Dallas-Based REIT Paid $129 Million To Extend Maturing Loans on 15 Other Properties

The W Atlanta Downtown is among 19 hotels Ashford Hospitality Trust is handing back to lenders. (CoStar)

Dallas-Based REIT Paid $129 Million To Extend Maturing Loans on 15 Other Properties

The W Atlanta Downtown is among 19 hotels Ashford Hospitality Trust is handing back to lenders. (CoStar)

Over the past several months we’ve seen a series of progressively negative headlines over commercial real estate – predictions becoming more and more dire.

(Neil Callanian) Almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025. The big question facing those borrowers is who’s going to lend to them?

Blackstone is giving up on one of its Midtown Manhattan office buildings, the latest sign yet that distress is beginning to hit the office sector.

The world’s largest owner of commercial real estate, Blackstone has turned over the keys of 1740 Broadway, a 26-story office tower a block from Carnegie Hall, to the special servicer on its $308M commercial mortgage-backed security, Commercial Observer reports.

Property investors are about to discover just how much the global fallout from the coronavirus pandemic has spread from deserted and cast-off buildings to their bottom lines.

“I don’t see any way of avoiding a great deal of pain in the commercial real estate market in 2021. It is almost inevitable. My friends at the Federal Reserve and FDIC are becoming increasingly uncomfortable with what’s going on in the commercial real estate world.”

Cam Fine, Former President of Independent Community Bankers of America

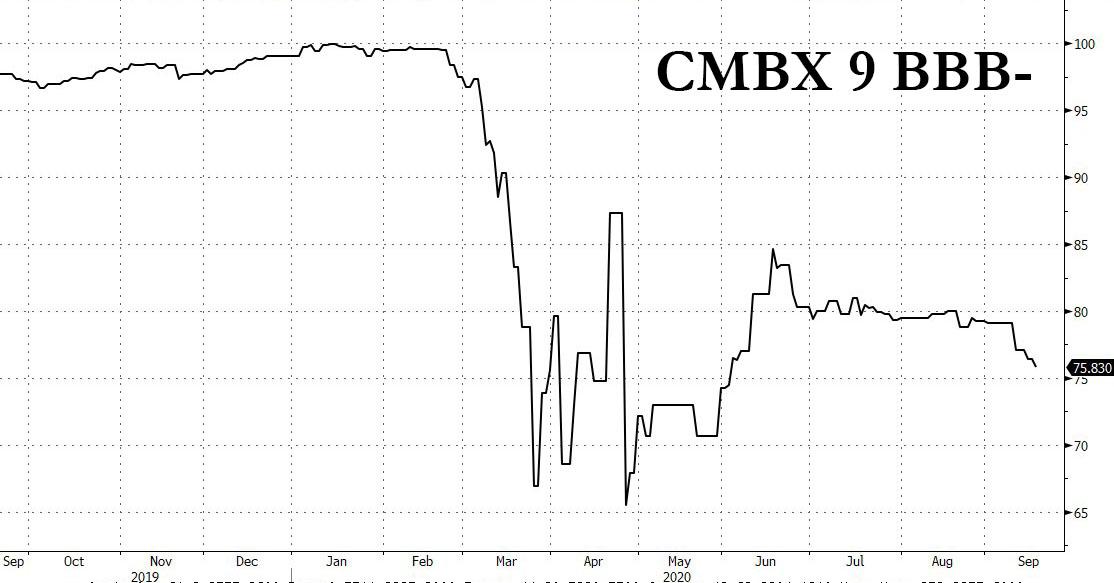

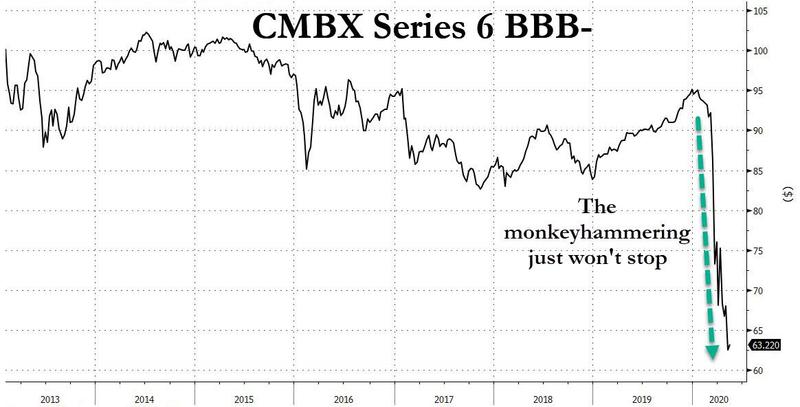

Over the past 6 months ZeroHedge has repeatedly discussed the plight of commercial real estate which unlike most other financial assets, failed to benefit from a Fed bailout or backstop (but that may soon change). It culminated in June when we wrote that the “Unprecedented Surge In New CMBS Delinquencies Heralds Commercial Real Estate Disaster.” The ongoing crisis in structured debt backed by commercial real estate in general and hotel properties in particular, prompted Wall Street to launch the “Big Short 3.0“ trade: betting against hotel-backed loans, which had the broadest representation in the CMBX 9 index, whose fulcrum BBB- series has continued to slide even as the broader market rebounded.

One of the bedrocks of modern US capitalism – which is now mutating by the day if not hour as the Fed scrambles to preserve at any cost its the towering edifice after decades of malinvestment, even the nationalziation of the very capital markets that made America great – and one of the constants along with death and taxes, is that residential debt is non-recourse, meaning one can simply walk away from one’s mortgage if the bill is untenable, while commercial debt is recourse, or pledged by collateral that has to be handed over to the creditor if an event of default occurs.

However, in the aftermath of the sheer devastation unleashed upon countless small and medium commercial businesses which will be forced to file for bankruptcy by the thousands, this may all change soon.

As the Commercial Observer reports, last Friday, the California Senate Judiciary Committee advanced a bill that would allow small businesses — like cafes, restaurants and bars — to renegotiate and modify lease deals if they have been impacted by shelter-in-place orders and economic shutdowns. If an agreement isn’t reached after 30 days of negotiations, the tenant can break the lease with no penalty, effectively starting a revolution in the world of credit by retroactively transforming commercial loans into non-recourse debt.

Landlord advocates have, predictably, been mobilizing in opposition, arguing that the proposal is unconstitutional, and that it would “upend” leases around the state. Justin Thompson, a real estate partner with Nixon Peabody, told Commercial Observer that it was illuminating to see so many industry organizations come out “so vehemently opposed” in a short period of time. Having heard from industry groups all week, Thompson said the general consensus in the commercial real estate community is that the bill is “overly broad, overreaching, and it is a bit of a sledgehammer” when something less blunt would do.

“Everyone recognizes that restaurant tenants and smaller non-franchise retail tenants in particular really are in dire straits and in need of assistance,” Thompson said. “But I think the implications of SB 939 are really laying it at the feet of landlords, and putting them in the situation where, even if they have tenants that were going to make it through this, they might now rethink that and leave the landlord in the lurch.”

Senate Bill 939 was initially introduced as a statewide moratorium that would prohibit landlords from evicting businesses and nonprofits that can’t pay rent during the coronavirus emergency. But it was amended in the week to also give smaller businesses the ability to trigger re-negotiations if they have lost more than 40 percent of their revenue due to emergency government restrictions, and if they will be operating with stricter capacity limits due to continued social distancing mandates.

If the parties do not reach a “mutually satisfactory agreement” within 30 days after the landlord received the negotiation notice, then the tenant can terminate the lease without liability for future rent, fees, or costs that otherwise would have been due under the lease.

One of the bill’s authors, Sen. Scott Wiener, said during the hearing that the bill is focused on the hospitality sector, which has been most devastated. The renegotiation provision will not apply to publicly owned companies or their businesses. The law would be in effect until the end of 2021, or two months after the state of emergency ends, whichever is later.

Quoted by the Commercial Observer, Wiener argued that the state faces “a mass extinction event of small businesses and nonprofits in every neighborhood,” and the “very real prospect” of them permanently closing due to prolonged mandates that reduce capacity, “chopping in half someone’s business.”

“This would change the face of our state permanently,” he said. “It would severely hamper our ability to recover.”

So, the choice facing California is either a “mass extinction event of small businesses” or “financial collapse.” Sounds about right.

* * *

“This postponement of rents will cause … landlord’s financials to crumble and lead to lenders putting out cash calls to lower loan balance and foreclose when landlords cannot pay, and cripple landlords’ abilities to keep their properties open and maintained,” the letter read. CBPA also argued it is unconstitutional for a state to pass a law impairing the obligation to contracts, and warned it would “allow one party to unilaterally abrogate real estate leasing contracts.”

CBPA is the designated legislative advocate in California for the International Council of Shopping Centers, the California Chapters of the Commercial Real Estate Development Association, the Building Owners and Managers Association of California, the National Association of Real Estate Investment Trusts, AIR Commercial Real Estate Association, and others. Those groups also warned members and clients about the bill, and voiced opposition during the hearing on Friday.

Thompson added that the bill risks crushing foundational landlord-tenant relationships throughout the state. Worse, if it passes in California and is adopted in other states across the country, the very foundations of modern finance would be shaken resulting in catastrophic consequences.

“Everything we do, especially in real estate, runs on relationships,” he said. “I think that when you tip the balance so far in favor of the tenant the way that [SB 939] does, it certainly strikes at the heart of the idea that we are in this together. … This does not make it feel like landlords and tenants are in this together anymore.”

The law firm Buchalter, which has offices in L.A., Orange County, San Francisco and around the West Coast, warned clients that the bill sets a “terrible precedent” that will “upend all your leases.”

