Is that really what you want to spend your time doing, paying higher taxes?

“No matter how much money I make, they will always print more. I can’t print anymore time.”

Is that really what you want to spend your time doing, paying higher taxes?

“No matter how much money I make, they will always print more. I can’t print anymore time.”

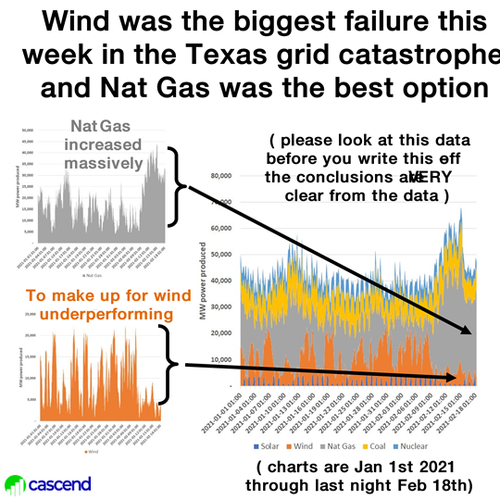

With the worst of the Texas power crisis now behind us, the blame and finger pointing begins, and while the jury is still out whose actions (or lack thereof) may have led to the deadly and widespread blackouts that shocked Texas this week, Cascend Strategy writes that “in case there was any doubt why the Texas grid collapsed, the data is clear”

President Trump’s trade war is back. It’s an election year, and the efforts by the administration to ‘turbocharge’ an initiative to deglobalize that world by removing critical supply chains from China could be seen with new rounds of tariffs to strike Beijing for its handling of the COVID-19 outbreak, US officials told Reuters.

It’s clear that coronavirus lock downs have resulted in a crashed economy with more than 30 million people unemployed have derailed President Trump’s normal campaigning process and the promises of a vibrant economy. This could suggest President Trump is about to unleash tariff hell on Beijing as it would do two things: First, it would pressure US companies with supply chains in China to exit, and second, the president can say the tariffs are a punishment for the more than 68,000 Americans that have died from the virus.

“We’ve been working on [reducing the reliance of our supply chains in China] over the last few years but we are now turbocharging that initiative,” Keith Krach, undersecretary for Economic Growth, Energy and the Environment at the U.S. State Department told Reuters.

“I think it is essential to understand where the critical areas are and where critical bottlenecks exist,” Krach said, adding that the matter was key to U.S. security and one the government could announce new action on soon.

Current and former officials said the Commerce Department and other federal agencies are investigating ways to push US companies away from sourcing and manufacturing in China. “Tax incentives and potential re-shoring subsidies are among measures being considered to spur changes,” they said.

“There is a whole of government push on this,” said one. Agencies are probing which manufacturing should be deemed “essential” and how to produce these goods outside of China.

Another official said, “this moment is a perfect storm; the pandemic has crystallized all the worries that people have had about doing business with China.”

“All the money that people think they made by making deals with China before, now they’ve been eclipsed many-fold by the economic damage” from the coronavirus, the official said.

Amid a pandemic and recession, it appears the comments from US officials suggest geopolitics could soon become major headaches for global markets. President Trump’s latest comments have stirred new concerns that an economic war with China is about to restart. This could be potentially dangerous for investors who are looking for V-shaped recoveries.

Last week, President Trump said China “will do anything they can” to make him lose his re-election bid in November. He said Beijing faced a “lot” of possible consequences for the virus outbreak.

He told Reuters: “There are many things I can do. We’re looking for what happened.”

President Trump recently said he could slap new tariffs of up to 25% tax on $370 billion in Chinese goods currently in place. Officials said the president could introduce new sanctions on officials or companies or project closer relations with Taiwan, all moves that would infuriate Beijing.

Secretary of State Mike Pompeo recently said the administration is working with allies, including Australia, India, Japan, New Zealand, South Korea, and Vietnam, to “move the global economy forward.”

Conversations among US officials have so far been about “how we restructure … supply chains to prevent something like this from ever happening again,” Pompeo said.

And it appears Beijing is preparing for President Trump to strike. We noted on Monday that Chinese President Xi Jinping is preparing for a worst-case scenario of armed conflict with the US.

For years, we have documented the possibility of Thucydides Trap playing out between the US and China. That is when a dominant regional power (the US) feels threatened by the rise of a competing power (China). Read:

The evolution of the pandemic and economic crash appears to be deepening geopolitical tensions between Washington and Beijing.

War Room Pandemic Must Listen: Intelligence Reports Damn China In Virus Outbreaks:

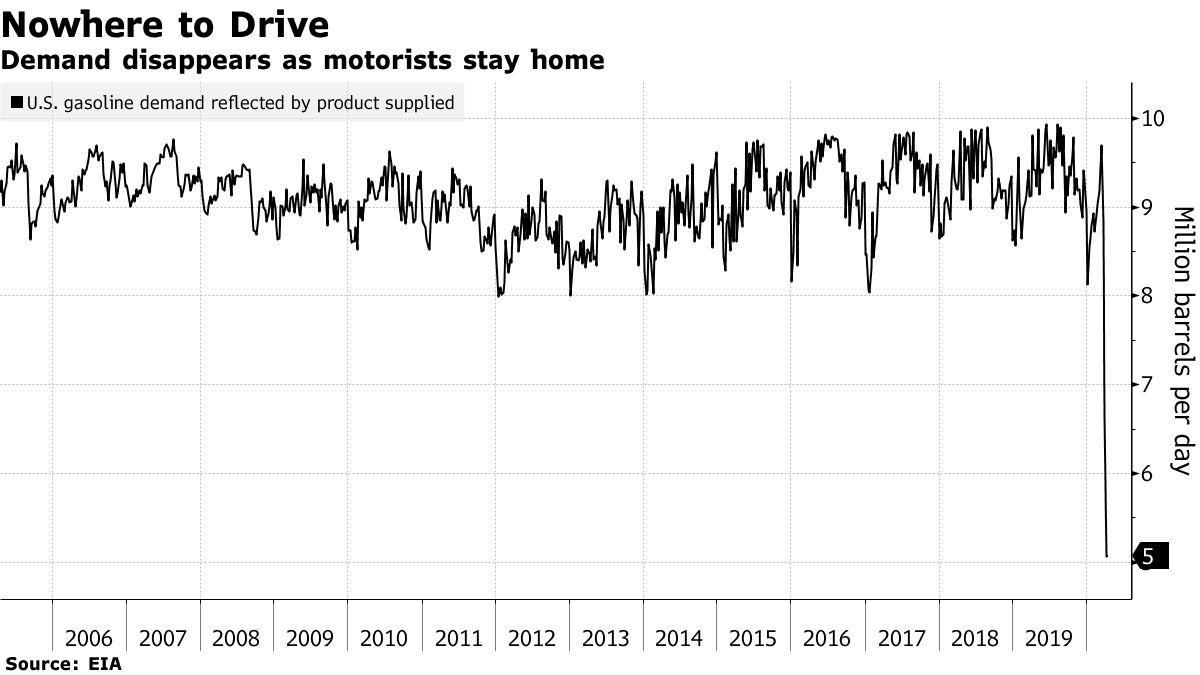

Two weeks ago ZeroHedge reported how the “steepest decline in global oil consumption ever recorded” spelled negative prices for crude in what Goldman’s Jeffrey Currie as “the largest economic shock of our lifetimes.”

Now, the unprecedented collapse in consumption has hit the other end of the industry – gasoline.

According to Bloomberg, gasoline in Fargo, North Dakota has hit 12 cents a gallon at ‘the rack’ – the wholesale market where gas station owners buy fuel before marking it up at the pumps – which have become “little more than makeshift storage for ballooning inventories.”

“When you see gasoline down around 12 cents a gallon, no one is going to be making money,” said Ron Ness, President of the North Dakota Petroleum Council, who added that it’s nearly impossible for retailers to turn a profit at that price.

“Our gasoline business has been cut in half,” said David Olson, general manager of RJ’s Gas Station outside of Fargo. Nearby, Shaun Lugurt told Bloomberg that he estimates sales at his station have tumbled 80% in a month.

“The biggest part for us that has been so hard is the unknown,” said Lugurt, adding “It’s been kind of a roller coaster.” Lugert co-owns Don’s Car Washes, and has also been forced too cut back store and worker hours.

The slump in rack prices, which are typically stable due to intense competition among distributors, is the latest sign that the coronavirus pandemic is wreaking havoc on every aspect of the fuel market. American gasoline consumption fell to the lowest level on record last week as lock downs take drivers off the road while gasoline stockpiles rose to a record high. That’s caused rack prices across the U.S to collapse. Milwaukee this week beat out Fargo for the lowest price in the nation. –Bloomberg

“The local racks are just inundated with material,” according to Patrick De Haan, head of petroleum analysis at GasBuddy – who suggested that some refineries may be selling gasoline “at a break even or even a loss.”

“What we are seeing is that a lot of the big pipelines are being used as storage, and the product will just get pushed and pushed until it has no place else to go,” said DTN refined products analyst, Brian Milne. “Those places are at the end of the line.”

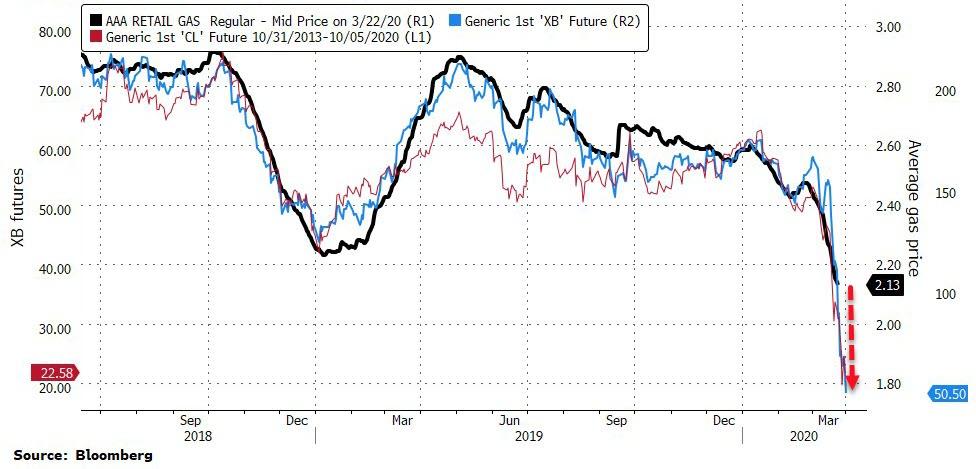

Retail gas prices, meanwhile, are catching up.

