(Ethan Huff) Voyager Digital LLC just issued a notice of default to Three Arrows Capital (3AC) after the latter failed to make the required payments on a loan of 15,250 bitcoins (BTC) and $350 million of USD Coin (USDC).

Tag Archives: Bitcoin

Coinbase Earnings Were Bad. Warning That Bankruptcy Could Wipe Out User Funds

(Nicholas Gordon) Hidden away in Coinbase Global’s disappointing first-quarter earnings report—in which the U.S.’s largest cryptocurrency exchange reported a quarterly loss of $430 million and a 19% drop in monthly users—is an update on the risks of using Coinbase’s service that may come as a surprise to its millions of users.

In the event the crypto exchange goes bankrupt, Coinbase says, its users might lose all the cryptocurrency stored in their accounts too.

Miami Jury Rules In Favor Of Craig Wright, Who Claimed To Invent Bitcoin

(MacKenzie Sigalos) A man who has claimed to be the inventor of bitcoin just won a major U.S. court case, saving him from paying a former business partner tens of billions of dollars in the cryptocurrency.

The Inflation Threat Just Got Real

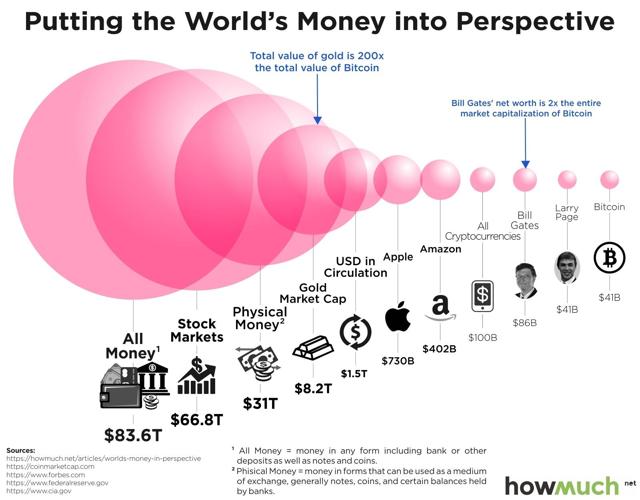

(Neils Christensen) The debate between gold and bitcoin, as to which is the ultimate safe-haven and inflation hedge, continued to rage this past week. However, I feel that the longer this debate goes on, the more investors are missing the bigger picture.

The stark reality is that there is more than $16 trillion worth of negative-yielding debt floating around the world right now. The U.S. government continues to move forward with its proposed $1.9 trillion stimulus package to support the U.S. economy. The Federal Reserve’s balance sheeting grows from record high to record high, pushing above $7.4 trillion.

The U.S. also isn’t in this boat alone; central banks around the world are maintaining extremely accommodative monetary policies and growing their balance sheets to record levels.

What Every Bitcoin Investor Needs To Know

(Kitco News) – Bitcoin is one of the most unequally distributed assets in the world, with just under half a percent of all bitcoin investors owning more than 80% of all bitcoins, and should they liquidate, the market could see a substantial sell-off, said Ryan Giannotto, director of Research at GraniteShares ETFs.

“It’s a major challenge for the asset class: it’s intended to be a financially democratizing force, yet it is so profoundly distributed in an unequal fashion. It’s really unlike anything we’ve ever seen. This is one of the perils of bitcoin investing that go unreported, undiscussed,” Giannotto said. “It is a seriously cornered asset class.”

Five hundredths of a percent of bitcoin investors control over 40% of all bitcoin, and just under half a percent of all bitcoin investors control over 5/6ths, or 83%, of bitcoin, he noted.

Most of these larger stakeholders, or “whales” as they are referred to as in the crypto community, are early adopters of bitcoin.

If these early adopters of bitcoin were to sell their holdings altogether, that would exceed the daily trading volume, effectively “wiping out” the asset, Giannotto said.

IRS Says It’s Sending Demand Letters to US Cryptocurrency Owners

The U.S. Internal Revenue Service (IRS) announced Friday that it has begun sending letters to taxpayers who own cryptocurrency, advising them to pay any back taxes they may owe or to file amended tax returns regarding their holdings.

In a news bulletin, the agency said that it began mailing what it called “educational letters” last week. According to the statement, there are three variations of the letter that were sent.

The IRS further said that it will have sent such letters to “more than 10,000 taxpayers” by the end of this month,” adding that “the names of these taxpayers were obtained through various ongoing IRS compliance efforts.”

“Taxpayers should take these letters very seriously by reviewing their tax filings and when appropriate, amend past returns and pay back taxes, interest and penalties,” IRS Commissioner Chuck Rettig said in a statement. “The IRS is expanding our efforts involving virtual currency, including increased use of data analytics. We are focused on enforcing the law and helping taxpayers fully understand and meet their obligations.”

In May, it was reported that the IRS is beginning to work on new guidance regarding cryptocurrencies, its first such effort since 2014. A number of organizations and industry advocates have called on the agency in past years to update its guidance following its decision to treat cryptocurrencies as a form of intangible property for tax purposes.

On Thursday, a user of the r/bitcoin subreddit described receiving such a letter. Lawyer Tyson Cross, writing for Forbes, also detailed how a number of his crypto-focused clients have received this kind of letter from the IRS.

Bitcoin Soars Above $9K, And This Time Is Different: “It’s Mostly Institutions Now”

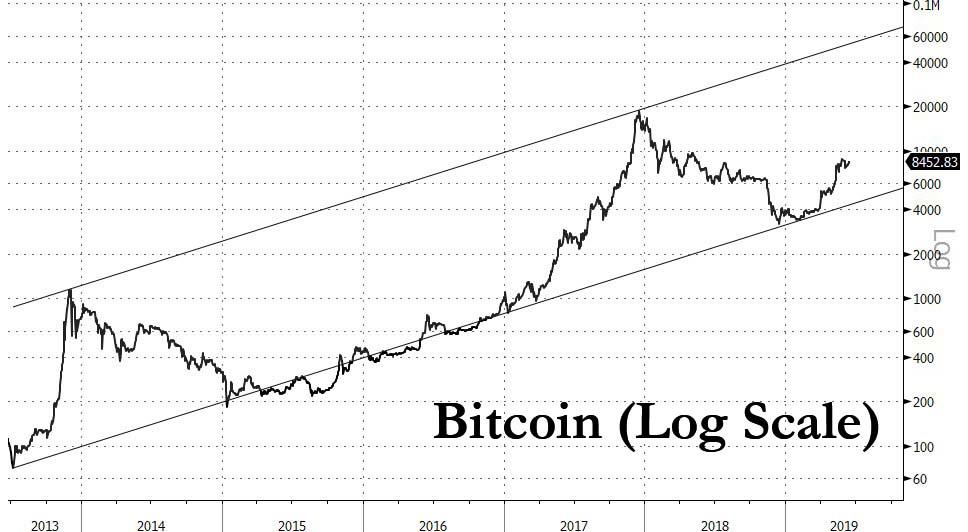

The recent surge in bitcoin, and the entire cryptocurrency space accelerated over the weekend, coinciding with the latest massive protest in Hong Kong which may be among the catalysts for the aggressive buying, and sending bitcoin above $9,000 for the first time since May 10, 2018, a price that is almost triple where bitcoin traded at the start of the year, making it the best performing major asset class of 2019, with a market cap of $163 billion.

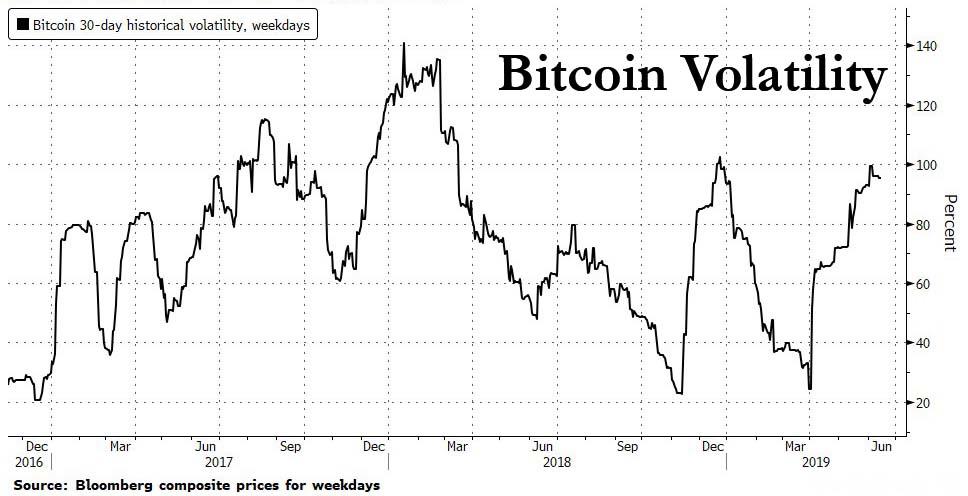

And as the price of bitcoin surge, naturally so does its volatility, which has quadrupled from its near all-time lows hit at the start of April to 95 for the 30-day historical vol, in the process making it once again a favorite of traders desperate for highly-volatile assets.

It’s not just Bitcoin’s volatility that has returned: so have volumes as what appears to be the latest reflation of the bitcoin bubble is drawing in investors from around the globe, hoping to make a quick profit. Only this time there is one major difference as JPMorgan explains.

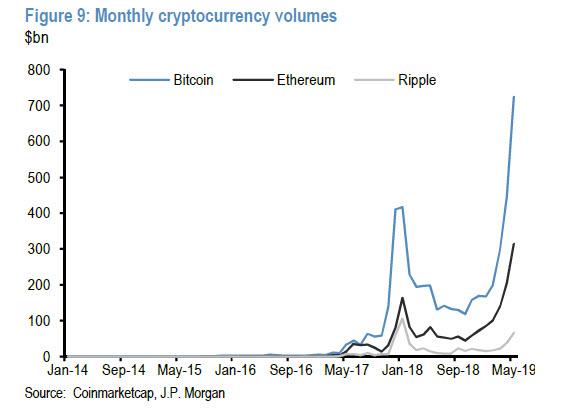

According to JPMorgan’s Nikolaos Panigirtzoglou writes, there has been a sharp increase in reported trading volumes of Bitcoin and other cryptocurrencies over the past few months, with Bitcoin trading volumes on crypto exchanges increasing to $445bn in April from a 1Q19 average of $220bn per month, and in May volumes increased further to around $725bn. This compares to previous peak volumes in Dec17 and Jan18 of $420bn. Curiously, for the three largest three cryptocurrencies by market capitalization, Bitcoin, Ethereum and Ripple, the combined volumes for May stand at above $1tr compared to a previous peak in Jan18 of around $685bn, suggesting that all else equal, there is an even greater interest in the crypto space .

Meanwhile, this development comes at a time when the market value of outstanding bitcoins is around half of its Dec17 high, and the combined market value of all crypto currencies is around a third of its previous high. While a substantial part of the increase in volumes in dollar terms reflects an increase in the market value of bitcoin and other crypto currencies, the volumes in bitcoin terms are also significantly above their previous peaks.

