Buying Power

For the Wealthiest, a Private Tax System That Saves Them Billions

Daniel S. Loeb, shown with his wife, Margaret, runs the $17 billion Third Point hedge fund. Mr. Loeb, who has owned a home in East Hampton, has contributed to Jeb Bush’s super PAC and given $1 million to the American Unity Super PAC, which supports gay rights.

Daniel S. Loeb, shown with his wife, Margaret, runs the $17 billion Third Point hedge fund. Mr. Loeb, who has owned a home in East Hampton, has contributed to Jeb Bush’s super PAC and given $1 million to the American Unity Super PAC, which supports gay rights.

By NOAM SCHEIBER and PATRICIA COHEN for The New York Times, December 29, 2015

WASHINGTON — The hedge fund magnates Daniel S. Loeb, Louis Moore Bacon and Steven A. Cohen have much in common. They have managed billions of dollars in capital, earning vast fortunes. They have invested large sums in art — and millions more in political candidates.

Moreover, each has exploited an esoteric tax loophole that saved them millions in taxes. The trick? Route the money to Bermuda and back.

With inequality at its highest levels in nearly a century and public debate rising over whether the government should respond to it through higher taxes on the wealthy, the very richest Americans have financed a sophisticated and astonishingly effective apparatus for shielding their fortunes. Some call it the “income defense industry,” consisting of a high-priced phalanx of lawyers, estate planners, lobbyists and anti-tax activists who exploit and defend a dizzying array of tax maneuvers, virtually none of them available to taxpayers of more modest means.

In recent years, this apparatus has become one of the most powerful avenues of influence for wealthy Americans of all political stripes, including Mr. Loeb and Mr. Cohen, who give heavily to Republicans, and the liberal billionaire George Soros, who has called for higher levies on the rich while at the same time using tax loopholes to bolster his own fortune.

All are among a small group providing much of the early cash for the 2016 presidential campaign.

Operating largely out of public view — in tax court, through arcane legislative provisions and in private negotiations with the Internal Revenue Service — the wealthy have used their influence to steadily whittle away at the government’s ability to tax them. The effect has been to create a kind of private tax system, catering to only several thousand Americans.

The impact on their own fortunes has been stark. Two decades ago, when Bill Clinton was elected president, the 400 highest-earning taxpayers in America paid nearly 27 percent of their income in federal taxes, according to I.R.S. data. By 2012, when President Obama was re-elected, that figure had fallen to less than 17 percent, which is just slightly more than the typical family making $100,000 annually, when payroll taxes are included for both groups.

The ultra-wealthy “literally pay millions of dollars for these services,” said Jeffrey A. Winters, a political scientist at Northwestern University who studies economic elites, “and save in the tens or hundreds of millions in taxes.”

Some of the biggest current tax battles are being waged by some of the most generous supporters of 2016 candidates. They include the families of the hedge fund investors Robert Mercer, who gives to Republicans, and James Simons, who gives to Democrats; as well as the options trader Jeffrey Yass, a libertarian-leaning donor to Republicans.

Mr. Yass’s firm is litigating what the agency deemed to be tens of millions of dollars in underpaid taxes. Renaissance Technologies, the hedge fund Mr. Simons founded and which Mr. Mercer helps run, is currently under review by the I.R.S. over a loophole that saved their fund an estimated $6.8 billion in taxes over roughly a decade, according to a Senate investigation. Some of these same families have also contributed hundreds of thousands of dollars to conservative groups that have attacked virtually any effort to raises taxes on the wealthy.

In the heat of the presidential race, the influence of wealthy donors is being tested. At stake is the Obama administration’s 2013 tax increase on high earners — the first substantial increase in two decades — and an I.R.S. initiative to ensure that, in effect, the higher rates stick by cracking down on tax avoidance by the wealthy.

While Democrats like Bernie Sanders and Hillary Clinton have pledged to raise taxes on these voters, virtually every Republican has advanced policies that would vastly reduce their tax bills, sometimes to as little as 10 percent of their income.

At the same time, most Republican candidates favor eliminating the inheritance tax, a move that would allow the new rich, and the old, to bequeath their fortunes intact, solidifying the wealth gap far into the future. And several have proposed a substantial reduction — or even elimination — in the already deeply discounted tax rates on investment gains, a foundation of the most lucrative tax strategies.

“There’s this notion that the wealthy use their money to buy politicians; more accurately, it’s that they can buy policy, and specifically, tax policy,” said Jared Bernstein, a senior fellow at the left-leaning Center on Budget and Policy Priorities who served as chief economic adviser to Vice President Joseph R. Biden Jr. “That’s why these egregious loopholes exist, and why it’s so hard to close them.”

The Family Office

Each of the top 400 earners took home, on average, about $336 million in 2012, the latest year for which data is available. If the bulk of that money had been paid out as salary or wages, as it is for the typical American, the tax obligations of those wealthy taxpayers could have more than doubled.

Instead, much of their income came from convoluted partnerships and high-end investment funds. Other earnings accrued in opaque family trusts and foreign shell corporations, beyond the reach of the tax authorities.

The well-paid technicians who devise these arrangements toil away at white-shoe law firms and elite investment banks, as well as a variety of obscure boutiques. But at the fulcrum of the strategizing over how to minimize taxes are so-called family offices, the customized wealth management departments of Americans with hundreds of millions or billions of dollars in assets.

Family offices have existed since the late 19th century, when the Rockefellers pioneered the institution, and gained popularity in the 1980s. But they have proliferated rapidly over the last decade, as the ranks of the super-rich, and the size of their fortunes, swelled to record proportions.

“We have so much wealth being created, significant wealth, that it creates a need for the family office structure now,” said Sree Arimilli, an industry recruiting consultant.

Family offices, many of which are dedicated to managing and protecting the wealth of a single family, oversee everything from investment strategy to philanthropy. But tax planning is a core function. While the specific techniques these advisers employ to minimize taxes can be mind-numbingly complex, they generally follow a few simple principles, like converting one type of income into another type that’s taxed at a lower rate.

Mr. Loeb, for example, has invested in a Bermuda-based reinsurer — an insurer to insurance companies — that turns around and invests the money in his hedge fund. That maneuver transforms his profits from short-term bets in the market, which the government taxes at roughly 40 percent, into long-term profits, known as capital gains, which are taxed at roughly half that rate. It has had the added advantage of letting Mr. Loeb defer taxes on this income indefinitely, allowing his wealth to compound and grow more quickly.

The Bermuda insurer Mr. Loeb helped set up went public in 2013 and is active in the insurance business, not merely a tax dodge. Mr. Cohen and Mr. Bacon abandoned similar insurance-based strategies in recent years. “Our investment in Max Re was not a tax-driven scheme, but rather a sound investment response to investor interest in a more dynamically managed portfolio akin to Warren Buffett’s Berkshire Hathaway,” said Mr. Bacon, who leads Moore Capital Management. “Hedge funds were a minority of the investment portfolio, and Moore Capital’s products a much smaller subset of this alternative portfolio.” Mr. Loeb and Mr. Cohen declined to comment.

Louis Moore Bacon, shown with his wife, Gabrielle, is the founder of a highly successful hedge fund and a leading contributor to Jeb Bush’s super PAC. Among his homes is one on Robins Island, off Long Island. Bloomberg News, via Getty Images

Louis Moore Bacon, shown with his wife, Gabrielle, is the founder of a highly successful hedge fund and a leading contributor to Jeb Bush’s super PAC. Among his homes is one on Robins Island, off Long Island. Bloomberg News, via Getty Images

Organizing one’s business as a partnership can be lucrative in its own right. Some of the partnerships from which the wealthy derive their income are allowed to sell shares to the public, making it easy to cash out a chunk of the business while retaining control. But unlike publicly traded corporations, they pay no corporate income tax; the partners pay taxes as individuals. And the income taxes are often reduced by large deductions, such as for depreciation.

For large private partnerships, meanwhile, the I.R.S. often struggles “to determine whether a tax shelter exists, an abusive tax transaction is being used,” according to a recent report by the Government Accountability Office. The agency is not allowed to collect underpaid taxes directly from these partnerships, even those with several hundred partners. Instead, it must collect from each individual partner, requiring the agency to commit significant time and manpower.