“You’re not going to be able to flip a switch and go back to what it was before coronavirus,” said Olson, the station manager at RJ’s. “Even with businesses opened back up again, people are going to be apprehensive.“

Olson is probably right – as a recent Gallup poll found that 80% of Americans say they will wait to return to normal activities after the government lifts the nationwide coronavirus lock down.

Gasoline futures in New York fell as much as 13% to 50.00 cents a gallon, the lowest level since the current contract started trading in 2005.

The previous gasoline contract last traded that low in 2001…

All of which means Americans – on average – except Californians – can expect gas-prices at the pump to plunge below $2/gallon very soon…

Energy prices slid toward this multi-decade low on plunging demand due to the economic fallout from the coronavirus crisis, and as prospects for a OPEC-Texas production deal faded.

“The government is taking a ‘whatever it takes’ approach,” said Marshall Steeves, an analyst at IHS Markit.

“That doesn’t change the fact that demand destruction is going to continue. There are still so many unknowns on the demand front. The duration of this economic shutdown is so uncertain that it’s making me believe the bottom may not be in yet.”

As Bloomberg notes, the prospects for the oil market remain bleak with more nations going into lockdown to tackle the virus. At the same time, supply is surging. The chance that either Saudi Arabia or Russia will back down from their price war seems remote, with President Vladimir Putin unlikely to submit to what he sees as the kingdom’s oil blackmail, according to Kremlin watchers.

Even if crude demand recovers to normal levels by the middle of the year, 2020 is still on course to suffer the biggest decline in consumption since reliable records started in the mid-1960s.

“We are now looking at a scale of surplus in the second quarter we probably never have seen before,” said Bjarne Schieldrop, chief commodities analyst at SEB.

Until now, the biggest annual contraction was recorded in 1980, when it tumbled by 2.6 million barrels a day as the global economy reeled under the impact of the second oil crisis.

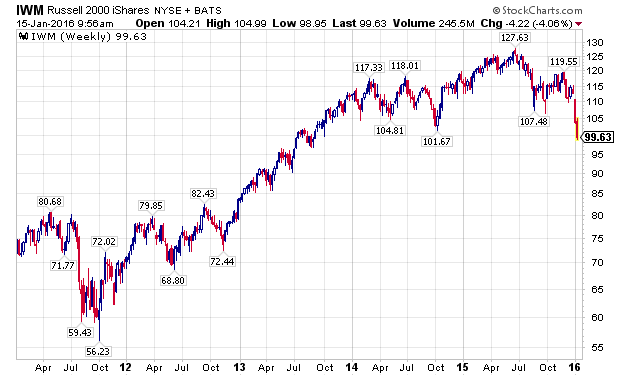

We just witnessed a global collapse in asset prices the likes we haven’t seen before. Not even in 2008 or 2000. All these prior beginnings of bear markets happened over time, relatively slowly at first, then accelerating to the downside.

This collapse here has come from some of the historically most stretched valuations ever setting the stage for the biggest bull trap ever. The coronavirus that no one could have predicted is brutally punishing investors that complacently bought into the multiple expansion story that was sold to them by Wall Street. Technical signals that outlined trouble way in advance were ignored while the Big Short 2 was already calling for a massive explosion in $VIX way before anybody ever heard of corona virus.

Worse, there is zero visibility going forward as nobody knows how to price in collapsing revenues and earnings amid entire countries shutting down virtually all public gatherings and activities. Denmark just shut down all of its borders on Friday, flight cancellations everywhere, the planet is literally shutting down in unprecedented fashion.

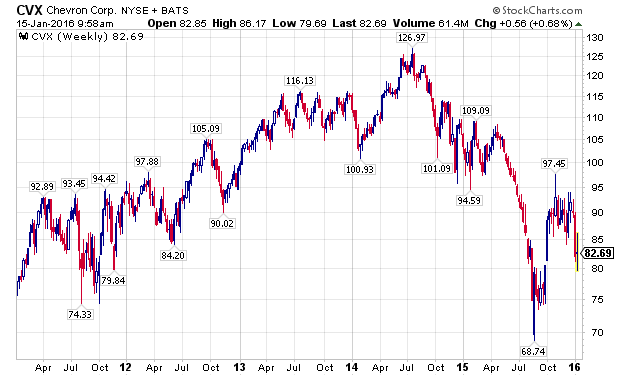

After the bloodbath caused by Saudi Arabia’s decision to ramp up output, European oil companies at first blush look enticingly cheap.

The Johan Sverdrup oil field in the North Sea, west of Stavanger, Norway, Getty Images

The dividend yield in BP, for example, is a mouth-watering 9.35%, according to FactSet Research. For perspective, the yield on a British 10-year gilt is 0.27%.

But with oil prices so low, how could BP possibly afford to pay such a dividend?

In a note to clients with little in the way of commentary, Morgan Stanley ran the numbers on what European major oil companies would look like with Brent crude at $35 a barrel.

Probably the most jarring numbers are the dividend cover at that level.

Equinor this year could cover just 1% of its dividend versus its previous estimate of 93%, according to the Morgan Stanley calculation of life at $35 a barrel.

The best positioned is OMV, which can still cover 107% of its dividend at $35, down from an estimated 198%.

BP’s dividend cover falls to 54% from 107%; Shell’s drops to 72% from 115%; Total’s goes to 62% from 125%; Eni’s drops to 57% from 87%; Repsol’s falls to 79% from 123%; and Galp’s drops to 52% from 115%.

Stock buybacks for the European major oil companies would drop by two-thirds on the Morgan Stanley numbers.

This comes as demand has been slashed due to the coronavirus outbreak

Prince Abdulaziz, energy minister of Saudi Arabia

Saudi Arabia will increase its oil output next month to more than 10 million barrels per day, following talks between OPEC and its allies which failed to come to an agreement.

KSA has cut its oil prices drastically, more than it has in 20 years, with discounts to buyers in Europe, the Far East, and the US meant to draw more refiners to Saudi crude rather than other crude oil suppliers.

Bloomberg reported that Saudi Arabia has privately said it could raise production to 12 million barrels per day, citing anonymous sources.

This comes as demand is slashed due to the ongoing coronavirus outbreak.

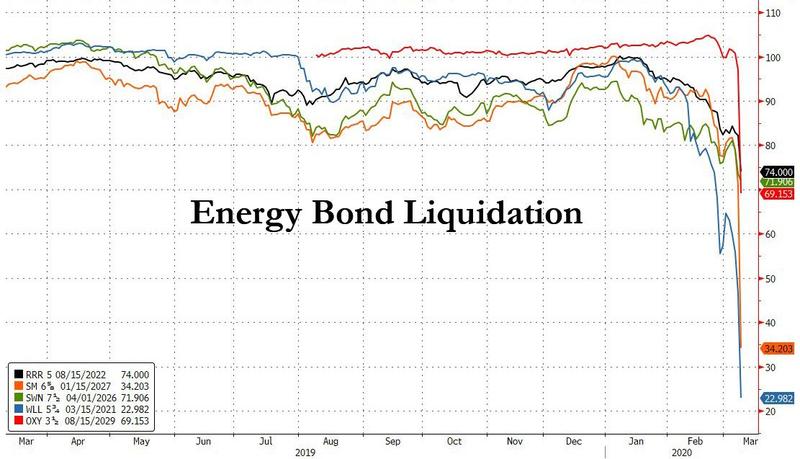

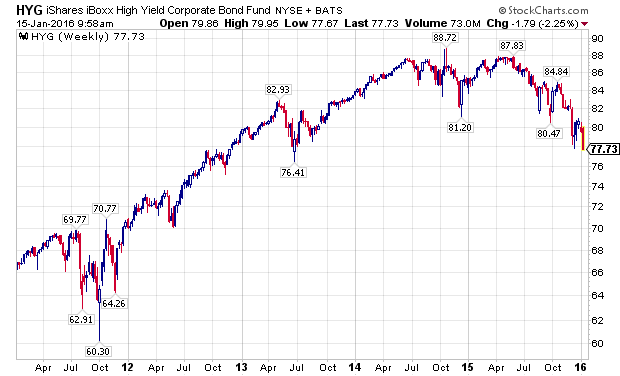

With energy junk bonds crashing…

… amid a (long-overdue) investor revulsion to the highly levered energy sector, much of which is funded in the high yield market, as crashing oil prices bring front and center a doomsday scenario of mass defaults as shale companies are unable to meet their debt and interest payment obligations, investor focus is shifting up the funding chain, and after assessing which shale names are likely to be hit the hardest, with many filing for bankruptcy if oil remains at or below $30, the next question is which banks have the most exposure to the energy loans funding these same E&P companies.

Conveniently, in a note this morning looking at the impact of plunging interest rates on bank profitability, Morgan Stanley also lays out the US banks that have the highest exposure to energy in their Q4 loan books.

The supply chain shock emanating from China to other Asia Pacific countries and Europe, could become a major headache for India.

Bloomberg focuses on how an industrial shutdown of China’s economy has already had a profound effect on India’s economy and could get worse.

Pankaj R. Patel, chairman of Zydus Cadila, said prices of medicine in India have exponentially jumped in the last several weeks, thanks to much of the medicine is sourced from China.

The Indian pharmaceutical industry is experiencing massive disruptions that could face shortages starting in April if supplies aren’t replenished in the next couple weeks, Patel warned.

Manufacturers in China have idled plants, and at least two-thirds of the economy is halted. Some factories came online last week with promises of full production by the end of the month, but for most factories, their resumption will likely be delayed. This will undoubtedly lead to medicine shortages in India in the coming months ahead.

A new theme is developing from all this mayhem – that is the reorganization of complex supply chains out of China to a more localized approach to avoid severing. But in the meantime, these complex supply chains in India and across the world will experience massive disruption caused by the shutdown. All of this points to ugly end of globalization:

Pankaj Mahindroo, chairman of the India Cellular and Electronics Association (ICEA), said the wrecking of supply chains in China could soon have a devastating impact on India’s smartphone production.

Mahindroo represents companies including Foxconn, Apple Inc., Micromax Informatics Ltd., and Salcomp India, warned the “impact is already visible… If things don’t improve soon, production will have to be stopped.”

Already, the production of iPhones and Airpods has been reduced in China because of factory shutdowns.