But there is more here than meets the eye.

As JPM explains, taken at face value, this volume surge would suggest a dramatic increase in cryptocurrency activity. But over the past year or so, concerns have increasingly been expressed over how authentic the reported volumes really are. To wit:

… recently published work by Bitwise, a cryptocurrency asset manager, to the SEC as part of an application for a bitcoin ETF suggests that bitcoin trading volumes on many cryptocurrency exchanges are significantly overstated by ‘fake’ trading, e.g. exchanges reporting volume of trades that never took place or via wash trades, and that genuine trading volumes could be around 5% of the reported total. Similarly, the Blockchain Transparency Institute publish monthly market surveillance reports, and estimated in April 2019 that less than 1% of reported volume for some exchanges represented real trades.

If these estimates of the proportion of real trades are correct, i.e. “that only around 5% of trading is genuine,” that would imply that the genuine volumes of Bitcoin trading on cryptocurrency exchanges in May were around $36bn, rather than $725bn.

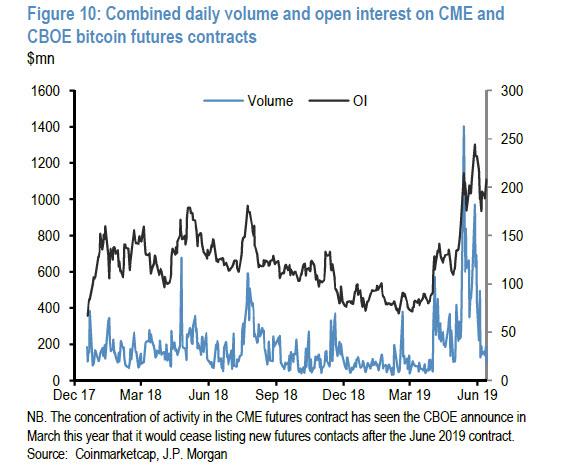

If this sharp revision in actual trading volumes is accurate, a critical implication, beyond the fact that the actual market size is markedly lower than reported numbers would suggest, is that as JPM notes, “the importance of the listed futures market has been significantly understated.” According to the Bitwise report, traded futures are credited as an important development in allowing short exposures that enabled arbitrageurs in properly engaging in arbitrage (and also resulted in a massive squeeze at the start of April that sent bitcoin breaking out again, and which we discussed previously), and that the futures share of spot bitcoin volumes increased sharply in April/May.

Indeed, when looking at aggregate volumes on both the CME and CBOE futures contracts (shown below), JPM estimates around $12bn of traded volume on these two futures exchanges in May. Indeed, the $12bn of bitcoin futures trading volume in May also represented a significant increase on the April’s $5.5bn and a 1Q19 monthly average of $1.8bn, suggesting that some rise in trading volume was genuine, even if the total volumes on cryptocurrency exchanges was likely vastly overstated.

The conclusion to this overstatement of trading volumes by cryptocurrency exchanges, and by implication theunderstatement of the importance of listed futures, suggests that in the two years since bitcoin’s last major spike in 2017 the “market structure has likely changed considerably… with a greater influence from institutional investors.”

This also means that whereas bitcoin’s historic surge to its all time high of $20,000 in December 2017 was largely retail driven, and thus extremely fickle as the subsequent crash showed, this time it is largely the result of institutional buying, which is far more stable and far less prone to sudden, painful shifts in sentiment and volatility.

In other words, “this time may be different” for bitcoin in a good way: because with institutions now piling into the crypto space, this is precisely the investor group that bitcoin bulls wanted from the beginning as it creates a far more stable price base for the future. Add to this the potential return of retail buying from east Asian (or even US) retail clients, and it is possible that what we predicted in early April, namely that the 3rd bitcoin bubble is starting…

… may soon be confirmed, and that the next bitcoin bubble peak will be somewhere between $60,000 and $100,000.

Modern Cryptocurrency Portfolio Theory

Summary

Modern Portfolio Theory doesn’t work with cryptocurrencies.

In a cryptocurrency portfolio, it’s all about managing risk.

As the cryptocurrency space matures, more high-level allocation models will become relevant.

This idea was first discussed with members of my private investing community, Crypto Blue Chips. To get an exclusive ‘first look’ at my best ideas, start your free trial today >>

Why Modern Portfolio Theory doesn’t work with cryptos

Aside from the obvious (that cryptocurrencies are not companies, they’re just software and the network of people involved), MPT asks the portfolio manager to make some basic assumptions.

- We are able to estimate the likely return of an asset (to compare it to the likely risk and determine the efficient frontier)

- We look for assets that are not highly correlated to reduce risk

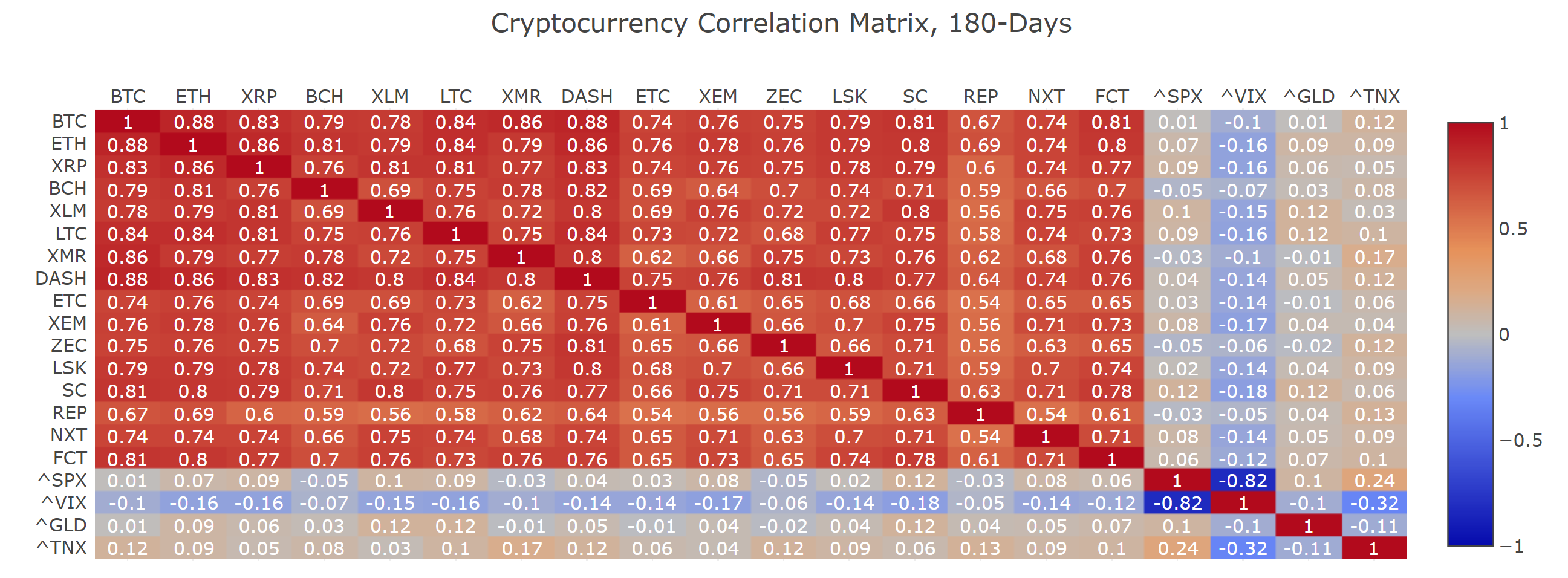

Both of these are a big problem for cryptocurrencies, because the probable return is somewhere between zero and 100x, and nearly every cryptocurrency in the top 20 is highly correlated with bitcoin (at least for now).

Image Source: Sifrdata

Image Source: Sifrdata

Cryptocurrency projects by sector

What about building a cryptocurrency portfolio based on sector?

I’d like to tell you that it’s possible to just look at the different categories of cryptocurrency projects out there, and just build a sector weighted portfolio like you might do with traditional equities. If that were possible, you might want to use a chart like this to narrow down your choices.

Image Source: Twitter

Image Source: Twitter

Or, perhaps one like this.

Image Source: Reddit

Image Source: Reddit

But unfortunately, we can’t have nice things. Recall that 80% of ICOs in the last year are dead already or were simply scams in the first place (the real figure is probably over 90% now).

So, what can we do? We could just skip cryptocurrency all together, or we could take a different approach.

Building a cryptocurrency portfolio is about disciplined, rational reduction

When investing in cryptocurrencies, I suggest that you start off assuming everything is a scam and working backwards from there. Out of the 1900 or so cryptocurrencies listed on CMC, we might be able to argue for a handful as being legit projects that:

- solve a real problem

- aren’t a scam

- didn’t start last week

- have had their security model stress tested in the wild

- have people working on them still

- have an active community

In order to build your own cryptocurrency portfolio, I’m going to give you a list of questions to ask. This list is not exhaustive, but it’s a good place to start.

Can I replace the word “blockchain” with database?

This one comes from Andreas Antonopoulos. If the problem the project is trying to solve would work just as well without a blockchain, then we have a problem. Blockchains are slow, expensive data structures that when used properly can operate in a hostile environment with nobody at the helm.

If performance and control are important, a blockchain is probably not the correct tool for the job.

Is the code open source?

One of the main reasons that bitcoin has been successful is that the code is open source. This allows the community to share ideas and work together to solve problems that they find interesting and even exciting. Projects that hide their code away should be viewed with suspicion as many bugs could be lingering behind the walled gardens. Remember, closed systems maximize control while open systems maximize innovation at the edge.

Can I rent enough hash power to 51% this network right now?