“The rights afforded under SB 939 would effectively rewrite every commercial lease in California”other than publicly traded companies, the firm said. It “negates all current commercial leases to the benefit of one business over another.”

Instead, Buchalter said the state should provide assistance to tenants impacted by the stay-at-home orders, and pointed to the “more reasonable” renter relief proposals introduced by Senate Pro Tem Toni Atkins

Wiener said they are sensitive to the needs of property owners in terms of their loan obligations.

“It’s a complicated issue. We don’t want these property owners to default on their loans,” he said. “But we also need to be clear: these landlords aren’t going to be able to collect the pre-COVID rents from these restaurants, bars and cafes. That is not the reality. The choice is not between full rent and reduced rent. The choice is between reduced rent and no rent.”

He argued current leases negotiated before the pandemic reflect a “different financial reality.”

“Restaurants, bars, and cafes are expected, frankly, to just suck it up, and magically come up with the high rent that was obtained in pre-COVID circumstances,” he said. “This provision is not for leases to be terminated. It is to provide space and incentive to actually get the renegotiation done. … We know that overwhelmingly, these businesses don’t want to close down. This is their life’s work, they want to find a way to survive.”

Wiener said many commercial landlords are already working with renters, waiving back rents, and restructuring leases.

“It’s not in anyone’s interest where the landlord gets no revenue,” he said. “Sadly, on the other hand, all too many commercial landlords are refusing to renegotiate; are insisting that the pre-COVID, unrealistic rent be paid; are invoking lease-rent escalators; are imposing late fees on backrent. That is happening all over the state.”

During a press conference Thursday, Roberta Economidis, a partner with GE Law Group hospitality law practice, said that in order to survive, “hospitality-related businesses need long-term rent relief, not simply a deferral of high rents now that will become an insurmountable debt later.”

Governor Gavin Newsom already gave local governments authority to halt commercial evictions, and some cities like San Francisco and Los Angeles quickly did so. But SB 939 would cover all California businesses and nonprofits from eviction, whether their local jurisdictions have acted to do so or not.

SB 939 will be heard in the Senate Appropriations Committee this month; if passed it will trigger the next wave of devastation in the commercial real estate space.

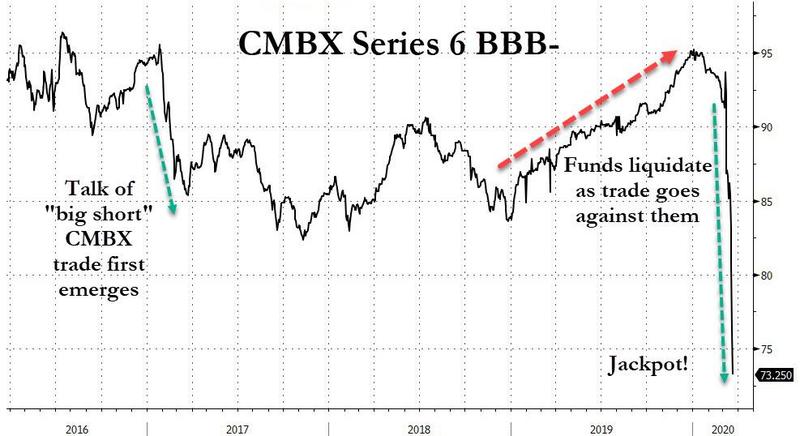

(ZeroHedge) Back in March 2017, a bearish trade emerged which quickly gained popularity on Wall Street, and promptly received the moniker “The Next Big Short.”

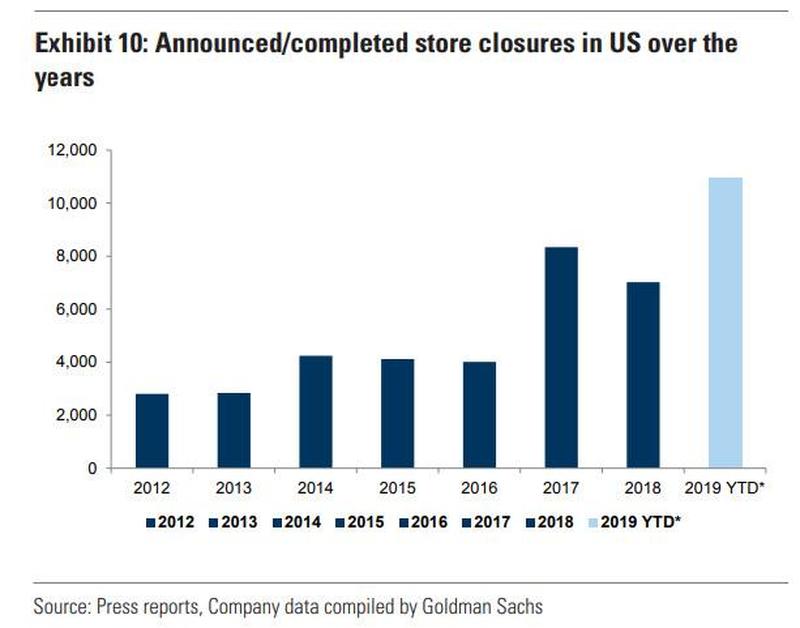

As we reported at the time, similar to the run-up to the housing debacle, a small number of bearish funds were positioning to profit from a “retail apocalypse” that could spur a wave of defaults. Their target: securities backed not by subprime mortgages, but by loans taken out by beleaguered mall and shopping center operators which had fallen victim to the Amazon juggernaut. And as bad news piled up for anchor chains like Macy’s and J.C. Penney, bearish bets against commercial mortgage-backed securities kept rising.

The trade was simple: shorting malls by going long default risk via CMBX 6 (BBB- or BB) or otherwise shorting the CMBS complex. For those who have not read our previous reports (here, here, here, here, here, here and here) on the second Big Short, here is a brief rundown via the Journal:

each side of the trade is speculating on the direction of an index, called CMBX 6, which tracks the value of 25 commercial-mortgage-backed securities, or CMBS. The index has grabbed investor attention because it has significant exposure to loans made in 2012 to malls that lately have been running into difficulties. Bulls profit when the index rises and shorts make money when it falls.

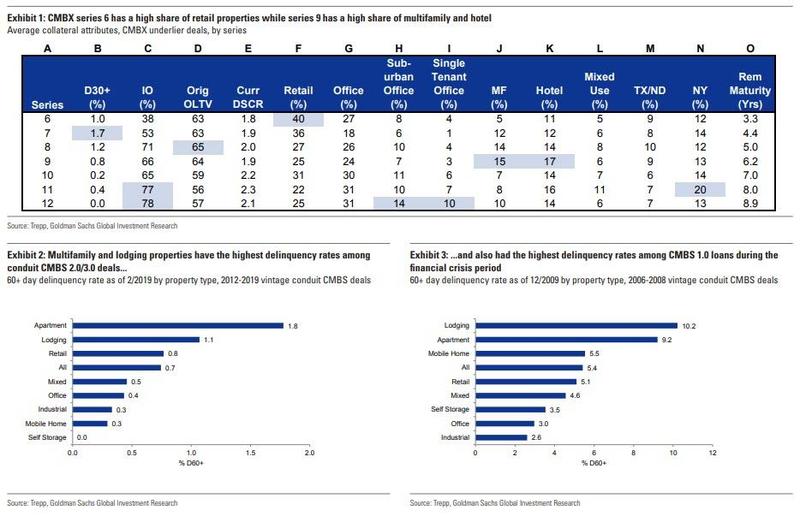

The various CMBX series are shown in the chart below, with the notorious CMBX 6 most notable for its substantial, 40% exposure to retail properties.

One of the firms that had put on the “Big Short 2” trade back in late 2016 was hedge fund Alder Hill Management – an outfit started by protégés of hedge-fund billionaire David Tepper – which ramped up wagers against the mall bonds. Alder Hill joined other traders which in early 2017 bought a net $985 million contracts that targeted the two riskiest types of CMBS.

“These malls are dying, and we see very limited prospect of a turnaround in performance,” said a January 2017 report from Alder Hill, which began shorting the securities. “We expect 2017 to be a tipping point.”

Alas, Alder Hill was wrong, because while the deluge of retail bankruptcies…

… and mall vacancies accelerated since then, hitting an all time high in 2019…

… not only was 2017 not a tipping point, but the trade failed to generate the kinds of desired mass defaults that the shorters were betting on, while the negative carry associated with the short hurt many of those who were hoping for quick riches.

One of them was investing legend Carl Icahn who as we reported last November, emerged as one of the big fans of the “Big Short 2“, although as even he found out, CMBX was a very painful short as it was not reflecting fundamentals, but merely the overall euphoria sweeping the market and record Fed bubble (very much like most other shorts in the past decade). The resulting loss, as we reported last November, was “tens if not hundreds of millions in losses so far” for the storied corporate raider.

That said, while Carl Icahn was far from shutting down his family office because one particular trade has gone against him, this trade put him on a collision course with two of the largest money managers, including Putnam Investments and AllianceBernstein, which for the past few years had a bullish view on malls and had taken the other side of the Big Short/CMBX trade, the WSJ reports. This face-off, in the words of Dan McNamara a principal at the NY-based MP Securitized Credit Partners, was “the biggest battle in the mortgage bond market today” adding that the showdown is the talk of this corner of the bond market, where more than $10 billion of potential profits are at stake on an obscure index.

However, as they say, good things come to those who wait, and are willing to shoulder big losses as they wait for a massive payoffs, and for the likes of Carl Icahn, McNamara and others who were short the CMBX, payday arrived in mid-March, just as the market collapsed, hammering the CMBX Series BBB-.