The closure of Foxconn plants in India would be absolutely devastating for Apple.

Apple produces iPhone XR in India. If the production of affordable smartphones is halted or reduced, the Californian based company could see full-year earnings guidance slashed.

Mohnidroo said if things don’t improve in the next couple of weeks, smartphone factories in India could start running out of “critical components like printed circuit boards, camera modules, semiconductors, resistors, and capacitors.”

A spokesperson for Xiaomi Corp.’s India unit said alternative sourcing attempts are underway to mitigate any supply chain disruption from China.

Even before all of this, India’s economy is rapidly decelerating into an economic crisis.

Former Indian Finance Minister Yashwant Sinha warned several months ago that the country is in a “very deep crisis,” witnessing “death of demand,” and the government is “befooling people” with its economic distortions of how growth is around the corner.

Supply chain disruptions are moving from East to West. It’s only a matter of time before production lines are halted in the US because sourcing of Chinese parts is offline. The disruptions of supply chains is the shock that could tilt the global economy into recession.

Until now, the general public was only aware of the remarkable ability of Tesla cars to spontaneously combust, that is at least when they are not smashing into random things while on autopilot. It now appears that Tesla’s solar panels (some may be unaware that several years ago, Elon Musk tried to unsuccessfully pivot Tesla into a solar power company as well as that’s where a few billion in government subsidies were to be found) are just as combustible.

On Tuesday, Walmart sued Tesla, after its solar panels atop seven of the retailer’s stores allegedly caught fire, alleging breach of contract, gross negligence and failure to live up to industry standards. Walmart is asking Tesla to remove solar panels from more than 240 Walmart locations where they have been installed, and to pay damages related to all the fires Walmart says that Tesla caused.

Walmart said it had leased or licensed roof space on top of more than 240 stores to Tesla’s energy operations unit, formerly known as SolarCity (which was basically a bailout by Elon Musk for Elon Musk who was also the largest SolarCity shareholder), for the installation and operation of solar systems. But as of November, fires had broken out at no fewer than seven of the stores, forcing the disconnection of all the solar panel systems for the safety of the public.

The breach-of-contract suit by Walmart, which was filed in the state of New York, alleges that: “As of November 2018, no fewer than seven Walmart stores had experienced fires due to Tesla’s solar systems-including the four fires described above and three others that had occurred earlier.” The fires resulted in evacuations, damaged property and inventory.

Walmart’s inspectors additionally found that Tesla “had engaged in widespread, systemic negligence and had failed to abide by prudent industry practices in installing, operating and maintaining its solar systems.’

Walmart also claimed that “Tesla routinely deployed individuals to inspect the solar systems who lacked basic solar training and knowledge“ and also alleged that Tesla failed to ground its solar and electrical systems properly, and that Tesla-installed solar panels on-site at Walmart stores contained a high number of defects that were visible to the naked eye, including loose and hanging wires at several locations, and which Tesla should have found and repaired before they led to fires.

It gets better: according to the suit, Tesla’s own inspection reports revealed “improper wire management, including abraded and hanging wires,” as well as “poor grounding” and “solar panel modules that were broken or contained dangerous hot spots.”

“To state the obvious, properly designed, installed, inspected and maintained solar systems do not spontaneously combust, and the occurrence of multiple fires involving Tesla’s solar systems is but one unmistakable sign of negligence by Tesla,” Walmart said in the suit. “To this day, Tesla has not provided Walmart with the complete set of final ‘root cause’ analyses needed to identify the precise defects in its systems that caused all of the fires described above.”

Walmart said the first fire broke out at a store in Beavercreek, Ohio, a suburb of Dayton, in March 2018, and two more fires occurred at stores in California and Maryland in May of that year. While Tesla disconnected the panels at Walmart’s request that same month, it wasn’t enough to stop fires from occurring, and another blaze broke out in November at a store in Yuba City, California.

Ironically, the lawsuit comes at a time when Tesla has been trying to salvage its collapsing solar business; on Sunday, Elon Musk announced in a string of tweets which reeked of desperation that customers in some states can now rent Tesla’s residential, solar rooftop systems without a contract. The offer is available in six states, and will cost customers at least $50 a month (or $65 a month in California). And although Musk touted the ease of cancelling a rented roof at anytime, CNBC noted that the fine print on Tesla’s website mentions a $1,500 fee to take out the solar panels and restore the customer’s roof.

There is a reason why Tesla is basically giving the spontaneously combustible solar panels away: In the second quarter, Tesla installed a mere 29 megawatts of solar, a record low for the company in a single quarter. In its heyday, Tesla’s solar division (formerly SolarCity) installed over 200 megawatts in a single quarter.

But wait there is more.

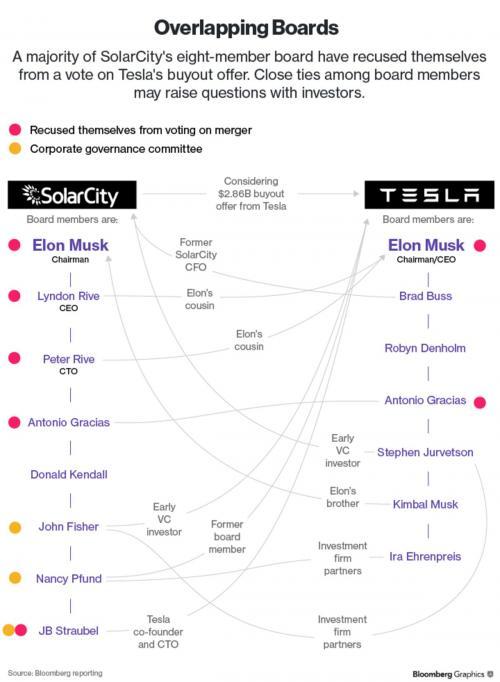

As if allegations of shoddy quality control, dismal workmanship and overall blatant lack of professionalism weren’t enough, Walmart also “went there” and in the “explosive”, pun not intended 114-page lawsuit, piled onto a long-running controversy according to which Tesla bailed out a failing SolarCity in 2016 when it purchased the company for $2.6 billion (Elon Musk was also the biggest shareholder of SolarCity at the time, while Tesla’s Elon Musk bought out SolarCity in a gross conflict of interest), with WalMart highlighting the familial ties between Tesla and SolarCity as the underpinnings of a flawed merger that allegedly produced shoddy craftsmanship and led to fires at seven Walmart stores.

“On information and belief, when Tesla purchased SolarCity to bail out the flailing company (whose executives included two of Tesla CEO Elon Musk’s first cousins), Tesla failed to correct SolarCity’s chaotic installation practices or to adopt adequate maintenance protocols, which would have been particularly important in light of the improper installation practices,” Walmart claimed in a suit that is sure to draw regulators attention to the 2016 deal that should never have been allowed. As shown in the diagram above, SolarCity co-founders Lyndon Rive and Peter Rive are Musk’s cousins, while Musk was the largest shareholder of both companies.

So already facing a slumping stock price from dozens of lawsuits and investigations, store closings, delayed loan repayments and the departure of key executives, CNBC notes that the Walmart suit lands at a particularly difficult time for Tesla and Musk. Specifically in regards to SolarCity, Musk was slated to be deposed earlier this month in a complaint brought by shareholders over the deal.

The name “SolarCity” shows up 46 times in the lawsuit, which alleges the company had a failed business model, stemming from a goal to speed up revenue growth at all costs.

“Walmart’s experience bears out Tesla, Inc.’s and Tesla’s inability to turn around and bail out the solar panel operations acquired from SolarCity,” the suit says.

* * *

Walmart is asking a judge to declare Tesla in breach of contract, order the company to remove the solar panels from all of its stores and award damages equal to its costs and consulting fees in connection with the fires.

Tesla shares fell as much as 1.7% to $222.70 as of 6:45 p.m. in after hours trading. The stock is down 32% this year.

The case is Walmart Inc. v. Tesla Energy Operations, New York State Supreme Court, New York County; Index No. 654765/2019.

The full lawsuit is below

Today, gasoline taxes are rising in a dozen U.S. states. The following infographic shows where gasoline taxes are going up today and it’s based on data from the Institute on Taxation and Economic Policy.

(source)

(source)

California is among the states with increases and taxes in the Golden State are going up by 5.6 cents. That now equates to 47.3 cents per gallon, meaning California once again has the highest gasoline prices in the country.

