, and yesterday General Electric lost just over $5bn in market capitalization. While far less than the $49bn wiped out from AAPL the same day, it was arguably the bigger headline grabber.

The shares slumped -6.88% after dropping as much as -10% at the lows after the company’s CEO, in an interview with CNBC yesterday, failed to reassure market fears about a weakening financial position. The CEO suggested that the company will now urgently sell assets to address leverage and its precarious liquidity situation whereby it will have to rely on revolvers – and the generosity of its banks – now that it is locked out of the commercial paper market.

Indeed, shares hit levels first seen in 1995 yesterday and have only been lower since, very briefly, during the financial crisis when they hit $6.66 in March 2009. For a bit of perspective, Deutsche Bank notes that the market cap of GE now is $69.5bn and it’s the 80th largest company in the S&P 500. Yet in August 2003, GE was the largest company in the index (and regularly the world between 1993-2005) at a market cap of $296bn, $12bn more than Microsoft in second place. Since then, the tech giant has grown to be a $826bn company well over 10 times the size, while GE’s market cap peaked (ironically) during the dot com bubble in August 2000 at $594BN before tumbling first in the tech crash and then the GFC.

But while most investors have been focusing on GE’s sliding equity, the bigger concern is what happens to the company’s giant debt load, especially if it is downgraded to junk.

First, some background: GE had about $115 billion of debt outstanding as of the end of September, down from $136 billion a year earlier. And while GE is targeting a net EBITDA leverage ratio of 2.5x, this hasn’t been enough to appease credit raters, which have expressed concern recently that GE’s beleaguered power business and deteriorating cash flows will continue to weaken the company’s financial position. As a result, Moody’s downgraded GE two levels last month to Baa1, three steps above speculative grade. S&P Global Ratings and Fitch Ratings assign the company an equivalent BBB+, all with stable outlooks.

The problem is that while the rating agencies still hold GE as an investment grade company, the market disagrees.

GE – a top 15 issuer in both the US and EU indices – was recently downgraded into the BBB bucket, and as recently as September it was trading 20bps inside BBB- bonds. However they crossed over at the end of that month and now trade up to 50bps wide to the average of the weakest notch of IG.

In other words, GE is already trading like junk, and has become the proverbial canary in the coalmine for what many have said could be the biggest risk facing the bond market: over $1 trillion in potential “fallen angel” debt, or investment grade names that end up being downgraded to high yield, resulting in a junk bond crisis.

As Deutsche Bank’s Jim Reid notes, GE’s recent collapse has come at time when much discussion in recent months has been about BBBs as a percentage of the size of the HY market. Since 2005, BBBs have been steadily rising as a percentage of HY climbing back above the previous peak in 2014 (175%) before extending that growth to a current level of 274%. Meanwhile, the total notional of BBB investment grade debt has grown to $2.5 trillion in par value today, a 227% increase since 2009, and now represents 50% of the entire IG index.

Next, to get a sense of just how large the risk of fallen angels in the US is, consider that the BBB part of the IG index is now ~2.5x as large as the entire HY index.

So large BBB companies – and none are larger than GE – with a deteriorating credit story are prone to additional widening pressure as investors fear the risks of an eventual downgrade to HY and a swamping of paper into that market. This, as Deutsche Bank writes, isn’t helping GE at the moment and may be a dress rehearsal for what happens for weaker and large BBB issuers in the next recession.

Meanwhile, while GE is not trading as a pure play junk bond just yet, it is well on its way as the following chart of GE’s spread in the context of both IG and HY shows.

Which is both sad, and ironic: as Bloomberg’s Sebastian Boyd writes this morning, “the company’s CEOs boasted of its AAA rating as a key strategic asset, but it was more than that. The rating, which it maintained for more than half a century, was symbolic of the company’s status as a champion of American commerce. Now, Microsoft and Johnson & Johnson are the only U.S. corporates with the top rating from S&P.”

And while rating agencies have yet to indicate they are contemplating further cuts to the company’s investment grade rating, the bond market has clearly awoken, and nowhere more so than in the swap space, where GE’s Credit Default Swaps have exploded in recent weeks.

What kind of an impact would GE’s downgrade have? With $48 billion of bonds in the Bloomberg Barclays US Corporate index, GE would become almost 9% of the BB universe. And one look at Boyd’s chart below shows that the market is increasingly pricing GE’s index-eligible bonds as junk, especially in the context of the move over the past month.

An additional risk to the company’s credit profile: GE has more debt coming due in the next 18 months than any other BBB rated borrower: that fact alone makes it the most exposed to higher rates according to Boyd.