And while the broader market has rebounded since then by a whopping 30%, the trade also known as the “Big Short 2” has continued to collapse and today CMBX 6 hit a new lifetime low of just $62.83, down $10 since our last update on this storied trade several weeks ago.

That, in the parlance of our times, is what traders call a “jackpot.”

Why the continued selling? Because it is no longer just retail outlets and malls: as a result of the Covid lock down, and America’s transition to “Work From Home” and “stay away from all crowded places”, the entire commercial real estate sector is on the verge of collapse, as we reported last week in “A Quarter Of All Outstanding CMBS Debt Is On Verge Of Default“

Sure enough, according to a Bloomberg update, a record 167 CMBS 2.0 loans turned newly delinquent in May even though only 25% of loans have reported remits so far, Morgan Stanley analysts said in a research note Wednesday, triple the April total when 68 loans became delinquent. This suggests delinquencies may rise to 5% in May, and those that are late but still within grace period track at 10% for the second month.

Looking at the carnage in the latest remittance data, and explaining the sharp leg lower in the “Big Short 2” index, Morgan Stanley said that several troubled malls that are a part of CMBX 6 are among the loans that were newly delinquent or transferred to special servicers. Among these:

Of course, the record crash in the CMBX 6 BBB has meant that all those shorts who for years suffered the slings and stones of outrageous margin calls but held on to this “big short”, have not only gotten very rich, but are now getting even richer – this is one case where everyone will admit that Carl Icahn adding another zero to his net worth was fully deserved as he did it using his brain and not some crony central bank pumping the rich with newly printed money – it has also means the pain is just starting for all those “superstar” funds on the other side of the trade who were long CMBX over the past few years, collecting pennies and clipping coupons in front of a P&L mauling steamroller.

One of them is mutual fund giant AllianceBernstein, which has suffered massive paper losses on the trade, amid soaring fears that the coronavirus pandemic is the straw on the camel’s back that will finally cripple US shopping malls whose debt is now expected to default en masse, something which the latest remittance data is confirming with every passing week!

According to the FT, more than two dozen funds managed by AllianceBernstein have sold over $4 billion worth of CMBX protection to the likes of Icahn. One among them is AllianceBernstein’s $29 billion American Income Portfolio, which crashed after written $1.9bn of protection on CMBX 6, while some of the group’s smaller funds have even higher concentrations.

The trade reflected AB’s conviction that American malls are “evolving, not dying,” as the firm put it last October, in a paper entitled “The Real Story Behind the CMBX. 6: Debunking the Next ‘Big Short’” (reader can get some cheap laughs courtesy of Brian Philips, AB’s CRE Credit Research Director, at this link).

Hillariously, that paper quietly “disappeared” from AllianceBernstein’s website, but magically reappeared in late March, shortly after the Financial Times asked about it.

“We definitely still like this,” said Gershon Distenfeld, AllianceBernstein’s co-head of fixed income. “You can expect this will be on the potential list of things we might buy [more of].”

Sure, quadruple down, why not: it appears that there are still greater fools who haven’t redeemed their money.

In addition to AllianceBernstein, another listed property fund, run by Canadian asset management group Brookfield, that is exposed to the wrong side of the CMBX trade recently moved to reassure investors about its financial health. “We continue to enjoy the sponsorship of Brookfield Asset Management,” the group said in a statement, adding that its parent company was “in excellent financial condition should we ever require assistance.”

Alas, if the plunge in CMBX continues, that won’t be the case for long.

Meanwhile, as stunned funds try to make sense of epic portfolio losses, the denials got even louder: execs at AllianceBernstein told FT the paper losses on their CMBX 6 positions reflected outflows of capital from high-yielding assets that investors see as risky. They added that the trade outperformed last year. Well yes, it outperformed last year… but maybe check where it is trading now.

Even if some borrowers ultimately default, CDS owners are not likely to be owed any cash for several years, said Brian Phillips, a senior vice-president at AllianceBernstein.

He believes any liabilities under the insurance will ultimately be smaller than the annual coupon payment the funds receive. “We’re going to continue to get a coupon from Carl Icahn or whoever — I don’t know who’s on the other side,” Phillips added. “And they’re going to keep [paying] that coupon in for many years.”

What can one say here but lol: Brian, buddy, no idea what alternative universe you are living in, but in the world called reality, it’s a second great depression for commercial real estate which due to the coronavirus is facing an outright apocalypse, and not only are malls going to be swept in mass defaults soon, but your fund will likely implode even sooner between unprecedented capital losses and massive redemptions… but you keep “clipping those coupons” we’ll see how far that takes you. As for Uncle Carl who absolutely crushed you – and judging by the ongoing collapse in commercial real estate is crushing you with every passing day – since you will be begging him for a job soon, it’s probably a good idea to go easy on the mocking.

Afterthought: with CMBX 6 now done, keep a close eye on CMBX 9. With its outlier exposure to hotels which have quickly emerged as the most impacted sector from the pandemic, this may well be the next big short.

First it was on-line shopping spearheaded by Amazon that helped crush physical retail space. Then the knock-out punch was the government shutdown of the the US economy.

(Bloomberg) — Emptied out malls and hotels across the U.S. have triggered an unprecedented surge in requests for payment relief on commercial mortgage-backed securities (CMBS), an early sign of a pandemic-induced real estate crisis.

Borrowers with mortgages representing almost $150 billion in CMBS, accounting for 26% of the outstanding debt, have asked about suspending payments in recent weeks, according to Fitch Ratings. Following the last financial crisis, delinquencies and foreclosures on the debt peaked at 9% in July 2011.

Special servicers — firms assigned to handle vulnerable CMBS loans — are bracing for the worst crash of their careers. They’re staffing up following years of downsizing to handle a wave of defaults, modification requests and other workouts, including potential foreclosures.

“Everything is happening at once,” said James Shevlin, president of CWCapital, a unit of private equity firm Fortress Investment Group and one of the largest special servicers. “It’s kind of exciting times. I mean, this is what you live for.”

A surge in residential foreclosures helped ignite the last financial crisis. Now, commercial real estate is getting hit because the economic shutdown has shuttered stores and put travel on ice.

Not all of the borrowers who have requested forbearance will be delinquent or enter foreclosure, but Fitch estimates that the $584 billion industry could near the 2011 peak as soon as the third quarter of this year.

There’s no government relief plan for commercial real estate. Bankers usually have leeway to negotiate payment plans on commercial property, but options for borrowers and lenders are limited for CMBS.

Debt transferred to special servicers from master servicers, mostly banks that handle routine payment collections, is already swelling. Unpaid principal in workouts jumped to $22 billion in April, up 56% from a month earlier, according to the data firm Trepp.

Special servicers make money by charging fees based on the unpaid principal on the loans they manage. Most are units of larger finance companies. Midland Financial, named as special servicer on approximately $200 billion of CMBS debt, is a unit of PNC Financial Services Group Inc., a Pittsburgh-based bank.

Rialto Capital, owned by private equity firm Stone Point Capital, was a named special servicer on about $100 billionof CMBS loans. LNR Partners, which finished 2019 with the largest active special-servicer portfolio, is owned by Starwood Property Trust, a real estate firm founded by Barry Sternlicht.

Sternlicht said during a conference call on Monday that special servicers don’t “get paid a ton money” for granting forbearance.

“Where the servicer begins to make a lot of money is when the loans default,” he said. “They have to work them out and they ultimately have to resolve the loan and sell it or take back the asset.”

Like debt collectors in any industry, special servicers often play hardball, demanding personal guarantees, coverage of legal costs and complete repayment of deferred installments, according to Ann Hambly, chief executive officer of 1st Service Solutions, which works for about 250 borrowers who’ve sought debt relief in the current crisis.

“They’re at the mercy of this handful of special servicers that are run by hedge funds and, arguably, have an ulterior motive,” said Hambly, who started working for loan servicers in 1985 before switching sides to represent borrowers.

But fears about self-dealing are exaggerated, according to Fitch’s Adam Fox, whose research after the 2008 crisis concluded most special servicers abide by their obligations to protect the interests of bondholders.

“There were some concerns that servicers were pillaging the trust and picking up assets on the cheap,” he said. “We just didn’t find it.”

Hotels, which have closed across the U.S. as travelers stay home, have been the fastest to run into trouble during the pandemic. More than 20% of CMBS lodging loans were as much as 30 days late in April, up from 1.5% in March, according to CRE Finance Council, an industry trade group. Retail debt has also seen a surge of late payments in the last 30 days.

Special servicers are trying to mobilize after years of downsizing. The seven largest firms employed 385 people at the end of 2019, less than half their headcount at the peak of the last crisis, according to Fitch.

Miami-based LNR, where headcount ended last year down 40% from its 2013 level, is calling back veterans from other duties at Starwood and looking at resumes.

CWCapital, which reduced staff by almost 75% from its 2011 peak, is drafting Fortress workers from other duties and recruiting new talent, while relying on technology upgrades to help manage the incoming wave more efficiently.

“It’s going to be a very different crisis,” said Shevlin, who has been in the industry for more than 20 years.

Ya think?

