A new rule from the Biden administration will force homebuyers with good credit scores to pay higher mortgage rates in order to subsidize loans to those with riskier borrowing profiles, the Washington Times reports.

Tag Archives: affordable housing

California To Front 20% Down Payments With 0% Interest For Homebuyers With Incomes Up To $211,000

California homebuyers making up to $211,000 annually will be able to receive a 20% down payment, and all closing costs, at a 0% interest rate.

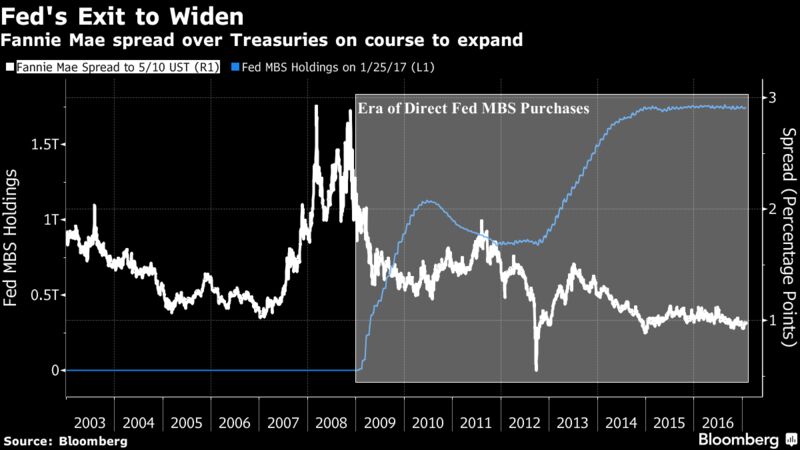

Rate Hikes Jeopardize Much More Than Just American Home Ownership

(J.G. Collins) Someone once said that you never actually “buy” a home. Instead, you merely commit to paying an annuity: the mortgage.

That’s largely true. The price and “value” of homes for the overwhelming majority of homeowners is a function of home buyers’ ability to make payments.

And with the Federal Reserve signaling further interest rate hikes, home buyers and sellers—and assorted others who use credit—will incur knock-on effects from those increases.

Want To Own Apartment Buildings? Buy Distressed Hotels For Pennies On The Dollar

(Diana Olick) Communities are desperate for more affordable housing, but the cost for developers is just too high. Land, labor and materials were pricey before the pandemic, and they are even more so now.

That is why some creative developers are now turning to hotels – and it appears to be a match made in real estate heaven.

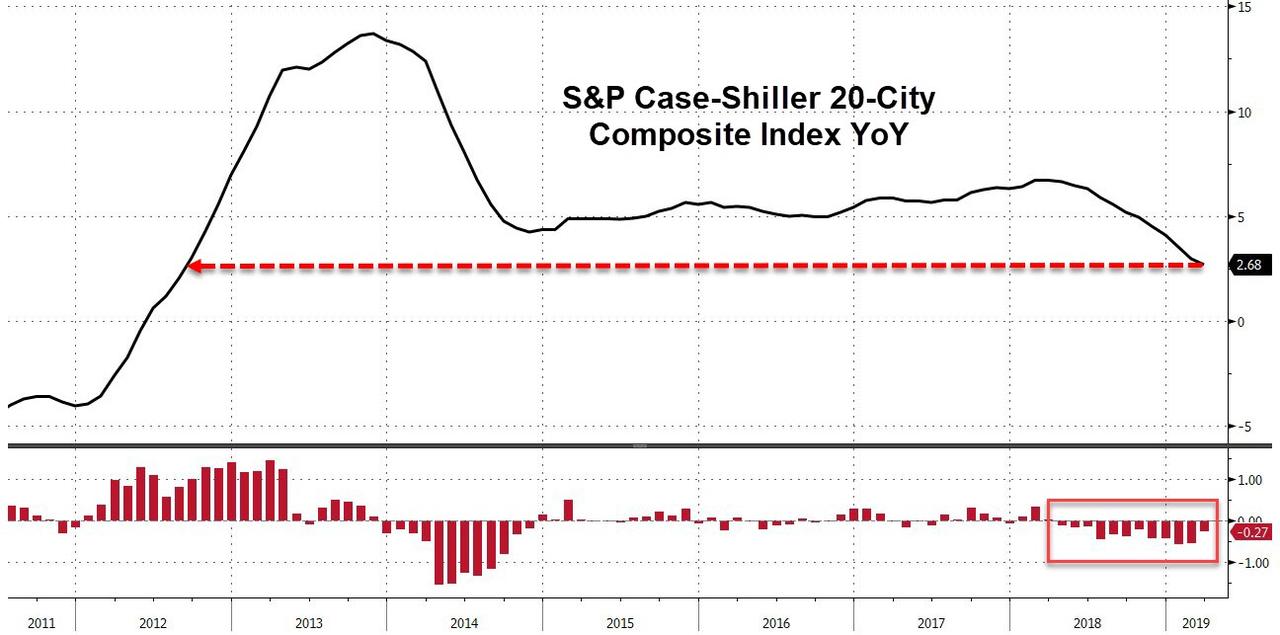

US Home Price Gains Slump For 12th Straight Month, Weakest In 7 Years

Case-Shiller’s March home price index showed yet another deceleration in growth – the 12 months in a row of slowing equals the 2014 growth scare’s length but is the weakest growth since July 2012.

After February’s 20-City Composite 3.00% YoY print, expectations were for 2.55% growth in March and it surprised very modestly with a 2.68% YoY print (still the lowest in 7 years)…

Nationally, home-price gains slowed to a 3.7% pace.

“Given the broader economic picture, housing should be doing better,” David Blitzer, chairman of the S&P index committee, said in a statement.

“Measures of household debt service do not reveal any problems and consumer sentiment surveys are upbeat. The difficulty facing housing may be too-high price increases,” which continue to outpace inflation, he said.

While all 20 cities in the index showed year-over-year gains, five were below 2%: Chicago, Los Angeles, San Diego, San Francisco and Seattle, which a year ago posted a 13% increase. Las Vegas led the nation in March with an 8.2% gain, followed by Phoenix.

Attention Millennials: You Can Now Buy Tiny Homes On Amazon

One of the main goals of the Federal Reserve’s monetary policies of the past decade was to generate the “wealth effect”: by pushing the valuations of homes higher, would make American households feel wealthier. But it didn’t. Most Americans can’t afford the traditional home with a white picket fence around a private yard (otherwise known as the American dream), and as a result, has led to the popularity of tiny homes among heavily indebted millennials.

Tiny homes are popping up across West Coast cities as a solution to out of control rents and bubbly home prices, also known as the housing affordability crisis.

Amazon has recognized the hot market for tiny homes among millennials and has recently started selling DIY kits and complete tiny homes.

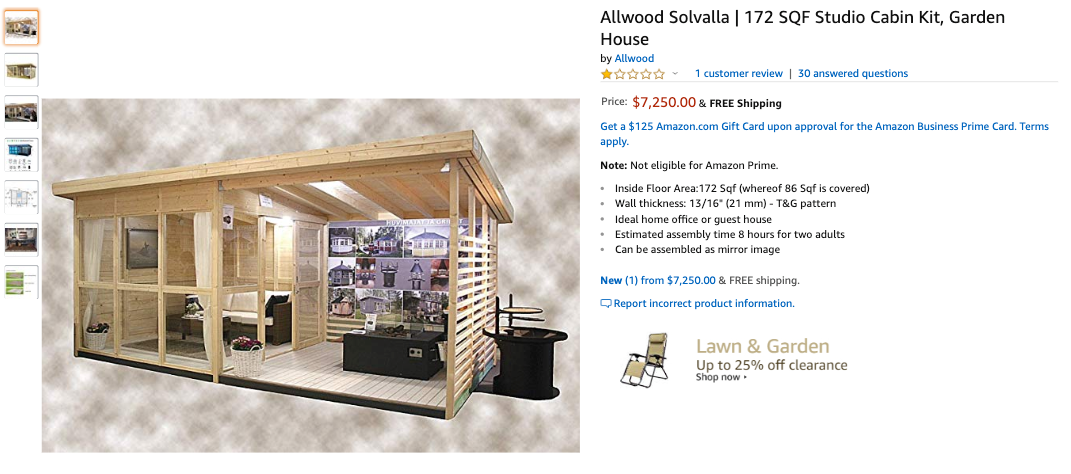

One of the first tiny homes we spotted on Amazon is a $7,250 kit for a tiny home that can be assembled in about eight hours.

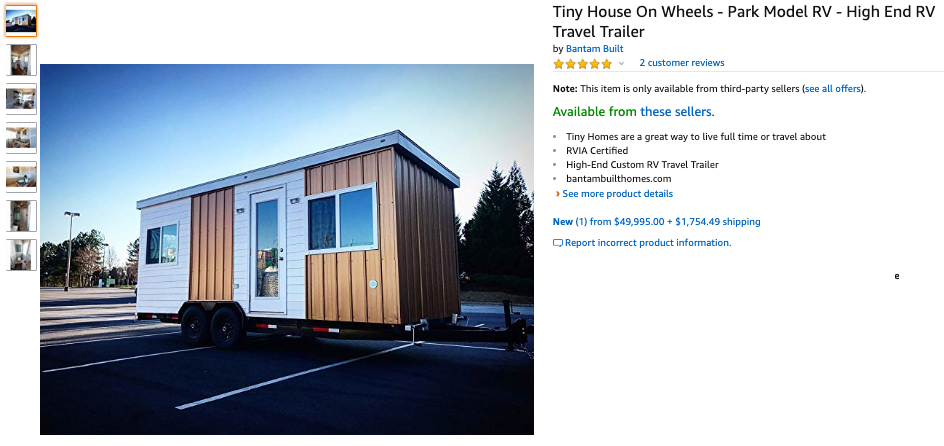

A more luxurious tiny home on the e-commerce website is selling for $49,995 +$1,745.49 for shipping. This one is certified by the RV Industry Association’s standards inspection program, which means millennials can travel from Seattle to San Diego in a nomadic fashion searching for gig-economy jobs.

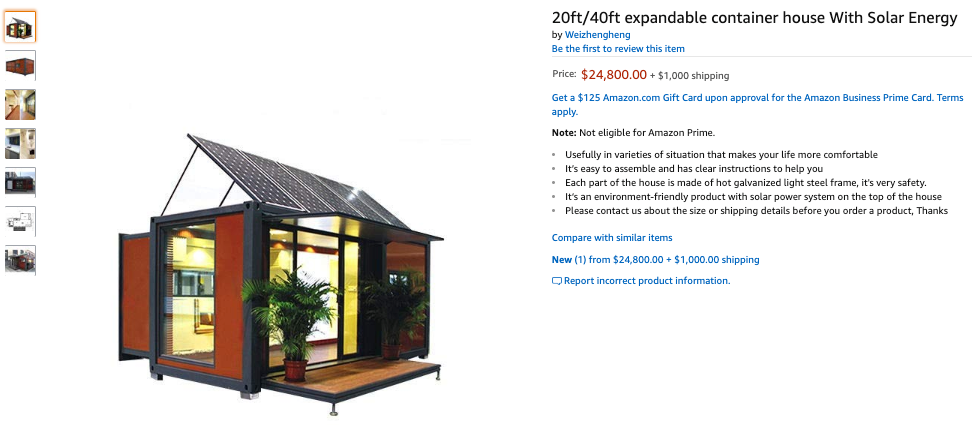

Those who want a 20 ft/40 ft expandable container house with solar energy, well, Amazon has that too. This tiny home has it all: a post-industrial feel using an old shipping container, virtue signaling with solar panels, full bathroom, and a kitchen to make avocado and toast.

With almost two-thirds of Millennials living paycheck to paycheck and less than half of them have $500 in savings, we’re sure this lost generation could afford one of these trailers tiny homes with their Amazon credit card. Nevertheless, the tiny home craze among millennials is more evidence that living standards are collapsing.