The wealthy can also avail themselves of a range of esoteric and customized tax deductions that go far beyond writing off a home office or dinner with a client. One aggressive strategy is to place income in a type of charitable trust, generating a deduction that offsets the income tax. The trust then purchases what’s known as a private placement life insurance policy, which invests the money on a tax-free basis, frequently in a number of hedge funds. The person’s heirs can inherit, also tax-free, whatever money is left after the trust pays out a percentage each year to charity, often a considerable sum.

Many of these maneuvers are well established, and wealthy taxpayers say they are well within their rights to exploit them. Others exist in a legal gray area, its boundaries defined by the willingness of taxpayers to defend their strategies against the I.R.S. Almost all are outside the price range of the average taxpayer.

Among tax lawyers and accountants, “the best and brightest get a high from figuring out how to do tricky little deals,” said Karen L. Hawkins, who until recently headed the I.R.S. office that oversees tax practitioners. “Frankly, it is almost beyond the intellectual and resource capacity of the Internal Revenue Service to catch.”

The combination of cost and complexity has had a profound effect, tax experts said. Whatever tax rates Congress sets, the actual rates paid by the ultra-wealthy tend to fall over time as they exploit their numerous advantages.

From Mr. Obama’s inauguration through the end of 2012, federal income tax rates on individuals did not change (excluding payroll taxes). But the highest-earning one-thousandth of Americans went from paying an average of 20.9 percent to 17.6 percent. By contrast, the top 1 percent, excluding the very wealthy, went from paying just under 24 percent on average to just over that level.

“We do have two different tax systems, one for normal wage-earners and another for those who can afford sophisticated tax advice,” said Victor Fleischer, a law professor at the University of San Diego who studies the intersection of tax policy and inequality. “At the very top of the income distribution, the effective rate of tax goes down, contrary to the principles of a progressive income tax system.”

A Very Quiet Defense

Having helped foster an alternative tax system, wealthy Americans have been aggressive in defending it.

Trade groups representing the Bermuda-based insurance company Mr. Loeb helped set up, for example, have spent the last several months pleading with the I.R.S. that its proposed rules tightening the hedge fund insurance loophole are too onerous.

The major industry group representing private equity funds spends hundreds of thousands of dollars each year lobbying on such issues as “carried interest,” the granddaddy of Wall Street tax loopholes, which makes it possible for fund managers to pay the capital gains rate rather than the higher standard tax rate on a substantial share of their income for running the fund.

The budget deal that Congress approved in October allows the I.R.S. to collect underpaid taxes from large partnerships at the firm level for the first time — which is far easier for the agency — thanks to a provision that lawmakers slipped into the deal at the last minute, before many lobbyists could mobilize. But the new rules are relatively weak — firms can still choose to have partners pay the taxes — and don’t take effect until 2018, giving the wealthy plenty of time to weaken them further.

Shortly after the provision passed, the Managed Funds Association, an industry group that represents prominent hedge funds like D. E. Shaw, Renaissance Technologies, Tiger Management and Third Point, began meeting with members of Congress to discuss a wish list of adjustments. The founders of these funds have all donated at least $500,000 to 2016 presidential candidates. During the Obama presidency, the association itself has risen to become one of the most powerful trade groups in Washington, spending over $4 million a year on lobbying.

And while the lobbying clout of the wealthy is most often deployed through industry trade associations and lawyers, some rich families have locked arms to advance their interests more directly.

The inheritance tax has been a primary target. In the early 1990s, a California family office executive named Patricia Soldano began lobbying on behalf of wealthy families to repeal the tax, which would not only save them money, but also make it easier to preserve their business empires from one generation to the next. The idea struck many hardened operatives as unrealistic at the time, given that the tax affected only the wealthiest Americans. But Ms. Soldano’s efforts — funded in part by the Mars and Koch families — laid the groundwork for a one-year elimination in 2010.

The tax has been restored, but currently applies only to couples leaving roughly $11 million or more to their heirs, up from those leaving more than $1.2 million when Ms. Soldano started her campaign. It affected fewer than 5,200 families last year.

“If anyone would have told me we’d be where we are today, I would never have guessed it,” Ms. Soldano said in an interview.

Some of the most profound victories are barely known outside the insular world of the wealthy and their financial managers.

In 2009, Congress set out to require that investment partnerships like hedge funds register with the Securities and Exchange Commission, partly so that regulators would have a better grasp on the risks they posed to the financial system.

The early legislative language would have required single-family offices to register as well, exposing the highly secretive institutions to scrutiny that their clients were eager to avoid. Some of the I.R.S.’s cases against the wealthy originate with tips from the S.E.C., which is often better positioned to spot tax evasion.

By the summer of 2009, several family office executives had formed a lobbying group called the Private Investor Coalition to push back against the proposal. The coalition won an exemption in the 2010 Dodd-Frank financial reform bill, then spent much of the next year persuading the S.E.C. to largely adopt its preferred definition of “family office.”

So expansive was the resulting loophole that Mr. Soros’s $24.5 billion hedge fund took advantage of it, converting to a family office after returning capital to its remaining outside investors. The hedge fund manager Stanley Druckenmiller, a former business partner of Mr. Soros, took the same step.

The Soros family, which generally supports Democrats, has committed at least $1 million to the 2016 presidential campaign; Mr. Druckenmiller, who favors Republicans, has put slightly more than $300,000 behind three different G.O.P. presidential candidates.

A slide presentation from the Private Investor Coalition’s 2013 annual meeting credited the success to multiple meetings with members of the Senate Banking Committee, the House Financial Services Committee, congressional staff and S.E.C. staff. “All with a low profile,” the document noted. “We got most of what we wanted AND a few extras we didn’t request.”

A Hobbled Monitor

After all the loopholes and all the lobbying, what remains of the government’s ability to collect taxes from the wealthy runs up against one final hurdle: the crisis facing the I.R.S.

President Obama has made fighting tax evasion by the rich a priority. In 2010, he signed legislation making it easier to identify Americans who squirreled away assets in Swiss bank accounts and Cayman Islands shelters.

His I.R.S. convened a Global High Wealth Industry Group, known colloquially as “the wealth squad,” to scrutinize the returns of Americans with incomes of at least $10 million a year.

But while these measures have helped the government retrieve billions, the agency’s efforts have flagged in the face of scandal, political pressure and budget cuts. Between 2010, the year before Republicans took control of the House of Representatives, and 2014, the I.R.S. budget dropped by almost $2 billion in real terms, or nearly 15 percent. That has forced it to shed about 5,000 high-level enforcement positions out of about 23,000, according to the agency.

Audit rates for the $10 million-plus club spiked in the first few years of the Global High Wealth program, but have plummeted since then.

Steven A. Cohen, shown with his wife, Alexandra, is the founder of SAC Capital and owns a home in East Hampton. He is a prominent art collector and has focused his political contributions on a super PAC for Gov. Chris Christie.

Steven A. Cohen, shown with his wife, Alexandra, is the founder of SAC Capital and owns a home in East Hampton. He is a prominent art collector and has focused his political contributions on a super PAC for Gov. Chris Christie.

The political challenge for the agency became especially acute in 2013, after the agency acknowledged singling out conservative nonprofits in a review of political activity by tax-exempt groups. (Senior officials left the agency as a result of the controversy.)

Several former I.R.S. officials, including Marcus Owens, who once headed the agency’s Exempt Organizations division, said the controversy badly damaged the agency’s willingness to investigate other taxpayers, even outside the exempt division.

“I.R.S. enforcement is either absent or diminished” in certain areas, he said. Mr. Owens added that his former department — which provides some oversight of money used by charities and nonprofits — has been decimated.

Groups like FreedomWorks and Americans for Tax Reform, which are financed partly by the foundations of wealthy families and large businesses, have called for impeaching the I.R.S. commissioner. They are bolstered by deep-pocketed advocacy groups like the Club for Growth, which has aided primary challenges against Republicans who have voted in favor of higher taxes.

