Tag Archives: San Francisco Housing

San Francisco Rents Drop Most On Record As People Flee Medical Martial Laws For Suburbs

Source: RentSFNow

Readers may recall, as early as March, city dwellers in California fled to suburbs and remote areas to isolate from the virus pandemic. The proliferation of remote work arrangements has led this shift to become more permanent.

At first, the exodus out of the city was due to virus-related lock downs, then social unrest, and now it appears a steady flow of folks are leaving the San Francisco Bay Area for rural communities as their flexible work environment (i.e., remote access) allows them to work from anywhere, more specifically, outside city centers where the cost of living is a whole lot cheaper.

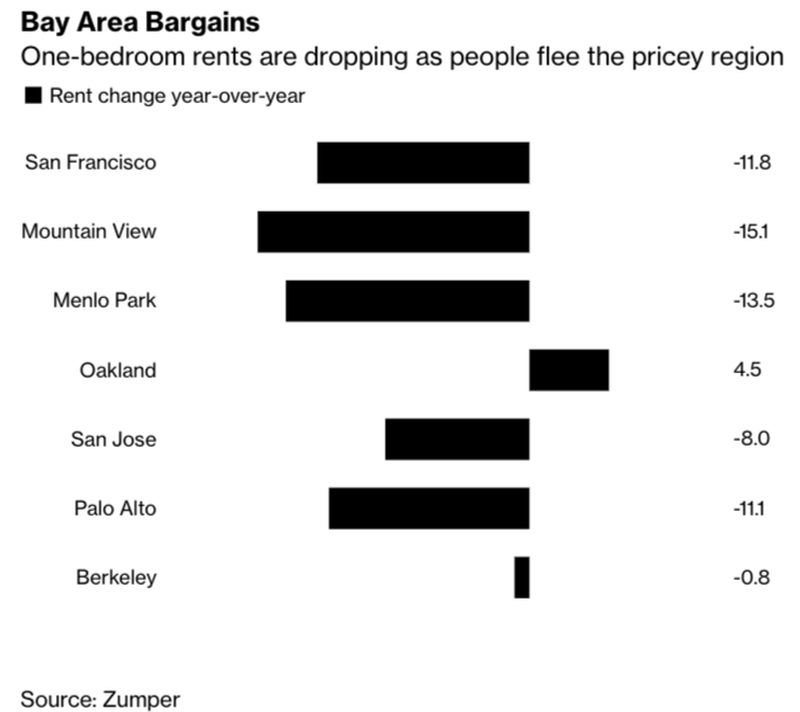

Bloomberg notes, citing a new report from rental website Zumper, the latest emigration trend out of the Bay Area has resulted in rents for a San Francisco one-bedroom apartment to plunge 12% in June compared with last year, which is one of the most significant monthly declines on record.

“Zumper has been tracking rent prices across the country for over five years but we have never seen the market fluctuate quite like this,” Zumper co-founder and CEO Anthemos Georgiades said. “For example, rent prices in San Francisco have historically only gone up and typically only incrementally, yet now we are seeing double-digit percent rent reductions. This is unprecedented for this generation of renters.”

Georgiades said the ability to work remotely led to the exodus of city dwellers:

“The very real move of many mainly technology employers to a future of remote work, meaning millions of employees now looking outside of dense metropolitan areas for their next home now that their commute time is no longer a factor,” Georgiades said.

“Silicon Valley hubs such as Mountain View and Palo Alto also saw rents plunge — a sign residents of the tech-heavy region are taking advantage of remote work arrangements to flee to cheaper areas,” Bloomberg said.

“This is the strangest downturn I’ve ever seen,” J.J. Panzer with the Real Management Company told San Francisco KPIX 5.

Rental inventory in the Bay Area has increased since the pandemic began – allowing renters to renegotiate leases and ask for a 10-15% reduction in rents.

Other factors for the steep drop in rents is mainly because of the recession and high unemployment. People can no longer afford pricey rentals in San Francisco – must leave city centers for suburbs where rents are significantly less.

“As the pandemic persists on, the demand for rentals has continued to shift away from these pricey areas, and a significant amount of that demand seems to be moving toward neighboring, less expensive areas,” Zumper said on its blog.

“Your landlord, given the widespread nature of the job loss, actually does have an incentive to negotiate a lower rent with you,” said senior Zillow economist Skyler Olsen.

“Vacant units have no value coming upstream to pay their property taxes and their mortgage and that value as part of the system,” said Olsen.

Financial blog Market Crumbs notes, “with the rise of remote work seemingly inevitable at this point, this trend should continue in San Francisco as well as other major cities in the years to come.”

Home Prices In 80% Of US Cities Grew 2x Faster Than Wages… And Then There Is San Francisco

The housing market is starting to overheat. Again.