Where Home Prices Are Rising the Fastest (Slowest) In America

Since the end of the great recession, home prices in America have rebounded substantially. Since the dark days of 2009, prices have steadily climbed and are up over 50% on average from the lowest point.

This is great news for homeowners whose homes may be worth more than their pre-recession values, but less great news for homebuyers who can afford less house for the dollar. What’s more is that in some places, home prices have spiked much faster than average, while in other places, home prices have remained depressed.

So where in America are home prices increasing the fastest and the slowest? In light of fluctuating mortgage interest rates, tax reform that’s limited many homeowner deductions, and an affordability crisis in many urban areas, along with Priceonomics customer RefiGuide.org thought we’d dive deeper into the home price data published, aggregated and made available by Zillow.

Over the last year, the median home prices increased the fastest at the state level in Idaho, where prices increased by a staggering 17.2%. In just two states did home prices actually fall last year (Alaska and Delaware). The large cities with the fastest home appreciation were Newark, Dallas, and Buffalo where prices increased more than 15% in each place. The large city where prices decreased the fastest was Seattle, where home prices actually fell 2.4%.

Lastly, we looked at the expensive markets (where homes cost more than a million dollars) that had the highest price appreciation. St. Helena, CA, Quogue, NY and Stinson Beach, CA all had prices increase over 20% last year.

***

For this analysis, we looked at data from the beginning of March 2019 compared to prices one year earlier. We looked at Zillow’s seasonally adjusted median price estimate as published by Zillow Research Data.

Nationally, home prices increased 7.2% last year or about $15,000 more than the year before. However, in some states prices spiked much more than that.

Idaho leads the country with home prices increasing by 17.2% last year, driven by strong demand in the Boise market. In Utah the impact of a thriving economy and growing population is that prices increased 14% in just one year. Nevada, likewise is seeing strong home price growth as people migrate from California and the state’s low taxes are more favorable under the most recent tax reform. Alaska and Delaware have the distinction of being the only states where home prices fell over the last year.

Next, we looked at home prices in the top one hundred largest housing markets, as measured by population. Which cities were experiencing rapid home equity appreciation and which ones are not?

At the city level, home prices have increased the fastest in Newark, NJ where prices have increased more than 17% as buyers who are priced out of New York City have purchased in this area. Dallas, a city with a strong economy and low taxes has seen home prices increase nearly 17% as well.

Notably, some of the most expensive and desirable cities like Seattle, Oakland and Portland have seen their prices decrease in the last year. Each of these locations has experienced price appreciation during this decade, however.

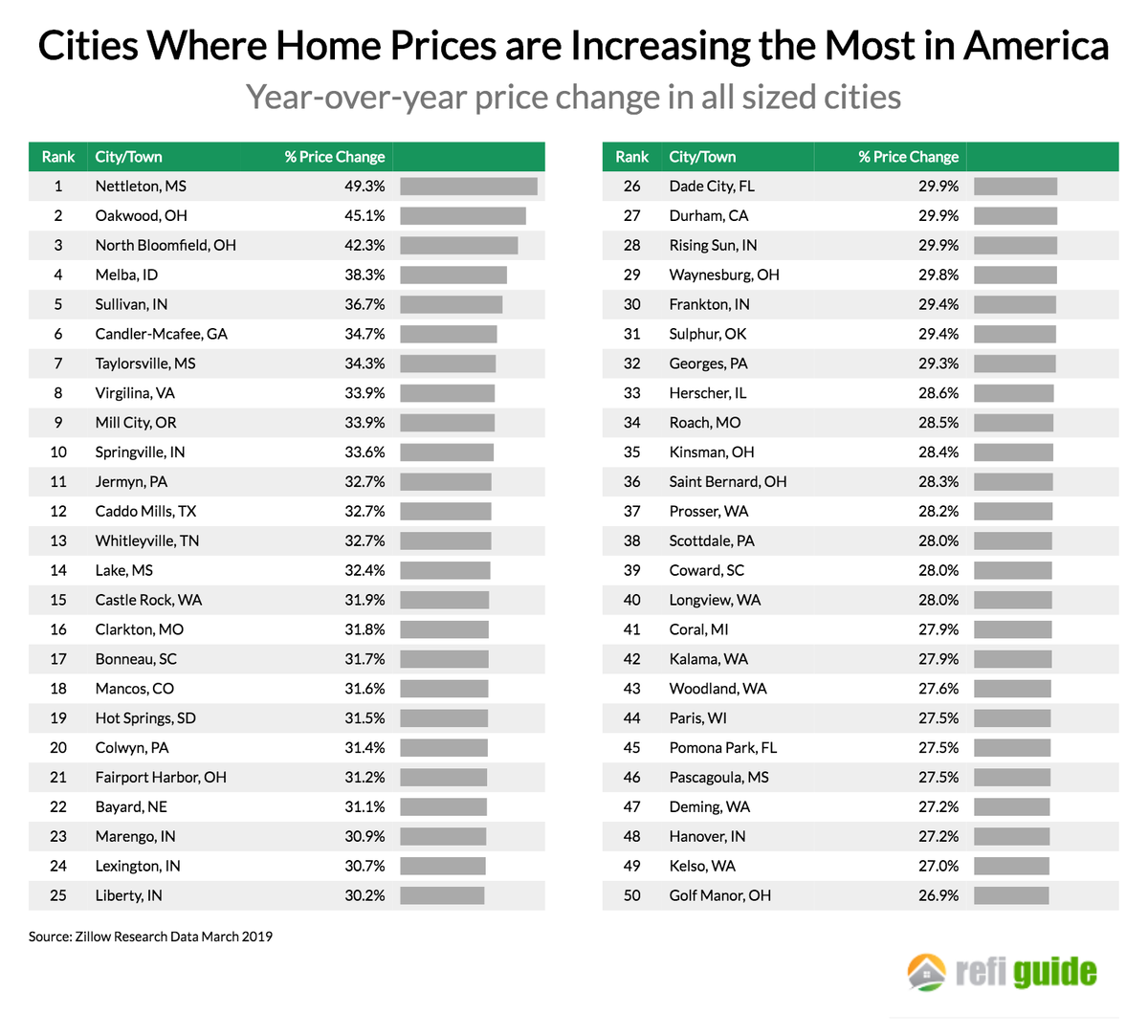

Were there any smaller cities and towns that experienced home prices rising faster than the big cities? Below shows the fifty places in the United States where home prices increased the most this last year:

Across the Midwest and South, numerous smaller cities experienced price appreciation much greater than 25% last year. In Nettleton, MS prices increased 49% in just one year! Notably, almost none of these high-price growth cities are located on the coasts.

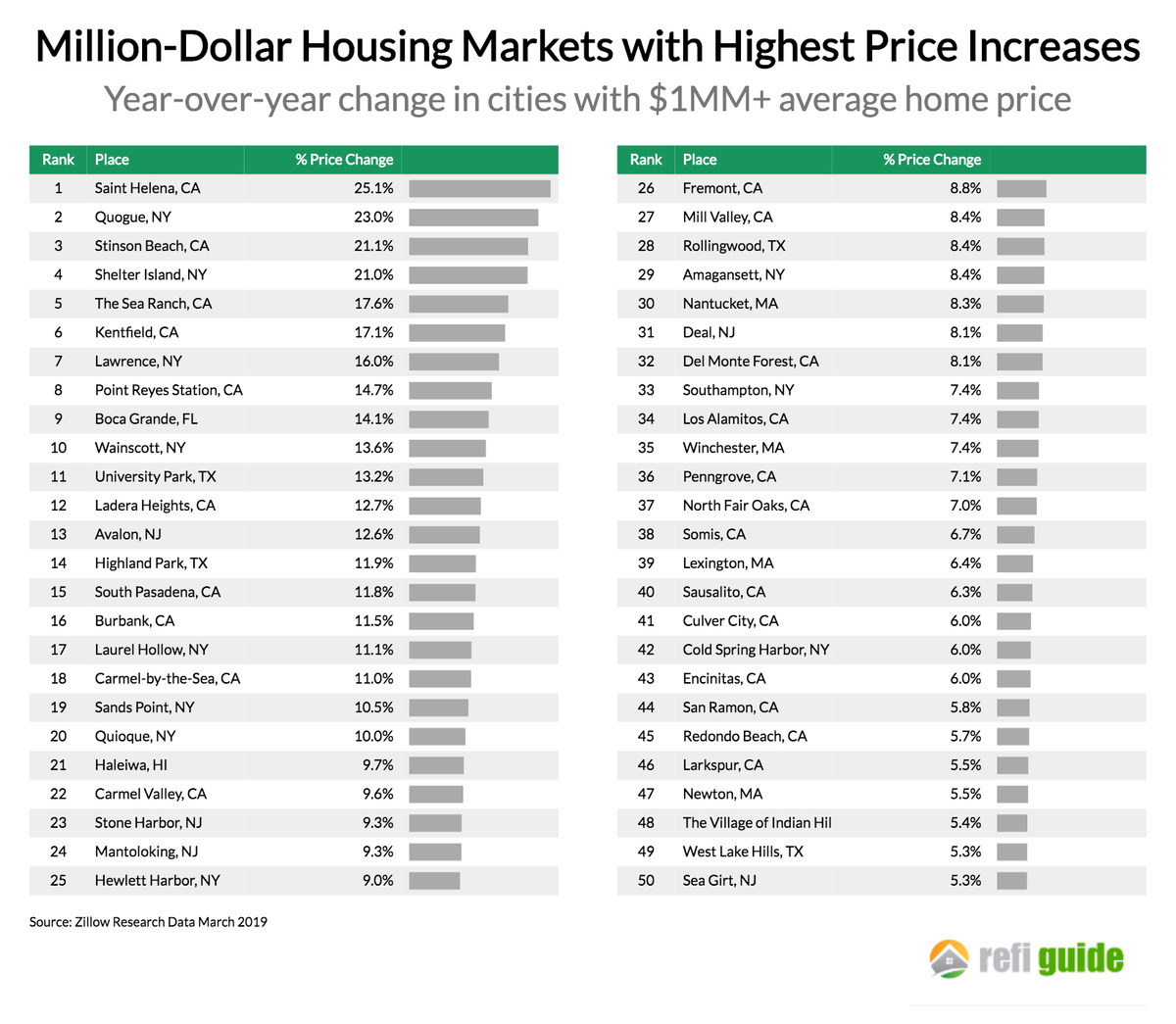

Lastly, what are expensive places to buy a home in America that are just getting more expensive? To conclude we looked at locations where the median home price was over one million dollars and the prices keep rising:

In this rarefied group, prices increased the most in Saint Helena, CA. In this tony town in Napa Valley, prices increased over 25% last year. In second place was Quogue, NY a town in the Hamptons. In fact, 9 out of the top 10 expensive cities with high price appreciation are in California or New York. More specifically, many of these locations are in the vicinity of San Francisco and New York City, the two very large economic engines that are driving home prices.

***

After nearly a decade of vibrant stock market and real estate returns, this year home prices have continued to climb at a steady clip. In only two states in America did prices actually fall, and in five states prices grew more than 10% in a year. As the economy has continued roaring, places that were once known for being affordable like Idaho, Utah, and Nevada have seen home prices spike. While expensive cities like Seattle, Portland and Oakland have seen prices level off in the last year, and places like Newark, Dallas and Buffalo have become less affordable. In this stage of American economic expansion, the once affordable places are seeing their prices escalate.