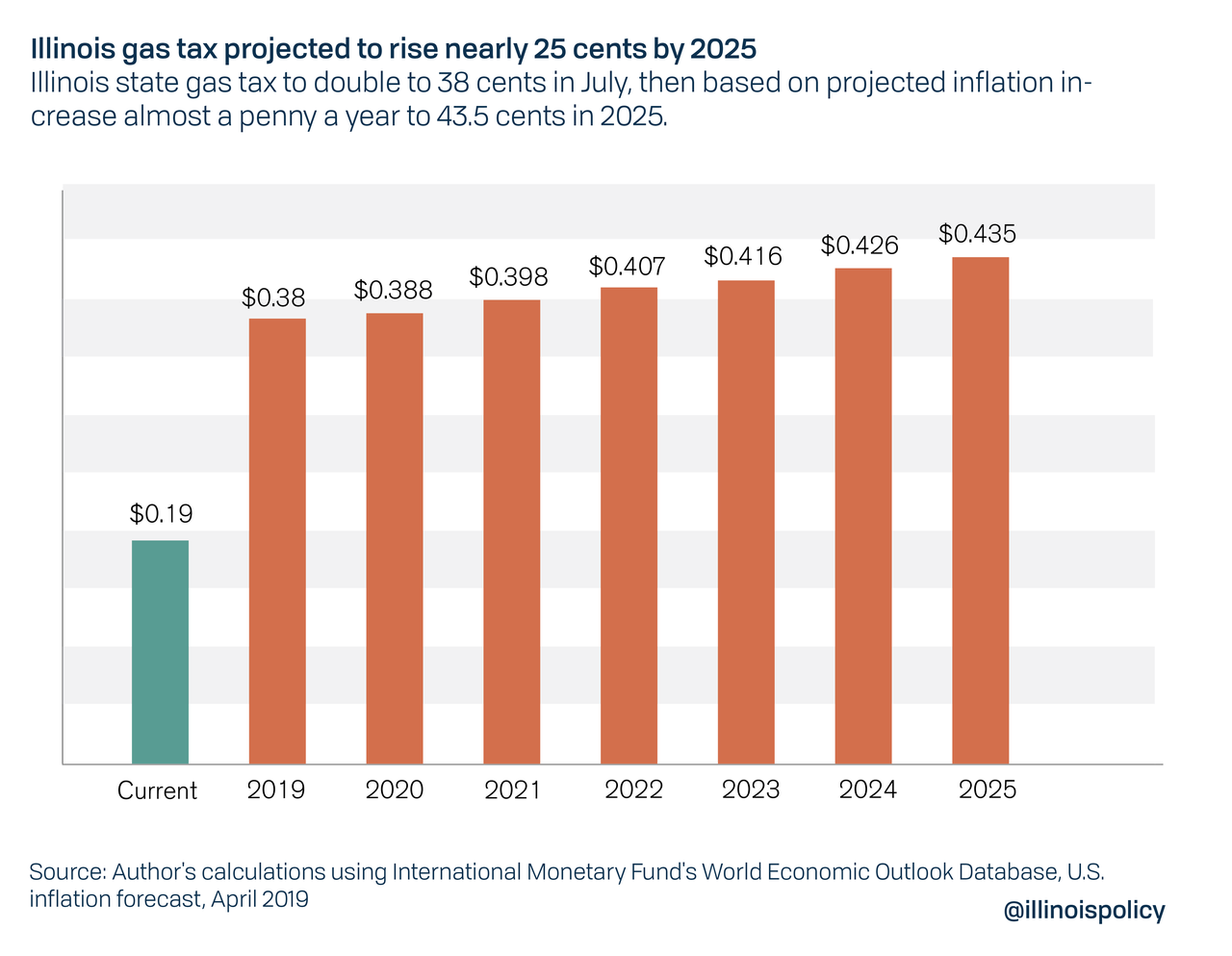

But, the increase is particularly notable in Illinois given, as Statista’s Niall McCarthy notes, that the state hasn’t altered its gas tax since 1990. It’s bumping its gas tax by 19 cents to 38 cents a gallon.

As IllinoisPolicy.org’s Vincent Carudo and Joe Barnas detail below, Illinoisans will shoulder one of the nation’s heaviest tax burdens at the pump – and the DMV.

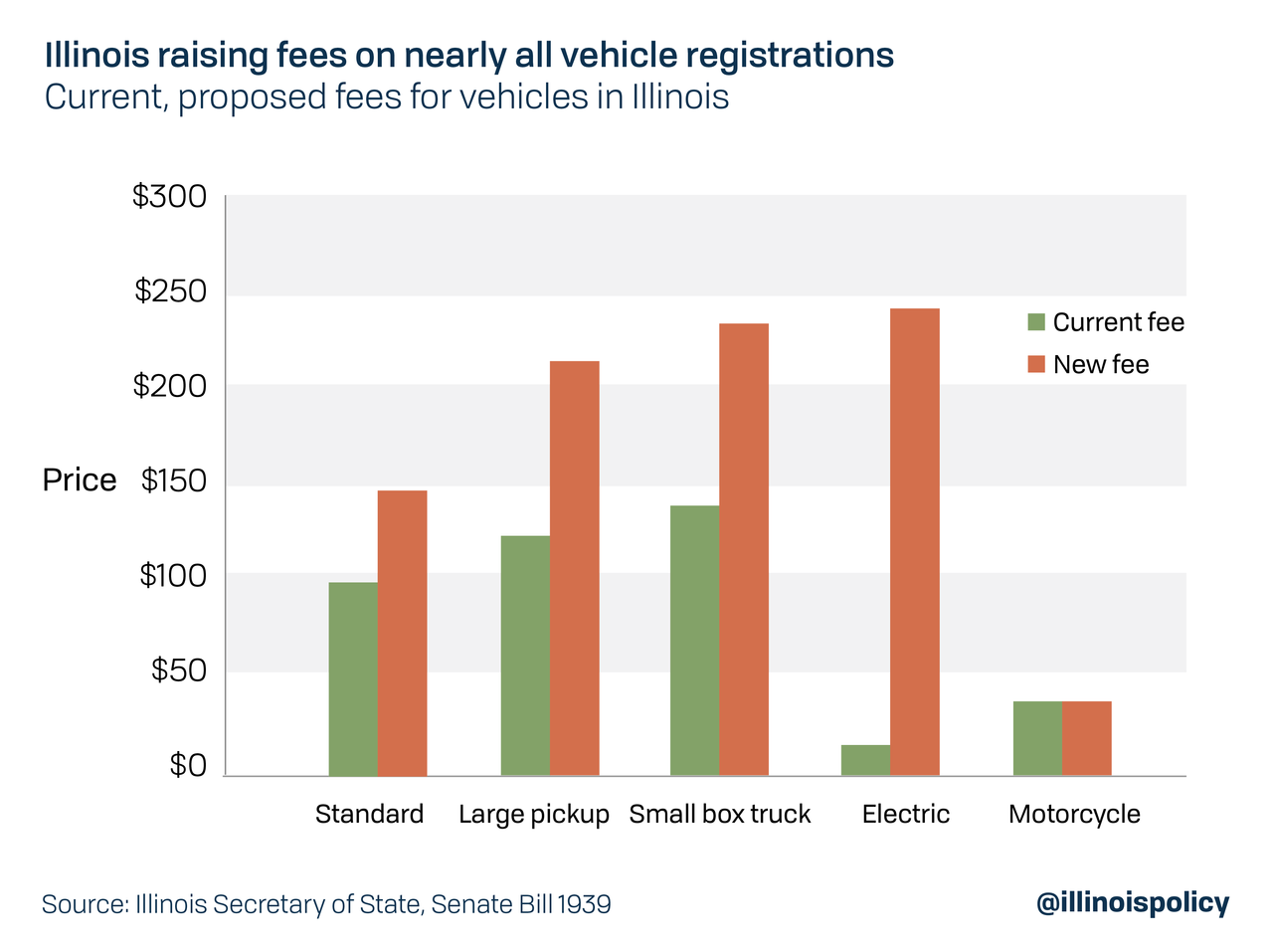

On June 28, Gov. J.B. Pritzker signed into law a $45 billion infrastructure plan that will bring Illinois drivers a record gas tax hike and higher vehicle registration costs.

Those tax and fee increases will come in addition to tax hikes on cigarettes, e-cigarettes, parking and real-estate transfers, on top of new revenue from a massive gambling expansion that includes new casinos and legalized sport betting – all of which the Illinois General Assembly introduced and passed in a single day.

The gas tax hike is the most painful increase to come, doubling to 38 cents from 19 cents per gallon.

This will bump Illinois’ total gas tax burden to the third-highest in the nation, and possibly higher if local governments exercise their increased taxing authority under the plan. An Illinois Policy Institute analysis found the typical Illinois driver will pay at least $100 more on gasoline each year under a doubled gas tax.

Illinois is one of just seven states where drivers pay layers of both general sales taxes and special excise taxes on gasoline at the state and local levels. Those multiple layers mean drivers filling up in Chicago, for example, will pay 96 cents in taxes and fees on a $2.46 gallon of gasoline – an effective tax burden of 39%.

The infrastructure plan also hikes Illinois’ vehicle registration fees to among the highest in the nation. Illinois drivers of standard vehicles weighing 8,000 pounds or less will see registration fees jump to $148 from $98.

The gas tax hike kicks in July 1, and motorists will pay more for license plate stickers starting in 2020.

Taken together, increases in the gas tax and vehicle registration fees alone erase any promised income tax savings included in Pritzker’s progressive income tax plan, which Illinoisans will vote on in November 2020.

Under Pritzker’s proposed progressive tax system, a married couple in Illinois with two kids earning the $79,168 median annual income and paying the average property tax bill of $4,157 would see $195 in total tax relief, according to the Pritzker administration’s online “fair tax calculator.”

But if that same family uses two cars on a regular basis, their budget will take a $300 hit – a $200 gas tax increase and a $100 vehicle registration fee hike.

Notably, the gas tax will be tied to inflation, meaning it will automatically rise annually. This allows state lawmakers in future years to avoid blame from frustrated motorists.

Based on current inflation projections, the gas tax will rise almost a penny a year. Lawmakers’ inflation mechanism could drive the gas tax to 43.5 cents by 2025, nearly 25 cents per gallon more than it is now.

Using the most recent inflation forecasts for the United States, the gas tax will grow just short of a penny each year until 2025 – a 130% increase.

The new law lets Chicago raise its local gas tax by an extra 3 cents, which would put it at 8 cents. It allows Lake County and Will County to impose a gas tax of up to 8 cents per gallon. DuPage, Kane and McHenry counties would be able to double their 4-cent-per-gallon gas taxes to 8 cents.

According to state projections, the doubled gas tax alone will raise $1.2 billion, with $560 million going to the state and $650 million to local governments.

If Chicago and the collar counties increase their motor fuel taxes – along with automatic yearly inflation-tied increases at the state level – residents could soon be looking at the highest average gas tax burden in the country.

The Illinois Policy Institute outlined a plan in May showing how Illinois could finance $10 billion in new capital spending without tax hikes.

State lawmakers could have achieved a more responsible plan by focusing on maintenance infrastructure, reforming costly prevailing wage mandates and using an objective project selection process, while dedicating revenue from legalized sports betting and sales taxes on gasoline to transportation infrastructure.

Instead, state leaders once again chose to demand more of already-overburdened Illinois taxpayers.

