The bloom is off the rose for home builders. Yes, it had been a great run, fueled by The Fed’s zero-interest rate policy (ZIRP) and asset purchases (QE). But despite a roaring economy, SPDR S&P Home builders ETF have been falling since January as The Federal Reserve Open Market Committee (FOMC) sticks to their guns and keeps normalizing interest rates.

Yes, the Fed Dots Plot project indicates that there is still upside momentum to short-term interest rates.

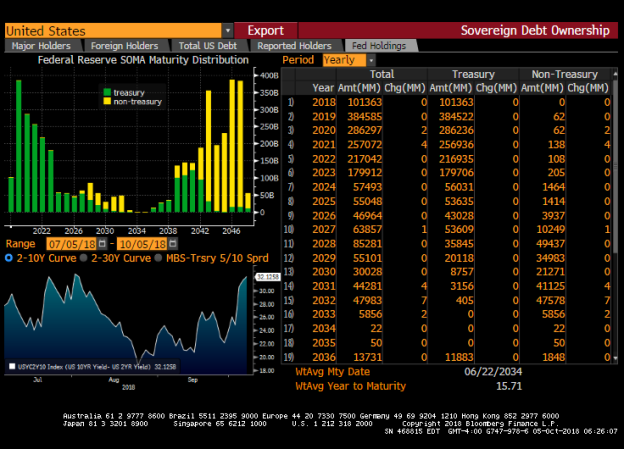

And the Fed’s System Open Market Accounts (SOMA) show a declining inventory of Treasury Notes and Bonds to let mature.