Meanwhile, GE’s ongoing spread blow out, and junk-equivalent price, has not escaped unnoticed, and as we have been warning for a while, could portend a broader repricing in the credit sector. As Guggenheim CIO commented this morning, “the selloff in GE is not an isolated event. More investment grade credits to follow. The slide and collapse in investment grade debt has begun.”

Then again, Minerd’s concern pales in comparison to what some other credit strategists. In an interview with Bloomberg TV on November 8, Bruce Richards, chairman and chief executive officer of the multi-billion Marathon Asset Management warned that over leveraged companies “are going to get crushed” in the next recession. Richards also warned that when the cycle does turn, “with no liquidity in the high-yield market to speak of, when these tens of billions or potentially hundreds of billions falls into junk land, it’s “Watch out below!” because there’s going to be enormous price adjustments.”

Echoing what we said above, Richards noted that about $1 trillion of bonds are rated as BBB, as investment- grade, when they has leverage ratios worthy of junk, adding that “the magnifying glass is now shifting” toward ratings companies.

For now the “magnifying glass” appears to have focused on GE, and judging by the blow out in spreads for this “investment grade” credit, what it has found has been unexpected. Which brings us to the question we asked at the top: will GE be the canary in the credit crisis coalmine and, when the next crisis finally does strike, the biggest fallen angel of them all?

“Without that central bank support and transitioning off the fiscal stimulus, our long-term outlook for investment grade is definitely on the more bearish side over the last two to three years.”

The bloom is off the rose for home builders. Yes, it had been a great run, fueled by The Fed’s zero-interest rate policy (ZIRP) and asset purchases (QE). But despite a roaring economy, SPDR S&P Home builders ETF have been falling since January as The Federal Reserve Open Market Committee (FOMC) sticks to their guns and keeps normalizing interest rates.

Yes, the Fed Dots Plot project indicates that there is still upside momentum to short-term interest rates.

And the Fed’s System Open Market Accounts (SOMA) show a declining inventory of Treasury Notes and Bonds to let mature.

One month ago, when Apple finally crossed above $1 trillion in market cap, Goldman’s chief equity strategist David Kostin said that investors had been focusing on the “wrong $1 trillion question”, adding that the correct question was: what amount of buyback will companies authorize in 2018? The reason was that according to the latest estimate from Goldman’s buyback desk, stock buyback authorizations in 2018 had increased to a record $1.0 trillion – a result of tax reform and strong cash flow growth – a 46% rise from last year.

The upward revision was warranted: according to TrimTabs calculations, buyback announcements swelled to a record $436.6 billion in the second quarter, smashing the previous record of $242.1 billion set just one quarter earlier, in Q1. Combined, this meant that buybacks in the first half totaled a ridiculous $680 billion which annualized amounted to a staggering $1.35 trillion, indicating that Goldman’s revised estimate may in fact be conservative.

Furthermore, with many strategists warning that August could be a volatile month, Goldman remained optimistic noting that “August is the most popular month for repurchase executions, accounting for 13% of annual activity”, implying that a solid buyback bid would support the market in a worst case scenario which never materialized as the S&P rose to a fresh all time high at the end of the month.

Based on the Goldman data and estimates, it is probably safe to say that August was one of the all-time record months in terms of buyback activity. That companies would be scrambling to repurchase their stock last month was not lost on one particular group of investors: the corporate insiders of the companies buying back their own stocks.

According to data compiled by TrimTabs, insider selling reached $450 million daily in August, the highest level this year; on a monthly basis, insiders sold more than $10 billion of their stock, the most of any month this year and near the most on record.

“As corporate buying is at least taking a breather, corporate insiders are ramping up share selling as the major U.S. stock market averages are at or near record highs,” TrimTabs wrote in a note.

In other words, as insiders and management teams authorized record buybacks, the same insiders and management teams were some of the biggest sellers into this very bid, which one would say is a rather risk-free way of dumping their stock without any risk of the clearing price declining. It also suggests that contrary to prevailing expectations, stocks are anything but cheap when viewed from the lens of insiders who know their own profit potential best.

There is another consideration: September is traditionally the most volatile month for the stock market (especially the last two weeks), and it may be the insiders are simply looking to offload their holdings ahead of a potential air pocket in prices.

As CNBC further notes, September is usually the worst month for stocks, possibly explaining why corporate executives sold so much stock last month. Data from the “Stock Trader’s Almanac” show the S&P 500 and Nasdaq both fall an average of 0.5% in September. The Dow Jones Industrial Average, meanwhile, averages a loss of 0.7% in September.