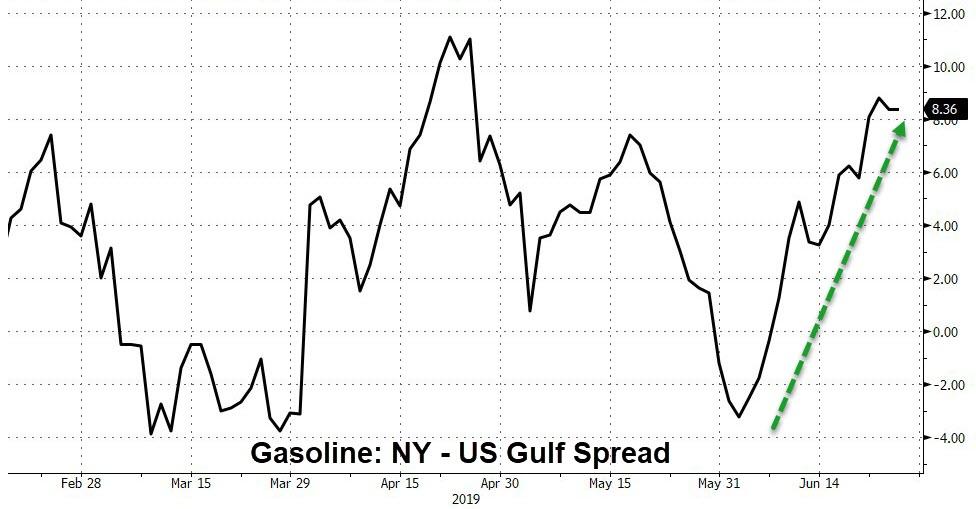

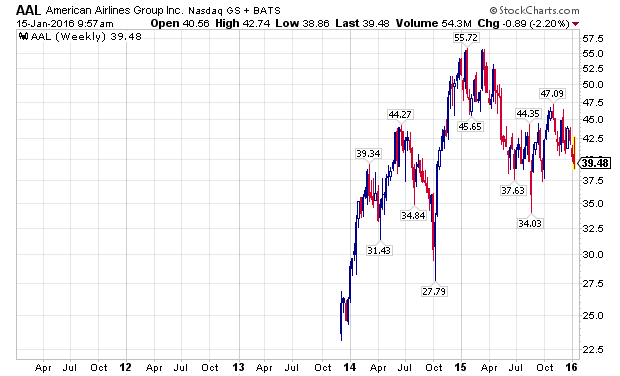

RBOB Gasoline futures jumped overnight, accelerating their recent ascent ever since the explosion and massive inferon at the Philadelphia Energy Solutions (PES) plant, following a Reuters report that the largest east coast refinery is expected to seek to permanently shut its oil refinery in the city after a massive fire caused substantial damage to the complex.

Shutting the refinery, the largest and oldest on the U.S. East Coast, would result in not only hundreds of lost jobs but also sharply higher gasoline prices as gasoline supplies are squeezed in the busiest, most densely populated corridor of the United States.

PES is expected to file a notice of intent with state and federal regulators as early as Wednesday, setting in motion the process of closing the refinery, the sources said.

The refinery, which could still change its plans, is also expected to begin layoffs of the 700 union workers at the plant as early as Wednesday, Reuters reported. The layoffs could include about half of the union workforce, with the remaining staff staying at the site until the investigation into the blast concludes.

As reported previously, the 335,000 barrel-per-day (bpd) complex, located in a densely populated area in the southern part of the city, erupted in flames in the early hours on Friday, in a series of explosions that could be heard miles away and which some compared to a meteor strike or a nuclear bomb going off.

The cause of the fire was still unknown as of Tuesday, though city fire officials said it started in a butane vat around 4 a.m. (0800 GMT). It destroyed a 30,000-bpd alkylation unit that uses hydrofluoric acid to process refined products. Had the acid caught fire, it could have resulted in a vapor cloud that can damage the skin, eyes and lungs of nearby residents.

Prior to the massive inferno, the refinery had suffered from years of financial struggles, forcing it to slash worker benefits and scale back capital projects to save cash. It went through a bankruptcy process last year to reduce its debt, but its difficulties continued as its cash on hand dwindled even after emerging from bankruptcy in August; some have speculated that cost cutting resulted in the structure becoming fragile and susceptible to accident.

After bankruptcy, Credit Suisse Asset Management and Bardin Hill became the controlling owners, with former primary owners Carlyle Group and Sunoco Logistics, an Energy Transfer subsidiary, holding a minority stake.

Last Friday’s blaze was the second in two weeks at the complex, spurring calls from Philadelphia’s mayor for a task force to look into both the cause and community outreach in the wake of the incidents. A spokesperson for Mayor Jim Kenney declined to comment on the potential closure of the plant.

That may be difficult as investigators on the scene are said to be dealing with unstable structures that need to be certified by engineers, slowing down the inquiry, city officials said. The investigation could ultimately take months or perhaps years. Additionally, the state Department of Environmental Protection said they have concerns about the integrity of storage tanks on site, the agency said on Tuesday. The U.S. Chemical Safety Board is also investigating the incident, according to Reuters.

While none of this will make much news outside of Philly, what will impact all East Coast drivers is that gasoline futures rose as much as 5.4% on Wednesday to $1.9787 a gallon, the highest since May 23. The front month price was at $1.945 early on Wednesday.

Futures are up 8.9% since Thursday’s close.

NY Gasoline prices have surged back into a premium over US Gulf Gasoline…

All of which will drag, as always with a lag, the price of gas at the pump notably higher…

The rally in U.S. gasoline futures has pushed U.S. gasoline prices above European and Asian markets, raising the prospects for US imports. According to Matthew Chew, oil analyst at IHS Markit, “chances are that (the wider price spread) could open up the arbs between U.S. Gulf/Europe and [the East Coast] PADD 1.”

And so the sun seems to stand still this last day before the resumption of business-as-usual, and whatever remains of labor in this sclerotic republic takes its ease in the ominous late summer heat, and the people across this land marinate in anxious uncertainty. What can be done?

Some kind of epic national restructuring is in the works. It will either happen consciously and deliberately or it will be forced on us by circumstance. One side wants to magically reenact the 1950s; the other wants a Gnostic transhuman utopia. Neither of these is a plausible outcome. Most of the arguments ranging around them are what Jordan Peterson calls “pseudo issues.” Let’s try to take stock of what the real issues might be.

Energy: The shale oil “miracle” was a stunt enabled by supernaturally low interest rates, i.e. Federal Reserve policy. Even The New York Times said so yesterday (The Next Financial Crisis Lurks Underground). For all that, the shale oil producers still couldn’t make money at it. If interest rates go up, the industry will choke on the debt it has already accumulated and lose access to new loans. If the Fed reverses its current course — say, to rescue the stock and bond markets — then the shale oil industry has perhaps three more years before it collapses on a geological basis, maybe less. After that, we’re out of tricks. It will affect everything.

The perceived solution is to run all our stuff on electricity, with the electricity produced by other means than fossil fuels, so-called alt energy. This will only happen on the most limited basis and perhaps not at all. (And it is apart from the question of the decrepit electric grid itself.) What’s required is a political conversation about how we inhabit the landscape, how we do business, and what kind of business we do. The prospect of dismantling suburbia — or at least moving out of it — is evidently unthinkable. But it’s going to happen whether we make plans and policies, or we’re dragged kicking and screaming away from it.

Corporate tyranny: The nation is groaning under despotic corporate rule. The fragility of these operations is moving toward criticality. As with shale oil, they depend largely on dishonest financial legerdemain. They are also threatened by the crack-up of globalism, and its 12,000-mile supply lines, now well underway. Get ready for business at a much smaller scale.

Hard as this sounds, it presents great opportunities for making Americans useful again, that is, giving them something to do, a meaningful place in society, and livelihoods. The implosion of national chain retail is already underway. Amazon is not the answer, because each Amazon sales item requires a separate truck trip to its destination, and that just doesn’t square with our energy predicament. We’ve got to rebuild main street economies and the layers of local and regional distribution that support them. That’s where many jobs and careers are.

Climate change is most immediately affecting farming. 2018 will be a year of bad harvests in many parts of the world. Agri-biz style farming, based on oil-and-gas plus bank loans is a ruinous practice, and will not continue in any case. Can we make choices and policies to promote a return to smaller scale farming with intelligent methods rather than just brute industrial force plus debt? If we don’t, a lot of people will starve to death. By the way, here is the useful work for a large number of citizens currently regarded as unemployable for one reason or another.

Pervasive racketeering rules because we allow it to, especially in education and medicine. Both are self-destructing under the weight of their own money-grubbing schemes. Both are destined to be severely downscaled. A lot of colleges will go out of business. Most college loans will never be paid back (and the derivatives based on them will blow up). We need millions of small farmers more than we need millions of communications majors with a public relations minor. It may be too late for a single-payer medical system. A collapsing oil-based industrial economy means a lack of capital, and fiscal hocus-pocus is just another form of racketeering. Medicine will have to get smaller and less complex and that means local clinic-based health care. Lots of careers there, and that is where things are going, so get ready.

Government over-reach: the leviathan state is too large, too reckless, and too corrupt. Insolvency will eventually reduce its scope and scale. Most immediately, the giant matrix of domestic spying agencies has turned on American citizens. It will resist at all costs being dismantled or even reined in. One task at hand is to prosecute the people in the Department of Justice and the FBI who ran illegal political operations in and around the 2016 election. These are agencies which use their considerable power to destroy the lives of individual citizens. Their officers must answer to grand juries.

As with everything else on the table for debate, the reach and scope of US imperial arrangements has to be reduced. It’s happening already, whether we like it or not, as geopolitical relations shift drastically and the other nations on the planet scramble for survival in a post-industrial world that will be a good deal harsher than the robotic paradise of digitally “creative” economies that the credulous expect. This country has enough to do within its own boundaries to prepare for survival without making extra trouble for itself and other people around the world. As a practical matter, this means close as many overseas bases as possible, as soon as possible.

As we get back to business tomorrow, ask yourself where you stand in the blather-storm of false issues and foolish ideas, in contrast to the things that actually matter.

Today U.S. Chamber of Commerce President Tom Donohue announced another campaign to protect and defend his Wall Street contributors against initiatives that benefit Main Street U.S.A. This is not the first time, and unfortunately it will likely not be the last time.

For a great historic reference consider THIS ARTICLE from 2014; when the U.S. Chamber of Commerce announced their direct attack against the Tea Party backed candidates that threatened to remove the massive lobbying power of Tom Donohue’s corrupt officials. That 2014 reference point has two parts. I strongly urge anyone who would defend the U.S. CoC approach to read both.

The overwhelming majority of economic punditry and opinion come from salespeople on the purchased payroll, direct and indirect, of the chamber. It is one of the most, check that, it is the most corrupt and abusive enterprise in the history of our nation. They are pulling out a very familiar playbook.

(Reuters) – The U.S. Chamber of Commerce on Monday denounced President Donald Trump’s handling of a global trade dispute, issuing a report that argued the tariffs imposed by Washington and retaliation by its partners would boomerang badly on the American economy.