According to the latest BLS data, average hourly wages for all US workers in November rose at a relatively brisk 2.7% relative to the previous year, if below the Fed’s “target” of 3.5-4.5% as countless economists are unable to explain how 4.1% unemployment, and “no slack” in the economy fails to boost wage growth. Another problem with tepid wage growth, in addition to crushing the Fed’s credibility, is that it keeps a lid on how much overall price levels can rise by, i.e. inflation. Meanwhile, with record global debt, it has been the Fed’s imperative to boost inflation at any cost to inflate away the debt overhang, however weak wages have made this impossible.

Well, not really.

Because a quick look at US housing shows that while wages may be growing at roughly 2.7%, according to the latest Case Shiller data, 18 of 20 metro areas in the US saw home prices grow at a higher pace, while 16 of 20 major U.S. cities experienced home price growth of 5.4% or higher, double the average wage growth, and something which even the NAR has been complaining about with its chief economist Larry Yun warning that as the disconnect between prices and wages becomes wider, homes become increasingly unaffordable for most Americans.

Confirming the recent jump in home prices, at the national level in February home prices for the Top 20 metro areas soared 6.8% YoY according to Case Shiller, the fastest rate since June 2014…

… and hitting a new all time high nationwide.

And while this should not come as a surprise – considering we have pointed it out on numerous occasions in the past – one look at the chart below confirms that something very troubling is taking place in San Francisco, which has either become “Vancouver South” when it comes to Chinese hot money laundering, or the second housing bubble has finally arrived on the West Coast. And while according to Case-Shiller data, home prices in San Francisco rose “only” 10.1% Y/Y, a more accurate breakdown of San Fran housing prices from Paragon Real Estate indicates a record 24% annual increase in San Francisco home prices, which increased by $110,000 in just the past quarter.

Behold: a housing bubble…

Also worth keeping an eye on: price appreciation in Sin City has quietly surged in recent months, and in February home prices jumped 11.6% Y/Y, the highest annual increase in years. Considering Las Vegas was the epicenter of the last housing bubble when prices exploded higher only to crash, it may be a good idea to keep a close eye on price tendencies in this metro area for a broader confirmation of the second housing bubble, than just the microcosm that is San Francisco.

* * *

Meanwhile, for those looking to buy for the first time, conditions have never been worse. Growth in property values is outpacing wage gains and limiting affordability, representing a major headwind for first-time buyers, and the broader market.

Finally, putting the above data in context, here are two charts courtesy of real-estate expert Mark Hanson, the first of which shows how much household income increase is needed to buy the median priced home in key US cities…

… while the next chart shows the divergence between actual household income, and the income needed to buy the median priced house.

Median San Francisco Home Price Soars By Over $100,000 In One Quarter To Record $1.6 Million

In San Francisco, a boom is always associated with its essential – and subsequent counterpart – the bust. They’re as typical to the city as sun and fog. And currently, judging by the insatiable appetite of home buyers in the city’s red-hot real estate market who appear completely unfazed stock-market volatility, tax-law changes, and tech sector gyrations, the city is in one heck of a housing boom, perhaps the biggest one ever, and national indices don’t do justice to how over-the-top mind-blowing crazy the situation has gotten.

Take for example, the S&P/Case-Shiller Home price index which covers not just the city (or county) of San Francisco but includes four other Bay Area counties: Alameda, Contra Costa, Marin, and San Mateo. There are more counties in the Bay Area, but they’re not included in the index. In terms of home prices, the five-county Case-Shiller index for “San Francisco,” though showing a significant, double digit annual gain of just over 10%, waters down the insanity happening every day on the streets of San Francisco.

To get a far more accurate, and granular neighborhood-by-neighborhood data for San Francisco itself, we go to Paragon Real Estate Group’s March-April 2018 report, and what we find are vertigo-inducing price increases that have now beautifully spiked.

During the prior nationwide housing bubble that blew up with such fanfare, helped take down the world financial system, and caused central banks and governments to instigate the largest bail-out schemes the world has ever seen – from banks to entire countries – well, during that bubble, while it was still going on, homes in San Francisco reached what afterward were called totally crazy valuations, with the median price topping out in November 2007 at a mind-boggling $895,000. People were shaking their heads at the time. But after the boom came the inevitable bust. By January 2012, the median home price had plunged 31% to $615,000.

By then, however, the tsunami of money that global central bankers had unleashed was already washing over San Francisco from multiple directions: a stock-market and startup boom that the city is so dependent on, a tourist boom from around the world, wave after wave of Chinese, Russian and Petro-oligarchs desperate to park their ill-gotten cash in real estate, and of course, the veritable flood of nearly free funding. Everything came perfectly together. Then, over the course of just a little over three years, the median home price about doubled to $1,225,000, and we duly noted the unprecedented surge in prices back in the spring of 2015.