In 2014, the Club for Growth Action fund raised more than $9 million and spent much of it helping candidates critical of the I.R.S. Roughly 60 percent of the money raised by the fund came from just 12 donors, including Mr. Mercer, who has given the group $2 million in the last five years. Mr. Mercer and his immediate family have also donated more than $11 million to several super PACs supporting Senator Ted Cruz of Texas, an outspoken I.R.S. critic and a presidential candidate.

Another prominent donor is Mr. Yass, who helps run a trading firm called the Susquehanna International Group. He donated $100,000 to the Club for Growth Action fund in September. Mr. Yass serves on the board of the libertarian Cato Institute and, like Mr. Mercer, appears to subscribe to limited-government views that partly motivate his political spending.

But he may also have more than a passing interest in creating a political environment that undermines the I.R.S. Susquehanna is currently challenging a proposed I.R.S. determination that an affiliate of the firm effectively repatriated more than $375 million in income from subsidiaries located in Ireland and the Cayman Islands in 2007, creating a large tax liability. (The affiliate brought the money back to the United States in later years and paid dividend taxes on it; the I.R.S. asserts that it should have paid the ordinary income tax rate, at a cost of tens of millions of dollars more.)

In June, Mr. Yass donated more than $2 million to three super PACs aligned with Senator Rand Paul of Kentucky, who has called for taxing all income at a flat rate of 14.5 percent. That change in itself would save wealthy supporters like Mr. Yass millions of dollars.

Mr. Paul, also a presidential candididate, has suggested going even further, calling the I.R.S. a “rogue agency” and circulating a petition in 2013 calling for the tax equivalent of regime change. “Be it now therefore resolved,” the petition reads, “that we, the undersigned, demand the immediate abolishment of the Internal Revenue Service.”

But even if that campaign is a long shot, the richest taxpayers will continue to enjoy advantages over everyone else.

For the ultra-wealthy, “our tax code is like a leaky barrel,” said J. Todd Metcalf, the Democrats’ chief tax counsel on the Senate Finance Committee. ”Unless you plug every hole or get a new barrel, it’s going to leak out.”

If you have a bank account anywhere in Europe, you need to read this article. On January 1st, 2016, a new bail-in system will go into effect for all European banks. This new system is based on the Cyprus bank bail-ins that we witnessed a few years ago. If you will remember, money was grabbed from anyone that had more than 100,000 euros in their bank accounts in order to bail out the banks. Now the exact same principles that were used in Cyprus are going to apply to all of Europe. And with the entire global financial system teetering on the brink of chaos, that is not good news for those that have large amounts of money stashed in shaky European banks.

Below, I have shared part of an announcement about this new bail-in system that comes directly from the official website of the European Parliament. I want you to notice that they explicitly say that “unsecured depositors would be affected last”. What they really mean is that any time a bank in Europe fails, they are going to come after private bank accounts once the shareholders and bond holders have been wiped out. So if you have more than 100,000 euros in a European bank right now, you are potentially on the hook when that bank goes under…

The directive establishes a bail-in system which will ensure that taxpayers will be last in the line to the pay the bills of a struggling bank. In a bail-in, creditors, according to a pre-defined hierarchy, forfeit some or all of their holdings to keep the bank alive. The bail-in system will apply from 1 January 2016.

The bail-in tool set out in the directive would require shareholders and bond holders to take the first big hits. Unsecured depositors (over €100,000) would be affected last, in many cases even after the bank-financed resolution fund and the national deposit guarantee fund in the country where it is located have stepped in to help stabilize the bank. Smaller depositors would in any case be explicitly excluded from any bail-in.

And as we have seen in the past, these rules can change overnight in the midst of a major crisis.

So they may be promising that those with under 100,000 euros will be safe right now, but that doesn’t necessarily mean that it will be true.

It is also important to note that there has been a really big hurry to get all of this in place by January 1. In fact, at the end of October the European Commission actually sued six nations that had not yet passed legislation adopting the new bail-in rules…

The European Commission is taking legal action against member states including the Netherlands and Luxembourg, after they failed to implement rules protecting European taxpayers from funding billions in bank rescues.

Six countries will be referred to the European Court of Justice (ECJ) for their continued failure to transpose the EU’s “bail-in” laws into national legislation, the European Commission said on Thursday.

So why was the European Commission in such a rush?

Is there some particular reason why January 1 is so important?

This is something that I will be watching.

Meanwhile, there have been major changes in the U.S. as well. The Federal Reserve recently adopted a new rule that limits what it can do to bail out the “too big to fail” banks. The following comes from CNN…

The Federal Reserve is cutting its lifeline to big banks in financial trouble.

The Fed officially adopted a new rule Monday that limits its ability to lend emergency money to banks.

In theory, the new rule should quash the notion that Wall Street banks are “too big to fail.”

If this new rule had been in effect during the last financial crisis, the Federal Reserve would not have been able to bail out AIG or Bear Stearns. As a result, the final outcome of the last crisis may have been far different. Here is more from CNN…

Under the new rule, banks that are going bankrupt — or appear to be going bankrupt — can no longer receive emergency funds from the Fed under any circumstances.

If the rule had been in place during the financial crisis, it would have prevented the Fed from lending to insurance giant AIG (AIG) and Bear Stearns, Fed chair Janet Yellen points out.

So if the Federal Reserve does not bail out these big financial institutions during the next crisis, what is going to happen?

Will we see European-style “bail-ins” when large banks start failing?

And exactly what would such a “bail-in” look like?

Earlier this year, I discussed the concept of a “bail-in”…

Essentially, what happens is that wealth is transferred from the “stakeholders” in the bank to the bank itself in order to keep it solvent. That means that creditors and shareholders could potentially lose everything if a major bank in Europe fails. And if their “contributions” are not enough to save the bank, those holding private bank accounts will have to take “haircuts” just like we saw in Cyprus. In fact, the travesty that we witnessed in Cyprus is being used as a “template” for much of the new legislation that is being enacted all over Europe.

Many Americans assume that when they put money in the bank that they have a right to go back and get “their money” whenever they want. But if we all went to the bank at the same time, there wouldn’t be nearly enough money for all of us. The reason for this is that the banks only keep a small fraction of our money on hand to satisfy the demands of those that conduct withdrawals on a day to day basis. The banks take the rest of the money that we have deposited and use it however they think is best.

If you have money at a bank that goes under, that bank will still be obligated to pay you back, but it may not be able to do so. This is where the FDIC comes in. The FDIC supposedly guarantees the safety of deposits in member banks, but at any given time it only has a very, very small amount of money on hand.

If some major crisis comes along that causes banks all over the United States to start falling like dominoes, the FDIC will be in panic mode. During such a scenario, the FDIC would be forced to ask Congress for a massive amount of money, and since we already run a giant deficit every year the government would have to borrow whatever funds would be required.

Personally, I find it very interesting that we have seen major rule changes in Europe and at the Federal Reserve just as we are entering a new global financial crisis.

Do they know something that the rest of us do not?

Be very careful with your money, because I am convinced that “bank bail-ins” will soon be making front page headlines all over the world.

So, where do we begin?

The economy has been firing on all eight cylinders for several years now. So long, in fact, that many do not or cannot accept the fact that all good things must come to an end. Since the 2008 recession, the only negative that has remained constant is the continuing dilemma of the “underemployed”.

Let me digress for a while and delve into the real issues I see as storm clouds on the horizon. Below are the top five storms I see brewing:

Just this past week there was an article detailing data from the National Association of Realtors (NAR), disclosing that existing home sales dropped 10.5% on an annual basis to 3.76 million units. This was the sharpest decline in over five years. The blame for the drop was tied to new required regulations for home buyers. What is perplexing about this excuse is NAR economist Lawrence Yun’s comments. The article cited Yun as saying that:

“most of November’s decline was likely due to regulations that came into effect in October aimed at simplifying paperwork for home purchasing. Yun said it appeared lenders and closing companies were being cautious about using the new mandated paperwork.”

Here is what I do not understand. How can simplifying paperwork make lenders “more cautious about using… the new mandated paperwork”?

Also noted was the fact that median home prices increased 6.3% in November to $220,300. This comes as interest rates are on the cusp of finally rising, thus putting pressure (albeit minor) on monthly mortgage rate payments. This has the very real possibility of pricing out investors whose eligibility for financing was borderline to begin with.