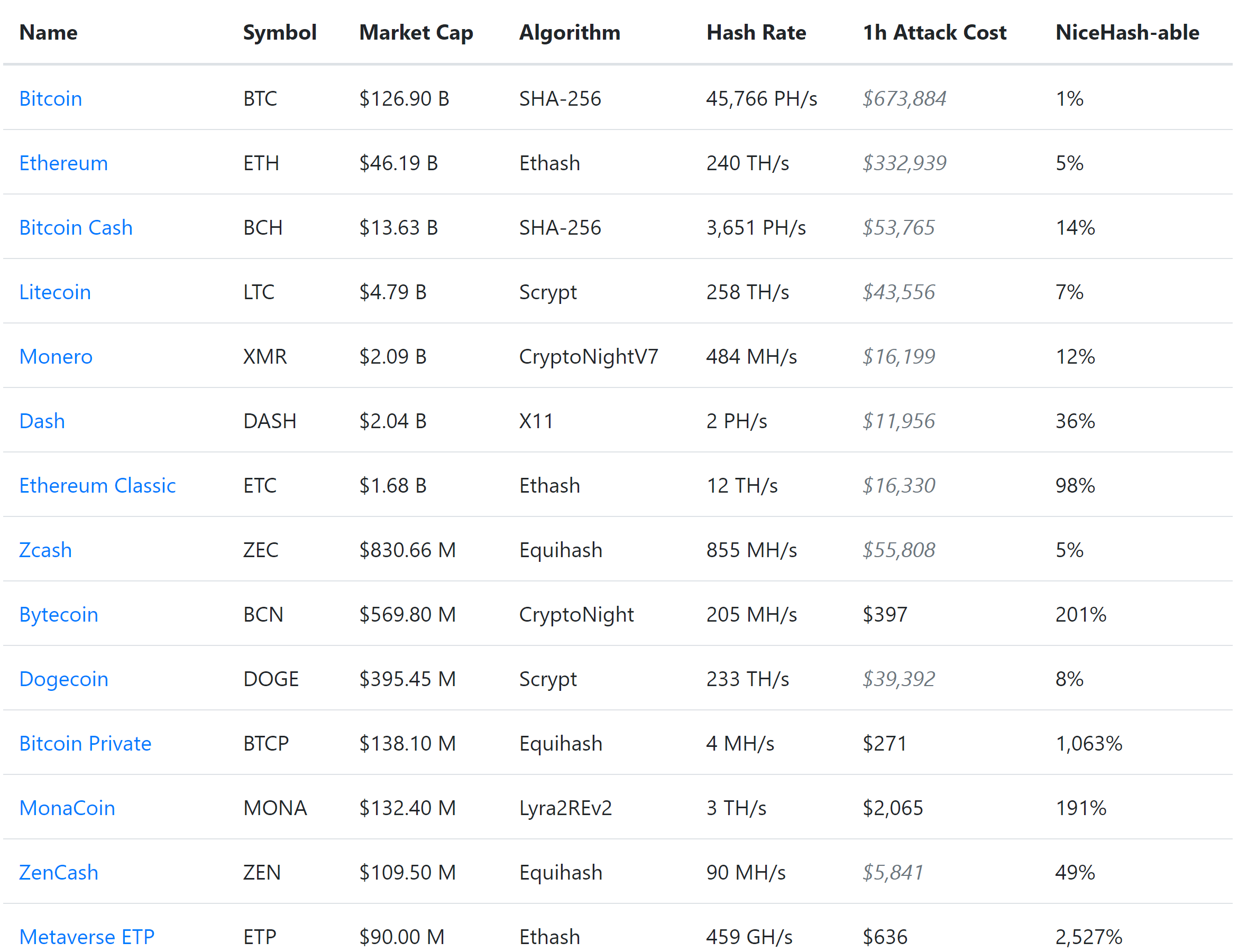

Many cryptocurrencies are secured by proof of work. However, not all coins are created equal. Mining secures a PoW coin, but it can also be its downfall. For example, Ethereum (ETH-USD) shares a mining algorithm with Ethereum Classic (ETC-USD). However, Ethereum has attracted 20x more hash power than Ethereum Classic, which means that if you go to Nicehash, you can rent enough hash power to just take over Ethereum Classic for about $16,330 per hour. The reason for this is that the Ethash algorithm can be run on just about any GPU, so by using a marketplace for renting hash power, anyone that wants to can literally take over a the cryptocurrency of their choice if they pay the price.

However, not all coins can be hijacked in this way. Some coins like Bitcoin (BTC-USD) are so huge that only 1% of the necessary hardware could be rented for such an attack. Any coin that shares the SHA-256 algorithm is orders of magnitude easier to attack than bitcoin because bitcoin is the most profitable to mine, so that’s the network that the miners point their hardware at.

Bitcoin Cash (BCH-USD), for example, can be attacked with 1/14th the hardware that you would need to attack bitcoin, making it much less secure from a 51% attack standpoint.

See chart below.

Image Source: Crypto51

Image Source: Crypto51

Does the coin have a fancy new security model or data structure?

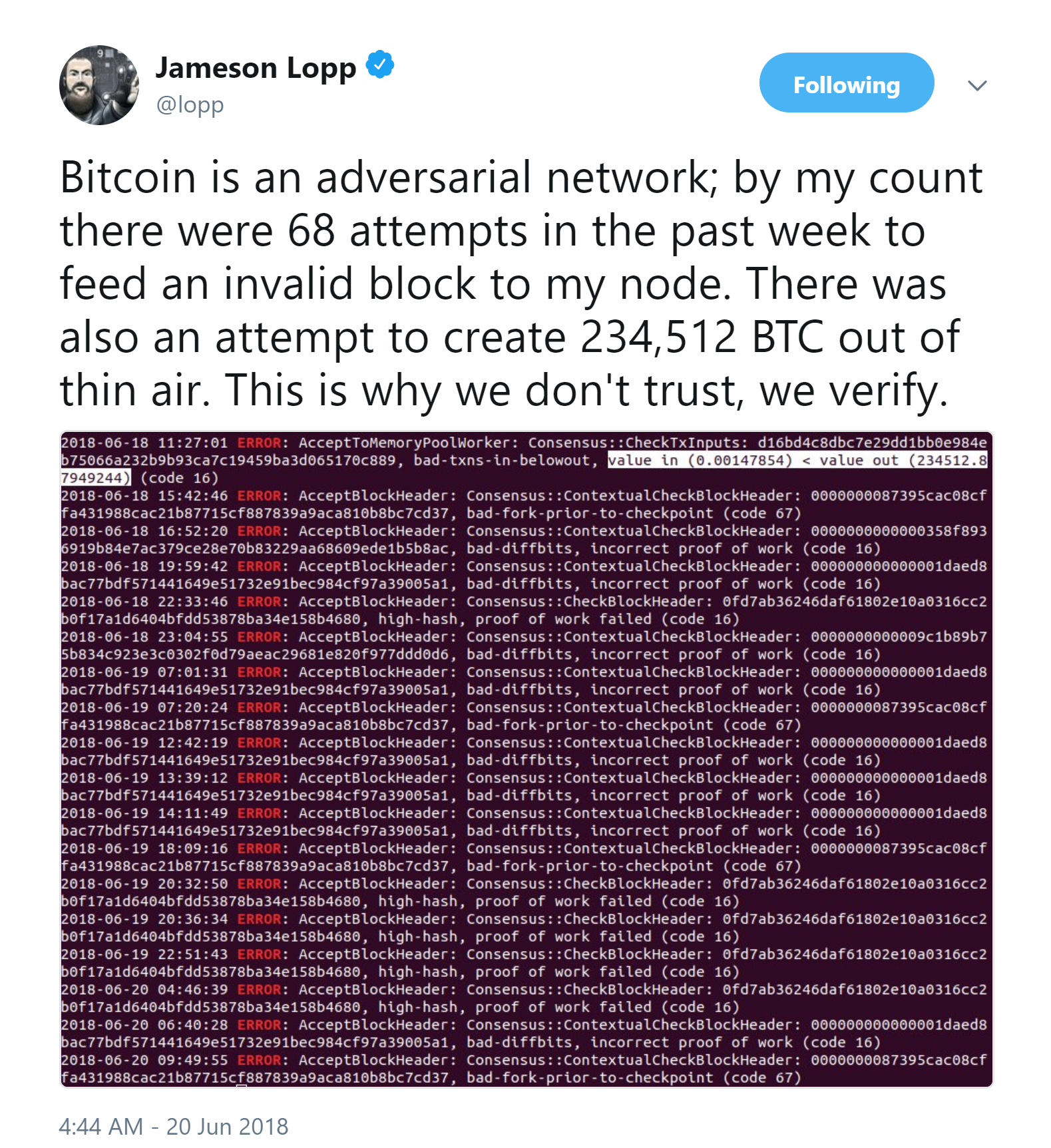

If it does, it might just be the next big thing. But, more likely the security model has major flaws that have yet to be discovered. Bitcoin’s blockchain and proof of work has been operating in the wild since 2009, and it has been attacked constantly.

Image Source: Twitter

Image Source: Twitter

Smaller cryptocurrencies have the disadvantage of not being in the spotlight, so their networks’ bandwidth and security are tested at only a fraction of the pressure placed on larger networks like Bitcoin and Ethereum.

This doesn’t mean that we should stop trying to innovate, we just need to understand that the risk/reward ratio for these new concepts should be seen as orders of magnitude higher than that of Bitcoin and Ethereum because of the fact that they just haven’t been around long enough, they haven’t grown large enough to really be put to the test.

Some examples of this are the tangle, block lattice, and delegated proof of stake. They might be great ideas, they might even be the future, but betting on them now is a different animal than investing in Bitcoin.

Can this cryptocurrency be properly secured (preferably in a hardware wallet) in cold storage?

As I wrote about in my blog, part of the joy of investing in cryptocurrencies is understanding how to take custody of the assets. While there are many ways to secure cryptocurrency, my preference is to use a hardware wallet and store the coins offline (cold storage).

There are some really cool projects I’d like to invest in, but I just don’t want to deal with the mess of having to run full nodes of each project on my local machine, or worrying about if my paper wallet is safe.

A hardware wallet like Trezor or Ledger Nano S can store many of the top cryptocurrencies is a highly secure manner. As a fiduciary, I owe it to my investors to use the best security possible, so I rarely invest in cryptocurrencies that cannot be stored in a hardware wallet.

Is anyone using this cryptocurrency, and are there any software engineers working on the project still?

These seem like basic questions that you wouldn’t have to worry about if you were investing in a traditional company. I mean, nobody asks “I wonder if any software engineers at Amazon are writing code this month?” before buying Amazon (AMZN). But, with cryptocurrency things are a bit different.

Some projects I would like to invest in fail at this step. Either the number of transactions does not seem to be growing, or the development team seems to have wandered off.

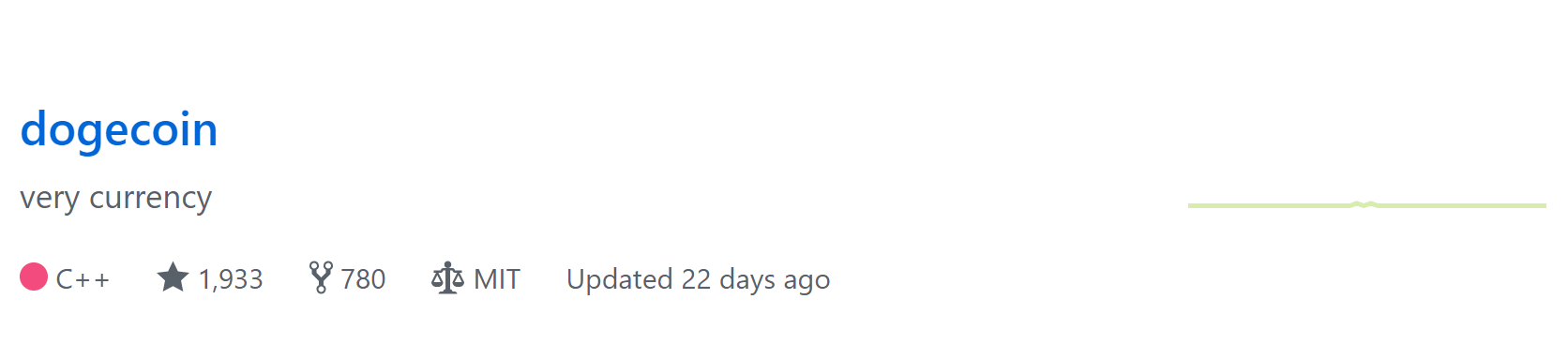

Two projects I would be investing in if they were actively maintained are Dogecoin (DOGE-USD) and Litecoin (LTC-USD). See the development activity below.