TrimTabs summarizes this best:

“One cautionary sign for U.S. stocks is that corporate insiders have accelerated their selling of U.S. equities,” said Winston Chua, an analyst at TrimTabs. “They’ve dedicated record amounts of shareholder money to buybacks but aren’t doing the same with their own which suggests that companies aren’t buying stocks because they’re cheap.”

Finally, as we noted yesterday, the September selling may have started early this year in an ominous sign for the rest of the month:

it’s already been a tough start to the month of September for the S&P 500, which has fallen for the fourth day in a row. This is notable, as LPL Financial notes “going back to the Great Depression, only two times did it start down the first four days. 1987 and 2001.“

And with insiders dumping a near record amount of stock, it may be the case that the selling is only just getting started.

For years, in fact for the duration of the US dollar’s use as a global carry currency, Emerging Markets – especially those with a currency peg – were a welcome destination for yield starved US investors who found an easy source of yield differential pick up. All that came to a crashing halt first after the Chinese devaluation in 2015 which sent the dollar surging and slammed the EM sector, and then again in recent months when renewed strong dollar-inspired turmoil gripped the emerging markets, first due to idiosyncratic factors – such as those in Turkey and Argentina…

… and gradually across the entire world, as contagion spread.

And while many pundits have stated that there is no reason to be concerned, and that the EM spillover will not reach developed markets, Morgan Stanley points out that the real pain may lie ahead.

As the following chart from the bank’s global head of EM Fixed Income strategy, James Lord, shows, whereas returns have slumped across EM rates, outflows from the EM space have a ways to go before they catch down to the disappointing recent returns.

One can make two observations here: the first is that despite the equity rout, EM stocks (as captured by the EEM ETF) have a long way to go to catch down to EM bonds as shown by the Templeton EM Bond Fund (TEMEMFI on BBG).

The second, more salient point is that a key reason for the solid growth across emerging markets in recent years, has been the constant inflow of foreign capital, resulting in a significant external funding requirement for continued growth, especially for Turkey as discussed previously.

But what happens if this outside capital inflow stops, or worse, reverses? This is where things get dicey. To answer that question, Morgan Stanley has created its own calculation of Emerging Market external funding needs, and defined it as an “external coverage ratio.” It is calculated be dividing a country’s reserves by its 12 month external funding needs, which in turn are the sum of the i) current account, ii) short-term external debt and iii) the next 12 months amortizations from long-term external debt.

More importantly, what this ratio shows is how long a given emerging market has before it runs out of cash. And, as the chart below shows, if we were investors in Turkey, Ukraine, Argentina, or any of the other nations on the left side of the chart – and certainly those with less than a year of reserves to fund its external funding needs – we would be worried.

So to answer the question posed by the title, which Emerging Markets will run out of funding first, start on the left and proceed to the right.

The market has been buzzing about Apple’s $1 trillion market valuation.

It’s an incredible amount of wealth creation in any context – but, as Visual Capitalist’s Jeff Desjardins notes, getting to 12 zeros is especially impressive when you consider that Apple was just 90 days from declaring bankruptcy in 1997.

Today’s chart shows this milestone – as well as many of the ones before it – through a period of over 200 years of U.S. market history. It was inspired by this interesting post by Global Financial Data, which is worth reading in its own right.

Courtesy of: Visual Capitalist

Over the last couple of centuries, and with the exception of brief moments in time such as the Japanese stock bubble of 1989, the largest company in the world has almost always been based in the United States.

Here are the major market cap milestones in the U.S. that preceded Apple’s recent $1 trillion valuation, achieved August 2nd, 2018:

Bank of North America (1781)

The first company to hit $1 million in market capitalization. It was the first ever IPO in the United States.Bank of the United States (1791)

The first company to hit $10 million in market capitalization had a 20 year charter to start, and was championed by Alexander Hamilton.New York Central Railroad (1878)

The first company to hit $100 million in market capitalization was a crucial railroad that connected New York City, Chicago, Boston, and St. Louis.AT&T (1924)

The first company to hit $1 billion in market capitalization – this was far before the breakup of AT&T into the “Baby Bells”, which occurred in 1982.General Motors (1955)

The first company to hit $10 billion in market capitalization. The 1950s were the golden years of growth for U.S. auto companies like GM and Ford, taking place well before the mass entry of foreign companies like Toyota into the domestic automobile market.General Electric (1995)

The first company to hit $100 billion in market capitalization was only able to do so 23 years ago.

Interestingly, Apple is not the first company globally to ever hit $1 trillion in market capitalization.