Casey Research has a terrific article that sums up the problems in the subprime auto market. I strongly suggest that you read the article. Just a few of the highlights of the article are the following points:

The only logical conclusion that can be derived is that the finances of the average American are still so weak that they will do anything/everything to get a car. Regardless of the rate, or risks associated with it.

Remember $100 crude oil prices? Or $1,700 gold prices? Or $100 ton iron ore prices? They are all distant faded memories. Currently, oil is $36 a barrel, gold is $1,070 an ounce, and iron ore is $42 a ton. Commodity stocks from Cliffs Natural Resources (NYSE:CLF) to Peabody Energy (NYSE:BTU) (both of which I have written articles about) are struggling to pay off debt and keep their operations running due to the declines in commodity prices. Just this past week, Cliffs announced that it sold its coal operations to streamline its business and strengthen its balance sheet while waiting for the iron ore business to stabilize and or strengthen. Similarly, oil producers and metals mining/exploration companies are either going out of business or curtailing their operations at an ever increasing pace.

For 2016, Citi’s predictions commodity by commodity can be found here. Its outlook calls for 30% plus returns from natural gas and oil. Where are these predictions coming from? The backdrop of huge 2015 losses obviously produced a low base from which to begin 2016, but the overwhelming consensus is for oil and natural gas to be stable during 2016. This is clearly a case of Citi sticking its neck out with a prediction that will garnish plenty of attention. Give it credit for not sticking with the herd mentality on this one.

Historically, the equities markets have produced stellar returns. According to an article from geeksonfinace.com, the average return in equities markets from 1926 to 2010 was 9.8%. For 2015, the markets are struggling to erase negative returns. Interestingly, the Barron’s round table consensus group predicted a nearly 10% rise in equity prices in 2015 (which obviously did not materialize) and also repeated that bullish prediction for 2016 by anticipating an 8% return in the S&P. So what happened in 2015? Corporate earnings were not as robust as expected. Commodity prices put pressure on margins of commodity producing companies. Furthermore, there are headwinds from external market forces that are also weighing on the equities markets. As referenced by this article which appeared on Business Insider, equities markets are on the precipice of doing something they have not done since 1939: see negative returns during a pre-election year. Per the article, on average, the DJIA gains 10.4% during pre-election years. With less than one week to go in 2015, the DJIA is currently negative by 1.5%

Once again, we have stumbled upon an excellent Bloomberg article discussing unpaid student loan debt. The main takeaway from the article is the fact that “about 3 million parents have $71 billion in loans, contributing to more than $1.2 trillion in federal education debt. As of May 2014, half of the balance was in deferment, racking up interest at annual rates as high as 7.9 percent.” The rate was as low as 1.8 percent just four years ago. It is key to note that this is debt that parents have taken out for the education of their children and does not include loans for their own college education.

The Institute for College Access & Success released a detailed 36 page analysis of what the class of 2014 faces regarding student debt. Some highlights:

So, what does this all mean?

To look at any one or two of the above categories and see their potential to stymie the economy, one would be smart to be cautious. To look at all five, one needs to contemplate the very real possibility of these creating the beginnings of another downturn in the economy. I strongly suggest a cautious and conservative investment outlook for 2016. While the risk one takes should always be based on your own risk tolerance levels, they should also be balanced by the very real possibility of a slowing economy which may also include deflation. Best of health and trading to all in 2016!

The Federal Reserve did it — raised the target federal funds rate a quarter point, its first boost in nearly a decade. That does not, however, mean that the average rate on the 30-year fixed mortgage will be a quarter point higher when we all wake up on Thursday. That’s not how mortgage rates work.

Mortgage rates follow the yields on mortgage-backed securities. These bonds track the yield on the U.S. 10-year Treasury. The bond market is still sorting itself out right now, and yields could end up higher or lower by the end of the week.

The bigger deal for mortgage rates is not the Fed’s headline move, but five paragraphs lower in its statement:

“The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way.”

When U.S. financial markets crashed in 2008, the Federal Reserve began buying billions of dollars worth of agency mortgage-backed securities (loans backed by Fannie Mae, Freddie Mac and Ginnie Mae). As part of the so-called “taper” in 2013, it gradually stopped using new money to buy MBS but continued to reinvest money it made from the bonds it had into more, newer bonds.

“In other words, all the income they receive from all that MBS they bought is going right back into buying more MBS,” wrote Matthew Graham, chief operating officer of Mortgage News Daily. “Over the past few cycles, that’s been $24-$26 billion a month — a staggering amount that accounts for nearly every newly originated MBS.”

At some point, the Fed will have to stop that and let the private market back into mortgage land, but so far that hasn’t happened. Mortgage finance reform is basically on the back-burner until we get a new president and a new Congress. As long as the Fed is the mortgage market’s sugar daddy, rates won’t move much higher.

“Also important is the continued popularity of US Treasury investments around the world, which puts downward pressure on Treasury rates, specifically the 10-year bond rate, which is the benchmark for MBS/mortgage pricing,” said Guy Cecala, CEO of Inside Mortgage Finance. “Both are much more significant than any small hike in the Fed rate.”

Still, consumers are likely going to be freaked out, especially young consumers, if mortgage rates inch up even slightly. That is because apparently they don’t understand just how low rates are. Sixty-seven percent of prospective home buyers surveyed by Berkshire Hathaway HomeServices, a network of real estate brokerages, categorized the level of today’s mortgage rates as “average” or “high.”

The current rate of 4 percent on the 30-year fixed is less than 1 percentage point higher than its record low. Fun fact, in the early 1980s, the rate was around 18 percent.

So a couple of weeks ago, we did a show about how the CFPB used a site to use names, to determine the race of a borrower. If you recall, 2 out of 3 of our test subjects came out with the wrong race. I, Brian Stevens, was the only correct conclusion.

So a couple of weeks ago, we did a show about how the CFPB used a site to use names, to determine the race of a borrower. If you recall, 2 out of 3 of our test subjects came out with the wrong race. I, Brian Stevens, was the only correct conclusion.

We use our show, The National Real Estate Post, to point out the absurdity of the lending ecosystem. The problem is, because we use humor as our conduit, we’re not often taken seriously. However, when you consider the point that the CFPB uses a site, with an algorithm, to determine a consumer’s race; it’s not funny. Further, when you consider that the CFPB, a government agency, then uses that information to slander and sue lenders, it becomes less funny. Finally when you consider the fact that a government agency, who uses flawed racially bias information to slander and sue lenders, then tries to hide that information, we’ve got problems that make Donald Trump’s bullshit look like a playground prank. Yet here we are.

So the problem is, the CFPB operates as “judge, jury, and executioner” over those they regulate. For example; did you know the CFPB operates outside of congress, unaccountable to the judicial system, and off the books of taxpayers. Honestly, the CFPB is not part of the annual budget determined by congress. They are funded by the Federal Reserve, which means they can receive as little or as much money as they choose. That must be nice.

Did you know when the CFPB chooses to seemingly and ambiguously sue a lender, they use predetermined administrative law judges? In the past, they use judges from the SEC. So in the past, the CFPB gets to pick the judge on the cases they bring against lenders. How is a government agency allowed to operate under these rules? Short answer is “you’re not accountable to anyone.” This should infuriate you.

Good news is, the CFPB is no longer using SEC admin judges. The bad news is, they have white page job postings looking for their own judges. In an article by Ballard Spahr, who are probably the best CFPB law minds in the country, posted an article on July 20, that goes as follows:

The CFPB recently posted a job opening for an administrative law judge (ALJ). According to the government jobs website, the position is closed which suggests that it has been filled. A recent Politico article indicated that the CFPB posted the opening because it has ended its arrangement with the SEC to borrow ALJs.

OK so it’s time to insert outrage here. In case you missed it, the CFPB has a posting, on a government site, looking for judges to hire. To hire to work as the unbiased voice of reason to settle cases the CFPB has brought and will continue to bring against lenders. How can this happen?

Fast forward. It has now been proven that the CFPB has been using an algorithm to determine someone’s race based exclusively on their name. I proved this absurdity a month ago on my show “The National Real Estate Post,” and I’ll prove it again. I’m going to ask the first person I see their name, race, and identity. Here it goes.