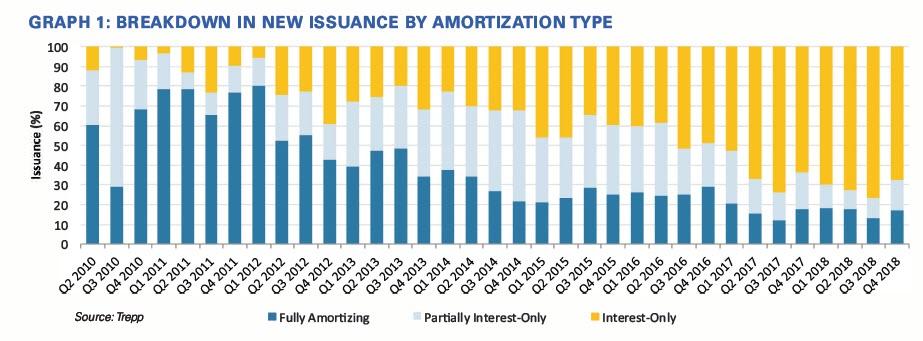

A larger volume of CMBS loans are being issued with interest-only (IO) structures, but this rise may put the CMBS market in a dicey position when the economy reaches its next downturn. To put things in perspective, interest-only loan issuance reached $19.5 billion in Q3 2018, six times greater than fully amortizing loan issuance. In comparison, nearly 80% of all CMBS issued in the FY 2006 and FY 2007 was either interest-only or partially interest-only loans.

In theory, the popularity of interest-only loans makes sense, because they provide lower debt service payments and free up cash flow for borrowers. But these benefits are partially offset by some additional risks in the interest-only structure, with the borrower’s inability to deleverage during the loan’s life perhaps being the biggest concern. Additionally, borrowers who opt for a partial interest-only structure incur a built-in “payment shock” when the payments switch from interest-only to principal and interest.

Why are we seeing a spike in interest-only issuance if the loans are inherently riskier than fully amortizing loans? Commercial real estate values are at all-time highs; interest rates are still historically low; expectations for future economic and rent growth are fundamentally sound, and competition for loans on stabilized, income-producing properties is higher than ever. Furthermore, the refinancing pipeline is miniscule compared to the 2015-2017Wall of Maturities, so more capital is chasing fewer deals. This causes lenders to augment loan proceeds and loosen underwriting parameters, including offering more interest-only deals.

Then and Now: Why the Rise in 10 Debt Has Raised Concerns

Between Q1 2010 and Q1 2012, fully amortizing loans dominated new issuance, with its market share amassing as much as 80.4% (Q1 2012). Interest-only issuance was nearly equal to the fully amortizing tally by Q3 2012, as interest-only debt totaled $5.10 billion, only $510 million less than fully amortized loans. Interest-only issuance would soon overtake fully amortizing loan issuance by Q2 2017, as its volume skyrocketed from $5.3 billion in Q1 2017 to $19.5 billion in Q3 2018.

Prior to the 2008 recession, the CMBS market experienced a similar upward trend in interest-only issuance. By 02 2006, interest-only loans represented 57.6% of new issuance, outpacing fully amortizing notes by 38.86%. The difference in issuance between interest-only and fully amortizing loans continued to widen as the market approached the recession, eventually reaching a point where interest-only debt represented 78.8% of new issuance in 01 2007. Even though the prevalence of interest-only debt is mounting, why would this be a concern in today’s market?

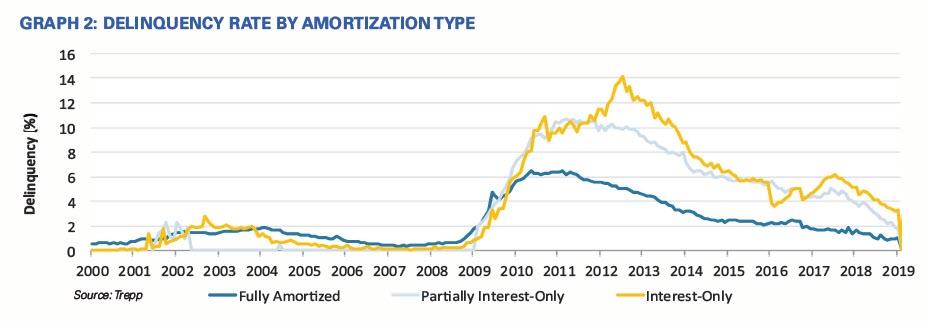

IO Loans Are More Likely to Become Delinquent

Interest-only loans have historically been more susceptible to delinquency when the economy falters. Immediately following the recession, delinquency rates across all CMBS loans moved upward. Once the economy began to show signs of recovery, the delinquency rate for fully amortized loans began to decline, while interest-only and partially interest-only delinquencies continued to rise. In July 2012, the delinquency rate for fully amortizing loans was sitting at 5.07% while the interest-only reading reached 14.15%. The outsized delinquency rate for interest-only loans during this time period is not surprising, since many of the five-year and seven-year loans originated in the years prior to the recession were maturing. Many of the borrowers were unable to meet their payments due to significant declines in property prices paired with loan balances that had never amortized.

Over time, the stabilization of the CMBS market led to subsequent declines in the delinquency rates for both the interest-only and partial interest-only sectors. The delinquency rate for interest-only loans clocked in at 3.17% in December 2018, which is down nearly 11 % from its peak. Delinquency rates across all amortization types have failed to return to pre-crisis levels.

Just because a large chunk of interest-only debt became delinquent during the previous recession does not mean the same is destined to happen in the next downturn.

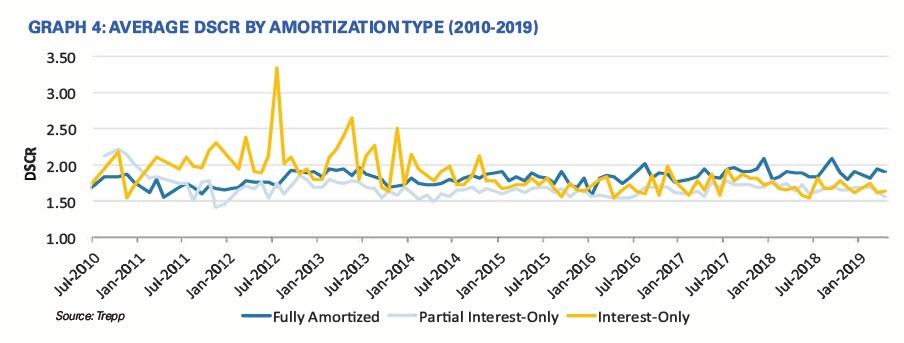

Measuring the likelihood of a loan turning delinquent is typically done by calculating its debt-service coverage ratio (DSCR). Between 2010 and 2015, the average DSCR across all interest-only loans was a relatively high 1.94x. Since 2016, the average DSCR for interest-only debt has fallen slightly. If the average DSCR for interest-only loans continues to decline, the inherent risk those loans pose to the CMBS market will become more concerning.

The average DSCR for newly issued interest-only loans in March 2019 registered at 1.61 x, which is about 0.35x higher than the minimum DSCR recommended by the Commercial Real Estate Finance Council (CREFC). In 2015, CREFC released a study analyzing the impact of prudential and securities regulation across the CRE finance sector. In the study, CREFC cited a 1.25x-DSCR as the cutoff point between relatively healthy and unhealthy loans. The value was chosen through loan-level analysis and anecdotal information from conversations with members.

The figure below maps the DSCR for both fully amortizing and interest-only loans issued between 2004 and 2008. Notice that toward the end of 2006, the average DSCR hugged the 1.25x cutoff level recommended by CREFC. Beyond 2006, the average DSCR for interest-only loans oscillated between healthy and concerning levels.

The second figure focuses on CMBS 2.0 loans, where a similar trend can be spotted. After roughly converting interes-tonly loan DSCRs to amortizing DSCRs using underwritten NOI levels and assuming 30-year amortization, the average DSCR for interest-only loans issued between 2010 and mid- 2014 (2.04x) is much greater than that for fully amortizing issuance (1.78x). While part of this trend can be attributed to looser underwriting standards and/or growing competition, the other driver of the trend is due to selection bias. Lenders will typically give interest-only loans to stronger properties and require amortization from weaker properties, so it makes sense that they would also require less P&I coverage for those interest-only loans on lower-risk properties.

What Lies Ahead for the IO Sector?

Rising interest-only loan issuance paired with a drop in average DSCR may spell for a messy future for the CMBS industry if the US economy encounters another recession. At this point, CMBS market participants can breath a little easier since interest-only performance has remained above the market standard. However, this trend is worth monitoring as the larger volume could portend a loosening in underwriting standards.

Beijing is reportedly urging Chinese real-estate investors to divest their U.S. commercial real estate holdings, a cunning strategy reflecting China’s efforts to deleverage debt and stabilize the yuan ahead of future market shocks created by President Trump’s trade war.

Taiwan News quoted Liberty Times, a newspaper published in Taiwan, suggested that a significant liquidation of U.S. commercial real estate by Chinese companies could be in the near term, as the catalyst for such an event would be explained by policymakers cracking down on bad debt.

According to the Wall Street Journal, Real Capital Analytics has noted that Chinese real-estate investors have already started dumping U.S. commercial real estate for the first time in a decade. Chinese companies have sold more real estate assets in a single quarter (US$1.29 billion) than they have purchased (US$126.2 million).

“This marked the first time that these investors were net sellers for a quarter since 2008. The more than $1 billion in net sales reflects how much the Chinese government’s attitude toward investing overseas has changed in recent months,” said WSJ.

Chinese investors began acquiring US commercial real estate a few years after the 2008 financial crisis. More recently, Beijing officials loosened restrictions on foreign investment, which spurred investments in numerous US cities like Los Angeles, San Francisco, and Chicago with high-profile acquisitions—including the $1.95 billion acquisition of the Waldorf Astoria, the highest price ever paid for a U.S. hotel.

The Waldorf Astoria hotel in New York, which was purchased by China’s Anbang Insurance Group in 2014. (Source: Kathy Willens/AP/WSJ)

The Waldorf Astoria hotel in New York, which was purchased by China’s Anbang Insurance Group in 2014. (Source: Kathy Willens/AP/WSJ)

Chinese companies like HNA Group and Greenland Holding Group have been offloading assets and potentially could create headwinds for real estate markets. The Wall Street Journal suggests that Beijing is currently pressuring companies to decrease their debt levels to lower the default risk ahead of the next credit crunch.