It turns out, that was just the start, because according to the latest Paragon report, the median sale price of a house in the city has since soared to a record $1.6 million in the first quarter, a 24% jump from a year earlier, and more than double the annual price increase reported by Case-Shiller. Q1 also rose above the previous high set in the fourth quarter of 2017 by $100,000.

This is what a real boom looks like.

As the report’s authors observe, prices in the city have been soaring for several years, as “feverish” demand far outstrips supply. Putting the recent price explosion in context, the median home price is now 80% above the prior-bubble completely mind-boggling median price that afterwards everyone admitted had been based on totally crazy valuations. Surely, this time is be different?

When compared to either California or the US, San Francisco houses and condos are in a world of their own: the median SF house sales price in 2017 was $1,420,000 (up from $1,325,000 in 2016), and for condos, it was $1,150,000 (up from $1,095,000). Looking just at the 4th quarter, median prices were $1,500,000 for houses (up from $1,350,000 in Q4 2016) and $1,185,000 for condos (up from $1,078,000) respectively.

On a neighborhood-by-neighborhood basis, the differences in median home prices are enormous. In the table below, the median house prices range from $960,000 in Bayview, one of the more troubled neighborhoods, to over $5 million in Pacific Heights. It is in this exclusive, gorgeous, and groomed neighborhood, endowed with breathtaking views of the Bay, where you find the humble abode of the champion of the poor, former Speaker of the House Nancy Pelosi.

How much bigger can this bubble get?

As the report’s authors write, “it is still very early in the year to come to definitive conclusions about where the year is going, but right now, in most market segments, buyer demand is competing ferociously for a limited supply of listings. Indeed, by some standard statistical measures of supply and demand – days on market, months supply of inventory, absorption rate – the SF market is about as heated now as it has been at any time in the past 10 years. This is especially true in the more affordable home segments, and particularly for house listings.”

The situation is somewhat more complicated in the highest price ranges, especially in the luxury condo segment where supply has been rapidly increasing. Of course, whatever the property type or price segment, it all ultimately depends on the specific property, and its location, appeal, preparation, marketing and pricing, although if there is a place where the bubble will pop, it will be in the ultra luxury segment, where the supply is off the charts:

The rest of the market, however, remains incredibly tight: only about 2% of house owners are putting their homes on the market each year, which is incredibly low by historical measures – and why should they? For many owners, the house doubles as a real-estate piggy bank where funds are parked for the indefinite future. Meanwhile, about 5% of condo owners sell their homes each year, plus the new-construction condos that come on the market. This dynamic has made houses into the scarce commodity, and has fueled dramatic house price appreciation.

Looking at the charts above, one thing is clear: the dynamics of the housing market in San Francisco have put the 2005-2007 bubble to shame – what is taking place is unprecedented, much the same as parallel events in capital markets. However, just like in the stock market, so among San Francisco housing what the catalyst will be that punctures this appreciation utopia, is still very much unknown.

Historic: A 1906 “video-enhanced” film of an original taken more than a hundred years ago on Market Street in San Francisco, with sounds representative of that time and location. Interesting to note that the average life expectancy in 1906 was 47 years; there were only 8,000 cars on the road in America; only 144 miles of paved roads; and the maximum speed limit was 10 mph. 1906 most popular songs can also be heard as you’re traveling down Market Street. To see the “Raw” film footage from which this enhanced version came from (with a detailed, scene-by-scene description) go to this site: The Library of Congress: https://www.loc.gov/item/00694408

Median Home Price In San Francisco Hits $1.42 million: A Standard Condo In San Francisco Is Now Selling For $1.15 Million.

San Francisco housing has entered into a new reality. Tech money and foreign cash continues to flood the market and pushing prices to astronomical levels. The typical San Francisco crap shack now will cost you $1.42 million, a new record high with condos going for $1.15 million. The city is entering into escape velocity of gentrification. You have older Taco Tuesday baby boomers with rudimentary tech knowledge that bought decades ago living next to a new generation of wealth and tech savvy professionals. You see this as well in Los Angeles. Some real estate “experts” barely have a working understanding of tech but definitely know how to navigate to Zillow to view their inflated prices. San Francisco is such an odd case study. A city that outwardly states it supports the poor but when you look at prices even making $100,000 a year makes you part of a new high income poor – at that income level a sizable amount of your net income is going to go to simply paying for housing unless you want to be part of the mega commuting culture that is now emerging in California. What is going on in San Francisco?

The new ultra rich in San Francisco

It is hard for people to wrap their minds around the cost of housing in a place like California. Not so much that it is expensive, but once you look at the property and price you realize people are paying high prices for crap shacks.