That’s Andrew Strah, he’s a 20 something “tech support” at listing booster. After our short video clip he went back to his computer and “googled” his name. After all he was a little perplexed about the nature of my questions and wanted to find the answer to a question he never really considered. It turns out his name is Greek/Italian. His last name is Slavonian, which makes this Black/White kid Russian; according to him. How is it fair for the CFPB to use any system to determine anyone’s race when such issues are personal and complicated.

![]()

Yet this is the system the CFPB is using to pigeon hole guys like Andrew, and then bring lawsuits against lenders for being racist. If ever there was a system that made no sense this is it. Again, insert outrage here.

An agency with an unlimited budget, off the books, and unaccountable to the taxpayer. The very people they are protecting, while buying judges to bring lawsuits against people, with a protocol that makes no sense. Yet this is the system that allows the CFPB to force companies like Hudson City Savings and loan to pay 27 Million for Redlining for which they were not guilty. Insert outrage here.

Now the best part of the story. The CFPB knew that their information was bullshit. In an article from Right Side News.

Much like using a “ready-fire-aim” approach to shooting at targets, the Consumer Financial Protection Bureau (CFPB) appears to have conducted in racial discrimination witch hunt against auto lenders in this same manner. The CFPB investigated and sought racial discrimination charges against auto lenders, as it turns out, on the basis of guessing the race and ethnicity of borrowers based on their last names, and using this “evidence” to prove their allegations. Only 54 percent of those identified as African-American by this “proxy methodology,” the Wall Street Journal reported, were actually African-Americans. The CFPB drafted rules to solve a problem they only believed existed, racial discrimination in auto lending.

Further.

The Republican staff of the House Financial Services Committee has released a trove of documents showing that bureau officials knew their information was flawed and even deliberated on ways to prevent people outside the bureau from learning how flawed it was.

The bureau has been guessing the race and ethnicity of car-loan borrowers based on their last names and addresses—and then suing banks whenever it looks like the people the government guesses are white seem to be getting a better deal than the people it guesses are minorities. This largely fact-free prosecutorial method is the reason a bipartisan House super majority recently voted to roll back the bureau’s auto-loan rules.

And we wonder why lenders don’t trust and will not approach the CFPB. They are crooked and untouchable and now we know that they know it.

Strangely, I think the solution is not as severe as my opinion in this article would suggest. I believe lending needs an agency. I think the CFPB is the answer. Further, I think every lender in the country agrees. The problem is that we have the wrong CFPB. It cannot be built on lies. It cannot view lenders as the problem. It cannot be unaccountable to congress. It cannot be off the books of the taxpayers.

The CFPB needs to view lenders as its partners. It needs to enforce rules and violations where they truly exist. It need to have more than one voice in rule making. It needs to make its direction clearly stated and understandable. Finally, it needs to work toward consumer protection.

The junk bond market is looking more and more like the boogeyman for stock market investors.

The iShares iBoxx $ High Yield Corporate Bond exchange-traded fund HYG, -2.34% tumbled 2.4% in midday trade Friday, putting the ETF (HYG) on course for the lowest close since July 2009. Volume as of 12 p.m. Eastern was already more than double the full-day average, according to FactSet.

While weakness in the junk bonds — bonds with credit ratings below investment grade — is nothing new, fears of meltdown have increased after high-yield mutual fund Third Avenue Focused Credit Fund TFCIX, -2.86% TFCVX, -2.70% on Thursday blocked investors from withdrawing their money amid a flood of redemption requests and reduced liquidity.

This chart shows why stock market investors should care:

FactSet

FactSet

When junk bonds and stocks disagree, junks bonds tend to be right.

The MainStay High Yield Corporate Bond Fund MHCAX, -0.19% was used in the chart instead of the HYG, because HYG started trading in April 2007.

When investors start scaling back, and market liquidity starts to dry up, the riskiest investments tend to get hurt first. And when money starts flowing again, and investors start feeling safe, bottom-pickers tend to look at the hardest hit sectors first.

So it’s no coincidence that when the junk bond market and the stock market diverged, it was the junk bond market that proved prescient. Read more about the junk bond market’s message for stocks.

There’s still no reason to believe the run on the junk bond market is nearing an end.

As Jason Goepfert, president of Sundial Capital Research, points out, he hasn’t seen any sign of panic selling in the HYG, which has been associated with previous short-term bottoms. “Looking at one-month and three-month lows [in the HYG] over the past six years, almost all of them saw more extreme sentiment than we’re seeing now,” Goepfert wrote in a note to clients.

by Tomi Gilmore in MarketWatch

by Tyler Durden

by Tyler DurdenAmid the biggest weekly collapse in high-yield bonds since March 2009, Carl Icahn gently reminds investors that he saw this coming… and that it’s only just getting started!

As we warned here, and confirmed here, something has blown-up in high-yield…

With the biggest discount to NAV since 2011…

The carnage is across the entire credit complex… with yields on ‘triple hooks’ back to 2009 levels…

As fund outflows explode..

And here’s why equity investors simply can’t ignore it anymore…

If all of that wasn’t bad enough… the week is apocalyptic…

Icahn says, it’s only just getting started…

If you haven’t seen ‘Danger Ahead’ watch it on https://t.co/4rVAcLBsH9. Unfortunately I believe the meltdown in High Yield is just beginning

— Carl Icahn (@Carl_C_Icahn) December 11, 2015

As we detailed previously, to be sure, no one ever accused Carl Icahn of being shy and earlier this year he had a very candid sitdown with Larry Fink at whom Icahn leveled quite a bit of sharp (if good natured) criticism related to BlackRock’s role in creating the conditions that could end up conspiring to cause a meltdown in illiquid corporate credit markets. Still, talking one’s book speaking one’s mind is one thing, while making a video that might as well be called “The Sky Is Falling” is another and amusingly that is precisely what Carl Icahn has done.

Over the course of 15 minutes, Icahn lays out his concerns about many of the issues we’ve been warning about for years and while none of what he says will come as a surprise (especially to those who frequent these pages), the video, called “Danger Ahead”, is probably worth your time as it does a fairly good job of summarizing how the various risk factors work to reinforce one another on the way to setting the stage for a meltdown. Here’s a list of Icahn’s concerns:

Ultimately what Icahn has done is put the pieces together for anyone who might have been struggling to understand how it all fits together and how the multiple dynamics at play serve to feed off one another to pyramid risk on top of risk. Put differently: one more very “serious” person is now shouting about any and all of the things Zero Hedge readers have been keenly aware of for years.

* * *

Finally, here is Bill Gross also chiming in:

Gross: HY Fund closes exit doors. Who will get in if you can’t get out? Risk off.

— Janus Capital (@JanusCapital) December 11, 2015

Jeffrey Gundlach of DoubleLine Capital just wrapped up his latest webcast updating investors on his Total Return Fund and outlining his views on the markets and the economy.

The first slide gave us the title of his presentation: “Tick, Tick, Tick …”

Overall, Gundlach had a pretty downbeat view on how the Fed’s seemingly dead set path on raising interest rates would play out.

Gundlach expects the Fed will raise rates next week (probably!) but said that once interest rates start going up, everything changes for the market.

Time and again, Gundlach emphasized that sooner than most people expect, once the Fed raises rates for the first time we’ll quickly move to talking about the next rate hike.

As for specific assets, Gundlach was pretty downbeat on the junk bond markets and commodities, and thinks that if the Fed believe it has anything like an “all clear” signal to raise rates, it is mistaken.

Here’s our full rundown and live notes taken during the call:

Gundlach said that the title, as you’d expect, is a reference to the markets waiting for the Federal Reserve’s next meeting, set for December 15-16.

Right now, markets are basically expecting the Fed to raise rates for the first time in nine years.

Here’s Gundlach’s first section, with the board game “Kaboom” on it:

DoubleLine

DoubleLine

Gundlach says that the Fed “philosophically” wants to raise interest rates and will use “selectively back-tested evidence” to justify an increase in rates.