With no active development team, these projects simply can’t survive.

Does the team behind this project inspire confidence, and can they be identified?

In order to reduce the odds that the cryptocurrency project that you’re thinking about investing in is a scam, it’s worthwhile to take a look at the founders. If you can’t find a way to identify them, and their past work, then what kind of recourse do you have if they just take the funds and vanish?

Is there a whitepaper, and does it make sense?

You can learn a lot about a cryptocurrency project from the whitepaper. In fact, I think it’s a great place to start. Also, you might want to check that the entire thing wasn’t copied and pasted, because that’s a thing that happens all the time.

What is the token’s issuance model?

Bitcoin has a fixed issuance model that will result in 21 million tokens being created by the year 2140, but many other coins have no set maximum supply. Also, some of these ICOs have large portions of the tokens set aside for their foundation and early stage investors (and they probably bought it at a discounted rate before the rest of us even heard about the project).

Tokens that restrict the supply tend to be worth more as long as they can attract actual usage. It’s important to understand how new tokens are issued if you are trying to predict what they might be worth in the future if the project achieves the goals it set out for itself.

What the future of portfolio management might look like

I think that as the cryptocurrency market matures we will start being able to apply the more traditional valuation models. I think that when traditional assets start being tokenized, then it won’t be uncommon to have crypto assets in a traditional portfolio much in the same way that we have derivatives, ETFs, mutual funds and equities all in the same E-Trade (ETFC) account now.

Imagine having a basket of foreign currencies with some bitcoin thrown in, or a basket of utility companies that includes blockchain-based power tokens representing claims of future energy production.

I think that crypto assets will just become a tool, a technological means to an end in the future. Tokenizing existing assets and the discovery of new assets to tokenize may well define the digital revolution as we move into a world where the Internet of Things becomes a vivid reality.

Conclusion

It would be nice to apply modern portfolio theory to a cryptocurrency portfolio. However, the cryptocurrency market simply isn’t mature enough yet for this to be a reality. Today, the best we can do is look for signs of extraordinary risk and steer clear. This means taking a more skeptical approach and investing only in cryptocurrencies that might qualify as “Crypto Blue Chips.”

If you like this article, you will love Crypto Blue Chips, where this idea was discussed first. Besides posting articles early, there’s research in Crypto Blue Chips you can’t get anywhere else, like the BVIPE, the Bitcoin Value Indicator Professional Edition, posted with updates every week. Also, you can follow along as I build a portfolio of cryptocurrencies that we’ll be holding for the next 1-3 years. Get in on the ground floor with Crypto Blue Chips.

Bitcoin Whale Blows Up, Leading To Forced Liquidation, “Bail-Ins”

We may have found the reason for Bitcoin’s persistent weakness over the past week.

After hitting a price above $8,000 thanks to recent Blackrock ETF speculation, the cryptocurrency has dropped 10% in the past week, dropping as low as $7,300 today, leaving traders stumped what was causing this latest selloff in the absence of market-moving news.

It turns out the reason may have been a good, old-fashioned margin call forced liquidation, because as Bloomberg reports a massive wrong-way bet left an unidentified bitcoin futures trader unable to cover losses, resulting in a margin call that has “bailed-in” counter parties forced to chip in and cover the shortfall, while threatening to crush confidence in yet another major cryptocurrency venues.

According to a statement posted by Hong Kong’s OKEx crypto exchange on Friday, a long position in Bitcoin futures that crossed on Monday, July 30, had a notional value of about $416 million. After Bitcoin prices dropped sharply in subsequent days, OKEx moved to liquidate the position on Tuesday, “but the exchange was unable to cover the trader’s shortfall as Bitcoin’s price slumped.”

The exchange, which identified the problem trader only by an anonymous ID number 2051247, said the position was initiated at 2 a.m. Hong Kong time on July 31.

“Our risk management team immediately contacted the client, requesting the client several times to partially close the positions to reduce the overall market risks,” OKEx said. “However, the client refused to cooperate, which lead to our decision of freezing the client’s account to prevent further positions increasing. Shortly after this preemptive action, unfortunately, the BTC price tumbled, causing the liquidation of the account.”

The exchange was forced to inject 2,500 Bitcoins, roughly $18 million at current prices, into an insurance fund to help minimize the impact on clients. And since OKEx has a “socialized clawback” policy for such instances, it also forced other futures traders with unrealized gains this week to give up about 18 percent of their profits.

As Bloomberg notes, “while clawbacks are not unprecedented at OKEx, the size of this week’s debacle has attracted lots of attention in crypto circles.”

The episode underscores the risks of trading on lightly regulated virtual currency venues, which often allow high levels of leverage and lack the protections investors have come to expect from traditional stock and bond markets. Crypto platforms have been dogged by everything from outages to hacks to market manipulation over the past few years, a period when spectacular swings in Bitcoin and its ilk attracted hordes of new traders from all over the world.

“Everyone is talking about it,” said Jake Smith, a Tokyo-based adviser to Bitcoin.com, in reference to the OKEx trade.

And while everyone also wants to now how much capital was actually at risk, the biggest question is just how much margin there was in the trade. The problem here is that the exchange – ranked No. 2 by traded value – allows clients to leverage their positions by as much as 20 times.

For those who rhetorcially tend to ask “what can possibly go wrong” after every bitcoin slump, well now you know.

What happens next?

OKEx, which requires traders to pass a quiz on its rules before they can begin investing in futures, outlined planned changes to its margin system and liquidation procedures that it said would “vastly minimize the size of forced liquidation positions” and make clawbacks less frequent.

According to Bloomberg, clawbacks are unique to crypto markets and expose the exchanges who use them to reputational risks when clients are forced to absorb losses, said Tiantian Kullander, a former Morgan Stanley trader who co-founded crypto trading firm Amber AI Group.

“It’s a weird mechanism,” Kullander said.

Finally, judging by the bounce in bitcoin, the market appears relieved that it has identified the culprit of the selling, and with no more liquidation overhang left, is once again pushing prices across the crypto space higher.

PBoC Filings Reveal Big Picture for Planned Digital Currency

Chinese yuan image via Shutterstock

Chinese yuan image via Shutterstock

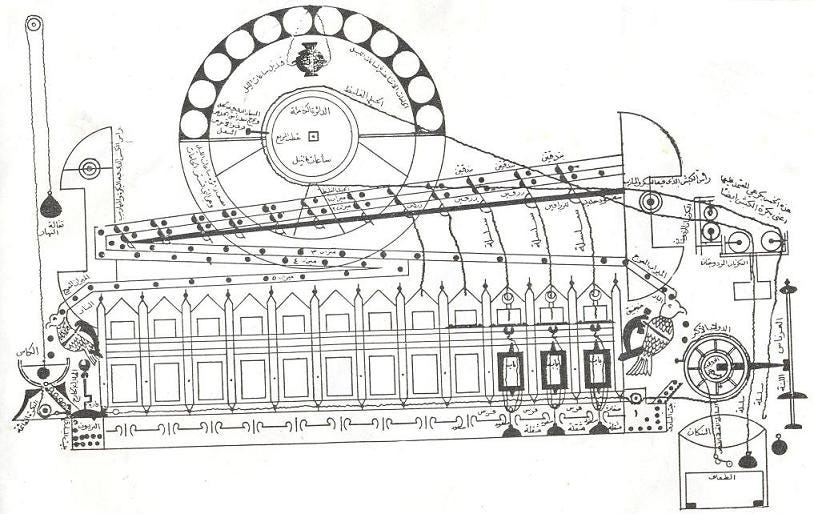

The Digital Currency Research Lab at the People’s Bank of China has filed more than 40 patent applications so far – all as part of an aim to create a digital currency combining the core features of cryptocurrency and the existing monetary system.

A national digital fiat currency, say what?

Data from China’s State Intellectual Property Office (SIPO) revealed two new patent applications on Friday, pushing the total number submitted by the lab to 41 over the 12 months since its launch.

Each of the 41 patent applications focuses on a certain aspect of a digital currency system, and, when combined, would create a technology that issues a digital currency, as well as provides a wallet that stores and transacts the asset in an “end-to-end” fashion.

For instance, the most recently revealed patent application explains how the envisioned digital wallet would allow users to check any transactions made through the service, while earlier documents offered details on how the wallet can facilitate transactions.

The ultimate goal, according to PBoC’s patents, is to “break the silo between blockchain-based cryptocurrency and the existing monetary system” so that the digital currency can sport cryptocurrency-like features, while being widely used in the existing financial structure.

Last week’s patents further explain that the envisioned wallet would not be limited, like a typical cryptocurrency wallet, to merely storing the private key to a certain asset. Nor would it be like another mobile payment service that only reflects a number on an application’s front-end interface without users actually holding the assets in a peer-to-peer manner.

Instead, the patents indicates the wallet would store a digital currency issued by the central bank or any authorized central entity that is encrypted like a cryptocurrency with private keys, offers multi-signature security and is held by users in a decentralized way.

The research lab said in one of the documents that it believes it is building a mechanism that makes a crypto-featured digital currency more applicable in the financial world.

The hybrid approach is also in line with opinions shared by the PBoC’s vice governor Fan Yifei and Yao Qian, the head of the research lab, who have both argued for a balance between the two polars of centralization and decentralization.

Overall, the patent applications filed so far signal the continuous efforts made by China’s central bank to develop its own central bank digital currency, as well as to potentially widen the application’s role among other central institutions.

The lab notably commented in a patent application released in November 2017:

“The virtual currencies issued by private entities are fundamental flaws given their volatility, low public trust, and limited useable scope. … Therefore, it’s inevitable for the central bank to launch its own digital currency to upscale the existing circulation of the fiat currency.”

Read one of the most recent patent applications below:

PBoC Digital Currency Research Lab by CoinDesk on Scribd

The Bitcoin Valuation Delusion

Summary

Some people seem to believe that Bitcoin might be worthless, we discuss their arguments.

If there was value in Bitcoin, how would we know?

Shared delusions, are they useful?

The case for Bitcoin having no value at all

(Hans Hauge) If you’ve read anything I’ve written so far, you know that I’m long Bitcoin (BTC-USD). However, that doesn’t mean I’ve turned a blind eye to the crowd that says it’s all an illusion, that Bitcoin is intrinsically worthless.

Let’s take a look at who is making these arguments, and what they’re saying.

Jamie Dimon – J.P. Morgan Chase CEO

In September of 2017, Jamie Dimon said:

And:

So, if I understand correctly, Mr. Dimon’s argument is that every government in the world will soon block all cryptocurrencies. Therefore, Bitcoin is doomed.