“I was shocked,” said Jim Costello, senior vice president at Real Capital Analytics. “They [Chinese real estate firms] really curtailed their buying and stepped up sales.”

Analysts told WSJ that increasing tensions over trade and national security between Washington and Beijing could have triggered the pullback.

“The China-US outbound cross-border real estate climate has been negatively impacted by the geopolitical climate,” said David Blumenfeld, a Hong Kong-based partner at Paul Hastings LLP.

WSJ notes that Anbang Insurance Group is considering shrinking its U.S. hotels book, but has yet to settle on any deals.

“The company is still in the process of reviewing overseas assets,” said Shen Gang, an Anbang spokesman. “We currently do not have specific asset optimization plan, nor a specific timetable.”

In June, the Green Street Commercial Property Price Index was unchanged. The index, which measures values across five major property sectors, has stalled over the past eighteen months and could come under pressure as Chinese investors have turned to net sellers.

For many Chinese firms, the long-term investment plan in the US has been abandoned after Beijing has pressured companies to reduce their debt levels amid the escalating geopolitical tensions and trade war.

However, not every Chinese investor is pressured to liquidated US real estate holdings. Lawyers for these developers told WSJ that investors of smaller residential projects, including warehouses and senior living centers, are holding tight.

Chinese investors said the government has allowed firms to dispose of properties that have increased in value to avoid taking a loss.

Earlier this year, HNA group and a partner sold 1180 Sixth Avenue in Manhattan to Northwood Investors for around $305 million. The conglomerate, which is headquarters in Haikou, a city in southern China’s Hainan province, bought a 90 percent stake in the office tower for $259 million in 2011.

HNA Group also sold a stake in 245 Park Avenue to SL Green Realty Corp. HNA bought the tower for $2.2 billion last year.

“HNA Group has long said it will be disciplined and thoughtful about its asset dispositions as it realigns its strategy,” said an HNA spokesman. Late last year, HNA Group outlined a plan to sell $6 billion worth of properties, according to an insider.

Last month, Taiwan News said a document intended for financial think tanks in China was leaked to the press that said China was “very likely to see financial panic” and the government should prepare financial institutions, industries, and also be ready for possible social unrest. Critics suggest that China’s financial difficulties have been in development for some time, however, the U.S.-China trade war exacerbated the problem and had brought the coming credit crisis forward.

Could the US commercial real estate market be the next indirect victim of President Trump’s trade war?

As we anticipated earlier this year, the first the signs of the coming implosion of the US real-estate bubble are emerging in the high end of the nation’s most overcrowded and expensive housing markets (Manhattan and San Francisco are two salient examples).

And in the latest confirmation of this trend, the Wall Street Journal published a report this week highlighting how the business environment for commercial landlords in New York City’s most densely populated borough is growing increasingly dire, as landlords who had left storefronts vacant in the hope of courting the next Bank of America or CVS have inadvertently turned trendy downtown Manhattan neighborhoods like SoHo into a “shopping wasteland”.

Thanks in large part to their intransigence, commercial landlords who catered to retail tenants are being hit twice as hard as they otherwise would’ve been, as tenants, no longer able to afford rents higher than $600 per square foot, are now demanding concessions and rent reductions, a phenomenon that has seen average rents in certain neighborhoods plummet on a year-over-year basis.

According to CBRE Group, a real estate services firm that pays close attention to commercial rents in Manhattan, some of the hardest-hit neighborhoods are also some of the borough’s most trendy, including the Meatpacking District, and SoHo.

Here’s an excerpt from the WSJ story, entitled “Retail Rents Plunge in Major Manhattan Shopping Districts”.

The average asking rent on Washington Street between 14th and Gansevoort streets in the Meatpacking District dropped to $490 a square foot from last year’s $623, a 21.3% decrease and the largest percentage drop in asking rents among the shopping corridors CBRE tracks.

Average asking rents tumbled 18.1% on both SoHo’s Broadway Avenue and the Upper East Side’s Third Avenue, where asking rents were $556 and $280 a square foot, respectively.

Availability remained flat compared with last year, with 209 ground-floor spaces marketed for direct leasing. The report noted, however, that landlords looking to directly lease space also will have to compete with sublease space, which has increased according to anecdotal reports. Some space available for sublease comes as retailers leave behind old quarters for better locations, Ms. LaRusso said.

Conditions are favorable for tenants, said Andrew Goldberg, vice chairman at CBRE. Landlords are more open to shorter-term leases and provisions allowing tenants to get out of leases if a retail concept doesn’t work.

“I think we will start to see some more of the savvier tenants of companies realize we’re starting to get to a point where they can drive some good deals for themselves,” Mr. Goldberg said.

The problem when rents enter free-fall territory is that it’s a self-reinforcing phenomenon (not unlike the blowup that triggered the demise of the XIV, but over a much longer period of time). As rents fall, retailers start wondering if they can procure a better deal, possibly in a better neighborhood. All of a sudden, landlords must now essentially compete with themselves as the number of subleases climbs.

Of course, Manhattan is Manhattan. There will always be hoards of boutique merchants, big-name brands and – well, Walgreens – clamoring for commercial rental space.

But after nearly a decade of soaring real-estate valuations, it appears one of America’s hottest housing markets is heading for a “gully.”

On the other end of the property market, a drop in valuations and transaction volumes has inspired some observers to proclaim that “this is the breaking point.”

In short, we wish the Kushner Cos the best of luck as they prepare to buy out the remaining stake in 666 Fifth Ave. Because overpaying for commercial real-estate in Manhattan in 2018, nine years into one of the longest economic expansions on record sounds like a fantastic plan.

Still no sign of a rebound:

Home prices rising about 6% annually and loans now growing at under 4% annually looks in line with at best flat housing sales:

Looks like the blip up as hurricane destroyed vehicles were replaced has run its course:

This had looked like it peaked a couple of years ago, but since went back up to new highs:

By Warren Mosler | Investment Watch Blog

So what do you do when the bubbly market for your exorbitantly priced New York City commercial real estate collapses by over 50% in two years? Well, you lever up, of course.

As Bloomberg notes this morning, the ‘smart money’ at U.S. banking institutions are tripping over themselves to throw money at commercial real estate projects all while ‘dumb money’ buyers have completely dried up.

A growing chasm between what buyers are willing to pay and what sellers think their properties are worth has put the brakes on deals. In New York City, the largest U.S. market for offices, apartments and other commercial buildings, transactions in the first half of the year tumbled about 50 percent from the same period in 2016, to $15.4 billion, the slowest start since 2012, according to research firm Real Capital Analytics Inc.

At the same time, the market for debt on commercial properties is booming. Investors of all stripes — from banks and insurance companies to hedge funds and private equity firms — are plowing into real estate loans as an alternative to lower-yielding bonds. That’s giving building owners another option to cash in if their plans to sell don’t work out.

“Sellers have a number in mind, and the market is not there right now,” said Aaron Appel, a managing director at brokerage Jones Lang LaSalle Inc. who arranges commercial real estate debt. “Owners are pulling out capital” by refinancing loans instead of finding buyers, he said.

But don’t concern yourself with talk of bubbles because Scott Rechler of RXR would like for you to rest assured that the lack of buyers is not at all concerning…they’ve just “hit the pause button” while they wander out in search of the ever elusive “price discovery.”

At 237 Park Ave., Walton Street Capital hired a broker in March to sell its stake in the midtown Manhattan tower, acquired in a partnership with RXR Realty for $810 million in 2013. After several months of marketing, the Chicago-based firm opted instead for $850 million in loans that value the 21-story building at more than $1.3 billion, according to financing documents. The owners kept about $23.4 million.

“The basic trend is you have a really strong debt market and a sales market that has hit the pause button while it seeks to find price discovery,” said Scott Rechler, chief executive officer of RXR.

The debt market has become so appealing that landlords are looking at mortgage options while simultaneously putting out feelers for buyers, said Rechler, whose company owns $15 billion of real estate throughout New York, New Jersey and Connecticut. That’s a departure for Manhattan’s property owners, who in prior years would pursue one track at a time, he said.

Of course, this isn’t just a NYC phenomenon as sales of office towers, apartment buildings, hotels and shopping centers across the U.S. have been plunging since reaching $262 billion nationally in 2015, just behind the record $311 billion of real estate that changed hands in 2007, according to Real Capital. Property investors are on the sidelines amid concern that rising interest rates will hurt values that have jumped as much as 85 percent in big cities like New York, compounded by overbuilding and a pullback of the foreign capital that helped power the recent property boom.

The tough sales market has put some property owners in a bind — most notably Kushner Cos., which has struggled to find partners for 666 Fifth Ave., the Midtown tower it bought for a record price in 2007. The mortgage on the building will need to be refinanced in 18 months.

Thankfully, at least someone interviewed by Bloomberg seemed to be grounded in reality with Jeff Nicholson of CreditFi saying that it just might be a “red flag” that buyers have completely abandoned the commercial real estate market at the same time that owners are massively levering up to take cash out of projects.

Some lenders view seeking a loan to take money off the table as a red flag, according to Jeff Nicholson, a senior analyst at CrediFi, a firm that collects and analyzes data on real estate loans. It may signal the borrower is less committed to the project, and makes it easier to walk away from the mortgage if something goes wrong, he said.

But, it’s probably nothing …

Even the Fed put commercial real estate on its financial-stability worry list.