The feat was achieved momentarily by PetroChina in 2007, after a successful debut on the Shanghai Stock Exchange that same year.

And as we noted previously, the $800 billion loss it experienced shortly after is also the largest the world has ever seen.

Is Tesla The New Theranos?

I originally started following Tesla as I felt it was a structurally unprofitable business nearing a cash crunch as hundreds of competing products were about to enter the market.

As I’ve studied Tesla more closely, I’ve come to realize that Elon Musk appears to be running a Ponzi Scheme disguised as an auto-manufacturer; where he has to keep unveiling new products, many of which will never come to market, in order to raise new capital (equity/debt/customer deposits) to keep the scheme alive. The question has always been; when will Tesla collapse?

Tesla’s Bullshit Conversion Cycle is the key financial metric underlying this scheme (from @ProphetTesla)

Tesla’s Bullshit Conversion Cycle is the key financial metric underlying this scheme (from @ProphetTesla)

As part of my research on Tesla, I decided to read Bad Blood by John Carreyrou, the journalist who first uncovered the Theranos fraud. It is the story of how Elizabeth Holmes created Theranos and then lurched between publicity events in order to raise additional capital and keep the fraud going, despite the fact that the technology did not work. The key lesson from Theranos for determining when a fraud will implode is that there are always idiots willing to put fresh money into a well marketed fraud – so you need a catalyst for when the funding dries up.

The other salient fact was that most senior employees actually knew that something wasn’t quite right, but feared losing their jobs or getting sued if they did anything about it. Therefore, employee turnover was off the charts but no one was willing to risk their career by saying anything publicly. However, when Theranos started risking customers’ lives, the secret got out pretty fast. This is because most people are inherently ethical – especially when they know that their employer is doing something immoral, like releasing flawed lab results to sick patients. Eventually, some employees felt compelled to become whistle-blowers and started to reach out to journalists and regulators. This started a cascading event.

First, one intrepid journalist took the career risk to write about the Theranos fraud. Then other whistle-blowers felt emboldened to step forward and contact this first journalist, as they also wanted their story told – especially as they had already reached out to government regulators who were too scared to investigate a politically powerful company.

Once a few good articles had been written about Theranos, the dam broke open and the feeding frenzy began. Other journalists, smelling page-clicks rapidly descend on Theranos; more workers spoke out, more incriminating evidence came to light and then there was a sense of voter outrage. Finally, the regulators who were first contacted by the whistle-blowers many months previously, felt compelled to act – at which point the fraud collapsed and the money spigot shut off.

Executives Fleeing Tesla Is A True Bull Market “Up And To The Right”

Executives Fleeing Tesla Is A True Bull Market “Up And To The Right”

We’ve already seen the mass exodus of senior Tesla executives. When they say they “want to spend time with their family,” it really means they “want to spend less time in prison.” Next, we have the first whistle-blowers—there will be MANY more. Currently there are at least 3 different ones feeding information to journalists. Using past frauds as a guide, once we get to this point of the media cycle, the fraud usually unravels pretty fast. Given the perilous state of Tesla’s finances, they are in urgent need of new capital. The question is; who would want to invest new capital when Tesla is now admitting to knowingly selling cars without testing the brakes in order to hit some arbitrary one week production target? When a company admits that it will sacrifice vehicle quality and even risk killing its customers to win a twitter feud and start a short squeeze, regulators must step in. The question is; what else has Tesla done illegally to hit its targets? We know that Tesla long ago passed over the ethical threshold of selling faulty products that have killed people—what other allegations will soon come to light? Elon Musk demanded that Tesla stop testing brakes on June 26. Doug Field, chief engineer, resigned on June 27. Is this a coincidence? Of course not—Doug Field doesn’t want to be responsible for killing people. I think Tuesday’s article will speed up the pace of Tesla’s bankruptcy quite dramatically and I purchased some shorter dated puts after reading it.

Tesla is the fluke stock-promote that found a way to address society’s fascination with ‘green technology’ and the ‘next Steve Jobs.’ Elon Musk eagerly stepped into the role of mad scientist and investors gave him a free pass. It now increasingly seems that everything he’s done for the past few years was simply designed to keep the share price up, keep the dream alive and raise more capital – as opposed to creating shareholder value. Along the way, customer safety has been ignored in order to hit production targets and appease the stock market. In addition to not testing brakes, a recent whistle-blower has accused Tesla of installing over 700 dangerously defective batteries into Model 3 vehicles.

I suspect there will be many more allegations as whistle-blowers come out of the woodwork. It really is the Theranos of auto makers. I suspect it will all end soon. Theranos and Enron both collapsed within 90 days of the journalists getting up to speed. The reporters now know the right questions to ask and Tesla will be out of cash by the time they are all answered.