The Chamber, the nation’s largest business lobby group and a traditional ally of Trump’s Republican Party, argued the White House is risking a global trade war with the push to protect U.S. industry and workers with tariffs.The group’s analysis of the potential hit each U.S. state may take from retaliation by U.S. trading partners painted a gloomy picture that could increase pressure on the White House from Republicans ahead of congressional elections in November.[…] The Chamber is expected to spend millions of dollars ahead of the November elections to help candidates who back free trade, immigration and lower taxes. It has already backed candidates who share those goals in Republican primaries. (read more)

The U.S. Chamber of Commerce consists of a massive multinational DC lobbying group that four consecutive administrations’ have allowed to write the actual language in U.S. trade deals and trade negotiations. Bush, Clinton, Clinton, Bush, Bush, Obama, Obama all gave the U.S. Chamber of Commerce the keys to the U.S. economy, and walked away. The U.S. middle-class was nearly destroyed in the process.

CTH has stood alone, for years, against the insufferable horde of CoC political mouthpieces and their media conscripts. The U.S. Chamber of Commerce is at the corrupt center of almost every scheme that fund the Deep Swamp to the detriment of our nation. They are the most vile and insidious UniParty group of lobbyists in Washington DC.

Until Donald Trump came along, they held virtually unlimited power over the U.S. economy. The Chamber is a cancer; and any politician who associates with that abhorrent group should be excised from existence with extreme prejudice.

Consumers, who are already being squeezed by rising interest rates (even as the return on their cash deposits remains anchored near zero), are facing another potential constraint on their already limited purchasing power. And that constraint is rising gasoline prices, which, as we pointed out last month, could erode the stimulative impact of President Trump’s tax plan as rising prices sop up what little money the middle class is saving.

As prices rise and banks scramble to update their forecasts, the Wall Street Journal has become the latest publication to sound the alarm over what is, in our view, one of the biggest threats facing the US economy in the ninth year of its post-crisis expansion.

In its story warning about $3 a gallon gas (of course, we’re already seeing $4 a gallon in parts of California and other high-tax states), WSJ cited Morgan Stanley’s latest projection that rising gas prices could wipe out about a third of the annual take-home pay generated by the tax cuts.

Rising fuel costs can also feed inflation and pressure interest rates. Even though the Federal Reserve typically looks past volatile energy prices in the short term, higher energy costs help shape consumer confidence. And with the central bank poised to be more active this year, rising energy costs pose an additional risk to the economy.

Morgan Stanley estimates that if gas averages $2.96 this year, it would take an annualized $38 billion from spending elsewhere, an upward revision from the bank’s $20 billion estimate in January. That would wipe out about a third of the additional take-home pay coming from tax cuts this year, the analysts said.

…

Patrick DeHaan, petroleum analyst at GasBuddy”Three dollars is like a small fence. You can get through it, you can get over it,” said Patrick DeHaan, petroleum analyst at GasBuddy, a fuel-tracking app. “But $4 is like the electric fence in Jurassic Park. There’s no getting over that.”

Of course, MS’s take appears downright pollyannaish when compared with a Brookings Center report that we highlighted last month.

The left-of-center think tank, which of course has every reason to hope that the next recession will materialize on President Trump’s watch, projected that consumers would soon spend about half of the money saved from tax cuts on fuel costs.

And in a report published in April, Deutsche Bank illustrated how rising fuel costs will disproportionately squeeze the most vulnerable among us – a cohort of consumers who already shoulder an outsize share of the country’s household debt.

The FT put it another way…

As the chart above shows, middle-income families – aka the engine of consumption – will be the hardest hit by rising gas prices.

Indeed, small business owners in California, where gas prices are the fifth highest in the nation thanks to taxes and stringent emissions standards, say they’ve seen their energy bills shoot higher in the past few months. Car salesmen say consumers are asking more questions about mileage, according to WSJ.

Robert Lozano, a car salesman in Los Angeles where some gas prices are already above $4, said the dealership’s gas bill has climbed from about $9,000 to about $12,000 a month recently.

Customers are inquiring more about electric vehicles, he said.

“It’s more in the consumer’s mind as to what the most efficient vehicle is.”

With oil already at $70 a barrel, early indicators imply that the summer driving season could see an unusually large spike in demand for gas…

…As the number of Americans intending to take vacations in the next six months climbs to its highest level in decades.

Heightened vacation intentions suggest the number of vehicle miles driven will also climb (because people tend to travel greater distances when they go on vacation). As the chart below shows, fluctuations in miles driven – a close proxy for gas demand – are quickly reflected in prices at the pump.

While the US’s increasing prominence in the oil-export market could soften some of the economic blow as the energy business booms, other large business from airlines to shipping companies would feel the pinch at a time when costs are already rising.

But some economists say the growing importance of energy to the U.S. economy could blunt some of the impact from rising oil prices.

The country has become a more prominent supplier of crude oil and fuel. Domestic production has reached record weekly levels of 10.7 million barrels per day and a lot of it is being exported.

[…]

“People don’t understand how we could double crude oil production” and see higher gas prices, said Tom Kloza, global head of energy analysis at the Oil Price Information Service. “The answer lies in the balance of payment. We are an exporting power right now.”

[…]

Airlines and shipping companies will also be paying more for jet fuel and diesel – costs that may be passed along to consumers. Even companies such as Whirlpool Corp. have noted that higher oil prices have boosted the cost of materials.

Refiner Valero Energy Corp. said it wouldn’t expect consumer demand to drop off until oil prices are at $80 to $100.

But demand is only one factor driving up oil prices. Supply issues have also weighed on oil traders’ minds. Traders pushed oil prices higher as the US pulled out of the Iran deal as some worried that it could impact global supplies (though, as we’ve pointed out, there are plenty of other buyers waiting to step in and buy Iranian crude). Even if the Iranian crude trade isn’t impacted by sanctions, plummeting production capacity in Venezuela could ultimately have a bigger impact on global supply.

Conflicts in other oil producing regions could also impact supplies, pushing prices higher.

Last week, Bank of America became the first Wall Street bank to call $100/bbl for Brent crude (at the time, it was trading around $77/bbl) in 2019. That could send prices to highs not seen since 2008. Other banks have been scrambling to raise their forecasts as well.

With the Fed changing its language in its latest policy statement to reflect rising inflation expectations, rising oil prices could also inspire the Fed to hike interest rates more quickly for fear that the economy might overheat. That could result in four – or perhaps five – rate hikes this year.

The resulting effect would be like economic kudzu strangling the buying power of consumers and possibly forcing a long-overdue debt reckoning as millennials, who are already drowning in debt, are forced to put off home ownership and family formation until they’re in their late 30s or even their 40s.

Just days after Beijing officially launched Yuan-denominated crude oil futures (with a bang, as shown in the chart below, surpassing Brent trading volume) which are expected to quickly become the third global price benchmark along Brent and WTI, China took the next major step in challenging the Dollar’s supremacy as global reserve currency (and internationalizing the Yuan) when on Thursday Reuters reported that China took the first steps to paying for crude oil imports in its own currency instead of US Dollars.

A pilot program for yuan payments could be launched as soon as the second half of the year and regulators have already asked some financial institutions to “prepare for pricing crude imports in the yuan“, Reuters sources reveal.

According to the proposed plan, Beijing would start with purchases from Russia and Angola, two nations which, like China, are keen to break the dollar’s global dominance. They are also two of the top suppliers of crude oil to China, along with Saudi Arabia.

A change in the default crude oil transactional currency – which for decades has been the “Petrodollar“, blessing the US with global reserve currency status – would have monumental consequences for capital allocations and trade flows, not to mention geopolitics: as Reuters notes, a shift in just a small part of global oil trade into the yuan is potentially huge. “Oil is the world’s most traded commodity, with an annual trade value of around $14 trillion, roughly equivalent to China’s gross domestic product last year.” Currently, virtually all global crude oil trading is in dollars, barring an estimated 1 per cent in other currencies. This is the basis of US dominance in the world economy.

However, as shown in the chart below which follows the first few days of Chinese oil futures trading, this status quo may be changing fast.

Superficially, for China it would be a matter of nationalistic pride to see oil trade transact in Yuan: “Being the biggest buyer of oil, it’s only natural for China to push for the usage of yuan for payment settlement. This will also improve the yuan liquidity in the global market,” said one of the people briefed on the matter by Chinese authorities.

There are other considerations behind the launch of the Yuan-denominated oil contract as Goldman explains:

The danger, of course, is that such a shift would also boost the value of the Yuan, hardly what China needs considering it was just two a half years ago that Beijing launched a controversial Yuan devaluation to boost its exports and economy.

Still, in light of the relative global economic stability, Beijing may be willing to take the gamble on a stronger Yuan if it means greater geopolitical clout and further acceptance of the renminbi.

Which is why restructuring oil fund flows may be the best first step: as of this moment, China is the world’s second-largest oil consumer and in 2017 overtook the United States as the biggest importer of crude oil; its demand is a key determinant of global oil prices.

If China’s plan to push the Petroyuan’s acceptance proves successful, it will result in greater momentum across all commodities, and could trigger the shift of other product payments to the yuan, including metals and mining raw materials.

Besides the potential of giving China more power over global oil prices, “this will help the Chinese government in its efforts to internationalize yuan,” said Sushant Gupta, research director at energy consultancy Wood Mackenzie. In a Wednesday note, Goldman Sachs said that the success of Shanghai’s crude futures was “indirectly promoting the use of the Chinese currency (which, however as noted above, has negative trade offs as it would also result in a stronger Yuan, something the PBOC may not be too excited about).

Meanwhile, China is wasting no time, and Unipec, the trading arm of Asia’s largest refiner Sinopec already signed a deal to import Middle East crude priced against the newly-launched Shanghai crude futures contract, which incidentally is traded in Yuan.

The bottom line here is whether Beijing is indeed prepared and ready to challenge the US Dollar for the title of global currency hegemon. As Rueters notes, China’s plan to use yuan to pay for oil comes amid a more than year-long gradual strengthening of the currency, which looks set to post a fifth straight quarterly gain, its longest winning streak since 2013.

In a sign that China’s recent Draconian capital control crackdowns have sapped market confidence in a freely-traded Yuan, the currency retained its No.5 ranking as a domestic and global payment currency in January this year, unmoved from a year ago, but its share among other currencies fell to 1.7 percent from 2.5 percent, according to industry tracker SWIFT.

A slew of measures put in place in the last 1-1/2 years to rein in capital flowing out of the country amid a slide in yuan value has taken off some its shine as a global payment currency.

But the yuan has now appreciated 3.4 percent against the dollar so far this year, with solid gains in recent sessions.

“For PBOC and other regulators, internationalization of the yuan is clearly one of the priorities now, and if this plan goes off smoothly then they can start thinking about replicating this model for other commodities purchases,” said a Reuters source.