Take a look at prices in San Francisco:

And people are still active and buying. You’ll notice that prices for the U.S. and California overall are merely back to their previous peak price points. Adjusting for inflation, things are moving along more carefully. In San Francisco, we are in a different dimension.

You have foreign money flooding the market and you also have dual income high tech households trying to buy up what little inventory exists. This new class of wealth would rather live in a million dollar dump than spend horrendous hours in a commute. The new sign of status is living near your work, not a McMansion out in the middle of nowhere.

And properties are moving along nicely in San Francisco even at a median price of $1.42 million:

What is telling is that the media is now in unison championing why real estate is a great buy, even at these prices. Forget about the multitude of factors that now face our economy including jobs that don’t last for a lifetime or the necessity for mobility with the new workforce. You have the Taco Tuesday baby boomer mentality where people want to stay put forever and assume everyone is going to follow in their same footsteps. Apple wasn’t built following the old. Facebook wasn’t built by following the old. Tesla wasn’t built by following the old. This generation is different and their need in housing are reflecting a changing tone.

Beyond the obvious, even at $1.42 million most are not going to have the money to buy these properties. So what does this do to the current market? What does it do to neighborhoods? Or how about the local school systems?

I think people just assume that high prices are always going to be part of the equation in California. But recent history shows that we go in booms and busts. For those that seem to think the market can only go up they should be out in the market buying real estate. That is their position. For those renting, you are already taking a position. And many parts of the state are becoming renting majority counties.

San Francisco real estate continues to go up. Who is buying right now? Funny how those buying real estate at these levels don’t see it as speculation but think stocks or crypto are “crazy” – everyone picks their “investment” product and the market seems frothy across all areas.

“Micro-Homes” Sprout Up All Over Bay Area To House The Growing Homeless Population

Roughly one year ago we shared the plans of a billionaire real estate developer in San Francisco who wanted to build communities for the homeless in Bay Area neighborhoods using stackable steel shipping containers (see: San Fran Billionaire Luanches Plan To House Homeless In Shipping Containers). Not surprisingly, the efforts were met with some resistance from the liberal elites of Santa Clara who, despite their vocal support of any number of federal subsidy programs for low-income families, would prefer that those low-income families, and their subsidies, stay far away from their posh, suburban, “safe places.”

Alas, as the San Francisco Chronicle points out today, like it or not, the boom in “micro-houses” is just getting started in the Bay Area with nearly 1,000 tiny homes, with less than 200 square feet of living space, currently being planned in San Francisco, San Jose, Richmond, Berkeley, Oakland and Santa Rosa.

Planners say that’s just the beginning. “We’re very excited about micro-homes,” said Lavonna Martin, director of Contra Costa County’s homeless programs. “They could be a big help. They have a lot of promise, and our county is happy to be on the cutting edge of this one. We’re ready.”

Contra Costa has a $750,000 federal homelessness grant to pay for 50 stackable micro-units of supportive housing, and Richmond Mayor Tom Butt would like to see them in his city. Developer Patrick Kennedy brought a prototype of his MicroPad unit to Richmond in November, and county and city leaders say they are leaning toward choosing it.

“They’re very fine, and they make a nice-looking building,” Butt said. “They’d be good for anybody looking for housing.”

The beauty of the tiny units is that they can be built in a fraction of the time it takes to construct typical affordable housing, and at a sliver of the cost, which means a lot of homeless folks can be housed quickly.

The homes have also caught on in San Jose where the City Council just approved $2.4 million to build a village of 40 units to help house the homeless. Of course, just like in Santa Clara, San Jose residents are lashing out at city officials over plans that they say will only serve to increase neighborhood crime.

San Jose resident Sue Halloway told the council she was afraid putting the village near residences would increase “neighborhood crime, neighborhood blight (and) poor sanitation,” and predicted that it would be “a magnet for more homeless.”

City Councilman Raul Peralez said he understands such concerns, but that “there are no facts surrounding these tiny homes and whatever blight or crime they might bring, because we haven’t done them yet.”

“I tell people you really have two options,” said Peralez, who said he wants the village in his downtown district. “You can allow the homeless to live on the streets, or you can provide not only shelter but services in a confined area — with security. In my mind, that’s a way better option for managing this community in an organized way.”

So, what do the stackable units look like? As seen in the video below, prototypes from one manufacturer, MicroPad, come complete with full bathrooms and kitchens and have up to 160-180 square feet of living space…

“These micro-homes may seem small at 160 to 180 square feet, but they’re actually pretty spacious when you’re in them,” she said. “And they go up very fast.”

Kennedy’s MicroPads have showers, beds and kitchens. Individually they resemble shipping containers, but once they’re bolted together with siding and utilities, they look like a regular building.

…which is more or less considered a mansion by struggling New York artist standards.