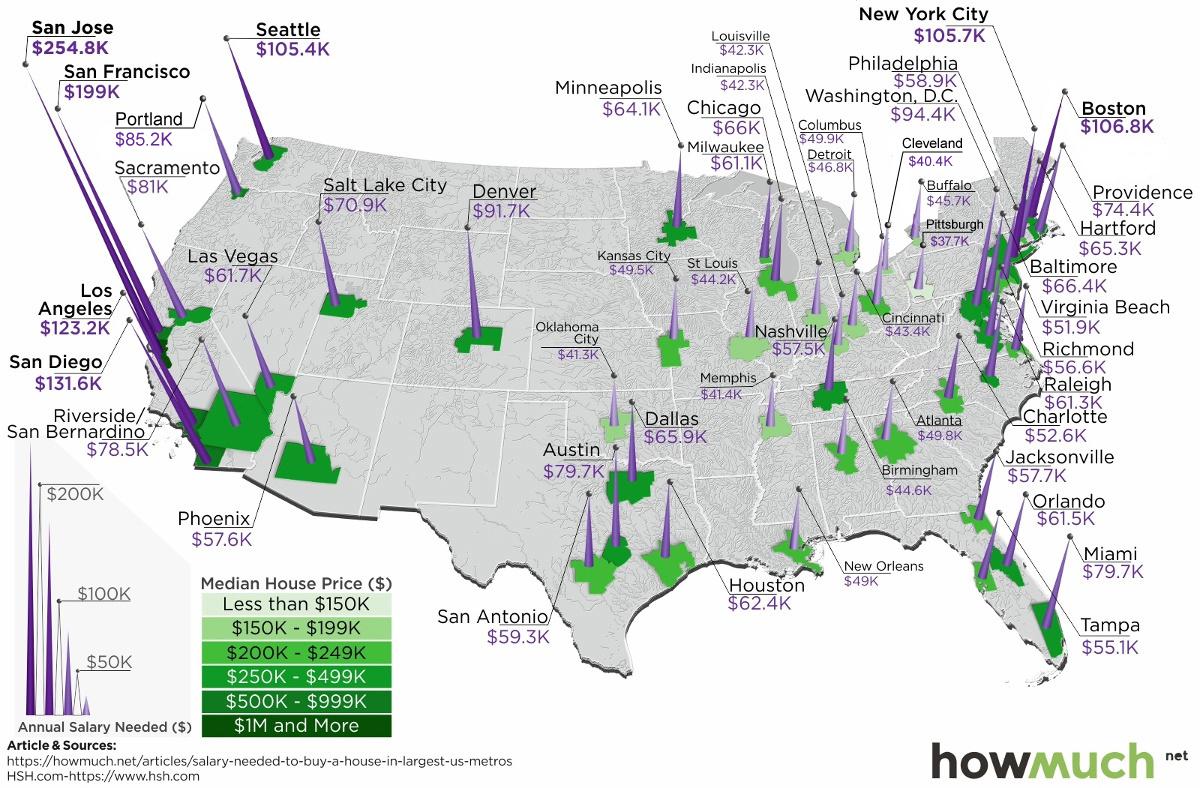

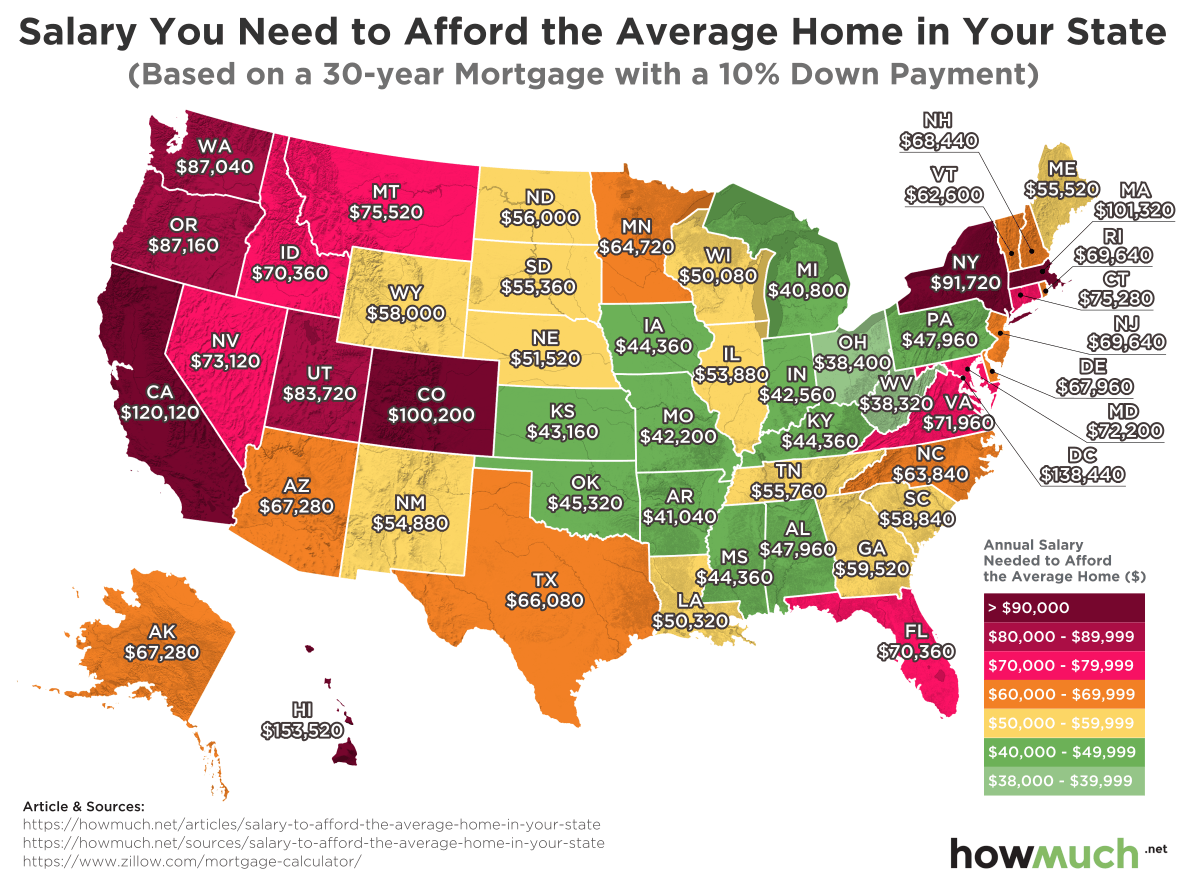

Mapped: The Salary Needed To Buy A Home In 50 U.S. Metro Areas

Over the last year, home prices have risen in 49 of the biggest 50 metro areas in the United States.

At the same time, mortgage rates have hit seven-year highs, making things more expensive for any prospective home buyer.

With this context in mind, today’s map comes from HowMuch.net, and it shows the salary needed to buy a home in the 50 largest U.S. metro areas.

The Least and Most Expensive Metro Areas

As a reference point, Visual Capitalist’s Jeff Desjardins points out that the median home in the United States costs about $257,600, according to the National Association of Realtors.

With a 20% down payment and a 4.90% mortgage rate, and taking into account what’s needed to pay principal, interest, taxes, and insurance (PITI) on the home, it would mean a prospective buyer would need to have $61,453.51 in salary to afford such a purchase.

However, based on your frame of reference, this national estimate may seem extremely low or quite high. That’s because the salary required to buy in different major cities in the U.S. can fall anywhere between $37,659 to $254,835.

The 10 Lowest Cost Metro Areas

Here are the lowest cost metro areas in the U.S., based on data and calculations from HSH.com:

After the dust settles, Pittsburgh ranks as the cheapest metro area in the U.S. to buy a home. According to these calculations, buying a median home in Pittsburgh – which includes the surrounding metro area – requires an annual income of less than $40,000 to buy.

Just missing the list was Detroit, where a salary of $48,002.89 is needed.

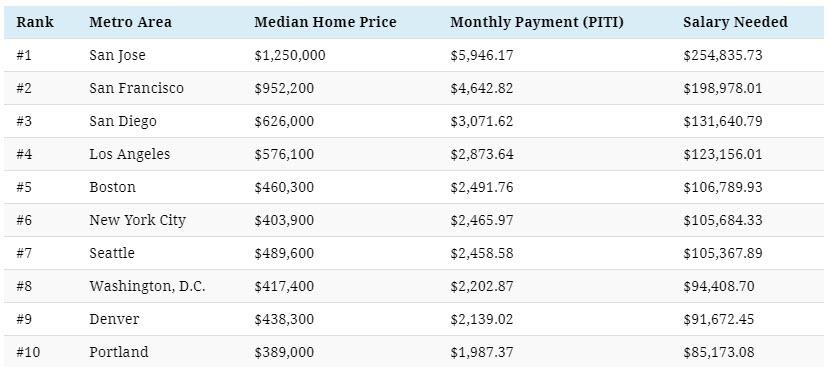

The 10 Most Expensive Metro Areas

Now, here are the priciest markets in the country, also based on data from HSH.com:

Topping the list of the most expensive metro areas are San Jose and San Francisco, which are both cities fueled by the economic boom in Silicon Valley. Meanwhile, two other major metro areas in California, Los Angeles and San Diego, are not far behind.

New York City only ranks in sixth here, though it is worth noting that the NYC metro area extends well beyond the five boroughs. It includes Newark, Jersey City, and many nearby counties as well.

As a final point, it’s worth mentioning that all cities here (with the exception of Denver) are in coastal states.

Notes on Calculations

Data on median home prices comes from the National Association of Realtors and is based on 2018 Q4 information, while national mortgage rate data is derived from weekly surveys by Freddie Mac and the Mortgage Bankers Association of America for 30-year fixed rate mortgages.

Calculations include tax and homeowners insurance costs to determine the annual salary it takes to afford the base cost of owning a home (principal, interest, property tax and homeowner’s insurance, or PITI) in the nation’s 50 largest metropolitan areas.

Standard 28% “front-end” debt ratios and a 20% down payments subtracted from the median-home-price data are used to arrive at these figures.

Americans Can’t Afford To Buy A Home In 70% Of The Country

Even at a time of low interest rates and rising wages, Americans simply can’t afford a home in more than 70% of the country, according to CBS. Out of 473 US counties that were analyzed in a recent report, 335 listed median home prices were more than what average wage earners could afford. According to the report from ATTOM Data Solutions, these counties included Los Angeles and San Diego in California, as well as places like Maricopa County in Arizona.

New York City claimed the largest share of a person’s income to purchase a home. While on average, earners nationwide needed to spend only about 33% of their income on a home, residents in Brooklyn and Manhattan need to shell out more than 115% of their income. In San Francisco this number is about 103%. Homes were found to be affordable in places like Chicago, Houston and Philadelphia.

This news is stunning because homes are considerably more affordable today than they were a year ago. Although prices are rising in many areas, they are also falling in places like Manhattan. Unaffordability in the market has been the result of slower home building and owners staying in their homes longer. Both have reduced the supply of homes in the market.

And the market may continue to create better conditions for buyers. Affordability could improve because of the fact that homes are out of reach for so many seekers, according to Todd Teta, chief product officer at ATTOM Data Solutions. Today’s market is also more affordable than it was a decade ago, before the crisis. Home prices were about the same prior to the crisis, even though income adjusted for inflation was lower.

“What kept the market going was looser lending standards, so that was compensating for affordability issues,” Teta said. Since then, standards have toughened (for now, at least).

We recently wrote about residents of New York City who simply claimed they couldn’t afford to live there.

More than a third of New York residents complained that they “can’t afford to live there” anymore (and yet they do). On top of that, many believe that economic hardships are going to force them to leave the city in five years or less, according to a Quinnipiac poll published a couple weeks ago. The poll surveyed 1,216 voters between March 13 and 18.

In total, 41% of New York residents said they couldn’t cope with the city’s high cost of living. They believe they will be forced to go somewhere where the “economic climate is more welcoming”, according to the report.