Gundlach said that 100% of economists believe the Fed will raise rates and with the Bloomberg WIRP reading — which measures market expectations for interest rates — building in around an 80% chance of rates things look quite good for the Fed to move next week.

DoubleLine

DoubleLine

Gundlach said that while US markets look okay, there are plenty of markets that are “falling apart.” He adds that what the Fed does from here is entirely dependent on what markets do.

The increase in 3-month LIBOR is noted by Gundlach as a clear signal that markets are expecting the Fed to raise interest rates. Gundlach adds that he will be on CNBC about an hour before the Fed rate decision next Wednesday.

Gundlach notes that cumulative GDP since the last rate hike is about the same as past rate cycles but the pace of growth has been considerably slower than ahead of prior cycles because of how long we’ve had interest rates at 0%.

Gundlach next cites the Atlanta Fed’s GDPNow, says that DoubleLine watches this measure:

DoubleLine

DoubleLine

The ISM survey is a “disaster” Gundlach says.

Gundlach can’t understand why there is such a divide between central bank plans in the US and Europe, given that markets were hugely disappointed by a lack of a major increase in European QE last week while the markets expect the Fed will raise rates next week.

DoubleLine

DoubleLine

If the Fed hikes in December follow the patterns elsewhere, Gundlach thinks the Fed could looks like the Swedish Riksbank.

DoubleLine

DoubleLine

And the infamous chart of all central banks that haven’t made it far off the lower bound.

DoubleLine

DoubleLine

Gundlach again cites the decline in profit margins as a recession indicator, says it is still his favorite chart and one to look at if you want to stay up at night worrying.

Gundlach said that while there are a number of excuses for why the drop in profit margins this time is because of, say, energy, he doesn’t like analysis that leaves out the bad things. “I’d love to do a client review where the only thing I talk about is the stuff that went up,” Gundlach said.

DoubleLine

DoubleLine

On the junk bond front, Gundlach cites the performance of the “JNK” ETF which is down 6% this year, including the coupon.

Gundlach said that looking at high-yield spreads, it would be “unthinkable” to raise interest rates in this environment.

Looking at leveraged loans, which are floating rates, Gundlach notes these assets are down about 13% in just a few months. The S&P 100 leveraged loan index is down 10% over that period.

“This is a little bit disconcerting, that we’re talking about raising interest rates with corporate credit tanking,” Gundlach said.

DoubleLine

DoubleLine

Gundlach now wants to talk about the “debt bomb,” something he says he hasn’t talked about it a long time.

“The trap door falls out from underneath us in the years to come,” Gundlach said.

In Gundlach’s view, this “greatly underestimates” the extent of the problem.

DoubleLine

DoubleLine

“I have a sneaking suspicion that defense spending could explode higher when a new administration takes office in about a year,” Gundlach said.

“I think the 2020 presidential election will be about what’s going on with the federal deficit,” Gundlach said.

DoubleLine

DoubleLine

Gundlach now shifting gears to look at the rest of the world.

“I think the only word for this is ‘depression.'”

DoubleLine

DoubleLine

Gundlach calls commodities, “The widow-maker.”

Down 43% in a little over a year. Cites massive declines in copper and lumber, among other things.

DoubleLine

DoubleLine

“It’s real simple: oil production is too high,” Gundlach said.

Gundlach calls this the “chart of the day” and wonders how you’ll get balance in the oil market with inventories up at these levels.

DoubleLine

DoubleLine

Gundlach talking about buying oil and junk bonds and says now, as he did a few months ago, “I don’t like to buy things that go down everyday.”

by Mlyes Udland in Business Insider

Jeffrey Gundlach, CEO and CIO of DoubleLine Capital

Jeffrey Gundlach, CEO and CIO of DoubleLine Funds, has a simple warning for the young money managers who haven’t yet been through a rate-hike cycle from the Federal Reserve: It’s a new world.

In his latest webcast updating investors on his DoubleLine Total Return bond fund on Tuesday night, Gundlach, the so-called Bond King, said that he’s seen surveys indicating two-thirds of money managers now haven’t been through a rate-hiking cycle.

And these folks are in for a surprise.

“I’m sure many people on the call have never seen the Fed raise rates,” Gundlach said. “And I’ve got a simple message for you: It’s a different world when the Fed is raising interest rates. Everybody needs to unwind trades at the same time, and it is a completely different environment for the market.”

Currently, markets widely expect the Fed will raise rates when it announces its latest policy decision on Wednesday. The Fed has had rates pegged near 0% since December 2008, and hasn’t actually raised rates since June 2006.

According to data from Bloomberg cited by Gundlach on Tuesday, markets are pricing in about an 80% chance the Fed raises rates on Wednesday. Gundlach added that at least one survey he saw recently had 100% of economists calling for a Fed rate hike.

The overall tone of Gundlach’s call indicated that while he believes it’s likely the Fed does pull the trigger, the “all clear” the Fed seems to think it has from markets and the economy to begin tightening financial conditions is not, in fact, in place.

In his presentation, Gundlach cited two financial readings that were particularly troubling: junk bonds and leveraged loans.

Junk bonds, as measured by the “JNK” exchange-traded fund which tracks that asset class, is down about 6% this year, including the coupon — or regular interest payment paid to the fund by the bonds in the portfolio.

Overall, Gundlach thinks it is “unthinkable” that the Fed would want to raise rates with junk bonds behaving this way. Doubleline Capital

Doubleline Capital

Meanwhile, leveraged loan indexes — which tracks debt taken on by the lowest-quality corporate borrowers — have collapsed in the last few months, indicating real stress in corporate credit markets.

“This is a little bit disconcerting,” Gundlach said, “that we’re talking about raising interest rates with corporate credit tanking.”

Gundlach was also asked in the Q&A that followed his presentation about comments from this same call a year ago that indicated his view that if crude oil fell to $40 a barrel, then there would be a major problem in the world.

On Tuesday, West Texas Intermediate crude oil, the US benchmark, fell below $37 a barrel for the first time in over six years.

The implication with Gundlach’s December 2014 call is that not only would there be financial stress with oil at $40 a barrel, but geopolitical tensions as well.

Gundlach noted that while junk bonds and leveraged loans are a reflection of the stress in oil and commodity markets, this doesn’t mean these impacts can just be netted out, as some seem quick to do. These are the factors markets are taking their lead from.

It doesn’t seem like much of a reach to say that when compared to this time a year ago, the global geopolitical situation is more uncertain. Or as Gundlach said simply on Tuesday: “Oil’s below $40 and we’ve got problems.”

Real estate investing is all about timing, and Sam Zell knows this better than anyone.

He sold his real estate firm, Equity Office, to Blackstone Group for $39 billion near the peak of the market. This was back in February 2007—only months before real estate credit markets started to spiral out of control.

He’s doing it again.

At the end of October, his real estate fund, Equity Residential, agreed to sell more than 23,000 apartment units to Starwood Capital for $5.4 billion. The sale represents over 20 percent of the Equity Residential portfolio.

The fund plans to sell another 4,700 apartment units in the near future. Most of the proceeds will be returned to investors in the form of a dividend sometime next year.

Another real estate fund managed by Zell, Equity Commonwealth, has sold 82 office properties worth $1.7 billion since February. The fund plans to raise another $1.3 billion by selling off more properties over the next few years.

Zell is cashing out of non-core assets after the run up in real estate prices in recent years. Rather than reinvest, much of the cash is being returned to investors. The message he is sending is clear—it’s time to sell.

REITs (real estate investment trusts) have been one of the hottest investment sectors in the aftermath of the 2008 credit crisis.

REIT prices are up 286% from their March 2009 low, compared to 209% for the S&P 500 over that same period. Real estate prices have benefited greatly from the Federal Reserve’s aggressive stimulus packages and zero-interest rate monetary policy.

Real Capital Analytics data showed that commercial property values across the country reached the highest level on record in August—up 14.5% on a nominal basis and surpassing the previous inflation adjusted mark from 2007 by 1.5%.

High prices have led to record low cap rates (cap rates measure a property’s yield by dividing the annual income by the property value). The average cap rate on all property types across the US hit 5.25% in September. This breaks the 5.65% low from 2007, according the Green Street Advisors.