Warren Buffet and Charlie Munger of Berkshire Hathaway

In May, 2018, Warren Buffet said that Bitcoin was:

And Charlie Munger said:

If I understand correctly, Mr. Buffet believes that Bitcoin is super tasty but very poisonous, like a Big Mac times itself, and Charlie Munger is trying to say that the Bitcoin market is pure FOMO, or the Fear of Missing Out. Therefore, Bitcoin is doomed.

Putting these ideas to the test

I hope you are a data driven person like me. I believe there’s no better way to have a clear understanding when people’s tempers are raging than to just look at data and slowly and carefully think about what makes sense.

Let’s start with Jamie Dimon’s argument that all governments in the world will ban Bitcoin. How does this argument stack up? Let’s look at what’s going on in the three largest economies in the world.

All governments to ban Bitcoin?

- While China has placed a temporary ban on Bitcoin exchanges and ICOs, China’s state TV recently said that blockchain could be ten times more valuable that the internet. While it may seem that China is falling in line with Mr. Dimon’s prediction, it’s worth noting that when the latest ban went into effect, business didn’t stop, it just moved to places with a more friendly regulatory environment, such as Switzerland, Japan and South Korea.

- In Japan, eleven Bitcoin exchanges are recognized by the FSA, and Bitcoin is legal tender. This would seem to be at odds with the idea that every government in the world is going to ban Bitcoin.

- In the United States, the largest Bitcoin exchange, Coinbase, is backed by ICE, the parent company of the New York Stock Exchange and the Federal reserve has said that they welcome anonymous cryptocurrencies. Bitcoin is classified as a digital asset and exchanges are regulated and must follow KYC and AML. While Bitcoin is not classified as a currency in the US, it certainly isn’t illegal. Saying that the government is going to completely ban Bitcoin is pure speculation, and I hardly think that ICE or the Federal reserve share Mr. Dimon’s opinion. Did you know that ICE is even building its own Bitcoin exchange?

When governments move too quickly to ban new technology, the country they represent ends up getting left behind. Coinbase for example, has 20 million users and has traded over 150 billion dollars of cryptocurrencies to date. This kind of economic activity is creating jobs and driving innovation.

Will governments regulate cryptocurrency exchanges? Of course, and they already are.

Will every government in the world ban cryptocurrency outright? I’m not convinced it’s going to happen, especially with what we’re seeing in the US and Japan so far.

Final thoughts on J.P. Morgan

Mr. Dimon’s comments would make more sense if they were, I don’t know, maybe trying to patent Bitcoin’s technology and make their own version. But, that would be kind of unethical, don’t you think? I guess it’s not really surprising since J.P. Morgan (JPM) has been fined more than 29 billion dollars for abusing the market since the year 2000. But, Bitcoin is the fraud?

Bitcoin value is based on nothing but FOMO?

I think people forget that Bitcoin is not some magical beast that lives in isolation. It’s a network with many stakeholders and it represents something different to each group. Bitcoin has created an ecosystem that includes Bitcoin Miners, Software Engineers, Exchanges, Cloud infrastructure like Blockchian as a Service, Merchants, Users, and of course, the speculators and the scammers.

Let’s look at some data.

FOMO or subject of scholarly research?

If Bitcoin was just FOMO, then surely academic interest in the subject would be small, and certainly not growing over time. What’s the big deal after all?

| Year | Number of Scholarly Articles Mentioning “Bitcoin” |

| 2012 | 1,040 |

| 2013 | 2,030 |

| 2014 | 4,080 |

| 2015 | 4,640 |

| 2016 | 5,860 |

| 2017 | 9,990 |

Data Source: Google Scholar

FOMO or a life raft for those living in oppressive regimes?

If Bitcoin was just speculation, surely the countries with the highest search volume for the term “Bitcoin” would be wealthy countries where people are throwing money around, rather than in troubled places where a censorship resistant currency might be of use. As you can see, with the exception Finland in 2012, the interest is overwhelming coming from troubled geographic areas.

| Year | Number one Country by Search Volume for the term “Bitcoin” |

| 2012 | Finland |

| 2013 | Estonia |

| 2014 | Estonia |

| 2015 | Ghana |

| 2016 | Nigeria |

| 2017 | South Africa |

Data Source: Google Trends

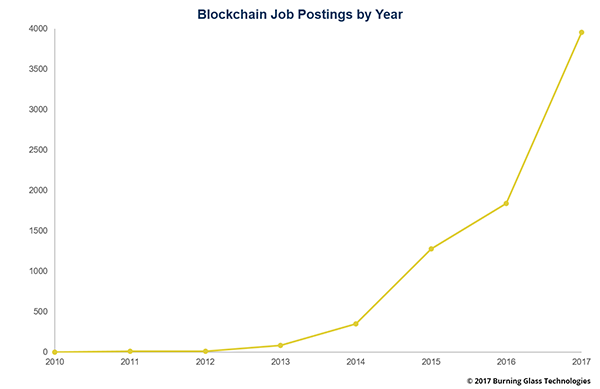

FOMO or a source of jobs and innovation?

If Bitcoin was just FOMO, surely it wouldn’t be creating jobs, and certainly it wouldn’t be one of the fastest growing fields in technology.

Image Source: Burning Glass

Image Source: Burning Glass

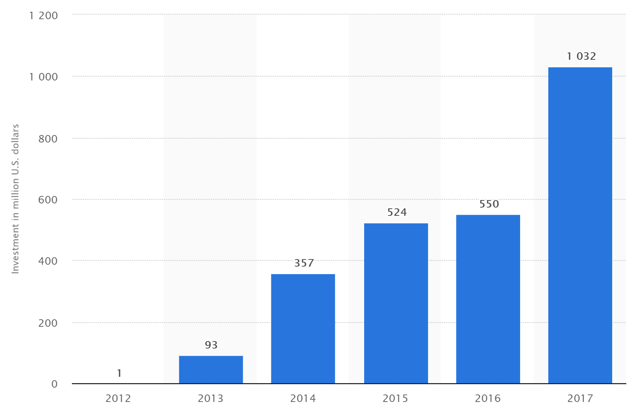

FOMO or the new obsession of Venture Capitalists?

If Bitcoin was just FOMO, then why are VC firms investing more in blockchain startups each year? Maybe some of them are caught up in the craze, but just look at the chart below.

Image Source: Statista

A shared delusion?

To say that Bitcoin has no value is to say that academics (students and professors), governments, venture capitalists, software engineers, hiring managers, and people living in the most troubled areas of the world are completely off their rockers because they dare to challenge our assumptions about what value is and the ways in which it might be transferred.

Is Bitcoin a shared delusion? Sure, but so are lines of latitude and longitude, global time standards, our existing money system, right and wrong, cultural norms, beauty, art and hope. The more important question is, does this shared delusion give us something back? Do we gain something by believing in it?

For me, the answer is clear. I think Bitcoin is one of the most powerful forces for the rights of the individual. I think Bitcoin can at once weaken the oppressors of the downtrodden and create opportunity for the bold.

Conclusion

It may challenge our assumptions that money might come from the crowd, rather than from on high. But, maybe this time it’s up to us to save ourselves? Ask yourself what it might mean to live in a world where currencies exist that reach the entire globe and yet don’t require the backing of a military. I don’t know for sure what it means, but I’ve decided to follow this path and find out for myself, rather than relying on the old guard to hand down truth to me.

Source: Hans Hauge | Seeking Alpha

***

Can Bitcoin Become A Flight-To-Quality Asset?

2018 might be the year we find out.

There’s an old saying on Wall Street that when times are good, you should focus on the return on your capital, but when times are bad, you should only care about the return of your capital. A flight to quality asset then is anything that tends to go up in times of turmoil because investors perceive it as a safe place to park their money.

Upon first glance, Bitcoin is a terrible candidate for such a role. It’s volatile, hard to understand, and difficult to access given how it exists outside of the traditional banking system.

So why would anyone consider it desirable during a crisis? Because it exists outside of the traditional banking system.

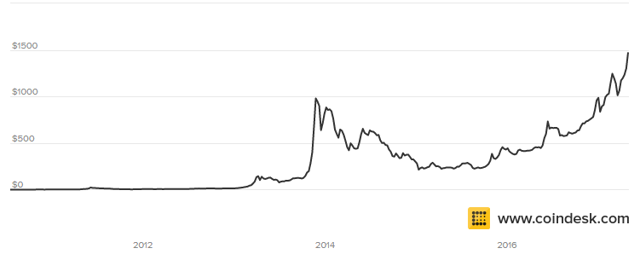

One of the first parabolic up-moves for the cryptocoin began with a banking crisis in Cypress. Back in 2013, while still reeling from the aftermath of the financial crisis, the tiny Mediterranean country found its banking system teetering, and reached out to the bigger European powers for help.

But instead of offering them a bailout, the EU came back with something more along the lines of a bail-in, as it demanded that Cypriot banks confiscate a portion of their customers deposits to shore up their balance sheets. To add insult to injury, they also imposed capital controls that prevented people from moving their money to a safer jurisdiction.

As you can see on the chart below, a decentralized form of money like Bitcoin, despite its drawbacks, can suddenly look very appealing when the centralized system starts to falter.

Crypto skeptics who tell us that digital money should not be worth anything often forget that fiat money like the Euro is also in of itself worthless. It’s only valuable when someone else is willing to trade a good or service for it. But you can’t get anything in exchange for money that the government is taking or locking up, which is why the Cypriot crisis brought a lot of attention to the then relatively unknown Bitcoin.

Government officials don’t like cryptocurrency because they transfer the sovereignty of money from their control to a decentralized consensus mechanism, a transfer that they view as a downgrade in the quality of money. If our existing system of money and banking was always stable, they would have a point.

But every time there is a crisis, it reminds the public that the folks in charge are not as smart as they think they are. When those same leaders respond to the crisis with draconian capital controls (or selective bailouts for their once and future employers on Wall Street) they remind the public that they aren’t as fair as they think they are, either. Bitcoin might be volatile and hard to understand, but it’s always fair, because math does not discriminate, nor does it change the rules when people start to panic.

So why bring this issue up now? Because there is financial trouble brewing in certain corners of the global financial system, and if things continue to deteriorate, this year might serve as an important test of the crypto economy.

Iran and Venezuela are in the midst of the kinds of hyper inflationary currency death spirals that bring societies to their knees. In Argentina, the peso has fallen to an all-time low against the dollar as inflation and interest rates spike. Turkey is having problems of its own, and China continues to do everything it can to prevent its citizens from liberating their own money.

Some of this weakness was to be expected, because the Federal Reserve is now removing the liquidity it has provided for the past decade. But there’s a bigger issue in play, as the perennial economic mismanagement of developing nations is now rubbing up against the increasing political instability (Brexit, Trump, Catalonia, Five Star) of developed ones.

In the old days, the two best candidates for flight to quality assets were gold and the Dollar. But the former is hard to get a hold of and even harder to store, and the latter is no panacea either. When the Argentinian government last devalued its currency back in 2001, it first forced all local banks to convert the dollar-denominated accounts of its citizens to the Peso. Even the citizens that were smart enough not to trust the local currency had their savings destroyed, learning the valuable lesson that dollars in the bank is not the same as dollars under the mattress.