No, the crane counters were not wrong. In 2017, the ongoing apartment building-boom in the US will set a new record: 346,000 new rental apartments in buildings with 50+ units are expected to hit the market.

How superlative is this? Deliveries in 2017 will be 21% above the prior record set in 2016, based on data going back to 1997, by Yardi Matrix, via Rent Café. And even 2015 had set a record. Between 1997 and 2006, so pre-Financial-Crisis, annual completions averaged 212,740 units; 2017 will be 63% higher!

These numbers do not include condos, though many condos are purchased by investors and show up on the rental market. And they do not include apartments in buildings with fewer than 50 units. This chart shows just how phenomenal the building boom of large apartment developments has been over the past few years:

The largest metros are experiencing the largest additions to the rental stock. The chart below shows the number of rental apartments to be delivered in those metros in 2017. But caution in over-interpreting the chart – the population sizes of the metros differ enormously.

The New York City metro includes Northern New Jersey, Central New Jersey, and White Plains and is by far the largest metro in the US. So the nearly 27,000 apartments it is adding this year cannot be compared to the 5,400 apartments for San Francisco (near the bottom of the list). The city of San Francisco is small (about 1/10th the size of New York City itself), and is relatively small even when part of the Bay Area is included.

Other metros on this list are vast, such as the Dallas-Fort Worth metro which includes the surrounding cities such as Plano. Driving through the area on I-35 East gives you a feel for just how vast the metro is. However, I walk across San Francisco in less than two hours:

Special note: Chicago is adding 7,800 apartments even though the population has begun to shrink. So this isn’t necessarily going to work out.

This building boom of large apartment buildings is starting to have an impact on rents. In nearly all of the 12 most expensive rental markets, median asking rents have fallen from their peaks, and in several markets by the double digits, including Chicago (-19%!), Honolulu, San Francisco, and New York City.

And it has an impact on the prices of these buildings. Apartments are a big part of commercial real estate. They’re highly leveraged. Government Sponsored Enterprises such as Fanny Mae guarantee commercial mortgages on apartment buildings and package them in Commercial Mortgage-Backed Securities. So taxpayers are on the hook. Banks are on the hook too.

This is big business. And it is now doing something it hasn’t done since the Great Recession. The Commercial Property Price Index (CPPI) by Green Street, which tracks the “prices at which commercial real estate transactions are currently being negotiated and contracted,” plateaued briefly in December through February and then started to decline. By June, it was below where it had been in June 2016 – the first year-over-year decline since the Great Recession:

Some segments in the CPPI were up, notably industrial, which rose 9% year over year, benefiting from the shift to ecommerce, which entails a massive need for warehouses by Amazon [Is Amazon Eating UPS’s Lunch?] and other companies delivering goods to consumers.

But prices of mall properties fell 5%, prices of strip retail fell 4%, and prices of apartment buildings fell 3% year-over-year.

So for renters, there is some relief on the horizon, or already at hand – depending on the market. There’s nothing like an apartment glut to bring down rents. See what the oil glut in the US has done to the price of oil.

Investors in apartment buildings, lenders, and taxpayers (via Fannie Mae et al. that guarantee commercial mortgage-backed securities), however, face a treacherous road. Commercial real estate goes in cycles as the above chart shows. Those cycles are not benign. Plateaus don’t last long. And declines can be just as sharp, or sharper, than the surges, and the surges were breath-taking.

Even the Fed has put commercial real estate on its financial-stability worry list and has been tightening monetary policy in part to tamp down on the multi-year price surge. The Fed is worried about the banks, particularly the smaller banks that are heavily exposed to CRE loans and dropping collateral values.

But the new supply of apartment units hitting the market in 2018 and 2019 will even be larger. In Seattle, for example, there are 67,507 new apartment units in the pipeline.

With about 150 projects starting this year or in the pipeline just in the core of the city, construction is as frenzied as ever.

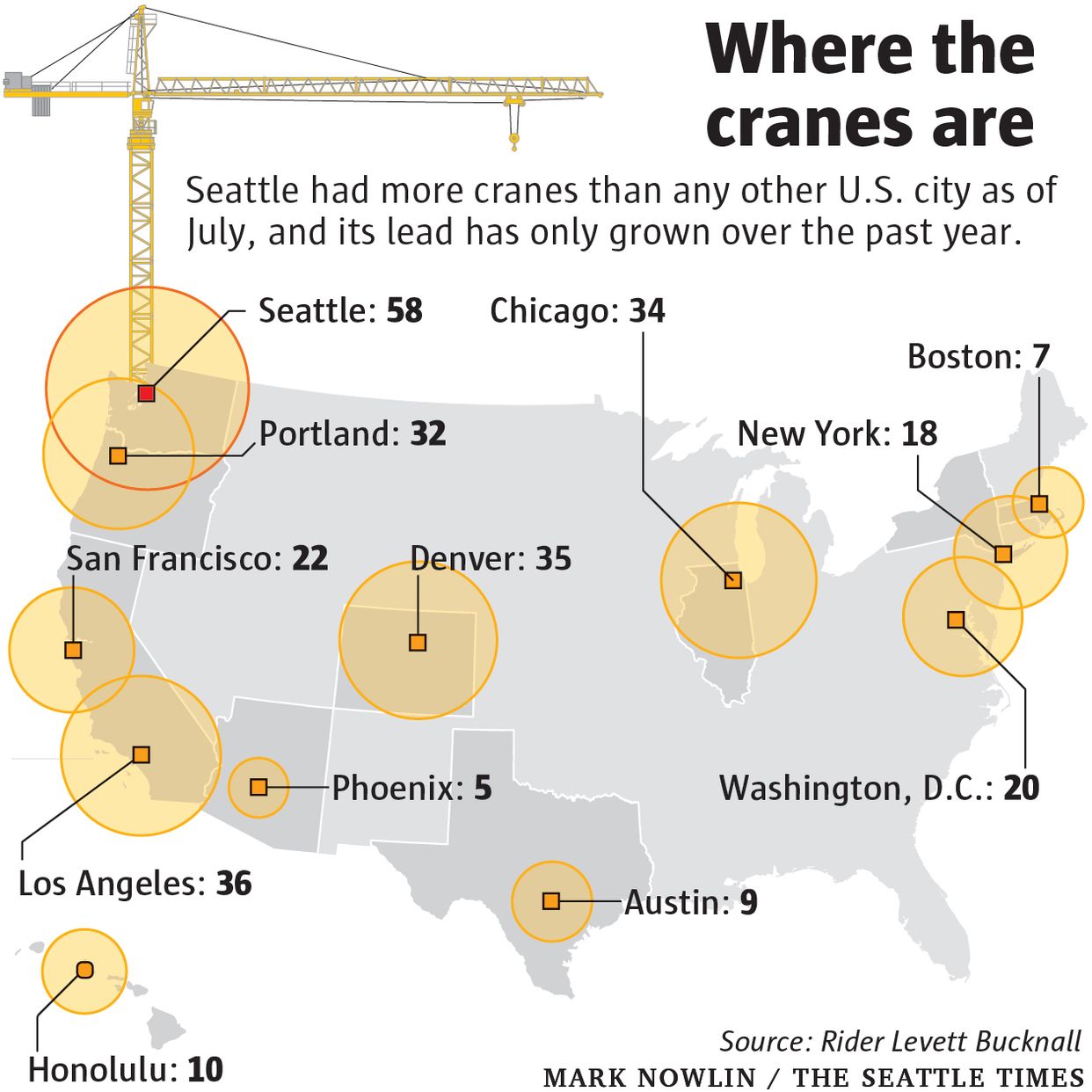

(The Seattle Times) For the second year in a row, Seattle has been named the crane capital of America — and no other city is even close, as the local construction boom transforming the city shows no signs of slowing.

Seattle had 58 construction cranes towering over the skyline at the start of the month, about 60 percent more than any other U.S. city, according to a new semiannual count from Rider Levett Bucknall, a firm that tracks cranes around the world.

Seattle first topped the list a year ago, when it also had 58 cranes, and again in January, when the tally grew to 62.

The designation has come to symbolize — for better or worse — the rapid growth and changing nature of the city, as mid-rises and skyscrapers pop up where parking lots and single-story buildings once stood.

And the title of most cranes might be here to stay, at least for a while. The city’s construction craze is continuing at the same pace as last year, while cranes are coming down elsewhere: Crane counts in major cities nationwide have dropped 8 percent over the past six months.

During the last count, Seattle had just six more cranes than the next-highest city, Chicago. Now it holds a 22-crane lead over second-place Los Angeles, with Denver, Chicago and Portland just behind.

Seattle has more than twice as many cranes as San Francisco or Washington, D.C., and three times as many cranes as New York. Seattle has more cranes than New York, Honolulu, Austin, Boston and Phoenix combined.

At the same time, Seattle’s construction cycle doesn’t look like it’s letting up. Just in the greater downtown region, 50 major projects are scheduled to begin construction this year, according to the Downtown Seattle Association. An additional 99 developments are in the pipeline for future years. And that’s on top of what is already the busiest-period ever for construction in the city’s core.

“We continue to see a lot of construction activity; projects that are finishing up are quickly replaced with new projects starting up,” said Emile Le Roux, who leads Rider Levett Bucknall’s Seattle office. “We are projecting that that’s going to continue for at least another year or two years.”

“It mainly has to do with the tech industry expanding big time here in Seattle,” Le Roux said.

Companies that supply the tower cranes say there’s a shortage of both equipment and manpower, so developers need to book the cranes and their operators several months in advance. It costs up to about $50,000 a month to rent one, and they can rise 600 feet into the air.

Most cranes continue to be clustered in downtown and South Lake Union, but several other neighborhoods have at least one, from Ballard to Interbay and Capitol Hill to Columbia City.