The data dependent Fed has trapped itself in a corner. On the one hand, they can see that property values and stock markets have skyrocketed. On the other hand, real economic growth appears to have stalled.

The Fed has tried to signal an end to its easy money policies all year long. However, poor US economic data and fear of a global slowdown has kept them from taking action.

Still, the potential for higher interest rates has caused REIT investors to take a pause. Higher interest rates make dividend yields from REITs less attractive than the safer alternatives, such as Treasury bonds. It also makes it more costly to finance new acquisitions and real estate developments.

The S&P US REIT Index has under performed the S&P 500 benchmark so far this year. If this holds, it will mark only the second year since 2009 that REITs have under performed the S&P 500 index—the other being 2013, when the Fed began its process of backing out of its aggressive bond-buying program.

Sam Zell is not alone. Over the last twelve months, insiders were net sellers of shares at all but one of the top ten funds on the index.

And the institutional money has started to follow suit as well. Five of the top ten REITs on the index had net outflows from institutional investors as of the most recent quarterly filing.

As Steven Roth, CEO of Vornado Realty Trust, said on an investor call in August, “The easy money has been made in this cycle… this is a time when the smart guys are starting to build cash.” You can choose to ignore the writing on the wall or perhaps it’s time for investors to follow the smart money and move their cash out of real estate.

Source: Business Insider. Read the original article on Thoughts From The Frontline.

• No empire has ever prospered or endured by weakening its currency.

• Those who argue the Fed can’t possibly raise rates in a weakening domestic economy have forgotten the one absolutely critical mission of the Fed in the Imperial Project is maintaining U.S. dollar hegemony.

• In essence, the Fed must raise rates to strengthen the U.S. dollar ((USD)) and keep commodities such as oil cheap for American consumers.

• Another critical element of U.S. hegemony is to be the dumping ground for exports of our trading partners.

• If stocks are the tail of the bond dog, the foreign exchange market is the dog’s owner.

• No empire has ever prospered or endured by weakening its currency.

Now that the Fed isn’t feeding the baby QE, it’s throwing a tantrum. A great many insightful commentators have made the case for why the Fed shouldn’t raise rates this month – or indeed, any other month. The basic idea is that the Fed blew it by waiting until the economy is weakening to raise rates. More specifically, former Fed Chair Ben Bernanke – self-hailed as a “hero that saved the global economy” – blew it by keeping rates at zero and overfeeding the stock market bubble baby with quantitative easing (QE).

On the other side of the ledger, is the argument that the Fed must raise rates to maintain its rapidly thinning credibility. I have made both of these arguments: that the Bernanke Fed blew it big time, and that the Fed has to raise rates lest its credibility as the caretaker not just of the stock market but of the real economy implodes.

But there is another even more persuasive reason why the Fed must raise rates. It may appear to fall into the devil’s advocate camp at first, but if we consider the Fed’s action through the lens of Triffin’s Paradox, which I have covered numerous times, then it makes sense.

The Federal Reserve, Interest Rates and Triffin’s Paradox

Understanding the “Exorbitant Privilege” of the U.S. Dollar (November 19, 2012)

The core of Triffin’s Paradox is that the issuer of a reserve currency must serve two quite different sets of users: the domestic economy, and the international economy.

Those who argue the Fed can’t possibly raise rates in a weakening domestic economy have forgotten the one absolutely critical mission of the Fed in the Imperial Project is maintaining U.S. dollar hegemony.

No nation ever achieved global hegemony by weakening its currency. Hegemony requires a strong currency, for the ultimate arbitrage is trading fiat currency that has been created out of thin air for real commodities and goods.

Generating currency out of thin air and trading it for tangible goods is the definition of hegemony. Is there any greater magic power than that?

In essence, the Fed must raise rates to strengthen the U.S. dollar (USD) and keep commodities such as oil cheap for American consumers. The most direct way to keep commodities cheap is to strengthen one’s currency, which makes commodities extracted in other nations cheaper by raising the purchasing power of the domestic economy on the global stage.

Another critical element of U.S. hegemony is to be the dumping ground for exports of our trading partners. By strengthening the dollar, the Fed increases the purchasing power of everyone who holds USD. This lowers the cost of goods imported from nations with weakening currencies, who are more than willing to trade their commodities and goods for fiat USD.

The Fed may not actually be able to raise rates in the domestic economy, as explained here: “But It’s Just A 0.25% Rate Hike, What’s The Big Deal?” – Here Is The Stunning Answer.

But in this case, perception and signaling are more important than the actual rates: By signaling a sea change in U.S. rates, the Fed will make the USD even more attractive as a reserve currency and U.S.-denominated assets more attractive to those holding weakening currencies.

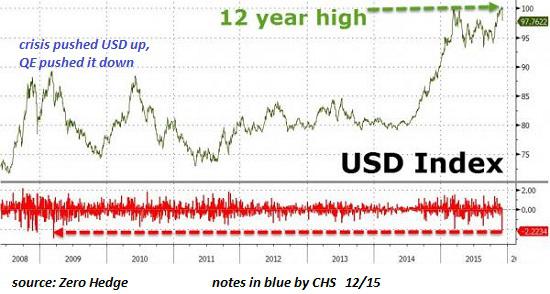

If stocks are the tail of the bond dog, the foreign exchange market is the dog’s owner. Despite its recent thumping (due to being the most over loved, crowded trade out there), the USD is trading in a range defined by multi-year highs.

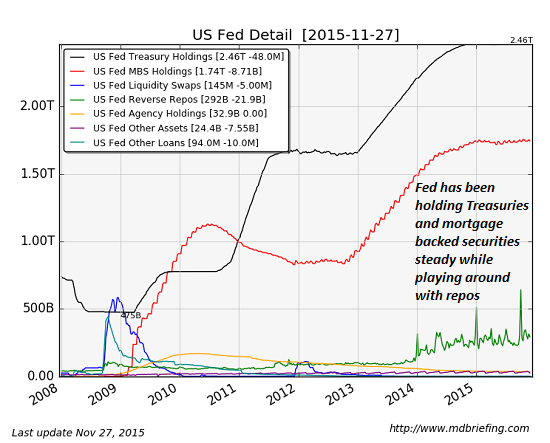

The Fed’s balance sheet reveals its basic strategy going forward: maintain its holdings of Treasury bonds and mortgage-backed securities (MBS) while playing around in the repo market in an attempt to manipulate rates higher.

Whether or not the Fed actually manages to raise rates in the real world is less important than maintaining USD hegemony. No empire has ever prospered or endured by weakening its currency.

Mortgage delinquency rates are low as long as home prices are soaring since you can always sell the home and pay off the mortgage, or most of it, and losses for lenders are minimal. Nonbank lenders with complicated corporate structures backed by a mix of PE firms, hedge funds, debt, and IPO monies revel in it. Regulators close their eyes because no one loses money when home prices are soaring. The Fed talks about having “healed” the housing market. And the whole industry is happy.

The show is run by some experienced hands: former executives from Countrywide Financial, which exploded during the Financial Crisis and left behind one of the biggest craters related to mortgages and mortgage backed securities ever. Only this time, they’re even bigger.

PennyMac is the nation’s sixth largest mortgage lender and largest nonbank mortgage lender. Others in that elite club include AmeriHome Mortgage, Stearns Lending, and Impac Mortgage. The LA Times:

All are headquartered in Southern California, the epicenter of the last decade’s subprime lending industry. And all are run by former executives of Countrywide Financial, the once-giant mortgage lender that made tens of billions of dollars in risky loans that contributed to the 2008 financial crisis.

During their heyday in 2005, non-bank lenders, often targeting subprime borrowers, originated 31% of all home mortgages. Then it blew up. From 2009 through 2011, non-bank lenders originated about 10% of all mortgages. But then PE firms stormed into the housing market. In 2012, non-bank lenders originated over 20% of all mortgages, in 2013 nearly 30%, in 2014 about 42%. And it will likely be even higher this year.

During their heyday in 2005, non-bank lenders, often targeting subprime borrowers, originated 31% of all home mortgages. Then it blew up. From 2009 through 2011, non-bank lenders originated about 10% of all mortgages. But then PE firms stormed into the housing market. In 2012, non-bank lenders originated over 20% of all mortgages, in 2013 nearly 30%, in 2014 about 42%. And it will likely be even higher this year.