Stock Promotion In Overdrive Lately. What’s Elon Trying To Distract People From?

Stock Promotion In Overdrive Lately. What’s Elon Trying To Distract People From?

Besides, Elon Musk isn’t even all that innovative. Hitler already tried this same automotive customer deposit scam 80 years ago (From Wages of Destruction)

Source: ZeroHedge | Submitted by Kuppy Via AdventuresInCapitalism.com

The conditions at Tesla’s production facility leading up to meeting its Model 3 production goal have been reported as nothing short of hellish as Elon Musk “barked” at employees working 12 hour shifts, bottlenecking other parts of the company’s production and reportedly causing concern by employees that the long hours and strenuous environment would cause even more workplace injuries and accidents.

2017 was a banner year for many things – record low volatility, record high complacency, and record amounts of money printed by the world’s biggest central banks, among many others.

All of which heralded the belief in the super-human, ‘can-do-no-wrong’ venture capitalist… and of course the ‘exit’ cash-out moment.

108 operating companies went public in the U.S. in 2017 with the average first day return a healthy 15.0% – well above the average 12.9% bump seen since the start of the 21st century.

But of most note in years to come, we suspect, is the fact that over 80% of IPOs in 2017 had negative earnings… the most since the peak of the dot-com bubble in 1999/2000…

Put a slightly different way, 2017 was the biggest “money for nothing” year since Pets.com… consider that the next time you’re told to buy the dip. Remember the only reason “the water is warm” is because it has been ‘chummed’ by the the last greater fool ready for the professional sharks to hand their ‘risk’ to…

Over the weekend, ZH looked at the notional amount of non-financial Libor-linked debt (so excluding the roughly $200 trillion in floating-rate derivatives which have little practical impact on the real world until there is a Lehman-like collateral chain break, of course at which point everyone is on the hook), to see what the real-world impact of the recent blow out in 3M USD Libor is on the business and household sector.

To this end, JPM calculated that based on Fed data, there is a little under $8 trillion in pure Libor-related debt…

… and that a 35bps widening in the LIBOR-OIS spread could raise the business sector interest burden by $21 billion. As we wondered previously, “whether or not that modest amount in monetary tightening is enough to “break” the market remains to be seen.”

In other words, unless the Fed – and JPMorgan – have massively miscalculated how much floating-rate debt is outstanding, and how much more interest expense the rising LIBOR will prompt, the ongoing surge in Libor and Libor-OIS, should not have a systemic impact on the financial system, or economy.

What about at the corporate borrower level?

In an analysis released on Monday afternoon, Goldman’s Ben Snider writes that while for equities in aggregate, rising borrowing costs pose only a modest headwind, “stocks with high variable rate debt have recently lagged in response to the move in borrowing costs.”

Goldman cautions that these stocks should struggle if borrowing costs continue to climb – which they will unless the Fed completely reverses course on its tightening strategy – amid a backdrop of elevated corporate leverage and tightening financial conditions.

Indeed, while various macro Polyannas have said to ignore the blowout in both Libor and Libor-OIS because, drum roll, they are based on “technicals” and thus not a system risk to the banking sector (former Fed Chair Alan Greenspan once called the Libor-OIS “a barometer of fears of bank insolvency”), what they forget, and what Goldman demonstrates is what many traders already know well: the share prices of companies with high floating rate debt has mirrored the sharp fluctuation in short-term borrowing costs. This is shown below in the chart of 50 S&P 500 companies with floating rate bond debt (i.e. linked to Libor) amounting to more than 5% of total.

Here are some details on how Goldman constructed the screen:

We exclude Financials and Real Estate, and the screen captures stocks from every remaining sector except for Telecommunication Services. So far in 2018, as short-term rates have climbed, these stocks have lagged the S&P 500 by 320 bp (-4% vs. -1%). The group now trades at a 10% P/E multiple discount to the median S&P 500 stock (16.0x vs. 17.6x). These stocks should struggle if borrowing costs continue to climb, but may present a tactical value opportunity for investors who expect a reversion in spreads. The tightening in late March of the forward-looking FRA/OIS spread has been accompanied by a rebound of floating rate debt stocks and suggests investors expect some mean-reversion in borrowing costs.

Goldman also notes that small-caps generally carry a larger share of floating rate debt than do large-caps, which may lead to a higher beta for the data set due to size considerations.

In any event, the inverse correlation between tighter funding conditions (higher Libor spreads) and the stock under performance of floating debt-heavy companies is unmistakable.