Still, it will be a long and difficult climb before the Yuan can challenge the dollar and for Beijing to shift the bulk of its commodity purchases to the yuan because of the currency’s illiquidity in forex markets. According to the latest BIS Triennial Survey, nearly 90% of all transactions in the $5 trillion-a-day FX markets involved the dollar on one side of a trade, while only 4% use the yuan.

* * *

Still, not everyone is convinced that the new Yuan-denominated contract will create a “petro-yuan” as the following take from Goldman highlights:

The launch of the INE contract is not just about oil, as it will also be the first Yuan denominated commodity contract tradable by offshore investors. Such a set-up meets the PBOC’s monetary policy committee goal to raise the profile of its currency in the pricing of commodities. It has raised however the question of whether the INE contract is an incremental step in achieving the currency reserve status for the Yuan. We do not believe so.

While the INE launch does represent an additional step in the CNY internationalization, the CNY denomination of the INE contract does not in itself imply CNY investments. The INE contract does not represent an opening of China’s capital accounts since foreign deposits operate in a closed circuit, deposited in designated accounts and not to be used to purchase other domestic assets. In practice, the collateral deposit and any capital gains can be transferred back to offshore accounts. The potential for greater foreign ownership of Chinese assets is therefore not impacted by CNY oil invoicing and would require instead oil exporters to recycle their proceeds in local assets, for example. The incentive to do this has not changed with the introduction of the INE contracts. In particular, most Middle East oil producers still have currencies pegged to the dollar and limited ability to hedge CNY exposure.

Whether or not Goldman is right remains to be seen, however it is undeniable that a monumental change is afoot in global capital flows, where the US – whether Beijing wants to or not – will soon be forced to defend its currency status as oil exporters (and investors in this highly financialized market) will now have a choice: go with US hegemony, or start accepting Yuan in exchange for the world’s most important commodity.

https://www.corbettreport.com/update-china-to-start-paying-yuan-for-oil/

In what is the latest move to undermine the imperial world order maintained by the United States, which is underpinned through use of the petrodollar as the world reserve currency, the Wall Street Journal reports that Venezuelan President Maduro has officially followed through on his threat to stop accepting US Dollars as payment for crude oil exports in the wake of recent US sanctions.

Last Thursday, President Nicolas Maduro said that if the US went ahead with the sanction, Venezuela would “free” itself from the US Dollar.

According to Reuters:

“Venezuela is going to implement a new system of international payments and will create a basket of currencies to free us from the dollar,” Maduro said in a multi-hour address to a new legislative “superbody.”

Unsurprisingly, Maduro noted that his country would look to the BRICS countries, and begin using the Chinese yuan and Russian ruble instead — along with other currencies — to bypass the US Dollar stranglehold.

Rather than work diplomatically with other nations, the United States often uses sanctions to force compliance. Due to the dollar being accepted as the world’s reserve currency, almost all financial transactions are denominated in dollars. This phenomenon gives the US a powerful weapon to wield against states that refuse to follow US directives, and underpins the unipolar model of global domination exercised by the US.

Interestingly, the decision by Venezuela – the nation with the world’s largest proven oil reserves – comes just days after China and Russia unveiled an Oil/Yuan/Gold plan at the recent annual BRICS conference. This plan would strongly undermine the hegemonic control the US enjoys over the global financial system.

During the BRICS conference, Putin unveiled a geopolitical/geoeconomic bombshell as he forwarded the notion of a “fair multipolar world.” He emphasized a stance “against protectionism and new barriers in global trade” — a reference to the manner in which US operates its empire to maintain primacy.

Russia shares the BRICS countries’ concerns over the unfairness of the global financial and economic architecture, which does not give due regard to the growing weight of the emerging economies. We are ready to work together with our partners to promote international financial regulation reforms and to overcome the excessive domination of the limited number of reserve currencies.

“To overcome the excessive domination of the limited number of reserve currencies” is simply a nice way of saying that the BRICS will create a system to bypass the US dollar, as well as the petrodollar, in an effort to undermine the unipolar paradigm embraced by the United States.

As we previously reported, China will soon launch a crude oil futures contract priced in yuan that is fully convertible into gold.

What this means is that countries who refuse to bend to the imperial will of the United States, i.e. Russia, Iran, etc., will now be able to bypass US sanctions by making energy trades in their own currencies, or in Chinese yuan – with the knowledge that they can convert the yuan into gold as added incentive/insurance/security.

The yuan will be fully convertible into gold on both the Shanghai and Hong Kong exchanges. Typically, crude oil is priced in relation to Brent or West Texas Intermediate futures, both denominated in U.S. dollars.

“The rules of the global oil game may begin to change enormously,” said Luke Gromen, founder of U.S.-based macroeconomic research company FFTT.

This new paradigm of oil, yuan, and gold is, without question, an international game changer. The key takeaway here is that the US dollar can now be bypassed without so much as a second thought.

Russia and China – via the Russian Central Bank and the People’s Bank of China – have been steadily working on ruble-yuan swaps as a means of hedging against US hegemony.

There is a strategic movement to take these actions beyond the BRICS, first allowing aspiring “BRICS Plus” members, then entire Global South to divest themselves from dependence on the US dollar.

Essentially, Russia and China are working together to usher in a new paradigm of Eurasian integration, something that goes directly against US strategic doctrine – which dictates that Russia and China, the United States’ two main geopolitical rivals, should never be allowed to dominate Eurasia.

“In 2014 Russia and China signed two mammoth 30-year contracts for Russian gas to China. The contracts specified that the exchange would be done in Renminbi [yuan] and Russian rubles, not in dollars. That was the beginning of an accelerating process of de-dollarization that is underway today,” according to strategic risk consultant F. William Engdahl.

Russia and China are now creating a new paradigm for the world economy and paving the way for a global de-dollarization, and Venezuela is just the beginning.

“A Russian-Chinese alternative to the dollar in the form of a gold-backed ruble and gold-backed Renminbi or yuan, could start a snowball exit from the US dollar, and with it, a severe decline in America’s ability to use the reserve dollar role to finance her wars with other peoples’ money,” Engdahl concludes.

Make no mistake that the BRICS are not only working to integrate Eurasia, but to geo-economically integrate the entire Global South under a new multipolar framework that treats states as equals, regardless of their power stature globally.

The Neolibcons in Washington – bent on eventual regime change in Russia and China – are in for an extremely rude awakening. Although the BRICS have their own structural economic problems, they have created a long-term plan that will change the face of geopolitics/geo-economics and degrade the imperialist will of those that wish to dictate and order the world as they see fit.

The DC War Party’s petrodollar imperialism, which funds the US war machine and allows for a constant war footing, is quickly running out of allies to maintain its global hegemony.

Video Commentary:

The world’s top oil importer, China, is preparing to launch a crude oil futures contract denominated in Chinese yuan and convertible into gold, potentially creating the most important Asian oil benchmark and allowing oil exporters to bypass U.S.-dollar denominated benchmarks by trading in yuan, Nikkei Asian Review reports.

The crude oil futures will be the first commodity contract in China open to foreign investment funds, trading houses, and oil firms. The circumvention of U.S. dollar trade could allow oil exporters such as Russia and Iran, for example, to bypass U.S. sanctions by trading in yuan, according to Nikkei Asian Review.

To make the yuan-denominated contract more attractive, China plans the yuan to be fully convertible in gold on the Shanghai and Hong Kong exchanges.

Last month, the Shanghai Futures Exchange and its subsidiary Shanghai International Energy Exchange, INE, successfully completed four tests in production environment for the crude oil futures, and the exchange continues with preparatory works for the listing of crude oil futures, aiming for the launch by the end of this year.

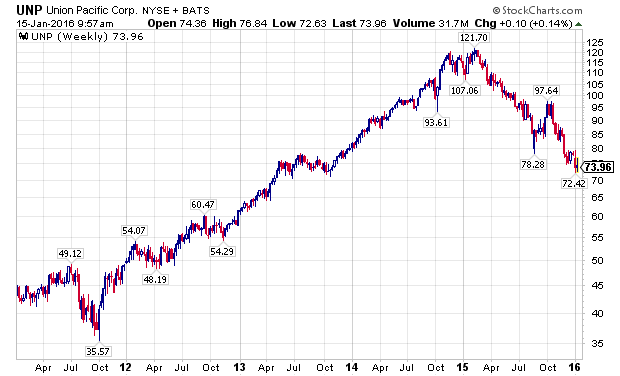

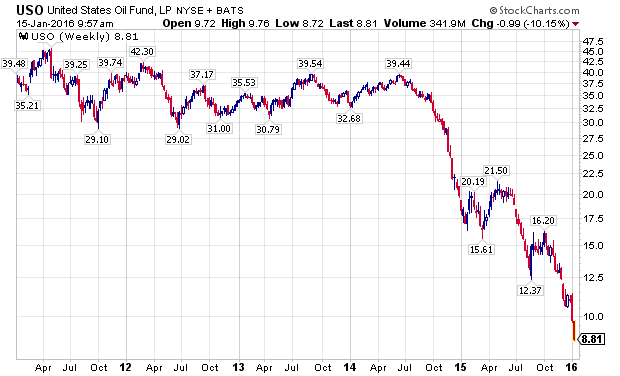

I believe it’s very clear this oil rally is running on fumes and was never the result of an improvement in fundamentals. That means to me this rally is going to quickly run out of steam if it isn’t able to run up quicker on existing momentum. I don’t see that happening, and it could pull back dramatically, catching a lot of investors by surprise. The Russian central bank agrees, saying it doesn’t believe the price of oil is sustainable under existing market conditions.

Cited by CNBC, the Russian central bank said, “the current oil market still features a continued oversupply, on the backdrop of a slowdown in the Chinese economy, more supplies originating from Iran and tighter competition for market share.”

In other words, most things in the market that should be improving to support the price of oil aren’t. That can only mean one thing: a violent pullback that could easily push the price of oil back down to the $30 to $32 range. If the price starts to fall quickly, we could see panic selling driving the price down even further.

I think most investors understand this is not a legitimate rally when looking at the lack of change in fundamentals. I’ll be glad when the production freeze hoax is seen for what it is: a manipulation of the price of oil by staggered press releases meant to pull investors along for the ride. The purpose is to buy some time to give the market more time to rebalance. Once this is seen for what it really is, oil will plummet. It could happen at any time in my opinion.