One of the most important takeaways from past financial crisis is that when the stuff hits the fan, banks are nothing more than a policy tool for the government.

So can a cryptocurrency like Bitcoin be considered a flight to quality asset for certain countries? Given everything we’ve learned in the past 20 years, a better question to ask might be how could it not.

Source: Authored by Omid Malekan via Medium.com, | ZeroHedge

JPMorgan Busted Over Bitcoin Fraud… Seriously!

Oh, the irony…

Jamie Dimon has come a long way in seven months…

Jamie Dimon has come a long way in seven months…

From “Bitcoin is a fraud” in September to “Busted for Bitcoin fraud” in April.

Reuters reports that JPMorgan Chase & Co has been hit with a lawsuit in Manhattan federal court accusing it of charging surprise fees when it stopped letting customers buy cryptocurrency with credit cards in late January and began treating the purchases as cash advances.

Simply put, the bank switched from charging regular interest rates to charging, higher, cash advance rates on purchases of cryptocurrencies without notice to customers about the change.

The named plaintiff in the lawsuit, Idaho resident Brady Tucker, was hit with $143.30 in fees and $20.61 in surprise interest charges by Chase for five cryptocurrency transactions between Jan. 27 and Feb. 2, his lawsuit said.

With no advance warning, Chase “stuck the plaintiff with the bill, after the fact of his transactions, and insisted that he pay it,” the lawsuit said.

Hundreds or possibly thousands of other Chase customers were hit with the charges, Tucker said.

The lawsuit is asking for actual damages and statutory damages of $1 million.

Full Docket below…

Bitcoin Battered To Fresh Lows After Twitter Joins Crypto Ad Ban

Facebook started it – banning crypto/ICO ads on Jan 30th, then came Google – copying Facebook’s ban on March 14h; and now, less than a week later, Twitter is virtue-signalling support for the crypto-crackdown, planning its own ban on ads.

Sky news reports that Twitter is preparing to prohibit a range of cryptocurrency advertisements amid looming regulatory intervention in the sector.

The microblogging platform is following similar moves by Facebook and Google which have restricted financial advertisements due to concerns about illicit activities.

Sky News understands that the new advertising policy will be implemented in two weeks and currently stands to prohibit advertisements for initial coin offerings (ICOs), token sales, and cryptocurrency wallets globally.

The reaction was swift, just as we have seen to the other crypto ad bans… smashing Bitcoin back below $7500 (into mystery-dip-buyer territory)…

But Ethereum and Ripple have been the worst performers since the crypto ad bans began…

Reportedly, Twitter has experienced an influx of fake accounts pretending to advertise cryptocurrency giveaways, often by users posing as famous crypto sphere personas like Litecoin’s Charlie Lee.

… is food next?

“Stocks No Longer Make Sense To Me” – Here’s Why Quants Are Embracing Bitcoin

Since bitcoin first seeped into the public consciousness in 2013, the stereotypical image of the cryptocurrency trader is the 25-year-old tech bro who uses phrases like “YOLO” and “FOMO” when describing his trading strategy and general investing philosophy.

In more recent years, the image of the mom-and-pop crypto trader has taken hold, as Mrs. Watanabe – the archetypal Japanese and South Korean house wife once known for trading foreign exchange – has migrated to trading bitcoin and ethereum.

But as the Financial Times pointed out in a story about financial professionals dabbling in crypto markets, the hoodie-wearing twenty something described above isn’t entirely representative of the crypto community. In fact, many former Wall Street professionals – some with backgrounds working at hedge funds or quantitative trading shops – have embraced cryptocurrency trading.

And while the allure of obscene returns is obviously one reason for the attraction, one venture capitalist interviewed by the FT offered an even more revealing answer:

He embraced crypto after becoming disillusioned with traditional markets, which “no longer make sense” thanks to nearly a decade of central bank intervention.

“I’ve been out of the stock market because it stopped making sense to me,” he says. Central bank support for the markets plus the trend of passive investing have turned it into a game with unclear rules.

“Over the past few years or so, everyone has just been buying indexes and they haven’t been doing price discovery. They’re just investing in a trend of something going up and up and up,” he says.

Until very recently, volatility in global stock markets had fallen to one of the lowest levels in history – making life difficult for quantitative traders who leverage up and play for small moves.

But in the crypto market, circumstances couldn’t be more different. Such high volatility is essentially a quantitative traders’ dream.

“In a days worth of cryptocurrency movement you have a week or a month of equity market movement or a decade of country debt,” he said.

Another apt description came from a hedge fund trader who said financial professionals are drawn to bitcoin for the same reasons they’re drawn to the poker table.

“It’s fun,” one hedge fund trader said, adding that she did not want “fomo,” the acronym for ‘fear of missing out’. One London-based banker was more blunt: it was gambling for people who could afford to lose a bit of money. “That’s it. Nothing else.”

We’re not sure the surprising number of people who bought bitcoin on their credit cards last year would agree.

Bitcoin Going Down! And I Can’t See the Bottom

“As we approach the 8400-8500 level, watch for volume to pick up. One of two things will happen, it will reverse sharply or drive through that level to find another level of value below. If we stall here and a lull in the market occurs, price will consolidate, and then move lower”

Bitcoin May Fail But We Now Know How To Do It

Taleb: Bitcoin Is “An Excellent Idea” And “Insurance Against An Orwellian Future”

Foreword to the book It may fail but we now know how to do it by Saifedean Ammous

Let us follow the logic of things from the beginning. Or, rather, from the end: modern times. We are, as I am writing these lines, witnessing a complete riot against some class of experts, in domains that are too difficult for us to understand, such as macroeconomic reality, and in which not only the expert is not an expert, but he doesn’t know it. That previous Federal Reserve bosses, Greenspan and Bernanke, had little grasp of empirical reality is something we only discovered a bit too late: one can macroBS longer than microBS, which is why we need to be careful on who to endow with centralized macro decisions.

What makes it worse is that all central banks operated under the same model, making it a perfect monoculture.

In the complex domain, expertise doesn’t concentrate: under organic reality, things work in a distributed way, as Hayek has convincingly demonstrated. But Hayek used the notion of distributed knowledge. Well, it looks like we do not even need that thing called knowledge for things to work well. Nor do we need individual rationality. All we need is structure.

It doesn’t mean all participants have a democratic sharing of decisions. One motivated participant can disproportionately move the needle (what I have studied as the asymmetry of the minority rule). But every participant has the option to be that player.

Somehow, under scale transformation, emerges a miraculous effect: rational markets do not require any individual trader to be rational. In fact they work well under zero-intelligence –a zero intelligence crowd, under the right design, works better than a Soviet-style management composed to maximally intelligent humans.

Which is why Bitcoin is an excellent idea. It fulfills the needs of the complex system, not because it is a cryptocurrency, but precisely because it has no owner, no authority that can decide on its fate. It is owned by the crowd, its users. And it has now a track record of several years, enough for it to be an animal in its own right.

For other cryptocurrencies to compete, they need to have such a Hayekian property.

Bitcoin is a currency without a government. But, one may ask, didn’t we have gold, silver and other metals, another class of currencies without a government? Not quite. When you trade gold, you trade “loco” Hong Kong and end up receiving a claim on a stock there, which you might need to move to New Jersey. Banks control the custodian game and governments control banks (or, rather, bankers and government officials are, to be polite, tight together). So Bitcoin has a huge advantage over gold in transactions: clearance does not require a specific custodian. No government can control what code you have in your head.

Finally, Bitcoin will go through hick-ups (hiccups). It may fail; but then it will be easily reinvented as we now know how it works. In its present state, it may not be convenient for transactions, not good enough to buy your decaffeinated expresso macchiato at your local virtue-signaling coffee chain. It may be too volatile to be a currency, for now. But it is the first organic currency.

But its mere existence is an insurance policy that will remind governments that the last object establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.

How To Survive The Crypto Crash

Summary

- Did a bear market in cryptocurrency just start?

- Many people are convinced that cryptocurrency will crash sooner or later and investors should at least consider the possibility that this could happen.

- What to do if you believe in the future of cryptocurrency and are currently invested?

- Having experienced the previous Bitcoin bear market from the end of 2013 until 2015, I will share some lessons I learned.

Down from a maximum market capitalization of about $800 billion, the cryptocurrency market has been falling to less than $600 billion in a less than 2 weeks. At moments like these, it can seem like the sky is falling. Almost all cryptocurrencies have fallen dramatically in a very short time period. The big three Bitcoin (COIN), Ethereum and Ripple are all down more than 25% from their all time highs. At the time this article gets published it could already be very different, but fact is that we reached a period of extreme volatility. What should investors who believe in the future of cryptocurrency do?

A short retrospective: the previous cryptocurrency bear market

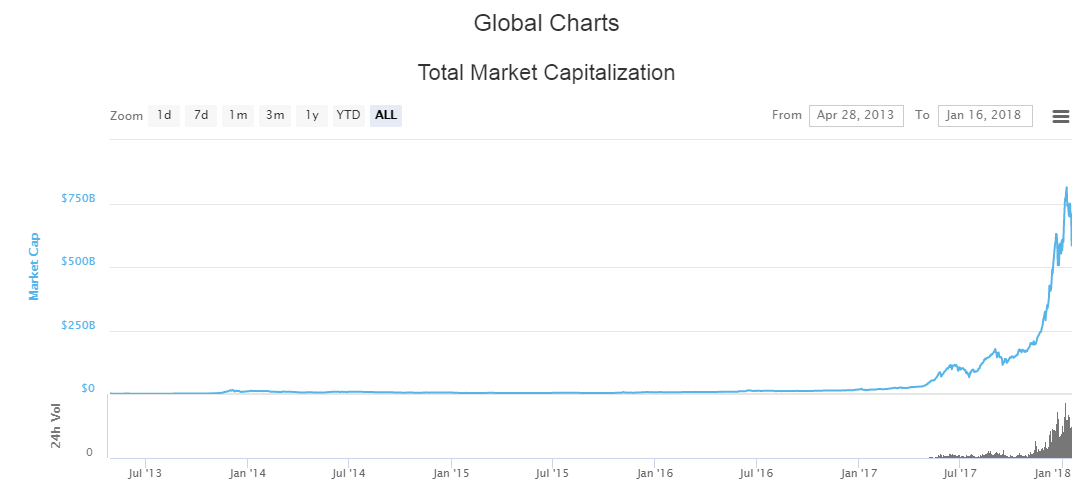

When looking at the total market capitalization of cryptocurrency, it seems that the market has exploded in 2017. Though cryptocurrencies (especially Bitcoin) have a longer history, it was only during the previous year that the market really took off. Just look at the graph below, it makes you feel that cryptocurrency was virtually non-existent before the beginning of 2017.