By Mike Rosenberg | The Seattle Times

2015 was a spectacular year for the commercial real estate market, and 2016 was a solid year. 2017, however, is likely to be a bit of wildcard, analysts say.

Despite a recent rise in interest rates and the uncertainty surrounding the new regime in Washington, market watchers are forecasting a good year for the market, with stable prices and lots of properties changing hands.

Still, it also could go the other way.

“If interest rates go up much more than they have, transaction volume might come down some more,” said Jim Costello, senior vice president with Real Capital Analytics (RCA). “If sellers aren’t forced to sell, they could just sit on the property for awhile until things look more favorable to them.”

Deal volume in 2016 dropped significantly compared to 2015 for properties valued over $2.5 million. Through November, the 2016 year-to-date transaction volume stood at $424.2 billion, which was down 10 percent compared to same 11-month period in 2015, RCA reported.

RCA’s numbers for the full-year in 2016 were not yet available, but it would take a huge month in December for 2016’s deal volume to match the 2015 levels. Transaction volume was trending down at the end of the year. In November, asset sales totaled $33.9 billion, which was down 6 percent compared to November 2015, RCA reported.

Sales in 2016 were still strong compared to previous years since the recovery. Year-to-date through November, the overall transaction volume in 2016 was 12 percent and 35 percent above the 2014 and 2015 levels, respectively.

2016 saw fewer large mega-deals involving multiple properties compared with 2015, but single-asset sales volume remained solid. “If anything, 2015 was almost an aberration,” Costello said. He was optimistic that sales volumes this year would run ahead of the 2016 pace. He noted that, outside a few pockets of the country, the commercial real estate market hasn’t generally seen a building boom that could flood the market with new space and weaken demand for pre-existing buildings.

The new year brings uncertainty, however. Costello said the higher interest rates could eventually lower property values, causing a standoff between buyers and sellers in 2017. Higher interest rates tend to lower commercial asset prices by driving up capitalization rates. Cap rates in all classes have been at historic lows, which have propelled the market forward in recent years.

Costello also said the policies of President-elect Donald Trump also are not fully known, but will ultimately have some impact on the market.

On the campaign trail, Trump proposed a huge infrastructure spending plan, which could lead to a significant rise in interest rates. However, Trump’s pro-growth tax policies also could spur more activity in the market, Costello said.

“The initial reaction of the market was that, well, President-elect Trump was talking about all these potentially inflationary policies, so we better be careful,” Costello said. “Will that come through? It remains to be seen. I am not sure that [House Speaker] Paul Ryan is going to be happy spending lots of money in a [New Deal-era] WPA-style jobs program for infrastructure. That was the thing that was thrown out there that was making the market spooked.”

Ken Riggs, president of Situs RERC, said that the market ended 2016 in a stable position, with prices perfectly matching the values. He said the performance of each property is highly dependent on its asset class and location, and varies widely. He doesn’t expect an overall market correction next year, although investors are growing more cautious with each passing year.

“There will be continued high interest for commercial real estate,” Riggs told Scotsman Guide News. “Investors will just have to be very selective, not only about the property types, but also where they invest within the capital stack.”

By Victor Whitman | Scotsman Guide

The overall price of multifamily and commercial properties valued above $2.5 million fell by 0.8 percent in January following a flat month of price growth in December, according to Moody’s/Real Capital Analytics (RCA).

“It is the first monthly decline in the index in six years,” said RCA’s Senior Vice President Jim Costello during a telephone interview. “It is not entirely surprising given that trends were flat in December.”

Analysts have been predicting a slowdown in commercial prices, which had been growing by double digits and reached a new peak this past year.

Over the past 12 months through January, the Moody’s/RCA Commercial Property Price Index has risen by 9.7 percent, but remained essentially flat over the last three months, rising just 0.3 percent.

There has been an even more dramatic slowdown in the nations’ top six commercial real estate (CRE) markets. For the 12 months, CRE prices rose by 13 percent in the major metros, but by just 0.1 percent over the past three months through January. Prices in these markets fell by 0.6 percent in January.

Costello said transaction volume remains high, however.

“In December and January, we had the strongest 60-day period of deal volume ever,” Costello said. “Even though you had this adjustment on the pricing side, people still came to the market and still did deals.”

Costello said that commercial banks and life insurance companies are still making financing available, although some lenders have pulled back. He said the commercial-mortgage backed securities (CMBS) market has been unsettled, however.

“In about September of last year, the spreads on CMBS shot up pretty quickly in response to turbulence in the corporate bond market, and it hasn’t come back down,” Costello said. “Normally, in the past, we have seen some disturbances and the rates come back down. This time, it stayed elevated. Suddenly, the cost of debt for commercial property investments has shifted upwards, and people have had to adjust what they are willing and able to pay for debt, and that is really a big part of the change in prices.”

The pause in the growth of CRE prices is healthy, said Ken Riggs, president of Situs RERC. Riggs said sales will probably also slow down because fewer properties will be available, and buyers are becoming more selective. Riggs also said a price correction could be more severe if interest rates rise significantly, a scenario that he does not believe is likely, however.

“The ability to raise capital is going to be more challenging than it was in the last year,” Riggs said. “It doesn’t mean it is terrible, but refinancing has become more selective as well. So naturally we should see a slowdown in the number of transactions, but for the right properties, you still will see properties come into the marketplace and buyers buying those properties.”

Real estate investing is all about timing, and Sam Zell knows this better than anyone.

He sold his real estate firm, Equity Office, to Blackstone Group for $39 billion near the peak of the market. This was back in February 2007—only months before real estate credit markets started to spiral out of control.

He’s doing it again.

At the end of October, his real estate fund, Equity Residential, agreed to sell more than 23,000 apartment units to Starwood Capital for $5.4 billion. The sale represents over 20 percent of the Equity Residential portfolio.

The fund plans to sell another 4,700 apartment units in the near future. Most of the proceeds will be returned to investors in the form of a dividend sometime next year.

Another real estate fund managed by Zell, Equity Commonwealth, has sold 82 office properties worth $1.7 billion since February. The fund plans to raise another $1.3 billion by selling off more properties over the next few years.

Zell is cashing out of non-core assets after the run up in real estate prices in recent years. Rather than reinvest, much of the cash is being returned to investors. The message he is sending is clear—it’s time to sell.

REITs (real estate investment trusts) have been one of the hottest investment sectors in the aftermath of the 2008 credit crisis.

REIT prices are up 286% from their March 2009 low, compared to 209% for the S&P 500 over that same period. Real estate prices have benefited greatly from the Federal Reserve’s aggressive stimulus packages and zero-interest rate monetary policy.

Real Capital Analytics data showed that commercial property values across the country reached the highest level on record in August—up 14.5% on a nominal basis and surpassing the previous inflation adjusted mark from 2007 by 1.5%.

High prices have led to record low cap rates (cap rates measure a property’s yield by dividing the annual income by the property value). The average cap rate on all property types across the US hit 5.25% in September. This breaks the 5.65% low from 2007, according the Green Street Advisors.

The data dependent Fed has trapped itself in a corner. On the one hand, they can see that property values and stock markets have skyrocketed. On the other hand, real economic growth appears to have stalled.

The Fed has tried to signal an end to its easy money policies all year long. However, poor US economic data and fear of a global slowdown has kept them from taking action.

Still, the potential for higher interest rates has caused REIT investors to take a pause. Higher interest rates make dividend yields from REITs less attractive than the safer alternatives, such as Treasury bonds. It also makes it more costly to finance new acquisitions and real estate developments.

The S&P US REIT Index has under performed the S&P 500 benchmark so far this year. If this holds, it will mark only the second year since 2009 that REITs have under performed the S&P 500 index—the other being 2013, when the Fed began its process of backing out of its aggressive bond-buying program.

Sam Zell is not alone. Over the last twelve months, insiders were net sellers of shares at all but one of the top ten funds on the index.

And the institutional money has started to follow suit as well. Five of the top ten REITs on the index had net outflows from institutional investors as of the most recent quarterly filing.

As Steven Roth, CEO of Vornado Realty Trust, said on an investor call in August, “The easy money has been made in this cycle… this is a time when the smart guys are starting to build cash.” You can choose to ignore the writing on the wall or perhaps it’s time for investors to follow the smart money and move their cash out of real estate.

Source: Business Insider. Read the original article on Thoughts From The Frontline.

Original investment in land and improvements are reported to be over $2 Billion dollars

by Michael Gerrity in World Property Journal

CBRE’s John Knott and Michael Parks announced this week the firm’s listing of the Fontainebleau Las Vegas, a partially completed hotel casino project that represents an original investment in land and improvements of more than $2 billion. At 730 feet, it stands as the tallest hotel tower on the Las Vegas Strip.

Situated on 22.65 acres on the east side of Las Vegas Boulevard south of Sahara Avenue, the project’s structure provides for flexibility relative to its completion and can be reconfigured to meet a new investor’s vision, according to Knott.

“A Las Vegas Boulevard address, coupled with adjacency to the planned expansion of the Convention Center District by the Las Vegas Convention and Visitors Authority (LVCVA), along with the tower’s iconic height, combine to make this one of the most exciting development opportunities in Las Vegas in many years,” said Knott. “The structure has been well-maintained and is ready for immediate development to bring to fruition the vision of its next owner. This is an unparalleled asset with significant potential on one of the most landmark streets in the world. Opportunities like this are few and far between.”

Originally programmed for 3,815 keys comprised of 2,882 hotel rooms and suites, 933 condominiums, 300,000 square feet of retail, 543,000 square feet of meeting space, 155,000 square feet of gaming space and a 3,200-seat theatre, the project is significant in size, function and possibility.