Ari Buitron, a 49-year-old paralegal from Queens said: “They are making this city a city for the wealthy, and they are really choking out the middle class. A lot of my friends have had to move to Florida, Texas, Oregon. You go to your local shop, and it’s $5 for a gallon of milk and $13 for shampoo. Do you know how much a one-bedroom, one-bathroom apartment is? $1700! What’s wrong with this picture?”

US Rents Still Growing 3.7% YoY For Low-income Households (vs. 2.9% for high-end)

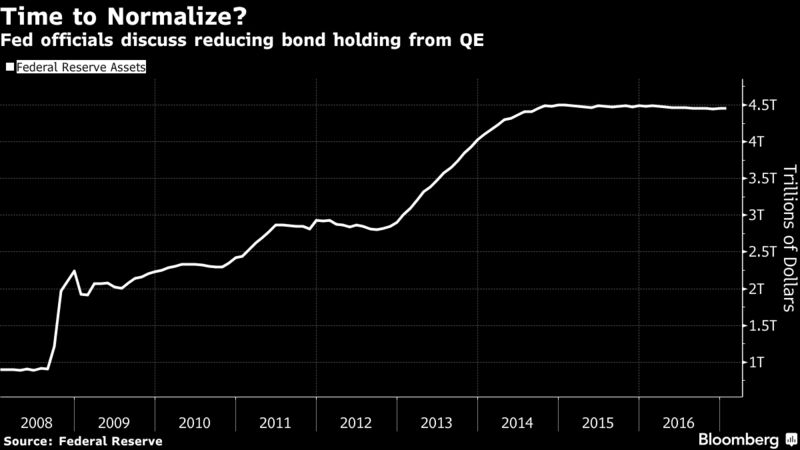

The Cycle That Has Been Saving Home Buyers $3,000 Per Year Just Ran Out Of Fuel

Summary

- After five years of supporting rising home prices, the latest phase of a long-term financial cycle is nearing its end.

- While little followed in the real estate market, this cycle of yield curve spread compression has been one of the largest determinants of home affordability and housing prices.

- Using a detailed analysis of national statistics, it is demonstrated that average home buyers in 2018 have been saving about $250 per month, or $3,000 per year.

- The reasons why the cycle is ending are mathematically and visually demonstrated.

(Daniel Amerian) Home buyers in every city and state have been benefiting from a powerful financial cycle for almost five years. Most people are not aware of this cycle, but it has lowered the average monthly mortgage payment for home buyers on a national basis by about $250 per month since the end of 2013.

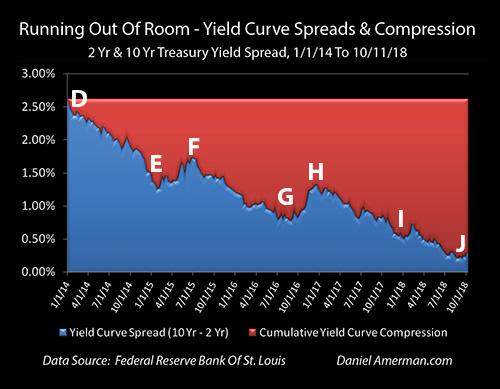

The interest rate cycle in question is one of “yield curve spread” expansion and compression, with yield curve spreads being the difference between long-term and short-term interest rates. This interest rate spread has been going through a compression phase in its ongoing cycle, meaning that the gap between long-term interest rates and short-term interest rates fell sharply in recent years.

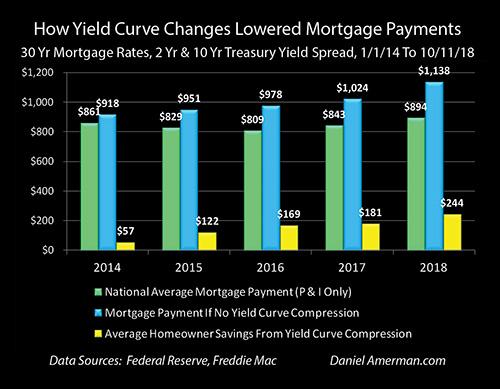

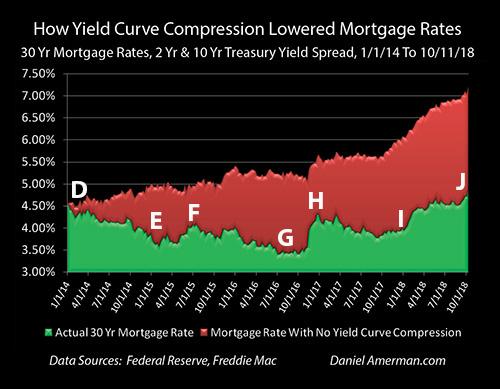

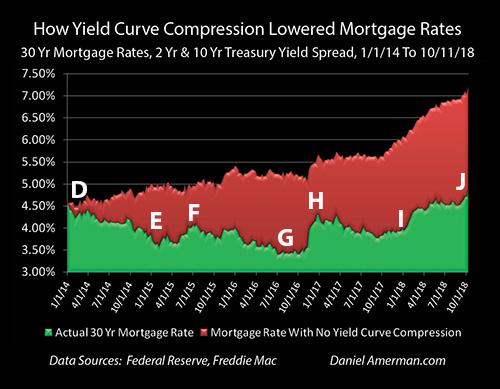

The green bars in the graph above show national average mortgage payments (principal and interest only), and they fell from $861 a month in 2013 to $809 a month in 2016 and have now risen to $894 per month. However, without the narrowing of the spread between short-term rates and long-term rates, mortgage payments would have been entirely different (and likely home prices as well).

Without the cycle of yield curve spread compression then, as shown with the blue bars, average mortgage payments would have been above $900 per month even in 2014, and they would have risen every year since without exception. If it had not been for compression, national average mortgage payments would have reached $978 per month in 2016 (instead of $809) and then $1,138 per month in 2018 (instead of $894).

The yellow bars show the average monthly savings for everyone buying a home during the years from 2014 to 2018. The monthly reduction in mortgage payments has risen from $57 per month in 2014 to $169 per month in 2016, to $244 per month by 2018 (through the week of October 11th).

In other words, the average home buyer in the U.S. in 2018 is saving almost $3,000 per year in mortgage payments because of this little-known cycle, even if they’ve never heard of the term “yield curve.” Indeed, while the particulars vary by location, home affordability, home prices and disposable household income have been powerfully impacted in each of the years shown by this interest rate cycle, in every city and neighborhood across the nation.

While knowledge of this cyclical cash flow engine has not been necessary for home buyers (and sellers) to enjoy these benefits in previous years, an issue has developed over the course of 2018 – the “fuel” available to power the engine has almost run out. That means that mortgage payments, home affordability and housing prices could be traveling a quite different path in the months and years ahead.

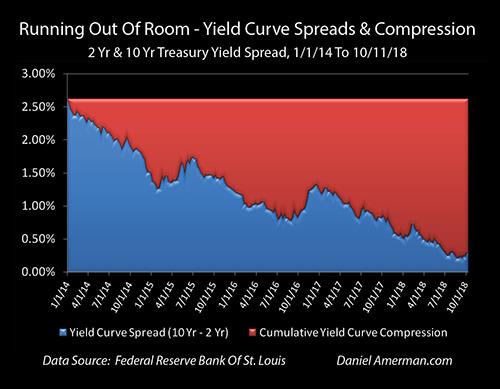

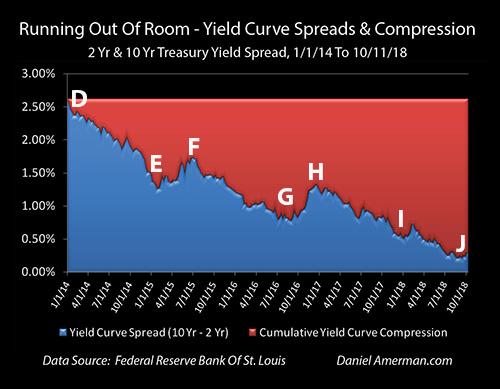

The yield curve spread is shown in the blue area above, and it was quite wide at the beginning of this particular cycle, equaling 2.62% as of the beginning of 2014. It has been steadily used up since that time, however, with the compression of the spread being shown in red. As of the current time, the yield curve compression which has powered the reduction in mortgage payments has almost maxed out, the blue area is almost gone and the ability to further compress (absent an inversion) is almost over.

This analysis is part of a series of related analyses; an overview of the rest of the series is linked here.

(More information on the data sources and calculations supporting the summary numbers above can be found in the rest of series, as well as in the more detailed analysis below. A quick summary is that mortgage rates are from the Freddie Mac Primary Mortgage Market Survey, Treasury yields are from the Federal Reserve, the national median home sale price is from Zillow for the year 2017 and the assumed mortgage LTV is 80%.)

A Cyclical Home Buyer Savings Engine

A yield curve spread is the difference in yields between short-term and long-term investments, and the most common yield curve measure the markets looks to is the difference between the 2-year and 10-year U.S. Treasury yields.

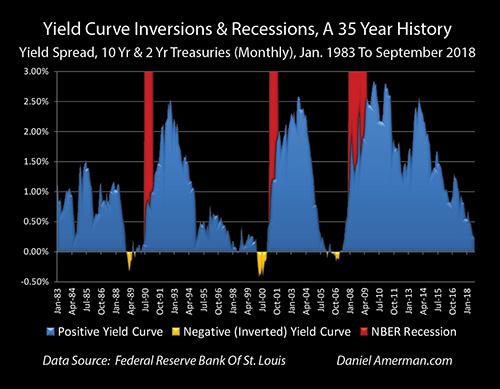

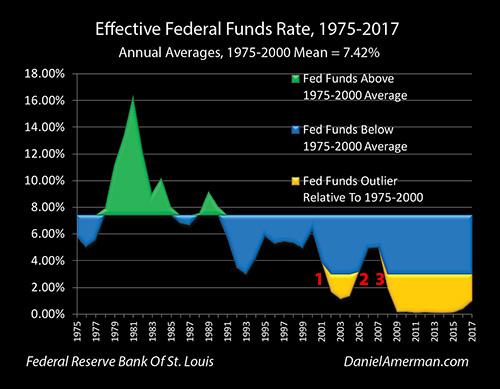

An introduction to what yield curves are and why they matter can be found in the analysis “A Remarkably Accurate Warning Indicator For Economic And Market Perils.” As can be seen in the graph below and as is explored in more detail in some of the linked analyses, there is a very long history of yield curve spreads expanding and compressing as part of the overall business cycle of economic expansions and recessions, as well as the related Federal Reserve cycles of increasing and decreasing interest rates.

Since the beginning of 2014, the rapid shrinkage of the blue area shows the current compression cycle, and a resemblance (in broad strokes) can be seen with the compression cycles of 1992-2000 and of 2003-2006.

What has seized the attention of the markets in recent months is what followed next in some previous cycles, which is that yield curve spreads went to zero and then became negative, creating “inversions” where short-term yields are higher than long-term yields (as shown in the golden areas). This is important because, while such inversions are quite uncommon, when they do occur they have had a perfect record in recent decades (over the last 35 years) of being followed by economic recessions within about 1-2 years.

However, yield curves don’t have to actually invert in order to turn the markets upside down, and as explored in the analysis linked here, when the Fed goes through cycles of increasing interest rates, we have a long-term history of yield curve spreads acting as a counter cyclical “shock absorber” and shielding long-term interest rates and bond prices from the Fed actions.

That only works until the “shock absorber” is used up, however, and as of the end of the third quarter of 2018, the yield curve “shock absorber” has been almost entirely used up. So, when the Fed increased short-term rates in late September of 2018, there was almost no buffer, and that increase passed straight through to 10-year Treasury yields. The results were painful for bond prices, stock prices and even the value of emerging market currencies.