Source: coinmarketcap

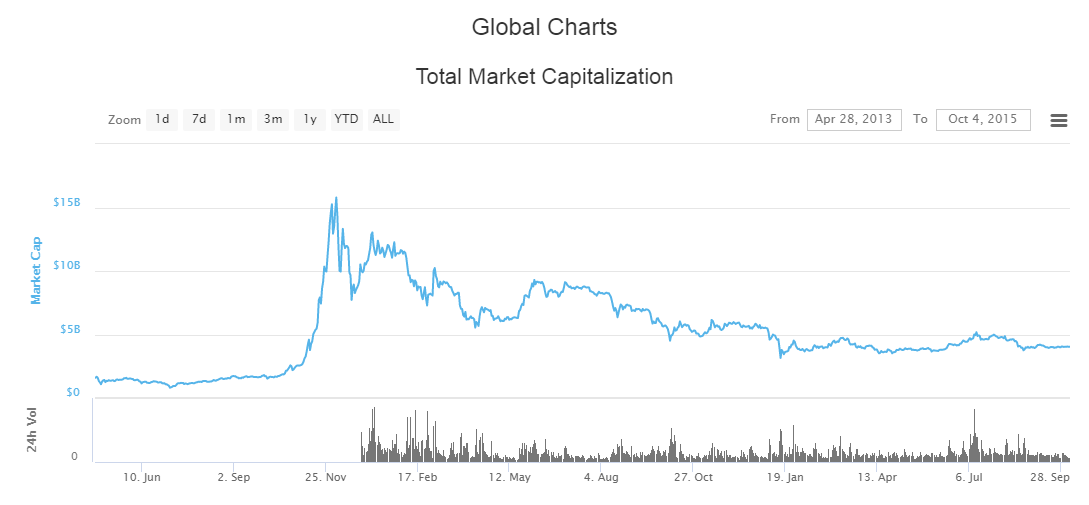

This makes us almost forget that cryptocurrency already experienced some dramatic downturns in the past. It is barely visible in the graph above, but let us take a look what happens when we zoom in on the time period from the end of 2013 until 2015.

Source: coinmarketcap

As we can see from the graph, from the end of 2013 total market capitalization of more than $15 billion dropped by about 75% to a bottom of around $4 billion in 2015. I think it is fair to say that this was a major bear market. Though there were heavy fluctuations in the price of cryptocurrency during this bear market, the entire process was much more gradual than you would expect of a market crash. Keep in mind that during this time period, a very big percentage of the cryptocurrency market capitalization consisted of Bitcoin only.

We can learn from this that, contrary to what many people are claiming, the expected ‘crash’ in cryptocurrency might as well prove to be a long bear market instead like in 2013-14.

My own experience during this bear market

At the end of 2013, I bought a limited amount of Bitcoin. Before buying I read a lot about the topic and I believed in the future of cryptocurrency. On top of this, I saw that the value of Bitcoin was booming and would not mind to get a quick win if the value kept rising quickly. But my main intention was to stay invested for a longer period of time.

At first, the value of my investment went up quickly. But of course, I did not foresee the huge bear market which started not long after I invested. At one point in time, my investment was down by about 75%. The only way I was able to stomach this bear market was by mentally writing off the entire investment. I still believed in Bitcoin though and had hope that it would recover eventually. It goes without saying that I am very happy that I didn’t sell in desperation. In hindsight, this probably means that I managed my risk tolerance in the right way, if I would have bought more Bitcoin I would have likely sold a big part of it during the downturn. A crash in cryptocurrency is different from a stock market crash: good companies still continue to pay dividend and make profit, even if their value drops dramatically. Bonds will still pay their coupon rate as long as the debtor doesn’t default. Cryptocurrency does not produce any of such income and can theoretically go to zero.

This is the reason why it is so important to manage your risk tolerance: honestly consider a worst case scenario and only buy cryptocurrency with money you can truly miss. Never buy crypto with borrowed money! You have the potential to win big, but might also lose much more than you own. People who went into debts to buy Bitcoin at the end of 2013 likely got slaughtered.

What options do investors have?

I am assuming that people who are invested in cryptocurrency believe in the long term viability of it. This article is not written for short term traders. There are a couple of things you can do when the crash or the bear market arrives.

Option 1: Sell

The first option is to sell, wait until the crash is over and maybe invest again. This strategy has the glaring downside that you might mistime and miss a lot of profit. Even worse, there might be no crash or bear market at all. But this option is especially attractive if your risk exposure is relatively high or if you are already sitting on huge profits.

Option 2: Buy the dip

If you truly believe in your investment, you can buy the dip. The difficulty of this strategy is that it stretches your exposure to risk. You might end up with a much larger risk than you intended, so be careful! When the market recovers quickly, this might be a winning strategy though.

Option 3: Wait and postpone the decision

It is said that doing nothing is often the best strategy when it comes to investing. Re-evaluation of the potential options is something which most investors do all the time, and when you are not sure, not doing anything seems like an attractive choice. Make sure your exposure to risk is within your tolerance when choosing this option!

Option 4: Protect your capital

This can be done in different ways: buying put options for instance is a way to ensure you will no longer be affected by a huge downturn. Diversifying your investment between multiple cryptocurrencies is also a solid strategy to not depend on a single cryptocoin. You could also buy put options on Bitcoin and go long a different cryptocurrency if you believe the second will outperform. Also, consider your exposure to stocks, bonds and cash. There are many possibilities to diversify, but no single one is the best, they all have their advantages and disadvantages.

Lessons learned

1. The predicted crash, if it arrives, might actually prove to be a long lasting bear market.

2. Only stay invested if you would be able to stomach a 100% loss of your crypto investment.

3. Never, and I really mean never ever, buy cryptocurrency on credit. If you did so, make this undone as soon as possible.

4. Surviving a possible crash is all about managing your risk tolerance.

5. Consider protecting your investment by diversification or buying protection.

6. Timing the market is very difficult. Do not invest to get rich quickly (unless you are a trader and really know what you’re doing).

7. If you do not believe a crash or a bear market is coming, by all means invest! But be sure to manage your risk tolerance and at least consider the possibility of a crash. It will happen eventually.

This Cryptocurrency Mining Rig Doubles As A Space Heater

The intensifying energy consumption of the bitcoin network is becoming a concern for environmentalists who have begun to question whether digital currencies should be considered a socially responsible investment. As we pointed out last month, Digiconomist’s Bitcoin Energy Consumption Index stood at 29.05TWh.

That’s the equivalent of 0.13% of total global electricity consumption. While that may not sound like a lot, it means Bitcoin mining is now using more electricity than 159 individual countries, including Ireland and Nigeria.

As the share of the world’s electricity consumed by miners of bitcoin and other cryptocurrencies rises, miners will likely face pressure – both economic and social – to find efficiencies wherever they can.

In anticipation of this trend, a crypto startup called Comino is marketing a mining rig that also functions as a heater.

Back in October, the Next Web published a report about the company and their new product, the Comino N1. In launching the product – priced at an affordable $5,000 per rig – the company is hoping t make it easier for novices and those who have only a glancing familiarity with crypto technology to start mining coin.

A reporter from The Next Web tested out the miner – and found that it both the heating and mining functions worked well. He even used it to heat his room during the winter.

After running the crypto-heater for a little over a month now, we are finally ready to share our experience with the device…

Once we installed the mining rig in our office, which practically included connecting the crypto-heater to the internet via the web-based dashboard system developed by Comino, it automatically created a wallet and began mining Ethereum. As easy as this.

Of course, if you already have a wallet, you still have the option to connect it to the dashboard. You can also connect any other mining rig to the Comino dashboard, in case you want to follow all of your mining efforts in one place.

Among other things, the online dashboard shows a number of statistics the Comino developers had programmed to monitor, including the current and average hashrate at which the miner is solving cryptographic puzzles, the current and average temperature at which it operates, as well as the unpaid balance of Ethereum you’ve accumulated. It also shows stats for the temperature of each separate GPU.

…

Throughout this one-month trial, the only issue I experienced with the miner was that – for some reason – its ambient temperature sensor inaccurately picked up the temperature of the GPUs inside (which had just taken a break from mining); this prevented the device from booting up again, until it cooled down a little.

…

And in case you were wondering about how reliable the Comino was as a heater : it certainly kept the temperature high enough to save some energy on heating bills, but not enough to make you turn on the air conditioner. Which is exactly what you want from a a machine that was built to bank on crypto.

The Comino N1 maintains an average hashrate of about 200 MH/s, and an average temperature of approximately 60 Celcius – about 140 degrees Farenheight.

Since installing the miner on Nov. 16, TNW reported that it has so far transferred a total of 1.2 ether to the company’s designated wallet. Since Ethereum is currently trading around $700 a coin, the miner would pay for itself in eight months, assuming the value of Ethereum doesn’t crash, or that an influx of new mining capacity decreases the miner’s efficiency.

Seller Of Luxury Miami Condo Demands To Be Paid Exclusively In Bitcoin

And they said bitcoin would never work as a currency ツ

While that might be true for small transactions – for now – real-estate markets across the US are increasingly demonstrating that bitcoin is a viable medium of exchange. Case in point: the seller of a luxury Miami condo will only accept payment in bitcoin. The asking price – according to real-estate listings site Redfin -33 bitcoins, or about $550,000 at bitcoin’s present valuation.

According to Redfin, this is the first time a seller is exclusively accepting payment in bitcoin. The seller’s identity wasn’t immediately clear.

But while this might be the first time that Redfin has noticed the phenomenon, home sellers have been asking to be paid in bitcoin since at least 2013, when an anonymous seller of a luxury condo in the Trump Soho of all places listed the price as 24,700 bitcoin, according to the Daily News. While this sale was the first that was documented in the media, it’s also notable that it occurred before the first bitcoin bubble burst.

Also over the summer, a realtor in Texas revealed that one of her clients had accepted payment for their home in bitcoin. The number of coins – and the identity of the seller and buyer – weren’t disclosed.

And as we recently reported, more realtors in hot markets like New York City and Miami are demanding to be paid in cryptocurrency, sometimes exclusively.

This trend in broader crypto acceptance – contrary to mainstream media reports – is undoubtedly a factor behind the unprecedented price appreciation which has seen bitcoin soar from $1,000 to $19,000 in 2017.

Meanwhile, any buyer who has accepted bitcoin as payment and kept it, has so far managed to generate a staggering profit, given the digital currency’s aggressive appreciation. The real test will come after the digital currency inevitably tanks again.

Crypto-Cornucopia: Five Part Series

Part 1 – Bitcoin Is A Trust Machine

Bitcoin is all the rage after it crossed over $10,000, a 10-bagger for the year, sparking many to look at what it is, what it isn’t, and why it’s become so popular.

Note my observations are those of a layman – which may be more useful than those of a programmer – but also those of a skeptic, which I’ll get to at the end.

First, what is Bitcoin? Well, the idea of digital money goes back to the first digits, financial mainframes. In fact, the “money” in use today throughout the financial system have long been no more than virtual 1’s and 0’s on a spinning hard drive somewhere, but the idea of Bitcoin-money, private-money, goes back further still. I mean, what is “money”? At its core, it’s no more than the most tradable good in a given society, a trading chit we use as a measurement tool, a token recording how much value we created or are owed. Arguably the first money was not gold, not seashells or even barter, but a promise. Let me borrow your net and I’ll give you a couple fish from the work. Why? Because you might break the net or I might use it, so I need to get paid for my risk, reward for my effort in making and storing the net to begin with.