Rig count increases for first time in three months

For the first time in three months, the U.S. rig count was up, increasing by one to 387. By itself this isn’t that important, but when combined with the probability that more shale supply may be coming to the market in 2016, it definitely could be an early sign of the process beginning.

EOG Resources (NYSE:EOG) has stated it plans on starting up to 270 wells in 2016. We don’t know yet how much additional supply it represents, but it’s going to offset some of the decline from other companies that can’t continue to produce at these price levels. There are other low-cost shale producers that may be doing the same, although I think the price of oil will have to climb further to make it profitable for them, probably around $45 per barrel.

It’s impossible to know at this time if the increase in the price of oil was a catalyst, or we’ve seen the bottom of the drop in rig counts. The next round of earnings reports will give a glimpse into that.

Fundamentals remain weak

Most of the recent strength of the price of oil has been the continual reporting on the proposed production freeze from OPEC and Russia. This is light of the fact there really won’t be a freeze, even if a piece of paper is signed saying there is.

We know Iran isn’t going to agree to a freeze, and with Russia producing at post-Soviet highs and Iraq producing at record levels, what would a freeze mean anyway? It would simply lock in output levels the countries were going to operate at with or without an agreement.

The idea is the freeze is having an effect on the market and this will lead to a production cut. That simply isn’t going to happen. There is zero chance of that being the outcome of a freeze, if that ever comes about.

And a freeze without Iran isn’t a freeze. To even call it that defies reality. How can there be a freeze when the one country that would make a difference isn’t part of it? If Iran doesn’t freeze production, it means more supply will be added to the market until it reaches pre-sanction levels. At that time, all Iran has promised is it may consider the idea.

What does that have to do with fundamentals? Absolutely nothing. That’s the point.

Analysis and decisions need to be based on supply and demand. Right now that doesn’t look good. The other major catalyst pushing up oil prices has been the belief that U.S. shale production will decline significantly in 2016, which would help support oil. The truth is we have no idea to what level production will drop. It seems every time a report comes out it’s revised in a way that points to shale production remaining more resilient than believed.

I have no doubt there will be some production loss in the U.S., but to what degree there will be a decline, when considering new supply from low-cost shale companies, has yet to be determined. I believe it’s not going to be near to what was originally estimated, and that will be another element weakening support over the next year.

Competing for market share

One part of the oil market that has been largely ignored has been the competition for market share itself. When U.S. shale supply flooded the market, the response from Saudi Arabia was to not cede market share in any way. That is the primary reason for the plunge in oil prices.

There has been no declaration by the Saudis that they are going to change their strategy in relationship to market share and have said numerous times they are going to let the market sort it out, as far as finding a balance between supply and demand. So the idea they are now heading in a different direction is a fiction created by those trying to find anything to push up the price of oil.

It is apparent some of the reason for increased U.S. imports comes from Saudi Arabia in particular lowering its prices to nudge out domestic supply. It’s also why the idea of inventory being reduced in conjunction with lower U.S. production can’t be counted on. It looks like imports will continue to climb while shale production declines.

More competition means lower prices, although in this case, Saudi Arabia is selling its oil at different price points to different markets. It’s the average that matters there, and we simply don’t have the data available to know what that is.

In the midst of all of this, Russia is battling the Saudis for share in China, while the two also battle it out in parts of Europe, with Saudi Arabia looking to take share away from Russia. Some of Europe has opened up to competitors because it doesn’t want to rely too much on Russia as its major energy source.

For this and other competitive reasons, I could never trust a production freeze agreement if it ever came to fruition. They haven’t been adhered to in the past, and they won’t be if it happens again. Saudi Arabia has stated several times that it feels the same way.

Conclusion

To me the Russian central bank is spot on in saying the chance of a sustainable oil rally is slim. It also accurately pointed out the reasons for that: it’s about the lack of the fundamentals changing.

With U.S. inventory increasing, rig counts probably at or near a bottom, no end in sight to oversupply continuing, and competition for a low-demand market heating up, there is nothing I see that can justify an ongoing upward price move. I don’t even see it being able to hold.

A weaker U.S. dollar has legitimately helped some, but it can’t support the price of oil on its own. When all the other factors come together in the minds of investors, and the price of oil starts to reverse direction, there is a very strong chance a lot of bullish investors are going to get crushed hard. It is probably time to take some profits and run for the exit if you’re in the oil market for the short term.

The longer the price of oil has upward momentum, and the higher it goes, the more risky it becomes for investors because there is nothing outside of a weakening U.S. dollar to justify any kind of move we’ve seen the price of oil make recently.

The falling dollar isn’t enough to keep the oil price from falling to where it belongs, and that means when the selloff begins, it’s likely to gravitate into full-panic mode, with sellers running for the exits before they get burned.

This is especially risky for those looking to make a quick windfall from the upward movement of oil. I’m not concerned about those taking long-term positions in quality energy companies with significant oil exposure, since they’ve probably enjoyed some great entry points. There is, of course, dividend risk, along with the strong probability of further share erosion before there is a real recovery that has legs to stand on because it’s based on fundamentals.

For that reason, investors should seriously consider taking profits off the table and wait for better conditions to re-enter.

Oil has become a fear play. Not the fear of losing money, but the fear of not getting in on the fast-moving action associated with the quick-rising price of oil. Whenever there is a fear play, it is ruled by emotion, and no amount of data will convince investors to abandon their giddy profits until they lose much, if not all, of what they gained. Don’t be one of them.

Having been a financial adviser in the past, I know what a lot of people are thinking at this time in response to what I just said. I’ve heard it many times before. It usually goes something like this: “What if the price of oil continues to rise and I lose a lot of money because of leaving the market too soon?” That’s a question arising from a fear mentality. The better question is this: “What if the oil price plunges and panic selling sets in?”

Oil is quickly becoming a casino play on the upside, and the longer investors stay in, the higher the probability they’ll lose the gains they’ve enjoyed. Worse, too much optimism could result in losses if preventative action isn’t taken quickly enough.

What needs to be considered is why one should stay in this market. What is so convincing it warrants this type of increasing risk, which offers much less in the way of reward than even a week ago? What fundamentals are in place that suggest a sustainable upward movement in the price of oil? The answer to those questions will determine how oil investors fare in the near future.

U.S. shale production

The more I think on the estimates associated with U.S. shale production in 2016, measured against the statements made by stronger producers that they’re going to boost supply from premium wells this year, the more I’m convinced it isn’t going to fall as much as expected. New supply will offset a lot of the less productive and higher cost wells being shuttered. I do believe there will be some loss of production from that, but not as much as is being suggested.

There are various predictions on how much production is going to be lost, but the general consensus is from 300,000 bpd to 600,000 bpd. It could come in on the lower side of that estimate, but I don’t think it’ll be close to the upper end of the estimate.

What is unknown because we don’t have an historical guideline to go by is, the amount of oil these premium wells will add to supply. We also don’t know if the stated goals will be followed up on. I think they will, but we won’t know for certain until the next couple of earnings reports give a clearer picture.

When combined with the added supply coming from Iran, and the ongoing high levels of production from Saudi Arabia, Russia and Iraq, I don’t see how the current support for the price of oil can continue on for any length of time.

There is no way of knowing exactly when the price of oil will once again collapse, but the longer it stays high without a change in the fundamentals, the higher the risk becomes, and the more chance it could swing the other way on momentum, even if it isn’t warranted. It could easily test the $30 mark again under those conditions.

Inventory challenges

What many investors don’t understand about storage and inventory is it definitely matters where the challenges are located. That’s why Cushing being over 90 percent capacity and Gulf storage only a little under 90 percent capacity means more than if other facilities were under similar pressure. Together, they account for over 60 percent of U.S. storage.

With the imbalance of supply and demand driving storage capacity levels, the idea of oil staying above $40 per barrel for any period of time is highly unlikely. A lower U.S. dollar and the highly irrelevant proposed production freeze talks can’t balance it off.

Once the market digests this, which could happen at any time, we’ll quickly enter bear mode again. The problem is the price of oil is straining against its upper limits, and if momentum starts to deflate, the race to sell positions will become a sprint and not a marathon.

Uncertainty about shale is the wild card

As already mentioned, U.S. shale production continues to be the major catalyst to watch. The problem is we have no way of knowing what has already been unfolding in the first quarter. If investors start to abandon their positions, and we find shale supply is stronger than projected, it’ll put further downward pressure on oil after it has already corrected.

What I mean by that is we should experience some fleeing from oil before the next earnings reports from shale producers are released. If the industry continues to surprise on the upside of supply, it’ll cause the price of oil to further deteriorate, making the outlook over the next couple of months potentially ominous.

This isn’t just something that has a small chance of happening; it’s something that has a very strong probability of happening. Agencies like IEA have already upwardly revised their outlook for shale supply in 2016, and if that’s how it plays out, the entire expected performance for the year will have to be adjusted.

Conclusion

Taking into account the more important variables surrounding what will move the price of oil, shale production remains the most important information to follow. Not much else will matter if supply continues to exceed expectations. It will obliterate all the models and force analysts to admit this has little to do with prior supply cycles and everything to do with a complete market disruption. Many are still in denial of this. They’ll learn the reality soon enough.

That doesn’t mean there won’t eventually be a time when demand finally catches up with supply, but within the parameters of this weak global economy and oil supply that continues to grow, it’s going to take a lot longer to realize than many thought.

For several months, it has been understood that the market underestimated the expertise and efficiency of U.S. shale producers, and to this day they continue to do so. We will find out if that remains in play in the first half of 2016, and by then, whether it’ll extend further into 2017.

As for how it will impact the price of oil now, if we start to have some panic selling before the earnings reports, and the earnings reports of the important shale producers exceed expectations on the supply side, with it being reflected in an increase in the overall output estimates for the year, it will put more downward pressure on oil.

The other scenario is oil lingers around $40 per barrel until the earnings reports come out. There will still be a decline in the price of oil, the level of which would depend on how much more supply shale producers brought to the market in the first quarter than expected.

My thought is we’re going to experience a drop in the price of oil before earnings reports, which then could trigger a secondary exodus from investors in it for short-term gains.

For those having already generated some decent returns, it may be time to take it off the table. I don’t see how the shrinking reward can justify the growing risk.

The Mosul Dam in Iraq could collapse at any time, causing massive flooding across the country.

Iraq produces over four million barrels of oil per day, a number which will drop immediately when this event occurs.

The destruction of oil production in Iraq will immediately decrease world supply, lifting oil prices.