The same lack of compression led to a sudden and sharp leap to the highest mortgage rates in seven years. Unfortunately, that jump may also potentially be just a taste of what could be on the way, with little further room for the yield curve to compress (without inverting).

Understanding The Relationships Between Mortgage Rates, Treasury Yields and Yield Curve Spreads

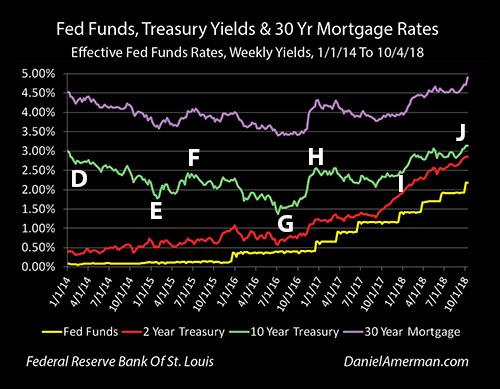

The graphic below shows weekly yields for Fed Funds, 2-year Treasuries, 10-year Treasuries and 30-year fixed-rate mortgages since the beginning of 2014.

The first relationship is the visually obvious close correlation between the top purple line of mortgage rates and the green line of 10-year Treasury yields. Mortgage amortization and prepayments mean that most mortgage principal is returned to investors well before the 30-year term of the mortgage, and therefore, investors typically price those mortgage rates at a spread (the distance between the green and purple lines) above 10-year Treasury yields. It isn’t a perfect relationship – the 10-year Treasury tends to be a bit more volatile – but is a close one.

The bottom two lines are the short-term yields, with the yellow line being effective overnight Fed Funds rates, and the red line being 2-year Treasury yields. Because the yield curve has been positive over the entire time period shown (as it almost always is), long-term rates have consistently been higher than short-term rates, and 10-year Treasury yields have been higher than 2-year Treasury yields, which have been higher than Fed Funds rates.

Now, the long-term rates have been moving together, and while the relationship is not quite as close, the short-term rates have also been generally moving together, with the 2-year Treasury yield more or less moving up with the Fed’s cycle of increasing interest rates (each “step” in the yellow staircase is another 0.25% increase in interest rates by the Federal Reserve).

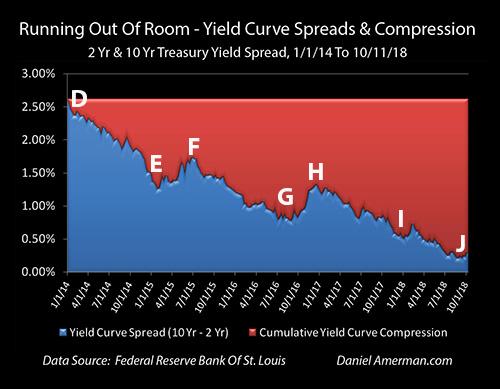

However, the long-term rates have not been moving with the short-term rates. As can be seen with point “D,” 10-year Treasury yields were 3.01% at the beginning of 2014, 2-year Treasury yields were a mere 0.39% and the yield curve spread – the difference between the yields – was a very wide 2.62%.

About a year later, by late January of 2015 (point “E”), 10-year Treasury yields had fallen to 1.77%, while 2-year Treasury yields had climbed to 0.51%. The yield curve spread – the distance between the green and red lines – had narrowed to only 1.26%, or a little less than half of the previous 2.62% spread.

It can be a little hard to accurately track the relative distance between two lines that are each continually changing, so the graphic below shows just that distance. The top of the blue area is the yield curve spread; it begins at 2.62% at point “D” and falls to 1.26% by point “E.” The great reduction between points “D” and “E” is now visually obvious.

So, if there had been no change in yield curve spreads, and the 2-year Treasury had risen to 0.51% while the spread remained constant at 2.62%, then the 10-year Treasury yields would have had to have moved to 3.13%.

But they didn’t – the yield curve compressed by 1.36% (2.62% – 1.26%) between points “D” and “E,” and the compression can be seen in the growing size of the red area labeled “Cumulative Yield Curve Compression.” If we start with a 2.62% interest rate spread, and that spread falls to 1.26% (the blue area), then we have used up 1.36% (the red area) of the starting spread and it is no longer available for us.

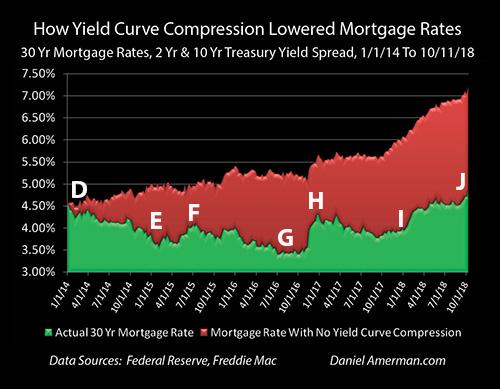

The critical importance of this yield curve compression for homeowners and housing investors, as well as some REIT investors, can be seen in the graphic below:

The top of the green area is the national average 30-year mortgage rate as reported weekly by Freddie Mac. That rate fell from 4.53% in the beginning of 2014 (point “D”) to 3.66% in late January of 2015.

But remember the tight relationship between the green and purple lines in the graph of all four yields / rates. Mortgage investors demand a spread above the 10-year Treasury, mortgage lenders will only lend at rates that will enable them to meet that spread requirement (and sell the mortgages), and therefore, it was the reduction in 10-year Treasury yields that drove the reduction in mortgage rates. And if the yield curve compression had not occurred, then neither would have the major reduction in mortgage rates.

As we saw in the “Running Out Of Room” graphic, the red area of yield curve compression increased by 1.36% between points “D” and “E.” If we simply take the red area of yield curve compression from that graph and we add it to the green area of actual mortgage rates, then we get what mortgage rates would have been with no yield curve compression (all else being equal).

With no yield curve compression, mortgage rates of 3.66% at point “E” would have been 5.02% instead (3.66% + 1.36% – 5.02%).

With a $176,766 mortgage in late January of 2015, a monthly P&I payment at a 3.66% rate is $810. (This is based on a national median home sale price for 2017 of $220,958 (per Zillow) and an assumed 80% mortgage LTV.)

At a 5.02% mortgage rate – which is what it would have been with no yield curve compression – the payment would have been $951. This meant that for any given size mortgage, monthly payments were reduced by 15% over the time period as a result of yield curve spread compression ($810 / $951 = 85%).

Now, at that time, housing prices were still in a somewhat fragile position. The largest decrease in home prices in modern history had just taken place between the peak year of 2006 and the floor years of 2011-2012. Nationally, average home prices had recovered by 9.5% in 2013, and then another 6.4% in 2014.

Here is a question to consider: Would housing prices have risen by 6.4% in 2014 if mortgage rates had not reduced monthly mortgage payments by 15%?

The Next Yield Curve Spread Compression

Our next key period to look at is between points “E” and “G,” late January of 2015 to late August of 2016. We are now beginning a rising interest rate cycle when it comes to short-term rates. The Fed had done its first slow and tentative 0.25% increase in Fed Funds rates, and 2-year Treasury yields were up to 0.80%, which was a 0.29% increase.

All else being equal, when we focus on the yellow and red lines of short-term interest rates, mortgage rates should have climbed as well. (Graphs are repeated for ease of scrolling.)

However, that isn’t what happened. After a brief jump upwards at point “F,” yield curve spreads had substantially fallen to 0.78% by point “G,” as can be seen in the reduction of the blue area above. For this to happen, the compression of yield curve spreads had to materially increase to 1.84%, as can be seen in the growth of the red area.

In the early stages of a cycle of rising interest rates (as part of the larger cycle of exiting the containment of crisis), mortgage rates did not rise, but fell from the very low level of 3.66% at point “E” to an even lower level of 3.46% at point “G,” as can be seen in the reduction of the green area.

To get that reduction in the green area during a rising interest rate cycle required a major growth in the red area of yield curve compression. To see what mortgage rates would have been without yield curve compression (all else being equal), we add the red area of cumulative yield curve compression of 1.84% to the green area of actual mortgage rates of 3.46% and find that mortgage rates would have been 5.30%.

Returning to our $176,766 mortgage example, the monthly mortgage payment (P&I only) is $790 with a 3.46% mortgage rate, and is $982 with a 5.30% mortgage rate. Yield curve compression was responsible for a 20% reduction in mortgage payments for any given borrowing amount by late August of 2016.

However, a problem is that by late August of 2016, the 1.84% cumulative cyclical compression of the yield curve meant that only 0.78% of yield curve spreads remained. A full 70% of the initial yield curve spread had been used up.

(Please note that the mortgage payments in this section of the analysis are calculated based on historical mortgage rates for the particular weeks identified. The annual average payments presented in the beginning of this analysis are the average of all weekly payment calculations for a given year, and therefore, do not correspond to any given week.)

Using Up The Rest Of The Fuel (Yield Curve Spreads):

After its slow and tentative start, the Federal Reserve returned to 0.25% Fed Funds rate increases in December of 2016, and has kept up a much steadier pace since that time. As of October of 2018, Fed Funds rates are now up a total of 2% from their floor. As can be seen in the line graph of the yield curve over time, 2-year Treasury yields have also been steadily climbing and were up to 2.85% by point “J,” the week ending October 11th.

However, 10-year Treasury yields are not up by nearly that amount. By late August of 2018, 10-year Treasury yields were only up to 2.87%, which was 1.29% above where they had been two years before.

The difference can be found by looking at the very small amount of blue area left by point “J” – yield curve spreads were down to a mere 0.22% by the week ending August 29th, or less than one 0.25% Fed Funds rate increase. This meant that the red area of total cumulative yield curve compression was up to 2.40%, which means that 92% of the “fuel” that had been driving the compression profit engine had been used up – before the Fed’s 0.25% Fed Funds rate increase of September 2018.

As explored in much more detail in the previous analysis linked here, when the Federal Reserve raised rates for the eighth time in September, the yield curve did not compress. Such a compression could have been problematic, as the yield curve would have been right on the very edge of inverting, and there is that troubling history when it comes to yield curve inversions being such an accurate warning signal of coming recessions.

Instead, the short-term Fed Funds rate increase went straight through to the long-term 10-year Treasury yields, full force, with no buffering or mitigation of the rate increase by yield curve compression. The resulting shock as the 10-year Treasury yield leaped to 3.22% led to sharp losses in bonds, stocks and even emerging market currencies.

The same shock also passed through in mostly un-buffered form to the mortgage market via the demand for mortgage investors to be able to buy mortgages at a spread above the 10-year Treasury bond. Thirty-year mortgage rates leaped from 4.71% to 4.90%, an increase of 0.19%, and the highest rate seen in more than seven years.

(I’ve concentrated on the 2- to 10-year yield curve spread in this analysis to keep things simple, to correspond to the market norm for the most commonly tracked yield curve spread and because it has a strong explanatory power for the big picture over time. If one wants to get more precise (and therefore, quite a bit messier), there are also the generally much smaller spread fluctuations between 1) Fed Funds rates and 2-year Treasury yields; and 2) 10-year Treasury yields and mortgage rates.)

When we look at the period between points “G” and “J,” it looks quite different than either of the previous periods we looked at. Mortgage rates have been rising, with the largest spike occurring at the time that the Federal Reserve proved it was serious about actually materially increasing interest rates with the Fed Funds rate increase of December 2016 (point “H”).

However, this does not mean that the money saving power of yield curve compression had lost its potency. Between points “D” and “J,” early January of 2014 and early October of 2018, average annual mortgage rates rose from 4.53% to 4.90%, as can be seen in the green area – which is an increase of only 0.37%. Meanwhile, the yield curve spread between the 2- and 10-year Treasuries was compressing from 2.62% to 0.29%, which was a yield curve compression of 2.33%. Adding the red area of cumulative yield curve compression to the green area of actual mortgage rates shows that current mortgage rates would be 7.23% if there had been no yield curve compression (all else being equal).