That share surpasses the peak prior to the Financial Crisis.

As before the Financial Crisis, they dominate the riskiest end of the housing market, according to the LA Times: “this time, loans insured by the Federal Housing Administration, aimed at first-time and bad-credit buyers. Such lenders now control 64% of the market for FHA and similar Veterans Affairs loans, compared with 18% in 2010.”

Low down payments increase the risks for lenders. Low credit scores also increase risks for lenders. And they coagulate into a toxic mix with high home prices during housing bubbles, such as Housing Bubble 2, which is in full swing.

The FHA allows down payments to be as low as 3.5%, and credit scores to be as low as 580, hence “subprime” borrowers. And these borrowers in many parts of the country, particularly in California, are now paying sky-high prices for very basic homes.

When home prices drop and mortgage payments become a challenge for whatever reason, such as a layoff or a miscalculation from get-go, nothing stops that underwater subprime borrower from not making any more payments and instead living in the home for free until kicked out.

“Those are the loans that are going to default, and those are the defaults we are going to be arguing about 10 years from now,” predicted Wells Fargo CFO John Shrewsberry at a conference in September. “We are not going to do that again,” he said, in reference to Wells Fargo’s decision to stay out of this end of the business.

But when home prices are soaring, as in California, delinquencies are low and don’t matter. They only matter after the bubble bursts. Then prices are deflating and delinquencies are soaring. Last time this happened, it triggered the most majestic bailouts the world has ever seen.

The LA Times:

For now, regulators aren’t worried. Sandra Thompson, a deputy director of the Federal Housing Finance Agency, which oversees government-sponsored mortgage buyers Fannie Mae and Freddie Mac, said non-bank lenders play an important role.

“We want to make sure there is broad liquidity in the mortgage market,” she said. “It gives borrowers options.”

But another regulator isn’t so sanguine about the breakneck growth of these new non-bank lenders: Ginnie Mae, which guarantees FHA and VA loans that are packaged into structured mortgage backed securities, has requested funding for 33 additional regulators. It’s fretting that these non-bank lenders won’t have the reserves to cover any losses.

“Where’s the money going to come from?” wondered Ginnie Mae’s president, Ted Tozer. “We want to make sure everyone’s going to be there when the next downturn comes.”

But the money, like last time, may not be there.

PennyMac was founded in 2008 by former Countrywide executives, including Stanford Kurland, as the LA Times put it, “the second-in-command to Angelo Mozilo, the Countrywide founder who came to symbolize the excesses of the subprime mortgage boom.” Kurland is PennyMac’s Chairman and CEO. The company is backed by BlackRock and hedge fund Highfields Capital Management.

In September 2013, PennyMac went public at $18 a share. Shares closed on Monday at $16.23. It also consists of PennyMac Mortgage Investment Trust, a REIT that invests primarily in residential mortgages and mortgage-backed securities. It went public in 2009 with an IPO price of $20 a share. It closed at $16.64 a share. There are other intricacies.

According to the company, “PennyMac manages private investment funds,” while PennyMac Mortgage Investment Trust is “a tax-efficient vehicle for investing in mortgage-related assets and has a successful track record of raising and deploying cost-effective capital in mortgage-related investments.”

The LA Times describes it this way:

It has a corporate structure that might be difficult for regulators to grasp. The business is two separate-but-related publicly traded companies, one that originates and services mortgages, the other a real estate investment trust that buys mortgages.

And they’re big: PennyMac originated $37 billion in mortgages during the first nine months this year.

Then there’s AmeriHome. Founded in 1988, it was acquired by Aris Mortgage Holding in 2014 from Impac Mortgage Holdings, a lender that almost toppled under its Alt-A mortgages during the Financial Crisis. Aris then started doing business as AmeriHome. James Furash, head of Countrywide’s banking operation until 2007, is CEO of AmeriHome. Clustered under him are other Countrywide executives.

It gets more complicated, with a private equity angle. In 2014, Bermuda-based insurer Athene Holding, home to other Countrywide executives and majority-owned by PE firm Apollo Global Management, acquired a large stake in AmeriHome and announced that it would buy some of its structured mortgage backed securities, in order to chase yield in the Fed-designed zero-yield environment.

Among the hottest products the nonbank lenders now offer are, to use AmeriHomes’ words, “a wider array of non-Agency programs,” including adjustable rate mortgages (ARM), “Non-Agency 5/1 Hybrid ARMs with Interest Only options,” and “Alt-QM” mortgages.

“Alt-QM” stands for Alternative to Qualified Mortgages. They’re the new Alt-A mortgages that blew up so spectacularly, after having been considered low-risk. They might exceed debt guidelines. They might come with higher rates, adjustable rates, and interest-only payment periods. And these lenders chase after subprime borrowers who’ve been rejected by banks and think they have no other options.

Even Impac Mortgage, which had cleaned up its ways after the Financial Crisis, is now offering, among other goodies, these “Alt-QM” mortgages.

Yet as long as home prices continue to rise, nothing matters, not the volume of these mortgages originated by non-bank lenders, not the risks involved, not the share of subprime borrowers, and not the often ludicrously high prices of even basic homes. As in 2006, the mantra reigns that you can’t lose money in real estate – as long as prices rise.

The Fed Funds Futures, which are largely based on statements from the Fed Presidents/Governors, are at 74% for a December 2015 raise as of November 26, 2015. This is up from 50% at the end of October 2015. If the Fed does raise the Fed Funds rate, will the raise have a positive effect or a negative one? Let’s examine a few data points.

First raising the Fed Funds rate will cause the value of the USD to go up relative to other currencies. It is expected that a Fed Funds rate raise will cause a rise in US Treasury yields. This means US Treasury bond values will go down at least in the near term. In the near term, this will cost investors money. However, the new higher yield Treasury notes and bonds will be more attractive to investors. This will increase the demand for them. That is the one positive. The US is currently in danger that demand may flag if a lot of countries decide to sell US Treasuries instead of buying them. The Chinese say they are selling so that they can defend the yuan. Their US Treasury bond sales will put upward pressure on the yields. That will in turn put upward pressure on the value of the USD relative to other currencies.

So far the Chinese have sold US Treasuries (“to defend the yuan”); but they have largely bought back later. Chinese US Treasuries holdings were $1.2391T as of January 2015. They were $1.258T as of September 2015. However, if China decided to just sell, there would be significant upward pressure on the US Treasury yields and on the USD. That would make China’s and other countries products that much cheaper in the US. It would make US exports that much more expensive. It would mean more US jobs lost to competing foreign products.

To better assess what may or may not happen on a Fed Funds rate raise, it is appropriate to look at the values of the USD (no current QE) versus the yen and the euro which have major easing in progress. Further it is appropriate to look at the behavior of the yen against the euro, where both parties are currently easing.

The chart below shows the performance of the euro against the USD over the last two years.

The chart below shows the performance of the Japanese yen against the USD over the last two years.

As readers can see both charts are similar. In each case the BOJ or the ECB started talking seriously about a huge QE plan in the summer or early fall of 2014. Meanwhile the US was in the process of ending its QE program. It did this in October 2014. The results of this combination of events on the values of the two foreign currencies relative to the USD are evident. The value of the USD went substantially upward against both currencies.

The chart below shows the performance of the euro against the Japanese yen over the last two years.

As readers can see the yen has depreciated versus the euro; but that depreciation has been less than the depreciation of the yen against the USD and the euro against the USD. Further the amount of Japanese QE relative to its GDP is a much higher at roughly 15%+ per year than the large ECB QE program that amounts to only about 3%+ per year of effectively “printed money”. The depreciation of the yen versus the euro is the result that one would expect based on the relative amounts of QE. Of course, some of the strength of the yen is due to the reasonable health of the Japanese economy. It is not just due to QE amount considerations. The actual picture is a complex one; and readers should not try to over simplify it. However, they can generally predict/assume trends based on the macro moves by the BOJ, the ECB, and the US Fed.

The chart below shows the relative growth rates of the various central banks’ assets.