So money at its most austere is simply a promise. But a promise to whom for what? And that’s the problem. No matter what good you use, people place differing values on it, different time-preferences, and most especially ways to cheat, game the system, and renege. This is bad among businesses, banks – who are after all only men – especially bad among governments, but worst of all among government and banks combined. Because, should the banks lie, renege, default, abuse their privilege, who then would hold them to task?

In the past, over and over, groups have created their own “money”. The whole 19th century was marked by general stores extending credit, bank notes issued by thousands of private banks, each with their own strength and solvency and geography and discounted accordingly. In the 20th century, with central banks controlling money, many cities issued local “scrip” – promises to pay – in Detroit in the Depression, or California in the budget crunch of 2009, or “Ithaca Dollars” in NY as a sort of ongoing Ivy League experiment. But the problem with these only highlight the problems with money generally:who can issue them? Everyone? A central authority? Can they deliver goods? And what can they buy, not just in value but in location?

Ithaca Dollars or California Tax Vouchers are not much good to buy oil from Texas or tea from China. People will always prefer a good that is accepted everywhere, with no decay and no discount, because ultimately the money flows away, offshore or to central taxation, which makes local currencies ever-less valuable. But even if successful it leads to a new set of problems: if Detroit or Ithaca Dollars were in high demand, there would be ever-stronger incentive to counterfeit, cheat, and double-spend them. Thus from the Renaissance to now we used reputable banks backed by force of governments, through the Gold standard and the Fiat age until today.

Enter The Hackers.

It’s not that these problems are unknown, or haven’t been approached or attempted before. Every generation, when they find the banks + government take a percentage for their costs to insure the system, thinks how can we do away with these guys, who both take too much and end up in an unapproachable seat of power? I mean, aren’t we supposed to be a Democracy? How can we have a fair society if the Iron Bank is both backing all governments at once, on both sides of a war? What good is it to work if compounding interest invariably leads to their winning Boardwalk and Park Place 100% of the time? But despite several digital attempts – some immediately shut down by government – no one had a solution until Satoshi Nakamoto.

We don’t know who Satoshi Nakamoto is, but since several of the well-meaning developers were immediately jailed for even attempting private money on reasons arguably groundless, we can suppose he had good incentive to remain anonymous. And speculation aside, it doesn’t matter: Satoshi’s addition was not “Bitcoin” per se, but simply an idea that made private currency possible. The domain Bitcoin.org was registered in 2008, showing intent, and the open-source code was promoted to a small cryptography group in January 2009. But what was it? What did it solve?

Double-spending. Basically, the problem of money comes down to trust. Trust between individuals, between the system, but also partly trust in non-interference of governments or other powerful groups. Bitcoin is a trust machine.

How Does It Work?

Well, the basic problem of cheating was one of not creating fake, hidden registers of value, as the U.S. Government, J.P. Morgan, and the Comex do every day. If they asked Yellen to type some extra zeros on the U.S. ledger, print a few pallets of $100 bills to send to Ukraine, who would know? Who could stop them? So with Bitcoin, the “value”, the register is created by essentially solving a math problem, akin to discovering prime numbers. Why do something so pointless? Simple: math doesn’t lie. Unlike U.S. Dollars, there are only so many prime numbers. We can be certain you won’t reach 11-digits and discover an unexpected trove of a thousand primes in the row. Can’t happen. However useless, Math is certainty. In this case, math is also limited. It’s also known and provable, unlike the U.S. budget or Federal Reserve accounting.

The second problem of cheating was someone simply claiming chits they did not own. This was solved by having the participants talk back and forth with each other, creating a public record or ledger. In fact, Bitcoin is nothing more than a very, very long accounting ledger of where every coin came from, and how every coin has moved since then, something computers do very well. These accounting lines register amongst all participants using a process of confirmed consensus.

Double-spending is when someone writes a check either against money they don’t have (yet) and round-robin in the money for the one second of clearing, or else write a check against money they DO have, but then cancel the check before it clears, walking away with the goods. In a standard commerce, the bank backfills fraud and loss and the government arrests, tries, and imprisons people, but it’s no small cost to do so. Although there is still a small possibility of double-spending, Satoshi’s plan effectively closed the issue: the ledger is either written, or unwritten. There is no time in the middle to exploit.

Great for him, but if I buy coins by Satoshi and the original cryptogroup, won’t I just be transferring all my value to make them rich? Although Bitcoin supply may be limited by mathematics, this is the issuer problem. It is solved because as a free, open source code, everyone has an equal opportunity to solve the next calculation.

Bitcoin starts with the original 50 coins mined in 2009, so yes, early adopters get more: but they took more risk and trouble back when it was a novelty valuable only as proof-of-concept. The original cash transaction was between hackers to buy two pizzas for 10,000 BTC ($98M today). Why shouldn’t they get preference? At the same time, we are not buying all 20 Million eventual coins from Satoshi and his close friends, which is arguably the case with the Federal Reserve and other central banks. Bitcoin is bought and created from equal participants who have been actively mining as the coins appear, that is, from doing electronic work.

This leads to the next challenge: why would anyone bother keeping their computers on to process this increasingly long accounting ledger? Electricity isn’t free. The process of “mining” is the recording of Bitcoin transactions. The discovery of coins therefore effectively pays for the time and trouble of participating in a public accounting experiment. Even should that stop, the act of using Bitcoin itself cannot be accomplished without turning on a node and adding lines to process the ledger. So we can reasonably expect that people will keep Bitcoin software “on” to help us all get Bitcoin work done. That’s why it’s a group project: public domain shareware.

What if they shut it down? What if it’s hacked? This leads to the next problem: resiliency. You have to go back a step and understand what Bitcoin is: a ledger. Anyone can store one, and in fact participants MUST store one. If Bitcoin were “shut off” as it were, it would be stored with each and every miner until they turned their computers back on. If it’s “off” there’s no problem, because no one transferred any Bitcoin. If it’s “on” then people somewhere are recording transactions. Think of it like a bowling group keeping a yearly prize of the ugliest shirt. Is there an actual shirt? No, the shirt is not the prize. Is there a gold trophy? No, “prize” is simply the knowledge of who won it. There is no “there”, no physical object at all. Strangely, that’s why it works.

This is important for the next problem: intervention. Many private monies have been attempted, notably e-gold within Bitcoin’s own origin. But the problem was, if there was anything real, like a gold bar, it could be encumbered, confiscated, and stolen. You’d have to trust the vault, the owner, the auditor and we’re back in the old system. At the same time, if Satoshi were keeping the Bitcoin record and had any human power over it at all, government could imprison him, pass a law, create a cease-and-desist, or demand he tamper with the record, which they did with e-gold. But Satoshi does not have that power, and no one else does either.

Why? Precisely because Bitcoin DOESN’T exist. It’s not a real thing. Or rather, the only “real” thing is the ledger itself which is already public to everyone everywhere. You can’t demand the secret keys to Bitcoin privacy because it’s already completely, entirely public. What would a government demand? Suppose they ordered a miner to alter the record: the other miners would instantly reject it and it would fail. Suppose they confiscated the ledger: they now own what everyone already has. Suppose they unplugged it: they would have to unplug the entire internet, and everything else on it, or every Bitcoin node, one-by-one, worldwide. If any nodes were ever turned on, all Bitcoin would exist again.

Can they track them down? Not really. In theory, Bitcoin can be written on paper without an Internet. In practice, any public or private keys certainly can be. So even chasing down the Internet it would be very difficult to stop it given sufficient motivation, like the Venezuelan hyperinflation where they are chasing down miners, wallets, and participants, and failing despite overwhelming force.

What about privacy? A completely public ledger recording every person and every transaction seems like a police state’s dream of enforcement and taxation. Is it private? Yes and no. The Bitcoin ledger is not written like “Senator Smith spent .0001 BTC on August 21st, 2015 to buy a sex toy from Guangzhou,” but Wallet #Hash2# transferred .00017 BTC to wallet #Hash3# at UTC 13:43:12 21:11:2017 – or not even that: it’s encrypted. Who is #Hash2#? You can go back, but it will only say #Hash2# exists and was created on Time:Date. Who is #Hash3#? The ledger only says #Hash3# was created a minute ago to receive the transaction. In fact, #Hash2# may have been created solely to mask the coin transferred from #Hash1#. So is it anonymous? Not exactly. Given enough nodes, enough access to the world’s routers, enough encryption, you might see #Hash2# was created in Pawtucket, and if #Hash2# is not using active countermeasures, perhaps begin to bring a cloudy metadata of #Hash2# possible transactions into focus, tying it to Amazon, then a home address, but the time and resources required to break through would be astronomical.

What about theft? Yes, like anything else it can be stolen. If you break into my house and tie me up, you can probably get the keys. This is also true online as you must log on, type a password that can be logged on a screen that can be logged over a network that can be logged, but think again about what you’re doing: does it make sense to break into every participant’s computer one by one? Most Bitcoin is held by a few early adopters, and probably those wallets were lost when their hard drives crashed, the users lost their passwords, or died before this computer experiment had any value. We know for a fact that all of Satoshi’s original coins, 2.2 million of them, have NEVER been spent, never moved on the ledger, suggesting either death or the austerity of a saint.

So even today hacking a wallet, is far more likely to net $1.00 than $1M. Take a page from Willie Sutton: when asked why he robbed banks, he said, “that’s where the money is.” So today. Where is the real money stolen, transferred? From the ’08 bailout, the kiting of fake bonds in the market, the MF Globals, the rigging of LIBOR or the fake purchase of EU bonds. You know, where the money is. At $160B market cap, Bitcoin is still one week’s purchase of central bank bond buying, i.e. a rounding error, no money at all. Hack a home wallet? I guess, but hacking Uber or Equifax once is a lot easier than hacking 100,000 wallets on 100,000 different computers. At least you know you’ll get something.

But MT Gox was hacked and 650,000 coins went missing. Surely Coinbase, Gemini, Poloniex are the same. Well…not exactly…

* * *

Part 2 – “This System Is Garbage, How Do We Fix It?”

You have to understand what exchanges are and are not. An exchange is a central point where owners post collateral and thereby join and trade on the exchange. The exchange backs the trades with their solvency and reputation, but it’s not a barter system, and it’s not free: the exchange has to make money too. Look at the Comex, which reaches back to the early history of commodities exchange which was founded to match buyers of say, wheat, like General Mills, with producers, the farmers. But why not just have the farmer drive to the local silo and sell there? Two reasons: one, unlike manufacturing, harvests are lumpy. To have everyone buy or sell at one time of the year would cripple the demand for money in that season. This may be why market crashes happen historically at harvest when the demand for money (i.e. Deflation) was highest. Secondly, however, suppose the weather turned bad: all farmers would be ruined simultaneously.