Mortgage principal and interest payments on a 30-year $176,766 mortgage with 4.90% interest rate are $938 per month, and they are $1,203 per month with a 7.23% mortgage rate. This means that yield curve compression has reduced the national average mortgage payment by about 22%.

Turning The Impossible Into The Possible:

This particular analysis is a specialized “outtake” from the much more comprehensive foundation built in the Five Graphs series linked here, which explores the cycles that have created a very different real estate market over the past twenty or so years.

As developed in that series, as part of the #1 cycle of the containment of crisis, the attempts to cure the financial and economic damage resulting from the collapse of the tech stock bubble and the resulting recession, the Federal Reserve pushed Fed Funds rates down into an outlier range (shown in gold), the lowest rates seen in almost 50 years.

As part of the #3 cycle of the containment of crisis, in the attempt to overcome the financial and economic damage from the Financial Crisis of 2008 and the resulting Great Recession, the Federal Reserve pushed interest rates even further into the golden outlier range, with near-zero percent Fed Funds rates that were the lowest in history.

By the time we reach early January of 2014 to late January of 2015, points “D” to “E,” Fed Funds rates were still where they had been the previous five to six years – near zero. Mathematically, there was no room to reduce interest rates, without the U.S. going to negative nominal interest rates.

But yet, mortgage rates fell sharply, from an already low 4.53% to an extraordinarily low 3.66%. This sharp reduction in rates transformed the housing markets and would steer extraordinary profits to homeowners and investors over the years that followed. However, none of it would have been possible without the compression of yield curve spreads.

Once the past has already happened, it is easy to not only take it for granted, but to internalize it and to make it the pattern that we believe is right and natural. Once this happens, the next natural step is to then either explicitly or implicitly project this assumed reality forward, as that trend line then becomes the basis for our financial and investment decisions.

However, where this natural process can run into difficulties is when what made the past possible becomes impossible. Yield curve spread compression took what would have been impossible – a plunge in mortgage rates even as short-term rates remained near a floor – and made it possible. But that pattern can’t repeat (at least not in that manner) when there is no longer the spread to compress.

San Francisco Bay Area Expats Are Driving Up Home Prices From Boise To Reno

In the not-too-distant future, it’s not improbable that low-wage laborers in San Francisco will be replaced by ubiquitous machines (the city is already home to the first restaurant run by a robot). And not just fast food workers, either – the jobs of teachers, fire fighters and law enforcement will all be assumed by robots, as NorCal’s prohibitively high cost of living and astronomical home prices spark a mass exodus of families earning less than $250,000 a year.

While this scenario might seem like an exaggeration (and it very well might be), we’ve paid close attention to the flight of Californians who are abandoning the Bay Area for all of the reasons mentioned above, as well as what Peter Thiel (himself a Bay Area emigre) once described as a political “monoculture” that has made California inhospitable for conservatives. And as if circumstances weren’t already dire enough for would-be homeowners (even miles away from San Francisco, relatively modest homes still sell for upwards of $2 million), a report published earlier this year by realtor.com illustrated how a lapse in new home construction has led to a serious imbalance between home supply and the increasing demand of the state’s ever-growing population, leading to a cavernous supply gap.

With this in mind, it shouldn’t be surprising that Californians comprise a majority of the residents moving into other states in the American West – even states like Idaho where the culture is very different from the liberal Bay Area. This week, Bloomberg published a story about how Californians constitute an increasing share of out-of-state homebuyers in small cities like Boise, Phoenix and Reno, which are significantly more affordable than California, and offer some semblance of the walkable urban environment that nesting millennials crave.

As Californians sell their homes in the Bay Area in search of roomier, cheaper locales, they’re bringing the curse of surging property prices with them. In fact, the influx of Californians is the primary factor leading to some of the largest YoY price increases in the country, as Bloomberg explains:

About 29 percent of the Idaho capital’s home-listing views are from Californians, according to Realtor.com. Reno and Prescott, Ariz., also were popular. These housing markets are soaring while much of the rest of the country cools. In Nevada, where Californians make up the largest share of arrivals, prices jumped 13 percent in August, the biggest increase for any state, according to CoreLogic Inc. data. It was followed closely by Idaho, with a 12 percent gain.

Even in places like deep-red Idaho, these transplants are beginning to remake the terrain in their own image, as food co-ops and Women’s Marches starting to populate the landscape. Businesses are rushing to Boise to meet every desire of the newly arrived Cali transplants.

D’Agostino, the Bay Area transplant, isn’t ashamed of her progressive views and is finding her place: at the natural foods co-op downtown, the Boise’s Women’s March last year, and with the volunteer group she founded to collect unused food for the needy. But it was also good to get out of her comfort zone, she says. “I can’t remember a time when it’s ever been this divided, so the fact that I can have some interaction with people who might not have exactly the same beliefs as me, that’s fine,” she says. “As long as we can respect each other.”

It’s not new for politics to factor into moving decisions—it’s just that in the age of Trump, tensions get magnified. “What’s different now is how far apart the parties are ideologically,” says Matt Lassiter, a professor of history at the University of Michigan.

Politics aside, businesses are rushing into Boise to fill every West Coast craving. In nearby Eagle, the new Renovare gated community is selling 1,900- to 4,000-square-foot homes with floor-to-ceiling glass and “wine walls” that start at $650,000—a bargain by California standards, says sales agent Nik Buich. About half of buyers are from out of state, he says.

One couple even opened a “boutique taqueria” and another transplant is preparing to start a blog about his experience moving to Idaho.

Julie and John Cuevas left Southern California a year ago to open Madre, a “boutique taqueria” in Boise that would make many of their fellow transplants feel at home. It’s more fusion than typical Mexican fare, with taco fillings including kimchi short rib and the popular “Idaho spud & chorizo.” It would have cost them three times as much to open a restaurant in California, says John, a former chef at a Beverly Hills hotel.

John Del Rio, a real estate agent sporting a beard, baseball cap, and sunglasses, just registered moving2idaho.com, where he’s planning to blog about all the things that make his new home great. He left Northern California two years ago with his wife in search of a place with less crime, lighter regulation, and more open space. Del Rio, a conservative with a libertarian bent, is reassured to see average people walking through Walmart with handguns in their holsters. In Idaho, he says, “nobody even flinches.”

In Boise alone, Californians made up 85% of new arrivals, and have driven home prices up nearly 20% in the span of a year. One realtor described the attitude of transplants as like “they’re playing with monopoly money.”

Nestled against the foothills of the Rocky Mountains, Boise (pop. 227,000) has drawn families for decades to its open spaces and short commutes. It’s been particularly attractive to Californians, who accounted for 85 percent of net domestic immigration to Idaho, according to Realtor.com’s analysis of 2016 Census data. While it has always prided itself on being welcoming, skyrocketing housing costs fueled by the influx is testing residents’ patience. In his state of the city speech last month, Mayor David Bieter outlined steps to keep housing affordable and asked Boise to stay friendly: “Call it Boise kind, our kindness manifesto,” he said.

It’s especially easy for buyers who have sold properties in the Golden State to push up prices in relatively cheap places because they feel like they’re playing with Monopoly money, Kelman says. The median existing-home price in Boise’s home of Ada County was $299,950 last month—up almost 18 percent from a year earlier, but still about half California’s. The influx is great news for people who already own homes in the area, says Danielle Hale, chief economist for Realtor.com. “But if you’re a local aspiring to home ownership, it feels very much that Californians are bringing high prices with them.”

And now that Trump’s tax reform package has been implemented, it’s only a matter of time before a whole new batch of Californian home owners, unwilling to forego their SALT tax write offs, start looking for greener pastures in low-cost red states.

US Home Prices Hit Peak Unaffordability ─ Prospective Buyers Are Better Off Renting

With unaffordability reaching levels not seen in decades across some of the most expensive urban markets in the US, a housing-market rout that began in the high-end of markets like New York City and San Francisco is beginning to spread. And as home sales continued to struggle in August, a phenomenon that realtors have blamed on a dearth of properties for sale, those who are choosing to sell might soon see a chasm open up between bids and asks – that is, if they haven’t already.

With unaffordability reaching levels not seen in decades across some of the most expensive urban markets in the US, a housing-market rout that began in the high-end of markets like New York City and San Francisco is beginning to spread. And as home sales continued to struggle in August, a phenomenon that realtors have blamed on a dearth of properties for sale, those who are choosing to sell might soon see a chasm open up between bids and asks – that is, if they haven’t already.

While home unaffordability is most egregious in urban markets, cities don’t have a monopoly on unaffordability. According to a report by ATTOM, which keeps the most comprehensive database of home prices in the US, of the 440 US counties analyzed in the report, roughly 80% of them had an unaffordability index below 100, the highest rate in ten years. Any reading below 100 is considered unaffordable, by ATTOM’s standards. Based on their analysis, one-third of Americans (roughly 220 million people) now live in counties where buying a median-priced home is considered unaffordable. And in 69 US counties, qualifying for a mortgage would require at least $100,000 in annual income (Assuming a 3% down payment and a maximum front-end debt-to-income ratio of 28%). As one might expect, prohibitively high home prices are inspiring some Americans to relocate to areas where the cost of living is lower. US Census data revealed that two-thirds of those highest-priced markets experienced negative net migration, while more than three-quarters of markets where people earning less than $100,000 a year can qualify for a mortgage experienced net positive migration.

Rising home prices have played a big part in driving home unaffordability, but they’re not the whole story. Stagnant wages are also an important factor. The median nationwide home price of $250,000 in Q3 2018 climbed 6% from a year earlier, which is nearly twice the 3% growth in wages during that time. Looking back over a longer period, median home prices have increased 76% since bottoming out in Q1 2012, while average weekly wages have increased 17% over the same period.

Instead of fighting to overpay for existing inventory, one study showed that, for now at least, most Americans would be better off renting than buying a residential property. According to the latest national index produced by Florida Atlantic University and Florida International University faculty, renting and reinvesting will “outperform owning and building equity in terms of wealth creation.”

However, with the average national rent at an all-time high, American consumers are increasingly finding that there are no good options in the modern housing market. Which could be one reason why millennials, despite having more college degrees than any preceding generation, are increasingly choosing to rent instead of buying, even after they get married and start a family.

New York Millennials Paying $1800 Per Month To Cram Into 98-Square-Foot Rooms

Millennials in New York are known for living in a state of perpetual brokeness – between student loans, $20 nightclub drinks and $15 avocado toast, it’s easy to understand why 70% of millennials have less than $1,000 in savings.

Now we can add expensive, glorified closets to the mix, as the Wall Street Journal reports.

30-year-old marketing manager Scott Levine lives in an $1,800 per month, 98-square-foot room in a postage-stamp of an apartment – “basically, a kitchen” – with two roomates. Every week, someone from Ollie – his property manager, stops by to drop off towels and toiletries.

A “community-engagement team” at Ollie helps plan Mr. Levine’s social calendar. A live-in “community manager”—sort of like a residential adviser for a college dorm—gets to know Mr. Levine and everyone else living on the 14 Ollie-managed floors of the Alta LIC building, known as Alta+, and finds creative ways to get them engaged in shared activities, like behind-the-scenes tours of Broadway shows or trips to organic farms. –WSJ

“Life in general can be a bit of a headache,” says Mr. Levine. Thanks to Ollie, he adds, “Everything is done for you, which is convenient.”

Ollie’s business model is all about convenience and roommates – usually single people in their 20s and 30s who have all amenities provided for them, while sharing a kitchen and common area.