“As the global and local economy rebounds and 2014 visitation to Las Vegas topped a record-setting 41 million tourists, the time is ideal to realize the potential of this incredibly valuable piece of Las Vegas real estate,” said Parks. “Hotel occupancy rates in Las Vegas are over 90 percent with record average daily rates, retail sales are strong and there is an improvement in mass market gaming numbers. The next generation of this development is limited only by the imagination and vision of its new owner.”

The property is located adjacent to the former Riviera Hotel & Casino site that is now owned by the LVCVA and is part of a planned 10-year, $2.5 billion expansion and redevelopment initiative that will add significant convention and meeting space, a World Trade Center and improve the area via aesthetic enhancements and technology upgrades. The goal of the initiative is to ensure Las Vegas remains the world’s number one tradeshow destination for decades to come.

“The Fontainebleau gives a well-heeled investor or group the opportunity to do something meaningful and wonderful that will add to the Las Vegas experience,” said Parks.

When it comes to housing, sometimes it seems we never learn. Just when America appeared to be recovering from the last housing crisis—the trigger, in many ways, for 2008’s grand financial meltdown and the beginning of a three-year recession—another one may be looming on the horizon.

For one, the housing market never truly recovered from the recession. Trulia Chief Economist Jed Kolko points out that, while the third quarter of 2014 saw improvement in a number of housing key barometers, none have returned to normal, pre-recession levels. Existing home sales are now 80 percent of the way back to normal, while home prices are stuck at 75 percent back, remaining undervalued by 3.4 percent. More troubling, new construction is less than halfway (49 percent) back to normal. Kolko also notes that the fundamental building blocks of the economy, including employment levels, income and household formation, have also been slow to improve. “In this recovery, jobs and housing can’t get what they need from each other,” he writes.

Second, Americans continue to overspend on housing. Even as the economy drags itself out of its recession, a spate of reports show that families are having a harder and harder time paying for housing. Part of the problem is that Americans continue to want more space in bigger homes, and not just in the suburbs but in urban areas, as well. Americans more than 33 percent of their income on housing in 2013, up nearly 13 percent from two decades ago, according to newly released data from the Bureau of Labor Statistics (BLS). The graph below plots the trend by age.

Over-spending on housing is far worse in some places than others; the housing market and its recovery remain highly uneven. Another BLS report released last month showed that households in Washington, D.C., spent nearly twice as much on housing ($17,603) as those in Cleveland, Ohio ($9,061). The chart below, from the BLS report, shows average annual expenses on housing related items:

The result, of course, is that more and more American households, especially middle- and working-class people, are having a harder time affording housing. This is particularly the case in reviving urban centers, as more affluent, highly educated and creative-class workers snap up the best spaces, particularly those along convenient transit, pushing the service and working class further out.

Last but certainly not least, the rate of home ownership continues to fall, and dramatically. Home ownership has reached its lowest level in two decades—64.4 percent (as of the third quarter of 2014). Here’s the data, from the U.S. Census Bureau:

Home ownership currently hovers from the mid-50 to low-60 percent range in some of the most highly productive and innovative metros in this country—places like San Francisco, New York, and Los Angeles. This range seems “to provide the flexibility of rental and ownership options required for a fast-paced, rapidly changing knowledge economy. Widespread home ownership is no longer the key to a thriving economy,” I’ve written.

What we are going through is much more than a generational shift or simple lifestyle change. It’s a deep economic shift—I’ve called it the Great Reset. It entails a shift away from the economic system, population patterns and geographic layout of the old suburban growth model, which was deeply connected to old industrial economy, toward a new kind of denser, more urban growth more in line with today’s knowledge economy. We remain in the early stages of this reset. If history is any guide, the complete shift will take a generation or so.

The upshot, as the Nobel Prize winner Edmund Phelps has written, is that it is time for Americans to get over their house passion. The new knowledge economy requires we spend less on housing and cars, and more on education, human capital and innovation—exactly those inputs that fuel the new economic and social system.

But we’re not moving in that direction; in fact, we appear to be going the other way. This past weekend, Peter J. Wallison pointed out in a New York Times op-ed that federal regulators moved back off tougher mortgage-underwriting standards brought on by 2010’s Dodd-Frank Act and instead relaxed them. Regulators are hoping to encourage more home ownership, but they’re essentially recreating the conditions that led to 2008’s crash.

Wallison notes that this amounts to “underwriting the next housing crisis.” He’s right: It’s time to impose stricter underwriting standards and encourage the dense, mixed-use, more flexible housing options that the knowledge economy requires.

During the depression and after World War II, this country’s leaders pioneered a series of purposeful and ultimately game-changing polices that set in motion the old suburban growth model, helping propel the industrial economy and creating a middle class of workers and owners. Now that our economy has changed again, we need to do the same for the denser urban growth model, creating more flexible housing system that can help bolster today’s economy.

Dream housing for new economy workers?

The dramatic resurgence of the oil industry over the past few years has been a notable factor in the national economic recovery. Production levels have reached totals not seen since the late 1980s and continue to increase, and rig counts are in the 1,900 range. While prices have dipped recently, it will take more than that to markedly slow the level of activity. Cycles are inevitable, but activity is forecast to remain at relatively high levels.

An outgrowth of oil and gas activity strength is a need for additional workers. At the same time, the industry workforce is aging, and shortages are likely to emerge in key fields ranging from petroleum engineers to experienced drilling crews. I was recently asked to comment on the topic at a gathering of energy workforce professionals. Because the industry is so important to many parts of Texas, it’s an issue with relevance to future prosperity.

Although direct employment in the energy industry is a small percentage of total jobs in the state, the work is often well paying. Moreover, the ripple effects through the economy of this high value-added industry are large, especially in areas which have a substantial concentration of support services.

Employment in oil and gas extraction has expanded rapidly, up from 119,800 in January 2004 to 213,500 in September 2014. Strong demand for key occupations is evidenced by the high salaries; for example, median pay was $130,280 for petroleum engineers in 2012 according to the Bureau of Labor Statistics (BLS).

Due to expansion in the industry alone, the BLS estimates employment growth of 39 percent through 2022 for petroleum engineers, which comprised 11 percent of total employment in oil and gas extraction in 2012. Other key categories (such as geoscientists, wellhead pumpers, and roustabouts) are also expected to see employment gains exceeding 15 percent. In high-activity regions, shortages are emerging in secondary fields such as welders, electricians, and truck drivers.

The fact that the industry workforce is aging is widely recognized. The cyclical nature of the energy industry contributes to uneven entry into fields such as petroleum engineering and others which support oil and gas activity. For example, the current surge has pushed up wages, and enrollment in related fields has increased sharply. Past downturns, however, led to relatively low enrollments, and therefore relatively lower numbers of workers in some age cohorts. The loss of the large baby boom generation of experienced workers to retirement will affect all industries. This problem is compounded in the energy sector because of the long stagnation of the industry in the 1980s and 1990s resulting in a generation of workers with little incentive to enter the industry. As a result, the projected need for workers due to replacement is particularly high for key fields.

The BLS estimates that 9,800 petroleum engineers (25.5 percent of the total) working in 2012 will need to be replaced by 2022 because they retire or permanently leave the field. Replacement rates are also projected to be high for other crucial occupations including petroleum pump system operators, refinery operators, and gaugers (37.1 percent); derrick, rotary drill, and service unit operators, oil, gas, and mining (40.4 percent).

Putting together the needs from industry expansion and replacement, most critical occupations will require new workers equal to 40 percent or more of the current employment levels. The total need for petroleum engineers is estimated to equal approximately 64.5 percent of the current workforce. Clearly, it will be a major challenge to deal with this rapid turnover.

Potential solutions which have been attempted or discussed present problems, and it will require cooperative efforts between the industry and higher education and training institutions to adequately deal with future workforce shortages. Universities have had problems filling open teaching positions, because private-sector jobs are more lucrative for qualified candidates. Given budget constraints and other considerations, it is not feasible for universities to compete on the basis of salary. Without additional teaching and research staff, it will be difficult to continue to expand enrollment while maintaining education quality. At the same time, high-paying jobs are enticing students into the workforce, and fewer are entering doctoral programs.

Another option which has been suggested is for engineers who are experienced in the workplace to spend some of their time teaching. However, busy companies are naturally resistant to allowing employees to take time away from their regular duties. Innovative training and associate degree and certification programs blending classroom and hands-on experience show promise for helping deal with current and potential shortages in support occupations. Such programs can prepare students for well-paying technical jobs in the industry. Encouraging experienced professionals to work past retirement, using flexible hours and locations to appeal to Millennials, and other innovative approaches must be part of the mix, as well as encouraging the entry of females into the field (only 20 percent of the current workforce is female, but over 40 percent of the new entries).

Industry observers have long been aware of the coming “changing of the guard” in the oil and gas business. We are now approaching the crucial time period for ensuring the availability of the workers needed to fill future jobs. Cooperative efforts between the industry and higher education/training institutions will likely be required, and it’s time to act.

Kenny DeLaGarza, a building inspector for the city of Midland, at a 600-home Betenbough development.

Kenny DeLaGarza, a building inspector for the city of Midland, at a 600-home Betenbough development.Single-family home construction is expected to increase 26 percent in 2015, the National Association of Home Builders reported Oct. 31. NAHB expects single-family production to total 802,000 units next year and reach 1.1 million by 2016.

Economists participating in the NAHB’s 2014 Fall Construction Forecast Webinar said that a growing economy, increased household formation, low interest rates and pent-up demand should help drive the market next year. They also said they expect continued growth in multifamily starts given the nation’s rental demand.