For city-dwellers accustomed to living cheek-by-jowl with people whose names they’ll never bother to learn, this might seem strange. But for young people still forming their postcollege friend groups—in an era when participation in civic life is down and going to a bar can mean huddling in a corner swiping on Tinder—it makes sense. So much sense that people put up with apartments so small they’re called “micro.” But hey, free shampoo. –WSJ

Meanwhile, startups such as Ollie and Common are competing with big-city real-estate developers. Common manages 20 co-living properties in six cities where roommate situations are more common, such as New York, Los Angeles and Washington DC. They have approximately 650 renters according to CEO Brad Hargreaves.

“Our audience is people who make $40,000 to $80,000 a year, who we believe are underserved in most markets today,” Mr. Hargreaves says.

Other startups are managing existing homes and apartments, “Airbnb-style” as the WSJ puts it.

Bungalow, which just announced $64 million in funding, wants property owners to offer space to “early-career professionals” looking for a low-maintenance place to stay. It charges rent that’s “slightly higher” than what it pays those owners, a company spokeswoman says. It currently maintains over 200 properties—housing nearly 800 residents—across seven big cities, says co-founder and CEO Andrew Collins.

As with Common and Ollie, Bungalow advertises that it furnishes the common areas in its homes, installs fast free Wi-Fi, and cleans them regularly. The company also organizes events and outings to help you “build a community with… your new friends.” –WSJ

One of the underlying aspects of the co-living startup models is a technology platform that both advertises to prospective tenants and takes care of their needs once they’re living on-site. Ollie’s “Bedvetter” system, for example, shows apartments to potential tenants – and shows who’s already signed up to live there with links to their personal profiles in order to match roommates. Bedvetter also matches people into “pods” of “potential roommates” before they begin an apartment hunt.

“It’s like online dating,” says Levine – while his roommate, Joseph Watson, 29, compares it to eHarmony or Match.com vs. Tinder, as it’s designed for long term pairings.

“Micro Economics”

While millennials in New York and other urban areas scramble to make ends meet, developers are making hand over fist on the co-living movement – even though the renters themselves are paying less than they would for a private studio.

The Alta LIC building also has conventional apartments, but the co-living units are filling up faster, says Matthew Baron, one of the Alta LIC building’s developers. What’s more, he adds, he can get more than $80 a square foot for Ollie units compared with around $60 a square foot for the others, even though the Ollie ones are on the lower, less-desirable floors. –WSJ

Another complication with co-living arrangements is tricky community management. L.A.’s PodShare, for example, vets potential tenants beforehand – however issues with problem tenants are unavoidable. “We’ve hosted 25,000 people at this point, so there’s bound to be some problems,” says founder Elvina Beck.

Common building tenant Teiko Yakobson said that the “community vibe broke down after Common eliminated the paid “house leader,” complaining that “We all just became strangers, and it was no better than living in any other apartment.” Common instead replaced the program with “centralized” community managers at the corporate level – which Hargreaves says is “more coherent” for them.

It’s not all bad, however…

When it does work, co-living can re-create the kind of communities tenants seek online—ones grounded in common interests and shared socioeconomic status.

Mr. Levine, who not only lives in a co-living building but also works in a co-working space—and in whose social circle most people do either one of those or the other—is aware that, while this isn’t for everyone, he is hardly a standout. “One thing I’ve heard before is that I’m a stereotype of a New York millennial,” he says.

Just make sure you have earplugs in case your roommate is able to get laid in their respectively expensive, tiny room.

The Millennial Crisis

There is a serious economic crisis brewing that few seem to be paying attention. According to a new survey from Zillow Group Inc. (ZG – Get Report), approximately 22.5% of millennials ages 24 through 36 are living at home with their moms or both parents, up nine percentage points since 2005 which was 13.5% and the most in any year in the last decade. Between the student loans which cannot be discharged thanks to the Clintons (to get the support of bankers) even after they find that degrees are worthless when 60% of graduates cannot find employment with such a degree and the fact that taxes have escalated to nearly doubling over the last 20 years that is predominantly state and local, the affordability of buying a home has been fading fast. Despite the fact that millennials are eager to enter the real estate market, they’re bearing the brunt of the challenge directly caused by the combination of taxes and non-dischargeable student loans.

Now 63% of millennials under the age of 29 cannot even afford the cost of home ownership, according to a CoreLogic and RTi Research study. The expense, in fact, is their number one reason for remaining a renter. In their research, they concluded that one-third of millennial renters reported feeling they cannot afford a down payment to buy a home. This is a sad response that is not being taken into consideration by governments.

Where home prices have not risen sharply, taxes have. First-time home buyers face ever-growing challenges to find and buy affordable entry-level homes as the economics of inefficient governments at the state and local levels have refused to reform and raise taxes to meet pension costs they promised themselves. Politicians from London to Vancouver have increased taxes to try to bring home prices down rather than looking at the problem objectively. All they are accomplishing is punishing people who have owned homes and destroying their future when home values were their retirement savings.

California and Illinois are just two major examples at the top of the list of grossly mismanaged state governments. It is this net affordability factor that has begun to encumber sales of real estate, softening prices and turning many millennials into renters rather than home buyers. Then add the rise of interest rates and we have an economic cocktail of taxes that is beginning to kill the real estate market in a slow death drip by drip. Depressions take place when the debt and real estate markets collapse – not equities and commodities. The amount of money invested in debt markets dwarfs equities, It is ALWAYS the debt market that you undermine when you want to destroy an economy.

Taxes and the rise in interest rates will further erode affordability and is beginning to slow existing-home sales in many markets already. As this trend continues, home prices and mortgage rates over the next couple of years will likely dampen sales and home price growth. There was another study conducted by Freddie Mac which also found that affordability challenges are contributing to a downtrend in young adult home ownership. Long-term, real estate prices will decline as taxes and interest rates rise. The next crop of buyers is being culled and as that unfolds, real estate cannot rise when banks also begin to curtail the availability of mortgages.

Millennials Are Flocking To Cheap Rust Belt Cities

Educated, but poor, millennials are transforming neighborhoods in several Rust Belt states like Ohio, Michigan, and Wisconsin in search for affordable communities.

Since the end of the American high (the late 1960s), the Rust Belt had experienced decades of de-industrialization and a mass exodus of residents. Manufacturing plants closed down, jobs disappeared, and communities disintegrated, as this once vibrant region is now a symbol of decay and opioids.

However, this trend has reversed in recent years, as some millennials have abandoned big cities for Rust Belt communities, in hopes to catch the falling knife and invest in real estate that could be near its lows.

It is a massive risk, and the narrative behind this “attractive investment bet” are affordable communities, unlike the Washington Metropolitan Area, San Francisco, New York, San Diego County, and Boston.

Yet this revitalization of the Rust Belt economy could not have come at the worse time: Last week, Bank of America rang the proverbial bell on the US real estate market, saying existing home sales have peaked, reflecting declining affordability, greater price reductions and deteriorating housing sentiment.

While it is difficult to say what exactly happens in Rust Belt communities in the next downturn, one should understand that housing prices in these regions will probably stay depressed for the foreseeable future. So, if the millennial who was hoping for a Bitcoin-style like move, they should think again as investing in Rust Belt communities is a long-term strategy.

Constantine Valhouli, Director of Research for the real estate research and analytics firm NeighborhoodX, told CNBC that millennials are flocking to these areas not just for home ownership, but rather rebuilding these communities from the bottom up.

“It is about having roots and contributing to the revival of a place that needs businesses that create jobs and create value.”

According to Paul Boomsma, president and CEO of Leading Real Estate Companies of the World (LeadingRE), some of these formerly blighted towns are gradually coming back to life. The latest influx of millennials view these regions as financial opportunities and places to construct new economies – especially with real estate prices far below the Case–Shiller 20-City Composite Home Price Index.

“Millennials are swiping up properties for next-to-nothing prices near downtown city areas that have completely revitalized,” Boomsma said. LendingRE has listed a three-bedroom Victorian home in Mansfield, Ohio, with an asking price of $39,900.

The median home value in Mansfield is $60,300, now compare that to the median home value of nearly $700,000 in New York City and a whopping $1.3 million in San Francisco, and it is obvious why millennials are flocking to the Rust Belt. Experts add that there is more to consider than discounted prices.

“There is a community-mindedness with millennials that attracts them to the smaller Rust Belt towns,” said Peter Haring, president of Haring Realty in Mansfield, Ohio.

“We are seeing an intense interest in participating in the revitalization of our towns and being a part of the community. It’s palpable, and it’s exciting,” he added.

Haring said affordable homes in Mansfield comes with a significant drawback: distance. The closest large cities, Cleveland and Columbus, are each an hour’s drive, and amenities are lacking.

“For people working in those cities, they are sacrificing drive time,” Haring said. “In some cases, they are sacrificing the convenience of nearby shopping and restaurants.”

But for millennials that is a little concern: they have the luxury of working remotely and ordering consumable goods from Amazon.

“More and more people are now working virtually, which means they do not need to be in their office and can work from almost anywhere,” said Ralph DiBugnara, senior vice president at Residential Home Funding. “So why not find somewhere to live where your city dollars can go a lot further?”

CNBC points out that some large corporations are moving back into these areas, the same areas that they left decades ago for cheap labor overseas. One example is home appliance manufacturer Whirlpool, whose corporate headquarters are in Benton Harbor, Michigan.

“It helped revitalize surrounding areas with new lifestyle and cultural amenities,” said LendingRe’s Boomsma. “This type of corporate commitment draws a young workforce, who are attracted by the lifestyle, paired with the relative affordability.”

Todd Stofflet, a Managing Partner at the KIG CRE brokerage firm, said for the millennials who still cannot afford to buy a home, the Rust Belt also has a robust rental market. Millennials who are heavily indebted with student loans, auto debt, and high-interest credit card loans could discover that these low-cost regions are perfect strategies to break free from the debt ball and chain and start saving again. Restore capitalism and say goodbye to creditism, something the Federal Reserve and the White House would not be happy about.

Millennials are creating demand for new apartments, which is a “a catalyst for retail, grocery and office development,” Stofflet added. “As downtown populations experience a resurgence, so does the dining, entertainment and lifestyle of the area.”

Although discounted real estate prices in Rust Belt regions are appealing in today’s overinflated Central Bank controlled markets, Daniela Andreevska, a marketing director at real estate data analytics company Mashvisor, cautioned millennials to learn about the dynamics of why these communities have low prices.

“One should keep in mind that many of the homes there are foreclosures or other types of distressed properties,” she said. “You should analyze and inspect the property well in order to know how much exactly you will have to pay in repairs before buying it.”

These migration trends indicate both positive and negative shifts: on one hand millennials are fleeing unaffordable large cities to Rust Belt regions, in an adverse reaction to failed economic policies to reinflate the housing market. On the other hand, for millennials with insurmountable debt, migrating to these low-cost regions could be the most viable solution to get their finances under control.

Existing Home Sales Tumble As Home-Buying Sentiment Hits Lehman Lows

After June’s dismal US housing data, hope was high for a rebound in July but it was crushed as existing home sales tumbled 0.7% MoM (against expectations of a 0.4% jump). This is the longest streak of declines since the taper tantrum in 2013.

- Single-family home sales fell 0.2% MoM (-1.2% YoY) to annual rate of 4.75 million

- Purchases of condominium and co-op units dropped 4.8% MoM (-3.3% YoY) to a 590,000 pace

As lower-priced home sales collapsed…

This is the weakest SAAR existing home sales (5.34mm) since Feb 2016…

The median sales price increased 4.5% YoY to $269,600, but dipped MoM (seasonal norm)

Lawrence Yun, NAR chief economist, says the continuous solid gains in home prices have now steadily reduced demand.

“Led by a notable decrease in closings in the Northeast, existing home sales trailed off again last month, sliding to their slowest pace since February 2016 at 5.21 million,” he said.

“Too many would-be buyers are either being priced out, or are deciding to postpone their search until more homes in their price range come onto the market.”

“In addition to the steady climb in home prices over the past year, it’s evident that the quick run-up in mortgage rates earlier this spring has had somewhat of a cooling effect on home sales,” said Yun.

“This weakening in affordability has put the most pressure on would-be first-time buyers in recent months, who continue to represent only around a third of sales despite a very healthy economy and labor market.”

Total housing inventory at the end of July decreased 0.5 percent to 1.92 million existing homes available for sale (unchanged from a year ago). Unsold inventory is at a 4.3-month supply at the current sales pace (also unchanged from a year ago).

And finally a glance at the following chart shows that the US housing market is in freefall – not what record high stocks would suggest…

Perhaps this helps explain it – Sentiment for Home-Buying Conditions are the worst since the infamous Lehman Brothers collapse …

Affordability Crisis: Low-Income Workers Can’t Afford A 2-Bedroom Rental Anywhere In America

The National Low Income Housing Coalition’s (NLIHC) annual report, Out of Reach, reveals the striking gap between wages and the price of housing across the United States. The report’s ‘Housing Wage’ is an estimate of what a full-time worker on a state by state basis must make to afford a one or two-bedroom rental home at the Housing and Urban Development’s (HUD) fair market rent without exceeding 30 percent of income on housing expenses.

With decades of declining wages and widening wealth inequality via the financialization of corporate America, and thanks to the Federal Reserve’s disastrous policies (whose direct outcome is the ascent of Trump), the recent insignificant countertrend in wage growth for low-income workers has not been enough to boost their standard of living.

The report finds that a full-time minimum wage worker, or the average American stuck in the gig economy, cannot afford to rent a two-bedroom apartment anywhere in the U.S.

According to the report, the 2018 national Housing Wage is $22.10 for a two-bedroom rental home and $17.90 for a one-bedroom rental. Across the country, the two-bedroom Housing Wage ranges from $13.84 in Arkansas to $36.13 in Hawaii.

The five cities with the highest two-bedroom Housing Wages are Stamford-Norwalk, CT ($38.19), Honolulu, HI ($39.06), Oakland-Fremont, CA ($44.79), San Jose-Sunnyvale-Santa Clara, CA ($48.50), and San Francisco, CA ($60.02).

For people earning minimum wage, which could be most millennials stuck in the gig economy, the situation is beyond dire. At $7.25 per hour, these hopeless souls would need to work 122 hours per week, or approximately three full-time jobs, to afford a two-bedroom rental at HUD’s fair market rent; for a one-bedroom, these individuals would need to work 99 hours per week, or hold at least two full-time jobs.

The disturbing reality is that many will work until they die to only rent a roof over their head.

The report warns: “in no state, metropolitan area, or county can a worker earning the federal minimum wage or prevailing state minimum wage afford a two-bedroom rental home at fair market rent by working a standard 40-hour week.”

The quest to afford rental homes is not limited to minimum-wage workers. NLIHC calculates that the average renter’s hourly wage is $16.88. The average renter in each county across the U.S. makes enough to afford a two-bedroom in only 11 percent of counties, and a one-bedroom, in just 43% .

FIGURE 1: States With The Largest Shortfall Between Average Renter Wage And Two-Bedroom Housing Wage

Low wages and widespread wage inequality contribute to the widening gap between what people earn and mandatory outlays, in the price of their housing. The national Housing Wage in 2018 is $22.10 for a two-bedroom rental home and $17.90 for a one-bedroom, the report found.

FIGURE 3: Hourly Wages By Percentile VS. One And Two-Bedroom Housing Wages

Here is how much it costs to rent a two-bedroom in your state:

Case Shiller House Prices have continued to surge to bubble levels with growing demand for rental housing in the decade post the Great Recession.

The report indicates that new rental construction has shifted toward the luxury market because it is more profitable for homebuilders. The number of rentals for $2000 or more per month has more than doubled between 2005 and 2015.

Here are the Most Expensive Jurisdictions for Housing Wage for Two-Bedroom Rentals

Here is how your state ranks regarding Housing Wage:

“While the housing market may have recovered for many, we are nonetheless experiencing an affordable housing crisis, especially for very low-income families,” said Bernie Sanders quoted in the report.

The fact is, the low-wage workforce is projected to soar over the next decade, particularly in unproductive service-sector jobs and odd jobs in the gig economy, as increasingly more menial jobs are replaced by automation/robots. This is not sustainable for a fragile economy where many are heavily indebted with limited savings; this should be a warning, as many Americans do not understand their living standards are in decline. American exceptionalism is dying.

The bad news is that for the government to combat the unaffordability crisis, deficits would have to explode because even more Americans would demand housing subsidies, setting the US debt on an even more unsustainable trajectory. Even though Congress marginally increased the 2018 HUD budget, the change in funding levels for some housing programs have declined.

Changes In Funding Levels For Key HUD Programs (FY10 Enacted To F18 Enacted)

But wait a minute, something does not quite add up: consider President Trump’s cheer leading on Twitter calling today’s economy the “greatest economy in History of America and the best time EVER to look for a job.”

Rents Surge Most in 16 Months Pressuring Home Buyer Wannabees

The Rent Cafe’s Monthly Rent Report for the 250 largest US cities shows a 3.2% Y-o-Y surge.

The national average rent in April clocked in at $1,377. This marks the highest annual growth rate since the end of 2016.

By Size

- Large cities: Las Vegas sees the fastest increasing rents Y-o-Y (6.0%), followed by Denver (5.8%) and Detroit (5.4%). Apartment prices in Brooklyn and Manhattan continue to slide, while rents in Washington, D.C., Portland, and Austin have been steady, growing by less than 1.5%.

- Mid-size cities: Rents in Sacramento cooled down to 6%, but still lead. At the other end of the spectrum are New Orleans (-2.2%), Tulsa (0.5%), and Wichita (1.0%), where rents are growing the slowest.

- Small cities see the top 20 most significant rent increases in April. Rents in the Midland-Odessa area skyrocketed for another month, 35.6% and 32.6% respectively. At the bottom of the list sit Norman (-2.5%), Lubbock (-2.5%), and Alexandria (-1.1%).

- No significant fluctuation in prices was noticed in Chicago, Philadelphia, and San Francisco, where apartment rents grew slower than 2% over the year.

Significant Changes

Wages Aren’t Keeping Up

The above chart was released today by the BLS. For details, please see Jobs Report: Payroll Miss +164K, Nonfarm Wage Growth Anemic +0.1%.

BLS in Agreement

The BLS also has rent of primary residence up 3.6% (from March).

Median New Home Sales Price

Median Real Wages

Home Buyer Wannabee Dilemma

Home buyer wannabees struggle with rents but cannot afford houses.

The most recent data for median wages is from May of 2016. May of 2017 will be out soon and I will update the chart.

New buyers struggle with rent but home buying is not an option.

Real median wages are down seven of the last 11 years while home prices (not even reflected in the CPI), have soared.

How the Fed’s Inflation Policies Crucify Workers in Pictures

For median wage details, please see How the Fed’s Inflation Policies Crucify Workers in Pictures

Deflationary Bust Coming

The current setup leads to another deflationary collapse as we saw in 2008-2009, not an inflation boom.

“If I were trying to create a deflationary bust, I would do exact exactly what the world’s central bankers have been doing the last six years,” said Stanley Druckenmiller, 2018 recipient of the Alexander Hamilton award.

That is precisely what I have been saying for a long time.

For an explanation of the coming deflationary collapse, please see Can We Please Try Capitalism? Just Once?

No Relief In Sight: Housing affordability is weakening at the fastest pace in a quarter century

- Rising home prices, rising mortgage rates and rising demand are colliding with a critical shortage of homes for sale. And all of that is slamming housing affordability.

- This year, affordability — based on the amount of the monthly mortgage payment will weaken at the fastest pace in a quarter century, according to researchers at Arch Mortgage Insurance.

- Other studies that factor in median income also show decreasing affordability because home prices are rising far faster than income growth.

It is the perfect storm: Rising home prices, rising mortgage rates and rising demand are colliding with a critical shortage of homes for sale.

And all of that is slamming housing affordability, which is causing more of today’s buyers to overstretch their budgets. This year, affordability — a metric based solely on the amount of the monthly mortgage payment — will weaken at the fastest pace in a quarter century, according to researchers at Arch Mortgage Insurance.

The average mortgage payment, based on the median-priced home, increased by 5 percent in the first quarter of 2018 nationally and could go up another 10 to 15 percent by the end of the year, according to their report.

Researchers looked at the median-priced home, now $250,000, and estimated price gains this year of 5 percent in addition to mortgage rates going from 4 percent to 5 percent on the 30-year fixed. Other studies that factor in median income also show decreasing affordability because home prices are rising far faster than income growth.

That is a national picture – but all real estate is local, and some markets will see affordability weaken more dramatically. The average monthly payment in Tacoma, Washington, is estimated to increase 25 percent this year, given sharply rising prices. In Baltimore and Boston, it could rise 21 percent in each. Philadelphia, Detroit and Las Vegas could all see 20 percent increases in the average monthly payment.

“If mortgage rates and home prices continue to rise as expected, affordability will get hammered by year-end as demand continues to outstrip supply,” said Ralph DeFranco, global chief economist-mortgage services at Arch Capital Services. “A strong U.S. economy combined with a housing shortage in many markets means that there is little hope of any price drop for buyers. Whether someone is looking to upgrade or purchase their first home, the window to buy before rates jump again is probably closing fast.”

Barely a decade after home values crashed especially, they are now hovering near their historical peak, accounting for inflation. Prices are being driven by record low inventory of homes for sale. Home builders are still producing well below historical norms, and demand for housing is very hot. The economy is stronger, which is giving younger buyers the incentive and the means to buy homes.

Stretching budgets and pushing limits

Maryland real estate agent Theresa Taylor said the supply shortage is hitting buyers hard. She is seeing more clients stretch their budgets to win a deal amid multiple offers.

“People are having to escalate offers on top of rates going up. I’m seeing it in all price ranges,” said Taylor, an agent at Keller Williams. “I am seeing it when I’m getting five offers, and people are trying to package up an offer where they’re pushing their limits.”

Buyers are taking on much higher debt levels today to be able to afford a home. In fact, the share of mortgage borrowers with more than 45 percent of their monthly gross income going to debt payments more than tripled in the second half of last year. Part of that was because Fannie Mae raised that debt-to-income threshold to 50 percent, but clearly there was demand waiting.

“Family income is rising more slowly than home prices and mortgage rates, meaning that the mortgage payment takes a bigger bite out of income for new home buyers,” said Frank Martell, president and CEO of CoreLogic. “CoreLogic’s Market Conditions Indicator has identified nearly one-half of the 50 largest metropolitan areas as overvalued. Often buyers are lulled into thinking these high-priced markets will continue, but we find that overvalued markets will tend to have a slowdown in price growth.”

CoreLogic considers a market overvalued when home prices are at least 10 percent higher than the long-term, sustainable level. High demand makes the likelihood of a national home price decline very slim, but certain markets could see prices cool if supply grows or if there is a hit to the local economy and local employment.

In any case, the more home buyers stretch, the more house-poor they become, and the less money they have to spend in the rest of the economy.

With no relief in either inventory or home price appreciation in sight, the housing market is likely to become even more competitive this year.

At some point, however, there will come a breaking point when sales slow, which is already beginning to happen in some cities. Home prices usually lag sales, so if history holds true, price gains should start to ease next year.

Economists Who Push Inflation Stunned That Rising Home Prices Have Put Buyers Deeper Into Debt

Once again, when the government intervenes – this time in housing – the left hand is starting a fire that the right hand is trying to put out. Rising prices for homes are once again pricing out prime borrowers and nobody can “figure out” why this is happening.

It is news like this article reported this morning by the Wall Street Journal that continues to perpetuate the hilarious notion of Keynesian economics as giving a job to one man digging a hole and another job to another man filling it, simply so that they both have jobs.